Overview

Understanding the cost to buy down an interest rate is essential for making informed financial decisions. It primarily involves paying upfront fees, typically around 1% of the loan amount for each percentage point reduction in the interest rate. This can lead to significant long-term savings on mortgage payments, which is something we know many families strive for.

We understand how challenging navigating these costs can be, especially for those planning to stay in their homes long-term. By calculating potential savings, you empower yourself to align your financial decisions with your budget and goals. This proactive approach not only alleviates concerns but also helps you feel more confident in your choices.

Remember, we’re here to support you every step of the way. Taking the time to understand these aspects can make a meaningful difference in your financial future. Let’s work together to ensure you’re equipped with the knowledge you need to thrive.

Introduction

We understand that navigating the intricacies of mortgage financing can feel overwhelming, especially when it comes to strategies like interest rate buydowns. This financial tool offers a way for borrowers to lower their mortgage interest rates by paying upfront fees, which can lead to potential long-term savings and improved cash flow.

Yet, with various types of buydowns and their associated costs to consider, how can you determine if this strategy is a wise investment? By exploring the costs and benefits of buying down an interest rate, you can empower yourself to make informed decisions that align with your financial goals.

We’re here to support you every step of the way.

Understand Mortgage Rate Buydowns

A loan interest reduction is a strategic financial tool that allows borrowers to pay an upfront fee, helping to lower their interest for the duration of the loan. This reduction can be temporary, decreasing the interest for the initial years, or permanent, maintaining a lower interest rate throughout the entire loan period. Understanding how buydowns work and how much does it cost to buy down interest rate is essential for making informed mortgage decisions, as they can lead to significant savings over time—especially for those who plan to stay in their homes for an extended period.

- Types of Buydowns: Temporary buydowns, like the popular 2-1 buydown, offer a 2% decrease in the first year and a 1% decrease in the second year. In contrast, permanent buydowns provide a consistent lower cost for the entire loan duration.

- Impact on Monthly Payments: By lowering the interest rate, buydowns can significantly reduce monthly payments, enhancing cash flow for homeowners. For instance, acquiring three credits for $12,000 can lower monthly payments by $300, with a breakeven period of 40 months.

- Long-Term Savings: A reduced interest rate can save borrowers thousands over the life of the loan, making homeownership more attainable. If a homeowner plans to stay in their property beyond the breakeven point, opting for a reduction in interest may be a financially sound decision.

As we look ahead to 2025, with loan applications remaining 39% below pre-pandemic levels, understanding the nuances of financing buydowns becomes increasingly important for buyers hoping to enhance their financial strategies. Whether you’re considering a temporary or permanent buydown, it’s vital to assess how much does it cost to buy down interest rate based on your personal situation. Seeking guidance from a knowledgeable finance expert can help you identify the best approach for your needs. We know how challenging this can be, and we’re here to support you every step of the way.

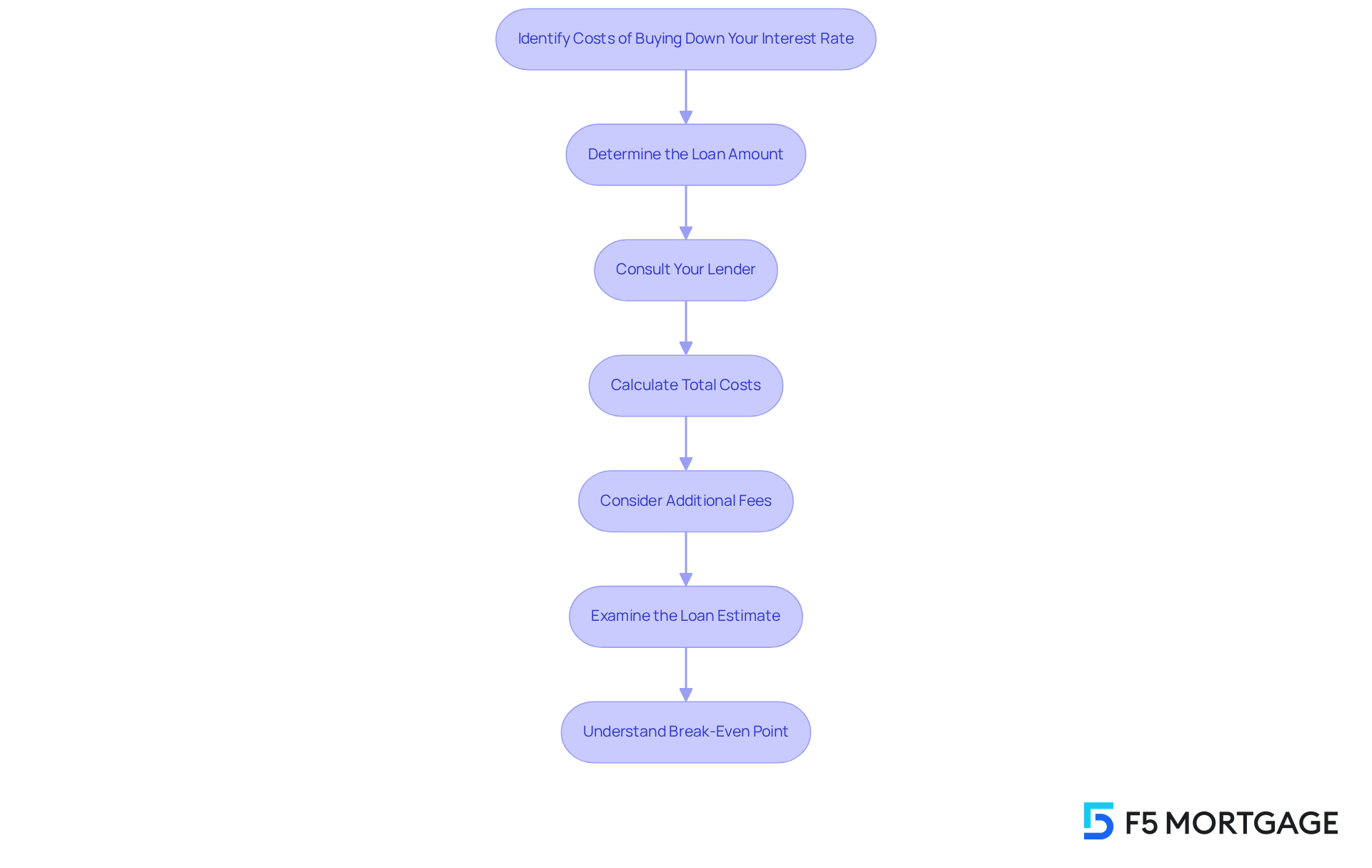

Identify Costs of Buying Down Your Interest Rate

To reduce your interest cost, it’s important to know how much does it cost to buy down interest rate, as this often involves purchasing fees typically set at 1% of the loan sum. For instance, on a $300,000 loan, one fee would amount to $3,000. Generally, each percentage point lowers your interest rate by about 0.25%. To help you navigate the costs associated with a mortgage buydown, consider these steps:

- Determine the Loan Amount: Start with your total mortgage sum to ensure accurate fee calculations.

- Consult your lender to ask how much does it cost to buy down interest rate and what fees are needed for a specific rate reduction.

- To find out how much does it cost to buy down interest rate, you should calculate the total costs by multiplying the number of credits by the loan amount.

- Consider additional fees, including how much does it cost to buy down interest rate, along with any extra fees that may apply, such as closing costs, which can range from 2% to 6% of your loan amount, or lender fees.

- Examine the Loan Estimate: Remember, lenders must provide a Loan Estimate within three business days, detailing the total loan expense, including any mortgage fees.

Example Calculation:

If your goal is to reduce your interest rate by 0.5% and your lender requires 2 points, the cost would be:

- Loan Amount: $300,000

- Points: 2

- Total Cost: 2% of $300,000 = $6,000.

Understanding these calculations, along with the concept of the break-even point—the time it takes for savings from a reduced interest rate to equal how much does it cost to buy down interest rate—can empower you to make informed choices about whether lowering your interest is a financially wise decision. We know how challenging this can be, and we’re here to support you every step of the way.

Calculate Your Potential Savings from a Buydown

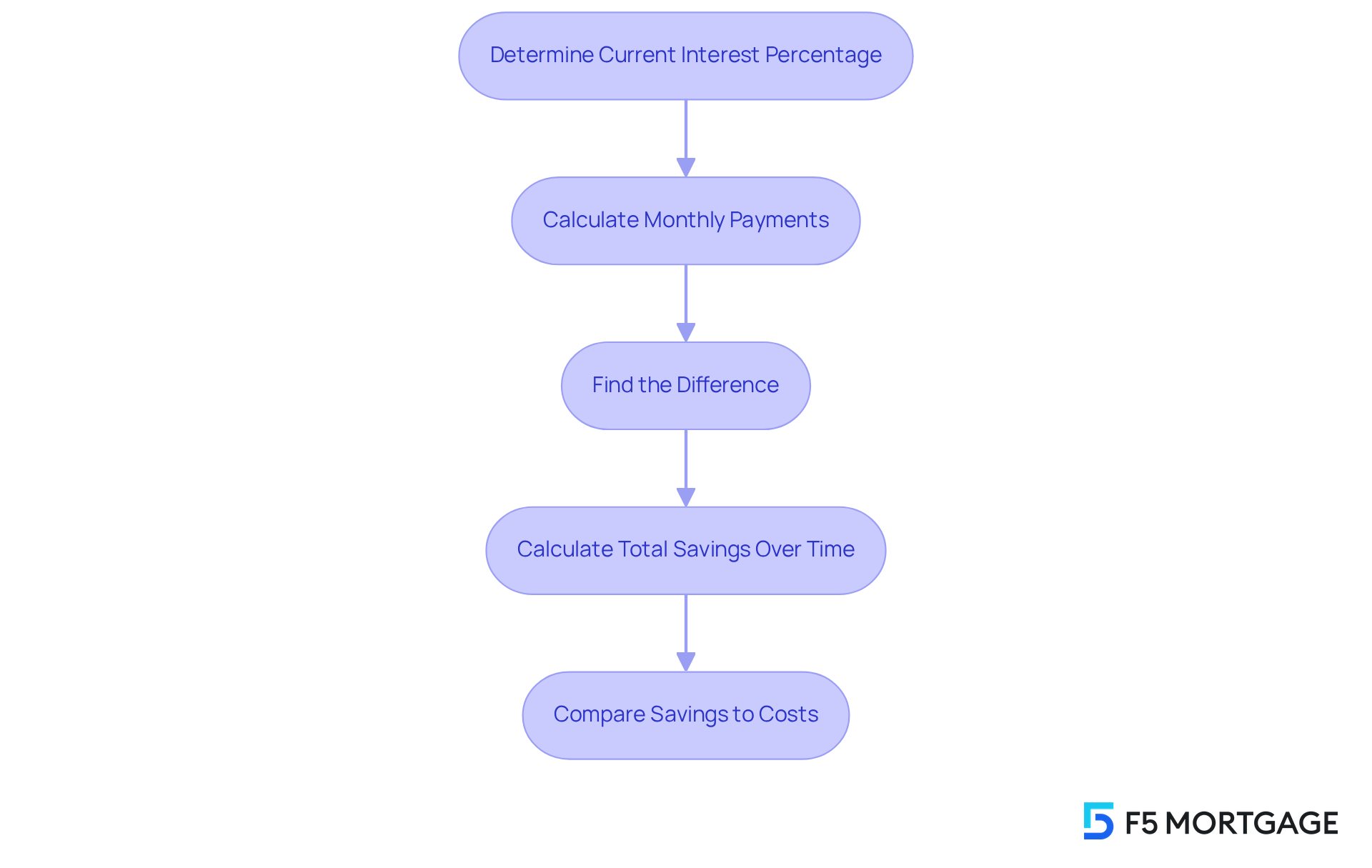

Calculating how much does it cost to buy down interest rate and your potential savings from a mortgage buydown can feel overwhelming, but we’re here to support you every step of the way. Here’s a simple guide to help you navigate this process:

- Determine Your Current Interest Percentage: Start by identifying your existing percentage. This will allow you to compare it with the new percentage after the reduction.

- Calculate Monthly Payments: Use a mortgage calculator to determine your monthly payment at both the current and reduced rates. This step is crucial in understanding your financial landscape.

- Find the Difference: Subtract the new monthly payment from the current payment to ascertain your monthly savings. This is where you begin to see the benefits of your efforts.

- Calculate Total Savings Over Time: Multiply your monthly savings by the number of months you plan to stay in the home. This gives you a clearer picture of your total savings.

- Compare savings to costs: Finally, assess your total savings in relation to how much does it cost to buy down interest rate. This will help you determine if it’s a valuable investment for your family.

Example Calculation:

- Current Rate: 4.5%

- New Rate: 4.0%

- Current Payment: $1,520

- New Payment: $1,432

- Monthly Savings: $88

- Total Savings Over 5 Years: $88 x 60 = $5,280. If the cost reduction was $6,000, it’s important to evaluate how much does it cost to buy down interest rate to see if the savings warrant the initial expenditure.

At F5 Mortgage, we understand that making the right choice is crucial. We offer several temporary rate reduction options, including the 1-0 reduction, which decreases the interest rate by 1% for the initial year, and the 1-1 reduction, which diminishes the rate by 1% for the first two years. Understanding these calculations is vital for making informed decisions about mortgage buydowns, as they can significantly impact your financial situation in the early years of homeownership.

Additionally, it’s important to consider that sellers or builders may contribute to financing the reduction, providing you with additional financial flexibility. As Kevin Graham wisely observes, “Although it’s the home purchaser who gains from a reduction, the buyer isn’t always the one who lowers the interest amount.” We know how challenging this can be, but with the right information and support, you can make decisions that benefit your family in the long run.

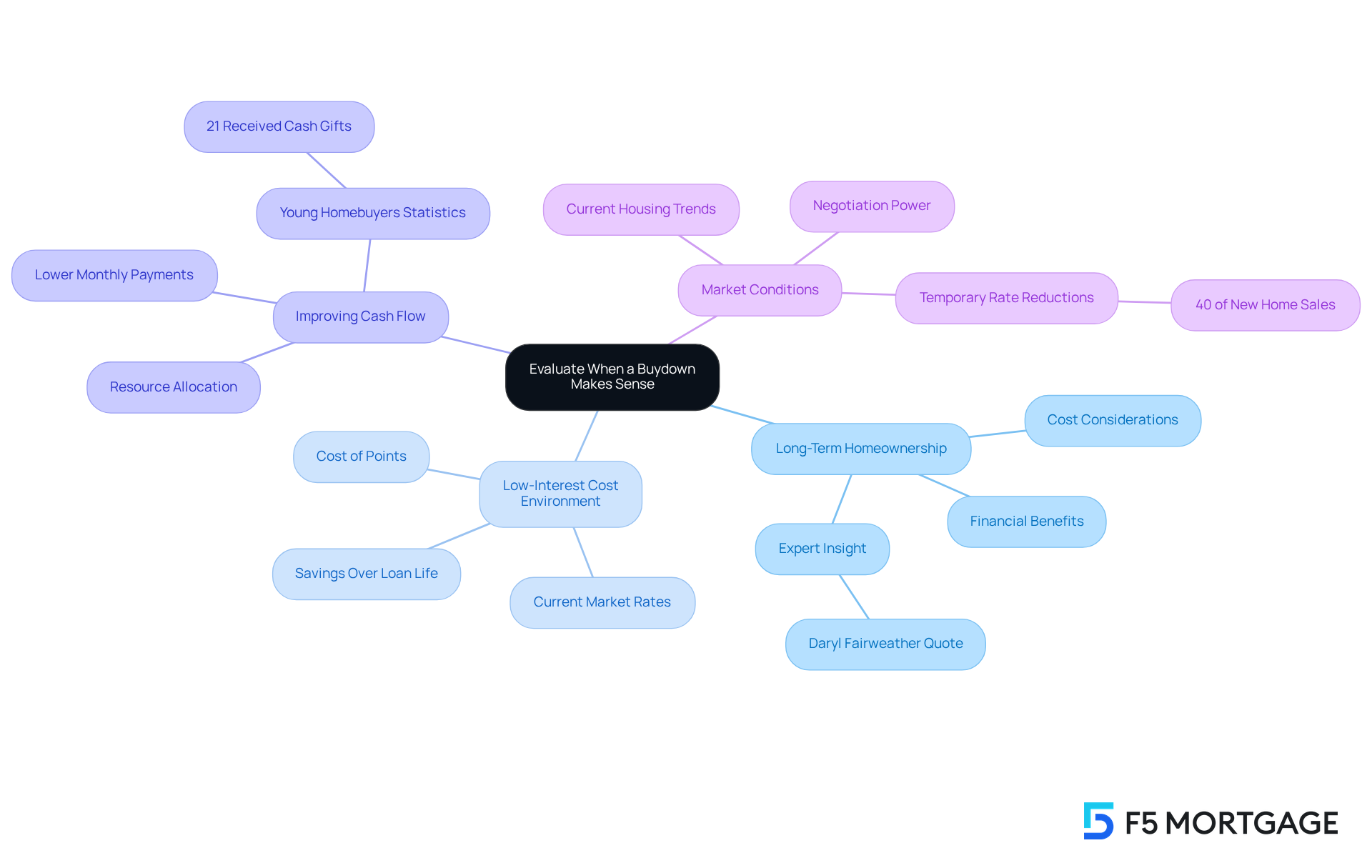

Evaluate When a Buydown Makes Sense

A mortgage buydown can be a strategic choice in various scenarios:

-

Long-Term Homeownership: If you’re planning to stay in your home for a while, it’s important to consider how much does it cost to buy down interest rate, as the financial benefits of a lower interest rate can outweigh the initial costs associated with the buydown. Many homeowners today are aiming to stabilize their monthly payments amidst fluctuating market conditions. As Daryl Fairweather, chief economist at Redfin, puts it, “It’s a good strategy if you have more cash upfront and you’re planning to stay in the house for the long term.”

-

Low-Interest Cost Environment: In a market where interest rates are relatively low, securing a lower rate through a buydown can lead to significant savings over the life of your loan. With loan costs hovering around 7%, now is an excellent time for buyers to consider advantageous financing options. Typically, one loan point costs 1% of the total loan amount and reduces the interest rate by 0.25%, illustrating how much does it cost to buy down interest rate in a cost-effective manner.

-

Improving Cash Flow: If enhancing your monthly cash flow is important, a buydown can help lower your mortgage payments. This is especially beneficial for families looking to upgrade their homes or first-time buyers working with tight budgets. It allows you to allocate resources toward other financial goals, such as education or retirement savings. Notably, nearly 21% of young homebuyers received a cash gift for their down payment, illustrating how financial assistance can influence homebuying decisions.

-

Market Conditions: It’s crucial to assess current housing market trends and interest rate forecasts when considering a buydown. With Goldman Sachs predicting a decline in year-over-year housing inflation, buyers might find themselves in a better negotiating position, creating a timely chance to explore financing options. Additionally, around 40% of new home sales feature a temporary rate reduction, highlighting its prevalence in today’s market.

Considerations:

- Break-Even Point: Understanding how long it will take to recover the costs of the buydown through monthly savings is essential. This calculation helps you determine if the investment is worthwhile based on your expected length of homeownership.

- Personal Financial Goals: Aligning your decision to pursue a buydown with your broader financial objectives is vital. Whether you’re saving for retirement or funding education, ensuring that the buydown fits within your overall financial strategy can lead to more informed decision-making.

- Potential Drawbacks: While buydowns can provide significant benefits, it’s important to weigh potential drawbacks, such as upfront costs and the risk of not fully utilizing the points purchased if you sell or refinance before reaching the breakeven point.

Conclusion

Understanding the intricacies of mortgage rate buydowns is essential for homeowners like you who are looking to manage financial commitments effectively. By strategically paying an upfront fee, you can significantly lower your interest rates, leading to reduced monthly payments and substantial long-term savings. Whether you opt for a temporary or permanent buydown, this decision can greatly influence your financial landscape, especially if you plan to remain in your home for an extended period.

This article delves into the various types of buydowns, their impact on monthly payments, and the potential savings over the life of the loan. It emphasizes the importance of calculating the costs associated with buydowns, including points and additional fees, to ensure that your investment aligns with your personal financial goals. Moreover, understanding the break-even point is crucial; it allows you to make informed decisions based on your unique circumstances.

Ultimately, exploring mortgage rate buydowns can provide significant advantages, particularly in a fluctuating market. As you consider your options, it’s vital to assess both current market conditions and your individual financial situation. Engaging with knowledgeable finance experts can further enhance your decision-making process, ensuring that each choice you make today leads to a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a mortgage rate buydown?

A mortgage rate buydown is a financial strategy where borrowers pay an upfront fee to lower their loan interest rate for the duration of the loan. This reduction can be either temporary or permanent.

What are the types of buydowns?

The two main types of buydowns are temporary buydowns, such as the 2-1 buydown that offers a 2% decrease in the first year and a 1% decrease in the second year, and permanent buydowns, which maintain a lower interest rate for the entire loan period.

How do buydowns impact monthly payments?

Buydowns can significantly reduce monthly payments by lowering the interest rate. For example, acquiring three credits for $12,000 can lower monthly payments by $300, with a breakeven period of 40 months.

What are the long-term savings associated with buydowns?

A reduced interest rate from a buydown can save borrowers thousands over the life of the loan, making homeownership more affordable, especially for those planning to stay in their property beyond the breakeven point.

Why is understanding buydowns important in the current market?

With loan applications remaining 39% below pre-pandemic levels as we approach 2025, understanding buydowns is crucial for buyers looking to improve their financial strategies in mortgage financing.

How can I determine the cost of a mortgage rate buydown?

It is essential to assess the cost of a mortgage rate buydown based on your personal financial situation. Consulting with a knowledgeable finance expert can help identify the best approach for your needs.