Overview

Understanding the annual percentage rate (APR) for mortgages is essential for families navigating the loan process. Unlike a traditional interest rate, the APR encompasses not just the cost of borrowing the principal amount, but also various fees and charges associated with the loan. This comprehensive view can be a game-changer, as it helps you grasp the total cost of your mortgage. We know how challenging this can be, and it’s crucial to evaluate all financing options carefully.

The APR allows you to see beyond the numbers. It accounts for costs like origination fees and mortgage insurance, providing a clearer picture of what you’ll be paying over time. By understanding these elements, you can make more informed decisions that align with your family’s financial goals. Remember, we’re here to support you every step of the way as you explore your mortgage options.

Introduction

We understand how challenging navigating mortgage financing can be for prospective homebuyers. Many people find themselves puzzled by the difference between an annual percentage rate (APR) and a traditional interest rate.

While the interest rate reflects the basic cost of borrowing, the APR offers a more complete picture by including additional fees and costs associated with the loan. This brings us to an important question: how can you navigate these figures to make informed financial decisions?

By exploring this topic, we can clarify the true cost of borrowing and empower you to compare mortgage offers effectively. This way, you can secure the best possible terms for your financial future.

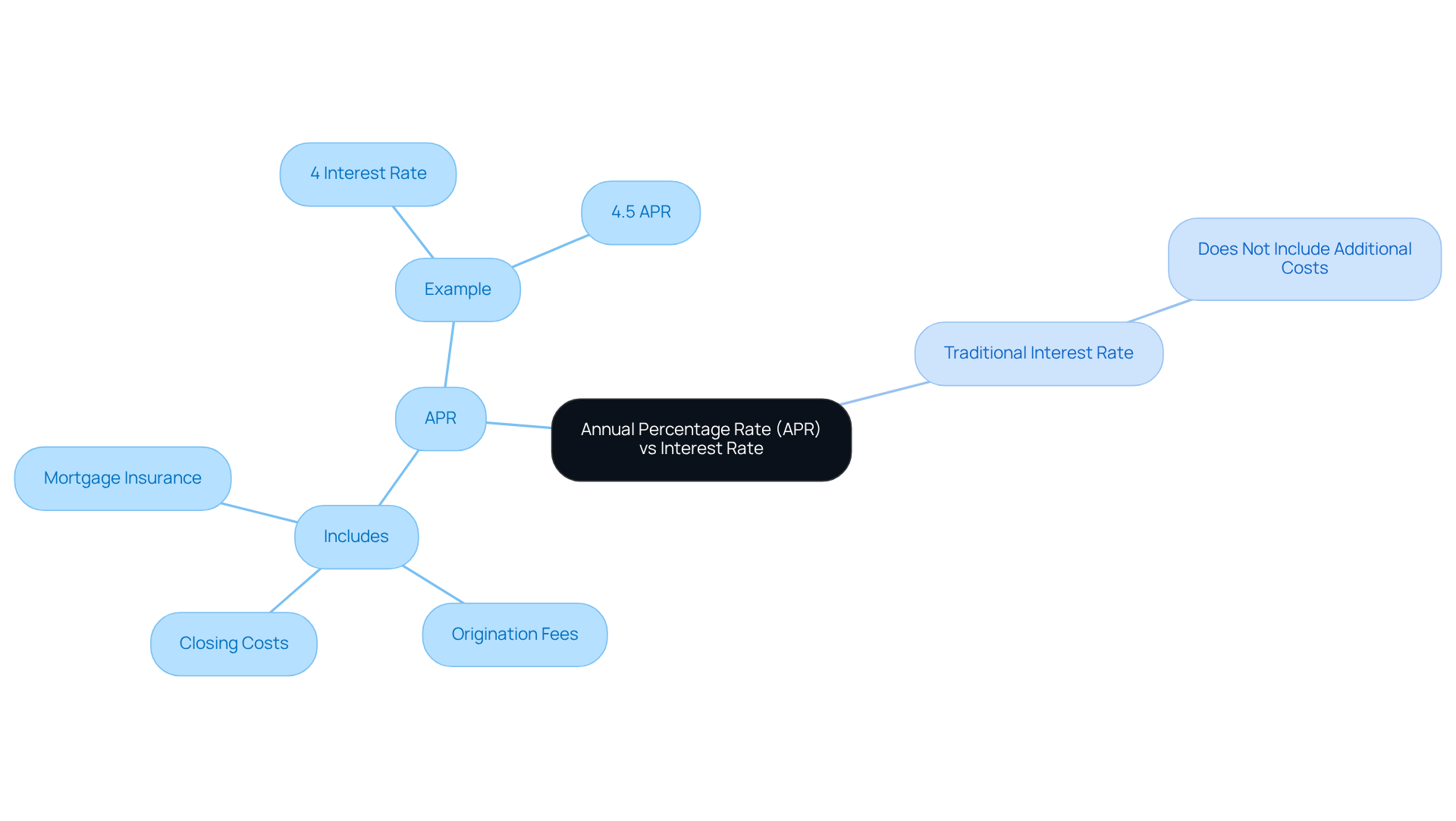

Define Annual Percentage Rate (APR) and Interest Rate

For anyone navigating the world of borrowing, it is essential to understand how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate. The question of how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate highlights the importance of understanding the total cost of borrowing money, which the APR comprehensively indicates as a yearly percentage. It encompasses not just the cost of borrowing but also additional charges related to the loan, such as:

- Origination fees

- Closing costs

- Mortgage insurance

This raises the question of how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate. In contrast, a simple percentage only reflects the expense of borrowing the principal sum, raising the question of how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, as it does not consider these extra costs.

For example, if you obtain a mortgage with a 4% interest rate, it raises the question of how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, since the APR of 4.5% provides a clearer picture of your overall borrowing expenses, including those extra fees. We know how challenging this can be, and grasping this difference is crucial for homebuyers. It empowers you to make informed choices when evaluating financing options and understanding the financial impact of your mortgage.

Furthermore, securing your mortgage terms is vital to protect against potential increases, which can significantly affect your payments. We encourage you to explore and evaluate mortgage offers from various lenders, as this can greatly influence your borrowing conditions. Considering F5 Mortgage, families can benefit from attractive pricing and personalized service, making it easier to find a mortgage that fits your needs.

While it is essential to understand how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, it shouldn’t be the only factor in deciding the best borrowing option for your unique situation. Reflect on how your credit scores might also influence both APR and costs. Remember, we’re here to support you every step of the way as you navigate this important decision.

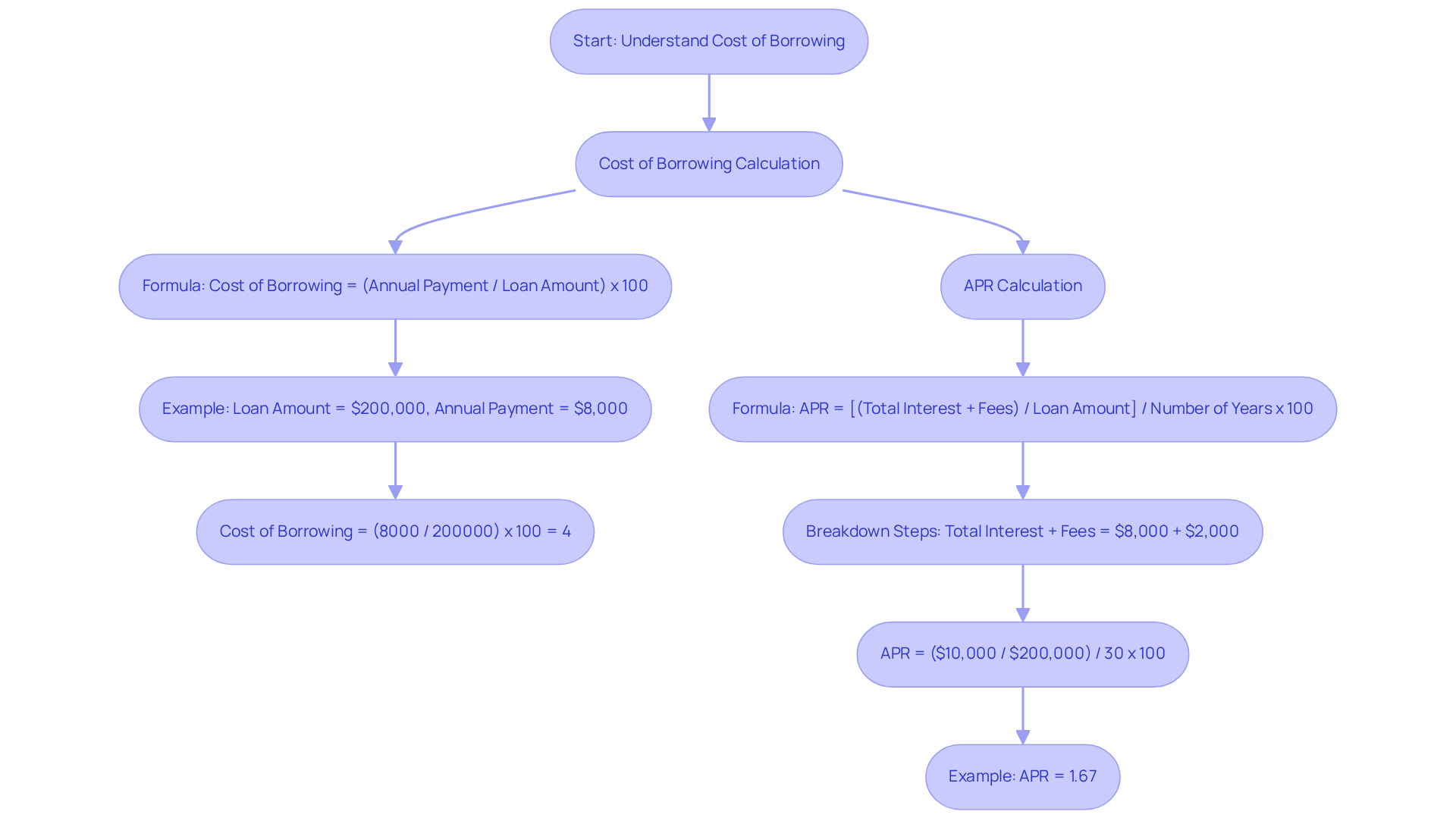

Explain How APR and Interest Rates Are Calculated

Understanding the cost of borrowing on a mortgage is crucial, and it can often feel overwhelming. Lenders determine this cost using the formula:

Cost of Borrowing = (Annual Payment / Loan Amount) x 100.

For instance, if you secure a loan of $200,000 with a yearly payment of $8,000, the percentage would be 4%. This simple calculation is just the beginning.

Calculating how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate is a bit more intricate, but we’re here to support you every step of the way. The formula for APR is:

APR = [(Total Interest + Fees) / Loan Amount] / Number of Years x 100.

Let’s break it down together. If you borrow $200,000, pay $8,000 in interest, and incur $2,000 in fees over a 30-year term, the APR calculation would look like this:

- Total Interest + Fees = $8,000 + $2,000 = $10,000.

- APR = ($10,000 / $200,000) / 30 x 100 = 1.67%.

This calculation raises the question of how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, revealing that the APR provides a comprehensive view of the overall expense of borrowing throughout the term, offering clearer insight than the cost alone.

When considering refinancing with F5 Mortgage, it’s essential to grasp these calculations as they play a vital role in determining your break-even point. After evaluating your financial situation, you’ll want to explore your refinancing options. This may involve comparing different lenders and loan alternatives to find the most favorable conditions and terms.

Once you submit your application, the lender will assess your property’s value through an appraisal process, followed by underwriting, where your credit history and financial details are reviewed. Ultimately, after receiving approval, you can finalize your new mortgage, ensuring that you understand both the cost of borrowing and how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate. This knowledge empowers you to make informed financial choices.

Looking ahead to 2025, typical fees factored into APR calculations are expected to reflect current market conditions, with lenders employing various methods to establish both charges and APR. We know how challenging this can be, but understanding these calculations is essential for borrowers, as they can significantly impact overall mortgage affordability and your financial planning.

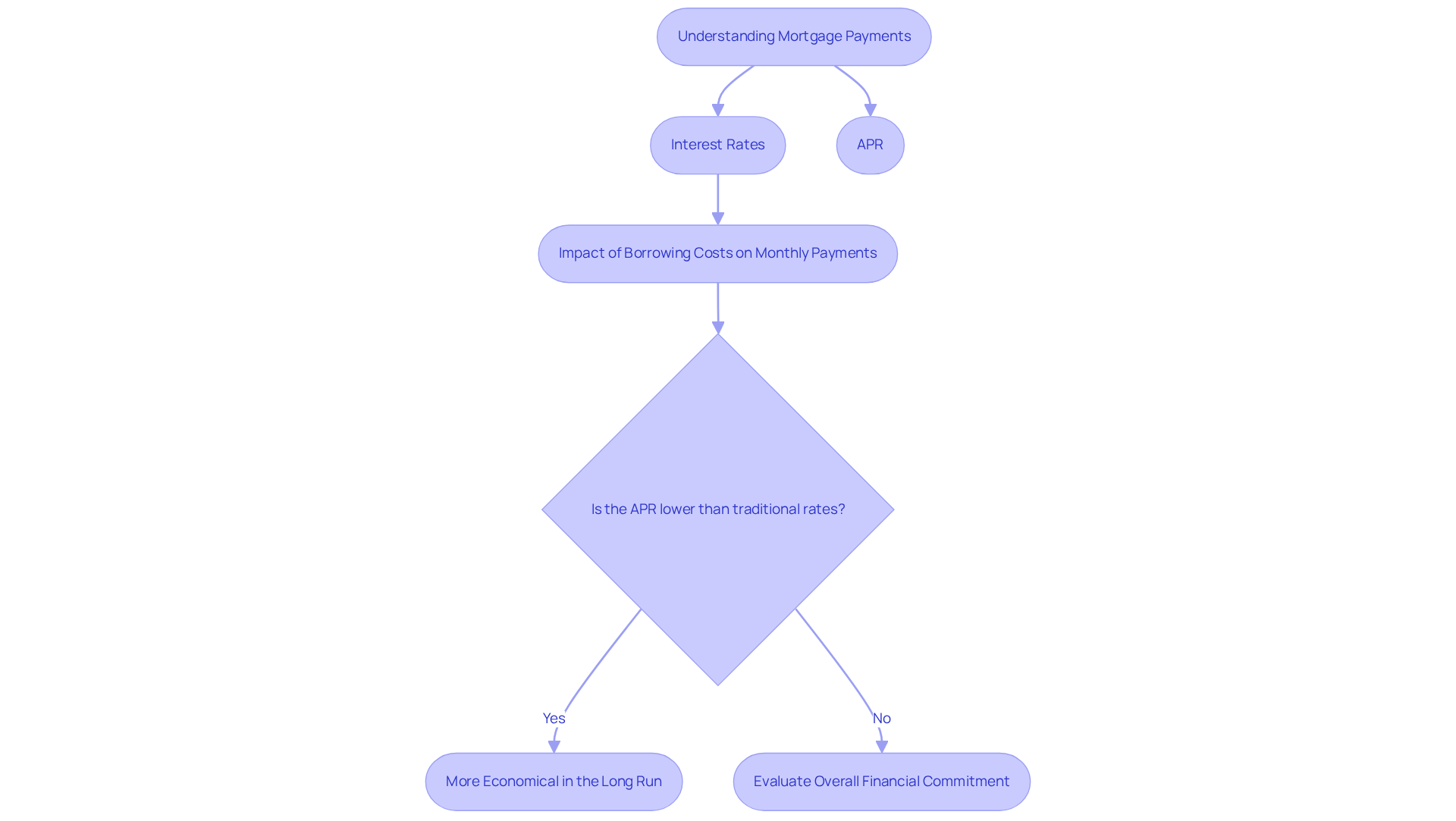

Discuss the Impact of APR and Interest Rates on Mortgage Payments

Understanding the financial charge is essential in shaping your monthly mortgage payment. When borrowing costs decrease, monthly payments become more manageable. Conversely, an increase in these costs leads to higher payments. For instance, on a $300,000 mortgage, a 3.5% charge results in a monthly payment of about $1,347, while a rise to 5.5% increases that payment to roughly $1,703. This highlights how even a 1% increase in fees can significantly impact your monthly responsibilities and the total costs over the life of the loan.

In contrast, one might ask how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, as it provides a broader perspective on the total expense, encompassing not just the charge but also any associated fees. While borrowing costs directly affect your monthly payments, it is important to understand how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, as this helps you evaluate the overall financial commitment of your debt. For example, two loans may have the same cost, but this raises the question of how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate due to varying fees. When considering loans, it is important to understand how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, as typically, the loan with the lower APR proves to be more economical in the long run, even if the monthly payments seem similar.

It’s crucial for homebuyers to grasp the relationship between borrowing costs and monthly payments. Higher borrowing costs can lead to significantly elevated monthly payments and overall financing expenses. Therefore, it’s vital to stay informed about current rates and to time your purchases wisely. Additionally, down payment assistance programs, such as the MyHome Assistance Program in California, which offers up to 3% of the home’s purchase price, and the My Choice Texas Home program, providing up to 5% for down payment and closing assistance, can alleviate some of these costs. In Florida, initiatives like the Florida Assist Second Mortgage Program provide up to $10,000 for upfront expenses, making homeownership more attainable.

As Monika Elguezabal wisely notes, “Understanding how lending costs operate is crucial for making informed borrowing choices.” By taking advantage of down payment assistance, homebuyers can lessen their initial financial burden, paving the way to homeownership. It’s also important to recognize that borrowing costs fluctuate based on economic conditions, inflation, and Federal Reserve decisions, all of which can impact mortgage affordability. We’re here to support you every step of the way.

Guide to Comparing Mortgage Offers: Focus on APR and Interest Rates

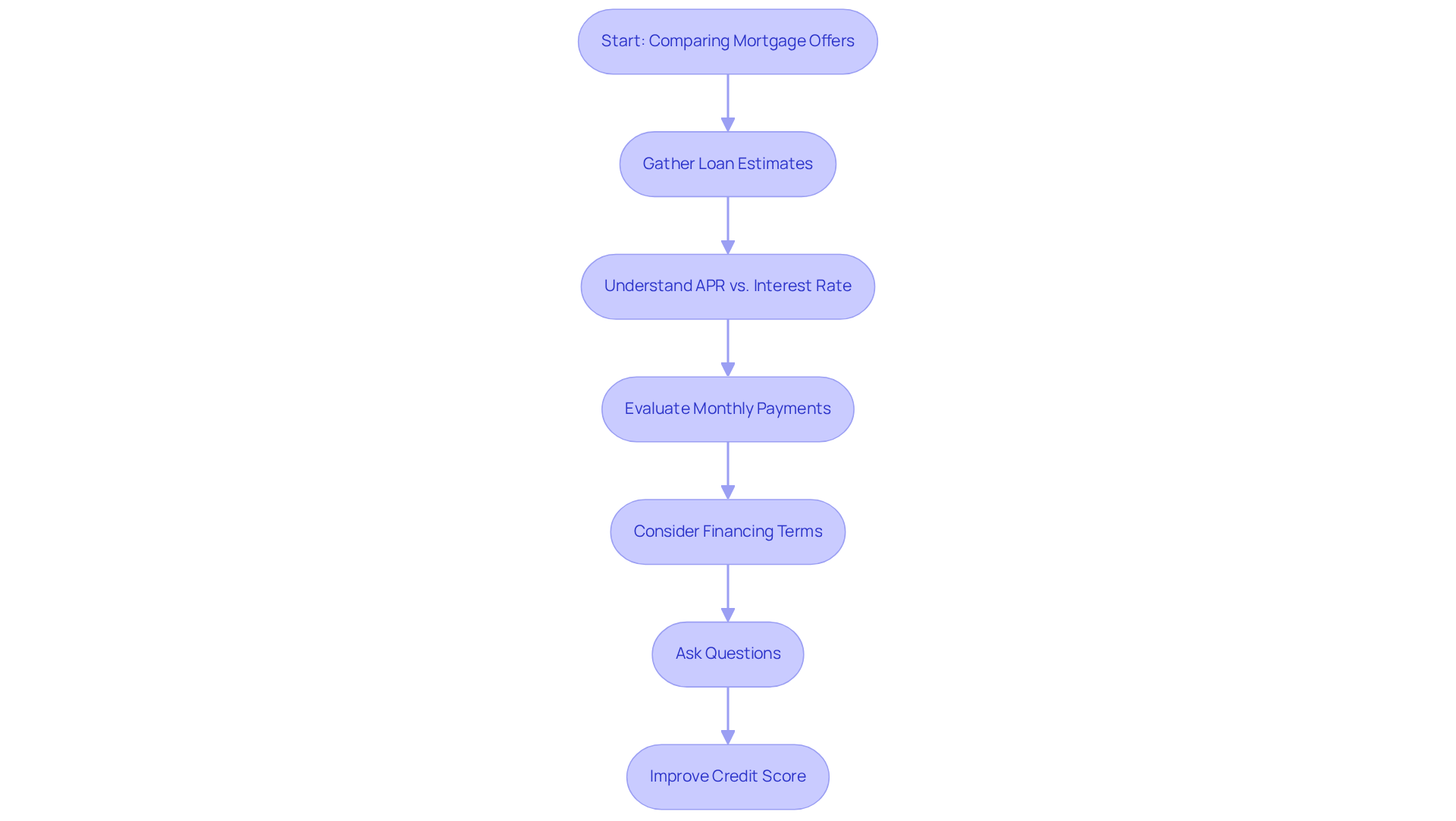

When evaluating mortgage proposals, we understand how overwhelming it can be. It’s essential to consider more than just the cost of borrowing. Here are some effective steps to ensure a thorough comparison that can lead to the best decision for your family:

- Gather Loan Estimates: Request Loan Estimates from multiple lenders. These documents outline the financing conditions, including the cost of borrowing and explaining how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate?, along with related charges, offering a clear understanding of what to anticipate.

- When comparing financing options, it’s important to understand how does an annual percentage rate (APR) for mortgages differ from a more traditional interest rate, as this provides a complete perspective of the overall expense, including both the rate and any charges. This is essential for understanding the true cost of borrowing.

- Evaluate Monthly Payments: While the APR is significant, also consider the monthly payment amount. Ensure that it aligns with your budget to avoid any financial strain.

- Consider Financing Terms: Examine the duration of the financing and any prepayment penalties. A lower APR might be appealing, but it could involve a longer repayment period, potentially raising the total interest paid over time.

- Ask Questions: Don’t hesitate to inquire about any unclear fees or costs. Gaining a full understanding of all aspects of the loan will empower you to make a well-informed decision.

Additionally, improving your credit score can significantly enhance your mortgage opportunities. Order a copy of your credit report to check for errors or discrepancies, and pay down existing debts to reduce your debt-to-income ratio. Using credit wisely by avoiding large purchases and making timely payments can also help.

By following these steps, you can effectively compare mortgage offers and select the one that best aligns with your financial goals. Engaging in this process is particularly important; research indicates that borrowers who compare offers can save significant amounts. In fact, those comparing five quotes save an average of about $3,000 more than those who accept the first offer. Moreover, being proactive in price comparison can result in improved financial outcomes, especially now when the variation between proposals for the same borrower profile has more than doubled. Remember to collect quotes on the same day for precise comparisons, as prices can vary daily. Lastly, be cautious of quotes that aren’t locked, as they are not binding. Consider working with F5 Mortgage for competitive rates and personalized service, ensuring you find the best mortgage solution for your family.

Conclusion

Understanding the distinction between the annual percentage rate (APR) for mortgages and traditional interest rates is crucial for any prospective borrower. We know how challenging this can be. While the interest rate reflects only the cost of borrowing the principal amount, the APR provides a more comprehensive view, incorporating additional fees and charges associated with the loan. This clarity empowers homebuyers to make informed decisions, ensuring they grasp the total financial commitment involved in their mortgage.

Throughout this article, we’ve shared key insights about:

- How APR is calculated

- The impact of both APR and interest rates on monthly mortgage payments

- Effective strategies for comparing mortgage offers

By emphasizing the importance of assessing all costs, including origination fees and closing costs, borrowers can better understand their true financial obligations. Additionally, we provided practical tips for evaluating different mortgage offers, highlighting the potential savings that can result from thorough comparisons.

In a landscape where borrowing costs can fluctuate significantly, being well-informed about APR and interest rates is essential for achieving financial stability and making sound mortgage choices. As economic conditions evolve, staying proactive and conducting comprehensive research can lead to substantial savings and a more favorable mortgage experience. Embracing this knowledge not only facilitates smarter borrowing decisions, but also paves the way toward successful homeownership. We’re here to support you every step of the way.

Frequently Asked Questions

What is an Annual Percentage Rate (APR)?

An Annual Percentage Rate (APR) is a yearly percentage that represents the total cost of borrowing money, including not just the interest on the loan but also additional charges such as origination fees, closing costs, and mortgage insurance.

How does APR differ from a traditional interest rate?

While a traditional interest rate only reflects the cost of borrowing the principal sum, the APR provides a more comprehensive picture by including additional costs associated with the loan, giving borrowers a clearer understanding of their overall borrowing expenses.

Can you provide an example of how APR works?

For instance, if you obtain a mortgage with a 4% interest rate, the APR might be 4.5%, which indicates a higher overall cost of borrowing when additional fees are taken into account.

Why is understanding the difference between APR and interest rate important for homebuyers?

Understanding the difference is crucial for homebuyers as it empowers them to make informed decisions when evaluating financing options and understanding the financial impact of their mortgage.

What should borrowers consider when evaluating mortgage offers?

Borrowers should explore and evaluate offers from various lenders to find favorable borrowing conditions. They should also consider how their credit scores may influence both the APR and overall costs.

Is APR the only factor to consider when choosing a mortgage?

No, while understanding APR is important, it shouldn’t be the only factor in deciding the best borrowing option. Borrowers should also reflect on their unique financial situations and other influencing factors.