Overview

Navigating the mortgage landscape for a $200,000 home can feel overwhelming, especially when considering various factors like interest rates, loan duration, and down payment amounts. Typically, monthly payments are estimated around $1,299 at a 6.74% interest rate for a 30-year term. We understand how challenging this can be, which is why it’s crucial to grasp these essential elements.

In addition to the mortgage itself, it’s important to consider extra costs such as property taxes and insurance. Understanding these expenses is vital for accurately assessing your total mortgage obligations. By being informed, you can make confident financial decisions that align with your family’s needs.

We’re here to support you every step of the way as you embark on this journey. Remember, knowledge is power, and taking the time to understand these factors will empower you to make the best choices for your future.

Introduction

We understand that grasping the intricacies of mortgage payments can feel overwhelming, especially for first-time homebuyers considering a $200,000 property. With various factors at play—from interest rates to down payments—it’s essential to navigate this financial landscape with care. As you seek clarity in this process, a pressing question arises: how can you accurately estimate the true cost of a mortgage while steering clear of common pitfalls?

In this article, we will explore the essential elements that influence mortgage payments. Our goal is to equip you with the knowledge and confidence needed to tackle your home financing journey. Remember, we’re here to support you every step of the way.

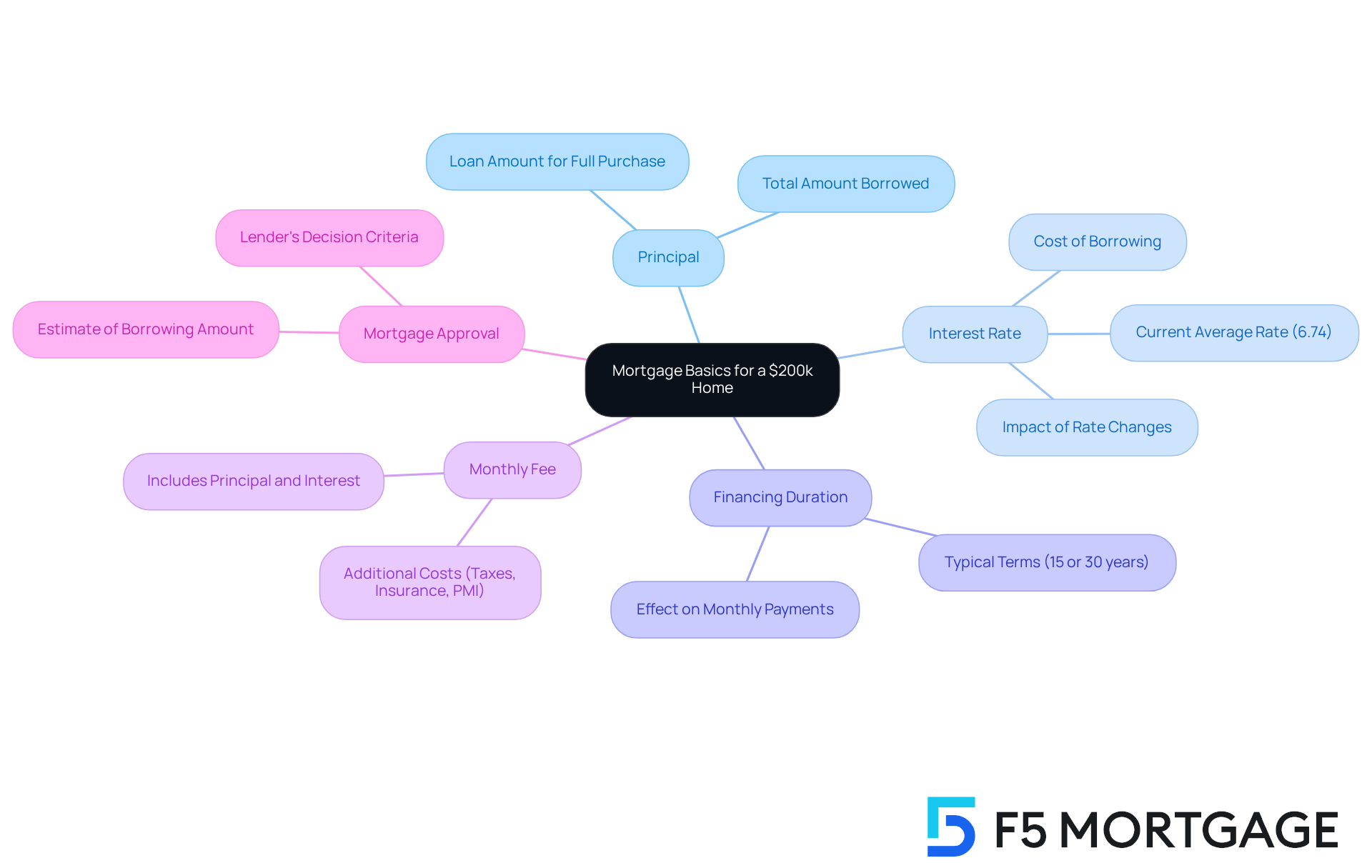

Understand Mortgage Basics for a $200k Home

To accurately assess the cost of a mortgage on a $200,000 home, we know how crucial it is to understand several fundamental mortgage concepts:

-

Principal: This is the total amount borrowed from the lender. If you want to find out how much is a mortgage on a 200k house, obtaining a loan for the full amount means your principal will be $200,000.

-

Interest Rate: This represents the cost of borrowing, expressed as a percentage. As of 2025, average borrowing costs for a 30-year fixed loan hover around 6.74%. However, these figures can vary based on market conditions, your credit score, and the specific loan type. If you’re considering adjustable-rate mortgages (ARMs), remember that they often start with lower introductory terms, which can be beneficial if you plan to sell or refinance in a few years. Just keep in mind that these rates adjust periodically, so understanding the caps on interest adjustments is essential for managing potential risks.

-

Financing Duration: This indicates the period over which you will repay the amount borrowed, typically 15 or 30 years. While an extended loan duration usually leads to reduced monthly costs, it raises the overall interest paid throughout the lifespan of the loan. For example, at a 6.74% interest rate, if you’re wondering how much is a mortgage on a 200k house, the monthly installments would be around $1,299. This clearly demonstrates the considerable effect of interest rates on affordability.

-

Monthly Fee: This includes the principal and interest, and may also incorporate property taxes, homeowners insurance, and private mortgage insurance (PMI) if your down payment is below 20%. It’s essential to factor in these additional costs to get a complete picture of your monthly financial commitment.

-

Mortgage Approval: An approval is a lender’s decision that you are a good candidate for a mortgage based on your financial information. This process generally offers an estimate of your borrowing amount, interest rate, and possible monthly payment, which can differ among lenders. Understanding this process is crucial, as it directly impacts your funding options and overall financial planning.

By grasping these essential ideas, you’ll feel more prepared to explore financing choices and make informed decisions as you pursue homeownership. Furthermore, comparing interest rates from various providers can lead to significant savings. In fact, borrowers who obtain a rate quote from just one more lender save an average of $600 over the duration of their financing. We’re here to support you every step of the way as you navigate this important journey.

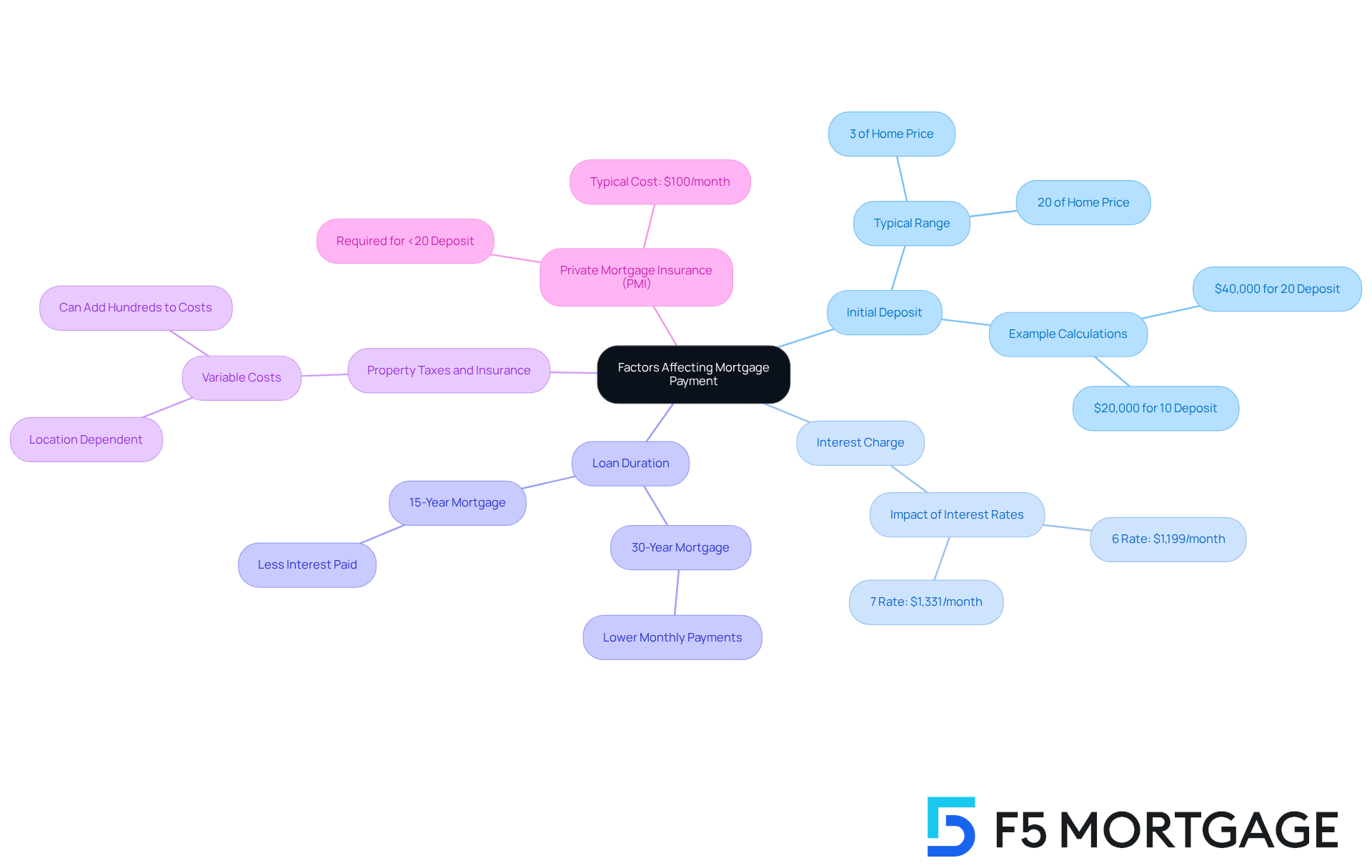

Identify Key Factors Affecting Your Mortgage Payment

When considering a mortgage payment on a $200,000 home, several key factors can significantly impact your financial journey:

-

Initial Deposit: The upfront sum you contribute can greatly reduce your borrowing amount and monthly payments. We understand that typical initial contributions range from 3% to 20% of the home’s price. For instance, a 20% deposit of $40,000 leads to a loan of $160,000, while a 10% deposit of $20,000 results in a loan of $180,000. Knowing this can help you plan better.

-

Interest Charge: The interest rate you secure directly affects your monthly installment. For example, if you ask how much is a mortgage on a 200k house with a 6% interest rate over 30 years, your monthly payment is approximately $1,199. If the rate increases to 7%, it will affect how much is a mortgage on a 200k house, raising the payment to around $1,331. This highlights the importance of finding a beneficial rate that suits your needs.

-

Loan Duration: The length of your loan can influence your monthly costs significantly. A 30-year mortgage often results in lower monthly payments compared to a 15-year mortgage. However, the latter can lead to less interest paid over the life of the loan, which is a crucial consideration.

-

Property Taxes and Insurance: These costs can vary widely based on your location and property value. It’s essential to factor in these additional expenses when calculating your overall monthly budget, as they can add several hundred dollars to your costs.

-

Private Mortgage Insurance (PMI): If your down payment is less than 20%, PMI may be required, adding around $100 or more to your monthly expenses. This insurance protects the lender in case of default, and understanding its implications can help you assess your overall affordability.

By grasping these elements, we hope you feel empowered to assess your loan costs more accurately and make informed financial decisions. Remember, we’re here to support you every step of the way.

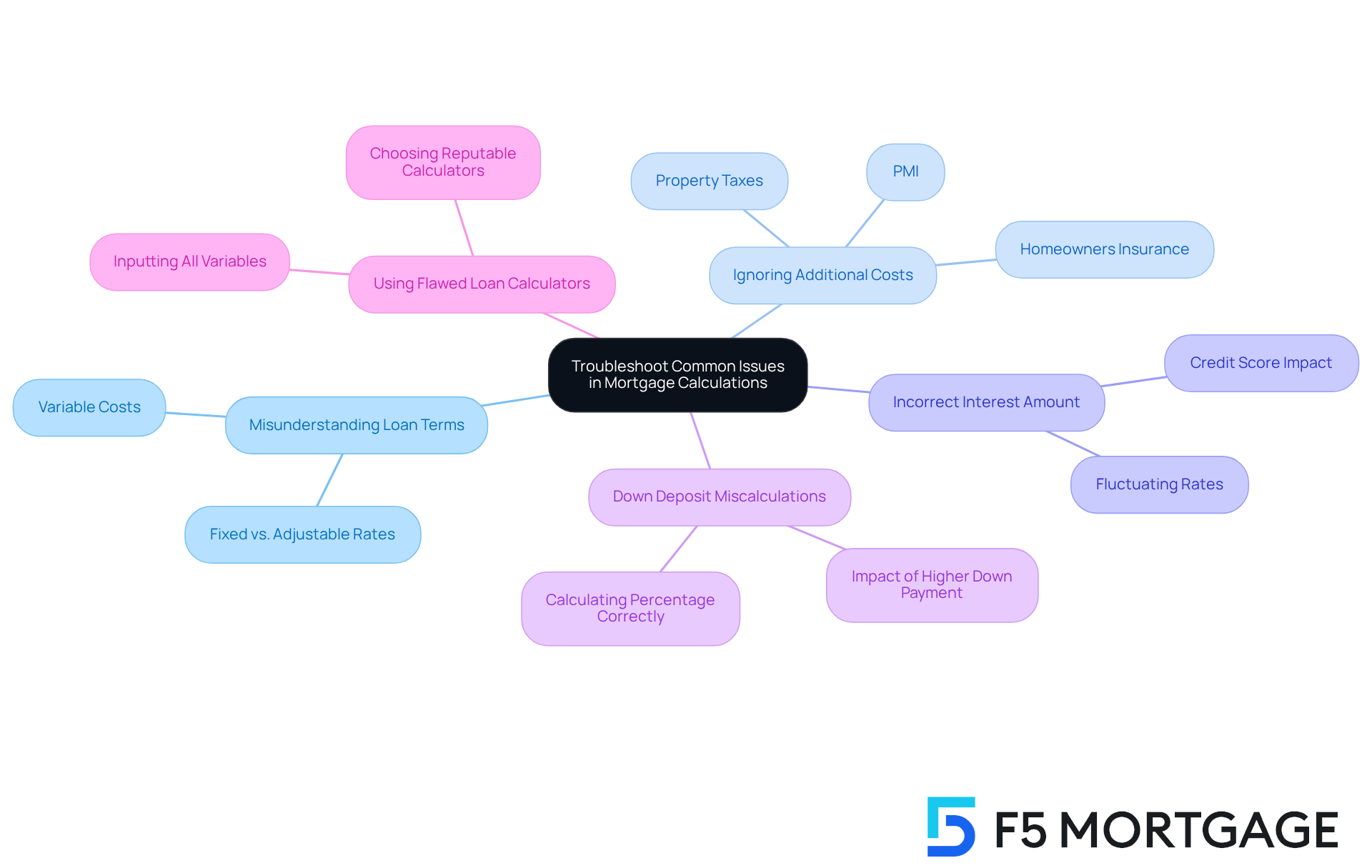

Troubleshoot Common Issues in Mortgage Calculations

When calculating your mortgage payment, it’s important to recognize that you may face some common challenges. We know how overwhelming this process can be, but understanding these issues can empower you to make informed decisions.

-

Misunderstanding Loan Terms: It’s crucial to know whether your interest rate is fixed or adjustable. An adjustable-rate mortgage (ARM) can lead to variable costs that might not be included in your initial estimations, which can be a source of confusion.

-

Ignoring Additional Costs: Many calculators only provide figures for principal and interest, but we encourage you to consider all expenses. Don’t forget to include property taxes, homeowners insurance, and PMI in your calculations to get a complete picture of your monthly payment.

-

Incorrect Interest Amount: Double-check the interest rate you are using. Rates can fluctuate based on your credit score and market conditions. Using an outdated or incorrect rate can significantly skew your calculations, leading to unexpected surprises.

-

Down Deposit Miscalculations: Ensure you accurately calculate your down payment percentage. A higher down payment reduces both your loan amount and monthly payments, so it’s essential to factor this in correctly.

-

Using Flawed Loan Calculators: Not all loan calculators are created equal. Choose reputable calculators that allow you to input all relevant variables, including taxes and insurance, for the most accurate estimates.

As you consider your mortgage options, remember that shopping for lenders is essential. Evaluating prices, expenses, and conditions can help ensure they align with your needs. Working with F5 Mortgage can provide you with competitive rates and personalized service tailored to your financial situation. By being aware of these common issues and utilizing the resources available through F5 Mortgage, you can troubleshoot effectively and ensure your mortgage calculations are accurate. We’re here to support you every step of the way as you navigate this important financial decision.

Conclusion

Understanding the intricacies of a mortgage on a $200,000 home is essential for making informed financial decisions. We know how challenging this can be, and this article has explored key components that influence mortgage costs. By grasping concepts like principal, interest rates, financing duration, and additional fees, prospective homeowners can navigate the complexities of securing a mortgage and achieve their homeownership goals.

Key insights discussed include:

- The impact of the initial deposit on loan amounts

- The significant role that interest rates play in determining monthly payments

- The importance of accounting for property taxes and insurance

- Common pitfalls in mortgage calculations, such as misunderstanding loan terms and ignoring additional costs

This knowledge empowers individuals to avoid costly mistakes and make strategic decisions when financing their homes.

In conclusion, taking the time to understand how mortgages work and the factors that affect payments enhances financial literacy. We’re here to support you every step of the way, equipping future homeowners with the tools needed to secure the best possible mortgage. By actively engaging in the mortgage shopping process and utilizing available resources, you can pave the way for a successful home-buying experience.

Frequently Asked Questions

What is the principal in a mortgage?

The principal is the total amount borrowed from the lender. For a $200,000 home, if you obtain a loan for the full amount, your principal will be $200,000.

What does the interest rate represent in a mortgage?

The interest rate represents the cost of borrowing, expressed as a percentage. As of 2025, the average interest rate for a 30-year fixed loan is around 6.74%, but it can vary based on market conditions, credit score, and the specific loan type.

How does the financing duration affect my mortgage?

The financing duration indicates the period over which you will repay the loan, typically 15 or 30 years. A longer loan duration usually results in lower monthly payments but increases the total interest paid over the life of the loan.

What is included in the monthly fee for a mortgage?

The monthly fee includes the principal and interest, and may also incorporate property taxes, homeowners insurance, and private mortgage insurance (PMI) if the down payment is below 20%.

What does mortgage approval mean?

Mortgage approval is a lender’s decision indicating that you are a suitable candidate for a mortgage based on your financial information. This process provides an estimate of your borrowing amount, interest rate, and potential monthly payment, which can vary among lenders.

How can comparing interest rates benefit me?

Comparing interest rates from various lenders can lead to significant savings. Borrowers who obtain a rate quote from just one additional lender save an average of $600 over the duration of their financing.