Overview

Finding a mortgage broker can feel overwhelming for families, but taking a systematic approach can make it easier. Start by researching potential agents and verifying their licensing. Schedule consultations to discuss your specific needs and financial situations.

We know how challenging this can be, and that’s why it’s essential to evaluate key criteria such as:

- Experience

- Reputation

- Communication

By doing so, you can select a broker who will provide the tailored support you deserve. This support will facilitate a smoother mortgage process, ultimately enhancing your home-buying experience. Remember, we’re here to support you every step of the way.

Introduction

Navigating the mortgage landscape can feel overwhelming, especially for families striving to secure their dream home. We understand how challenging this can be, and with more homebuyers seeking the guidance of mortgage brokers, knowing how to find the right one is crucial. This article explores essential steps and key criteria for selecting a mortgage broker who can simplify the financing process and tailor options to your specific needs. But what happens when unexpected challenges arise during this journey? How can families ensure they are making informed decisions? We’re here to support you every step of the way.

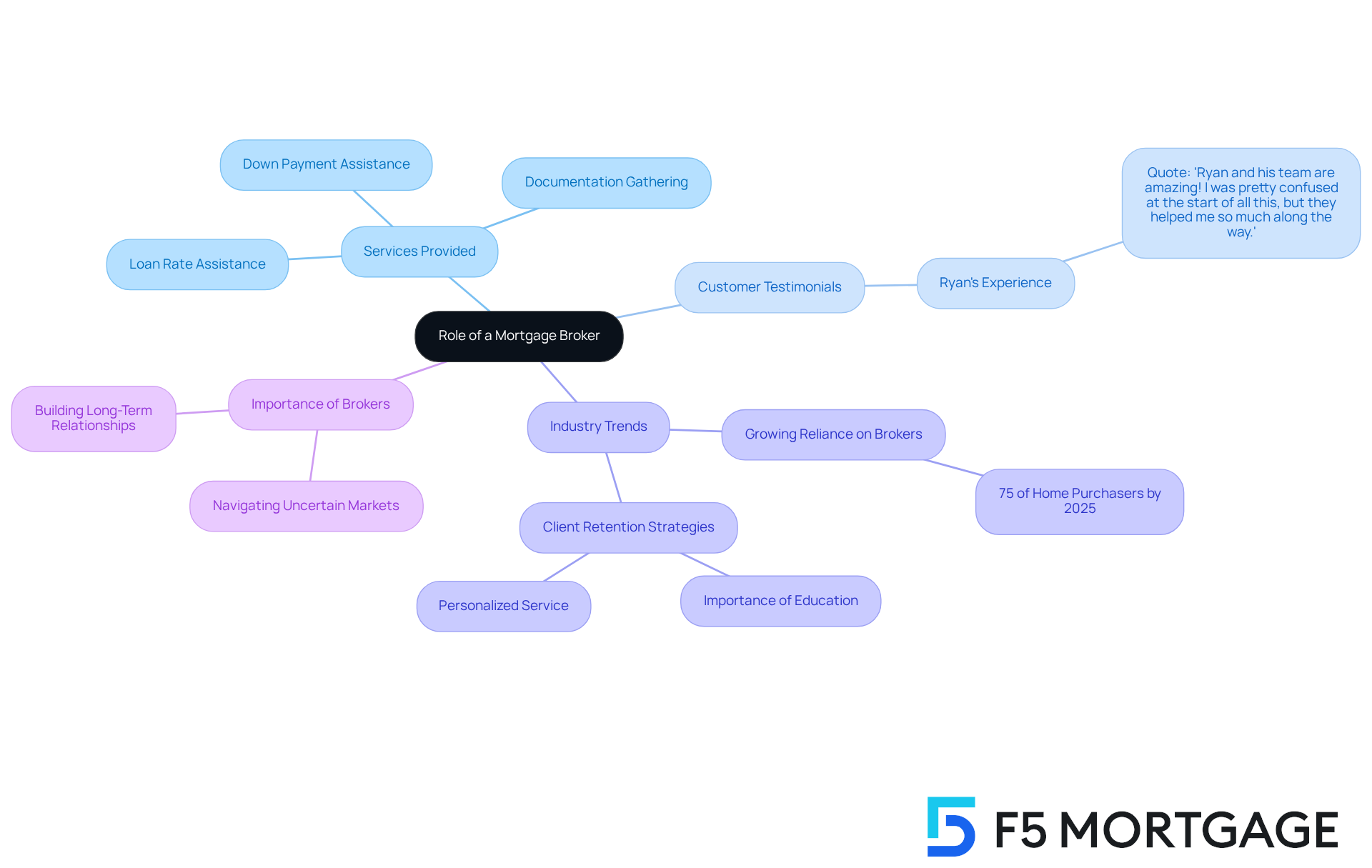

Understand the Role of a Mortgage Broker

Navigating the world of financing can feel overwhelming, but if you find a mortgage broker, they will help you every step of the way. Acting as an essential intermediary between you and potential lenders, they assess your financial profile and gather the necessary documentation. With their extensive network, they can find the most and conditions tailored to your needs. In fact, by 2025, it’s expected that around 75% of home purchasers will turn to loan advisors, highlighting a growing trend toward seeking professional support in securing funding. Brokers often achieve better deals than individuals can on their own, thanks to their established relationships with multiple lenders.

Successful broker-client relationships shine through in case studies, particularly during uncertain economic times. For instance, customers have praised F5 Mortgage for their exceptional service, sharing testimonials that reflect the team’s dedication throughout the mortgage process with patience and skill. One satisfied customer expressed, ‘Ryan and his team are amazing! I was pretty confused at the start of all this, but they helped me so much along the way.’ This proactive approach not only builds customer confidence but also fosters long-term loyalty, especially in a job market where uncertainty looms.

Industry experts emphasize the importance of utilizing a loan intermediary, stating that to navigate this evolution from mere transactional facilitators to trusted financial consultants, one should find a mortgage broker. By prioritizing customer education and personalized service, agents can significantly boost retention rates—a crucial differentiator in today’s high-rate environment. Hiring a loan consultant, like F5 Finance, which boasts numerous 5-star ratings from satisfied customers, can be a strategic step toward achieving your homeownership dreams with greater ease and confidence. Additionally, F5 Mortgage offers down payment assistance programs that can further enhance your home buying opportunities.

Identify Key Criteria for Choosing a Mortgage Broker

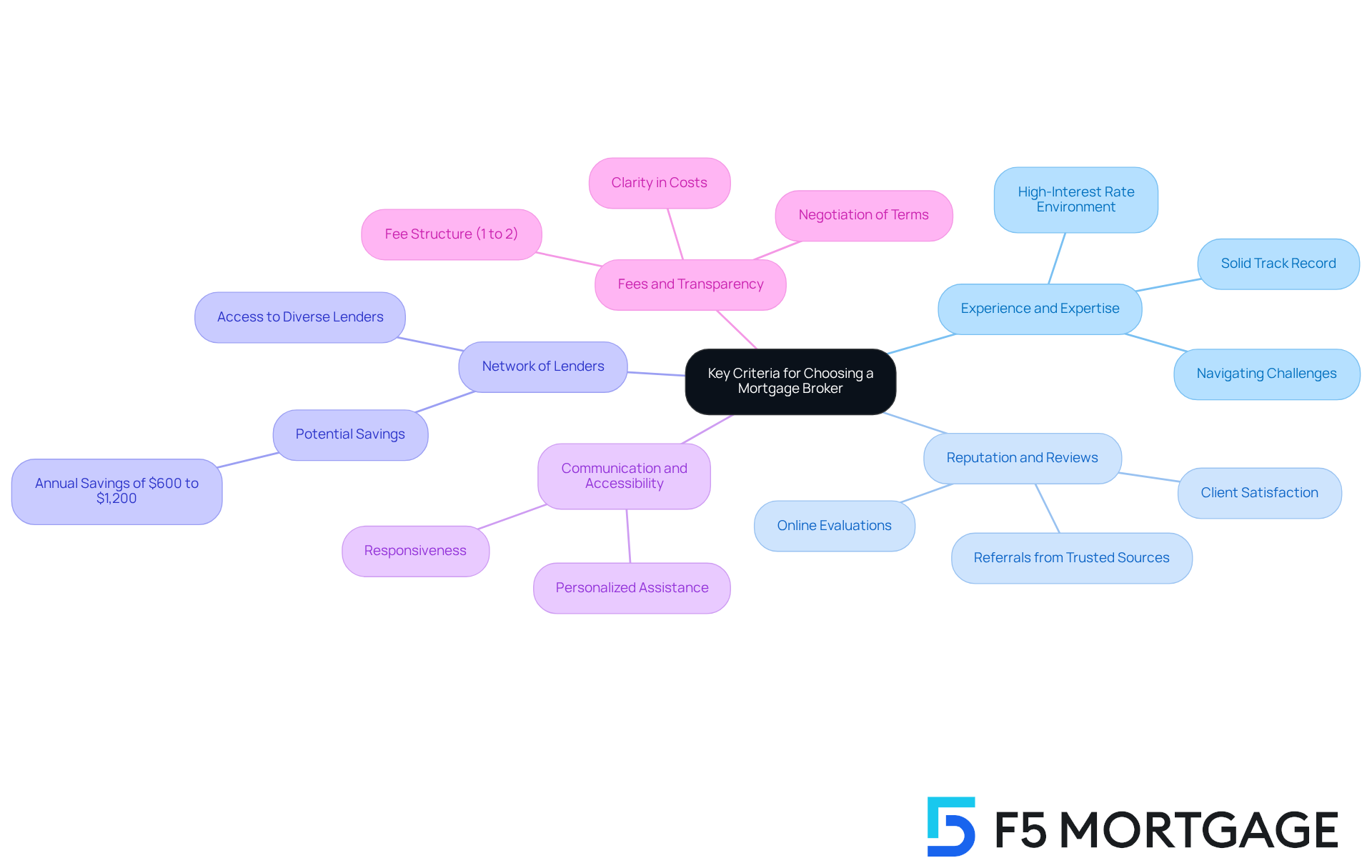

We know how challenging it can be to find a mortgage broker when selecting one. It’s essential to evaluate several key criteria to ensure a smooth and beneficial experience:

- Experience and Expertise: Choose agents with a solid track record in the mortgage industry. Their experience can be invaluable in navigating potential challenges and securing favorable terms, especially in a high-interest rate environment where finding affordable loans is crucial.

- Reputation and Reviews: To evaluate the agent’s reliability and service quality, it is essential to find a mortgage broker by investigating online evaluations and seeking referrals from trusted sources. A strong reputation often indicates a dedication to client satisfaction, which is a hallmark of F5’s approach.

- Network of Lenders: It is advisable to find a mortgage broker with access to a diverse array of lenders. F5 Mortgage partners with over two dozen top lenders and investors, providing a broad network that can lead to better rates tailored to your financial situation. By comparing options for your home loan, you could save between $600 to $1,200 each year, which can add up to considerable savings over the duration of the loan.

- Communication and Accessibility: Ensure that the agent is responsive and communicates effectively when you find a mortgage broker. F5 Financing takes pride in offering personalized, no-pressure assistance, crucial for a seamless lending experience and helping ease any worries you might have.

- Fees and Transparency: Familiarize yourself with the agent’s fee structure, which typically ranges from 1% to 2% of the loan amount, and when you find a mortgage broker, look for clarity in all costs. A trustworthy lender such as F5 Mortgage will offer a comprehensive outline of charges, ensuring you comprehend the financial consequences of your loan. Furthermore, agents can negotiate advantageous terms, such as reduced interest rates or more adaptable repayment choices, improving your overall loan experience.

We’re here to .

Follow a Step-by-Step Process to Engage a Mortgage Broker

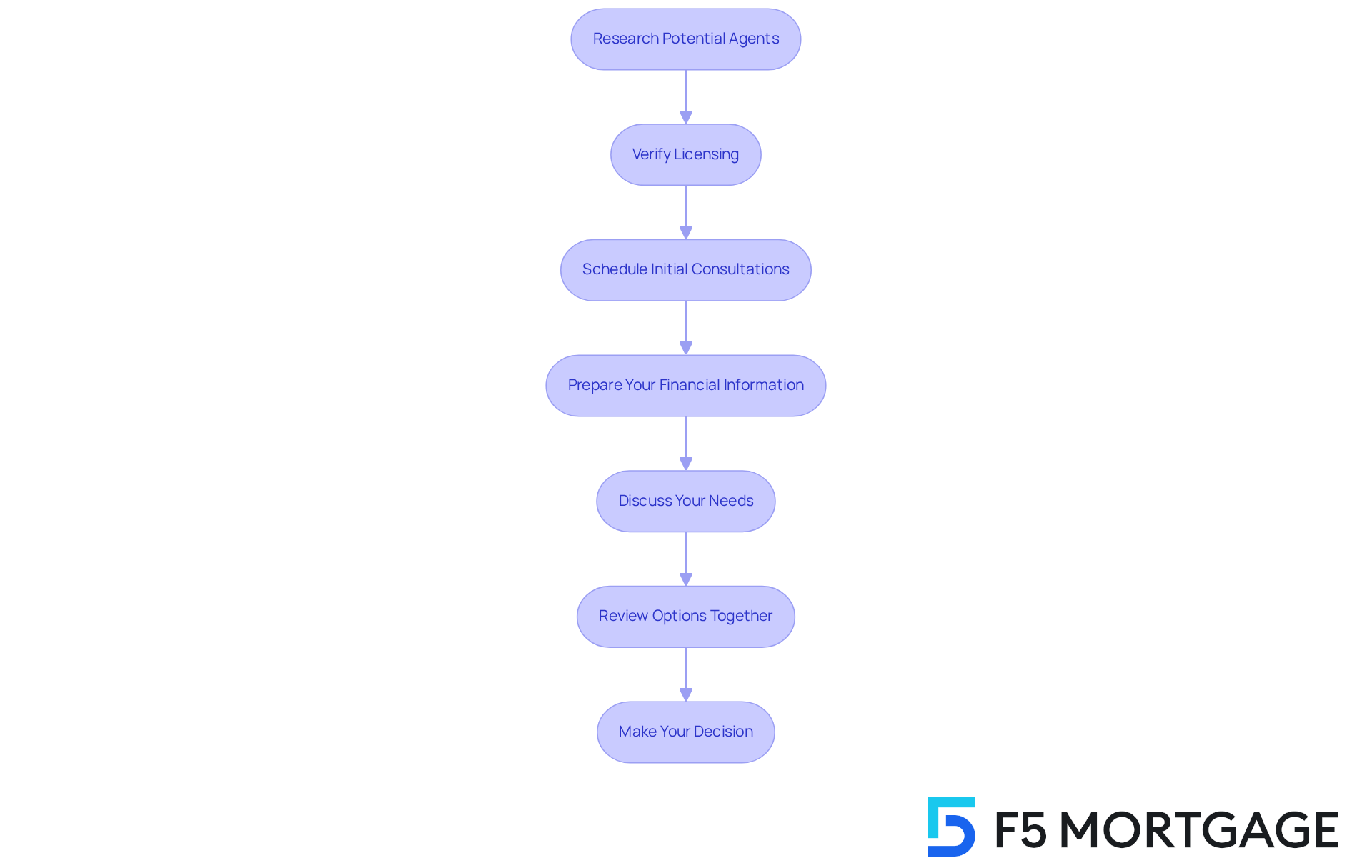

To effectively engage a mortgage broker, we recognize that families may feel overwhelmed. Here are some essential steps to guide you through the process:

- Research Potential Agents: Begin by gathering a list of possible agents through recommendations from friends and family, online reviews, and local listings. This foundational step ensures you have a range of options to consider, alleviating some of the stress.

- Verify Licensing: Before proceeding, through the Nationwide Mortgage Licensing System & Registry (NMLS). This step is crucial for ensuring that you are working with qualified professionals who can support your needs.

- Schedule Initial Consultations: Reach out to agents to arrange meetings. This is a vital opportunity to ask questions about their experience and gauge their expertise in handling your specific needs, helping you feel more secure in your choices.

- Prepare Your Financial Information: Gather necessary documents, including income statements, credit reports, and details about your debts. Having this information ready enables the agent to evaluate your financial circumstances precisely and suggest appropriate loan options. Understanding your Debt-to-Income (DTI) ratio is essential, as a maximum of 43% DTI is typically required for home loans, impacting the types of loans available to you.

- Discuss Your Needs: Clearly communicate your financial goals and preferences to the agent. This conversation is essential for customizing their search to identify the best financing options that align with your family’s aspirations.

- Review Options Together: Once the broker presents financing options, examine them thoroughly. Engage in discussions about the terms, rates, and any associated fees. This collaborative review process helps ensure you understand all aspects of the loan. Remember, borrowers who compare options for their loans can save an average of $600 to $1,200 annually, emphasizing the financial benefits of comprehensive research. F5 Mortgage offers various refinancing options, including conventional loans, FHA loans, and VA loans, which can be beneficial depending on your financial situation.

- Make Your Decision: After thorough consideration, choose the loan option that best fits your needs. Instruct your financial advisor to proceed with the application process, ensuring that all necessary documentation is submitted promptly.

By following these steps, families can simplify their interaction with loan specialists and find a mortgage broker who can make the process more efficient and tailored to their unique financial situations. Successful homebuyers often emphasize the importance of clear communication and preparation, which can significantly enhance the overall experience. However, it’s also important to be aware of commission fees, which typically range from 1% to 2% of the loan amount, as this can impact your overall costs. F5 Home Loans is dedicated to offering a hassle-free financing process through user-friendly technology and tailored assistance, ensuring we’re here to support you every step of the way.

Troubleshoot Common Issues When Working with a Mortgage Broker

Navigating the mortgage process can be overwhelming, but if you find a mortgage broker, they can help simplify things, even though challenges may still arise. We understand how daunting this can be, and here are some common issues along with effective strategies to address them, particularly through the lens of F5 Mortgage’s innovative approach:

- Lack of Communication: If your representative seems unresponsive, don’t hesitate to reach out through various channels, such as email and phone. Open communication is vital for a successful collaboration, and at F5, we prioritize keeping you informed every step of the way.

- Unexpected Fees: Encountering undisclosed fees can be frustrating. If this happens, request a detailed breakdown. A reliable agent will provide clarity about all expenses related to the loan process. At F5 Financing, we are committed to transparency, helping you avoid being among the 25% who face unforeseen charges during their financing journey.

- Limited Options: If you find that the broker offers fewer options than you expected, revisit your requirements. Ask if they can connect with additional lenders. At F5 Lending, we leverage industry-leading technology to provide a diverse selection of options tailored to meet your specific needs.

- Slow Processing Times: If your application is not progressing as quickly as you hoped, it’s important to inquire about its status and any potential delays. Understanding the timeline can help manage your expectations. F5 Mortgage utilizes advanced technology to streamline processing times, ensuring a more efficient experience for you.

- Disagreements on Terms: If you find yourself at odds with your agent’s recommendations, it’s crucial to voice your concerns. A skilled agent will collaborate with you to find solutions that align with your financial objectives. At F5 Financing, we empower our customers to express their preferences freely, fostering a partnership that emphasizes your best interests.

By proactively addressing these challenges and deciding to find a mortgage broker like F5 Mortgage, you can cultivate a more productive relationship, ultimately leading to a smoother and more transparent mortgage experience. Remember, we’re here to support you every step of the way.

Conclusion

Finding the right mortgage broker can truly enhance your home-buying experience, turning what might seem like a daunting process into a more manageable and informed journey. A mortgage broker doesn’t just facilitate; they are trusted advisors who navigate the complexities of financing, ensuring that families secure the most advantageous loan options tailored to their unique financial situations.

Throughout this guide, we highlighted key points that matter to you, such as:

- Understanding the broker’s role

- Evaluating essential criteria when selecting an agent

- Following a structured process to engage their services

Factors like experience, reputation, communication, and transparency are critical in ensuring a positive experience. Moreover, by proactively addressing common challenges, you can foster a more productive relationship with your broker, ultimately leading to a smoother mortgage process.

As you embark on your homeownership journey, remember that leveraging the expertise of a mortgage broker can bring significant financial benefits and peace of mind. By following the outlined steps and considering the insights shared, you can confidently navigate the mortgage landscape, making informed decisions that align with your long-term goals. Embracing this approach not only simplifies the process but also empowers you to achieve your dreams of homeownership with greater ease and confidence. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of a mortgage broker?

A mortgage broker acts as an intermediary between you and potential lenders, assessing your financial profile, gathering necessary documentation, and finding advantageous loan rates and conditions tailored to your needs.

Why are mortgage brokers becoming more popular?

By 2025, it’s expected that around 75% of home purchasers will seek the help of loan advisors, indicating a growing trend towards professional support in securing funding.

How do mortgage brokers achieve better deals for clients?

Brokers often achieve better deals than individuals can on their own due to their established relationships with multiple lenders, allowing them to negotiate more favorable loan terms.

Can you provide an example of successful broker-client relationships?

Customers have praised F5 Mortgage for their exceptional service, with testimonials highlighting the team’s dedication, patience, and skill throughout the mortgage process.

What are the benefits of hiring a mortgage broker?

Hiring a mortgage broker can provide customer education, personalized service, and access to better loan options, which can enhance your home buying experience and increase confidence in the process.

What additional services do some mortgage brokers offer?

Some mortgage brokers, like F5 Mortgage, offer down payment assistance programs that can further enhance home buying opportunities for clients.