Overview

This article is here to guide you through the eligibility criteria and options for obtaining multiple FHA loans, recognizing that many families face unique circumstances. We understand how challenging it can be to navigate the complexities of home financing, especially when life changes such as job relocation or an increase in family size come into play.

You may be relieved to know that under specific conditions, borrowers can indeed have more than one FHA loan. To help you, we outline the primary residence requirement and the conditions that allow for additional loans. It’s important to meet FHA guidelines, and we’re here to support you every step of the way.

By providing a clear understanding of how many FHA loans one can have, we aim to empower you with the knowledge needed to make informed decisions for your family’s future. Remember, you are not alone in this journey, and there are options available to help you achieve your homeownership goals.

Introduction

Navigating the world of home financing can feel overwhelming, especially when trying to grasp the complexities of FHA loans. We understand how challenging this can be. Designed to assist first-time homebuyers and those with limited financial resources, these government-backed mortgages provide unique benefits, such as lower down payments and more flexible credit requirements.

Yet, a common question arises: how many FHA loans can one truly have? This inquiry opens the door to exploring eligibility criteria and potential exceptions. By understanding the various factors that can influence a borrower’s ability to secure multiple FHA loans, we can guide families toward their homeownership goals.

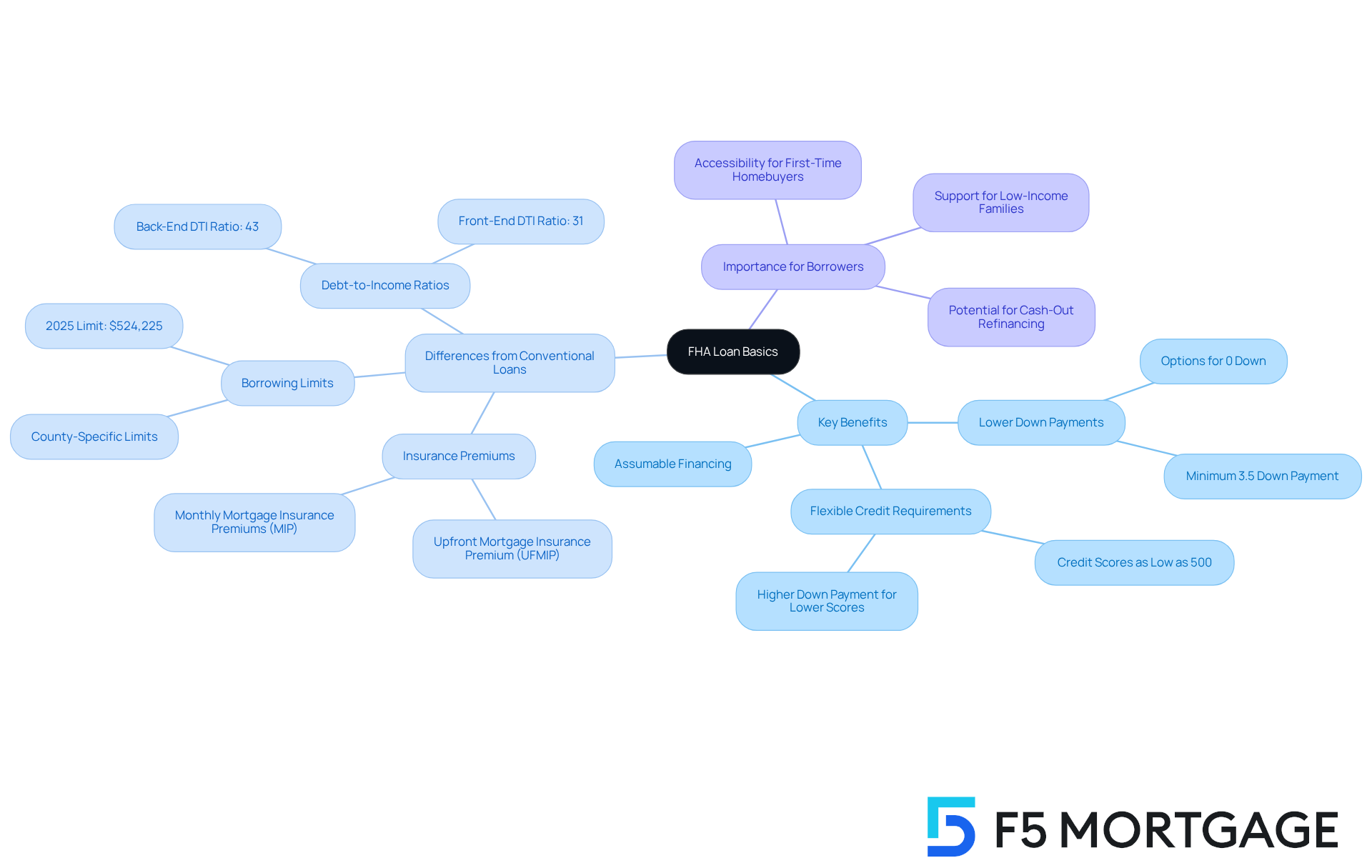

Understand FHA Loan Basics

FHA mortgages, or Federal Housing Administration mortgages, are government-supported financial products designed to assist lower-income and first-time homebuyers in securing funding. These financial products typically feature lower down payment expectations, allowing as little as 3.5%, and more flexible credit score criteria compared to traditional financing options. Primarily intended for owner-occupied properties, borrowers must reside in the home as their primary residence. Understanding these fundamentals is crucial for exploring how many FHA loans can you have and under what conditions.

Key Benefits of FHA Loans:

- Lower Down Payments: With , FHA loans significantly reduce the barrier to homeownership, making it more achievable for many families. Additionally, F5 Mortgage offers several low deposit alternatives, including options with 0% down, which can further ease the journey to owning a home.

- Flexible Credit Requirements: Borrowers can qualify with credit scores as low as 580. Those with scores between 500 and 579 may still be eligible with a higher down payment of 10%. This flexibility is vital for individuals with diverse credit histories, ensuring that more families have a chance at homeownership.

- Assumable Financing: FHA mortgages can be assumed by future buyers, providing a potential selling advantage when it comes time to sell your home.

Differences from Conventional Loans:

- Insurance Premiums: FHA loans require both an upfront mortgage insurance premium (UFMIP) and monthly mortgage insurance premiums (MIP), which can raise the overall cost of the loan. This is an important consideration for borrowers, as it impacts their monthly payments and total borrowing costs.

- Borrowing Limits: FHA financing has specific limits based on county regulations, which can restrict borrowing amounts compared to conventional financing that may offer higher limits based on the lender’s criteria. In 2025, the FHA borrowing limit for most areas is set at $524,225 for single-family residences, with higher limits in more expensive regions, reflecting local housing market conditions.

- Debt-to-Income Ratios: FHA mortgages generally require a debt-to-income (DTI) ratio of below 43%, although some lenders may allow higher ratios with compensating factors. This requirement is essential for evaluating a borrower’s ability to manage monthly payments.

These features make FHA financing particularly beneficial for first-time homebuyers and individuals with limited savings, as they provide a pathway to homeownership that might otherwise be out of reach. Additionally, for homeowners seeking to tap into their home equity, F5 Mortgage offers cash-out refinancing options, enabling them to leverage their existing mortgage for significant expenses like home renovations or debt consolidation.

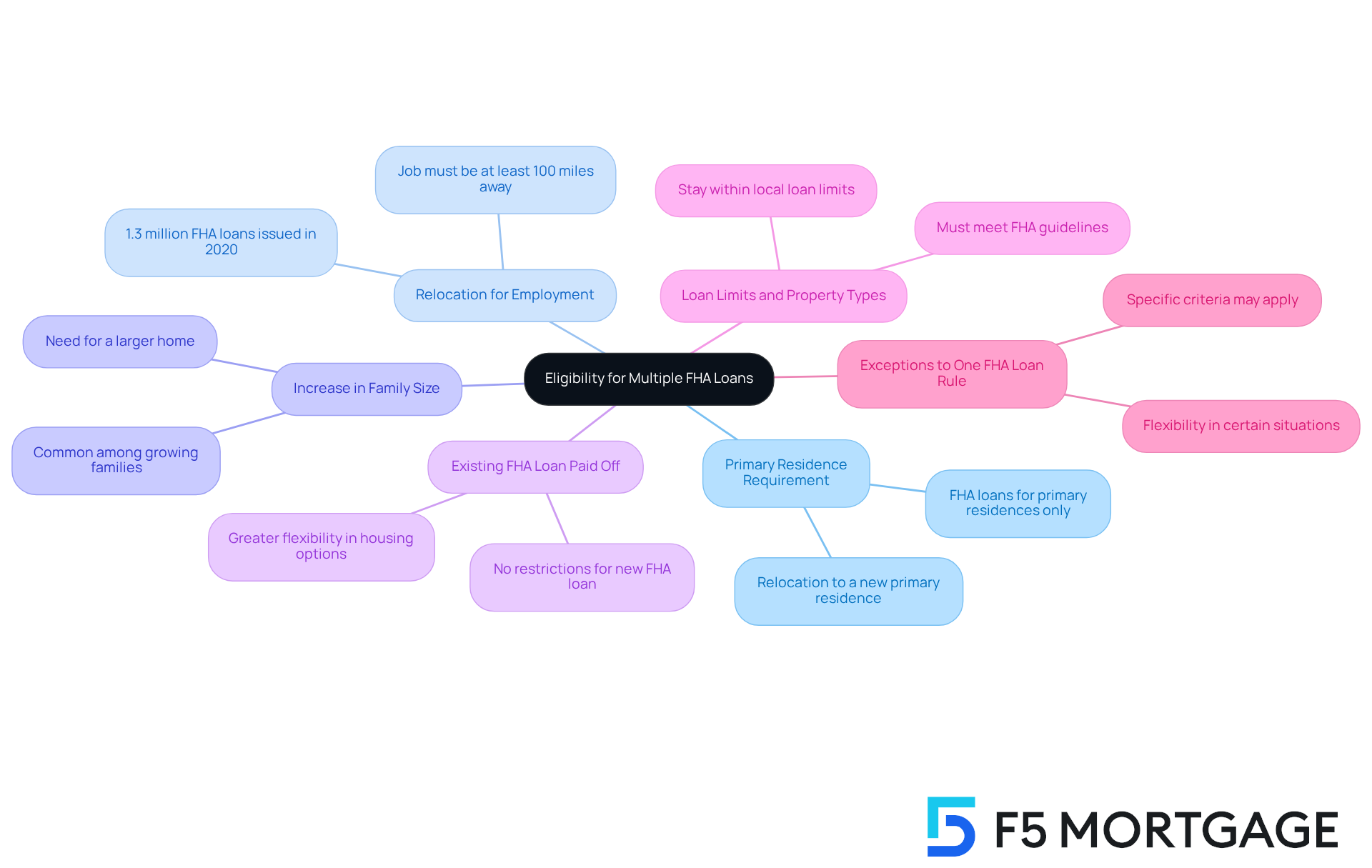

Identify Eligibility for Multiple FHA Loans

To qualify for multiple FHA mortgages, borrowers need to know how many FHA loans can you have and must meet specific eligibility criteria. Understanding these criteria can empower families to make , especially in the context of job relocations or changes in family dynamics. Here are the key factors to consider:

- Primary Residence Requirement:

FHA loans are intended for primary residences. If you already possess an FHA mortgage, you can only acquire another one if you are relocating to a new primary residence, which raises the question of how many FHA loans can you have. We know how challenging it can be to find the right home, and this requirement helps ensure that your new residence is truly a place to call home. - Relocation for Employment:

If you are relocating for a new job and the new job is at least 100 miles away from your current home, you may qualify for a second FHA loan. In fact, in 2020, 1.3 million FHA mortgages were issued, with many borrowers successfully navigating this process due to job relocations. This can be an exciting opportunity for you and your family. - Increase in Family Size:

If your family size has increased, necessitating a larger home, you may also be eligible for an additional FHA loan. This situation is common among families looking to upgrade their living space. We understand that a growing family often means a need for more room. - Existing FHA Loan Paid Off:

If you have paid off your existing FHA loan, you can apply for a new FHA loan without restrictions, allowing for greater flexibility in your housing options. This can open doors to new possibilities for your family. - Loan Limits and Property Types:

Ensure that the new property meets FHA guidelines and that you stay within the loan limits set for your area. This is crucial for maintaining compliance with FHA regulations and can help you avoid any unexpected hurdles. - Exceptions to the One FHA Loan Rule:

It’s important to note that exceptions to the one FHA loan rule may apply under specific criteria, allowing for more flexibility in certain situations. We’re here to support you every step of the way in understanding these nuances.

As Dale Lavine states, “The limit does not exist” when it comes to applying for multiple FHA mortgages throughout your lifetime. Remember, we’re here to help you navigate this journey with confidence.

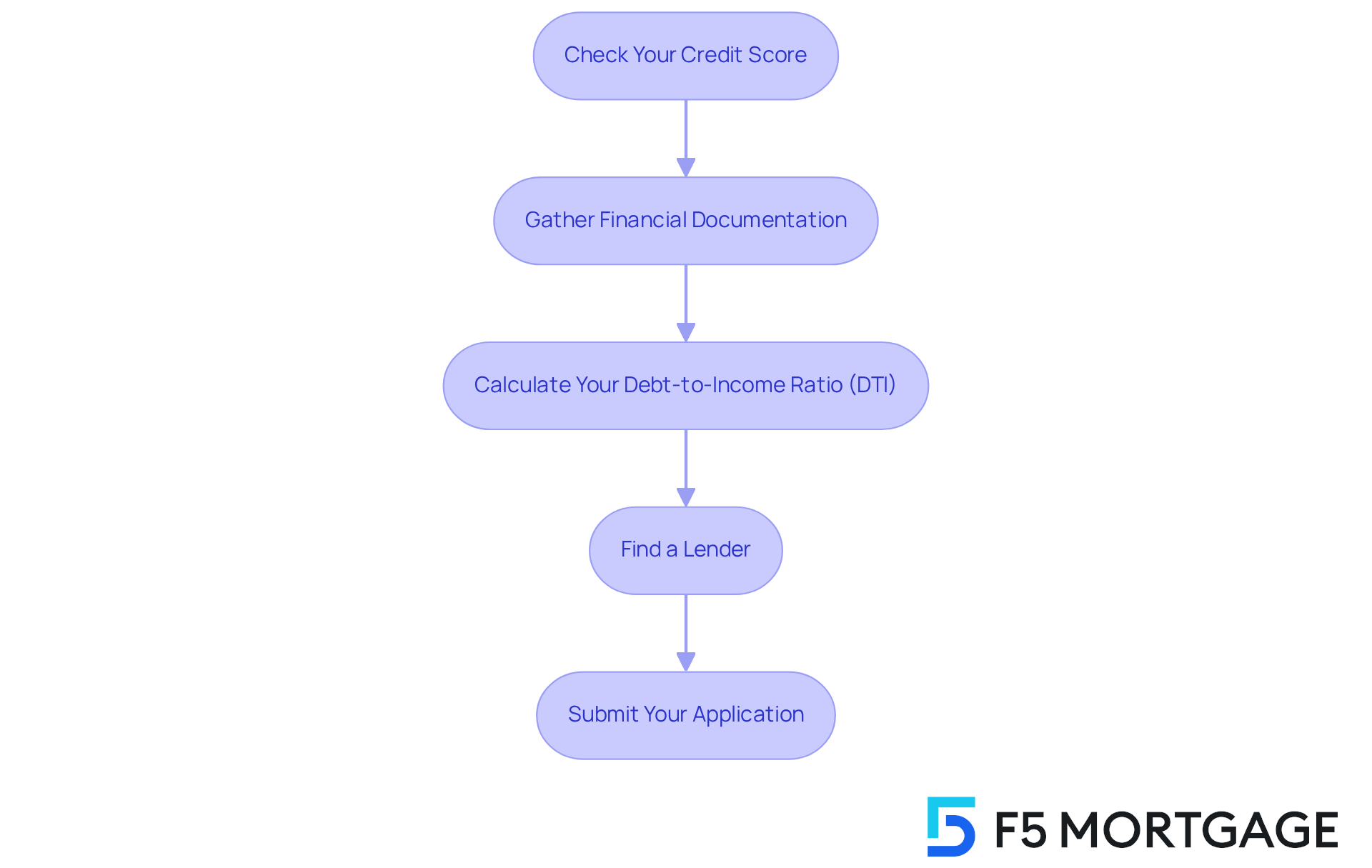

Qualify for Additional FHA Loans

To qualify for an additional FHA loan, it’s important to know how many [FHA loans](https://f5mortgage.com/loan-programs/fha-loans/california) can you have, as navigating the process can feel overwhelming. Here are some essential steps to guide you:

- Check Your Credit Score

We know how challenging it can be to keep track of your credit score. Ensure it meets FHA requirements, which typically require a minimum of 580 for a 3.5% down payment. If your score is below this threshold, consider taking steps to improve it before applying. Remember, FHA financing is available to individuals with credit scores as low as 500, but a higher score can significantly enhance your borrowing options. - Gather Financial Documentation

Preparing the necessary financial documents can seem daunting, but it’s an essential part of the process. Collect your tax returns, pay stubs, bank statements, and details of your current debts and assets. This documentation is crucial for your lender to assess your financial situation accurately. For instance, lenders will require proof of steady employment, which you can document through recent pay stubs and tax returns. - Calculate Your Debt-to-Income Ratio (DTI)

Understanding your DTI is vital. Ideally, it should be below 43%, although some flexibility exists depending on your overall financial profile. To calculate your DTI, divide your total monthly debt payments by your gross monthly income. If your DTI exceeds this threshold, consider strategies to reduce your existing debts before applying, as a lower DTI can improve your chances of approval. - Find a Lender

Choosing the right lender is crucial. Look for one experienced in FHA loans who can offer valuable advice during the application process. They will explain how many FHA loans you can have, including the specific criteria for securing a second FHA mortgage. Working with a knowledgeable lender can streamline your experience and help you navigate any complexities. - Submit Your Application

Complete the application process with your selected lender, ensuring you provide all required documentation. Be prepared for an appraisal and underwriting process, which may take several weeks. Understanding that FHA financing often entails both an will help you anticipate the expenses related to your financing.

By following these steps, you can position yourself for success in obtaining an additional FHA mortgage. Remember, we’re here to support you every step of the way, making your homeownership goals more achievable.

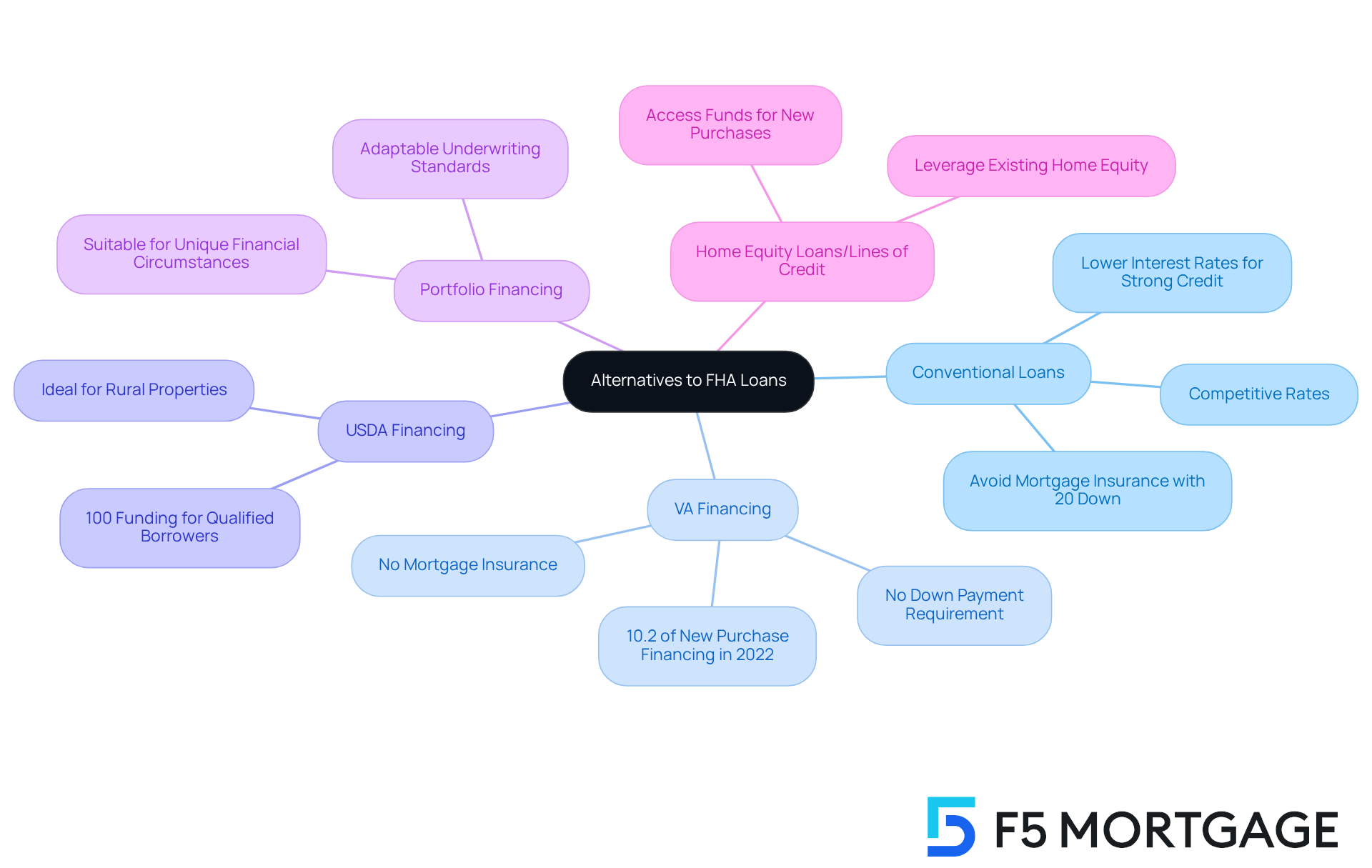

Explore Alternatives to FHA Loans

If multiple FHA loans do not align with your financial goals, we understand how challenging this can be. Here are some viable alternatives that you might consider:

- Conventional Loans: Conventional loans can provide competitive rates and terms, especially for borrowers with strong credit profiles. If you can provide a down payment of 20% or more, you can avoid mortgage insurance entirely, which can greatly lower your monthly costs. Many borrowers with excellent credit often find that traditional financing options offer lower interest rates compared to FHA alternatives, making them a financially sound choice.

- VA Financing: For our veterans and active-duty service members, VA financing offers exceptional benefits, including no down payment requirement and no mortgage insurance. This makes it an attractive option for those eligible, enabling them to secure financing with favorable terms. In 2022, VA financing represented 10.2% of all new purchase financing for one- to four-family owner-occupied residences, highlighting its popularity among service members.

- USDA Financing: If you’re contemplating a home in a rural region, USDA financing provides 100% funding for qualified borrowers. This presents a compelling option for those seeking to buy beyond urban areas, allowing you to explore more possibilities.

- Portfolio Financing: Some lenders offer portfolio financing, which is not sold on the secondary market. These financial products may have more adaptable underwriting standards, serving individuals with distinct financial circumstances, such as self-employed persons or those with unconventional income streams. This flexibility can be a real advantage.

- Home Equity Loans or Lines of Credit: If you already own a home, leveraging your home equity can be a strategic financing option. This approach allows you to access funds for a new purchase or refinancing without the need for an additional FHA loan. It provides you with the flexibility to manage your financial needs more effectively.

We’re here to support you every step of the way as you .

Conclusion

FHA loans are a vital resource for many aspiring homeowners, especially those facing financial challenges. We understand how daunting the journey to homeownership can be, and knowing the nuances of these government-backed mortgages can empower you to explore your options effectively. In some cases, acquiring multiple FHA loans is possible, offering even more opportunities. By grasping the fundamental principles and eligibility requirements, you can navigate the complexities of FHA financing and make informed decisions that truly align with your housing needs.

Throughout this guide, we’ve highlighted key insights about the affordability and accessibility of FHA loans. With lower down payment requirements and flexible credit criteria, these loans are designed to help. However, eligibility for multiple FHA loans depends on factors like:

- job relocation

- changes in family size

- the successful payoff of existing loans

These considerations are crucial for anyone looking to expand their homeownership opportunities while managing financial obligations.

Ultimately, the journey to homeownership is filled with choices and possibilities. Whether you’re pursuing an FHA loan or exploring viable alternatives like conventional, VA, or USDA financing, understanding the landscape of mortgage options is essential. We encourage you to evaluate your unique situation and seek guidance to make the best decisions for your financial future. Remember, the pathway to achieving your homeownership dreams is within reach, and knowledge is the first step toward unlocking those doors.

Frequently Asked Questions

What is an FHA loan?

An FHA loan, or Federal Housing Administration mortgage, is a government-supported financial product designed to assist lower-income and first-time homebuyers in securing funding, typically featuring lower down payment expectations and more flexible credit score criteria.

What are the down payment requirements for FHA loans?

FHA loans allow down payments as low as 3.5%. Additionally, there are options with 0% down offered by some lenders, such as F5 Mortgage, which can further ease the journey to homeownership.

What are the credit score requirements for FHA loans?

Borrowers can qualify for FHA loans with credit scores as low as 580. Those with scores between 500 and 579 may still be eligible if they make a higher down payment of 10%.

Can FHA loans be assumed by future buyers?

Yes, FHA mortgages can be assumed by future buyers, which can provide a potential selling advantage when it comes time to sell the home.

How do FHA loans differ from conventional loans?

FHA loans require both an upfront mortgage insurance premium (UFMIP) and monthly mortgage insurance premiums (MIP), which can increase the overall cost of the loan. Additionally, FHA loans have specific borrowing limits based on county regulations, while conventional loans may offer higher limits.

What are the borrowing limits for FHA loans?

In 2025, the FHA borrowing limit for most areas is set at $524,225 for single-family residences, with higher limits in more expensive regions, reflecting local housing market conditions.

What is the debt-to-income ratio requirement for FHA loans?

FHA mortgages generally require a debt-to-income (DTI) ratio of below 43%, although some lenders may allow higher ratios with compensating factors.

Who can benefit from FHA loans?

FHA loans are particularly beneficial for first-time homebuyers and individuals with limited savings, as they provide a pathway to homeownership that might otherwise be out of reach.