Overview

In this article, we understand how important it is for families to navigate the complexities of Home Equity Lines of Credit (HELOC) rates. We’re here to support you every step of the way as we compare Arizona’s HELOC rates with national trends.

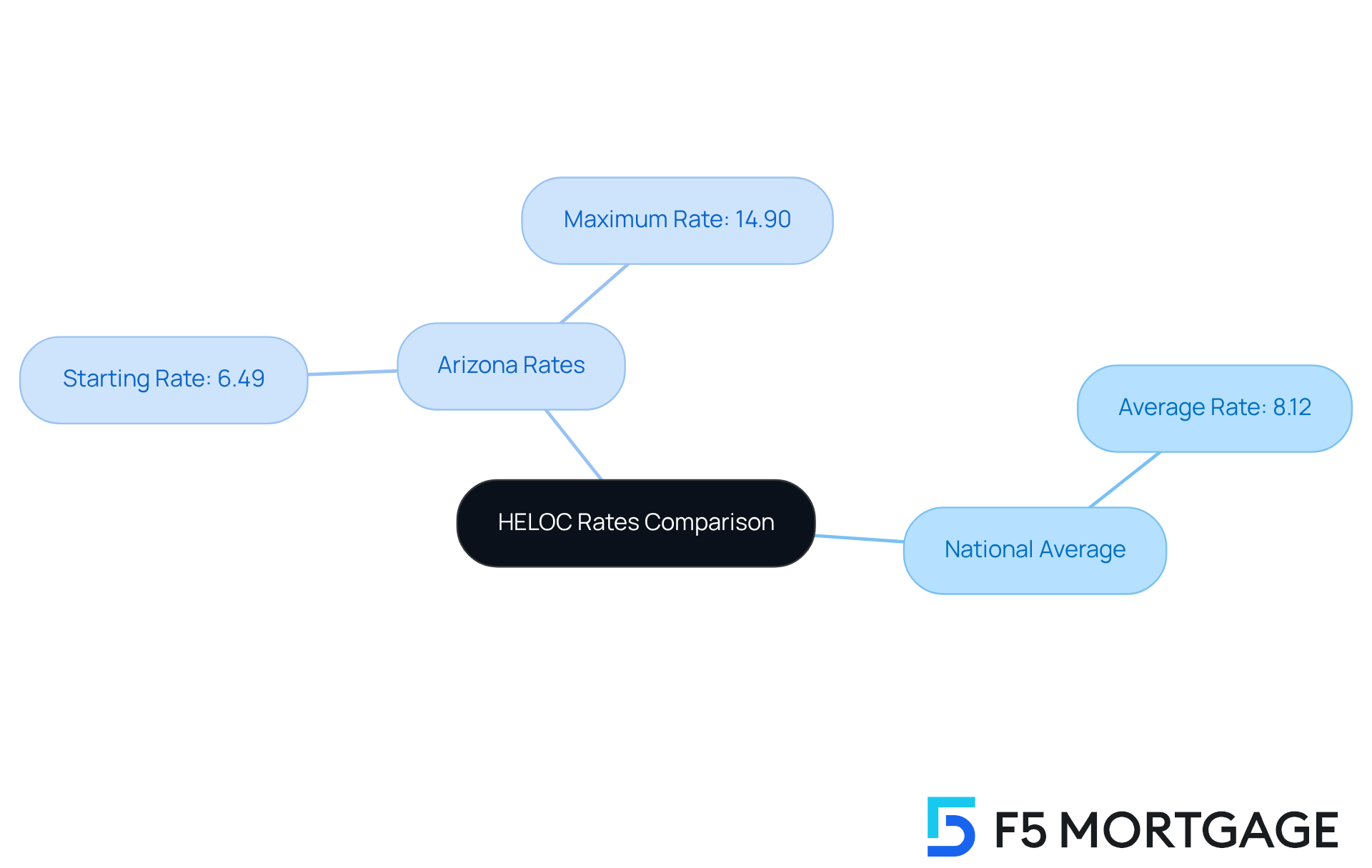

Currently, Arizona’s average rates hover around 8.12%, but they can start as low as 6.49%. This variation highlights the need for careful comparison of lender offers to secure the best terms.

We know how challenging this can be, especially since rates can differ significantly based on factors like credit scores and loan-to-value ratios. By sharing this information, we aim to empower you with the knowledge needed to make informed decisions.

Remember, taking the time to compare offers can make a meaningful difference in your financial journey.

Introduction

Homeowners are increasingly turning to Home Equity Lines of Credit (HELOCs) as a flexible financial tool. This trend is particularly evident in today’s landscape, where property values are on the rise. With current HELOC rates in Arizona averaging around 8.26%, the opportunity to leverage home equity for renovations, debt consolidation, or unexpected expenses is more appealing than ever.

However, we know how challenging this can be. The significant variations in rates among lenders—ranging from as low as 6.49% to as high as 14.90%—raise a critical question: how can homeowners effectively navigate this complex market to secure the best terms for their financial needs? We’re here to support you every step of the way, helping you understand your options and make informed decisions.

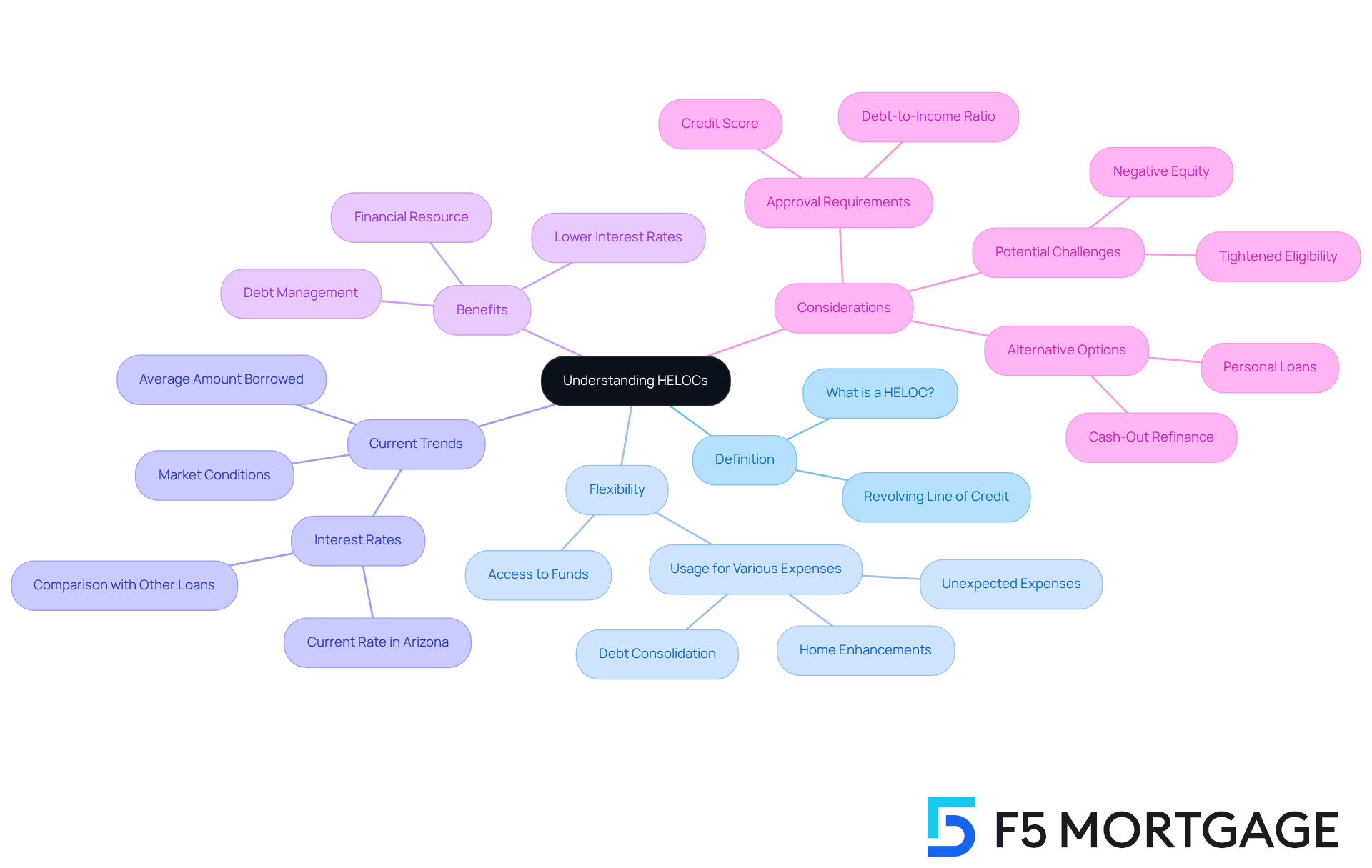

Understanding Home Equity Lines of Credit (HELOCs)

A , or HELOC, is a revolving line of funding secured by the equity in your residence. This means that as a property owner, you can borrow against the value of your home. Unlike traditional loans that provide a lump sum, a HELOC offers you the flexibility to access funds whenever you need them. Think of it as having a payment card that allows you to draw money up to a predetermined limit. This makes HELOCs particularly appealing for , consolidating debt, or managing unexpected expenses.

As we look ahead to 2025, it’s important to note that the average amount taken from has seen a significant increase. This trend highlights a growing reliance on . often emphasize that using a home equity line for property improvements can be a wise decision, particularly since it typically features . For instance, the current have recently dropped to an average of 8.26%, creating an excellent opportunity for homeowners to consider this option.

Real-life examples demonstrate how effective HELOCs can be for . Many homeowners have successfully utilized these lines of credit to pay off higher-interest debts, . Before applying for a HELOC, it’s crucial for property owners to , as this can greatly enhance their chances of approval.

In summary, HELOCs remain a valuable option for property owners looking to tap into their equity, especially in a favorable market. By understanding the latest trends and benefits associated with HELOCs, you can empower yourself to make informed financial decisions. We know how challenging navigating these options can be, but we’re here to support you every step of the way.

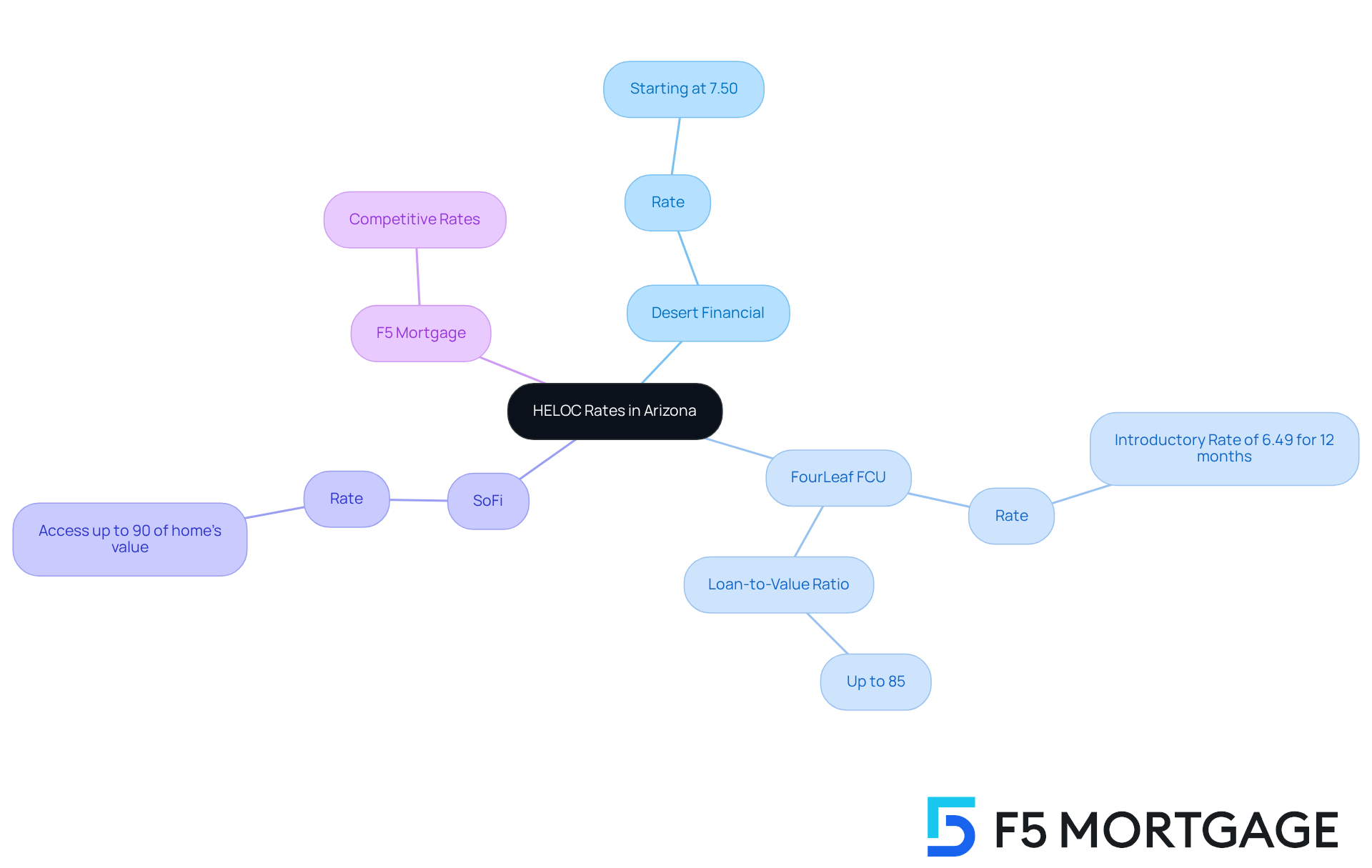

Current HELOC Rates in Arizona

As of August 2025, we know how challenging it can be to navigate the world of home equity lines of credit (HELOCs). In Arizona, the variations in HELOC rates among lenders are significant, with rates ranging from 6.49% to 14.90%. Factors such as your credit score and loan-to-value ratio play a crucial role in these percentages. For example:

- starting at 7.50%.

- FourLeaf FCU provides an appealing introductory rate of 6.49% for the first 12 months.

Additionally, some lenders, like SoFi, allow , which is higher than the typical 85% available from most lenders. This disparity highlights the necessity for homeowners to thoroughly , specifically looking into . , for instance, is recognized for its and , which can make a significant difference in your experience.

You can typically expect repayment terms that extend up to 30 years. Therefore, it’s crucial to evaluate the . Remember, acquiring a also requires proof of home insurance, as your residence acts as collateral for the loan.

By understanding the landscape of home equity line options and the importance of and equity, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way.

Comparing Arizona HELOC Rates to National Averages

As of August 2025, we understand that navigating the world of HELOCs can be challenging. The is around 8.12%. However, Arizona presents a more competitive landscape, with starting as low as 6.49%. Yet, it’s important to be aware that some lenders in Arizona may impose , reaching as high as 14.90%. This significant variation underscores the need for instead of relying solely on state or national averages.

While many lenders in Arizona provide attractive conditions, the lenders offer may not be as favorable. This highlights the importance of thorough research to secure the . We know how overwhelming this process can be, which is why we encourage you to consider . They offer tailored to your unique requirements. We’re here to as you make informed decisions about your financial future.

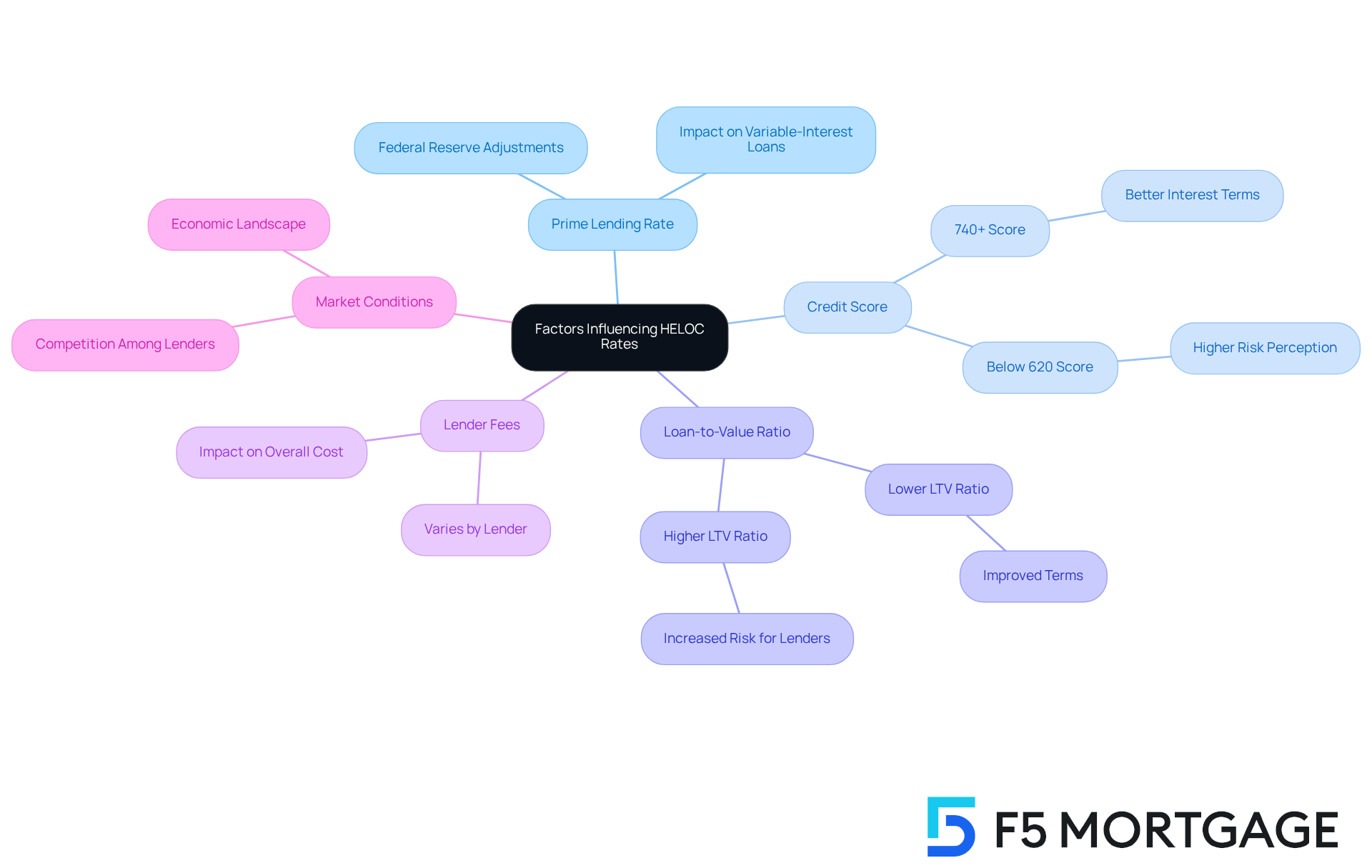

Factors Influencing HELOC Rates

The interest levels of , such as , can feel overwhelming, but understanding the factors at play can empower you. Key elements such as the , your , and the significantly influence HELOC rates in Arizona. The prime interest rate serves as a benchmark for variable-interest loans, meaning changes in this figure can directly impact your costs. For instance, as the Federal Reserve adjusts its benchmark interest level—recently reduced—HELOC rates in Arizona may also decrease, potentially lowering your .

We know how important your creditworthiness is. Borrowers with a strong credit score often qualify for better interest terms because they are viewed as lower risk by lenders. This relationship is crucial; for example, a borrower with a score above 740 may secure terms much more favorable than those available to someone with a score below 620. Understanding your credit position is essential, as even a change of 100 points can lead to significant differences in interest charges.

The LTV ratio is another vital factor. It measures the loan amount against your home’s appraised value. Generally, a lower LTV ratio can lead to improved terms, indicating a larger equity cushion for lenders. With home equity rising significantly, many homeowners are now classified as equity-rich—over 47% of mortgaged residential properties fall into this category. This presents an excellent opportunity for property owners in California to effectively utilize HELOCs, especially as HELOC rates in Arizona continue to decline, promoting refinancing options that can further enhance their equity position.

In addition to these factors, be aware that lenders’ fees, loan terms, and market conditions can vary widely, impacting the overall cost of borrowing. As of Q2 2025, the average HELOC rates in Arizona stand at approximately 8.12%, reflecting the current economic landscape and ongoing demand for home equity lines of credit. Homeowners can benefit from more predictable payments by through refinancing and switching from an adjustable-rate mortgage to a fixed-rate mortgage. The competition among lenders for new clients also influences these figures, making it crucial to compare prices and conditions to find the best option for your financial needs. We’re here to support you every step of the way—consider working with F5 Mortgage for .

Conclusion

Understanding HELOCs and their current rates in Arizona reveals a critical financial tool for homeowners looking to leverage their equity. As the landscape shifts, with Arizona’s average HELOC rates recently dropping to 8.26%, property owners are presented with a unique opportunity to access funds for home improvements, debt consolidation, or unexpected expenses. This flexibility can be a game-changer, especially as homeowners increasingly rely on their home equity as a financial resource.

The article highlights the significant variations in HELOC rates among lenders in Arizona, ranging from 6.49% to 14.90%. Key factors influencing these rates include:

- Credit scores

- Loan-to-value ratios

- The prime lending rate

We know how challenging it can be to navigate these elements, but understanding them is essential for homeowners to make informed decisions. By comparing offers and being aware of the competitive nature of Arizona’s market, borrowers can secure favorable terms tailored to their financial needs.

In light of these insights, it is crucial for homeowners to take proactive steps in exploring HELOC options. By conducting thorough research and considering partnerships with reputable lenders like F5 Mortgage, individuals can empower themselves to make informed decisions that align with their financial goals. As the market continues to evolve, staying informed about trends and rates will ensure that property owners can maximize their home equity effectively and responsibly. We’re here to support you every step of the way in this journey.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of funding secured by the equity in your home, allowing property owners to borrow against the value of their residence.

How does a HELOC differ from traditional loans?

Unlike traditional loans that provide a lump sum, a HELOC offers flexibility by allowing you to access funds whenever needed, similar to a payment card with a predetermined limit.

What are common uses for a HELOC?

Common uses for a HELOC include funding home enhancements, consolidating debt, and managing unexpected expenses.

What is the trend regarding the average amount taken from HELOCs as we approach 2025?

There has been a significant increase in the average amount taken from HELOCs, indicating a growing reliance on home equity as a financial resource.

Why do financial consultants recommend using a HELOC for property improvements?

Financial consultants often recommend using a HELOC for property improvements because it typically features lower interest rates compared to personal loans or credit cards.

What are the current HELOC rates in Arizona?

The current average HELOC rate in Arizona has recently dropped to 8.26%.

How can HELOCs be effective for debt consolidation?

Many homeowners have successfully used HELOCs to pay off higher-interest debts, which can significantly ease their financial burdens.

What should property owners consider before applying for a HELOC?

Property owners should ensure that their financial profiles are in good shape, as this can enhance their chances of approval for a HELOC.

Why are HELOCs considered a valuable option for property owners?

HELOCs are considered valuable because they allow property owners to tap into their equity, especially in a favorable market, enabling informed financial decisions.