Overview

This article serves as a compassionate guide to calculating mortgage interest, focusing on key elements such as principal, interest rates, and borrowing terms. We understand how challenging this can be, and we aim to empower you with a clear, step-by-step calculation process. By grasping these essential components, you can make informed financial decisions that suit your family’s needs.

Navigating the mortgage calculation process can feel overwhelming, but we’re here to support you every step of the way. This guide not only outlines practical solutions to common challenges but also emphasizes the importance of understanding these elements. With this knowledge, you can approach your mortgage financing with confidence and clarity.

Take a moment to explore this guide, and let it help you transform your mortgage journey into a more manageable and informed experience. Together, we can navigate the complexities of mortgage financing, ensuring you feel empowered and prepared for the road ahead.

Introduction

Understanding mortgage interest is essential for anyone navigating the complex world of home financing. We know how challenging this can be, especially with fluctuating rates and varying terms. The ability to accurately calculate mortgage interest can lead to significant savings over time. However, many potential homeowners find themselves grappling with the intricacies of these calculations. This raises an important question: how can one confidently determine the true cost of borrowing?

This article not only demystifies the process but also equips you with the tools to make informed financial decisions. We’re here to support you every step of the way, ultimately paving the path toward a more secure financial future.

Understand Mortgage Interest Basics

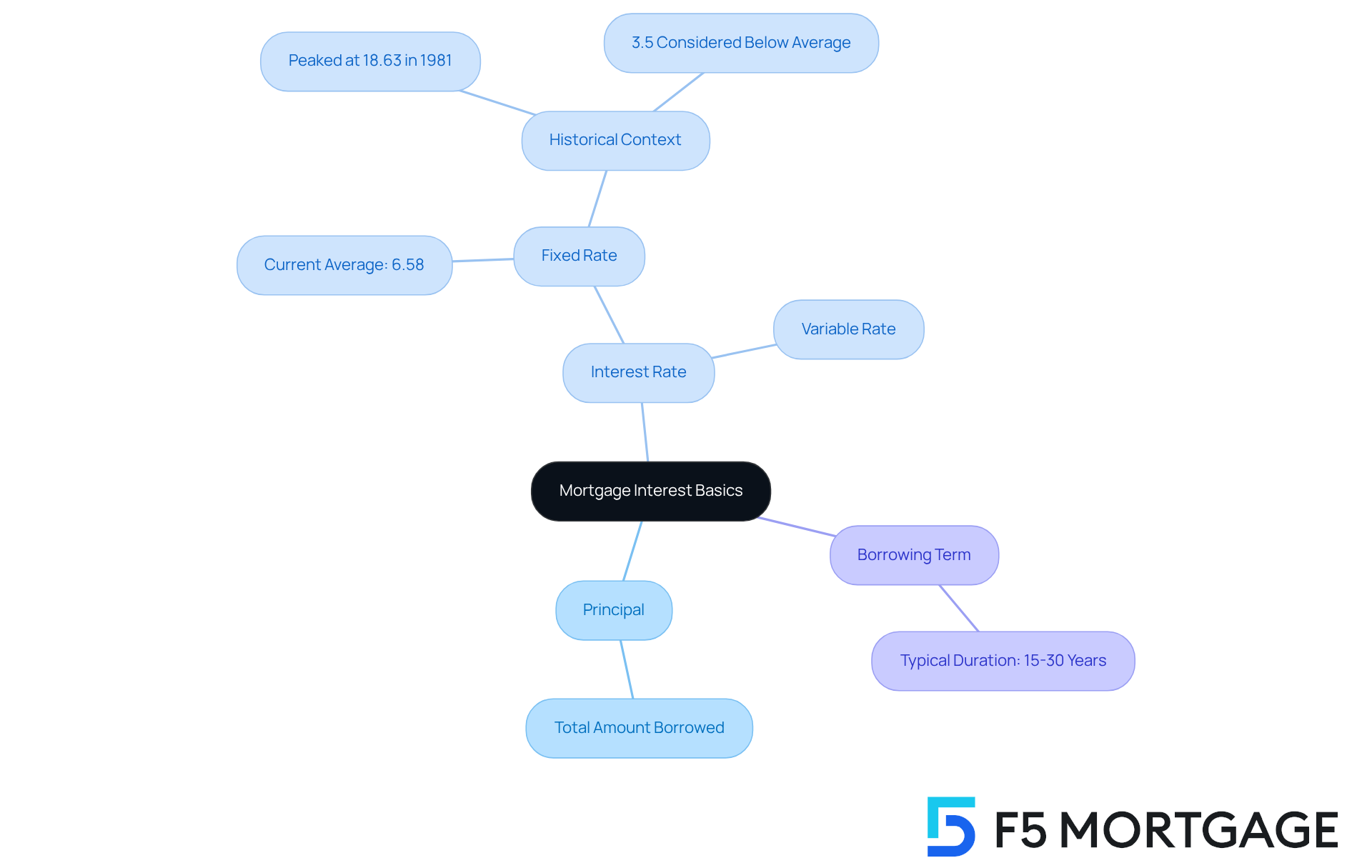

Before diving into calculations, it’s important to understand the fundamental components of mortgage interest:

- Principal: This is the total amount borrowed from the lender, forming the basis of your loan.

- Interest Rate: This percentage is charged on the principal and can be either fixed or variable. Currently, the average borrowing rate for a 30-year fixed mortgage is about 6.58%, reflecting a recent decline from previous levels.

- Borrowing Term: This indicates the duration over which the amount must be repaid, typically spanning 15 to 30 years.

Understanding these terms is crucial for grasping how fees are determined and their impact on monthly payments and total borrowing expenses. For instance, a reduced borrowing cost can lead to significant savings throughout the loan duration. Did you know that a 0.5% decrease in rates can save borrowers approximately $5,500 in the first five years alone? Therefore, evaluating offerings from various lenders is essential to secure the most advantageous terms.

In today’s market, where a 3.5% borrowing cost is considered below standard, being informed about these elements can empower you to make better financial choices. As economist Chen Zhao notes, current mortgage costs have already incorporated expected Federal Reserve reductions, making this an ideal moment to explore your alternatives. By understanding how to calculate mortgage interest in relation to principal, rate, and loan duration, you can successfully navigate the complexities of mortgage financing. We know how challenging this can be, and we’re here to support you every step of the way.

Follow Steps to Calculate Mortgage Interest

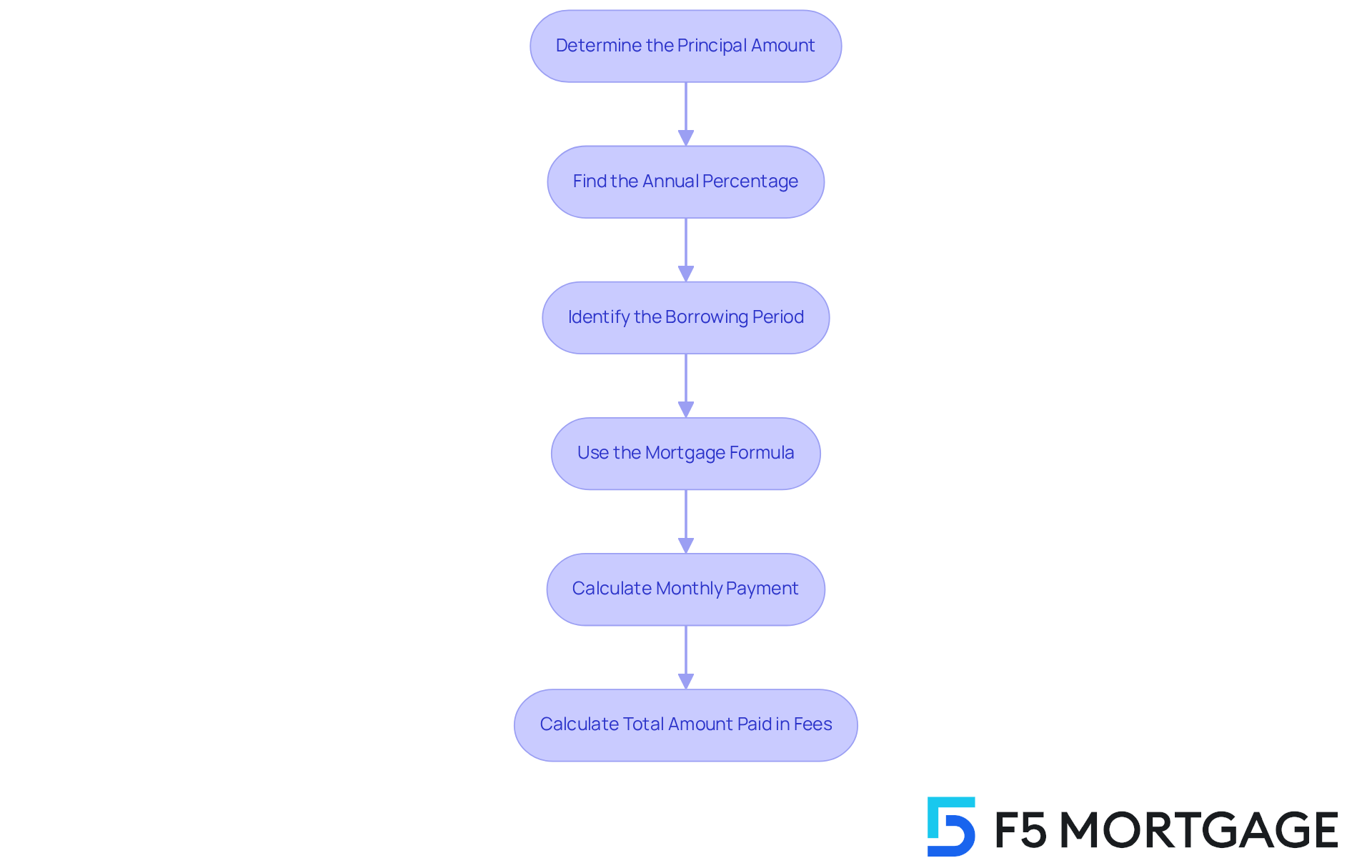

Calculating mortgage interest can feel overwhelming, especially if you’re unsure about how to calculate mortgage interest when considering refinancing. But we’re here to support you every step of the way. Let’s break it down into manageable steps:

-

Determine the Principal Amount: Start by identifying the total amount you will be borrowing. For example, if you’re purchasing a home for $300,000 and making a $60,000 down payment, your principal will be $240,000.

-

Find the Annual Percentage: Obtain the yearly charge from your lender. If your lender offers a 6.8% interest rate, this will be crucial for your calculations.

-

Identify the Borrowing Period: Decide on the length of your financing. Common terms are 15 or 30 years. Keep in mind that refinancing may come with different conditions that could affect your monthly costs.

-

Use the Mortgage Formula: The formula to calculate monthly mortgage payments (including interest) is:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]Where:

- M = total monthly mortgage payment

- P = the principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in years multiplied by 12)

-

Calculate Monthly Payment: Plug your values into the formula. For instance, if your principal is $240,000, your yearly rate is 6.8% (0.068), and your term is 30 years (360 months), your monthly rate would be 0.068/12 = 0.00567. Using the formula, you can determine your monthly cost, which would be approximately $1,558.

-

Calculate Total Amount Paid in Fees: Multiply your monthly fee by the total number of contributions (n) and subtract the principal to discover how much you will spend over the duration of the financing. For example, if your monthly payment is $1,558, over 30 years, you would pay about $363,000 in interest on a $240,000 borrowing. This highlights the importance of understanding how to calculate mortgage interest and the long-term costs associated with your mortgage.

As you consider refinancing, be aware that application requirements may be stricter. You might need a higher credit score and a low debt-to-income ratio to qualify for a lower rate. Remember, F5 Mortgage can assist you in navigating these requirements and choosing the right refinance loan tailored to your financial situation.

Navigate Challenges in Mortgage Interest Calculation

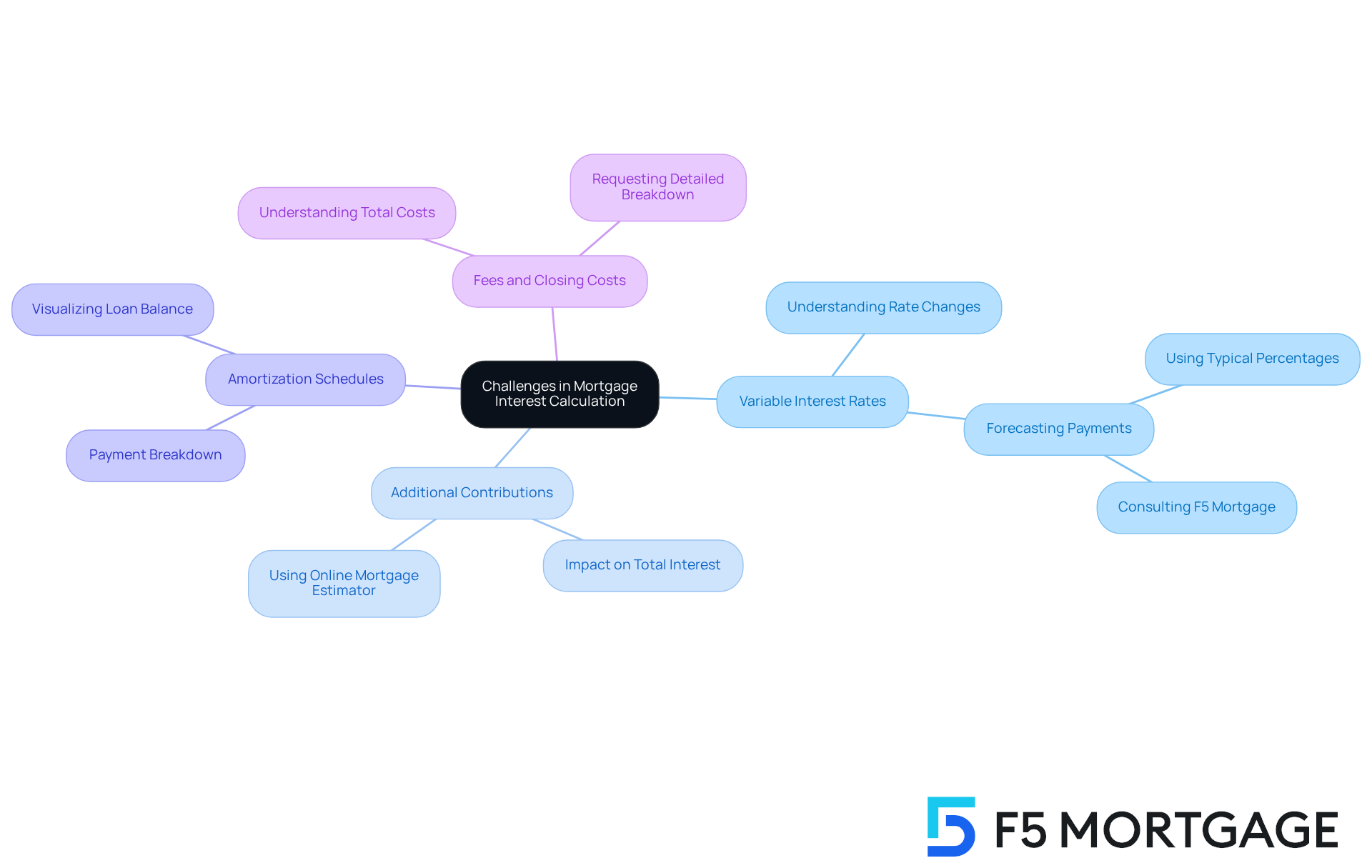

Calculating mortgage costs can present several challenges, and knowing how to calculate mortgage interest can feel overwhelming. However, with F5 Mortgage’s technology-driven approach, you can navigate these issues more effectively. Here are some common problems families face, along with our consumer-centric solutions that can help:

-

Variable Interest Rates: If your mortgage has a variable interest rate, your payments may change over time. To assess upcoming disbursements, consider using a typical percentage, or reach out to F5 Mortgage for forecasts tailored to your unique circumstances. Our transparent communication ensures you understand how these rates can impact your finances.

-

Additional Contributions: Are you planning to make extra contributions towards your principal? This can significantly reduce the total interest paid. Use our online mortgage estimator to see how extra contributions influence your financing, enabling you to make informed choices that align with your financial goals.

-

Amortization Schedules: Understanding how your contributions are allocated can be intricate. At F5 Mortgage, we provide clear amortization schedules that break down each payment into principal and other costs, helping you visualize how your loan balance diminishes over time.

-

Fees and Closing Costs: It’s essential to remember that the interest rate is not the only cost associated with a mortgage. Be aware of additional fees that may affect your overall financial picture. At F5 Mortgage, we prioritize transparency, so always feel free to ask us for a detailed breakdown of all costs involved.

By being aware of these challenges and leveraging F5 Mortgage’s innovative solutions, you can understand how to calculate mortgage interest with greater confidence and accuracy. We’re here to support you every step of the way, ensuring a stress-free experience as you upgrade your home.

Conclusion

Understanding how to calculate mortgage interest is essential for making informed financial decisions when it comes to home financing. We know how challenging this can be, but by grasping the core components such as principal, interest rate, and borrowing term, you can navigate the complexities of mortgage costs with greater ease. This knowledge not only empowers you to choose favorable terms but also highlights the potential savings that can be achieved through careful calculation and evaluation of different lending options.

This article provides a clear, step-by-step approach to calculating mortgage interest, emphasizing the importance of accurate figures and the use of the mortgage formula. Key insights include:

- The impact of interest rates on long-term payments.

- The value of making extra contributions toward the principal.

- Common challenges faced by borrowers, such as variable interest rates and hidden fees.

- Practical solutions to enhance your understanding and confidence in the mortgage process.

Ultimately, being well-informed about how to calculate mortgage interest can lead to significant financial benefits. Whether you are considering a new mortgage or refinancing an existing one, taking the time to understand these calculations is crucial. Leveraging resources and tools, such as those provided by F5 Mortgage, can simplify the process and ensure that you are equipped to make the best possible choices for your financial future. We’re here to support you every step of the way.

Frequently Asked Questions

What is the principal in a mortgage?

The principal is the total amount borrowed from the lender, forming the basis of your loan.

What is the interest rate in a mortgage?

The interest rate is the percentage charged on the principal and can be either fixed or variable. Currently, the average borrowing rate for a 30-year fixed mortgage is about 6.58%.

What does the borrowing term refer to in a mortgage?

The borrowing term indicates the duration over which the amount must be repaid, typically spanning 15 to 30 years.

Why is it important to understand mortgage interest components?

Understanding these components is crucial for grasping how fees are determined and their impact on monthly payments and total borrowing expenses.

How can a decrease in interest rates affect mortgage payments?

A 0.5% decrease in rates can save borrowers approximately $5,500 in the first five years alone.

What is considered a below-standard borrowing cost in today’s market?

A borrowing cost of 3.5% is considered below standard in today’s market.

Why is it important to evaluate offerings from various lenders?

Evaluating offerings from different lenders is essential to secure the most advantageous terms and potentially save on borrowing costs.

What should borrowers consider in relation to current mortgage costs?

Borrowers should consider that current mortgage costs have already incorporated expected Federal Reserve reductions, making it an ideal moment to explore alternatives.