Overview

Understanding your home equity is crucial, and we know how challenging this can be. This article serves as a compassionate guide for homeowners looking to assess their property value and mortgage balance. By following these steps, you can gain clarity on your financial situation and make informed decisions.

-

First, let’s capture your attention. Assessing your home’s current market value is the starting point. This can feel overwhelming, but remember, you’re not alone in this process. Many families face similar challenges, and we’re here to support you every step of the way.

-

Next, subtract your loan balances from this value. This simple calculation can reveal how much equity you truly have. Knowing this number is empowering—it’s a step toward understanding your financial options, whether it’s refinancing or borrowing against your home equity.

-

Finally, evaluate the loan-to-value ratio. This ratio is essential for making informed financial decisions. It helps you see the bigger picture of your home’s worth compared to what you owe.

By following these steps, you’re not just crunching numbers; you’re taking control of your financial future. Remember, understanding your equity can open doors to new opportunities. Let’s embark on this journey together.

Introduction

Understanding the value of home equity is crucial for homeowners looking to make informed financial decisions. We know how challenging this can be, especially with fluctuating property values and changing interest rates. This guide aims to demystify the process of calculating home equity. By shedding light on its significance in refinancing and securing loans, we hope to empower you in navigating your equity options effectively.

Home equity can be a powerful tool for maximizing your financial potential. With the right knowledge, you can make choices that align with your family’s goals. We’re here to support you every step of the way as you explore your options. Let’s take this journey together.

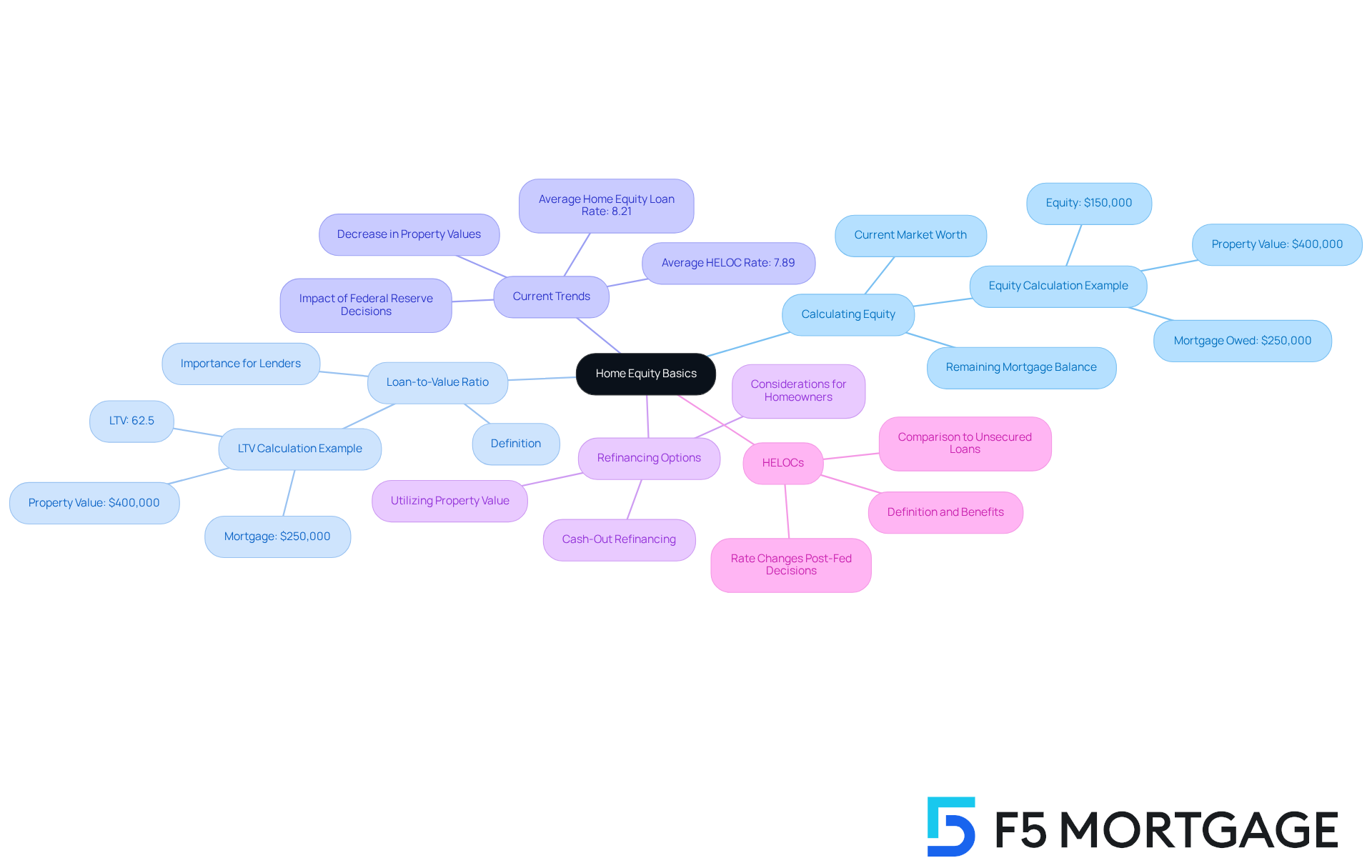

Understand Home Equity Basics

The value of your property reflects the difference between its current market worth and the remaining balance on your mortgage. For instance, if your property is valued at $400,000 and you owe $250,000, your ownership stake amounts to $150,000. Understanding how to find out how much equity you have in your home is essential, as it significantly influences your financial choices, including refinancing or obtaining a property loan. Property value can increase through two main paths: reducing your loan and the rise in your residence’s worth over time.

Understanding the loan-to-value ratio (LTV) is crucial, as it plays a vital role in how lenders evaluate your equity when processing loan applications. The LTV ratio is determined by dividing the loan amount by the appraised value of the property. For example, if you possess a mortgage of $250,000 on a property valued at $400,000, your LTV would be 62.5%. A lower LTV typically indicates less risk for lenders, which can lead to better loan terms.

Current trends show that residential asset values have decreased notably from their 2024 peaks. As of October 1, 2025, average HELOC figures are now at 7.89%, and asset loan figures at 8.21%. This change offers a chance for homeowners to utilize their assets for refinancing or other financial needs. As lending specialist Linda Bell states, “Small increases for property values are remaining close to 2025 lows,” indicating a positive atmosphere for individuals contemplating their options.

Furthermore, it’s essential to comprehend how to find out how much equity you have in your home and how it affects refinancing choices. Homeowners should be prepared for potential changes in interest levels following Federal Reserve decisions, as these can directly impact the cost of variable-interest products like HELOCs. With typical property value growth trends in the U.S. showing positive signs, now is a favorable moment to evaluate how to find out how much equity you have in your home and understand its effects on your financial future. Additionally, cash-out refinancing options in California allow homeowners to utilize their property value for significant expenses, making it a crucial factor for families aiming to enhance their residences.

HELOCs and property value loans typically provide lower rates compared to unsecured credit alternatives, making them a budget-friendly option for property owners seeking to utilize their assets. We know how challenging this can be, and we’re here to support you every step of the way.

Calculate Your Home Equity Step-by-Step

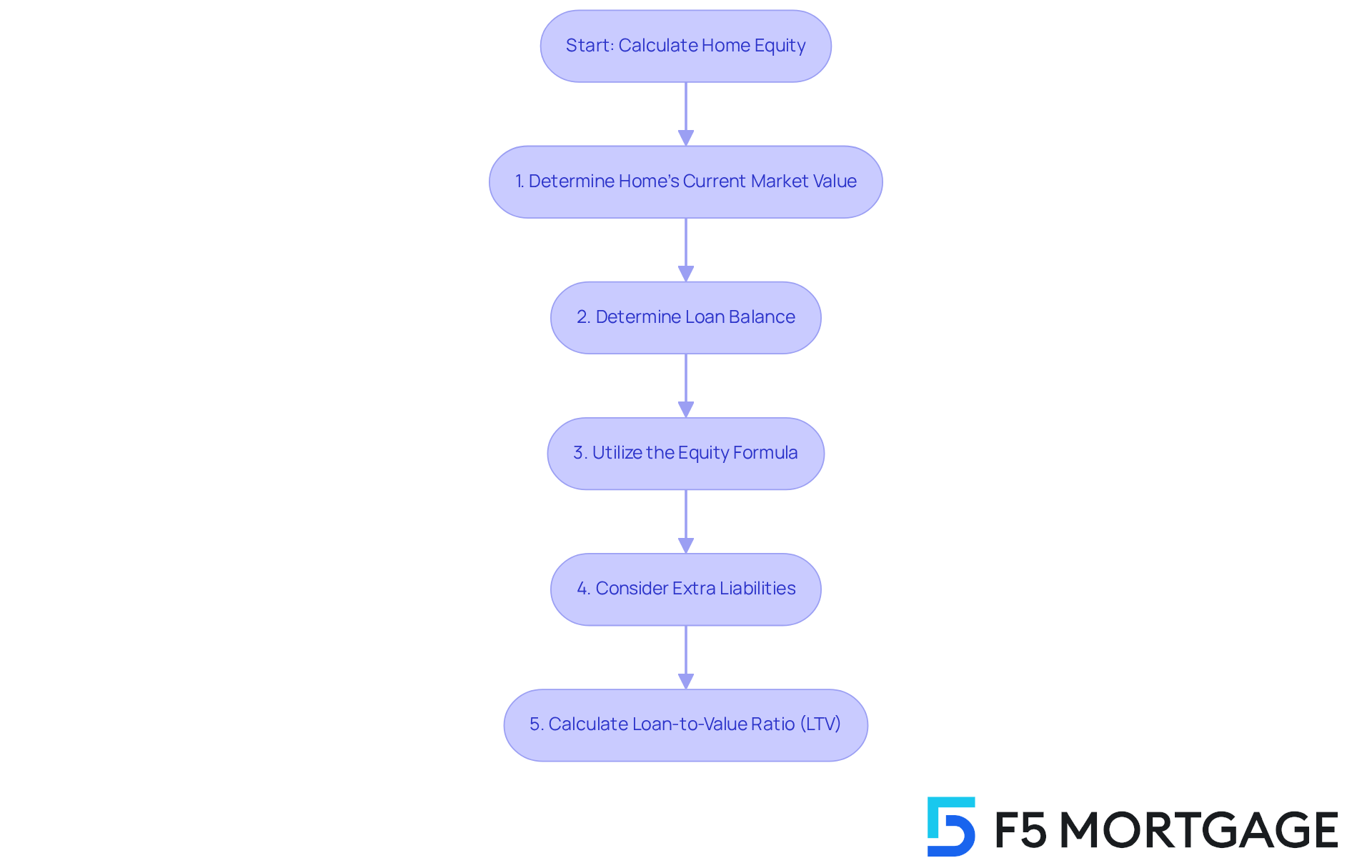

Calculating how to find out how much equity you have in your home can feel daunting, but we’re here to guide you through the process with care. Follow these steps to gain a clearer understanding of your financial standing:

-

Determine Your Home’s Current Market Value: Start by assessing how much your home is worth. You can hire a professional appraiser, check recent sales of similar homes in your area, or use online valuation tools. This evaluation is essential, as it helps you understand how to find out how much equity you have in your home, which directly impacts the current market value of your property and your loan rates.

-

Determine Your Loan Balance: Take a moment to review your most recent loan statement. This will show you exactly how much you currently owe on your loan.

-

Utilize the Equity Formula: Now, it’s time to calculate your equity. To determine how to find out how much equity you have in your home, simply subtract your loan balance from your property’s market value. For example, if your home is valued at $400,000 and your loan balance is $250,000, your ownership stake would be $150,000 (i.e., $400,000 – $250,000 = $150,000).

-

Consider Extra Liabilities: If you have any second loans or property value loans, remember to deduct these amounts from your total assets. This will give you a more accurate picture of your equity.

-

Calculate Your Loan-to-Value Ratio (LTV): This ratio is calculated by dividing your loan balance by your home’s value. Using our earlier example, the LTV would be 62.5% ($250,000 / $400,000). A lower LTV indicates more ownership, which can enhance your chances of securing loans based on that ownership. Additionally, keeping a favorable debt-to-income (DTI) ratio—ideally below 43%—can improve your eligibility for competitive mortgage rates, especially when considering refinancing options with F5 Mortgage.

We know how challenging this can be, but taking these steps can empower you to make informed decisions about your home and finances.

Explore Borrowing Options Against Your Home Equity

Once you understand how much equity you have in your home, you can explore several borrowing options that may suit your needs:

-

Home Equity Loan: This option allows you to borrow a lump sum against your home’s value, typically with a fixed interest rate and a defined repayment term. It’s a straightforward way to access funds when you need them.

-

Home Equity Line of Credit (HELOC): Think of a HELOC as a credit card for your home equity. It allows you to borrow as needed, up to a certain limit, usually with a variable interest rate. This flexibility can be very helpful in managing expenses as they arise.

-

Cash-Out Refinance: With this choice, you refinance your existing mortgage for more than you owe, taking the difference in cash. This can be particularly beneficial if you secure a lower interest rate, allowing you to fund renovations or other costs while potentially lowering your monthly payments.

-

Reverse Mortgage: If you’re 62 or older, a reverse mortgage lets you convert part of your home’s value into cash without selling your home. While it can provide financial relief, it’s important to consider how it may affect your estate and heirs.

-

Refinancing Options: In Colorado, you have access to various refinancing options, including conventional, FHA, and VA loans. Each type comes with specific eligibility requirements and benefits, so it’s crucial to choose one that aligns with your financial situation.

-

Considerations: Before borrowing against your home equity, reflect on your financial situation, the purpose of the loan, and any potential risks. We know how challenging this can be, and we’re here to support you every step of the way. Consulting with a mortgage professional at F5 Mortgage can provide you with insights on competitive rates and tailored refinancing options that suit your unique needs.

Conclusion

Understanding home equity is not just a financial concept; it’s a vital part of your journey as a homeowner. We know how challenging it can be to navigate refinancing, loans, and leveraging your property value. By grasping the concept of home equity, you can make informed choices that truly benefit your financial future. This guide highlights essential steps to calculate home equity, emphasizing how crucial it is to know how much equity exists in your home and what it means for your financial planning.

Key insights discussed include:

- The importance of accurately assessing your property’s current market value

- Understanding your loan balances

- Calculating the loan-to-value ratio (LTV)

These elements are fundamental in determining your home equity and can significantly influence your borrowing options, such as home equity loans, HELOCs, and cash-out refinancing. Additionally, staying attuned to current trends in interest rates and property values can help you evaluate your financial position and explore beneficial borrowing strategies.

Ultimately, taking the time to calculate your home equity empowers you to make strategic financial decisions. As property values fluctuate and lending conditions evolve, staying informed and proactive can lead to better financial outcomes. We encourage you to assess your equity regularly and consult with mortgage professionals who can support you in navigating the various options available. Together, we can ensure that you make the most of your investment in your home.

Frequently Asked Questions

What is home equity?

Home equity is the difference between the current market value of your property and the remaining balance on your mortgage. For example, if your property is valued at $400,000 and you owe $250,000, your home equity would be $150,000.

How can I find out how much equity I have in my home?

You can determine your home equity by calculating the difference between your property’s current market value and your remaining mortgage balance.

What is the loan-to-value (LTV) ratio, and why is it important?

The loan-to-value (LTV) ratio is calculated by dividing the loan amount by the appraised value of the property. It is important because lenders use it to evaluate your equity when processing loan applications; a lower LTV indicates less risk for lenders, potentially leading to better loan terms.

What are current trends in residential property values?

Current trends indicate that residential property values have decreased from their 2024 peaks. As of October 1, 2025, average HELOC figures are at 7.89%, and asset loan figures are at 8.21%, suggesting a favorable environment for homeowners considering refinancing or other financial needs.

How do Federal Reserve decisions impact homeowners?

Federal Reserve decisions can lead to changes in interest rates, which directly affect the cost of variable-interest products like HELOCs. Homeowners should be aware of these potential changes when considering their refinancing options.

What are HELOCs and how do they compare to unsecured credit options?

HELOCs (Home Equity Lines of Credit) and property value loans typically offer lower interest rates compared to unsecured credit alternatives, making them a more budget-friendly option for homeowners looking to utilize their assets.

What is cash-out refinancing, and how can it benefit homeowners?

Cash-out refinancing allows homeowners to borrow against their property value to access funds for significant expenses. This option can be particularly beneficial for families looking to enhance their residences.