Overview

Understanding the impact of a down payment on your monthly mortgage payments is crucial for your financial journey. We know how challenging this can be, and we’re here to support you every step of the way. Larger deposits can lead to lower payments and reduced total interest costs over the life of your loan, which can significantly ease your financial burden.

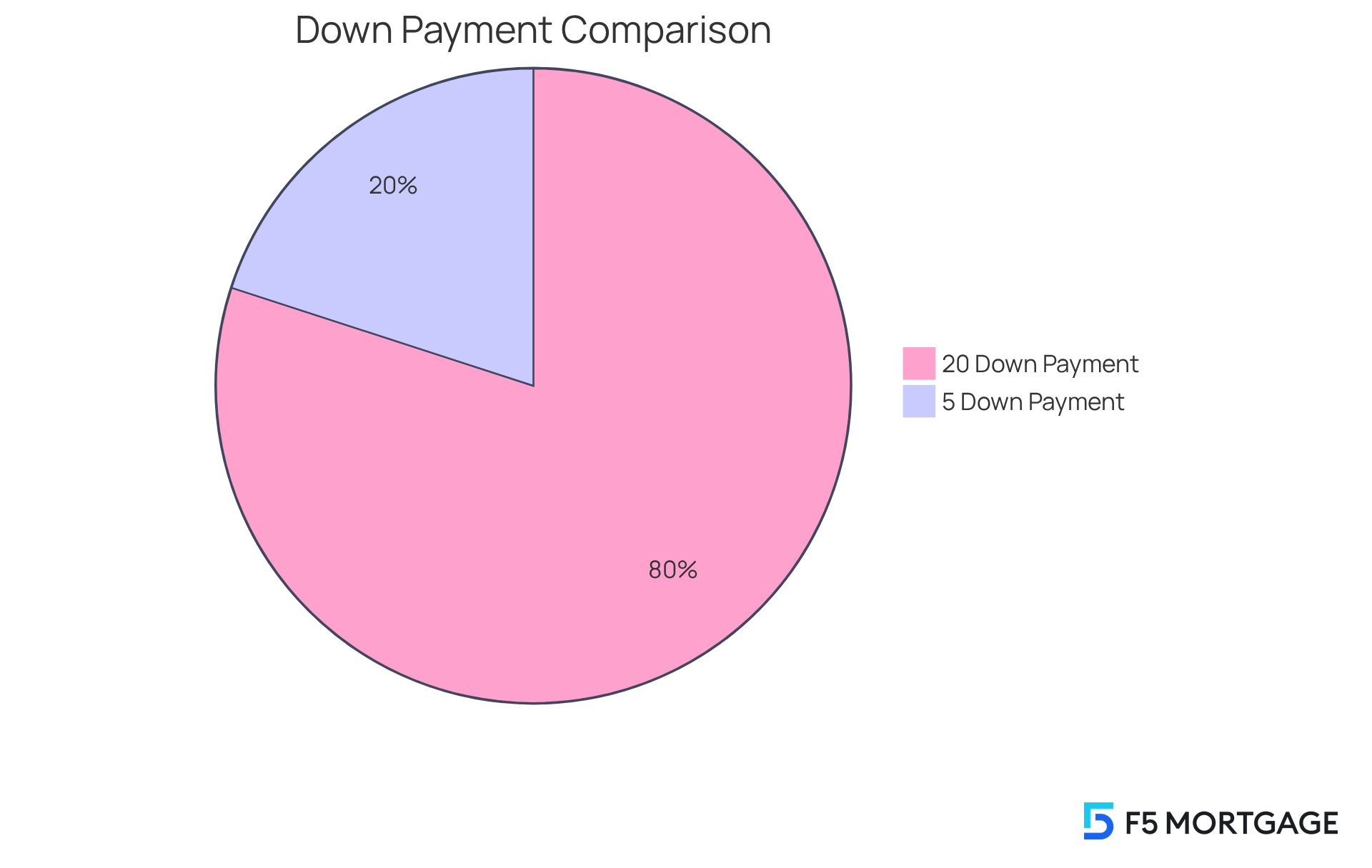

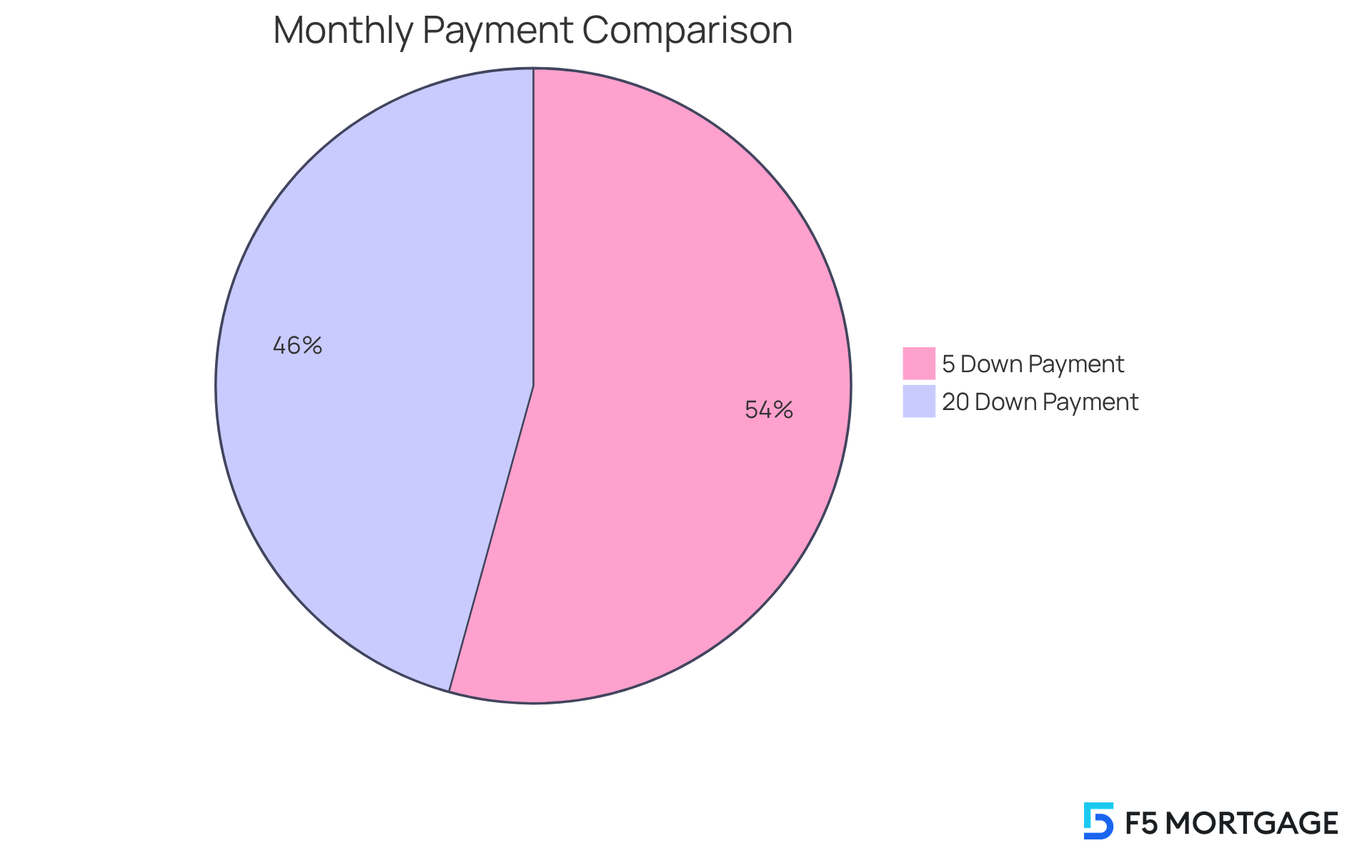

For instance, consider the difference between a 20% down payment and a 5% down payment. With a 20% down payment, your monthly payment would be approximately $1,439. In contrast, a 5% down payment raises that monthly payment to about $1,709. This comparison illustrates how your initial contribution can greatly impact your borrowing amounts and overall financial obligations.

By recognizing the importance of your down payment, you can make informed decisions that align with your financial goals. Take the time to evaluate your options, and remember that every little bit helps in securing a more manageable mortgage.

Introduction

We understand that navigating the world of down payments can feel overwhelming for prospective homebuyers. The size of your down payment is more than just a number; it significantly influences your monthly mortgage payments and shapes the overall cost of homeownership over time. As you embark on this journey, you may find yourself pondering a critical question: how does the amount of a down payment impact your financial future?

Exploring this topic reveals essential insights into budgeting, interest rates, and long-term equity. By understanding these elements, you can make informed decisions that truly align with your financial goals. Remember, we’re here to support you every step of the way as you take this important step towards homeownership.

Define Down Payment and Its Importance

A down deposit is the initial cash sum made by a homebuyer towards the purchase price of a house. Typically represented as a fraction of the overall home cost, these initial contributions can range from a minimum of 3% to a maximum of 20% or even higher, depending on the type of loan and lender criteria. We understand that the significance of a down payment lies in its ability to reduce overall borrowings, and we can explain how the amount of a down payment affects your monthly mortgage payments as well as the total costs paid over the life of the loan. In 2024, first-time homebuyers averaged a down deposit of about 9%, highlighting a trend toward smaller initial contributions that allow them to enter the housing market sooner.

A larger initial deposit not only demonstrates financial commitment but can also lead to better credit conditions, such as lower interest rates and the opportunity to avoid private mortgage insurance (PMI). For instance, putting down 20% can eliminate PMI, which typically adds 0.5% to 1.5% of the mortgage amount to annual expenses. To understand this reduction in monthly costs, it is important to explain how the amount of a down payment affects your monthly mortgage payments; for example, with a 20% down deposit on a $300,000 home, monthly payments could decrease from $1,450 to $1,150, greatly easing financial pressure. Additionally, a 10% deposit on FHA mortgages can limit mortgage insurance premiums to the first 11 years, providing another option for buyers.

Moreover, a larger initial deposit can create immediate equity in the home, allowing homeowners to access funds through home equity loans or cash-out refinancing. This equity can be vital for future financial needs, such as home improvements or unexpected expenses. On the flip side, while smaller initial deposits enable buyers to retain funds for repairs and other costs, it is necessary to explain how the amount of a down payment affects your monthly mortgage payments, as they may lead to higher payments and interest over time. It’s crucial to consider the potential downsides of draining savings for a larger deposit, as keeping cash reserves can help alleviate the stress that comes with homeownership.

Ultimately, deciding on the initial contribution amount should align with your long-term homeownership goals and financial situation. We’re here to support you every step of the way. Consulting with a mortgage advisor can help you evaluate your options, including available down payment assistance programs, and understand the implications of your contributions. This way, you can make informed decisions that enhance your financial well-being.

Explain How Down Payment Size Affects Loan Amount

To understand your borrowing needs, it is important to explain how the amount of a down payment affects your monthly mortgage payments. For example, if you are purchasing a home for $300,000 and make a 20% deposit of $60,000, your borrowed amount will be $240,000. However, if you only contribute 5% or $15,000, your borrowing amount increases to $285,000. This increase in the borrowed sum helps to explain how the amount of a down payment affects your monthly mortgage payments, resulting in higher monthly installments as you will be acquiring more funds.

Moreover, a larger initial deposit can significantly lower your debt-to-value (DTV) ratio. This ratio is a key factor that lenders evaluate when assessing credit eligibility and interest rates. With a 20% deposit, your loan-to-value (LTV) ratio is 80%, while a 5% deposit raises it to 95%. Lower LTV ratios often allow borrowers to secure better rates, ultimately saving you money over the life of the loan.

Financial experts emphasize that making a larger initial deposit can help explain how the amount of a down payment affects your monthly mortgage payments, as it not only reduces those payments but can also decrease the total interest paid throughout the loan term. This can be a strategic financial decision for many homebuyers. Additionally, the minimum down payment for FHA mortgages is 3.5%, which is particularly important for first-time homebuyers. It’s also noteworthy that the median initial contribution for first-time homebuyers is 9%, reflecting common practices among buyers.

As Kim Porter mentions, larger upfront contributions lower the loan amount and the risk for lenders, highlighting the financial benefits of making larger deposits. Furthermore, families looking to enhance their homes should consider down payment assistance programs, which can provide invaluable support in covering initial costs. We know how challenging this can be, and we’re here to support you every step of the way.

Illustrate the Impact of Down Payment on Monthly Payments

To explain how the amount of a down payment affects your monthly mortgage payments, we can consider a $300,000 loan with a 30-year fixed interest rate of 6%. If you make a 20% deposit of $60,000, your monthly payment would be approximately $1,439. This option allows you to avoid private mortgage insurance (PMI), which can significantly reduce your monthly costs.

In contrast, a 5% down payment of $15,000 increases your borrowing amount to $285,000, leading to a monthly charge of approximately $1,709. While the immediate difference of $270 may seem manageable, the long-term implications are substantial. Over the life of the loan, a smaller initial contribution can result in paying over $97,200 more in interest compared to a larger upfront payment.

We know how challenging this can be, especially for first-time buyers. It’s crucial to recognize that the typical initial deposit for first-time purchasers is merely 6%, indicating that many buyers are seeking alternatives to the conventional 20% benchmark. This highlights the importance of explaining how the amount of a down payment affects your monthly mortgage payments, as it also influences total loan expenses and liquidity issues. Committing savings to a down payment can restrict financial flexibility, and we’re here to support you every step of the way as you navigate these decisions.

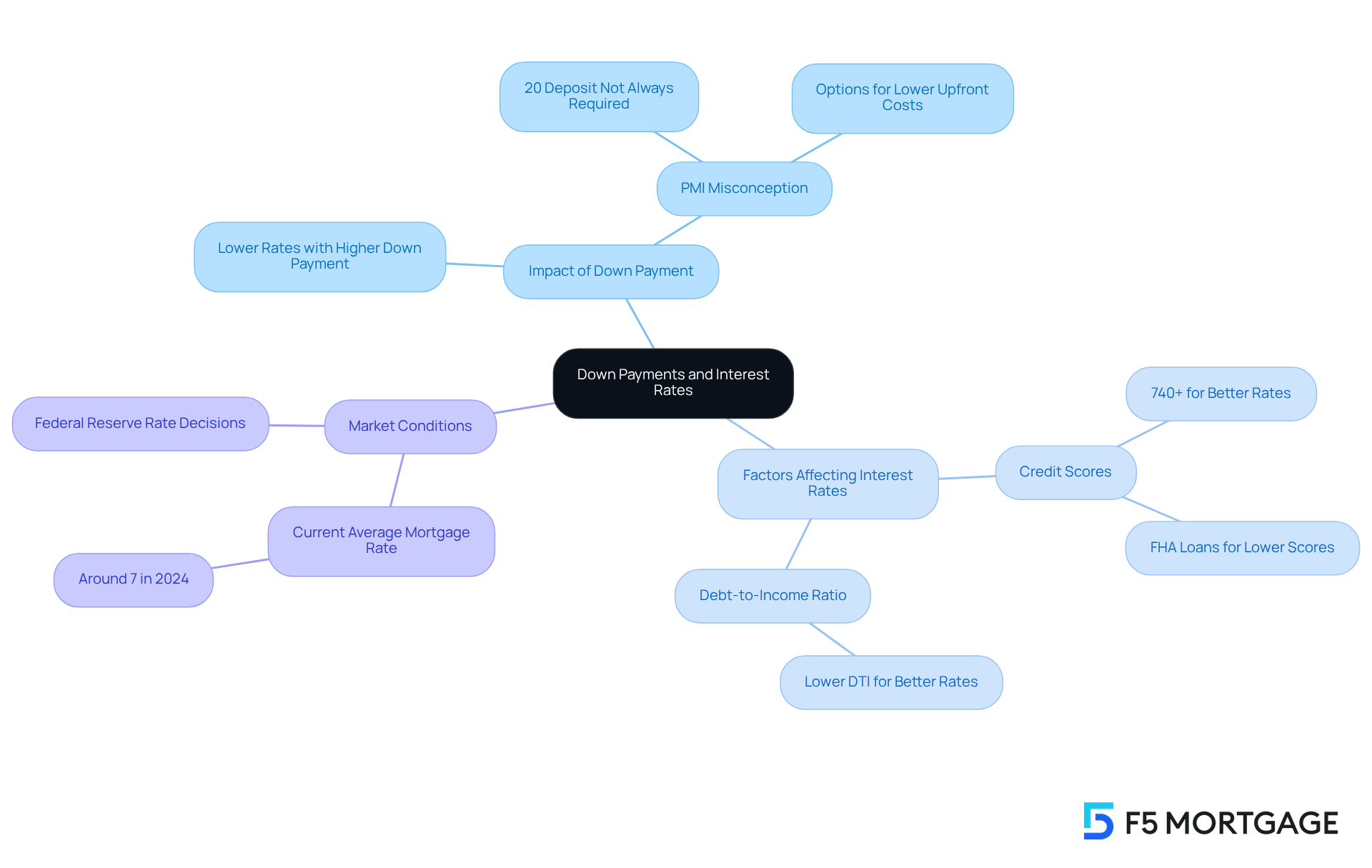

Clarify Misconceptions About Down Payments and Interest Rates

Many potential homebuyers often believe that making a larger down payment can help explain how the amount of a down payment affects your monthly mortgage payments and guarantees lower borrowing costs. While it’s true that lenders usually offer better rates to those who can provide a significant down payment—thanks to the reduced risk involved—other vital factors also come into play when determining interest rates. For instance, your credit score, debt-to-income (DTI) ratio, and overall financial stability are crucial. Homebuyers with credit scores of 740 or higher typically qualify for more favorable loan rates. Conversely, those with scores as low as 500 may still access Federal Housing Administration (FHA) financing, albeit at higher rates. Recent data indicates that the average loan rate has lingered around 7% in 2024, reflecting the current market conditions that influence homebuyers like you.

Additionally, there’s a common misconception that a 20% deposit is necessary to avoid private mortgage insurance (PMI). The truth is, there are various loan options available that allow for lower upfront costs without the burden of PMI, making homeownership more achievable. Understanding these nuances—such as how to explain how the amount of a down payment affects your monthly mortgage payments and the implications of PMI—empowers you to navigate your financing choices more effectively.

As Snejana Farberov wisely points out, ‘A credit score will determine whether you qualify for a home loan and the interest rate you’ll receive.’ This highlights the importance of grasping your personal financial factors throughout the home financing journey. Remember, we’re here to support you every step of the way.

Guide Readers in Choosing the Right Down Payment

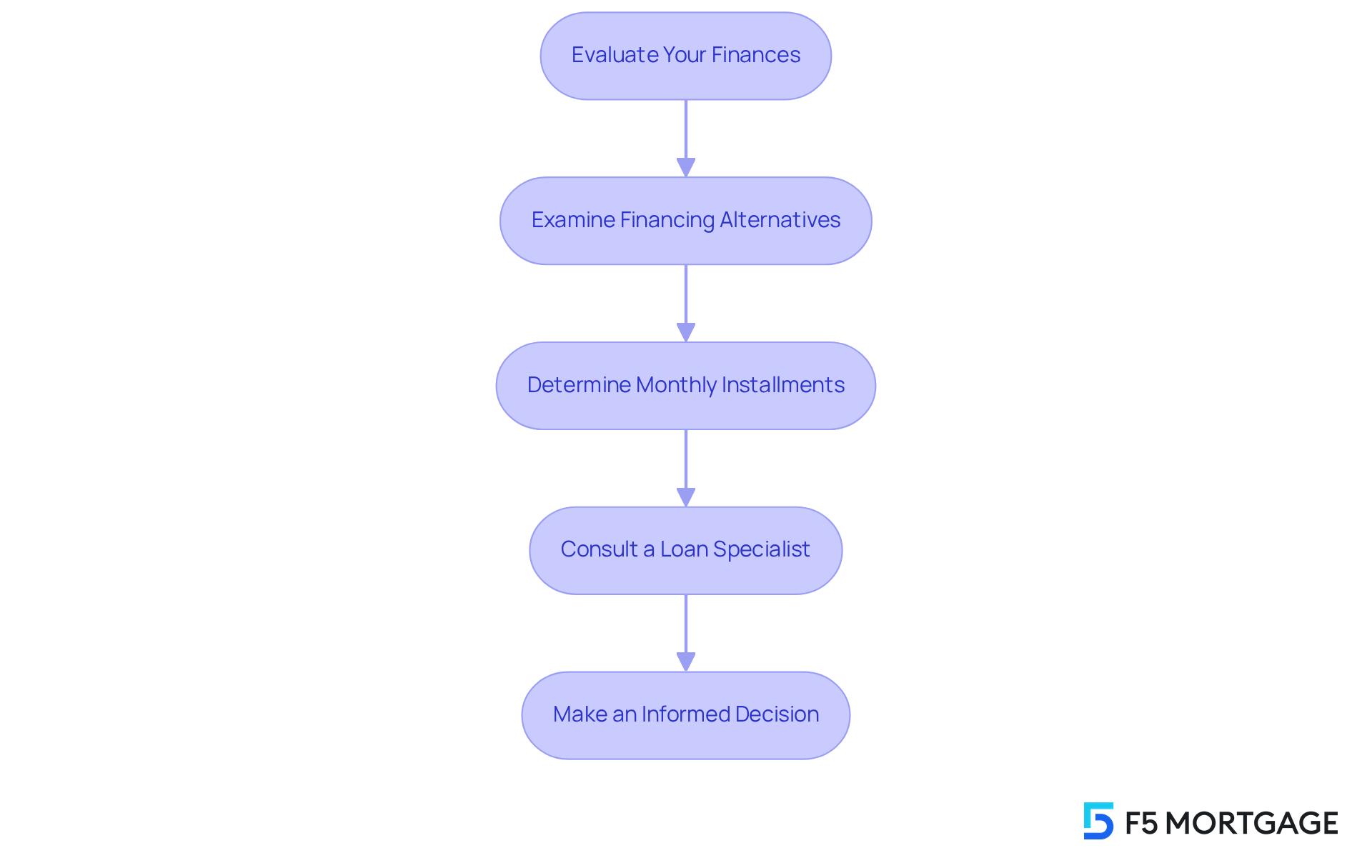

Choosing the right initial contribution can feel overwhelming, but we’re here to support you every step of the way. It’s essential to take a comprehensive look at your financial situation, goals, and the type of mortgage you’re considering. Here are some key steps to help guide your decision-making process:

-

Evaluate Your Finances: Start by assessing how much you can comfortably contribute as a down payment. It’s important to do this without putting your savings or emergency funds at risk. Remember, maintaining a financial cushion for unexpected expenses is crucial.

-

Examine Financing Alternatives: Explore various funding programs to understand their deposit criteria and benefits. For example, many lenders require an upfront contribution of 5% or more, while FHA mortgages often allow down payments as low as 3.5%. This makes homeownership more attainable for many first-time buyers. In fact, the average initial contribution for first-time homebuyers is just 6%, which can help set realistic expectations.

-

Determine Monthly Installments: Use a mortgage calculator to explain how the amount of a down payment affects your monthly mortgage payments and to see the impact on overall borrowing costs. It is important to explain how the amount of a down payment affects your monthly mortgage payments, as a larger initial deposit can lead to lower monthly payments, reduced interest costs over the life of the loan, and potentially better interest rates.

-

Consult a Loan Specialist: Reach out to a loan broker or lender to discuss your options and receive personalized advice tailored to your financial situation. Their expertise can help explain how the amount of a down payment affects your monthly mortgage payments. Additionally, consider exploring down payment assistance programs available for first-time homebuyers, as these can provide valuable resources.

By thoughtfully considering these factors, you can make an informed decision that aligns with your homeownership goals, ensuring a smoother transition into your new home.

Conclusion

Understanding the relationship between down payments and monthly mortgage payments is crucial for any prospective homebuyer. We know how challenging this can be. The size of your initial contribution can significantly influence not only the amount you borrow but also the overall financial burden over the life of your loan. By making a larger down payment, you can reduce your monthly payments, avoid additional costs like private mortgage insurance, and potentially secure better interest rates. This strategic financial decision can lead to substantial long-term savings and increased equity in your home.

Key insights from this discussion highlight the importance of:

- Evaluating your personal financial situation

- Exploring various financing options

- Recognizing that while larger down payments often yield better loan terms, they also require careful consideration of your cash reserves and future financial flexibility

The impact of down payment sizes on monthly payments underscores the necessity of making informed decisions that align with your individual homeownership goals.

Ultimately, navigating the complexities of down payments and mortgage payments requires thorough planning and expert guidance. Homebuyers are encouraged to consider their financial readiness, utilize mortgage calculators, and consult with loan specialists. By doing so, you can choose the most suitable down payment strategy and embark on your homeownership journey with confidence, paving the way for a more secure financial future.

Frequently Asked Questions

What is a down payment?

A down payment is the initial cash sum made by a homebuyer towards the purchase price of a house, typically ranging from 3% to 20% of the overall home cost, depending on the loan type and lender criteria.

Why is a down payment important?

A down payment reduces overall borrowings, affects monthly mortgage payments, and can influence total costs paid over the life of the loan. A larger down payment can also lead to better credit conditions, such as lower interest rates and the ability to avoid private mortgage insurance (PMI).

What is the average down payment for first-time homebuyers in 2024?

In 2024, first-time homebuyers averaged a down payment of about 9%.

How does the size of a down payment affect monthly mortgage payments?

A larger down payment decreases the borrowed amount, which in turn lowers monthly payments. For instance, a 20% down payment on a $300,000 home could reduce monthly payments from $1,450 to $1,150.

What happens if I make a smaller down payment?

Making a smaller down payment increases the borrowed amount, resulting in higher monthly payments and potentially higher interest costs over time.

How does a down payment impact equity in a home?

A larger down payment creates immediate equity in the home, allowing homeowners to access funds through home equity loans or cash-out refinancing for future financial needs.

What is the minimum down payment for FHA mortgages?

The minimum down payment for FHA mortgages is 3.5%.

How does the loan-to-value (LTV) ratio relate to down payments?

A larger down payment lowers the LTV ratio, which is a key factor lenders use to evaluate credit eligibility and interest rates. A 20% down payment results in an LTV ratio of 80%, while a 5% down payment raises it to 95%.

What should I consider when deciding on a down payment amount?

Consider your long-term homeownership goals and financial situation. Consulting with a mortgage advisor can help evaluate your options and understand the implications of your down payment contributions.