Overview

Home equity mortgage rates can be higher than traditional mortgage rates, which makes them a suitable option for homeowners who have built substantial equity and need funds for renovations or debt consolidation. On the other hand, conventional loans often serve first-time homebuyers better, as they provide stable financing.

We understand how challenging it can be to navigate these options. The article highlights the differences in interest rates and risk profiles, while also considering the financial goals of borrowers. It’s essential to evaluate your individual circumstances when choosing between these two mortgage options.

We’re here to support you every step of the way, ensuring you make the best decision for your unique situation.

Introduction

Navigating the world of mortgages can feel overwhelming, especially with the multitude of options available to homeowners today. We understand how challenging this can be. Home equity mortgages and traditional loans each offer unique advantages, but the choice of which path to take truly depends on your individual financial goals and circumstances.

As homeowners face rising property values and fluctuating interest rates, grasping the nuances between these two types of financing becomes essential. What factors should you consider when determining the best mortgage solution? We’re here to support you every step of the way as you make an informed choice in this complex landscape.

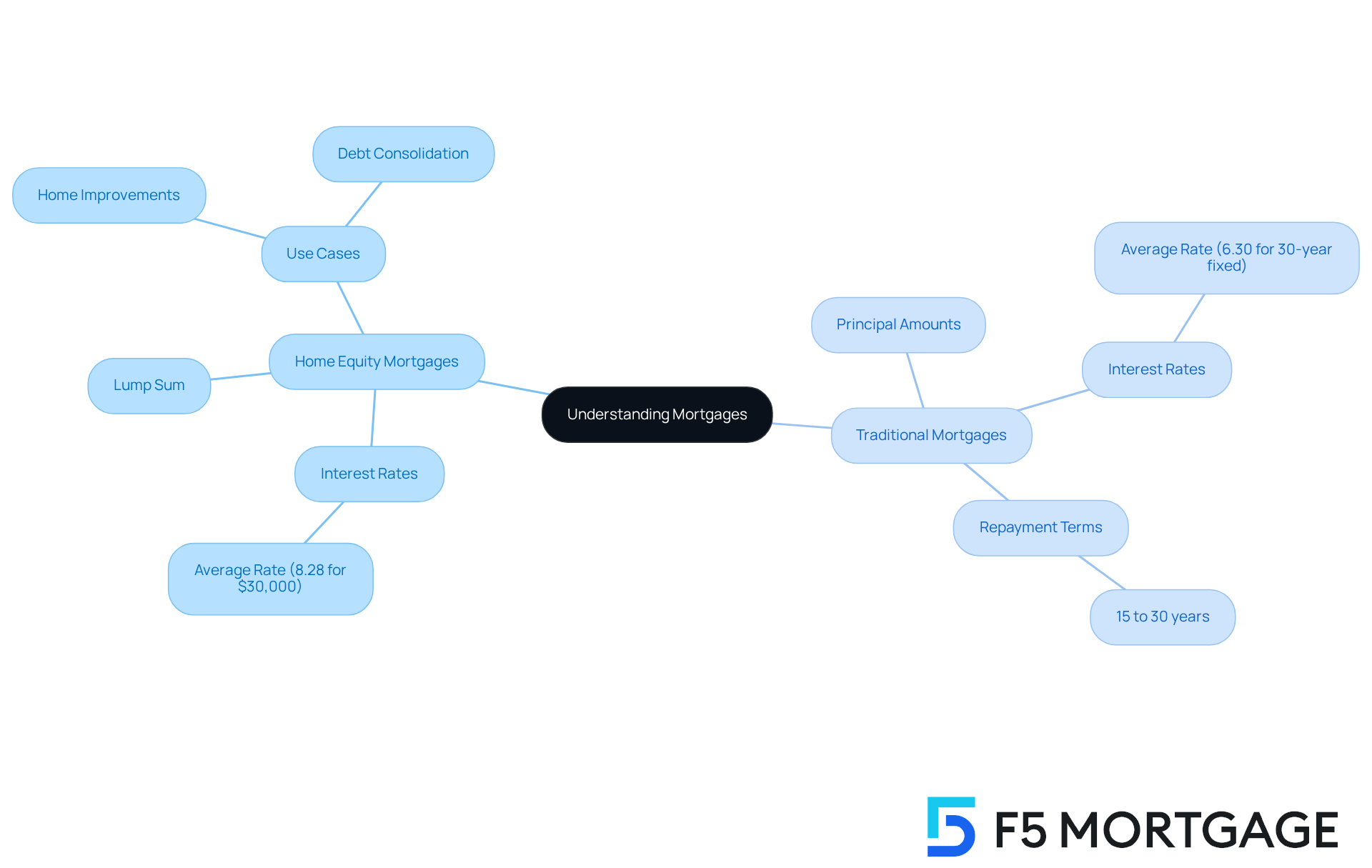

Understanding Home Equity Mortgages and Traditional Mortgages

Home value mortgages, often referred to as second mortgages, can be influenced by home equity mortgage rates, allowing homeowners to tap into the value they’ve built in their properties. These financial products typically offer a lump sum that is repaid over a fixed period, often featuring lower interest rates than unsecured options. As we look toward 2025, the average interest rate for a $30,000 property collateral financing stands at about 8.28 percent, while property collateral lines of credit (HELOCs) average around 8.05 percent. This makes home equity mortgage rates an appealing choice for those looking to fund home improvements or consolidate debts.

In contrast, conventional loans are primarily used for purchasing homes and are secured by the property itself. They usually involve larger principal amounts and longer repayment terms, often spanning 15 to 30 years. Recently, the typical rate for a 30-year fixed-rate loan has dropped to 6.30 percent, signaling a favorable borrowing climate.

Understanding these differences is vital for homeowners navigating their financing options. For instance, a homeowner might choose to borrow against their property’s value to finance enhancements that increase market value, while a conventional loan could be more suitable for new buyers seeking to purchase a home. Financial advisors emphasize the importance of considering individual financial goals and preferences when deciding between these two types of loans. With property values reaching unprecedented heights and total owner equity hitting $17.5 trillion in mid-2025, many homeowners find that leveraging residential value through home equity mortgage rates can be a strategic and empowering choice. We know how challenging this process can be, and we’re here to support you every step of the way.

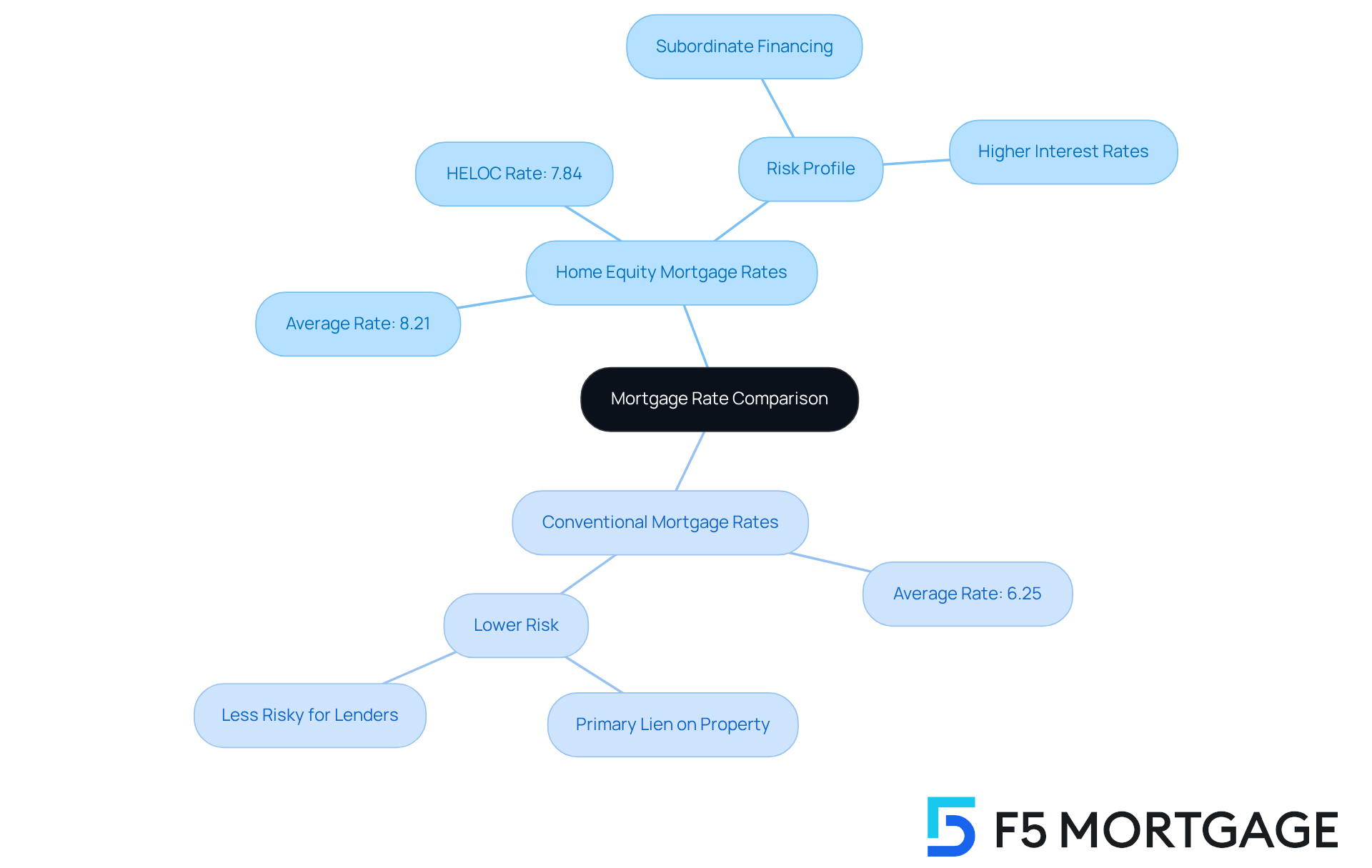

Comparing Home Equity Mortgage Rates and Traditional Mortgage Rates

In October 2025, many families may find themselves facing average home equity mortgage rates of approximately 8.21%. Meanwhile, conventional financing rates for a 30-year fixed-rate arrangement hover around 6.25%. This difference can be concerning, as it stems from the varying risk profiles associated with each type of credit. Conventional loans are generally viewed as less risky for lenders, since they hold the primary lien on the property. Conversely, residential asset borrowing is considered subordinate, meaning these loans are settled only after the main financing in the event of foreclosure.

As a result, while residential property financing offers access to essential funds, it often comes with higher interest rates compared to conventional mortgages. This reality can significantly impact long-term financial plans for families. Additionally, the average home equity mortgage rates are currently 7.84% for HELOCs, presenting another option for those seeking financial solutions. It’s noteworthy that 39% of borrowers explored a HELOC or property-backed financing option to consolidate debt in 2024. This statistic highlights a practical reason for considering these alternatives.

With the Federal Reserve’s recent actions possibly leading to further reductions in borrowing costs, experts are optimistic that home equity mortgage rates could drop below 8% soon. For families in Colorado, refinancing a loan typically results in a lower monthly payment if a reduced interest rate can be secured. However, it’s important to remember that refinancing usually involves some initial costs. The typical expense to refinance ranges from 2% to 5% of the overall amount, a factor that families should carefully consider when assessing their financial objectives.

We know how challenging this can be, and we encourage borrowers to thoroughly evaluate these rates and contemplate their financial strategies. Choosing between residential financing options and conventional lending can be daunting, but F5 Mortgage offers competitive rate comparisons and support programs designed to simplify the refinancing process. We’re here to support you every step of the way.

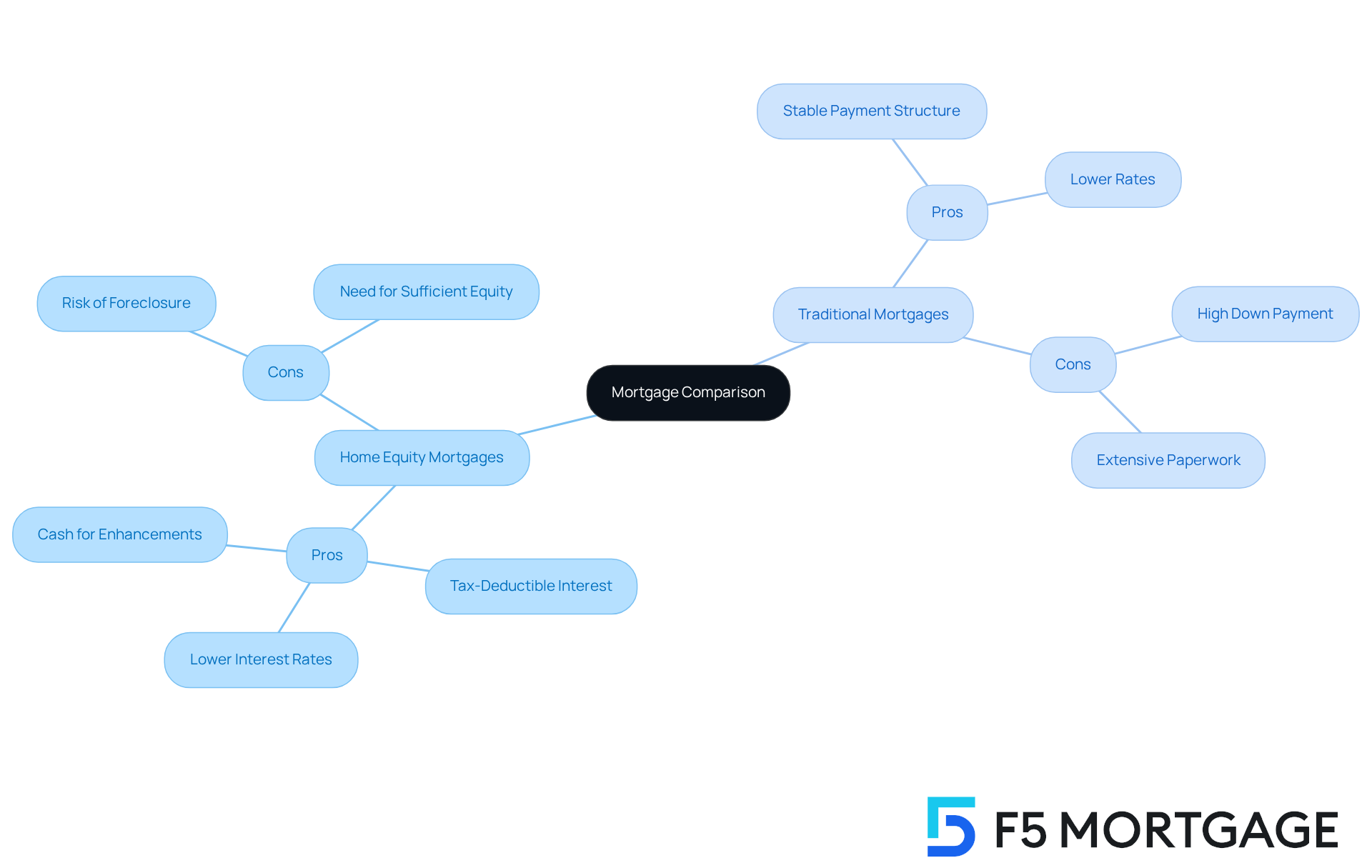

Evaluating the Pros and Cons of Home Equity Mortgages vs. Traditional Mortgages

Mortgages based on property value can provide unique benefits that many families find appealing. They often come with home equity mortgage rates that have reduced interest rates compared to personal financing, making them a great option for securing cash for property enhancements or restructuring debt. Additionally, the interest paid on property financing may be tax-deductible, presenting potential financial advantages for borrowers. However, it’s important to recognize the inherent risks, such as the possibility of foreclosure if payments are missed. Borrowers must also have sufficient equity in the property to qualify, typically assessed through the debt-to-income (DTI) ratio. A maximum DTI ratio of 43% is usually necessary for housing financing, and improving this ratio can lead to more favorable interest rates. Understanding your financial situation is crucial.

On the other hand, conventional loans offer a stable and predictable payment structure, often featuring lower rates and extended repayment terms. Yet, they usually require a significant down payment and involve extensive paperwork, which might deter some potential borrowers. For instance, property owners with substantial assets may find that a property-backed credit is the best choice for financing renovations, allowing them to enhance their living space without sacrificing the benefits of their initial financing agreements. Conversely, individuals with lower equity or concerns about fluctuating home values may prefer the stability that comes with a conventional loan.

At F5 Mortgage, we provide various refinancing options, including conventional and FHA loans, tailored to meet different financial needs and credit situations. Understanding these choices, along with the DTI criteria, is essential for borrowers to identify which financing solution, including home equity mortgage rates, aligns best with their financial goals. Ultimately, assessing factors such as home equity mortgage rates, payment structures, and potential risks is vital for homeowners to make informed decisions about their financing options. As the market evolves, staying informed about current trends and expert opinions can empower you to navigate your financial decisions effectively. Remember, we’re here to support you every step of the way.

Determining Suitability: Who Should Choose Home Equity Mortgages vs. Traditional Mortgages

Home equity mortgage rates can provide a great option for homeowners who have built up significant equity in their property. If you find yourself needing funds for renovations, education, or even debt consolidation, this could be the solution for you. We know how challenging it can be to navigate financial decisions, and these loans are particularly suitable for those who are comfortable with the risks associated with a secondary loan.

At F5 Mortgage, we are dedicated to providing quick and flexible financing options. Our goal is to assist families in achieving homeownership with exceptional service and competitive rates. Imagine the peace of mind that comes from knowing you have the support you need during this important journey.

On the other hand, conventional loans are tailored for first-time homebuyers or those looking to purchase a new home. They offer a systematic approach to financing a property, often with lower interest rates. This method can be especially reassuring for those who may feel overwhelmed by the home-buying process.

Ultimately, the choice between these two mortgage types, including home equity mortgage rates, should be based on your individual financial circumstances, long-term goals, and risk tolerance. We’re here to support you every step of the way, helping you make the best decision for your future.

Conclusion

Choosing between home equity mortgages and traditional mortgages is a significant decision that can deeply affect your financial well-being. We understand how challenging this can be, as each option presents unique advantages and considerations. It’s essential for homeowners to thoughtfully evaluate their specific needs and circumstances before committing to a financing strategy.

In this article, we’ve highlighted the fundamental differences between these two types of loans. From interest rates to repayment structures and their suitability for various financial goals, it’s all about finding what works best for you. Home equity mortgages can provide access to cash for renovations or debt consolidation, though they often come with higher interest rates due to their subordinate lien status. On the other hand, traditional mortgages typically offer lower rates and structured payments, making them ideal for first-time homebuyers or those purchasing a new property.

Ultimately, the choice between home equity and traditional mortgages depends on your individual financial situation, risk tolerance, and long-term objectives. As property values rise and interest rates fluctuate, staying informed about current trends is vital. We’re here to support you every step of the way. By carefully assessing these factors, you can make informed decisions that align with your financial aspirations and ensure a secure future.

Frequently Asked Questions

What are home equity mortgages?

Home equity mortgages, often referred to as second mortgages, allow homeowners to tap into the value they’ve built in their properties. They typically offer a lump sum that is repaid over a fixed period and often feature lower interest rates than unsecured options.

What are the current average interest rates for home equity mortgages and HELOCs?

As of 2025, the average interest rate for a $30,000 home equity mortgage is about 8.28 percent, while property collateral lines of credit (HELOCs) average around 8.05 percent.

What are traditional mortgages used for?

Traditional mortgages, or conventional loans, are primarily used for purchasing homes and are secured by the property itself. They usually involve larger principal amounts and longer repayment terms, often spanning 15 to 30 years.

What is the current typical rate for a 30-year fixed-rate loan?

The typical rate for a 30-year fixed-rate loan has recently dropped to 6.30 percent.

How should homeowners decide between a home equity mortgage and a traditional mortgage?

Homeowners should consider their individual financial goals and preferences. A home equity mortgage may be suitable for financing home improvements or consolidating debts, while a conventional loan could be more appropriate for new buyers seeking to purchase a home.

What is the significance of owner equity in the current housing market?

With total owner equity reaching $17.5 trillion in mid-2025, many homeowners find that leveraging their residential value through home equity mortgages can be a strategic and empowering choice.