Overview

The FHA Streamline Refinance program offers a simplified refinancing option for homeowners with existing FHA loans. We understand how overwhelming the refinancing process can be, and this program is designed to help ease that burden. With benefits like reduced documentation requirements and lower interest rates, it aims to lighten your financial load.

By promoting financial stability during challenging economic times, this program helps borrowers lower their monthly payments without the usual complexities. We know how important it is for you to find solutions that work for your family, and this program is here to support you every step of the way.

Consider exploring this option to make your refinancing journey smoother and more manageable. Your financial peace of mind is within reach, and we’re here to guide you through the process.

Introduction

Navigating the landscape of mortgage financing can often feel overwhelming. We understand how challenging it is for homeowners seeking relief from high interest rates and mounting payments. That’s where the FHA Streamline Refinance program comes in—a beacon of hope that offers a simplified pathway for borrowers to lower their monthly mortgage expenses with minimal hassle.

But how does this program truly work? What makes it a vital option for those looking to regain financial stability? Exploring the intricacies of FHA Streamline Refinance reveals not only its key features but also the significant benefits it can provide to homeowners during these challenging economic times. We’re here to support you every step of the way as you consider this valuable opportunity.

Define FHA Streamline Refinance

The is a compassionate solution designed specifically for . If you’re feeling overwhelmed by your current mortgage situation, this program provides a way to use the to reduce your FHA-insured mortgage interest rate. What’s more, it requires minimal documentation and underwriting, making the process simpler and more accessible.

We understand how challenging it can be to navigate loan adjustments. The main goal of the FHA Simplified Loan Modification is to ease this procedure, allowing you to without the stress of a complete credit assessment or valuation. Imagine the relief of having more manageable payments, enabling you to focus on what truly matters.

We’re here to support you every step of the way. If you’re ready to explore this option, take the first step towards a brighter financial future today. You deserve peace of mind and a home that feels secure.

Contextualize FHA Streamline Refinance in Mortgage Financing

The was launched to in managing their mortgage responsibilities, particularly during tough economic times. We understand how challenging this can be, and that’s why the program allows borrowers to refinance with less stringent requirements. By doing so, it aims to and promote stability in homeownership.

This program is especially significant during periods of changing interest rates. Homeowners now have a chance to benefit from reduced rates through the FHA streamline refinance, without the cumbersome procedures usually linked to loan adjustments. If you’ve faced financial difficulties but are now ready to , the FHA streamline refinance program could provide the solution you need.

We’re here to , ensuring that you have the resources to navigate these changes effectively. Together, we can work towards a more secure financial future.

Highlight Key Features of FHA Streamline Refinance

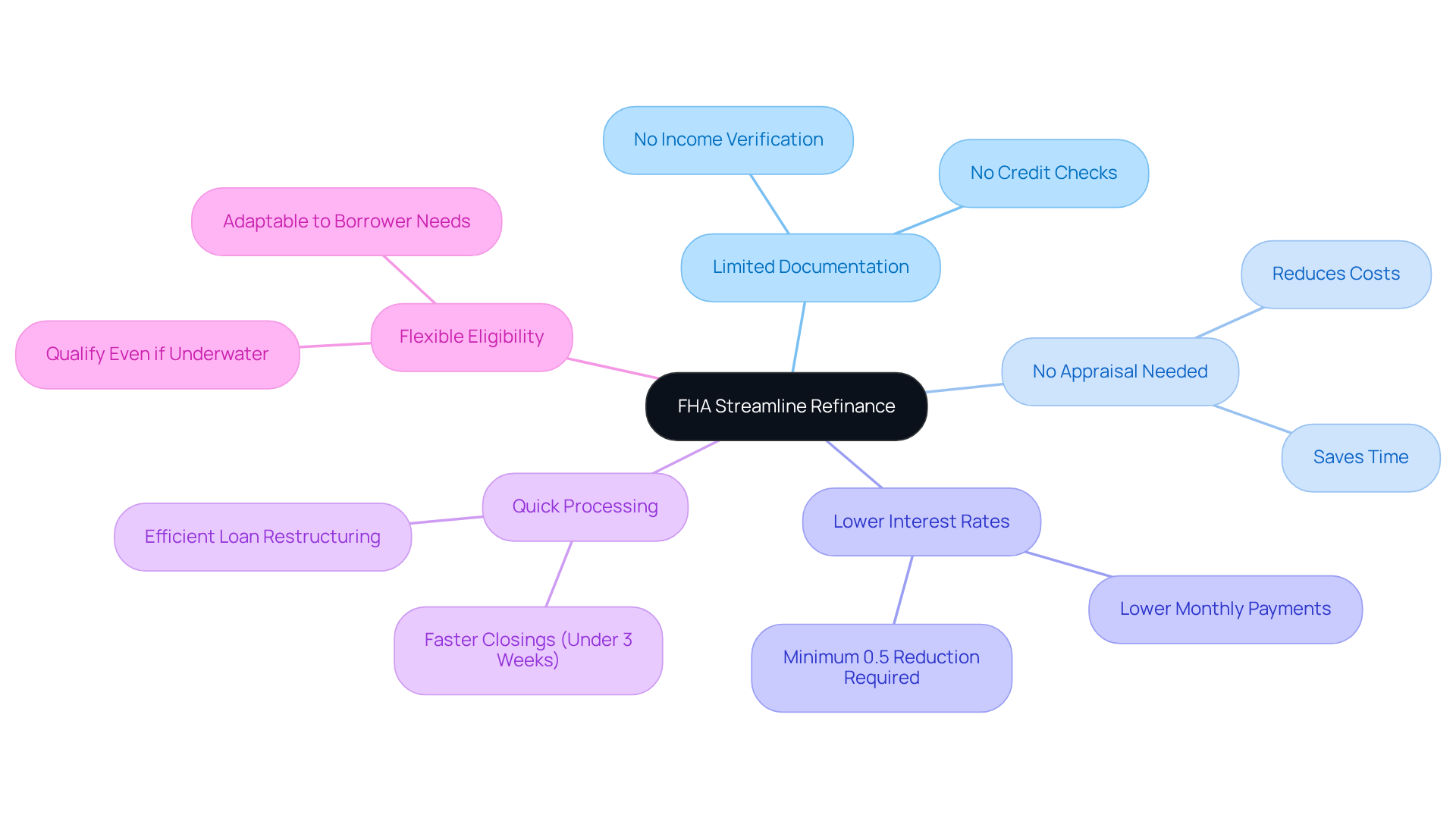

Key features of the include:

- : We understand how overwhelming paperwork can be. This program significantly reduces that burden, as borrowers are not required to provide extensive documentation, such as income verification or credit checks. This streamlined method not only speeds up the loan restructuring process but also makes it more accessible and less cumbersome for homeowners.

- : Unlike conventional options for loan modification, the FHA Simplified Loan does not require a home appraisal. This saves you time and removes extra expenses linked to appraisals, further simplifying the loan modification experience.

- : The program is designed to help you secure lower interest rates, leading to substantial reductions in monthly payments. To qualify for the FHA streamline refinance, you must achieve at least a 0.5% decrease in your fixed-rate mortgage payments.

- : We know how important time is when it comes to refinancing. The efficient nature of the FHA Simplified Loan allows for faster processing times, often leading to quicker closings compared to traditional loan modifications. Many borrowers can anticipate finalizing their loans in under three weeks, improving the overall efficiency of the loan modification process.

Flexible eligibility means that even if you owe more than your home is worth, you may still qualify for the FHA streamline refinance, as long as you meet other criteria. This adaptability is especially advantageous for individuals who may be underwater on their mortgages, enabling you to benefit from lower rates without the usual obstacles of loan modification.

Additionally, refinancing with F5 Mortgage offers . Our is here to assist you throughout the entire . We ensure you find the tailored to your needs, with over two dozen lenders in our network to help you secure competitive rates and maximize your home equity. Remember, we’re here to support you every step of the way.

Explore Benefits of FHA Streamline Refinance

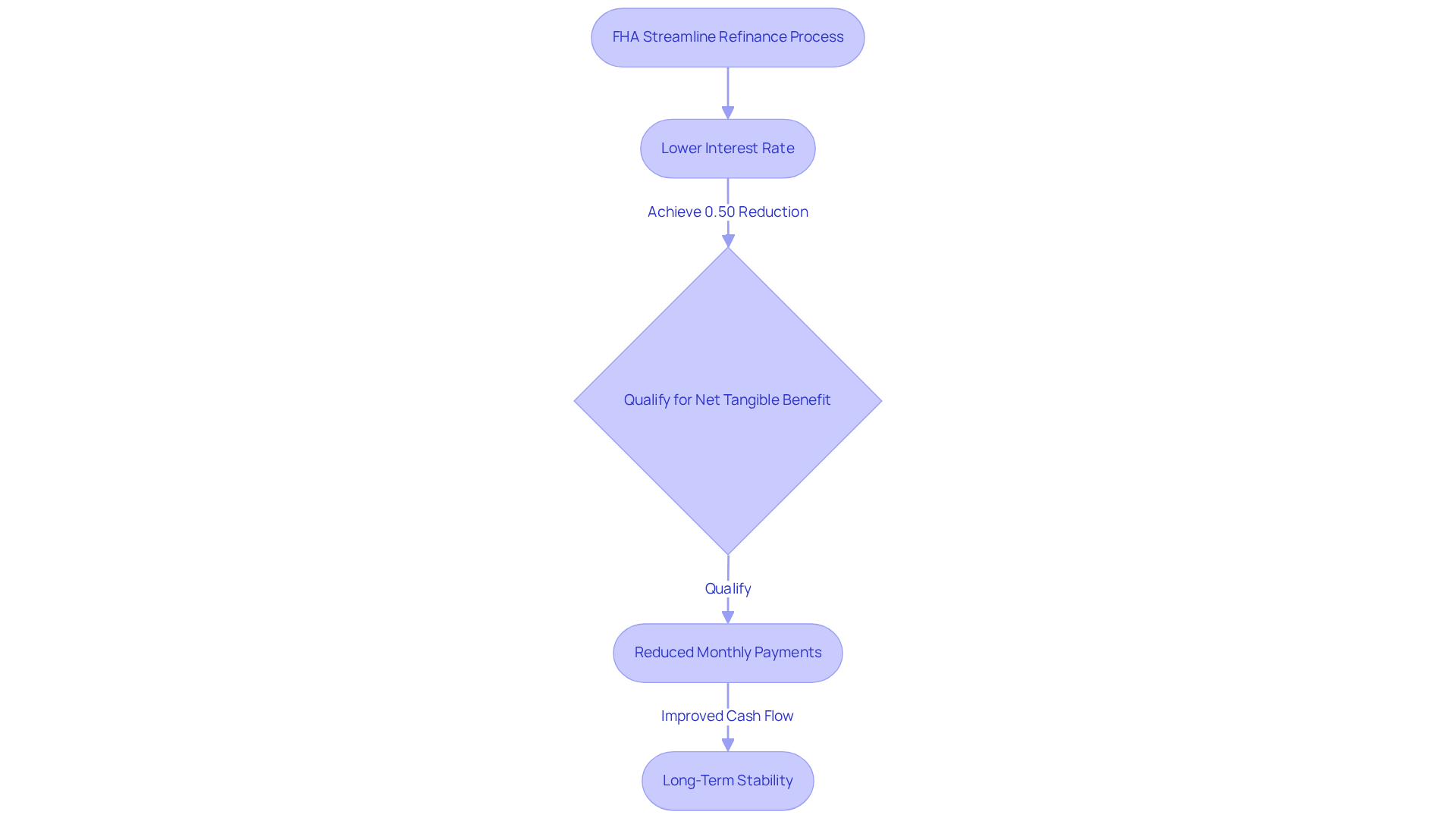

The presents a wonderful opportunity for homeowners, primarily by reducing . By securing a , you can significantly lessen your mortgage obligations, leading to improved financial health. As of July 8, 2025, the mortgage rate for a 30-year FHA loan refinance is 7.14%, typically 0.125% to 0.25% lower than conventional loan rates, which are currently at 6.85%. This makes the FHA Simplified Loan Modification an appealing choice for many homeowners in Colorado.

We understand that navigating the can feel overwhelming. Fortunately, the process is notably simplified, requiring limited documentation and eliminating the need for an appraisal. This alleviates stress for borrowers, making it easier for you to move forward. This streamlined approach not only expedites the process but also enhances accessibility for those with existing FHA loans. However, it’s important to note that are typically not available through the FHA Simplified Loan program, as cash-out loans are not permitted. Some lenders may allow you to access equity during the refinance under specific circumstances, but this is not a standard feature of the program.

To qualify for the FHA Simplified Loan Adjustment, you must demonstrate a ‘,’ which requires at least a 0.50% decrease in your interest rate. Additionally, there is a waiting period of 210 days from your last FHA mortgage transaction before applying for the FHA streamline refinance, which is a critical eligibility requirement. Typically, borrowers need a and a lower debt-to-income (DTI) ratio to qualify.

Lower monthly payments can significantly improve your cash flow, allowing you to allocate funds toward other essential expenses or savings. This financial relief contributes to increased stability, reducing the risk of default and foreclosure.

Moreover, the FHA streamline refinance can provide access to , such as shorter loan durations, resulting in substantial interest savings over time. Every FHA home loan in Colorado includes two insurance premiums:

- A premium of 1.75% of the loan amount, paid upfront at closing

- An annual premium between 0.45% to 0.85%

By taking advantage of this program, you can enhance your financial situation and work towards long-term stability, making it a key option among the various refinancing solutions available through .

Conclusion

The FHA Streamline Refinance program is a crucial lifeline for homeowners looking for relief from their existing FHA-insured loans. By simplifying the refinancing process with minimal documentation and no appraisal requirements, this program allows borrowers to secure lower interest rates and reduce their monthly mortgage payments. Ultimately, it fosters financial stability and peace of mind.

Key features of the FHA streamline refinance include:

- Limited documentation requirements

- Quick processing times

- Flexible eligibility criteria

These aspects are especially beneficial during times of economic uncertainty. Homeowners can take advantage of lower interest rates, often significantly below conventional loan rates, while avoiding the typical burdens associated with refinancing. This streamlined approach not only enhances accessibility but also empowers individuals facing financial challenges to regain control over their mortgage obligations.

Given these advantages, exploring the FHA Streamline Refinance is essential for homeowners eager to improve their financial situation. By taking proactive steps towards refinancing, you can alleviate immediate financial pressures and lay the groundwork for long-term stability and security in your homeownership journey. The FHA streamline refinance is more than just a financial tool; it represents a pathway to a brighter future for many homeowners navigating the complexities of mortgage financing. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is the FHA Streamline Refinance?

The FHA Streamline Refinance is a program designed for homeowners with existing Federal Housing Administration (FHA) loans, allowing them to reduce their mortgage interest rate with minimal documentation and underwriting.

Who is eligible for the FHA Streamline Refinance?

Homeowners with existing FHA-insured mortgages are eligible for the FHA Streamline Refinance.

What are the main benefits of the FHA Streamline Refinance?

The main benefits include the ability to lower monthly mortgage expenses without undergoing a complete credit assessment or property valuation, making the refinancing process simpler and more accessible.

How does the FHA Streamline Refinance help homeowners?

It helps homeowners by reducing their mortgage payments, allowing them to manage their finances better and focus on important aspects of their lives.

Is documentation required for the FHA Streamline Refinance?

Yes, but the FHA Streamline Refinance requires minimal documentation compared to traditional refinancing options.

How can I start the process of FHA Streamline Refinance?

To start the process, homeowners should reach out to their lenders or mortgage servicers to explore the FHA Streamline Refinance option.