Overview

This article is designed to guide you through the process of calculating your ideal house down payment step-by-step. We understand how overwhelming this can feel, and it’s important to grasp the various factors that influence the amount you’ll need. By outlining a systematic approach, we’ll help you determine your down payment based on property price, percentage choices, and additional costs.

Moreover, we want to highlight the resources and assistance programs available to support you in managing your financial obligations effectively. Our goal is to empower you with the knowledge and tools necessary to navigate this journey with confidence. Remember, we’re here to support you every step of the way.

Introduction

Embarking on the journey to homeownership can feel overwhelming, but it often begins with one vital step: understanding the down payment. This initial cash investment not only impacts loan approval and interest rates but also plays a crucial role in building equity and avoiding extra costs, such as private mortgage insurance. As potential buyers consider their options, they may wonder: how can they find the ideal down payment that aligns with their financial goals and the current market?

We know how challenging this can be, and that’s why this guide is here for you. It offers a comprehensive, step-by-step approach to calculating the perfect down payment, empowering you to make informed decisions on your path to owning a home. Together, we can navigate this process with confidence and clarity.

Define Down Payment and Its Importance

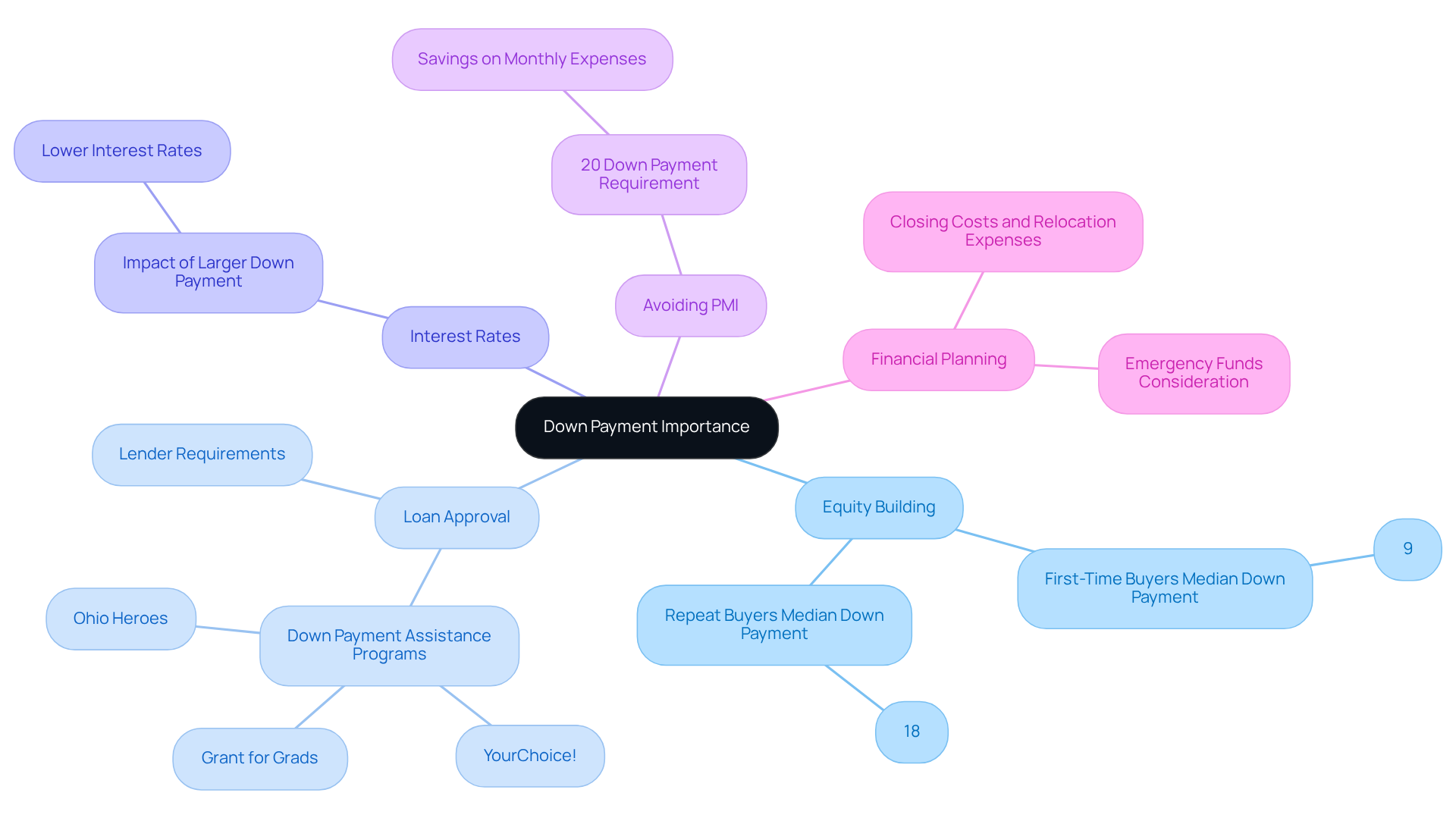

A house down payment is the initial cash sum made when purchasing a home, typically expressed as a percentage of the total purchase cost. This step is crucial in the mortgage financing process, and we understand how important it is to navigate it successfully.

- Equity Building: An initial deposit helps create equity in your home right from the start. This can be incredibly beneficial if you decide to sell or refinance later. For instance, first-time home purchasers in 2024 made a median down contribution of 9%, while repeat buyers invested 18%. This highlights the significance of equity in homeownership, and we know how vital it is to build that foundation.

- Loan Approval: Lenders often require a down deposit to ensure that buyers have a financial stake in the property, thus reducing the risk of default. This requirement can be especially challenging for first-time purchasers who may struggle to save enough for a deposit. Fortunately, numerous state and local initiatives, like YourChoice!, Grant for Grads, and Ohio Heroes, offer down payment assistance. These programs can help close the savings gap for prospective buyers. To take advantage of these options, it’s essential to research what’s available, gather necessary documentation, and partner with an like F5 Mortgage to guide you through the application process.

- Interest Rates: A larger down deposit can lead to lower interest rates, signaling to lenders that you are a lower-risk borrower. This can significantly reduce the overall cost of your mortgage over time, making homeownership more affordable.

- Avoiding PMI: If you can put down at least 20%, you can avoid private mortgage insurance (PMI), which typically adds $30 to $70 per month for every $100,000 borrowed. This can lead to substantial savings in your monthly expenses, allowing you to allocate funds where they matter most.

- Financial Planning: It’s crucial not to deplete your emergency funds for a down deposit, as closing costs and relocation expenses also need to be considered. While a smaller initial contribution can enable faster homeownership, it may lead to increased monthly costs and the requirement of PMI for contributions below 20%. We know how daunting this can feel, but with careful planning, you can navigate these challenges.

By grasping these elements and exploring the available down deposit assistance programs, you can make informed choices about how much to save for your down deposit. This understanding will ultimately enhance your property purchasing experience, and remember, we’re here to support you every step of the way.

Identify Key Factors Influencing Down Payment Amount

Several key factors influence the amount you should consider for your down payment:

- The total expense of the residence directly influences the house down payment amount. As of June 2024, the usual deposit nationwide was 18.6%, amounting to roughly $67,500. More expensive houses require a bigger house down payment, which can greatly influence your total financial obligation.

- We understand that choosing the right loan type can be overwhelming. Various mortgage programs have differing requirements for house down payment. For example, FHA mortgages may necessitate as little as 3.5%, while conventional mortgages generally anticipate down contributions varying from 5% to 20%. This variability enables purchasers to select a financing option for their house down payment that aligns with their financial situation.

- Your in this process. An elevated credit score can make you eligible for improved borrowing conditions, possibly enabling a reduced upfront cost. Lenders often view higher credit scores as indicative of lower risk, which can lead to more favorable financing options.

- We know how important it is to manage your finances. Lenders assess your monthly debt obligations compared to your income. A reduced debt-to-income ratio might allow you to qualify for a loan with a smaller house down payment, as it demonstrates your ability to manage monthly expenses effectively.

- Market conditions can also impact your strategy. In competitive housing markets, sellers may prefer buyers who can provide a larger house down payment. This preference can affect your strategy, as a larger upfront contribution may boost your offer’s appeal in bidding wars.

- If saving for a house down payment feels challenging, there are options available. Exploring state or local down payment assistance programs can provide valuable support. In California, the MyHome Assistance Program provides up to 3% of the house down payment based on the home’s purchase price. Texas has the My Choice Texas Home initiative, which offers up to 5% for house down payment and closing support. Florida also has several programs, including the Florida Assist Second Mortgage Program, which can provide assistance for house down payment of up to $10,000 in upfront costs. In Ohio, assistance for a house down payment can range from a few thousand dollars to over $30,000, available as loans or grants, with some loans being forgivable over time.

- Lastly, it’s important to be aware of private mortgage insurance (PMI). If your house down payment is less than 20%, you may be required to have PMI, which can raise your monthly expenses. Recognizing this possible extra cost is essential when arranging your house down payment.

By comprehending these elements, you can more effectively prepare for your property acquisition and make knowledgeable choices concerning your deposit. We’re here to support you every step of the way.

Calculate Your Ideal Down Payment Using a Step-by-Step Approach

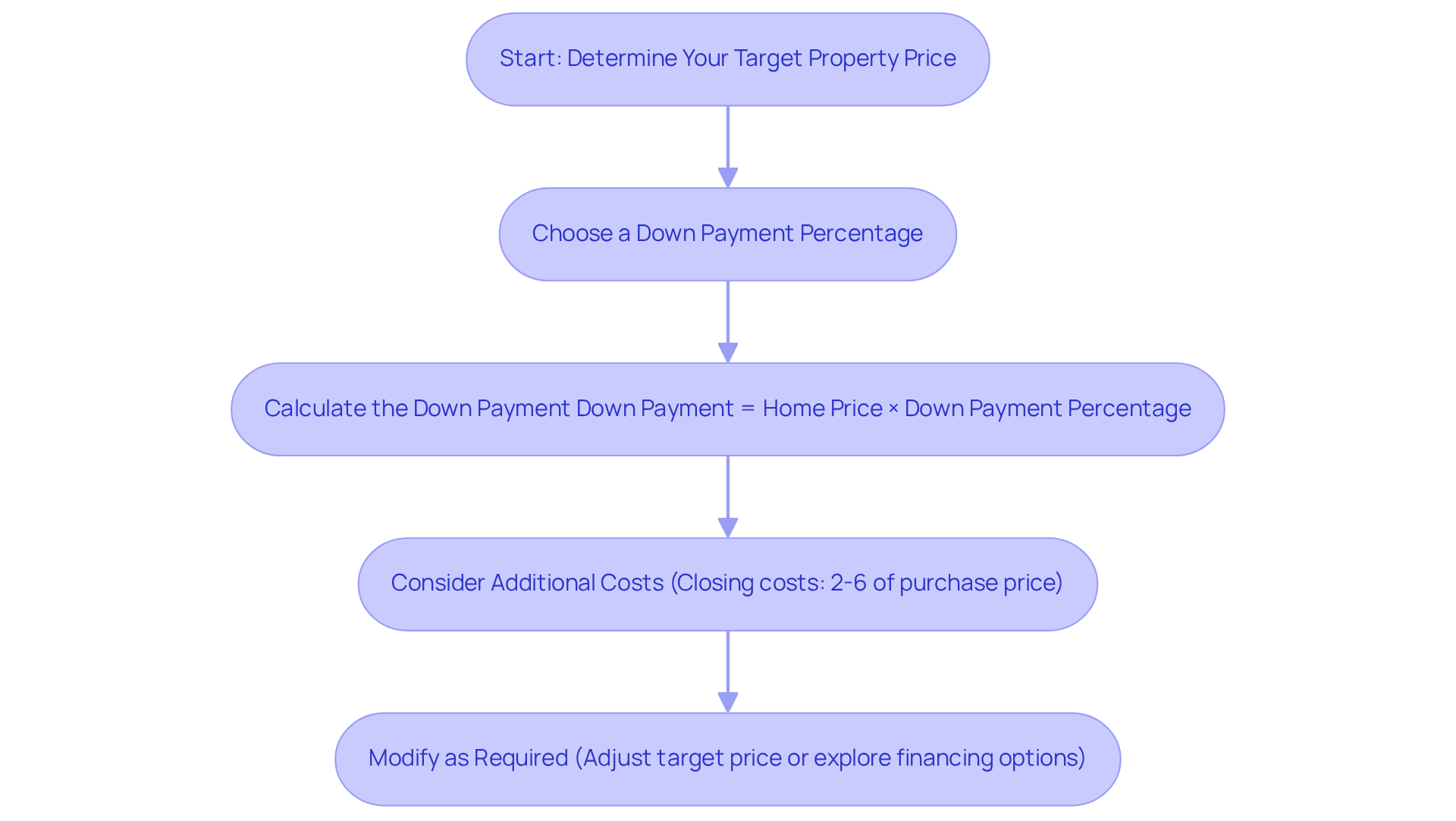

Calculating your ideal down payment can feel overwhelming, but we’re here to support you every step of the way. Follow these simple steps to navigate this process with confidence:

- Determine Your Target Property Price: Start by identifying the price range of properties that catch your interest. For example, if you’re looking at homes priced at $300,000, this will serve as your baseline.

- Choose a Down Payment Percentage: Select a percentage that aligns with your financial situation and the type of financing you plan to use. Typical down payment percentages are 3%, 5%, 10%, and 20%. For instance, conventional loans may allow as little as 3% down, while FHA loans typically require a minimum of 3.5%.

- Calculate the Down Payment: Use this straightforward formula:

Down Payment = Home Price × Down Payment Percentage

If you choose a 20% down payment on a $300,000 home, it would look like this:

Down Payment = $300,000 × 0.20 = $60,000. - Consider Additional Costs: Remember to account for closing costs and other fees that might arise during the property acquisition process. These usually range from 2% to 6% of the purchase price. This will help you understand the total amount you need to save. Your lender will provide a that details the fees and expenses related to your financing, which can change up to 10% before closing. Before you finalize your purchase, you’ll receive a Closing Disclosure that outlines your final numbers.

- Modify as Required: If your initial contribution exceeds your savings, consider adjusting your target home price or exploring financing options that require smaller down payments. For example, VA loans and USDA loans may offer 0% down options for qualified borrowers, making homeownership more attainable. Additionally, be aware that if your down payment is less than 20%, you might need to pay private mortgage insurance (PMI), which can add an extra $30-$70 per month for every $100,000 borrowed.

By following these steps, you can arrive at a practical down payment that aligns with your financial goals, ensuring you’re well-prepared for the home buying journey. Also, consider looking into down payment assistance programs available through F5 Mortgage, such as those offered by the Golden State Finance Authority, which can significantly ease the financial burden of a down payment.

Utilize Tools and Resources for Down Payment Calculation

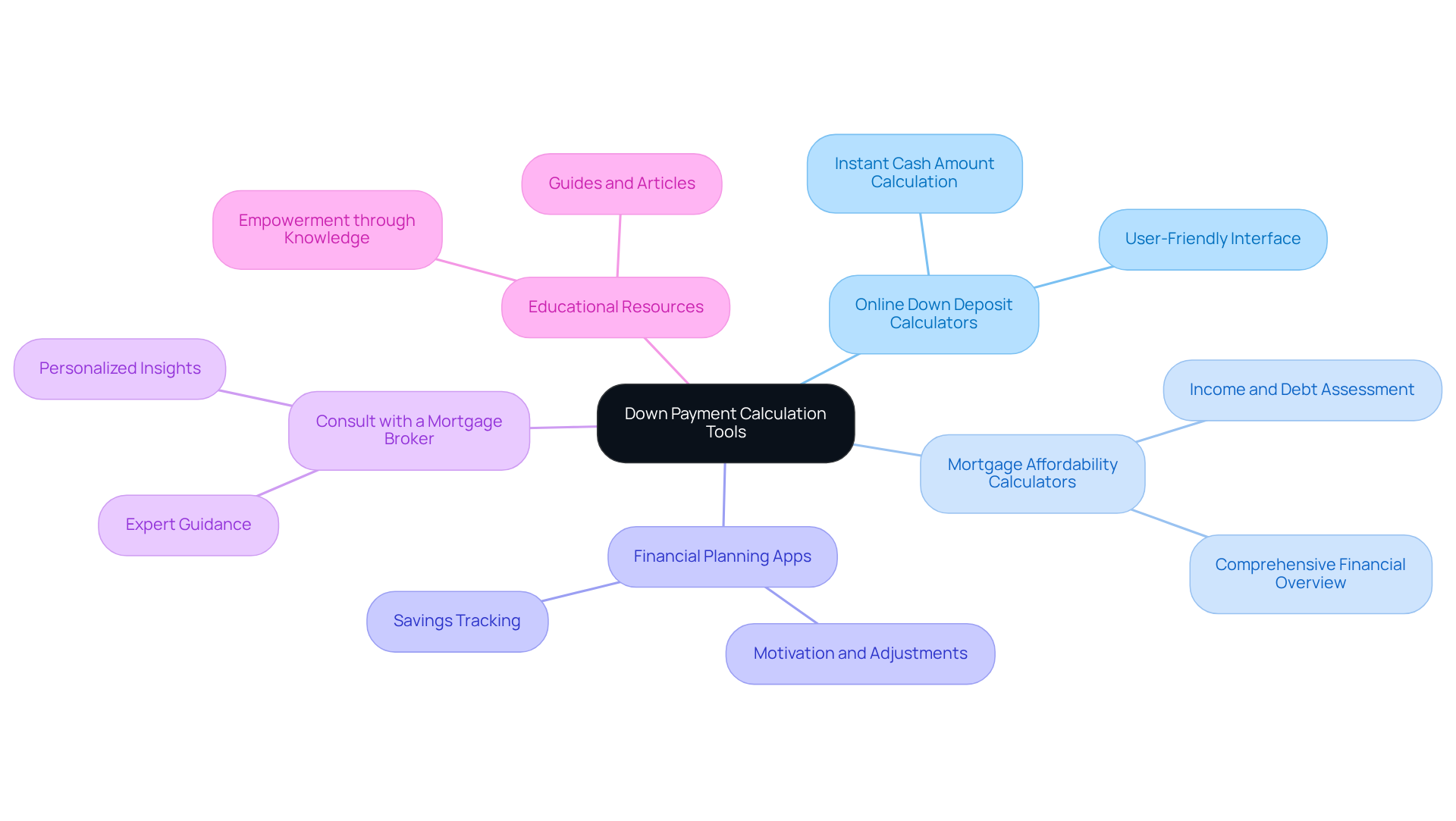

Calculating your house down payment can feel daunting, but you don’t have to navigate this journey alone. Here are some helpful tools and resources to guide you:

- Online Down Deposit Calculators: These user-friendly calculators, found on various websites, allow you to enter your home price and desired down payment percentage. They instantly show you the cash amount you’ll need, simplifying the process and providing clarity on your financial needs.

- Mortgage Affordability Calculators: Tools like Zillow’s Affordability Calculator help you assess how much home you can afford based on your income, debts, and initial deposit. This comprehensive approach ensures you fully understand your regarding your house down payment before making a commitment.

- Financial Planning Apps: Budgeting applications can be a great ally in tracking your savings as you work towards your house down payment goal. By keeping an eye on your finances, you can stay motivated and adjust your plans as necessary to reach your target.

- Consult with a Mortgage Broker: Partnering with a professional mortgage broker, such as F5 Mortgage, offers personalized insights tailored to your unique financial situation. Their expertise can help you navigate the complexities of mortgage financing and identify the best options for you.

- Educational Resources: Websites like the Consumer Financial Protection Bureau provide valuable guides and articles on down payments and home buying. These resources empower you with knowledge, enabling you to make informed decisions.

By leveraging these tools and resources, you can make your path to homeownership smoother and feel more prepared for the house down payment and the financial commitment that lies ahead. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of calculating an ideal house down payment is essential for prospective homeowners. We know how challenging this can be, as this process not only involves determining the right amount to contribute but also encompasses the broader implications of equity, loan approval, interest rates, and financial planning. Navigating these factors effectively empowers you to make informed decisions that align with your financial goals.

Key insights covered in this guide highlight the importance of down payments in building equity, securing favorable loan terms, and avoiding unnecessary costs like private mortgage insurance. Additionally, understanding the various influences on down payment amounts, including property prices, loan types, and credit scores, can significantly impact your strategy in the competitive housing market. Utilizing available tools and resources, such as online calculators and professional guidance, further enhances your ability to calculate a manageable down payment.

Ultimately, taking a proactive approach to understanding and calculating your ideal down payment can pave the way for a successful home buying journey. Embracing the available assistance programs and resources ensures that the path to homeownership is not only attainable but also financially sound. By prioritizing these considerations, you can confidently embark on this significant investment, making informed choices that lead to long-term stability and satisfaction in your new home.

Frequently Asked Questions

What is a down payment in the context of purchasing a home?

A down payment is the initial cash sum made when buying a home, typically expressed as a percentage of the total purchase cost.

Why is a down payment important?

A down payment is crucial for several reasons: it helps build equity in the home, is often required for loan approval, can lead to lower interest rates, and allows buyers to avoid private mortgage insurance (PMI) if the deposit is at least 20%.

How does a down payment contribute to equity building?

An initial down payment helps create equity in your home right from the start, which can be beneficial if you decide to sell or refinance later.

What role does a down payment play in loan approval?

Lenders typically require a down payment to ensure that buyers have a financial stake in the property, which reduces the risk of default.

Are there assistance programs available for down payments?

Yes, there are numerous state and local initiatives, such as YourChoice!, Grant for Grads, and Ohio Heroes, that offer down payment assistance to help prospective buyers close the savings gap.

How can a larger down payment affect interest rates?

A larger down payment can lead to lower interest rates, as it signals to lenders that the borrower is a lower-risk candidate, potentially reducing the overall cost of the mortgage.

What is private mortgage insurance (PMI) and how can it be avoided?

PMI is insurance that protects lenders in case of default and typically adds $30 to $70 per month for every $100,000 borrowed. It can be avoided if the down payment is at least 20%.

What should buyers consider regarding their finances when making a down payment?

Buyers should not deplete their emergency funds for a down payment, as they also need to account for closing costs and relocation expenses. A smaller down payment might enable faster homeownership but could lead to increased monthly costs and PMI if below 20%.