Overview

Navigating the world of mortgages can feel overwhelming, especially when considering a loan of $400,000 over 30 years. It’s essential to understand the components of your mortgage payment, including the principal, interest rates, and any additional costs that may arise.

To help you, we provide a straightforward formula for calculating your monthly payments. As of mid-July 2025, you might find that the average monthly payment stands at approximately $2,591 with a 6.81% interest rate. This figure highlights just how significantly interest rates and loan terms can affect your overall payment amounts.

We know how challenging this can be, but understanding these details empowers you to make informed decisions. Remember, we’re here to support you every step of the way as you embark on this important financial journey.

Introduction

We understand that navigating the intricacies of mortgage payments can feel overwhelming, especially when considering a significant loan amount like $400,000 over a 30-year term. This financial commitment involves much more than just the principal; it encompasses:

- Interest rates

- Down payments

- Various additional costs that can greatly impact your monthly obligations

As interest rates fluctuate and economic conditions evolve, we know how challenging this can be. How can you, as a prospective homeowner, navigate these complexities to ensure you make informed decisions? We’re here to support you every step of the way.

Understand the Basics of Mortgage Payments on a $400,000 Loan

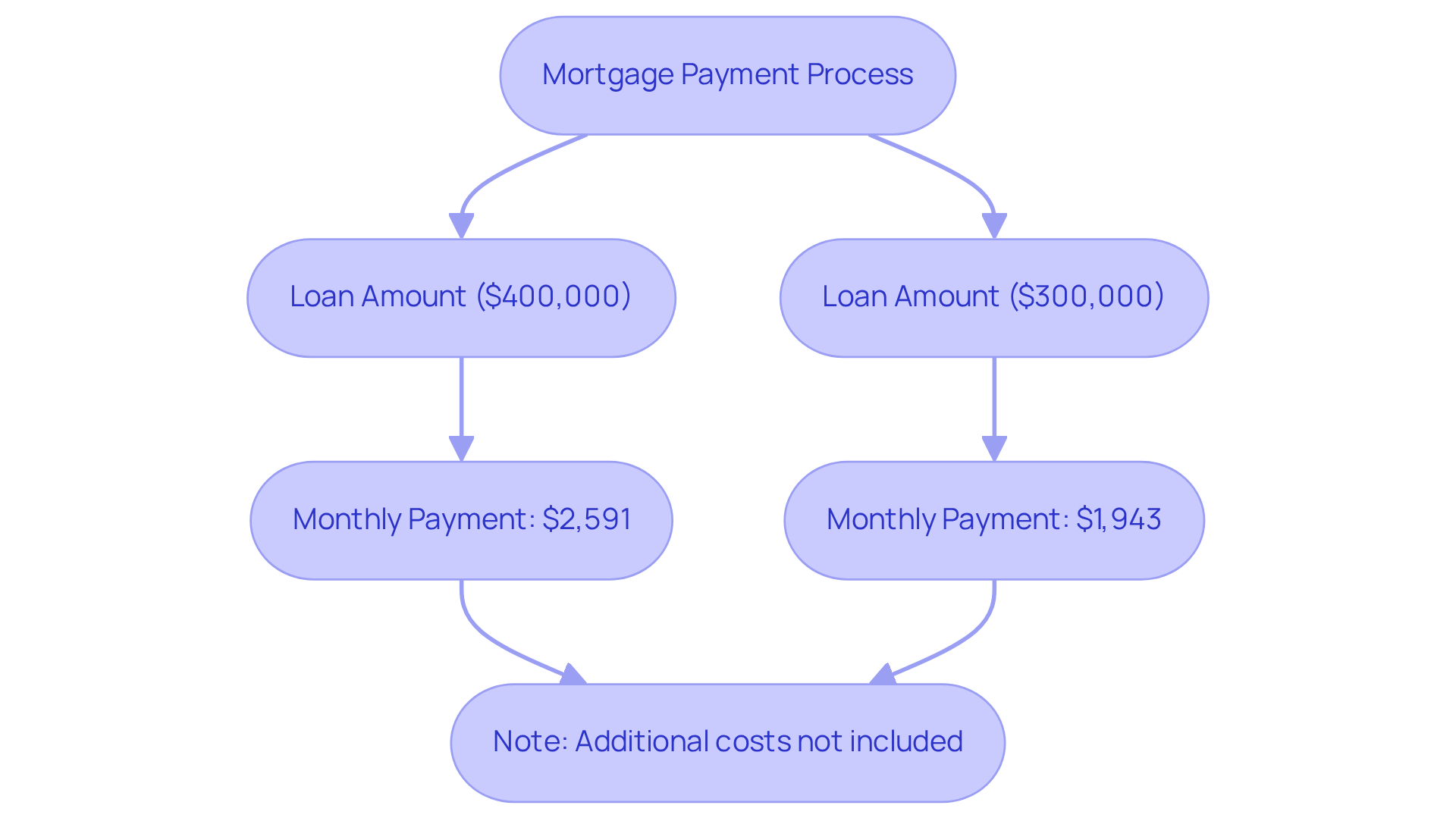

When considering a on $400,000 for 30 years, it’s important to understand that your regular payments will primarily consist of two key elements: the principal and the fees. The principal is the amount you borrow, while the fees represent the cost of borrowing that sum. For a 30-year fixed-interest loan, you will make a total of 360 payments each month. As of July 2025, the average borrowing rate for a loan results in a mortgage payment on $400,000 for 30 years of around 6.81%, leading to a monthly payment of approximately $2,591. This amount does not include additional costs like property taxes, homeowners insurance, and private mortgage insurance (PMI).

We know how challenging it can be to navigate these financial decisions. For instance, if you were to take out a $300,000 loan at the same rate, your monthly payment would be about $1,943. This example illustrates how even small changes in the loan amount can significantly impact your monthly obligations. As borrowing rates fluctuate, they directly affect your loan costs. Therefore, staying informed about current rates can empower you to make better financial choices.

In summary, when evaluating a mortgage payment on $400,000 for 30 years, it’s crucial to consider both the principal and the fees, along with any additional costs. This approach will help you accurately assess your total monthly payment and understand its impact on your budget. Remember, we’re here to support you every step of the way.

Identify Key Factors Affecting Your Mortgage Payment Calculation

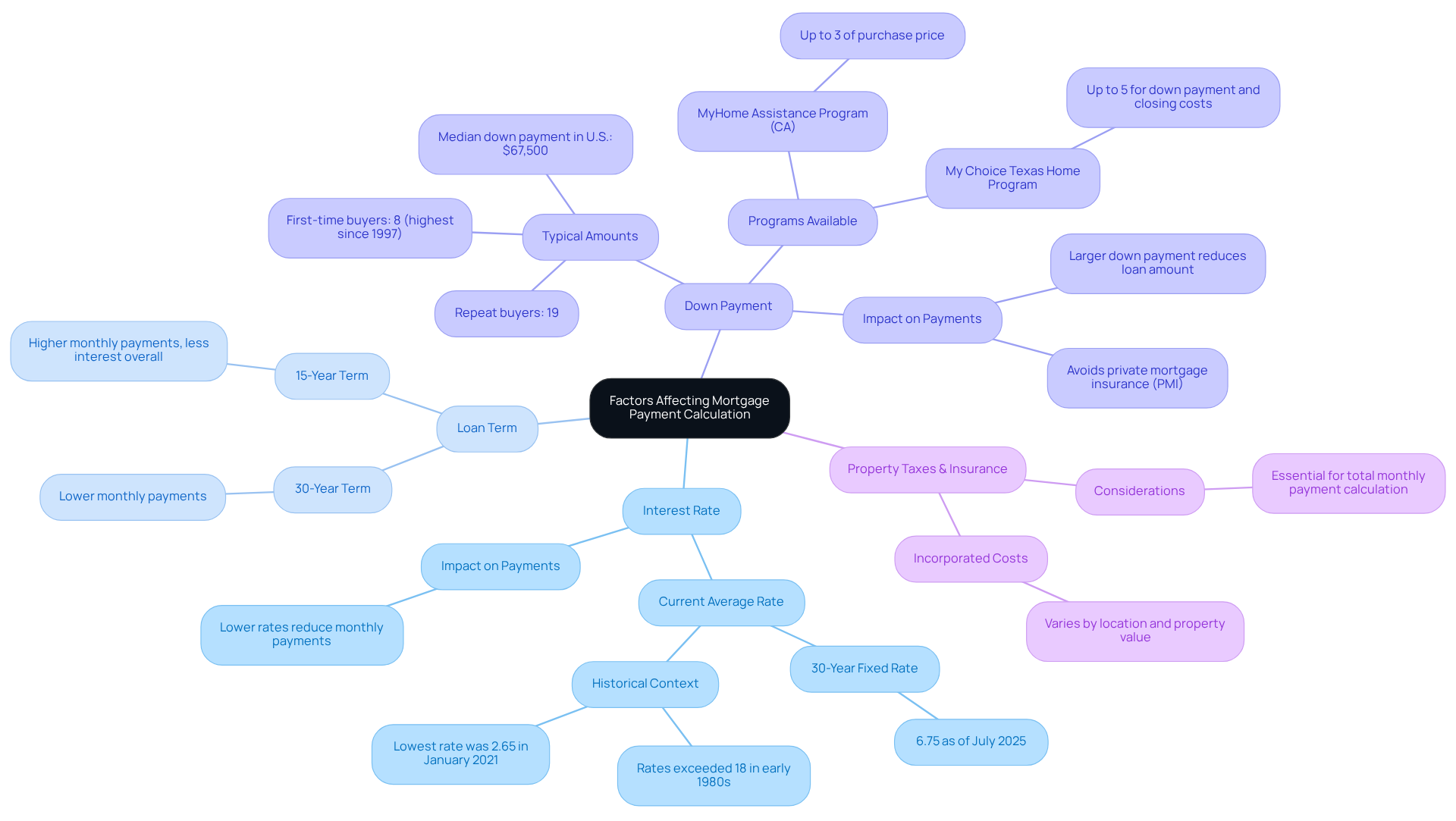

Several key factors will significantly influence your mortgage payment on a $400,000 loan:

- Interest Rate: We know how crucial the interest rate is—it’s the percentage charged by the lender for borrowing the money. As of mid-July 2025, the average rate for a 30-year fixed mortgage is approximately 6.75%. A decreased rate can significantly lessen your regular cost, making it more manageable throughout the loan’s term.

- Loan Term: The duration you have to repay the loan plays a vital role in determining your regular installment. A 30-year term generally results in lower installments, like the mortgage payment on $400,000 for 30 years, compared to a 15-year term, although you will incur more interest throughout the duration of the loan.

- Down Payment: The initial sum is the amount you pay upfront when buying a home. A larger initial contribution decreases the total loan sum, which can result in reduced monthly installments and may also influence mortgage insurance prerequisites. For example, providing a 20% deposit on a $400,000 house would entail paying $80,000 initially, leading to a loan of $320,000. Additionally, F5 Mortgage offers various down payment aid programs, such as the MyHome Assistance Program in California, which provides up to 3% of the home’s purchase price, and the My Choice Texas Home program, which offers up to 5% for deposit and closing support. These options can significantly reduce your regular obligations.

- Property Taxes and Insurance: These expenses are frequently incorporated into your regular mortgage installment and can differ significantly depending on location and property value. It’s crucial to consider these extra costs when determining your overall amount due each month.

Comprehending these elements will allow you to determine a more precise recurring charge and enhance your readiness for your financial obligations. We’re here to as you navigate this important journey.

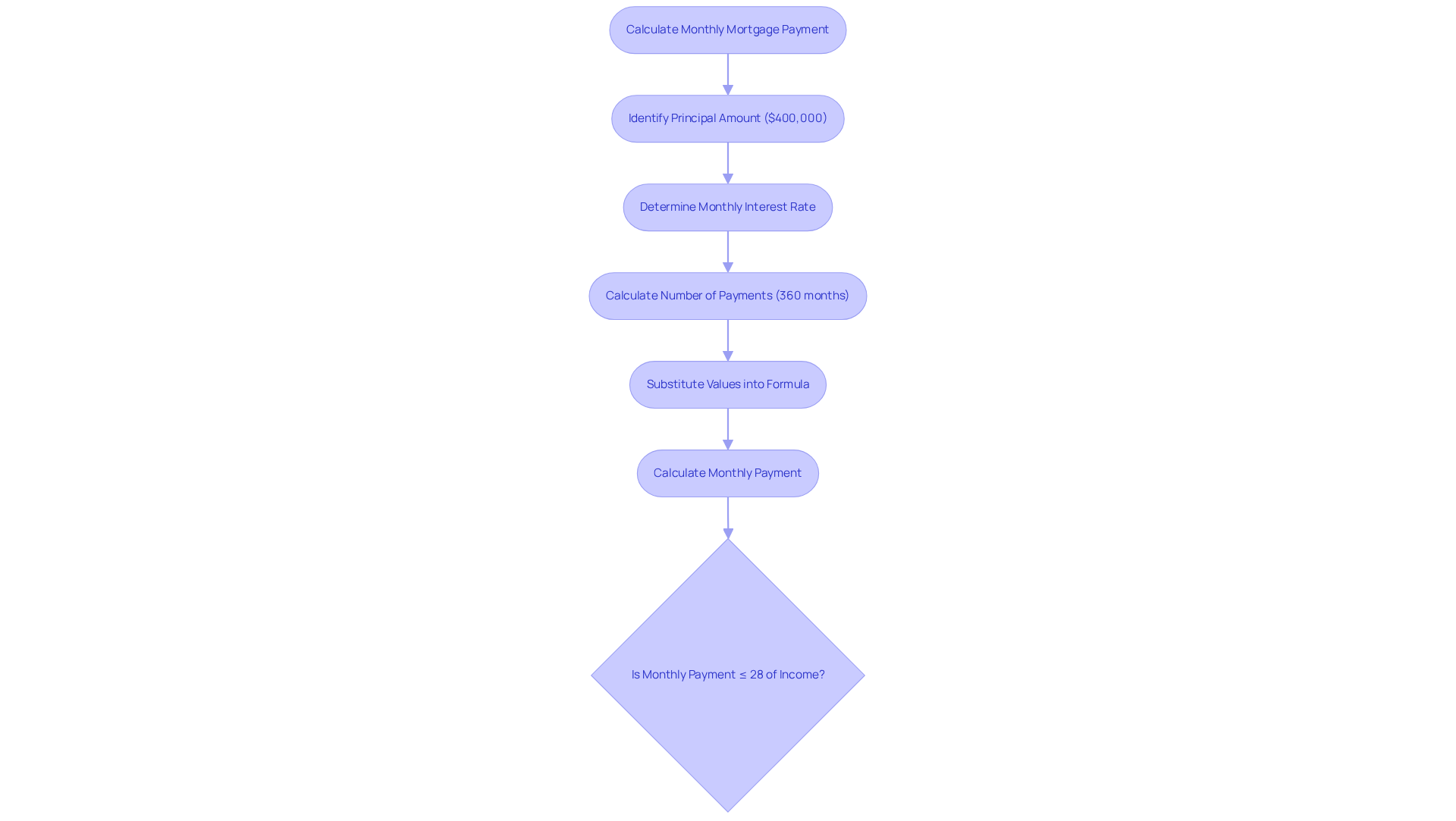

Calculate Your Monthly Mortgage Payment Using the Formula

Determining the mortgage payment on $400,000 for 30 years can feel overwhelming, but we’re here to support you every step of the way. You can utilize the following formula to make this process easier:

M = P [i(1 + i)^n] / [(1 + i)^n - 1]

Where:

- M = total monthly mortgage payment

- P = principal loan amount ($400,000)

- i = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

Let’s break it down together. For instance, if you have a 7% annual interest rate, the monthly interest rate is calculated as 0.07 / 12 = 0.005833. If you’re considering a 30-year loan, n equals 360 months. By substituting these values into the formula, you’ll find:

M = 400,000 [0.005833(1 + 0.005833)^360] / [(1 + 0.005833)^360 - 1]

This calculation will yield your monthly payment, which is essential for effective budgeting and financial planning.

As a reference, the average mortgage payment on $400,000 for 30 years at a 7% interest rate is approximately $2,661. Understanding this figure can help you assess your financial readiness for homeownership. We know how challenging this can be, and financial advisors often recommend adhering to the 28% rule. This rule suggests that no more than 28% of your gross monthly income should be allocated to housing expenses. For a household earning $100,000 each year, this equates to a reasonable expense of approximately $2,333.33, assisting you in making informed choices regarding your financing alternatives.

It’s also important to consider home equity requirements. Many lenders require homeowners to have at least an 80% home-to-value loan ratio. This means you should have paid down at least 20% of your original loan amount or your home should have increased in value. Moreover, keeping a favorable debt-to-income (DTI) ratio, ideally under 43%, can result in more competitive loan rates. To increase your loan opportunities, think about boosting your credit score by reviewing your credit report for mistakes, reducing current debts, and ensuring prompt payments. Taking these steps can significantly influence your loan application process.

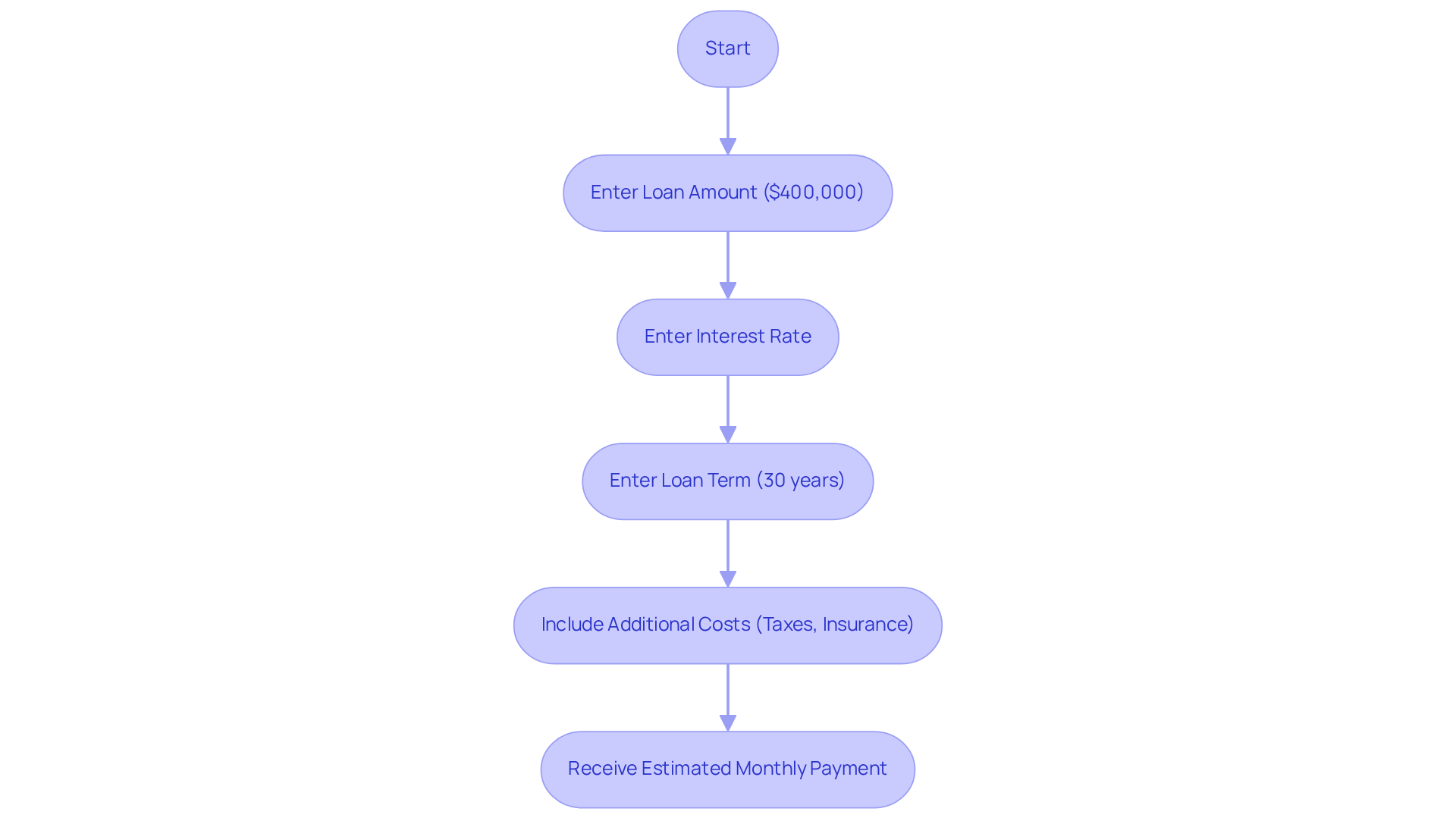

Utilize Online Tools and Calculators for Accurate Payment Estimates

While calculating your mortgage payment on $400,000 for 30 years can feel overwhelming, we’re here to help. Consider using the online mortgage calculator provided by F5 Mortgage. Our user-friendly technology allows you to easily enter your loan amount, interest rate, and loan term, helping you calculate the mortgage payment on $400,000 for 30 years and providing you with an instant estimate.

At F5 Mortgage, we understand how important personalized guidance is during this process. You can count on us to . Our calculator even lets you factor in additional costs, such as property taxes and insurance, so you can see a complete picture of your monthly obligations.

By utilizing this tool, you can save time and ensure accuracy in your calculations. We want you to enjoy a stress-free experience with our no-pressure approach. Remember, we know how challenging this can be, and we’re here for you.

Conclusion

Understanding the intricacies of mortgage payments on a $400,000 loan over 30 years is essential for making informed financial decisions. We know how challenging this can be, and this article has provided a comprehensive overview of the key components that influence your monthly obligations. These include:

- The principal amount

- Interest rates

- Loan terms

- Additional costs like property taxes and insurance

By grasping these elements, homeowners can better navigate their financial landscape and prepare for the long-term commitment of a mortgage.

The discussion highlighted several critical factors affecting mortgage payments. Consider:

- The impact of interest rates

- The significance of down payments

- The importance of maintaining a favorable debt-to-income ratio

Utilizing the mortgage payment formula and online calculators can further simplify the process, enabling prospective homeowners to estimate their monthly payments accurately. These tools are invaluable for budgeting and ensuring that housing expenses remain manageable.

Ultimately, being well-informed about mortgage payment calculations empowers individuals to make strategic decisions regarding homeownership. As interest rates and housing markets fluctuate, staying updated and utilizing available resources can lead to better financial outcomes. Engaging with tools like mortgage calculators not only streamlines the calculation process but also fosters confidence in navigating the complexities of home financing. Taking proactive steps now can pave the way for a secure and fulfilling homeownership experience.

Frequently Asked Questions

What are the main components of a mortgage payment on a $400,000 loan?

The main components of a mortgage payment on a $400,000 loan are the principal, which is the amount borrowed, and the fees, which represent the cost of borrowing that sum.

How long is the repayment period for a typical mortgage on a $400,000 loan?

The typical repayment period for a mortgage on a $400,000 loan is 30 years, resulting in a total of 360 monthly payments.

What is the average mortgage payment for a $400,000 loan as of July 2025?

As of July 2025, the average mortgage payment for a $400,000 loan over 30 years is approximately $2,591 per month.

Are there additional costs associated with a mortgage payment?

Yes, additional costs associated with a mortgage payment can include property taxes, homeowners insurance, and private mortgage insurance (PMI), which are not included in the monthly payment estimate.

How does the loan amount affect the monthly payment?

The loan amount significantly impacts the monthly payment. For example, a $300,000 loan at the same interest rate would result in a monthly payment of about $1,943, illustrating how even small changes in the loan amount can affect monthly obligations.

Why is it important to stay informed about borrowing rates?

Staying informed about borrowing rates is important because fluctuations in these rates directly affect loan costs, which can help individuals make better financial choices regarding their mortgage.