Introduction

Navigating the complexities of a mortgage payment can feel overwhelming, like trying to find your way through a maze. If you’re looking at a $170,000 mortgage over 30 years, it’s essential to understand the key components that shape your monthly payments:

- Principal

- Interest

- Taxes

- Insurance

We know how challenging this can be, and many homebuyers struggle to estimate these costs accurately, which can lead to financial missteps.

But don’t worry; you’re not alone in this journey. It’s crucial to be prepared for your monthly obligations and to make informed decisions about your home financing. By gaining clarity on these components, you can take control of your financial future and feel more confident in your choices. Let’s explore how you can navigate this process with ease and assurance.

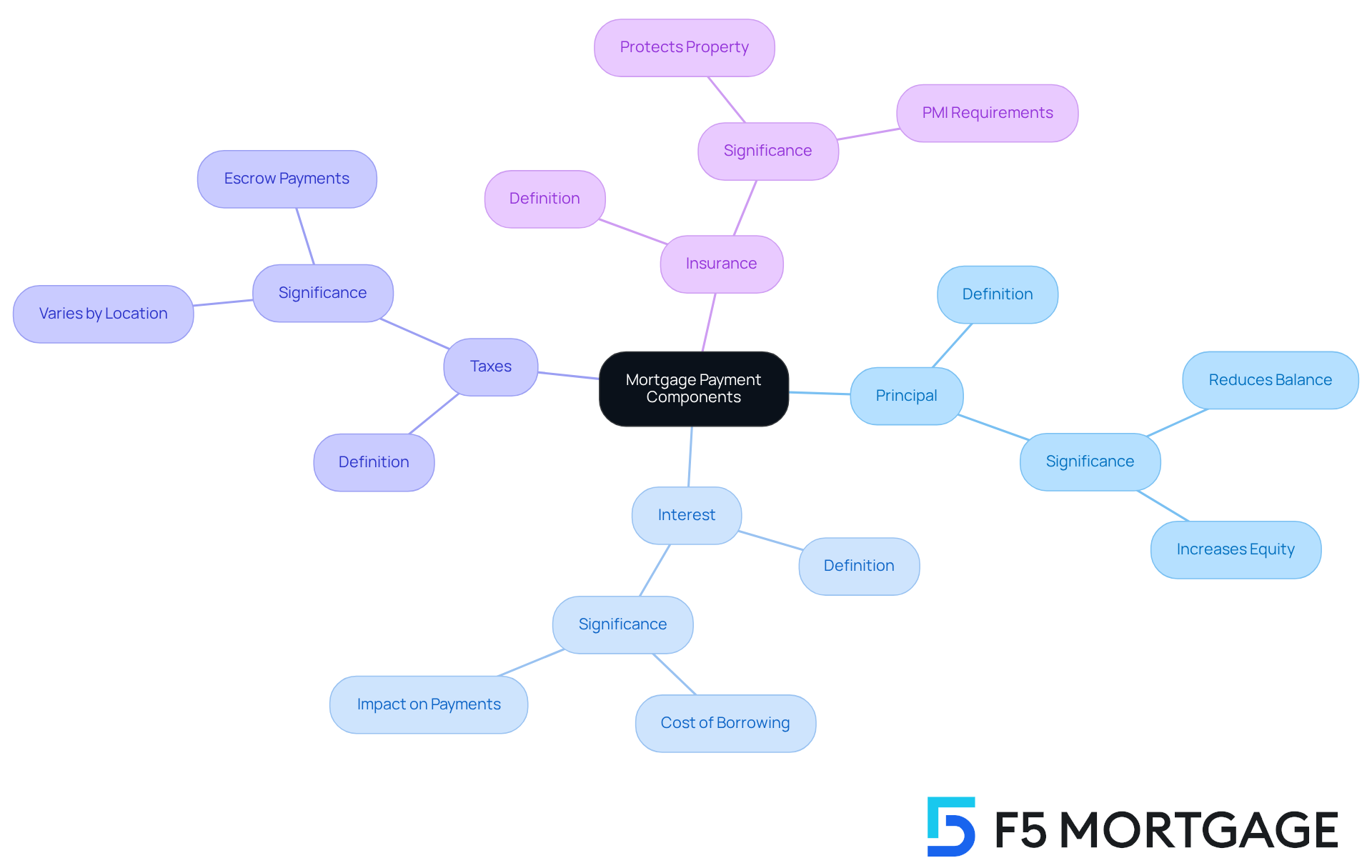

Understand Mortgage Payment Components

Understanding your mortgage installment can feel overwhelming, but we’re here to support you every step of the way. A mortgage payment typically consists of four key components, known as PITI: Principal, Interest, Taxes, and Insurance. Grasping the significance of each element is crucial for effective financial planning:

- Principal: This is the original amount borrowed from the lender. Each payment you make reduces the principal balance, gradually increasing your equity in your home.

- Interest: This represents the cost of borrowing the principal, expressed as an annual percentage. The interest rate can significantly impact your monthly payment, especially in the early years of the loan when a larger portion of your payment goes toward interest.

- Taxes: Property taxes are usually included in your monthly housing costs and can vary widely based on your location and the assessed value of your property. For instance, if your yearly property tax is $1,200, you would contribute about $100 each month into an escrow account, which the lender uses to pay the taxes when they’re due.

- Insurance: Homeowner’s insurance is vital for protecting your property against risks like fire or theft, and lenders often require it. If your down payment is less than 20%, you may also need to pay for private mortgage insurance, which adds to your monthly costs until you reach 20% equity in your home.

By understanding these components, you can calculate your monthly loan payment more accurately and manage your budget effectively. For example, understanding the breakdown of a $170,000 mortgage payment over 30 years can help you make informed financial decisions. Recent analyses show that the average breakdown of home financing costs in 2025 indicates that PITI can greatly influence overall affordability and loan eligibility. This makes it essential for homebuyers to consider these factors carefully.

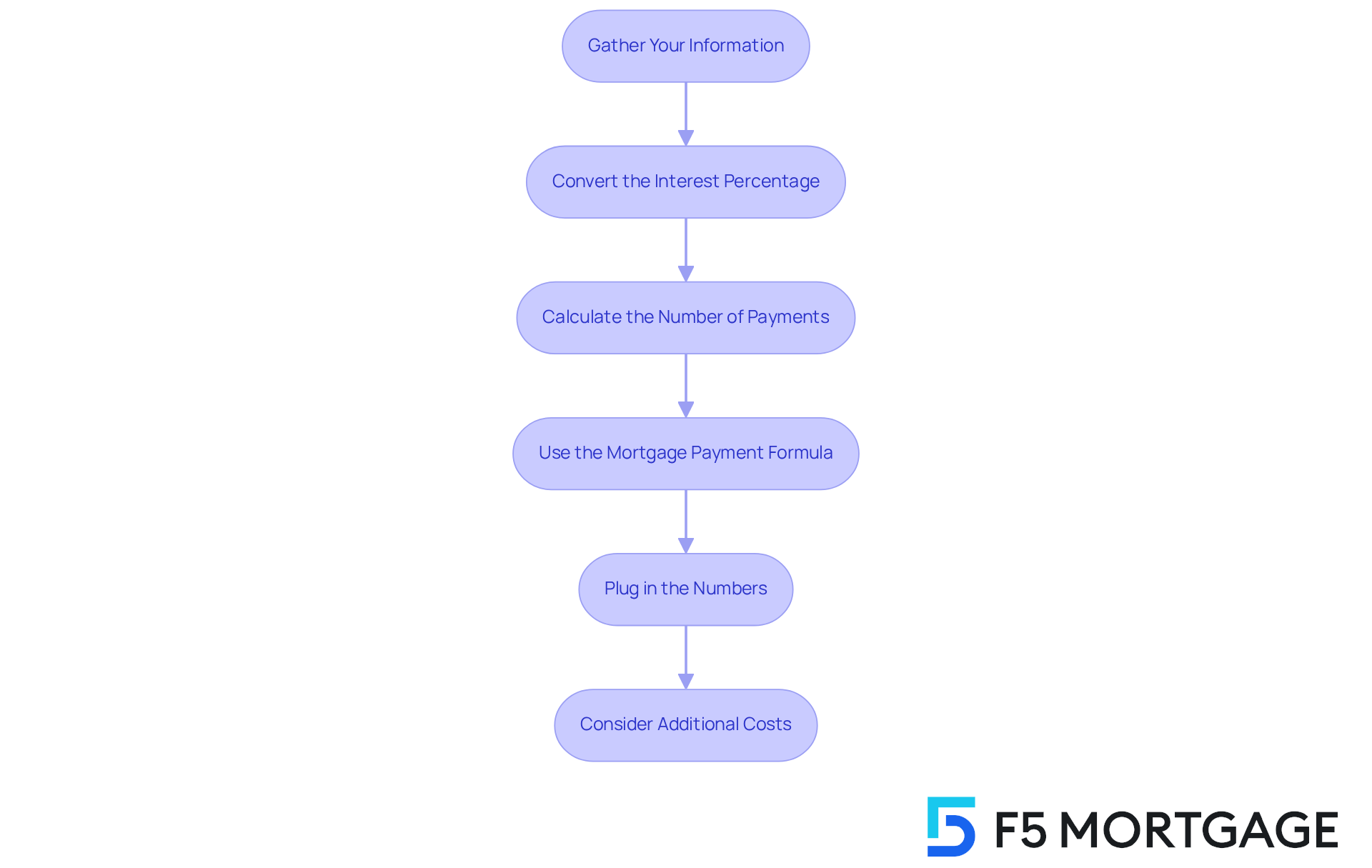

Calculate Your Monthly Payment Step-by-Step

Calculating your monthly mortgage payment can feel overwhelming, but we’re here to support you every step of the way. If you’re looking at a $170,000 mortgage payment over 30 years, let’s break it down together.

Gather Your Information: Start with the basics: your loan amount and the details of your $170,000 mortgage payment over 30 years, the interest rate (let’s assume 4% for this example), and the loan term. Knowing these details is the first step toward understanding your mortgage.

Convert the Interest Percentage: Next, divide the annual interest rate by 12 to find your monthly interest rate. For a 4% rate, that’s about 0.3333% (4/12). This small step is crucial for your calculations.

Calculate the Number of Payments: Multiply the number of years by 12 to find out how many payments you’ll make. For a 30-year mortgage, that’s 360 payments (30 x 12). It’s important to know what you’re committing to.

Use the Mortgage Payment Formula: The formula for calculating your monthly payment (M) is:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- P = principal loan amount ($170,000)

- r = monthly interest rate (0.04/12)

- n = number of payments (360)

- Plug in the Numbers: Now, let’s substitute those values into the formula:

M = 170000[0.003333(1 + 0.003333)^360] / [(1 + 0.003333)^360 - 1]

This calculation results in a monthly payment of approximately $811. Knowing this number helps you plan your budget.

- Consider Additional Costs: Don’t forget to factor in property taxes, homeowner’s insurance, and any HOA fees. These can significantly impact your monthly expenses, so it’s essential to include them in your financial planning. For instance, property taxes can add up quickly, and understanding this can help you avoid surprises.

Additionally, it’s vital to grasp your Debt-to-Income (DTI) ratio when considering refinancing options. A maximum DTI ratio of 43% is generally necessary for home loans, which can influence the terms you receive. At F5 Mortgage, we offer various refinancing options tailored to Colorado residents, including conventional and FHA loans, each with different DTI requirements. This flexibility can help you secure a more favorable loan interest rate and manage your monthly expenses better.

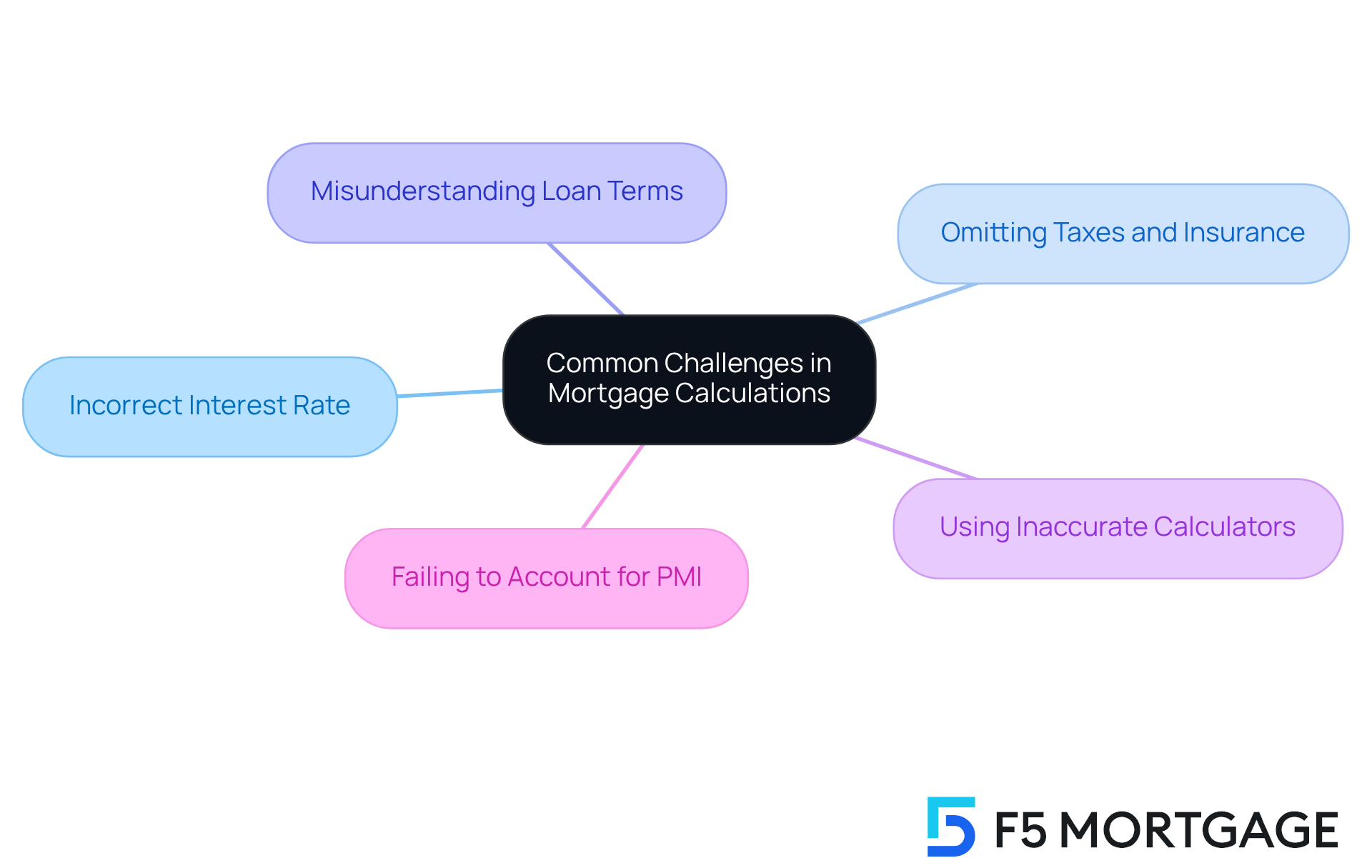

Address Common Challenges in Mortgage Calculations

Calculating your mortgage payment can feel overwhelming, and we know how challenging this can be. Here are some common hurdles you might face:

- Incorrect Interest Rate: It’s crucial to use the right interest rate. Even a small difference can significantly impact your monthly payment.

- Omitting Taxes and Insurance: Many calculators only show principal and interest. Remember to factor in property taxes and insurance for a complete picture.

- Misunderstanding Loan Terms: Understanding your loan term is vital. A 30-year loan has 360 payments, while a 15-year loan has just 180.

- Using Inaccurate Calculators: Not all online calculators are reliable. Make sure the one you choose covers all aspects of your mortgage costs.

- Failing to Account for PMI: If your down payment is less than 20%, you’ll likely need to include Private Mortgage Insurance (PMI) in your calculations. This can add a significant amount to your monthly expenses.

By being aware of these challenges and taking proactive steps to address them, you can achieve a more accurate calculation of your mortgage payment. We’re here to support you every step of the way!

Conclusion

Understanding the complexities of a $170,000 mortgage payment over a 30-year term can feel overwhelming. We know how challenging this can be, especially when navigating the home buying process. By breaking down mortgage payments into Principal, Interest, Taxes, and Insurance (PITI), you can gain clarity on how each element impacts your financial commitment. This knowledge not only helps with budgeting but also empowers you to make informed decisions.

Throughout this article, we’ve shared key insights on calculating monthly payments. Gathering accurate information, converting interest rates, and using the mortgage payment formula effectively are crucial steps. Don’t forget to consider property taxes, homeowner’s insurance, and potential Private Mortgage Insurance (PMI) when estimating your total monthly expenses. Recognizing common challenges, like using incorrect interest rates or omitting essential costs, can enhance the accuracy of your mortgage calculations.

Ultimately, approaching mortgage payment calculations with a comprehensive understanding of its components and potential pitfalls can lead to more successful financial planning. We encourage you to take these insights into account, utilize reliable tools, and seek expert guidance. By doing so, you can navigate your mortgage journey confidently, ensuring that your investment aligns with your financial goals and provides long-term stability.

Frequently Asked Questions

What are the main components of a mortgage payment?

A mortgage payment typically consists of four key components known as PITI: Principal, Interest, Taxes, and Insurance.

What is the principal in a mortgage payment?

The principal is the original amount borrowed from the lender. Each payment reduces the principal balance, gradually increasing your equity in your home.

How does interest affect my mortgage payment?

Interest represents the cost of borrowing the principal, expressed as an annual percentage. It can significantly impact your monthly payment, particularly in the early years of the loan when a larger portion of your payment goes toward interest.

What role do taxes play in mortgage payments?

Property taxes are usually included in your monthly housing costs and can vary based on location and the assessed value of your property. For example, if your yearly property tax is $1,200, you would contribute about $100 each month into an escrow account for tax payments.

Why is homeowner’s insurance important in mortgage payments?

Homeowner’s insurance protects your property against risks like fire or theft, and lenders often require it. If your down payment is less than 20%, you may also need to pay for private mortgage insurance, which adds to your monthly costs until you reach 20% equity in your home.

How can understanding these components help with financial planning?

By understanding the components of your mortgage payment, you can calculate your monthly loan payment more accurately and manage your budget effectively, enabling informed financial decisions.

Why is it important for homebuyers to consider PITI?

The breakdown of PITI greatly influences overall affordability and loan eligibility, making it essential for homebuyers to carefully consider these factors when planning their finances.