Overview

Cash-out refinancing with bad credit can be a viable option for homeowners who need to access cash for significant expenses. If you have sufficient equity in your property, this could be a helpful path forward. We understand how challenging this situation can be, and we’re here to support you every step of the way.

In this article, we outline the process and challenges associated with cash-out refinancing. We also provide strategies for improving your credit scores, emphasizing the importance of understanding loan terms. Exploring alternative financing options can enhance your financial stability and provide you with the resources you need.

Remember, you’re not alone in this journey. By taking informed steps, you can navigate these challenges and find solutions that work for you. Your financial well-being is important, and there are options available to help you achieve your goals.

Introduction

Navigating the world of cash-out refinancing can be particularly challenging for homeowners with bad credit. We understand how daunting this process can seem, yet it also presents a unique opportunity for financial rejuvenation. This strategic approach allows individuals to tap into their home equity, potentially providing the funds needed for essential expenses or debt consolidation.

However, the journey is fraught with hurdles, including higher interest rates and limited loan options. Many may wonder: is it truly possible to secure a cash-out refinance despite a less-than-perfect credit score? This guide is here to support you every step of the way, offering a comprehensive roadmap that addresses both the challenges and the steps necessary to unlock the potential of cash-out refinancing, even for those facing credit difficulties.

Understand Cash-Out Refinancing Basics

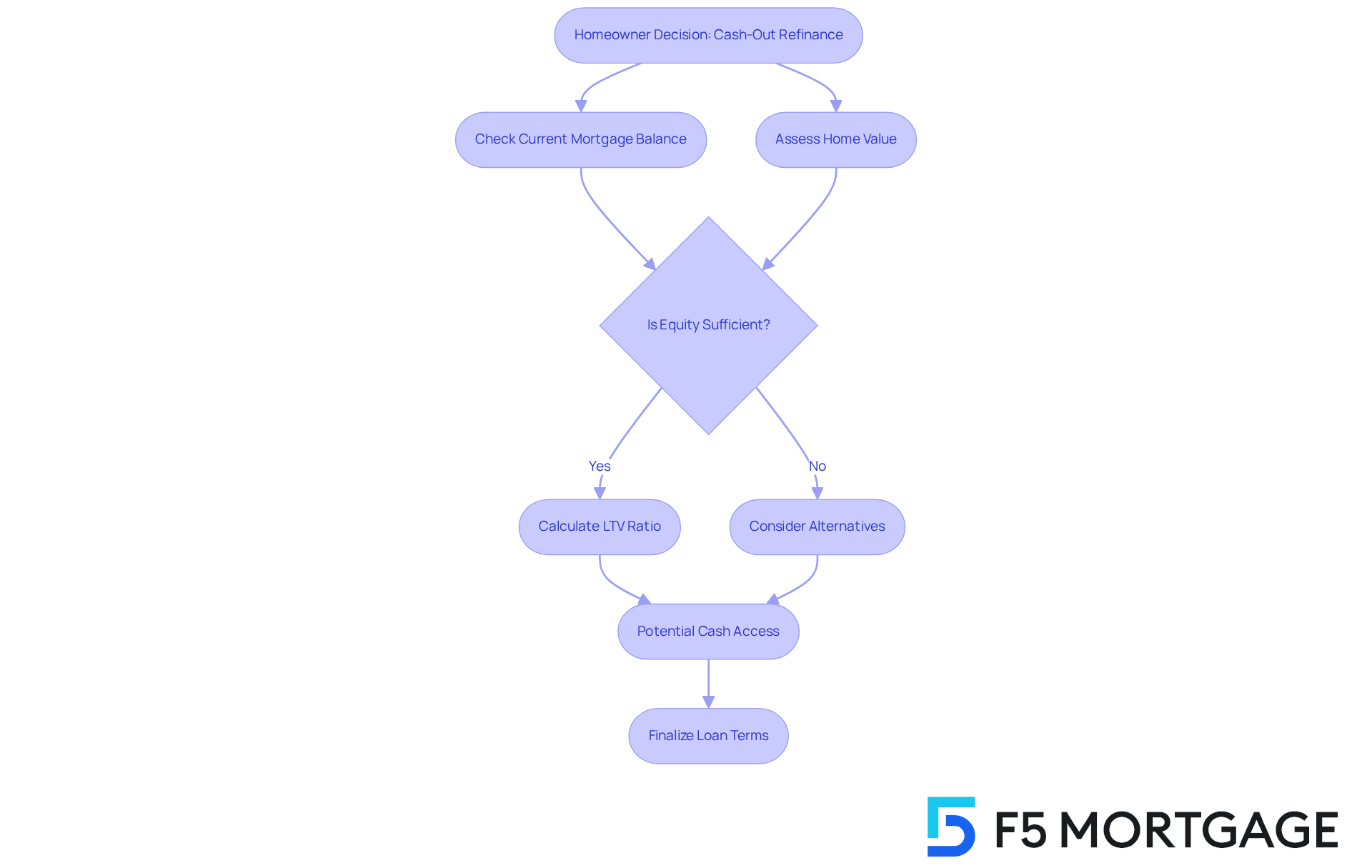

A cash out refinance with bad credit can serve as a strategic financial option for homeowners looking for a fresh start. By choosing a cash out refinance with bad credit, you can replace your current mortgage with a new, larger amount to access cash for important needs like home improvements, debt consolidation, or other significant expenses. To qualify, it’s essential to have sufficient equity in your property, which is the difference between your home’s current market value and the outstanding mortgage balance.

Understanding the loan-to-value (LTV) ratio is crucial in this process. Most lenders allow cash-out loan modifications up to 80% of your home’s appraised value. For instance, if your residence is assessed at $300,000, you could potentially access up to $240,000 through cash-out mortgage restructuring, provided you meet the necessary equity criteria. This financial strategy provides a means to cash out refinance with bad credit, enabling you to access your home equity while securing funds for pressing financial needs and possibly lowering your overall interest rates.

We know how challenging this can be, and we’re here to support you every step of the way. Exploring your options can lead to a brighter financial future.

Identify Challenges of Cash-Out Refinancing with Bad Credit

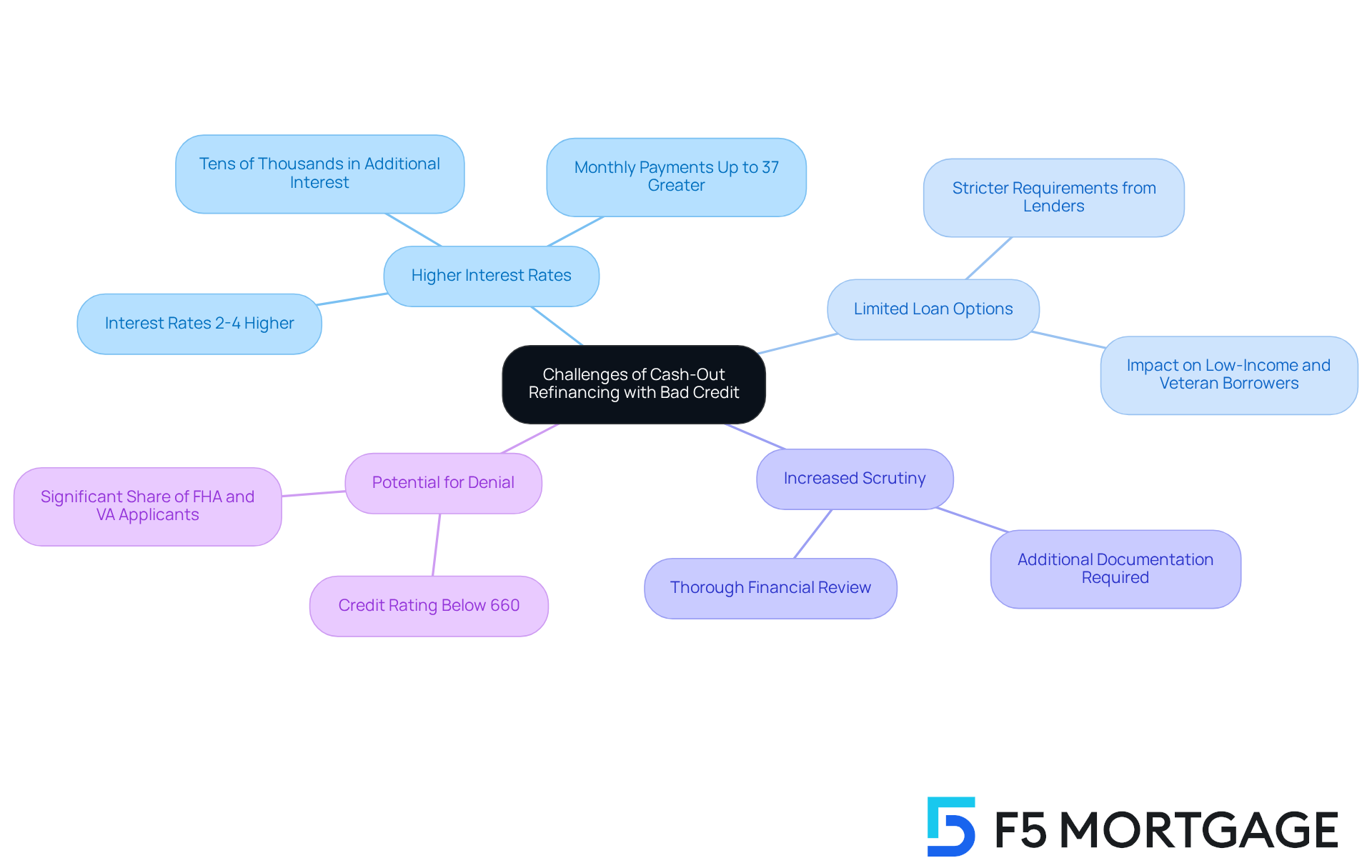

For individuals with a challenging financial history, a cash out refinance with bad credit can be particularly daunting. We understand how overwhelming this situation can feel. Lenders often view a low financial score as a heightened risk, which can lead to higher interest rates or even rejection of the application. Here are some common challenges you might face:

- Higher Interest Rates: If you have bad credit, you may encounter interest rates that are two to four percentage points higher than those available to borrowers with better credit. This increase can significantly elevate the overall cost of borrowing, resulting in monthly payments that could be as much as 37% greater. Over time, this could mean tens of thousands of dollars in additional interest, making it essential to grasp the long-term financial implications.

- Limited Loan Options: Many lenders set stricter requirements for borrowers with low credit scores, which can severely limit your loan options. This situation often impacts low-income and veteran borrowers, who may find it even more challenging to secure suitable financial solutions.

- Increased Scrutiny: Lenders might require additional documentation, such as Social Security numbers, bank statements, tax returns, and pay stubs. They may also conduct a more thorough review of your financial situation. This added complexity can make the process of obtaining new loans feel even more daunting when you’re already facing financial hurdles.

- Potential for Denial: If your credit rating falls below a certain threshold, lenders may reject your application outright. With individuals scoring below 660 increasingly making up a significant share of FHA and VA applicants for cash out refinance with bad credit, it underscores the importance of evaluating your financial health before seeking refinancing.

Understanding these challenges is crucial for anyone with a less-than-perfect financial history. It allows you to prepare adequately and explore alternative options that may be more attainable and financially feasible. Remember, we’re here to support you every step of the way.

Improve Your Credit Score Before Applying

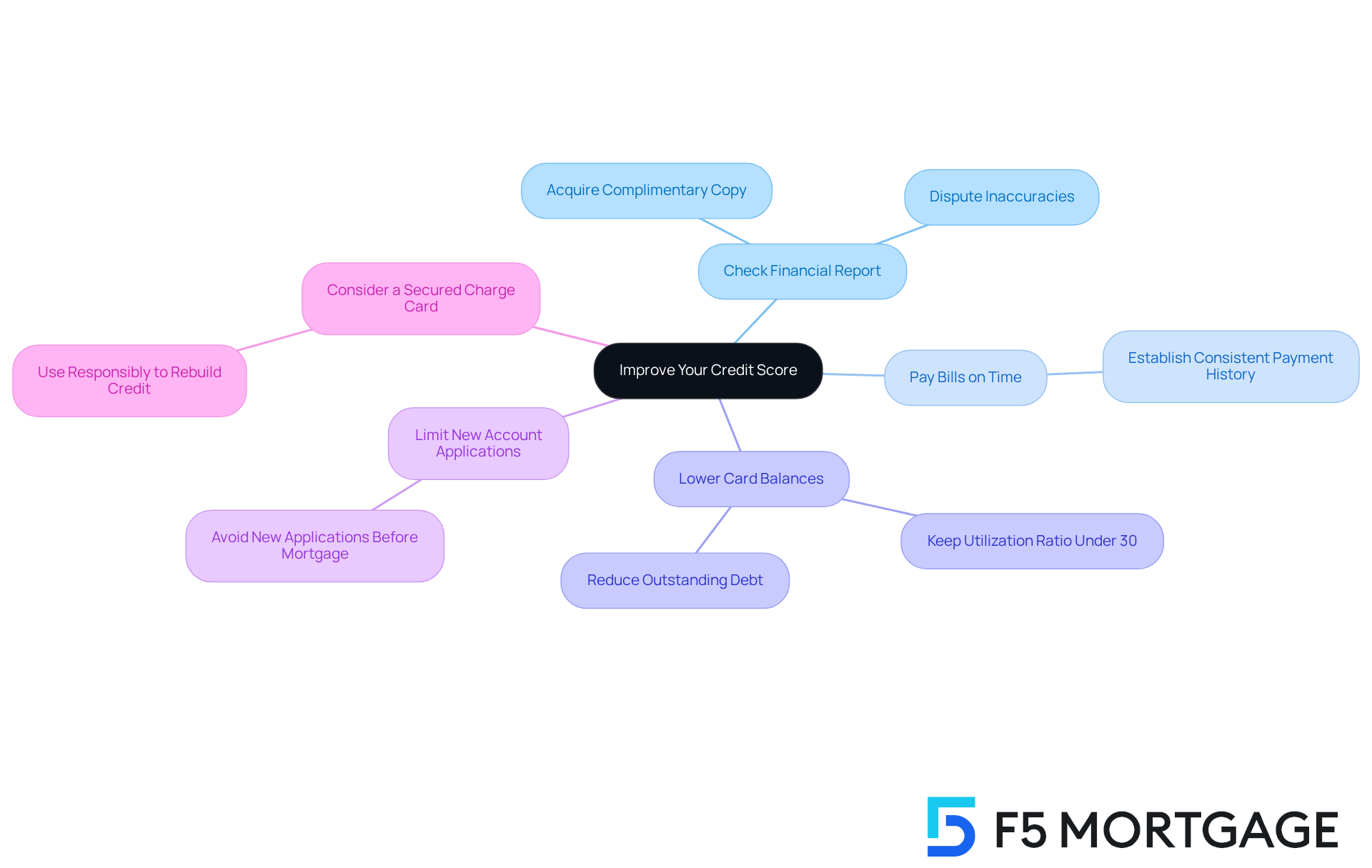

Before applying for a cash out refinance with bad credit, we understand the importance of taking proactive measures to boost your credit score. Doing so can significantly enhance your chances of approval and help you secure better terms. Here are some effective strategies to consider:

- Check Your Financial Report: Start by acquiring a complimentary copy of your financial report. Take the time to thoroughly examine it for any mistakes. Disputing inaccuracies can lead to a quick boost in your score, which is a step in the right direction.

- Pay Bills on Time: Prompt bill payments are essential. They represent a significant part of your score, and establishing a consistent payment history can have a positive impact on your overall financial health.

- Lower Card Balances: Strive to keep your utilization ratio under 30%. Reducing outstanding debt not only enhances your score but also demonstrates responsible financial management, which lenders appreciate.

- Limit New Account Applications: It’s wise to refrain from applying for new accounts before your mortgage application. Doing so can temporarily lower your score and raise red flags for lenders, which is something you want to avoid.

- Consider a Secured Charge Card: If your score is particularly low, responsibly using a secured charge card can assist you in rebuilding your credit history over time.

Once you’ve assessed your financial situation and improved your credit score, you can begin to research your refinance options. While modifying your mortgage with your current institution is a possibility, evaluating various providers and financing options can help you discover the most favorable rates and conditions available to you.

After submitting a refinancing application that includes details about your property and financial documents, you will undergo an appraisal process. This is where the institution evaluates your property’s current value. The next phase involves underwriting, during which the financial institution examines your application, financial history, debt-to-income ratio, and additional prerequisites to finalize the approval process.

Finally, once your application has been accepted, you can close the deal by signing the new documents and paying closing costs. After the deal is done, your new lender will repay your original loan, and your monthly mortgage payments will be directed to your new lender.

By applying these strategies and understanding the loan restructuring process, you can enhance your financial profile for a cash out refinance with bad credit. This will make you a more appealing candidate for loan options, even if your score is currently below average. Remember, we’re here to support you every step of the way.

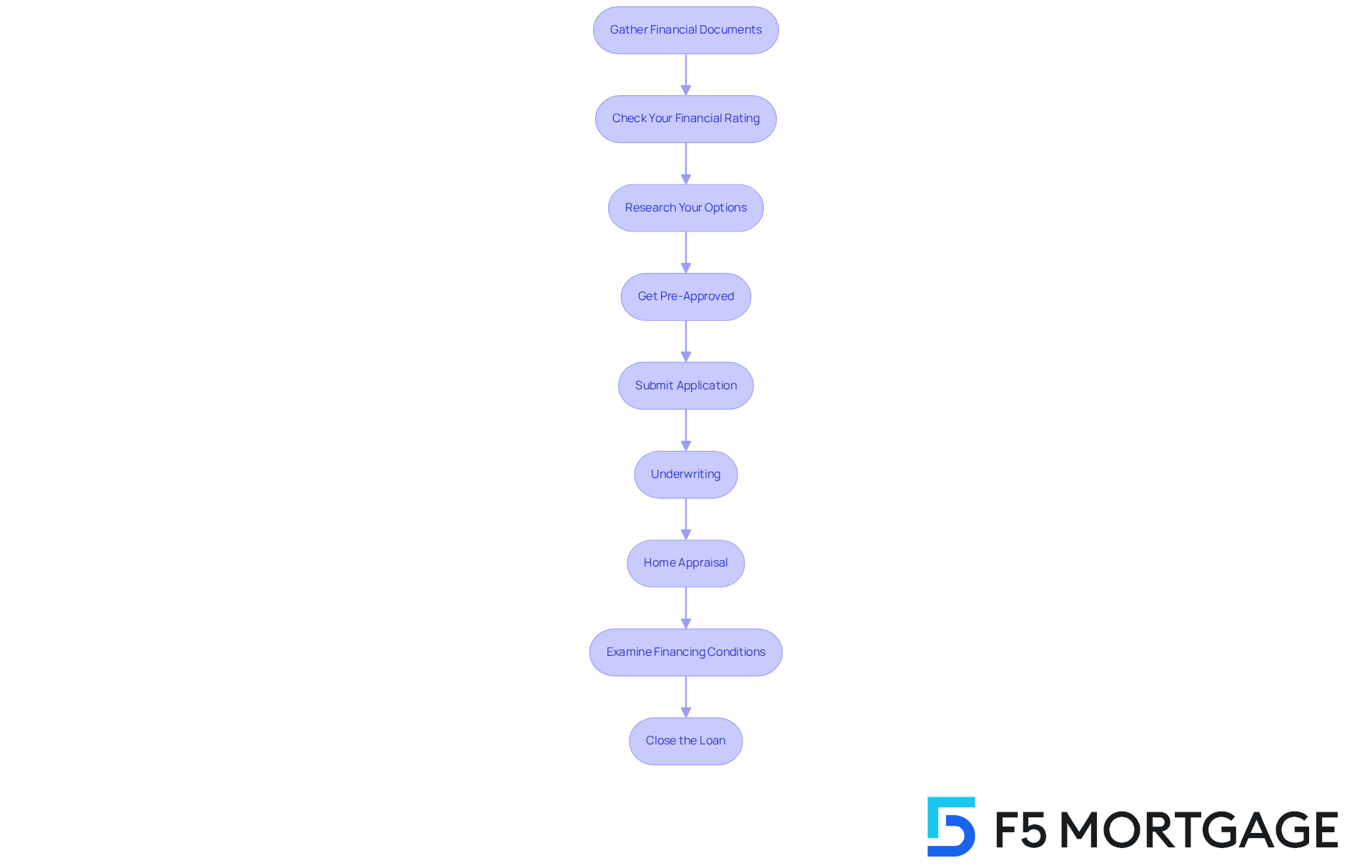

Apply for Cash-Out Refinance: Step-by-Step Process

Applying for a cash-out refinance can feel overwhelming, but we’re here to support you every step of the way. Here’s a detailed guide to help you navigate the process with confidence:

Step-by-Step Process:

-

Gather Financial Documents: Start by collecting necessary documents such as pay stubs, tax returns, bank statements, and information about your current mortgage. We know how challenging this can be, but having everything organized will make the process smoother.

-

Check Your Financial Rating: Take a moment to review your financial rating. Understanding your position can help identify areas for enhancement and empower you to make informed decisions.

-

Research Your Options: After assessing your financial situation, it’s time to explore your refinance options. While refinancing with your current financial institution is a possibility, comparing multiple providers can often lead to better rates and terms, particularly if you’re seeking a cash out refinance with bad credit.

-

Get Pre-Approved: Next, submit your financial documents to various financial institutions for pre-approval. This step will give you a clear idea of how much you can borrow and at what rate. An approval indicates that the institution sees you as a suitable candidate for a mortgage based on your financial information.

-

Submit Application: Once you’ve selected a financial institution, complete the application process by providing all required documentation. This includes details about your property and any other financial documents.

-

Underwriting: Your borrowing request will undergo examination during the underwriting process. The institution will review your credit history, debt-to-income ratio, assets, and other criteria to finalize the credit approval.

-

Home Appraisal: Typically, the lender will require a home appraisal to determine the current market value of your property. This step is crucial as it influences both your borrowing amount and terms.

-

Examine Financing Conditions: Once approved, take the time to carefully review the financing conditions, including interest rates and fees, before signing. Understanding these terms is essential to ensure they align with your financial goals.

-

Close the Loan: Finally, attend the closing meeting to finalize the refinance. Here, you will sign the necessary paperwork and receive your cash-out funds. After closing, your new lender will take care of reimbursing your initial debt, and your monthly payments will be directed to them.

Remember, this process may seem complex, but you’re not alone. With each step, you’re moving closer to achieving your financial goals.

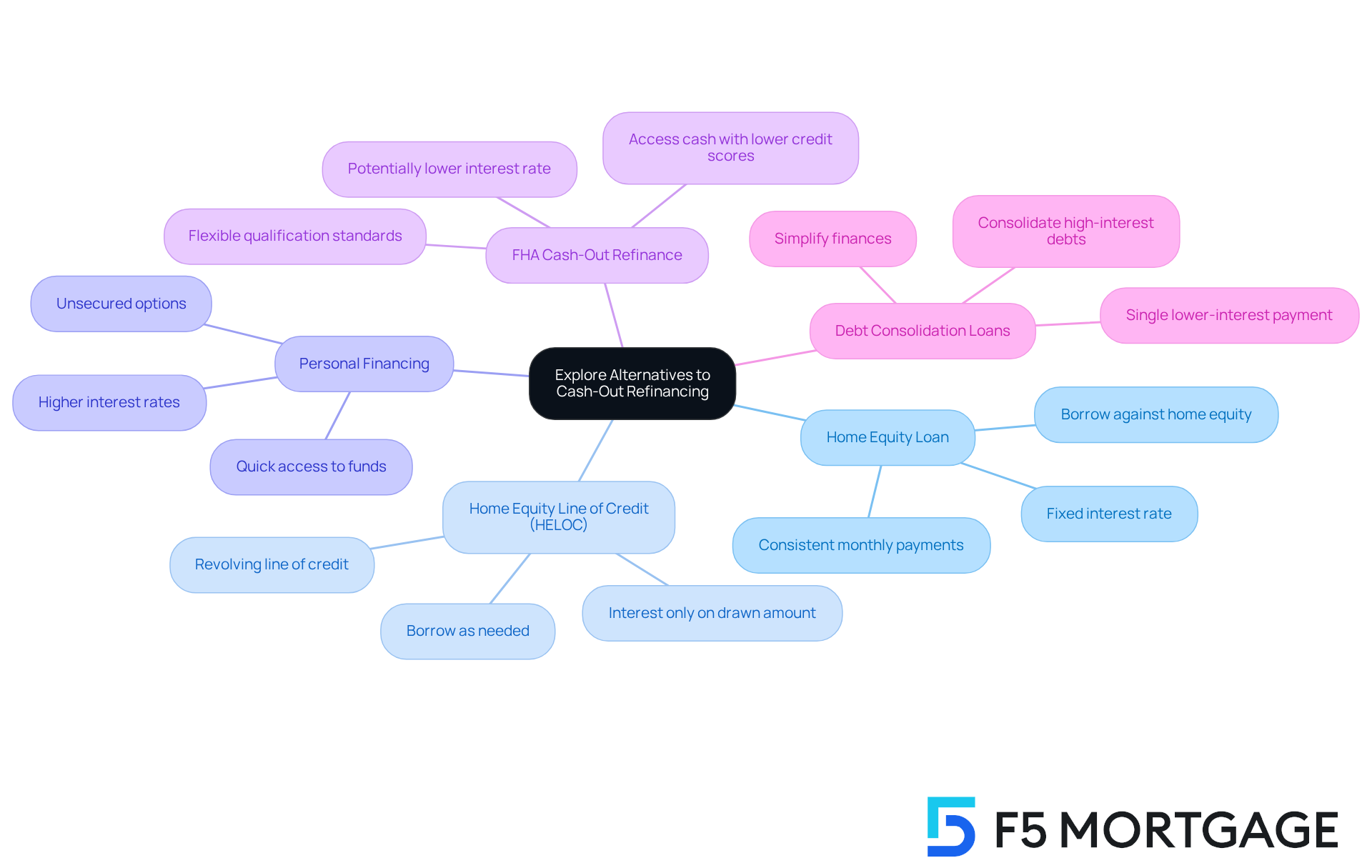

Explore Alternatives to Cash-Out Refinancing

If a cash out refinance with bad credit isn’t the right fit for you, we understand that exploring alternatives can feel overwhelming. Here are some options that may better suit your needs:

- Home Equity Loan: This option allows you to borrow against your home equity in a lump sum, typically at a fixed interest rate. Home equity financing can be especially advantageous for those seeking consistent monthly payments, simplifying budgeting and providing peace of mind.

- Home Equity Line of Credit (HELOC): A HELOC offers a revolving line of credit based on your home equity, allowing you to borrow as needed. This flexibility can be beneficial for ongoing expenses or projects, as you only pay interest on the amount drawn, making it a practical choice for many families.

- Personal Financing: Unsecured personal financing can be utilized for various purposes, although they might carry higher interest rates compared to secured options. These financial solutions include a cash out refinance with bad credit, which are perfect for individuals who may lack adequate equity in their homes but require prompt funds to address immediate needs.

- FHA Cash-Out Refinance: If you possess an FHA mortgage, this choice may have more flexible qualification standards compared to traditional cash-out refinancing. For borrowers with lower credit scores, a cash out refinance with bad credit can be a viable path, enabling them to access cash while potentially lowering their interest rate, which offers significant relief for many.

- Debt Consolidation Loans: These loans can help you consolidate high-interest debts into a single, lower-interest payment, improving your overall financial situation. By reducing the number of payments and interest rates, borrowers can simplify their finances and potentially save money, easing the burden of debt.

We know how challenging these decisions can be, and we’re here to support you every step of the way as you explore these options.

Conclusion

Opting for a cash-out refinance with bad credit can be a transformative financial decision for homeowners seeking to leverage their home equity. We know how daunting this may seem, but understanding the process can empower you to make informed choices that align with your financial goals.

Throughout this article, we shared key insights about:

- The basics of cash-out refinancing

- The challenges faced by those with poor credit

- Actionable steps to improve credit scores before applying

Additionally, we explored various alternatives, providing a comprehensive overview of options available to those who may not qualify for traditional refinancing. Each step of the refinancing journey was detailed, highlighting the importance of preparation and research in securing favorable terms.

Ultimately, navigating the cash-out refinance landscape requires careful consideration and proactive measures. By taking the time to improve your credit scores and exploring various financing options, you can position yourself for greater financial stability. Whether you choose to pursue a cash-out refinance or consider alternative solutions, remember that the journey toward financial empowerment begins with informed decision-making and a commitment to understanding your unique financial situation.

Frequently Asked Questions

What is cash-out refinancing with bad credit?

Cash-out refinancing with bad credit allows homeowners to replace their current mortgage with a new, larger loan to access cash for needs such as home improvements or debt consolidation, despite having a challenging credit history.

How do I qualify for a cash-out refinance?

To qualify for a cash-out refinance, you need to have sufficient equity in your property, which is the difference between your home’s current market value and the outstanding mortgage balance.

What is the loan-to-value (LTV) ratio in cash-out refinancing?

The loan-to-value (LTV) ratio is crucial in cash-out refinancing. Most lenders allow cash-out loan modifications up to 80% of your home’s appraised value. For example, if your home is valued at $300,000, you could access up to $240,000 if you meet the equity criteria.

What are the benefits of cash-out refinancing with bad credit?

Cash-out refinancing with bad credit can provide access to home equity for pressing financial needs, potentially lower overall interest rates, and a strategic financial option for a fresh start.

What challenges might I face with cash-out refinancing if I have bad credit?

Common challenges include higher interest rates (2 to 4 percentage points above average), limited loan options due to stricter lender requirements, increased scrutiny and documentation requests, and the potential for outright application denial if your credit score is too low.

How much can my monthly payments increase if I have bad credit?

Monthly payments for borrowers with bad credit could be as much as 37% greater than those with better credit, significantly increasing the overall cost of borrowing.

What documentation might lenders require for cash-out refinancing?

Lenders may require additional documentation such as Social Security numbers, bank statements, tax returns, and pay stubs, along with a thorough review of your financial situation.

What should I consider before seeking cash-out refinancing with bad credit?

It is important to evaluate your financial health and understand the challenges associated with cash-out refinancing, as this can help you prepare adequately and explore alternative options that may be more attainable.