Overview

Understanding your mortgage payment can feel overwhelming, but we’re here to support you every step of the way. Calculating your payment involves key components—principal, interest, taxes, and insurance—often referred to as PITI. By breaking this down, we can help you navigate the process with ease.

This article offers a step-by-step guide to accurately determine your monthly payments. We know how challenging this can be, especially when trying to include all relevant costs. It’s crucial to use the correct formulas to avoid common pitfalls in the calculation process.

As you read through, you’ll find that addressing these elements can empower you to make informed decisions. Let’s work together to ensure you feel confident in your mortgage journey.

Introduction

Understanding the intricacies of mortgage payments is crucial for families embarking on the journey of homeownership. We know how challenging this can be. With multiple components such as principal, interest, taxes, and insurance, calculating monthly obligations can feel overwhelming. This guide breaks down the mortgage payment calculation process into manageable steps, empowering you to take control of your financial future.

However, what happens when unexpected costs arise? Or when families struggle to grasp the nuances of interest rates and fees? We’re here to support you every step of the way. This article navigates common challenges and offers practical solutions for a smoother mortgage experience.

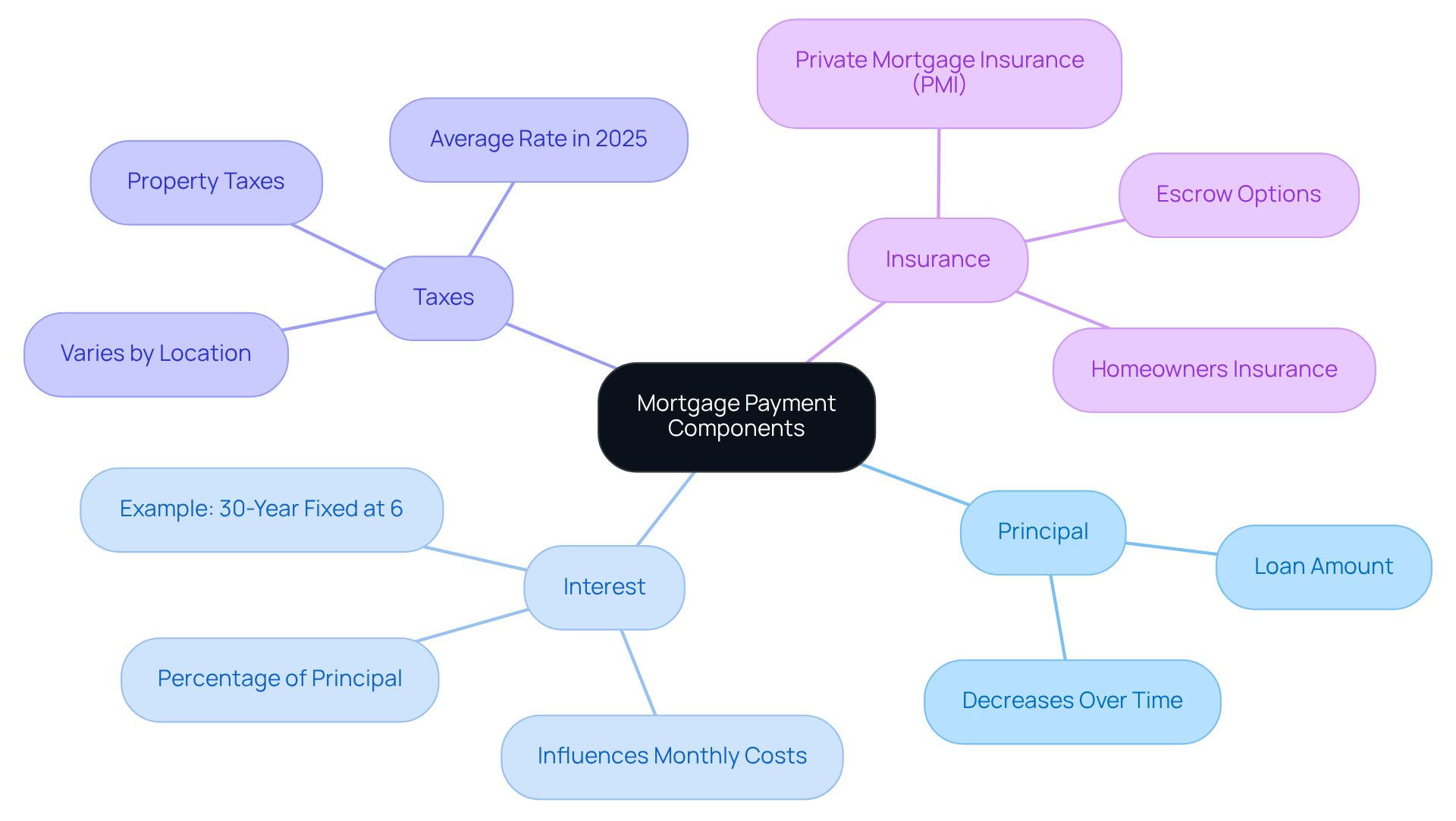

Understand Mortgage Payment Components

Understanding your calculating mortgage payment can feel overwhelming, but we’re here to help you navigate this important journey. It’s essential to grasp the four main components of your mortgage, often referred to as PITI:

- Principal: This is the amount you borrow from the lender, forming the foundation of your loan obligation.

- Interest: This cost of borrowing the principal is expressed as a percentage. It’s important to note that the interest rate can significantly influence your monthly expenses. For instance, a 30-year fixed loan at 6% can lead to substantial interest costs over time.

- Taxes: Property taxes are typically included in your regular loan payments and are determined by local authorities. These taxes can vary widely based on your home’s value and location, with average rates fluctuating across states in 2025.

- Insurance: Homeowners insurance safeguards your property against damages and is often mandated by lenders. If your initial contribution is less than 20%, you may need to pay for private mortgage insurance (PMI), which can add to your monthly costs.

Understanding these elements is essential for calculating mortgage payment and making informed choices about your loan. For example, if you purchase a home for $250,000 with a $30,000 down payment, you’re looking at a loan of $220,000. This could lead to a total monthly payment of approximately $1,956, encompassing principal, interest, taxes, and insurance. Understanding this breakdown not only clarifies your financial responsibilities but also empowers you to plan effectively for homeownership by calculating your mortgage payment. We know how challenging this can be, and we’re here to .

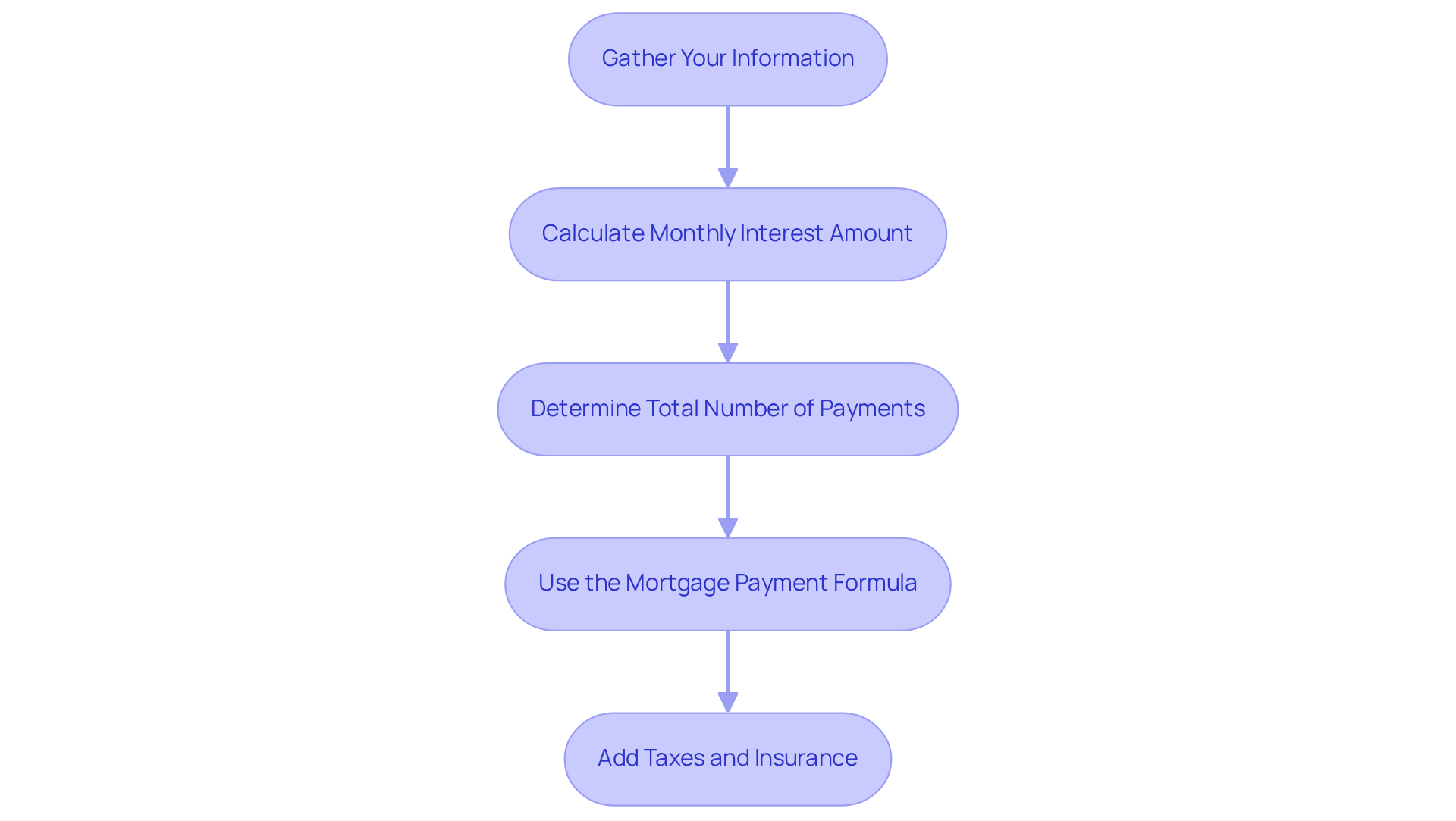

Follow the Step-by-Step Calculation Process

While calculating mortgage payment can feel overwhelming, we’re here to support you every step of the way. Follow these simple steps to gain clarity and confidence in your financial decisions.

Gather Your Information: Start by collecting essential details, including the loan amount (principal), interest percentage, loan term (in years), property taxes, and insurance costs. We know how challenging this can be, but having this information will set you on the right path.

Calculate Monthly Interest Amount: To find your monthly interest amount, divide your annual interest percentage by 12. For instance, if your yearly percentage is 7%, your monthly percentage would be roughly 0.583% (7% / 12). This step is crucial for understanding your payment breakdown.

Determine Total Number of Payments: Multiply the number of years in your loan term by 12. For a 30-year loan, this leads to 360 installments (30 x 12). Knowing the total payments helps you visualize your commitment.

Use the Mortgage Payment Formula: The formula to calculate your monthly payment (M) is:

M = P × (r(1 + r)^n) / ((1 + r)^n - 1)Where:

- P = principal loan amount

- r = monthly interest rate (as a decimal)

- n = number of payments

This formula will give you a clear picture of your monthly obligation.

Add Taxes and Insurance: After computing the principal and interest portion, incorporate your estimated property taxes and insurance expenses to calculate your overall obligation. Understanding this total is essential, especially in today’s market where the has increased considerably, approaching approximately $2,207 in 2024.

By following these steps, you can achieve calculating mortgage payment precisely, empowering your family to make informed decisions about home financing.

Additionally, boosting your credit score can open up more loan opportunities. Consider ordering a copy of your credit report to check for errors or discrepancies. Paying down existing debts can help reduce your debt-to-income ratio, making you more attractive to lenders. Remember to use credit wisely; avoid substantial purchases and ensure prompt payments to enhance your financial status.

To ensure financial stability, it’s suggested to set aside approximately 25% of your earnings for housing expenses, including all related costs. This proactive approach can provide peace of mind as you navigate your mortgage journey.

Address Common Challenges in Mortgage Calculation

Navigating the mortgage payment calculation process can be daunting, but at F5 Mortgage, we’re here to help you overcome these challenges with our technology-driven approach:

- Misunderstanding Interest Charges: Many families find themselves confused about fixed and variable interest rates. It’s crucial to understand which type applies to your loan, as it significantly affects your financial stability. As Sam Khater, Chief Economist at Freddie Mac, notes, the new standard for loan costs is expected to fall between 6% and 7%. This highlights the importance of grasping these figures. At F5 Mortgage, we provide clear, unbiased information to empower you in making informed decisions.

- Neglecting extra expenses like property taxes and insurance can happen when calculating mortgage payment. Research indicates that nearly half of participants miscalculated these figures, underscoring the common misconception about additional costs associated with home loans. Always factor in calculating mortgage payment into your estimates to avoid unexpected surprises. F5 Mortgage prioritizes transparency in all costs, ensuring you know exactly what to expect.

- Using in can be detrimental, so it’s vital to use the when calculating mortgage payment. A recent survey revealed that 28% of respondents were unaware of what a comparison figure is, emphasizing the need for accurate computations and understanding mortgage terminology. Double-checking your inputs can prevent errors that lead to inaccuracies when calculating mortgage payment. Our team at F5 Mortgage is ready to assist you in grasping these terms and calculations.

- Not Considering Future Adjustments: Interest rates and property taxes can change over time. It’s important to consider how these fluctuations may impact your future payments and to budget accordingly. The 2% decline in loan requests for home purchases from last year illustrates how rising interest rates affect buyer behavior. F5 Mortgage is dedicated to helping you secure favorable terms, providing peace of mind against future changes.

- Relying Solely on Online Calculators: While online loan calculators can offer some assistance, they often fail to account for all the unique variables in your situation. Andy Rigg, COO of Member Services, cautions that what appears to be a low rate may come with hidden fees and charges. Treat calculators as a guide, but always verify your calculations manually when possible. At F5 Mortgage, we offer personalized assistance to ensure you understand every aspect of your loan.

By recognizing these challenges and taking proactive steps to address them, you can approach the mortgage calculation process with greater confidence. Remember, F5 Mortgage is here to support you every step of the way.

Conclusion

Understanding how to calculate mortgage payments is an essential skill for families embarking on the journey of homeownership. We know how challenging this can be, and by breaking down the components of a mortgage—principal, interest, taxes, and insurance—homebuyers can gain clarity on their financial commitments. This foundational knowledge empowers families to make informed decisions and effectively navigate the complexities of mortgage calculations.

Throughout this article, we highlighted key steps to facilitate the calculation process. From gathering essential information to applying the mortgage payment formula and considering additional costs like property taxes and insurance, each step is crucial for accurate budgeting. We also addressed common challenges, such as misunderstanding interest rates and neglecting hidden expenses, emphasizing the importance of thoroughness in calculations.

Ultimately, the journey to homeownership can feel daunting, but with the right tools and knowledge, families can approach mortgage calculations with confidence. Taking proactive steps, such as consulting with professionals and verifying calculations, ensures a smoother process. Embracing these insights not only prepares families for their financial responsibilities but also paves the way for a successful and sustainable homeownership experience. We’re here to support you every step of the way.

Frequently Asked Questions

What are the main components of a mortgage payment?

The main components of a mortgage payment are Principal, Interest, Taxes, and Insurance, commonly referred to as PITI.

What does the principal refer to in a mortgage?

The principal is the amount you borrow from the lender, which forms the foundation of your loan obligation.

How is interest calculated in a mortgage?

Interest is the cost of borrowing the principal, expressed as a percentage. The interest rate can significantly impact your monthly expenses.

What role do property taxes play in mortgage payments?

Property taxes are typically included in your regular loan payments and are determined by local authorities. These taxes can vary based on your home’s value and location.

Why is homeowners insurance important in a mortgage?

Homeowners insurance protects your property against damages and is often required by lenders. If your down payment is less than 20%, you may also need to pay for private mortgage insurance (PMI).

How can understanding mortgage components help in financial planning?

Understanding the components of your mortgage payment helps clarify your financial responsibilities and empowers you to make informed decisions about homeownership and budgeting.

Can you provide an example of how mortgage payments are calculated?

For example, if you purchase a home for $250,000 with a $30,000 down payment, you would have a loan of $220,000. This could result in a total monthly payment of approximately $1,956, which includes principal, interest, taxes, and insurance.