Introduction

Navigating the complexities of homeownership can be overwhelming for families, and the thought of mortgage refinancing often feels like a beacon of hope. By replacing an existing mortgage with a new one, homeowners have the chance to secure lower interest rates, reduce monthly payments, or even access cash for other important expenses.

But with interest rates fluctuating and various lender options available, how can families ensure they’re making the best choice for their financial future? We know how challenging this can be, and understanding the critical steps and considerations in the refinancing process can empower you to maximize your savings.

Imagine being able to breathe a little easier each month, knowing you’ve made a smart financial decision. By taking the time to explore your options, you can achieve greater financial stability and peace of mind. We’re here to support you every step of the way.

Understand Mortgage Refinancing Basics

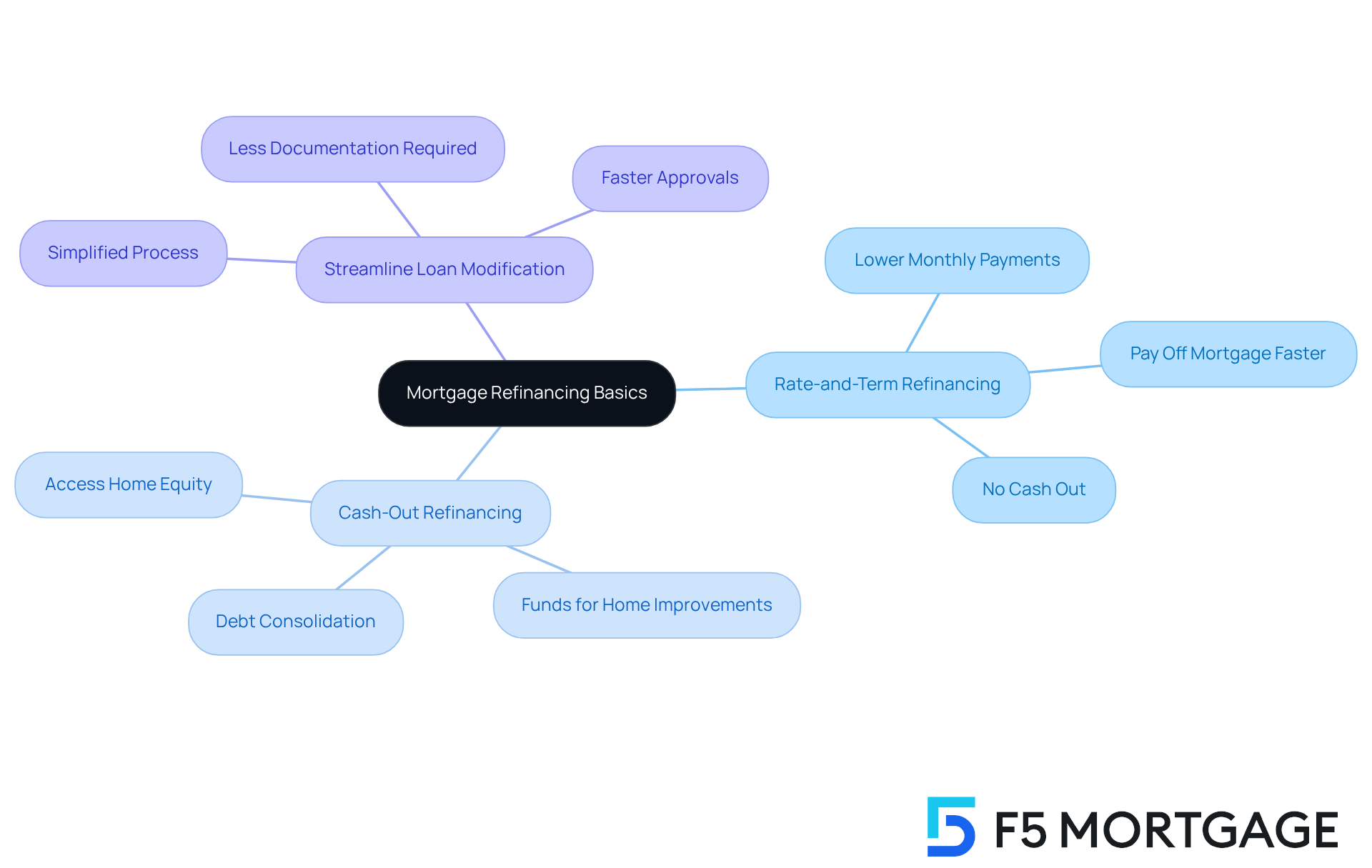

Mortgage restructuring can feel overwhelming, but it’s a valuable opportunity to ease your financial burden. By substituting your current mortgage with a new one, you can often secure a lower interest rate or adjust your repayment period. Many families are seeking to restructure their loans to lower monthly payments, tap into home equity, or consolidate debt. Understanding the different types of refinancing available is essential for making informed decisions that suit your needs:

- Rate-and-Term Refinancing: This option allows you to change the interest rate and/or the term of your loan without taking out additional cash. It’s perfect for those wanting to reduce monthly payments or pay off their mortgage faster.

- Cash-Out Refinancing: If you refinance for more than you owe on your current mortgage, you can receive the difference in cash. This can be a lifeline for families needing funds for home improvements, education, or debt consolidation.

- Streamline Loan Modification: Designed for current FHA or VA loans, this option simplifies the loan adjustment process, often requiring less documentation and offering quicker approvals.

As we look ahead to 2025, many families are considering how much to refinance mortgage, driven by average interest rates hovering around 6%. This presents substantial savings opportunities. For instance, families who purchased homes in 2023 or early 2024 with rates above 7% could save significantly by evaluating how much to refinance mortgage and restructuring their loans now.

Real-life examples of successful loan modifications highlight the benefits: families who adjusted their loans have reported monthly savings that can reach hundreds of dollars. This newfound flexibility can lead to better budget management and financial peace of mind. Financial consultants emphasize the importance of comparing your existing mortgage terms with current proposals. Consider your expenses and how long you plan to stay in your home. This thoughtful approach ensures you maximize your financial advantages while aligning with your long-term goals.

We know how challenging this process can be, but remember, you’re not alone. We’re here to support you every step of the way.

Identify Key Factors Affecting Refinance Amount

Several key factors can significantly influence how much you can refinance, and we know how challenging this process can be:

-

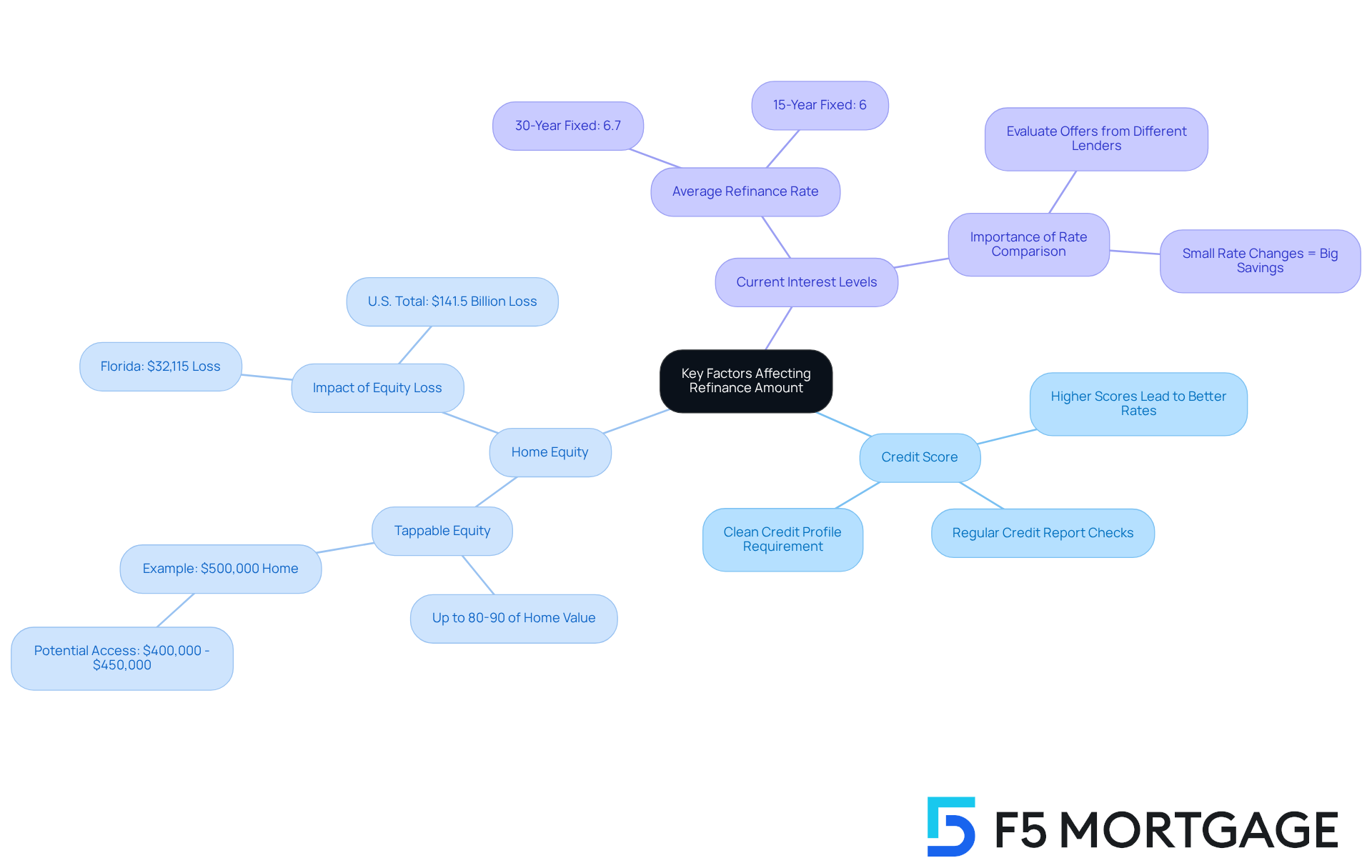

Credit Score: A higher credit score generally leads to more favorable interest rates and terms. Families should routinely examine their credit reports and take steps to improve their scores. A clean credit profile is often a requirement for obtaining a new loan, and we’re here to support you every step of the way.

-

Home Equity: The equity in your home plays a crucial role in determining your loan options. Lenders typically allow restructuring of loans up to 80-90% of your home’s appraised value. For instance, if your home is valued at $500,000, you could potentially access $400,000 to $450,000 in refinancing, depending on your lender’s policies. This ‘tappable’ equity can be a valuable resource for families looking to consolidate debt or fund home improvements.

-

Current Interest Levels: Keeping an eye on existing mortgage levels is essential, as lower rates can lead to significant savings. As of November 2025, the average refinance percentage for a 30-year fixed mortgage is around 6.7%. Families should evaluate offers from different financial institutions to find the best deal, as even a slight percentage reduction can result in considerable monthly savings.

Understanding these factors can empower families to make informed choices regarding loan adjustments, ultimately improving their financial well-being.

Calculate Your Potential Refinance Amount

Calculating your potential refinance amount can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps:

-

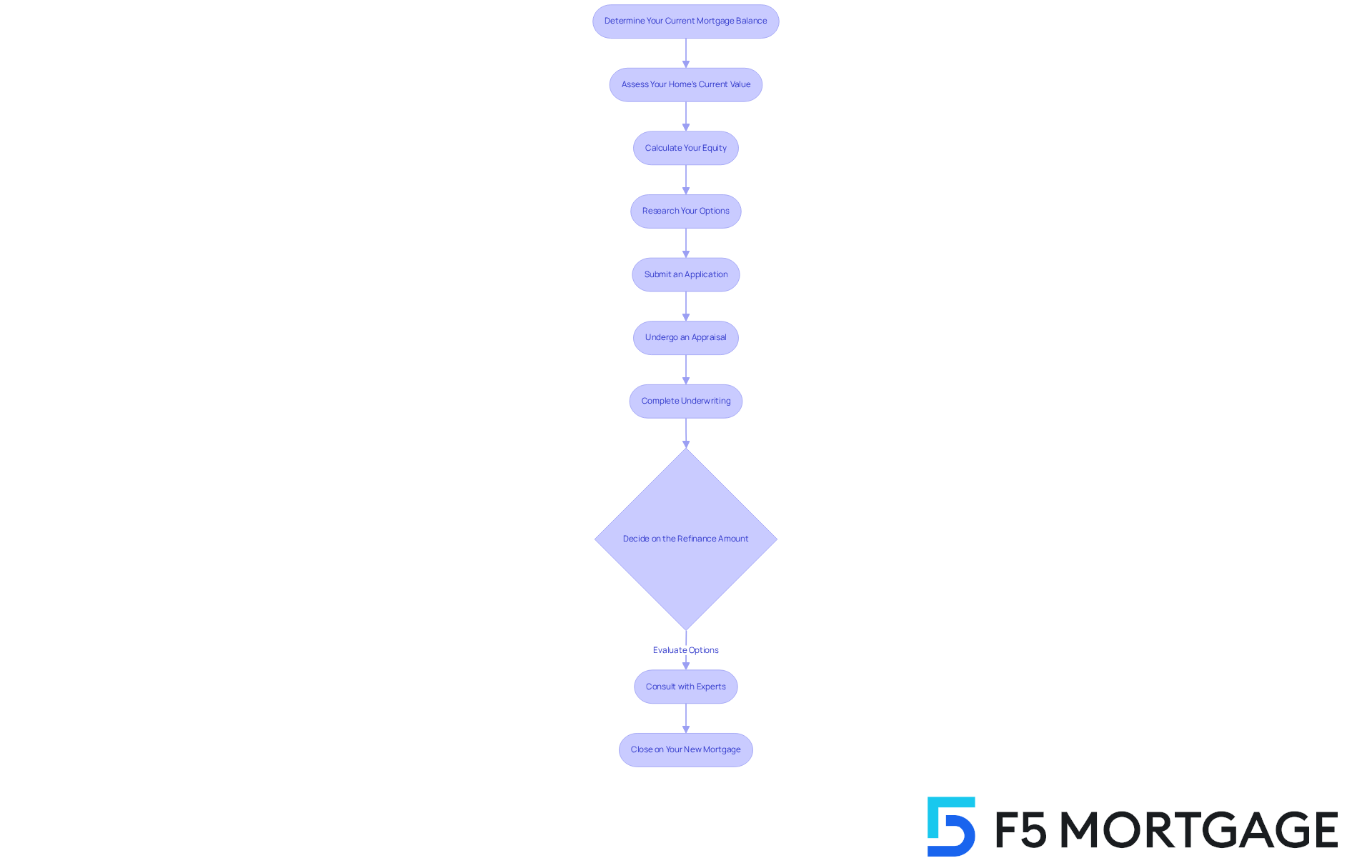

Determine Your Current Mortgage Balance: Start by checking your latest mortgage statement to see how much you owe. Knowing this number is crucial as it sets the stage for your refinancing journey.

-

Assess Your Home’s Current Value: Next, take a moment to estimate your home’s market value. You can use online real estate platforms or consult a trusted real estate agent. Understanding your home’s worth is key to making informed decisions.

-

Calculate Your Equity: Now, let’s figure out your equity. Simply subtract your mortgage balance from your home’s value. For instance, if your home is valued at $300,000 and you owe $200,000, your equity stands at $100,000. This equity can be a powerful tool in your refinancing process.

-

Research Your Options: Once you’ve assessed your financial situation, it’s time to explore your refinance options. While sticking with your current lender is one route, don’t hesitate to evaluate various institutions and loan choices. This can help you discover the most favorable rates and conditions that suit your needs.

-

Submit an Application: After you’ve done your research, you’ll need to submit a refinancing application. This will include information about your property and other financial documents. It might seem daunting, but remember, this is a crucial step toward achieving your financial goals.

-

Undergo an Appraisal: Once your application is submitted, the financial institution will conduct an appraisal to assess your property’s current value. This step is essential in determining how much to refinance mortgage.

-

Complete Underwriting: The next phase involves underwriting, where the lender will review your borrowing request, credit history, debt-to-income ratio, and other requirements. This process ensures that you’re making a sound financial decision.

-

Decide on the refinance amount by evaluating how much to refinance mortgage based on your equity and financial goals. Do you want to cash out some equity, or are you simply looking to lower your monthly payments? This decision is pivotal in shaping your refinancing experience.

-

Consult with Experts: Collaborating with a mortgage officer or real estate specialist can provide valuable insights. They can help you evaluate your home’s worth accurately and guide you through the refinancing process efficiently. Their expertise can empower you to make informed decisions that align with your financial aspirations.

-

Close on Your New Mortgage: Finally, once your application is accepted, you can close the deal. This involves signing the new documents and paying closing costs. After everything is finalized, your new lender will settle your initial credit, and your monthly mortgage payments will shift to your new lender.

We know how challenging this can be, but taking these steps can lead you to a more favorable financial future.

Evaluate Costs and Fees of Refinancing

Refinancing a mortgage can feel overwhelming, especially when you consider the various expenses involved. These costs typically range from 2% to 6% of the amount borrowed, and understanding how much to refinance mortgage is crucial for families considering their refinancing options. This is particularly true for those considering rate-and-term financing, a popular choice among California homeowners. These financial products aim to lower monthly payments by replacing an existing mortgage with one that offers a better rate or different term length.

Here are some key costs to keep in mind:

-

Loan Origination Fee: This fee covers the lender’s processing costs and usually amounts to about 1% of the loan amount. For example, on a $300,000 mortgage, this fee could be around $3,000.

-

Appraisal Fee: An appraisal is often necessary to determine your home’s current value, with costs typically ranging from $300 to $600. This step is vital for understanding how much equity you have in your home, especially when applying for a new loan.

-

Title Insurance and Search Fees: These fees protect against potential claims on the property and can vary significantly based on your location. It’s wise to ask how much to refinance mortgage early in the refinancing process.

-

Closing Costs: These encompass various administrative fees that can add up quickly. Always request a detailed estimate of all costs from your financial institution before proceeding to understand how much to refinance mortgage and ensure transparency.

Some lenders may even offer incentives, like waiving closing costs, which can be a great help for families looking to minimize upfront expenses. Improving your credit score can also significantly reduce refinancing costs, as a higher score often leads to lower borrowing costs. Additionally, consider the option of rolling closing expenses into the mortgage. This can ease the cash requirement upfront, though it may increase the total amount owed.

Mortgage professionals stress the importance of understanding how much to refinance mortgage and the associated fees. As one specialist noted, “Every provider is unique regarding rates and conditions for refinancing, so explore your options to discover the best choices for you.” By carefully evaluating these costs and considering all available options-like the potential benefits of rate-and-term loans and the flexibility to switch between variable and fixed-rate mortgages-families can make informed decisions that align with their financial goals. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Compare Refinancing Options and Lenders

When it comes to understanding how much to refinance mortgage, we know how challenging this can be for families in exploring refinancing options and lenders. It’s essential to focus on several critical factors that can make a significant difference in your financial journey:

-

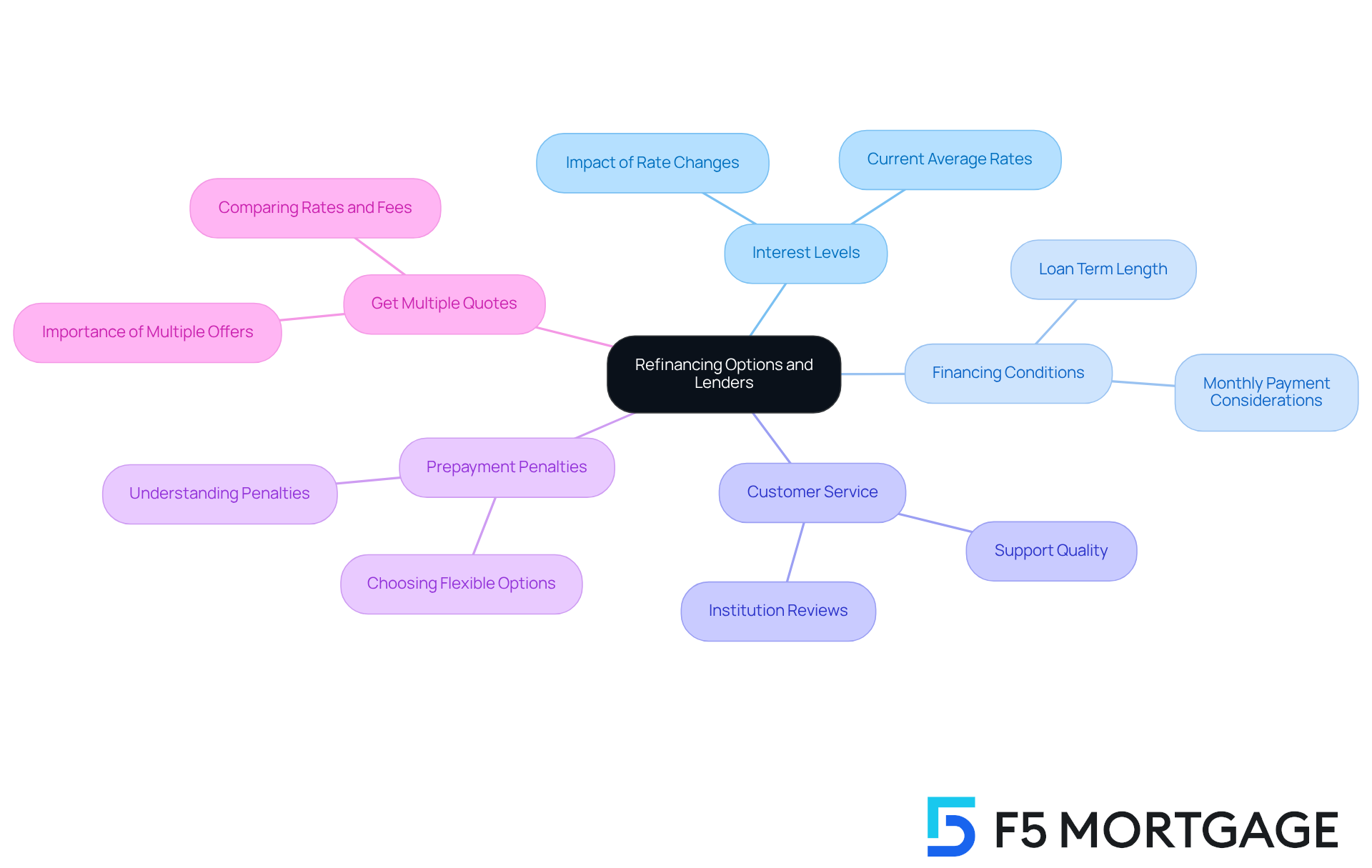

Interest Levels: Look for lenders that offer attractive terms. A seemingly minor difference in interest rates can lead to substantial savings over time. For instance, refinancing from a 30-year mortgage at 7% to one at 6% could save you thousands in interest payments.

-

Financing Conditions: Evaluate the length of the financing to ensure it aligns with your financial goals. While shorter loan terms typically come with higher monthly payments, they often result in lower overall interest costs. This can be a great option for those looking to pay off their mortgage sooner.

-

Customer Service: Take a moment to examine reviews and ratings of financial institutions. Understanding their customer service quality is crucial. An institution known for excellent support can significantly ease the refinancing process, ensuring you feel informed and confident every step of the way.

-

Prepayment Penalties: It’s important to ascertain if the financial institution imposes any penalties for early loan repayment. Such penalties can diminish long-term savings, so selecting a provider that offers flexibility is essential.

-

Get Multiple Quotes: We recommend obtaining quotes from at least three lenders. This practice allows families to effectively compare rates, fees, and terms, ensuring you understand how much to refinance mortgage to secure the best possible deal. With mortgage loan refinances accounting for nearly 47% of all mortgage applications recently, the competitive landscape offers ample opportunities for families to find favorable refinancing options.

Conclusion

Mortgage refinancing offers a valuable opportunity for families to ease financial burdens and potentially save thousands on their mortgage payments. We know how challenging this can be, but by exploring various refinancing options – like rate-and-term refinancing, cash-out refinancing, and streamline loan modifications – families can make informed decisions that align with their unique financial situations and long-term aspirations.

Key factors influencing the refinancing process include:

- Credit scores

- Home equity

- Current interest rates

Understanding these elements is crucial. We encourage families to take practical steps, such as calculating potential refinance amounts and evaluating costs and fees. Thorough research and comparison among lenders can make a significant difference. Engaging with financial professionals can further enhance your understanding and confidence as you navigate this complex process.

In light of the financial implications of refinancing, we urge families to take proactive steps in evaluating their mortgage options. By carefully considering your unique circumstances and seeking expert advice, you can harness the power of refinancing to achieve greater financial stability and peace of mind. The potential savings and benefits of mortgage refinancing in 2025 are substantial, making it an essential consideration for anyone looking to improve their financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing involves substituting your current mortgage with a new one, often to secure a lower interest rate or adjust the repayment period, which can help ease financial burdens.

What are the main types of mortgage refinancing?

The main types of mortgage refinancing are: – Rate-and-Term Refinancing: Changes the interest rate and/or term of the loan without taking out additional cash. – Cash-Out Refinancing: Allows you to refinance for more than you owe, providing the difference in cash for expenses like home improvements or debt consolidation. – Streamline Loan Modification: Simplifies the loan adjustment process for current FHA or VA loans, often requiring less documentation.

Why are families considering refinancing in 2025?

Many families are considering refinancing in 2025 due to average interest rates around 6%, which presents substantial savings opportunities for those with higher rates from previous home purchases.

How can refinancing benefit families financially?

Refinancing can lead to significant monthly savings, better budget management, and financial peace of mind, especially for families who adjust their loans to lower interest rates.

What factors affect how much I can refinance?

Key factors that influence refinancing amounts include: – Credit Score: Higher scores lead to better interest rates and terms. – Home Equity: Lenders typically allow restructuring up to 80-90% of your home’s appraised value. – Current Interest Levels: Monitoring existing mortgage rates is crucial, as lower rates can lead to savings.

How can I find the best refinancing deal?

Families should evaluate offers from different financial institutions and compare existing mortgage terms with current proposals to find the best deal, as even small percentage reductions can result in significant savings.