Overview

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. It involves several key steps:

- Choosing a financial institution

- Gathering necessary documents

- Completing the application

- Understanding the associated costs and terms

We know how challenging this can be, especially when navigating financial decisions that impact your family.

As you embark on this journey, it’s important to consider factors like your credit rating, debt-to-income ratio, and property equity. These elements can significantly influence your approval and help you effectively leverage your home equity for upgrades and renovations. By understanding these aspects, you can feel more empowered in your decision-making process.

Take a moment to gather your thoughts and documents. Remember, you’re not alone in this. Many families have successfully navigated this process, and with the right guidance, you can too. Let’s break down these steps together, ensuring you’re well-prepared to make the most of your home equity.

Introduction

Navigating the world of home financing can be daunting, especially when considering a Home Equity Line of Credit (HELOC). We know how challenging this can be, and as families increasingly seek to upgrade their living spaces, understanding the intricacies of applying for a HELOC becomes essential. This guide not only outlines the steps to secure a HELOC but also highlights the benefits and potential pitfalls, empowering homeowners to make informed decisions.

What challenges might arise during the application process? How can families effectively leverage their home equity to enhance their properties? We’re here to support you every step of the way.

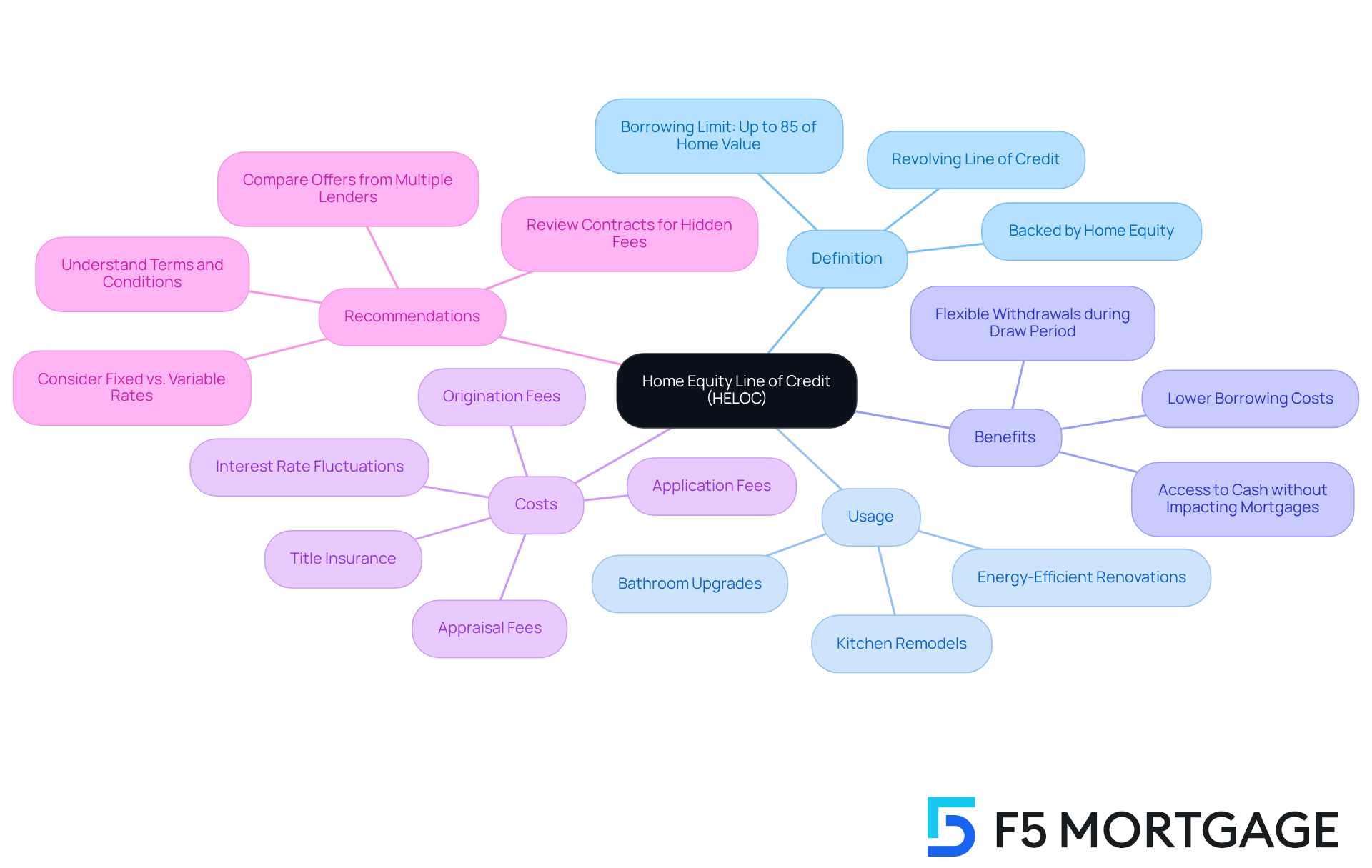

Understand Home Equity Lines of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a revolving line of credit backed by the equity in your property. It allows you to borrow against your home’s worth—typically up to 85% of the assessed value, minus any outstanding mortgage balance. In 2025, many families are turning to HELOCs for various purposes, such as home enhancements and renovations. The flexibility to withdraw funds as needed during the draw period, which usually lasts between 5 to 10 years, makes it an appealing choice. During this initial phase, borrowers often only need to make interest payments, which can help ease cash flow concerns.

As the draw period comes to an end, the repayment phase begins, requiring both principal and interest payments. Understanding this transition is vital for families, as it significantly impacts budgeting and financial planning. Financial advisors emphasize the importance of understanding how to apply for a HELOC and the terms of a home equity line of credit. They advise borrowers to carefully review contracts to uncover any hidden fees and to understand how interest rates may fluctuate based on market conditions.

In 2025, the average loan amounts for HELOCs are around $30,000, reflecting a growing trend among homeowners to leverage their equity for meaningful projects. Successful home improvement projects financed by HELOCs often include:

- Kitchen remodels

- Bathroom upgrades

- Energy-efficient renovations

These upgrades not only enhance the living space but also increase the property’s market value.

The key benefits of using a home equity line of credit for property enhancements include:

- Lower borrowing costs compared to credit cards and personal loans

- Access to cash without impacting current low-rate mortgages

We encourage families to compare offers from various lenders, such as F5 Mortgage, which is known for competitive rates and personalized service, especially when learning how to apply for a HELOC. This can help secure the best terms and rates available.

Furthermore, understanding the costs associated with refinancing in California is essential. These costs typically range from 2% to 5% of the loan amount and include application fees, origination fees, appraisal fees, and title insurance, among others. Given the current favorable lending environment and the potential for future rate reductions, we encourage families to explore home equity line options for financing their home improvement goals effectively.

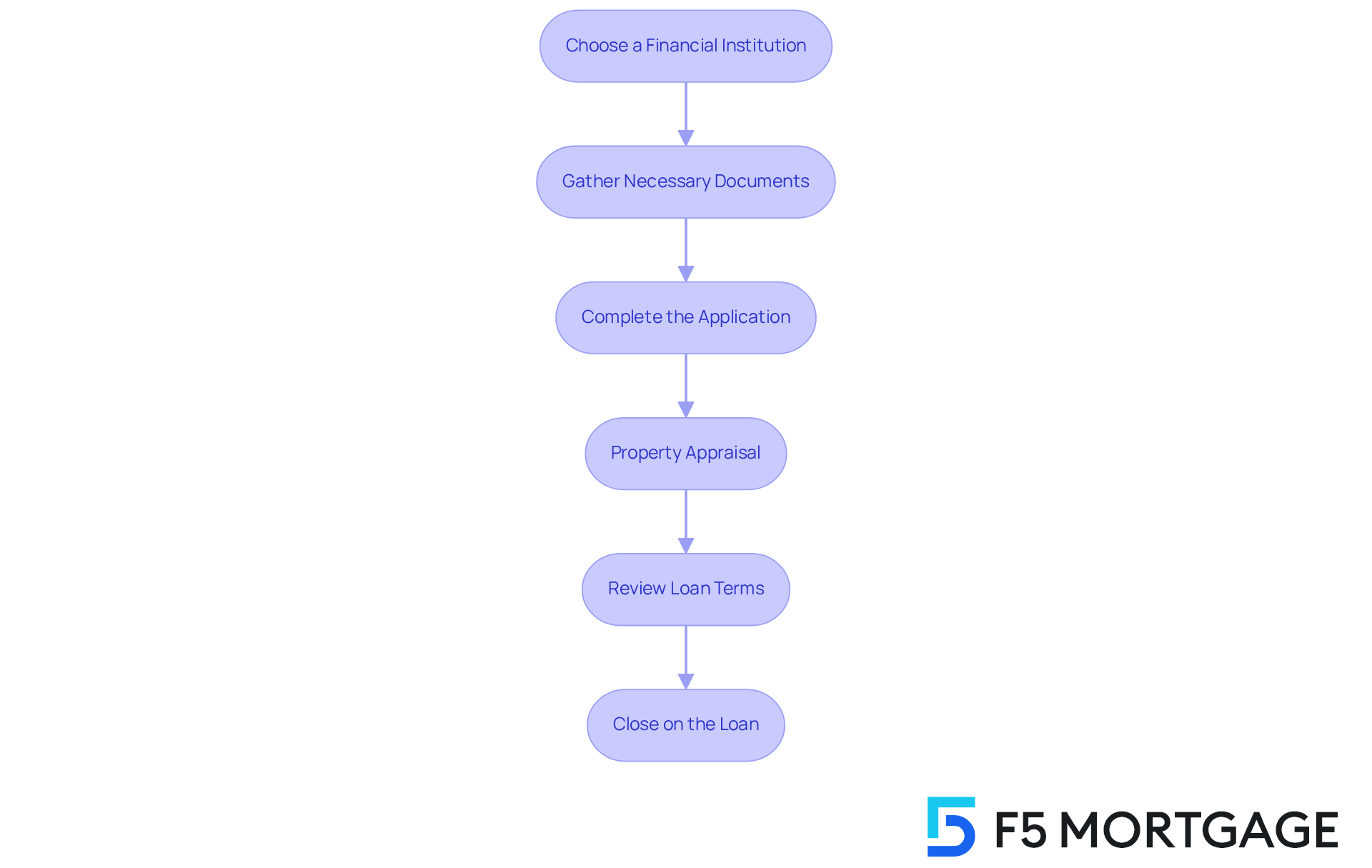

Follow the Application Steps for a HELOC

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way in learning how to apply for a HELOC. Follow these essential steps to navigate the process with ease:

-

Choose a financial institution: Start by researching various providers, including traditional banks and credit unions. Look for competitive rates and favorable terms. Consider partnering with F5 Mortgage for personalized service and competitive rates. Remember, HELOC requirements can differ greatly depending on the institution, so it’s wise to compare your options.

-

Gather Necessary Documents: Prepare key documents like proof of income (recent pay stubs and tax returns), a list of current debts, and details about your residence, including the property tax bill and mortgage statement. Most institutions require a credit score of at least 680 and a debt-to-income ratio under 43%. Additionally, many require homeowners to maintain a minimum of an 80% loan-to-value ratio, meaning you should have reduced at least 20% of your initial loan amount or that your property should have appreciated in value. Before understanding how to apply for a HELOC, ensure your financial record is unfrozen, as this is crucial for the application.

-

Complete the Application: To understand how to apply for a HELOC, fill out the application form accurately, providing information about your financial situation and how you plan to use the HELOC funds. Be prepared to disclose your current mortgage details, including the amount owed and monthly payments. If possible, improving your credit score or reducing debt before you learn how to apply for a HELOC can enhance your chances of approval.

-

Property Appraisal: Expect the institution to require a property appraisal to evaluate your asset’s current market value. This evaluation is vital, as it affects your borrowing ability. Most institutions allow borrowing up to 85% of your home’s worth.

-

Review Loan Terms: After approval, take the time to carefully review the loan terms, including interest rates, fees, and repayment schedules. Understanding these details is essential to ensure the home equity line of credit aligns with your financial objectives. Be mindful that closing expenses may vary from 2% to 5% of your borrowing capacity, depending on the institution.

-

Once you agree to the terms, close on the loan at a closing meeting where you can also learn how to apply for a HELOC. Here, you will sign the necessary documents and gain access to your funds, typically within two to six weeks after submitting your application.

We understand that this process can be daunting, but with the right preparation and support, you can navigate it successfully.

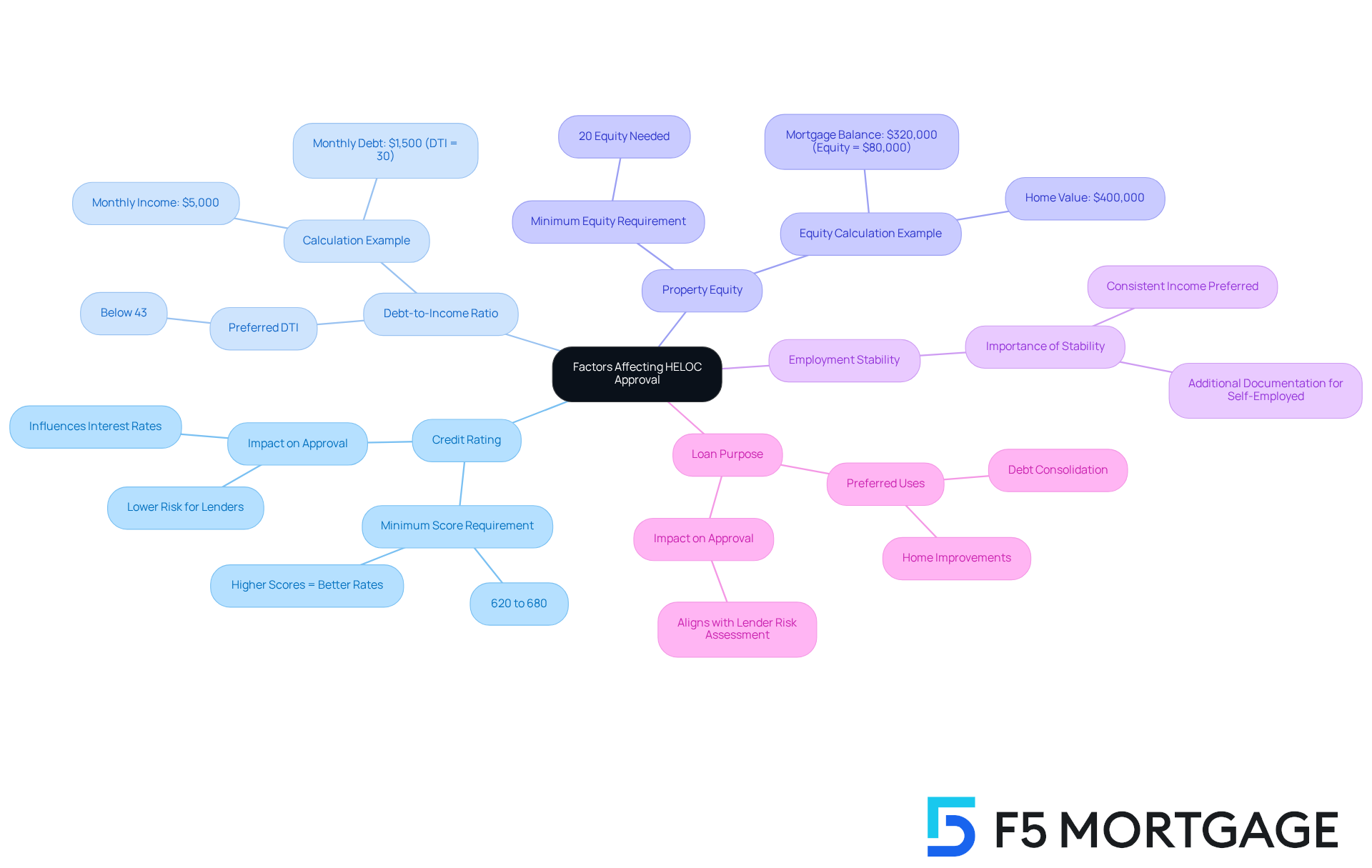

Evaluate Factors Affecting HELOC Approval

Several factors can significantly influence your HELOC approval, and we understand how challenging this process can be:

-

Credit Rating: Most financial institutions typically require a minimum score ranging from 620 to 680. A higher credit score not only enhances your chances of approval but also opens the door to more favorable rates and terms. For instance, borrowers with scores above 680 often secure better interest rates, reflecting their lower risk to lenders. We know how important it is to feel secure in your financial decisions.

-

Debt-to-Income Ratio (DTI): Lenders generally prefer a DTI ratio below 43%. This ratio compares your total monthly debt payments to your gross monthly income, serving as a key indicator of your ability to manage additional debt. For example, if your monthly earnings are $5,000 and your overall monthly debt obligations are $1,500, your DTI would be 30%, which is advantageous for eligibility for a home equity line of credit. Understanding how to apply for a heloc can empower you to take control of your finances.

-

Property Equity: To be eligible for a home equity line of credit, you usually require a minimum of 20% equity in your property. Lenders will assess your property’s current market value in comparison to your outstanding mortgage balance to ascertain your available equity. For instance, if your property is valued at $400,000 and your mortgage balance is $320,000, you possess $80,000 in equity, qualifying you for a home equity line of credit. Understanding your equity can provide guidance on how to apply for a heloc and help you plan your next steps effectively.

-

Employment and Income Stability: Lenders favor applicants with stable employment and consistent income. If you’re self-employed, you may need to provide additional documentation, such as tax returns and profit-loss statements, to demonstrate your income reliability. We’re here to support you every step of the way in understanding how to apply for a heloc to showcase your financial stability.

-

Loan Purpose: Clearly expressing the reason for your home equity line of credit can also affect approval. Lenders are more likely to favor applications intended for home improvements or debt consolidation, as these purposes align with their risk assessment strategies. For example, families seeking funds for renovations may be viewed as making a sound investment in their property, enhancing their overall financial profile. Remember, understanding how to apply for a heloc and presenting your intentions clearly can make a significant difference in the approval process.

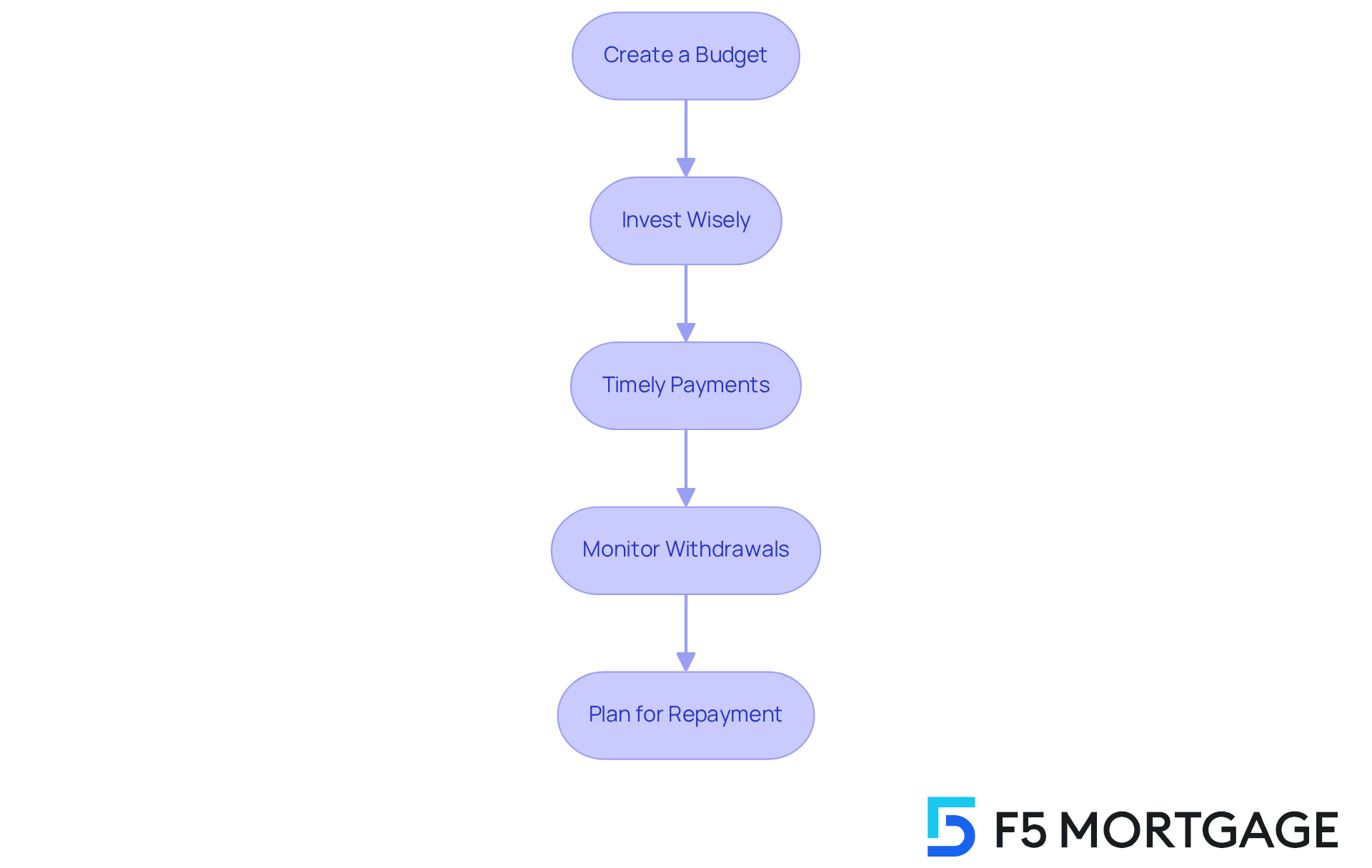

Manage and Utilize Your HELOC Effectively

To effectively manage and utilize your HELOC, we know how important it is to consider the following strategies:

-

Create a Budget: Establish a detailed budget outlining how you intend to use the funds. This approach helps prevent overspending and ensures you can repay the borrowed amount without financial strain. According to recent data, 54% of homeowners who’ve secured a home equity line of credit have utilized it for renovations, highlighting the importance of budgeting for such investments.

-

Invest Wisely: Consider using your HELOC for intentional investments, such as enhancements that can significantly boost your property value. Research suggests that renovations financed by HELOCs can lead to substantial increases in property value, often generating returns that surpass the original investment. For instance, homeowners have seen average increases in home value of up to 20% from strategic renovations.

-

Timely Payments: Make it a priority to pay your HELOC on time. Regular, prompt payments assist you in avoiding penalties and preserving a favorable score. Setting up automatic payments can simplify this process. As noted by financial experts, maintaining a good credit score is crucial for future borrowing opportunities.

-

Monitor Withdrawals: Keep a close eye on your withdrawals to ensure they align with your budget. Avoid using your home equity line of credit for daily expenses, as this can lead to financial strain and undermine your long-term goals. A case study of a family that successfully managed their home equity line of credit funds demonstrates how monitoring expenses can avoid excessive spending and guarantee funds are utilized efficiently.

-

Plan for Repayment: As you near the end of the draw period, begin planning for the repayment phase. Transitioning from interest-only payments to principal and interest payments requires careful budgeting and financial foresight. Experts recommend creating a repayment plan early to avoid surprises later.

By following these guidelines, families can maximize the benefits of their HELOC while minimizing risks, ensuring that their financial goals are met effectively. We’re here to support you every step of the way.

Conclusion

Applying for a Home Equity Line of Credit (HELOC) can be a strategic way for families to finance home improvements and renovations by leveraging the equity in their property. We understand how important it is to navigate this process with confidence, from selecting a lender to managing the funds effectively. By following the outlined steps and being aware of the factors that influence approval, families can make informed financial decisions.

Throughout this guide, we’ve highlighted key points such as:

- The importance of credit scores

- Debt-to-income ratios

- The various stages of the application process

Families have learned how to prepare necessary documents, the significance of property appraisals, and the need to review loan terms carefully. Additionally, we discussed effective management strategies for HELOC funds, emphasizing:

- Budgeting

- Timely payments

- Planning for the repayment phase

Ultimately, a HELOC can be a valuable resource for families looking to enhance their homes and increase property value. By utilizing this guide, families can approach the HELOC application process with a clearer understanding, ensuring they make the most of their financial opportunities. We know how challenging this can be, so it’s essential to act wisely, stay informed, and consider consulting with financial advisors to maximize the benefits of a HELOC while minimizing potential risks.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit that is backed by the equity in your property, allowing you to borrow against your home’s worth, typically up to 85% of the assessed value minus any outstanding mortgage balance.

What are common uses for a HELOC in 2025?

Many families are using HELOCs for home enhancements and renovations, such as kitchen remodels, bathroom upgrades, and energy-efficient renovations.

What is the draw period for a HELOC?

The draw period usually lasts between 5 to 10 years, during which borrowers can withdraw funds as needed and often only need to make interest payments.

What happens after the draw period ends?

After the draw period, the repayment phase begins, requiring borrowers to make both principal and interest payments, which can significantly impact budgeting and financial planning.

What should borrowers consider when applying for a HELOC?

Borrowers should carefully review contracts for hidden fees and understand how interest rates may fluctuate based on market conditions.

What is the average loan amount for HELOCs in 2025?

The average loan amount for HELOCs in 2025 is around $30,000.

What are the key benefits of using a HELOC for home improvements?

Key benefits include lower borrowing costs compared to credit cards and personal loans, as well as access to cash without impacting current low-rate mortgages.

How can families secure the best terms for a HELOC?

Families are encouraged to compare offers from various lenders, such as F5 Mortgage, known for competitive rates and personalized service.

What are the typical costs associated with refinancing in California?

Refinancing costs in California typically range from 2% to 5% of the loan amount and may include application fees, origination fees, appraisal fees, and title insurance.

Why should families explore home equity line options?

Given the current favorable lending environment and potential for future rate reductions, families are encouraged to explore HELOCs for effectively financing their home improvement goals.