Overview

Current rates for home equity loans average around 8.23%. This figure is influenced by several factors, including the Federal Reserve’s monetary policy and the rising home values that have increased total home equity to approximately $18 trillion.

We know how challenging it can be to navigate these financial waters. Understanding key factors like your credit score, loan-to-value ratio, and market conditions can empower your family to make informed decisions. By leveraging your home equity, you can address your financial needs more effectively.

We’re here to support you every step of the way as you explore your options. Take the time to assess your situation and consider how these elements can work in your favor.

Introduction

Home equity loans serve as a vital financial resource for families looking to leverage the value of their homes. They provide access to funds for various needs without the necessity of selling property. In 2025, average borrowing costs hover around 8.23%, prompting many homeowners to explore the potential benefits of tapping into their home equity amidst fluctuating market conditions.

However, we understand that as interest rates are influenced by economic factors and lender competition, families may find themselves questioning whether now is the right time to secure a loan. It’s important to recognize that these concerns are valid. Understanding the current landscape of home equity loans can empower families to make informed decisions that enhance their financial stability. We’re here to support you every step of the way.

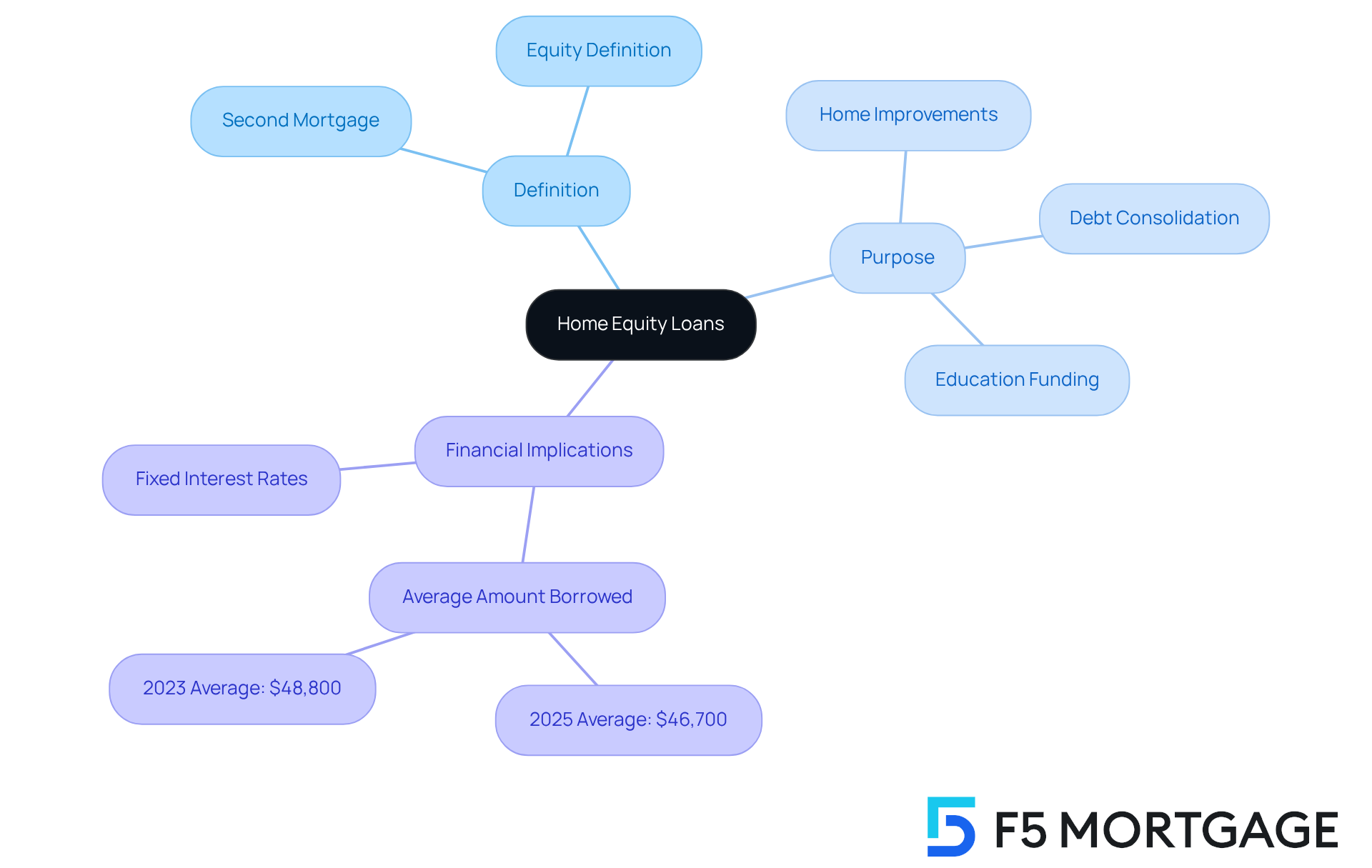

Define Home Equity Loans and Their Purpose

A property equity borrowing, often known as a second mortgage, provides a valuable opportunity for property owners to access the wealth they’ve built in their homes. Equity is simply the difference between what your property is worth in the current market and what you still owe on your mortgage. This financial option can be a lifeline for families facing significant expenses, whether it’s for home improvements, consolidating debt, or funding education.

Imagine having a lump sum of money available at a fixed interest rate, repayable over a term of 5 to 30 years. For many families, residential financing options serve as a crucial resource, allowing them to tap into cash without the need to sell their beloved home. In 2025, the average amount borrowed for residential financing was around $46,700, reflecting a steady demand for this supportive funding choice.

Financial advisors often recommend these options for their potential to ease the burden of high-interest debt or help cover educational costs. We know how challenging financial planning can be, and these tools can play a significant role in enhancing your overall financial well-being. By leveraging the value of your home, families can manage substantial expenses while maintaining their ownership and stability.

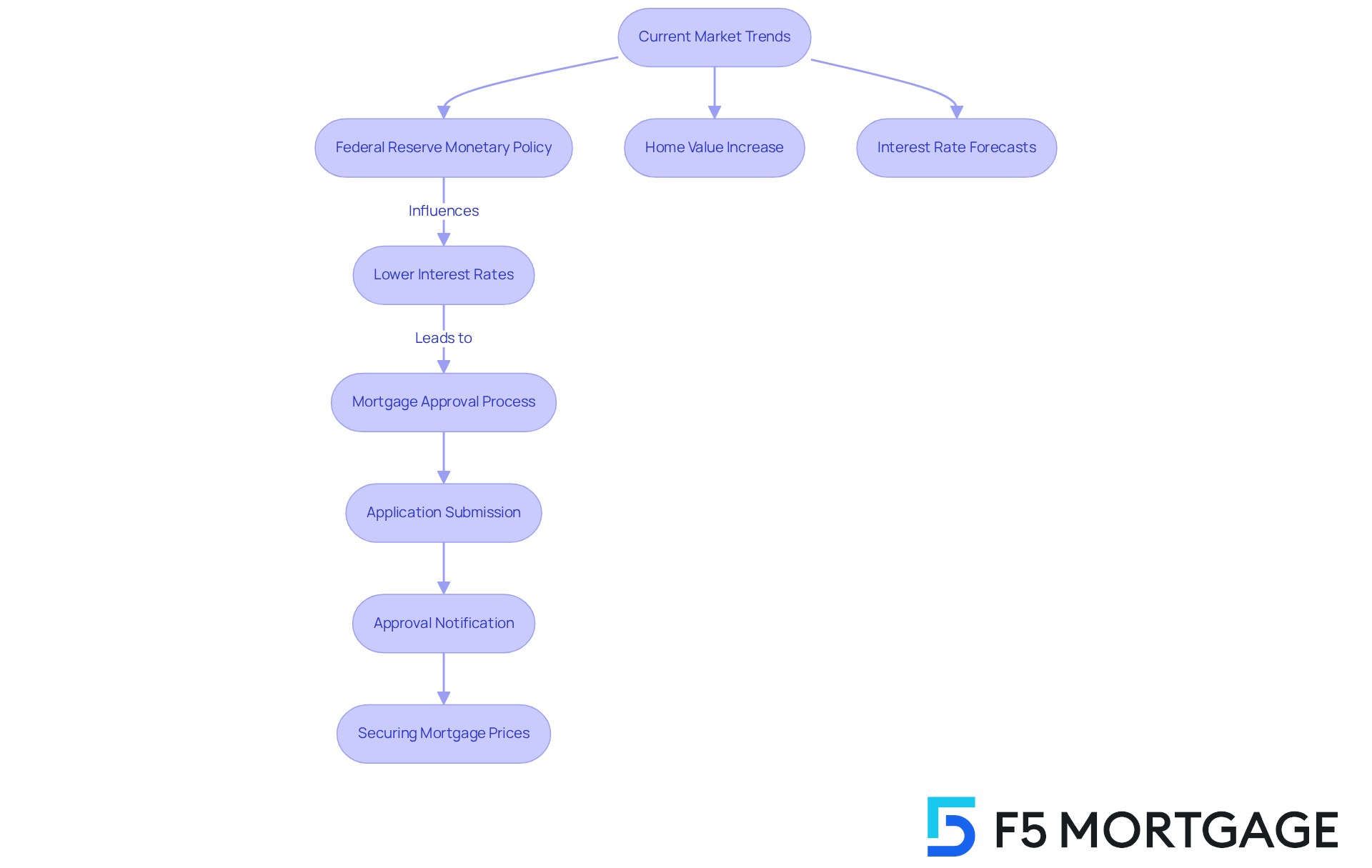

Analyze Current Market Trends Impacting Home Equity Loan Rates

As of September 2025, many families are noticing that residential borrowing costs are averaging around 8.23%. This reflects a minor decrease from earlier in the year, which can bring a sense of relief. This trend is largely influenced by the Federal Reserve’s monetary policy, a crucial factor in determining borrowing costs. When the Fed decreases interest levels, lenders typically respond by lowering loan costs, which can make borrowing more attainable for property owners.

In the current economic landscape, the notable increase in home equity borrowing can be attributed to rising home values—totaling close to $18 trillion in equity—and the current rates for home equity loans. This surge is also supported by the anticipation of moderate cuts, with analysts forecasting a potential reduction of 0.25% to 0.75% by year-end, provided inflation stabilizes and the labor market shows signs of weakening. Nicole Rueth, a mortgage executive, shares that if inflation remains under control, further cuts in interest rates are likely.

Historically, residential financing costs have fluctuated due to various economic circumstances. Currently, the low fixed charges and the current rates for home equity loans present a unique opportunity for property owners to leverage their assets, which could lead to considerable financial benefits, including tax advantages for qualified residential repairs. We understand how important it is for families to maintain a lower debt-to-value ratio, as this reduces lender risk and helps you stay informed about market dynamics. Home equity products can offer protections against market volatility, especially compared to variable-rate options like HELOCs.

Once your application is approved, it’s essential to secure your mortgage prices. This step protects you from market changes during the processing period. Understanding the approval process is crucial; it demonstrates that, based on your financial details, you are a strong candidate for a mortgage. This gives you an estimate of your borrowing amount, interest percentage, and potential monthly payment. We know how challenging this can be, and we’re here to support you every step of the way.

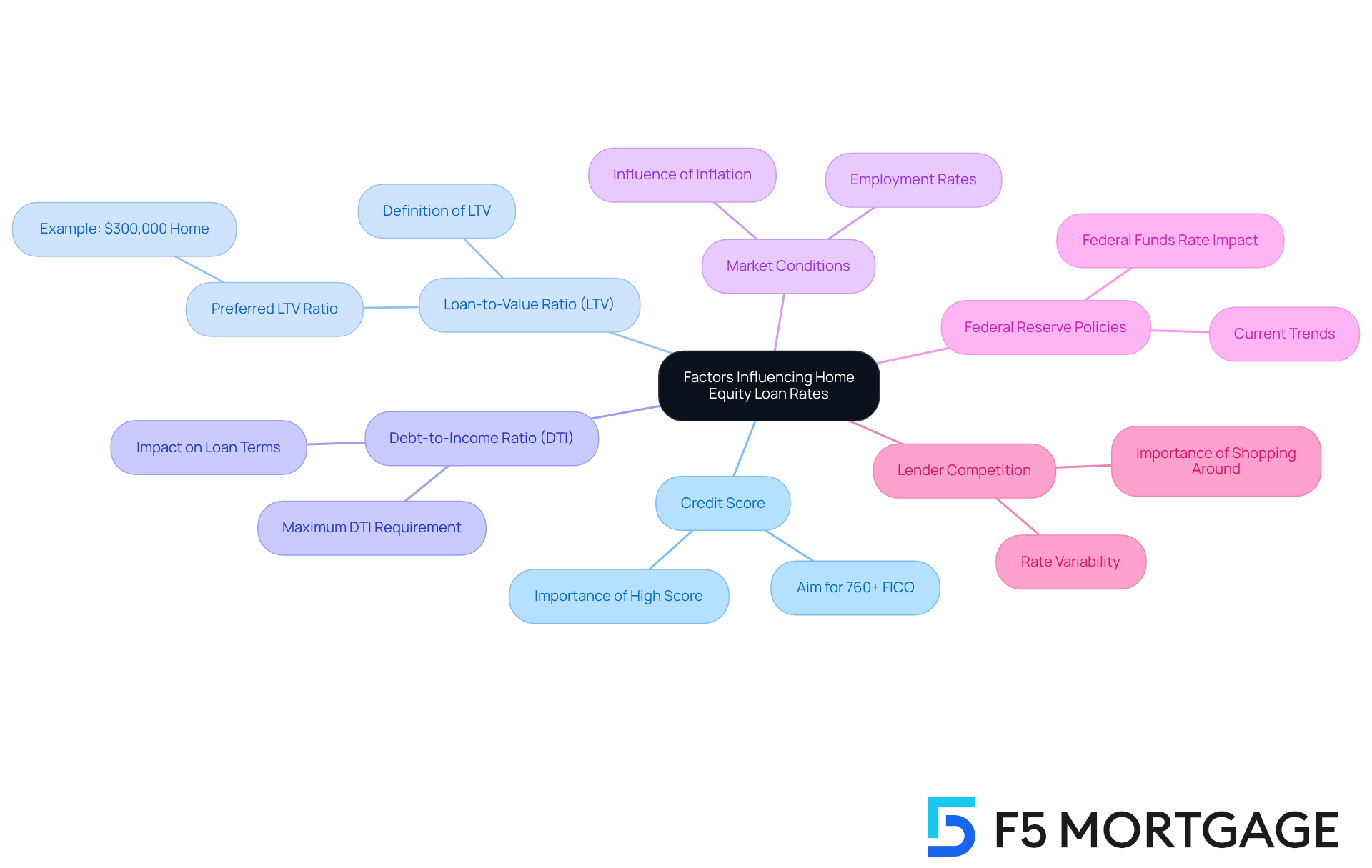

Identify Key Factors Influencing Home Equity Loan Rates

Several key factors influence the current rates for home equity loans, and understanding these factors can help you make informed decisions. We know how challenging this can be, so let’s explore these elements together.

-

Credit Score: A higher credit score is crucial for securing lower interest rates. It signals to lenders that you present less risk. If you’re aiming for the most favorable terms, strive for a credit score of 760 or above.

-

Loan-to-Value Ratio (LTV): This ratio compares the amount you borrow to the assessed value of your property. Lenders generally prefer lower LTV ratios, often advising borrowers to maintain a buffer by not exhausting their property value. For example, if your home is appraised at $300,000, borrowing $240,000 gives you an LTV of 80%, which usually qualifies for better terms.

-

Debt-to-Income Ratio (DTI): Most lenders look for a DTI ratio below 43% to qualify for a home equity loan or HELOC. This means your total monthly debt payments should not exceed 43% of your monthly income. A better DTI can lead to more favorable mortgage terms, and we’re here to help you understand how your DTI impacts your refinancing options.

-

Market Conditions: Economic indicators like inflation and employment rates significantly influence interest levels. For instance, if inflation remains high, the Federal Reserve may keep interest rates elevated, affecting your borrowing costs.

-

Federal Reserve Policies: The federal funds interest rate is a key factor in determining home equity loan costs. Changes in this rate can lead to shifts in borrowing expenses, as lenders adjust their charges. Recent trends suggest that if the Fed adopts a wait-and-see approach, interest rates may stabilize.

-

Lender Competition: The competitive landscape among lenders can also impact the rates offered. You might find rates differing by a full percentage point between lenders, so it’s wise to shop around for the best deal. With more lenders entering the market, including F5 Mortgage, you may discover varying prices for similar products, highlighting the importance of comparing offers.

By understanding these elements, you can make informed decisions regarding property-backed financing, particularly by considering the current rates for home equity loans, which can lead to improved financial outcomes. Currently, the average residential financing rate stands at 8.22%, and it’s anticipated that rates might decrease slightly by year-end, presenting potential opportunities for you.

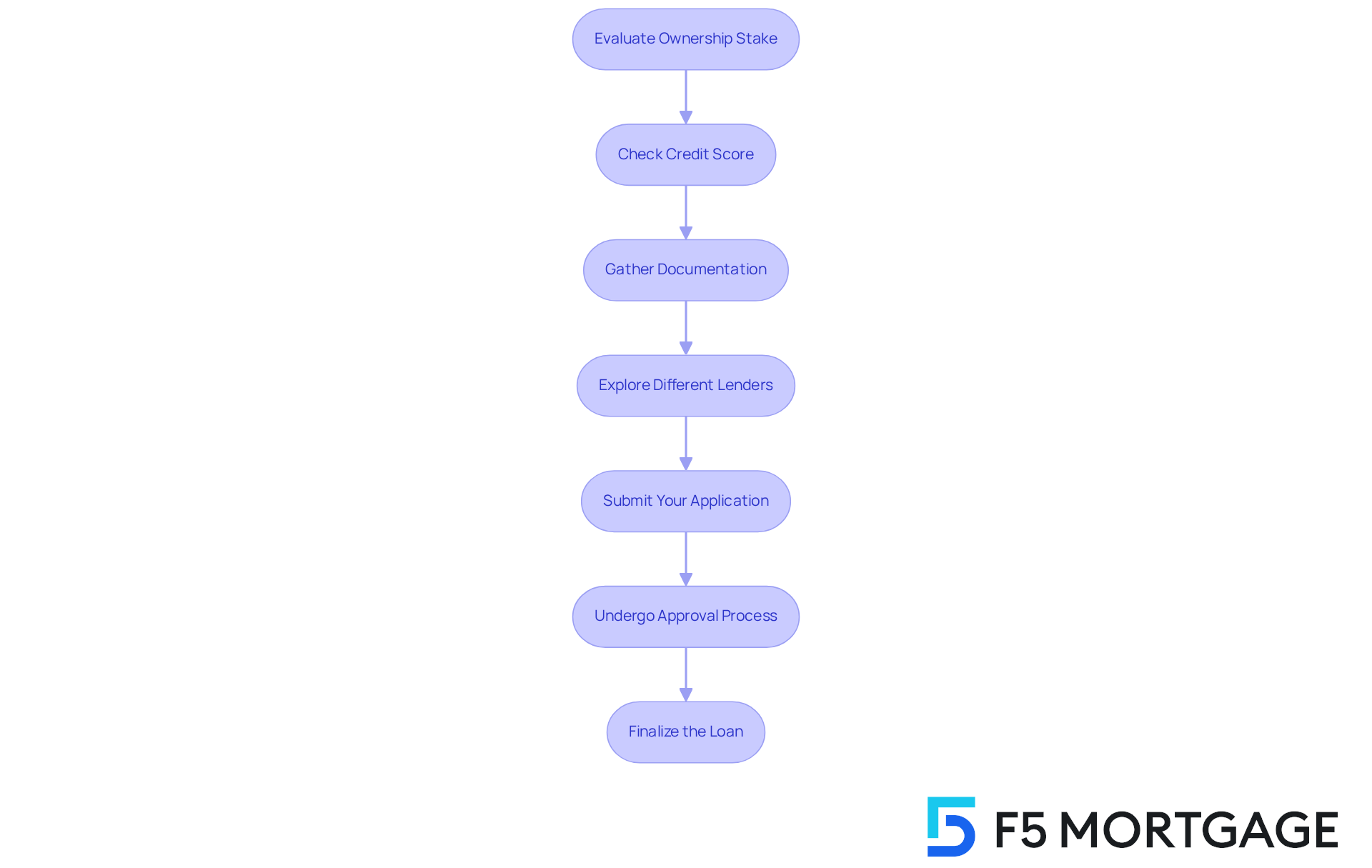

Guide Through the Home Equity Loan Application Process

Applying for a home equity loan can feel daunting, but by following a few essential steps, families can navigate this process with confidence and ease:

- Evaluate Your Ownership Stake: Start by determining your property’s worth. This is the difference between your residence’s current market value and your remaining mortgage balance. For example, if your home is valued at $500,000 and you owe $300,000, your equity would be $200,000.

- Check Your Credit Score: Take the time to review your credit report and score. This will give you insight into your borrowing capacity. Remember, an improved credit score can lead to better borrowing conditions.

- Gather Documentation: Prepare the necessary documents, such as proof of income, tax returns, and details about your existing mortgage. Having this documentation ready is crucial for the lender’s assessment.

- Explore Different Lenders: Assess offers and conditions from multiple lenders, including conventional banks and online alternatives. With current rates for home equity loans predicted to average 7.90% in 2025, it’s essential to secure the best offer.

- Submit Your Application: When you’ve chosen a lender, complete your application, ensuring all required documentation is included to avoid any delays.

- Undergo the Approval Process: The lender will review your application, conduct an appraisal, and evaluate your financial situation. This step is critical as it determines your eligibility.

- Finalize the Loan: If accepted, you will sign the loan paperwork and obtain your funds. These funds can be used for various purposes, such as renovations or debt consolidation.

As you consider accessing your home value, it’s important to have a repayment strategy in place. Many homeowners are currently sitting on significant equity, with the average tappable equity per borrower increasing by nearly $102,000. This financial resource can be a powerful tool when used wisely. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Accessing the wealth tied up in a home through a home equity loan can truly be a transformative financial decision for families. This option not only allows homeowners to tap into their property’s value but also provides a means to manage significant expenses while retaining ownership of their homes. We understand how important it is to grasp current rates and market trends, as these financial products can offer a lifeline in times of need.

As we reflect on the key points regarding home equity loans, it’s important to note that the current average interest rate stands at around 8.23%. This rate is influenced by various factors, including:

- Credit scores

- Loan-to-value ratios

- Federal Reserve policies

We encourage families to evaluate their financial situations carefully, comparing offers from different lenders to secure the best possible terms. While the application process may seem daunting, it can be navigated successfully with the right preparation and understanding of the necessary steps.

Ultimately, the ability to leverage home equity presents a significant opportunity for financial growth and stability. As families consider their options, it’s crucial to approach this decision with a clear strategy and an awareness of the broader economic landscape. By staying informed and proactive, homeowners can make the most of their equity, ensuring they are equipped to meet their financial goals while enhancing their overall well-being.

Frequently Asked Questions

What is a home equity loan?

A home equity loan, often referred to as a second mortgage, allows property owners to borrow against the equity they have built in their homes. Equity is the difference between the current market value of the property and the remaining mortgage balance.

What is the purpose of a home equity loan?

The primary purpose of a home equity loan is to provide homeowners with access to funds for significant expenses such as home improvements, debt consolidation, or educational costs without needing to sell their home.

How does a home equity loan work?

A home equity loan provides a lump sum of money at a fixed interest rate, which is repayable over a term ranging from 5 to 30 years. This allows homeowners to tap into cash while maintaining ownership of their property.

What was the average amount borrowed for home equity loans in 2025?

In 2025, the average amount borrowed for residential financing through home equity loans was approximately $46,700.

Why do financial advisors recommend home equity loans?

Financial advisors often recommend home equity loans because they can help ease the burden of high-interest debt or assist in covering educational costs, thereby enhancing overall financial well-being for families.