Overview

A cash-out refinance offers homeowners a valuable opportunity to replace their existing mortgage with a new, larger loan. This process allows you to access the equity in your home, which can be a crucial resource for various financial needs. We know how challenging it can be to navigate these decisions, so let’s explore the steps involved together.

- First, it’s essential to assess your financial situation. Understanding where you stand financially is the first step toward making informed decisions.

- Next, take the time to compare lenders. Finding the right lender can make a significant difference in your experience and outcomes.

- Additionally, it’s important to understand the requirements, such as home equity and credit scores. These factors play a vital role in leveraging your home equity effectively.

By being aware of these elements, you can approach the refinancing process with confidence, knowing you’re making choices that align with your financial goals.

Remember, we’re here to support you every step of the way as you consider your options. Taking action now can lead to a brighter financial future.

Introduction

Navigating the intricacies of home financing can feel overwhelming, especially when considering how to leverage the equity in your property. A cash-out refinance presents homeowners with a thoughtful opportunity to access this equity by replacing their existing mortgage with a larger one. This allows you to tap into cash for various needs—whether it’s for home improvements or consolidating debt.

However, while this option may appear appealing, it’s essential to recognize that the process comes with its own set of complexities and risks. We know how challenging this can be, and it’s crucial to understand the critical steps and considerations that you must navigate. By doing so, you can make informed decisions in this financial landscape, ensuring that you feel supported every step of the way.

Understand Cash-Out Refinance Basics

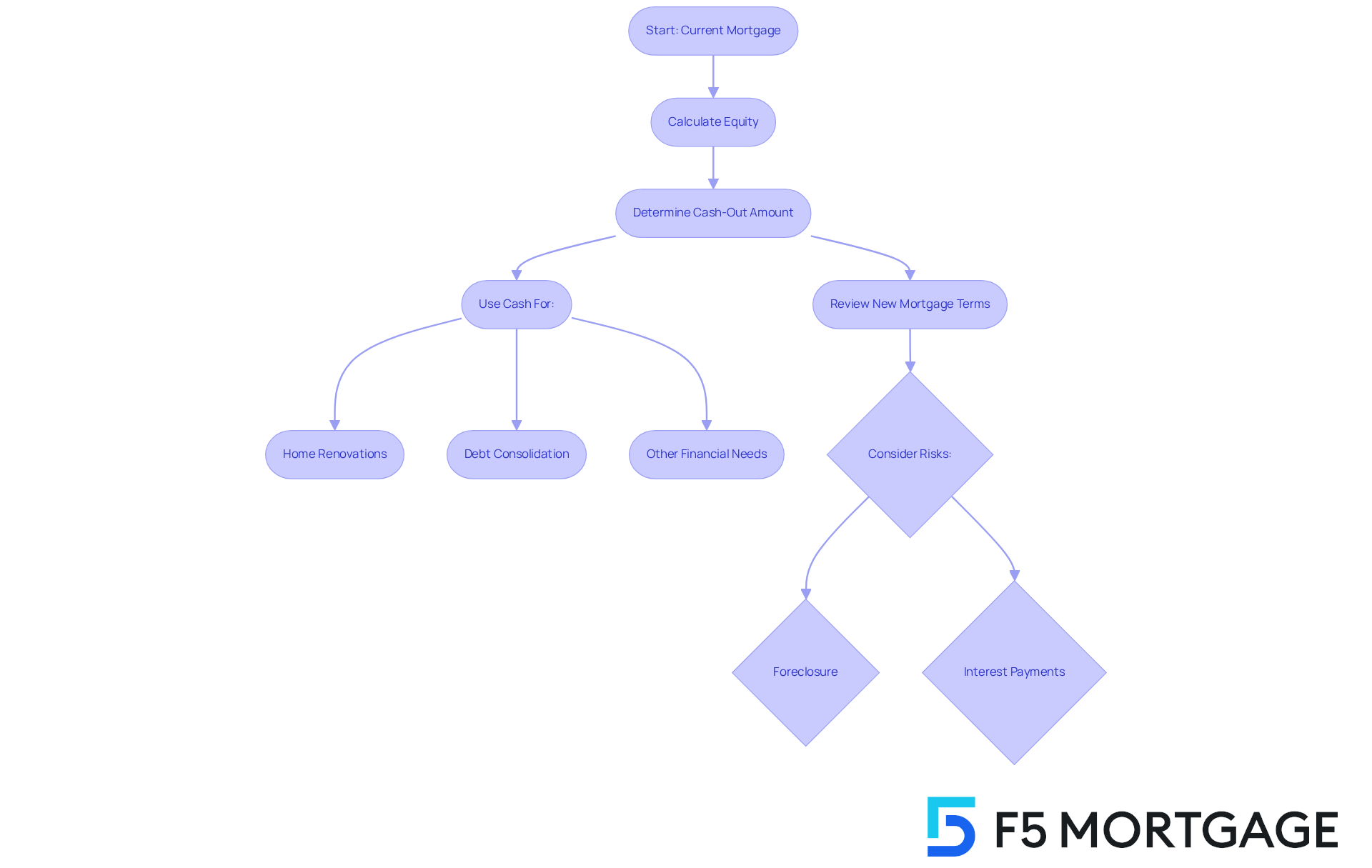

A cash-out refinance is a financial strategy that illustrates how a cash-out refinance works by allowing property owners to replace their current mortgage with a new, larger one, enabling them to access their equity. Equity in property is simply the difference between the current market value of your home and the balance remaining on your mortgage. For instance, if your home is valued at $300,000 and you owe $200,000, your equity is $100,000. By refinancing for $250,000, you can receive $50,000 in cash after paying off your existing mortgage. This cash can be used for various purposes, such as home renovations, debt consolidation, or other financial needs.

In 2025, the average cash-out refinance amount is expected to be significant, reflecting a growing trend among homeowners who are leveraging their equity for major expenses. At F5 Mortgage, we understand how important it is to have attractive pricing and user-friendly technology to simplify the refinancing process. Our goal is to ensure you can make informed decisions that align with your financial objectives. Plus, we offer a free quote to help you find the best rates and terms that suit your needs. However, it’s crucial to recognize how a cash-out refinance works, as this process comes with new mortgage terms that may differ from your original loan, making it essential to carefully review any changes and the total interest payments over the life of the loan.

There are many success stories of homeowners using refinancing to fund home improvements that increase property value or to consolidate high-interest debts, ultimately saving thousands in interest payments. As money management experts often point out, this option can be a powerful tool for managing budgets, as long as borrowers are aware of the associated risks, including the possibility of foreclosure if payments are missed. Understanding these fundamentals is vital for determining if a refinance aligns with your financial goals, especially with F5 Mortgage’s commitment to closing most loans in under three weeks. We know how challenging this can be, and we’re here to support you every step of the way.

Identify Cash-Out Refinance Requirements

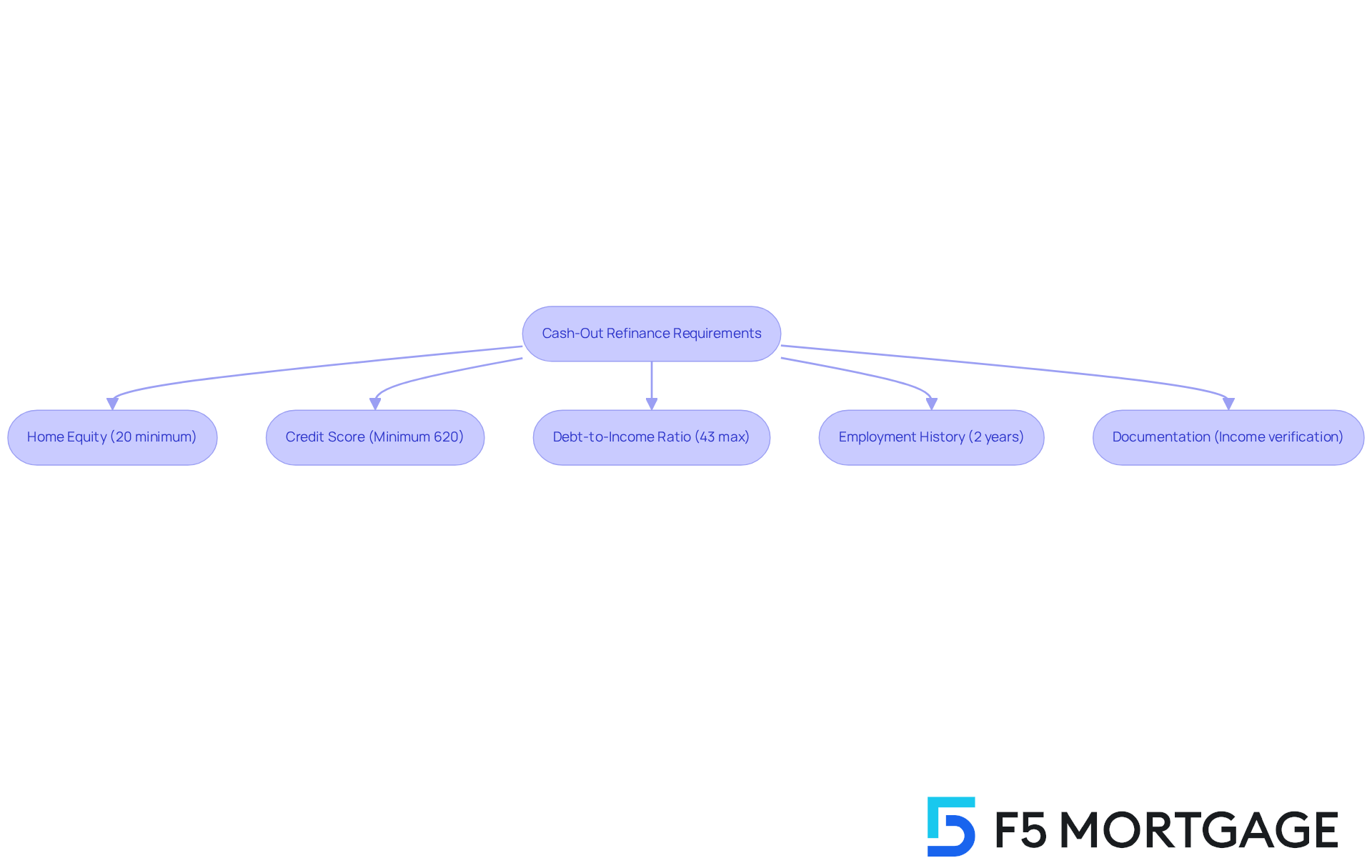

Qualifying for a cash-out refinance can feel daunting, but understanding how a cash-out refinance works and the essential criteria can make the process smoother for you. Here’s what you need to know:

-

Home Equity: Most lenders typically require at least 20% equity in your home. This means your mortgage balance should be less than 80% of your home’s appraised value. This requirement is crucial as it determines how a cash-out refinance works regarding how much cash you can access. In Colorado, many homeowners have built substantial equity due to rising property values, making refinancing for cash an appealing choice. If you’re considering an FHA refinance, remember that you must have made 12 on-time payments to qualify.

-

Credit Score: Generally, a minimum credit score of 620 is needed, although some lenders may accept lower scores under specific conditions. For example, FourLeaf Federal Credit Union requires a minimum score of 670, while First Federal Bank looks for a score of 680. To understand how a cash-out refinance works, it’s important to note that approval standards for it are usually similar to those for the original mortgage regarding debt-to-income and credit score.

-

Debt-to-Income Ratio (DTI): Your DTI ratio should not exceed 43%. This means your total monthly debt payments must be less than 43% of your gross monthly income. Maintaining a manageable DTI is crucial, especially with the rising living expenses in Colorado, as it ensures you can handle new mortgage payments alongside your existing debts.

-

Employment History: Lenders often look for a stable employment history, typically requiring at least two years in the same job or field. This stability gives lenders confidence in your ability to make consistent payments.

-

Documentation: Be prepared to provide necessary records, such as pay stubs, tax returns, and bank statements, to verify your income and financial status. This paperwork is essential for lenders to assess your financial health. Understanding the documentation process can help streamline your refinancing application with F5 Mortgage.

By meeting these criteria, you can unlock benefits like lower monthly payments and understand how a cash-out refinance works in terms of potential tax advantages. Recent trends show that the percentage of equity refinances has increased from 58% in January to 62% in February 2025, reflecting a growing interest among homeowners in leveraging their equity. However, it’s important to consider the potential risks of withdrawing equity through refinancing, such as the risk of losing your home if payments are missed. Additionally, refinancing costs typically range from 2% to 6% of the loan amount.

We know how challenging this can be, but grasping these requirements and considerations will empower you to navigate the refinancing process more effectively and prepare for the next steps in achieving your financial goals.

Follow Steps to Complete a Cash-Out Refinance

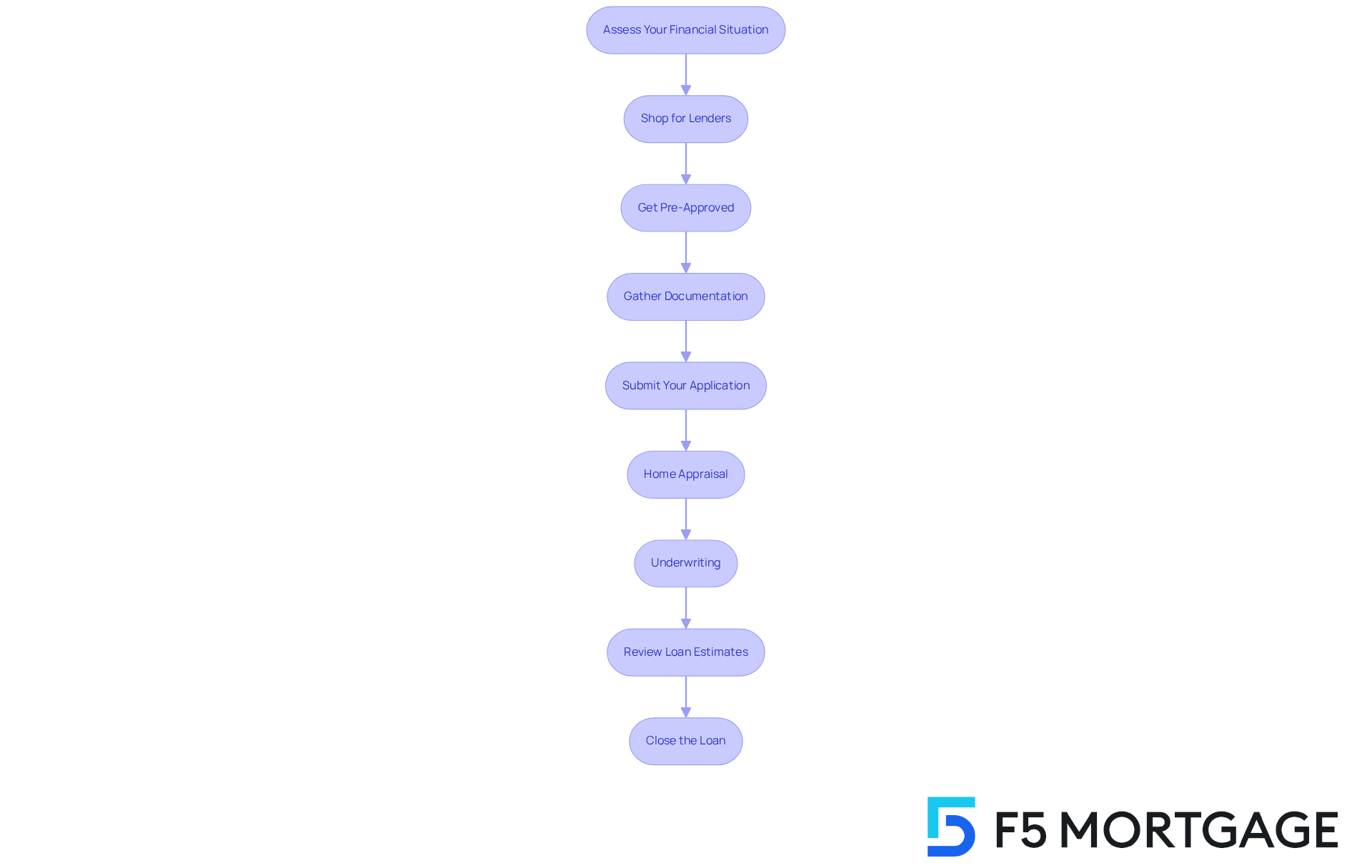

To successfully complete a cash-out refinance, we understand how important it is to follow these essential steps:

-

Assess Your Financial Situation: Start by taking a moment to review your current mortgage, equity, and financial goals. Consider how much cash you need and how you plan to use it. We know how challenging this can be, and understanding your situation is the first step toward making informed decisions.

-

Shop for Lenders: Explore various lenders to compare rates, terms, and fees. Focus on those that specialize in cash-out refinancing to find the best options tailored to your needs. Remember, this is about finding the right fit for you and your family.

-

Get Pre-Approved: Share your financial information with potential lenders to get pre-approved. This step will give you insight into how much you can borrow and the interest rates available to you, empowering you to move forward with confidence.

-

Gather Documentation: Prepare necessary documents, such as proof of income, tax returns, and details about your current mortgage. Having these ready can help expedite the process, reducing stress along the way.

-

Submit Your Application: Complete the application process with your chosen lender. Be prepared to answer questions and provide additional documentation as needed. We’re here to support you every step of the way.

-

Home Appraisal: The lender will typically require a home appraisal to assess your home’s current market value. This is crucial for determining your equity, and we understand that this can feel daunting.

-

Underwriting: After the appraisal, the lender will review your loan application, credit history, and other financial details to complete the credit approval process. This step is vital, and we want you to feel assured that your application is in good hands.

-

Review Loan Estimates: Once approved, carefully review the loan estimate provided by the lender. This document outlines the terms, interest rates, and closing costs associated with your refinance. Take your time to understand it fully; it’s an important part of the process.

-

Close the Loan: If you agree to the terms, schedule a closing date. During this meeting, you will sign the required documents, pay any closing expenses, and receive your funds. This is an exciting step, and we’re thrilled for you as you move forward.

By following these steps, you can ensure a smooth refinancing process and learn how does a cash out refinance work, allowing you to leverage your home equity effectively. With refinancing options accounting for approximately 13% of all loan locks today, it’s a feasible choice for homeowners wanting to tap into their equity. Particularly as interest levels have recently decreased, now is a favorable moment to consider refinancing.

Compare Cash-Out Refinance with Alternative Financing Options

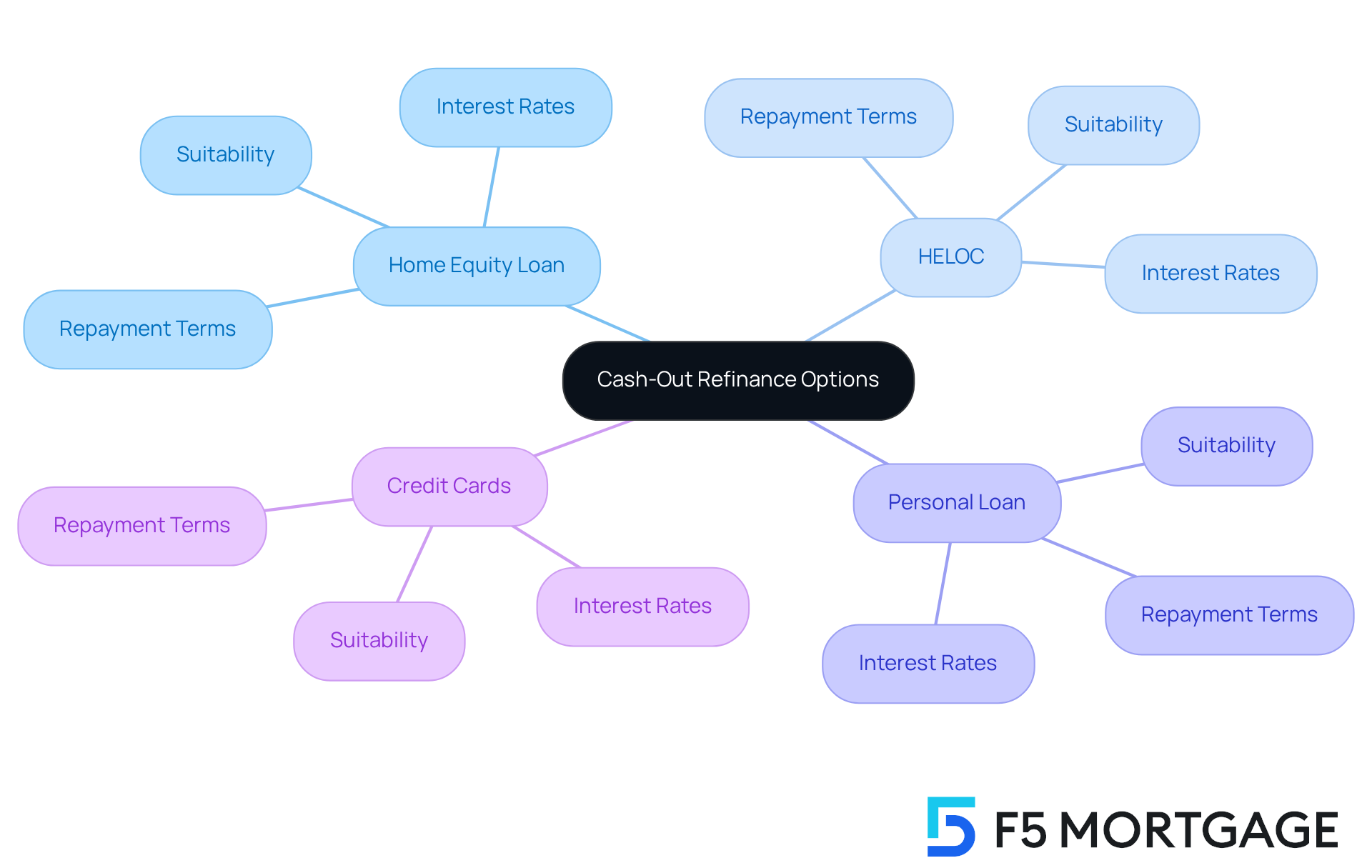

When evaluating a cash-out refinance, understanding how a cash-out refinance works can help navigate your options more easily. It’s crucial to compare it with other financing alternatives that may suit your needs better:

-

Home Equity Loan: This second mortgage allows you to borrow against your property’s equity. It typically offers a fixed interest percentage and a specified repayment term. Unlike a cash-out refinance, your original mortgage remains unchanged, making it a reliable option for those who wish to keep their current mortgage terms.

-

Home Equity Line of Credit (HELOC): A HELOC provides a revolving line of credit based on your home equity, offering flexibility in both borrowing and repayment. However, it often comes with fluctuating interest terms, which can vary over time and potentially increase your repayment expenses.

-

Personal Loan: Unsecured personal loans can be used for various purposes and generally provide quicker access to funds. However, they typically carry higher interest charges than cash-out refinances, making them a less cost-effective choice for larger sums.

-

Credit Cards: While not a traditional financing method, credit cards can offer immediate cash access. However, they usually have elevated interest charges, so they should be used carefully to avoid accumulating debt.

As you consider these choices, take a moment to examine key factors such as interest percentages, repayment conditions, tax implications, and your long-term financial objectives. A cash-out refinance may offer reduced costs and potential tax advantages, but understanding how a cash-out refinance works is crucial, as it can raise your mortgage balance and may extend your repayment period. For example, with current mortgage rates hovering around 7%, retaining a lower existing rate through a home equity loan might be more advantageous for some homeowners.

By evaluating these alternatives thoughtfully, you can empower yourself to select the best option tailored to your financial needs. We’re here to support you every step of the way.

Conclusion

A cash-out refinance can be a powerful financial tool for homeowners, enabling them to access their property equity by replacing their current mortgage with a new, larger loan. This process opens doors to cash for various needs—whether it’s for home improvements or consolidating debt. However, it’s essential to approach this option with careful consideration of the new mortgage terms and the potential risks involved. We understand how important it is to make informed financial decisions that align with your personal goals.

In this article, we’ve highlighted key elements, such as the fundamental requirements for qualifying, which include:

- Home equity

- Credit score

- Debt-to-income ratio

We’ve also laid out a step-by-step process for successfully completing a cash-out refinance. It’s crucial to assess your financial situation, shop for lenders, and gather the necessary documentation. Additionally, we compared cash-out refinancing with alternative financing options, providing insights into the benefits and drawbacks of each. This information empowers you to make the best decision for your circumstances.

Ultimately, leveraging a cash-out refinance can be an effective strategy for managing your finances. However, it’s vital to remain mindful of the associated risks and costs. As you navigate these options, we encourage you to weigh the benefits against potential pitfalls carefully. By taking the time to explore the refinancing landscape and understanding how a cash-out refinance works, you can make choices that significantly impact your financial well-being and future stability. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a cash-out refinance?

A cash-out refinance is a financial strategy that allows property owners to replace their current mortgage with a new, larger one, enabling them to access their home equity.

How is equity in property defined?

Equity in property is the difference between the current market value of a home and the balance remaining on the mortgage. For example, if a home is valued at $300,000 and the mortgage balance is $200,000, the equity is $100,000.

How does the cash-out refinance process work?

In a cash-out refinance, a homeowner can refinance for an amount greater than their existing mortgage. After paying off the current mortgage, the homeowner receives the difference in cash, which can be used for various purposes.

What can the cash received from a cash-out refinance be used for?

The cash from a cash-out refinance can be used for home renovations, debt consolidation, or other financial needs.

What should homeowners consider before opting for a cash-out refinance?

Homeowners should carefully review the new mortgage terms, as they may differ from the original loan. It is essential to understand the total interest payments over the life of the new loan.

What are some potential benefits of cash-out refinancing?

Cash-out refinancing can help fund home improvements that increase property value or consolidate high-interest debts, potentially saving homeowners thousands in interest payments.

What risks are associated with cash-out refinancing?

There are risks involved, including the possibility of foreclosure if mortgage payments are missed. Borrowers must be aware of these risks when considering refinancing.

How quickly can loans be closed with F5 Mortgage?

F5 Mortgage is committed to closing most loans in under three weeks, providing support throughout the refinancing process.

How can I get a quote for a cash-out refinance with F5 Mortgage?

F5 Mortgage offers a free quote to help you find the best rates and terms that suit your refinancing needs.