Overview

Navigating the journey of homeownership can be daunting, especially for first-time buyers in Indiana. We understand how challenging this can be, but with the right knowledge, you can achieve success. By familiarizing yourself with the housing market, securing mortgage pre-approval, and exploring various financial assistance programs available to you, you can take confident steps forward.

This article outlines essential steps to guide you through the process. We’ll discuss:

- Eligibility requirements

- The mortgage application process

- Specific programs like the IHCDA First Step Program

These resources are designed to provide crucial support, helping you navigate the complexities of homeownership effectively. Remember, we’re here to support you every step of the way.

Introduction

Navigating the Indiana housing market can feel daunting for first-time home buyers. We understand how challenging this can be, especially as prices continue to rise and competition intensifies. However, understanding the essential steps to homeownership can empower you and open doors to valuable financial assistance programs that ease the burden.

With so many options and requirements, it’s natural to feel overwhelmed. But don’t worry—we’re here to support you every step of the way. By making informed decisions, you can successfully navigate this ever-changing landscape and find the home that’s right for you.

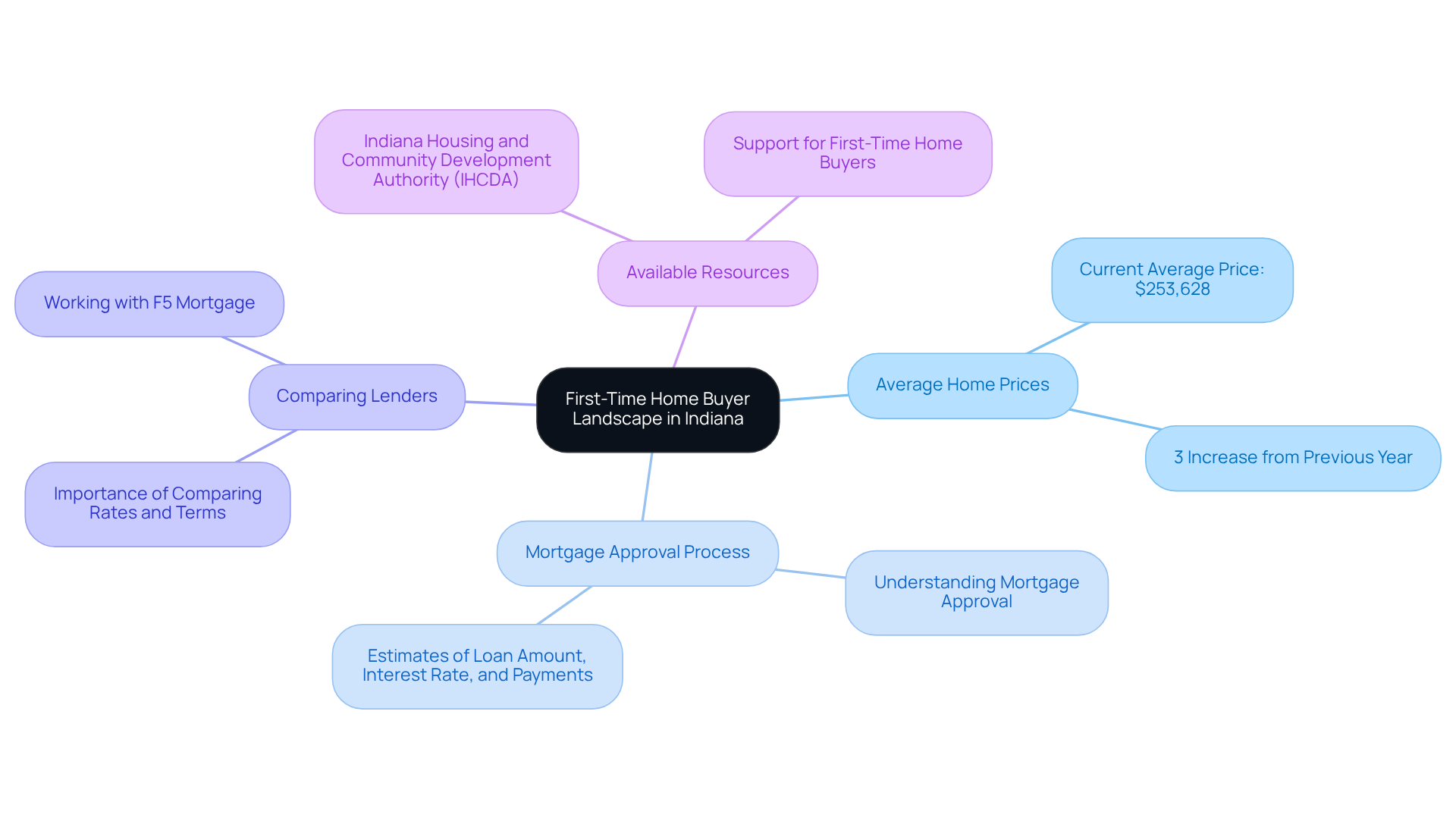

Understand the First-Time Home Buyer Landscape in Indiana

The Indiana housing market has undergone significant transformations in recent years, and we know how challenging this can be for families. As of 2025, the average home price in Indiana is approximately $253,628, reflecting a 3% increase from the previous year. First-time home buyers in Indiana should be aware of the competitive nature of the market, particularly in desirable areas where demand often exceeds supply.

Understanding mortgage approval is crucial. It indicates that a lender believes you are a good candidate for a mortgage based on your financial information. This process provides estimates of your loan amount, interest rate, and monthly payments, which can be overwhelming. We’re here to support you every step of the way.

Additionally, comparing rates, costs, and terms among lenders is essential to ensure they match your needs. Consider working with F5 Mortgage for competitive rates and personalized service tailored to your situation. Resources such as the Indiana Housing and Community Development Authority (IHCDA) offer valuable information on accessible initiatives and support for , helping you feel more confident in your journey.

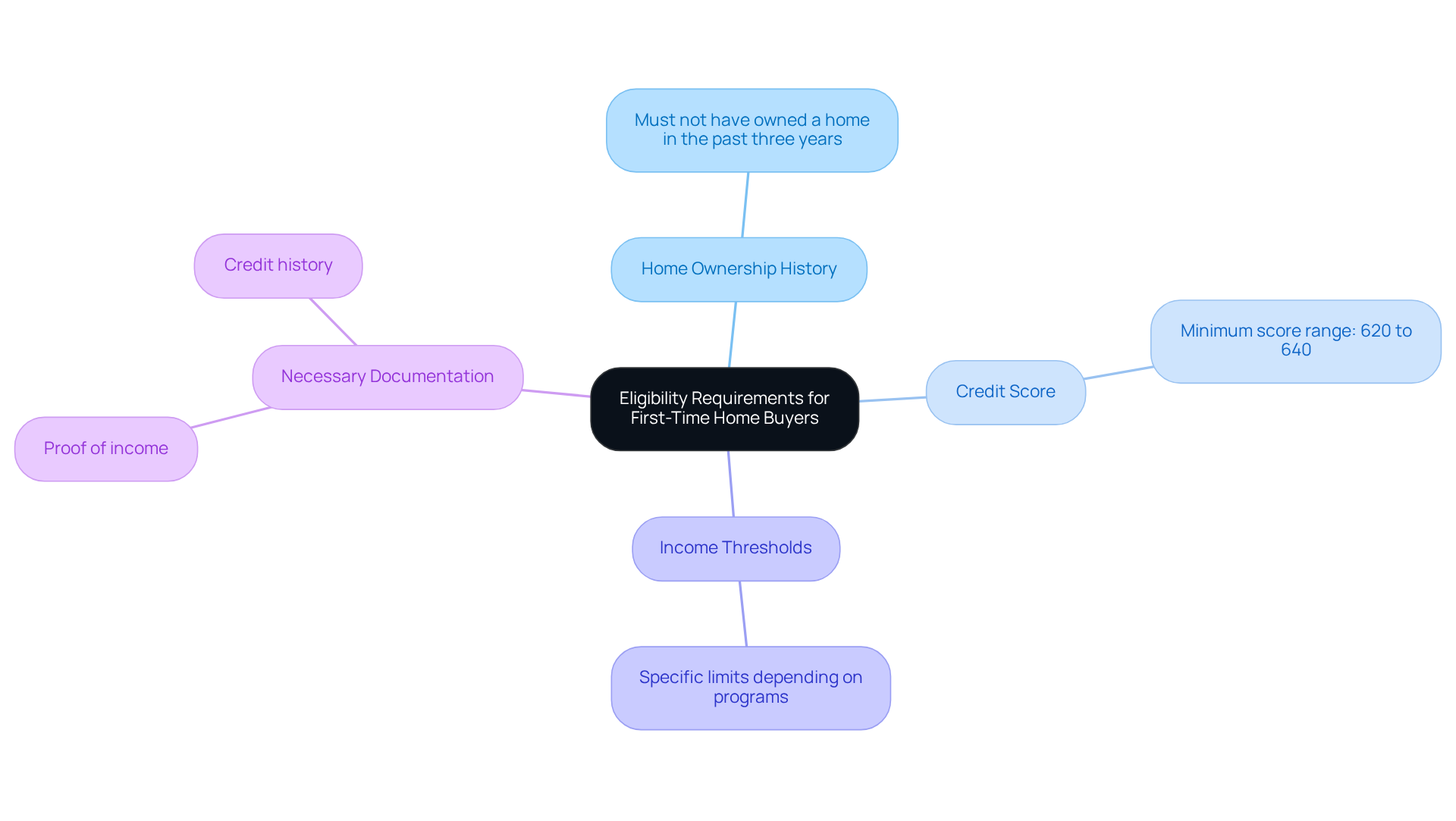

Identify Eligibility Requirements for First-Time Home Buyers

If you’re considering becoming a first time home buyer in Indiana, it’s important to know that you must not have owned a home in the past three years. Many applications require a minimum credit score ranging from 620 to 640, depending on the type of loan you’re interested in. Additionally, you’ll need to meet specific income thresholds, which can vary by program and location.

For example, the IHCDA’s First Step program provides down payment assistance for those whose income falls below certain limits. We understand how overwhelming this process can be, so gathering , such as proof of income and credit history, is crucial to making your application smoother.

By understanding these requirements early on, you can better prepare yourself and improve your chances of approval. Remember, we’re here to support you every step of the way as you navigate this journey toward homeownership.

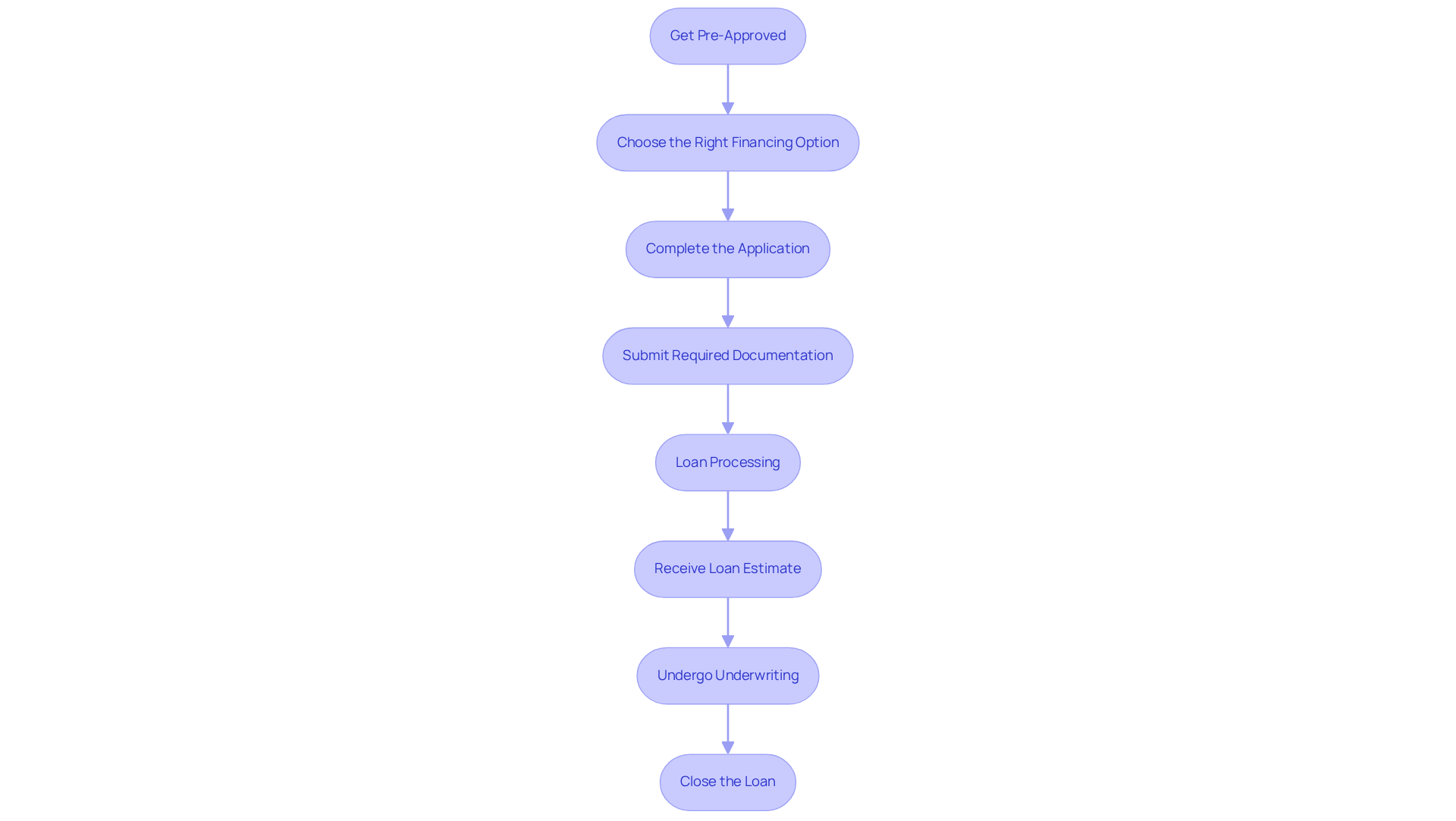

Apply for a Mortgage: Step-by-Step Process

- Get Pre-Approved: We know how challenging it can be to start your journey toward homeownership. Begin by reaching out to F5 Lending to obtain pre-approval. You can apply online, by phone, or through chat, making it convenient for you. This step involves submitting essential financial documents, including tax returns, pay stubs, and bank statements. Pre-approval gives you a clear idea of how much you can afford, providing peace of mind.

- Choose the Right Financing Option: Understanding your options is crucial. Research various borrowing alternatives, such as FHA, VA, or conventional mortgages. Each has its own benefits and requirements, so choose one that aligns with your financial situation. For self-employed borrowers, F5 offers bank statement financing that streamlines the process by relying on cash flow instead of tax returns, making it easier for you.

- Complete the Application: Once you’ve chosen your financing option, fill out the loan application form provided by F5. Be prepared to provide detailed information about your finances, employment history, and the property you wish to purchase. The bank statement loan process is fast and easy, requiring less paperwork than traditional applications, which can alleviate some stress.

- Submit Required Documentation: Along with your application, submit all required documentation. This may include proof of income, credit history, and any other information requested by the lender. F5 Financing aims to make this process efficient and straightforward for you, ensuring you feel supported every step of the way.

- Loan Processing: Once submitted, your application will undergo processing. Here, F5 verifies your information and evaluates your creditworthiness. This is a critical step, and we’re here to guide you through it.

- Receive Loan Estimate: After processing, you will receive a Loan Estimate, which outlines the terms of the loan, including interest rates and closing costs. Review this carefully, as it’s an important document that helps you understand your options.

- Undergo Underwriting: The involves a thorough review of your financial situation and the property. Be prepared to answer any additional questions from the underwriter, as this ensures everything is in order.

- Close the Loan: If approved, you will proceed to closing, where you will sign the final documents and pay any closing costs. After closing, you will officially be a homeowner! Take the first step toward the right mortgage with F5 Mortgage today, and remember, we’re here to support you every step of the way!

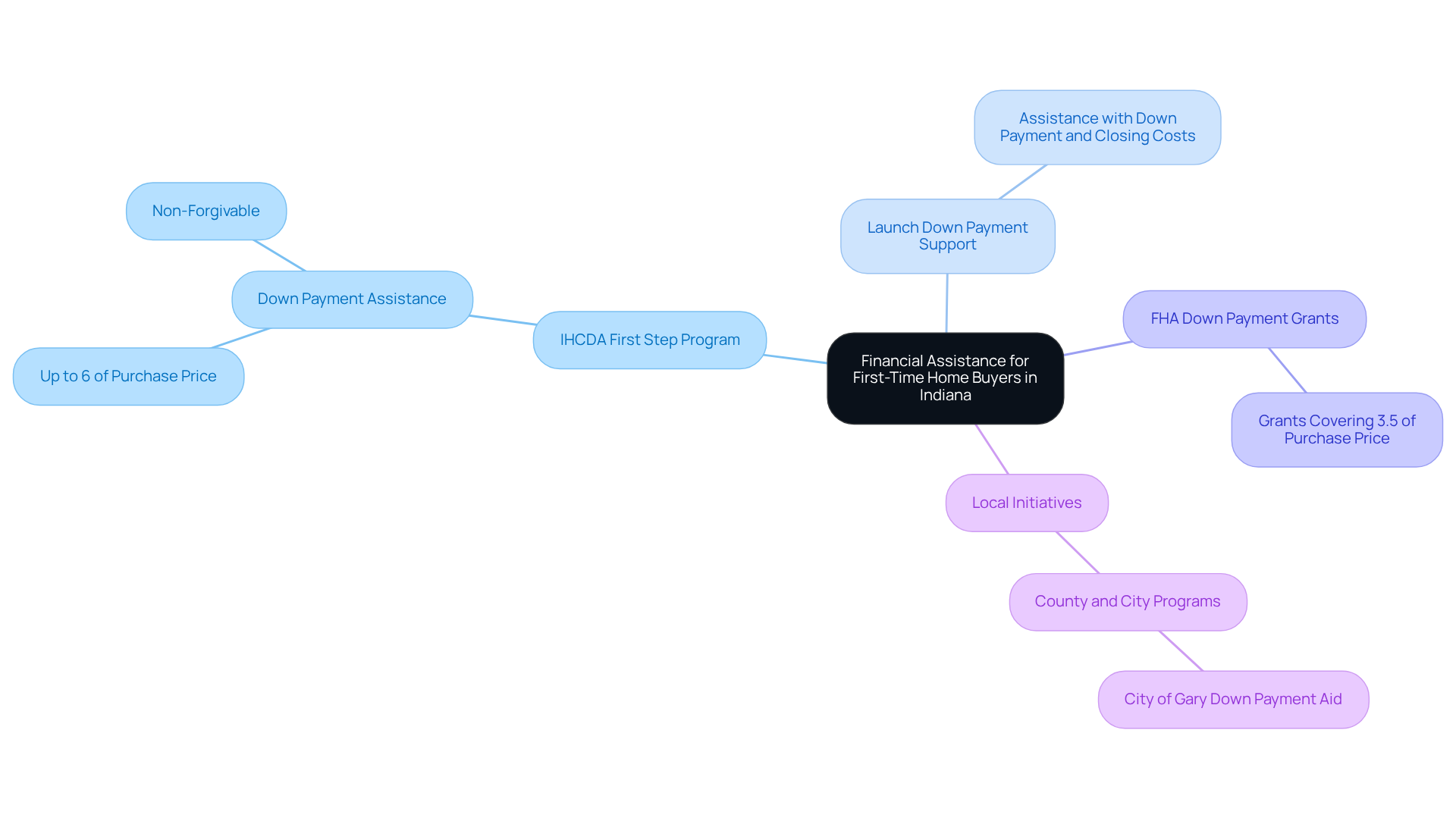

Explore Financial Assistance and Incentives for Home Buyers

If you’re a first time home buyer in Indiana, we understand how overwhelming the process can feel. Thankfully, there are several financial assistance programs available for first time home buyers in Indiana that are designed to help you navigate this journey with confidence.

- IHCDA First Step Program: This compassionate program provides assistance for first time home buyers in Indiana by offering up to 6% of the purchase price in down payment assistance. The best part? It’s non-forgivable, meaning you won’t have to repay it as long as you stay in your home for a specified period.

- Launch Down Payment Support for First Time Home Buyers in Indiana: This initiative is designed to assist first time home buyers in Indiana by providing help with down payment and closing costs, making homeownership more attainable.

- FHA Down Payment Grants for first time home buyers in Indiana: If you’re eligible, you can receive grants covering 3.5% of the purchase price. This support can significantly lighten your financial load as you take this important step as a first time home buyer in Indiana.

- Local Initiatives: Many counties and cities in Indiana have their own programs aimed at first time home buyers in Indiana. For instance, the City of Gary offers down payment aid, providing additional resources to help you succeed.

To access these available for first time home buyers in Indiana, we encourage you to reach out to your mortgage lender or local housing authority. They can guide you through the eligibility requirements and application processes. Remember, taking advantage of these resources can make a substantial difference in your journey toward homeownership, and we’re here to support you every step of the way.

Conclusion

Navigating the journey of homeownership as a first-time buyer in Indiana can be both exciting and daunting. We understand how challenging this can be, and recognizing the intricacies of the current housing market, mortgage processes, and available assistance programs is crucial for your success. By arming yourself with knowledge about eligibility requirements, financing options, and financial aid, you can position yourself for a smoother experience in achieving your dream of homeownership.

Key insights from this guide highlight the importance of:

- Getting pre-approved for a mortgage

- Comparing various lending options

- Utilizing programs designed to assist first-time buyers

The Indiana Housing and Community Development Authority (IHCDA) offers valuable resources, while local initiatives provide additional support tailored to your individual needs. By being proactive and informed, you can navigate the complexities of the market and make confident decisions that align with your financial goals.

Ultimately, taking the first step toward homeownership in Indiana requires preparation and support. Engaging with mortgage professionals and leveraging available financial assistance can significantly ease the process. Embracing these essential steps not only enhances your likelihood of success but also fosters a sense of empowerment as you embark on this significant life milestone. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the average home price in Indiana as of 2025?

The average home price in Indiana is approximately $253,628, reflecting a 3% increase from the previous year.

What challenges do first-time home buyers face in Indiana?

First-time home buyers in Indiana face a competitive market, particularly in desirable areas where demand often exceeds supply.

Why is understanding mortgage approval important for first-time home buyers?

Understanding mortgage approval is crucial because it indicates that a lender believes you are a good candidate for a mortgage based on your financial information and provides estimates of your loan amount, interest rate, and monthly payments.

How can first-time home buyers find competitive mortgage rates?

First-time home buyers should compare rates, costs, and terms among lenders to ensure they match their needs. Working with companies like F5 Mortgage can also provide competitive rates and personalized service.

What resources are available for first-time home buyers in Indiana?

The Indiana Housing and Community Development Authority (IHCDA) offers valuable information on accessible initiatives and support for first-time home buyers in Indiana, helping them feel more confident in their journey.