Overview

This article highlights the essential steps families should take to effectively calculate their VA mortgage payment. We understand how challenging this can be, and it’s important to grasp the components of VA mortgage payments. By utilizing a VA mortgage calculator accurately, families can gain clarity on their financial commitments. Additionally, we address common calculation issues, equipping families with the tools and knowledge they need to manage their home financing with confidence. Remember, we’re here to support you every step of the way.

Introduction

Understanding the intricacies of VA loans can truly be a game-changer for families seeking homeownership. We know how challenging this can be, especially with unique benefits like no down payment and competitive interest rates. These loans are designed to ease the financial burden for veterans and active-duty personnel. However, calculating the monthly mortgage payment can often seem daunting, raising questions about the true costs involved.

How can families navigate this process effectively? It’s essential to ensure that you are making informed financial decisions. This article delves into the essential steps for calculating VA mortgage payments, providing valuable insights and practical tools. We’re here to support you every step of the way on your journey to owning a home.

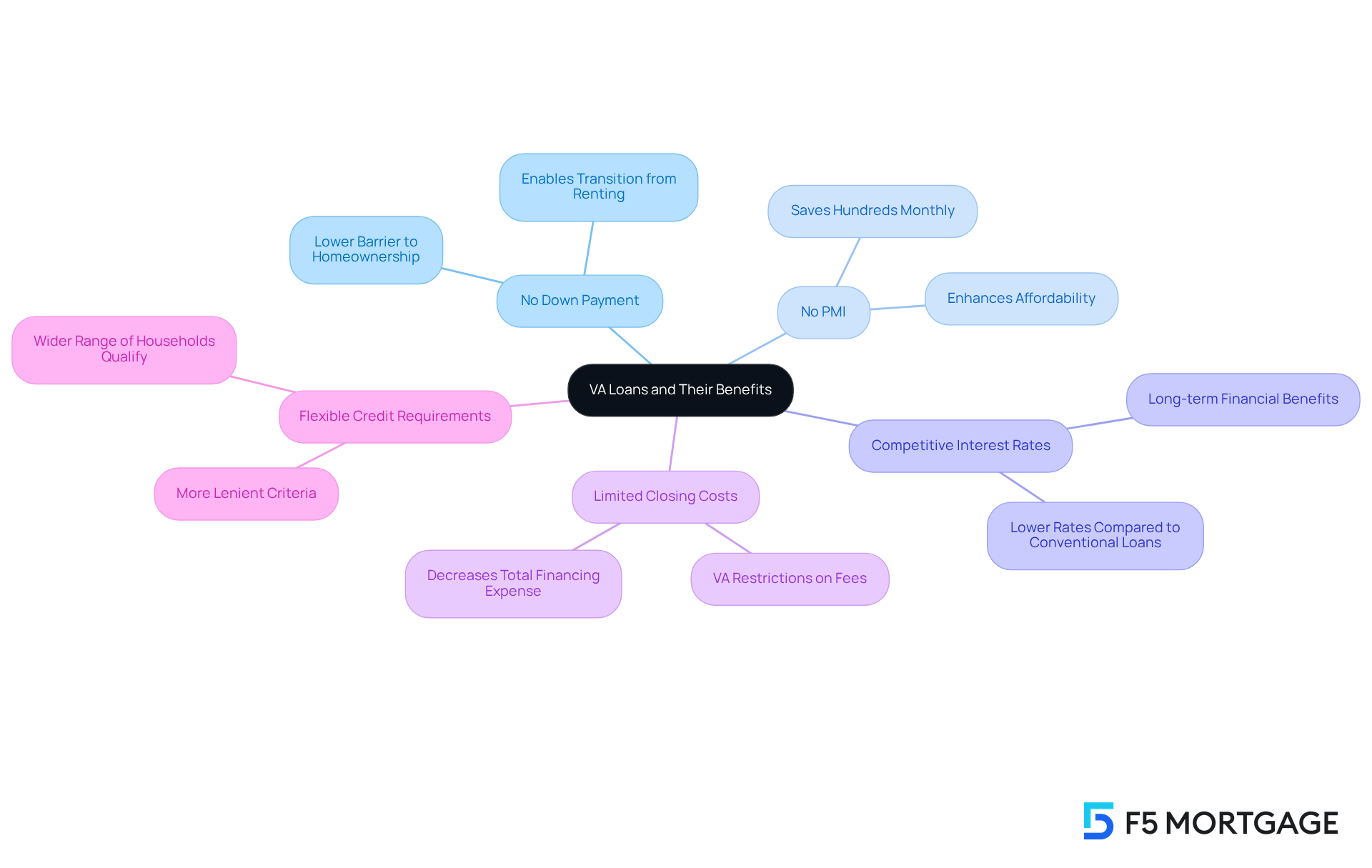

Understand VA Loans and Their Benefits

, supported by the U.S. Department of Veterans Affairs, is designed specifically to assist veterans, active-duty personnel, and certain members of the National Guard and Reserves in achieving their dream of homeownership. We understand how challenging this journey can be, and the advantages of are particularly compelling for families looking to upgrade their homes:

- : A standout feature of VA loans is the ability for eligible borrowers to purchase a home without a down payment, significantly lowering the barrier to homeownership.

- : Unlike traditional financing options, VA mortgages do not require PMI, which can save borrowers hundreds of dollars each month, enhancing affordability.

- : VA mortgages generally provide lower interest rates compared to traditional financing, leading to significant savings throughout the duration of the financing. This is especially beneficial in a rising rate environment, where locking in a lower rate can lead to substantial long-term financial benefits.

- : The VA sets restrictions on the closing costs lenders can impose, further decreasing the total expense of securing financing.

- : With more lenient credit criteria, VA financing enables a wider range of households to qualify, making homeownership more achievable.

In 2025, roughly 20% of veterans are anticipated to make use of VA financing, reflecting its increasing popularity among qualified borrowers. Specialists emphasize that the absence of an initial fee is a transformative factor, enabling households to invest in their future without the burden of upfront expenses. For example, numerous families have effectively transitioned from renting to ownership, utilizing VA financing to obtain their dream homes without the financial pressure of a down payment.

Additionally, it is important to note that that ranges from 0.5% to 3.3%, which helps sustain the program. Moreover, the property acquired with a VA mortgage must be the borrower’s main residence, ensuring that the advantages of the mortgage are utilized for homeownership rather than investment purposes.

Comprehending these advantages is essential for families as they explore their mortgage choices and to estimate potential costs. By considering VA loans, families can make informed decisions that align with their financial goals and homeownership aspirations. We’re here to support you every step of the way.

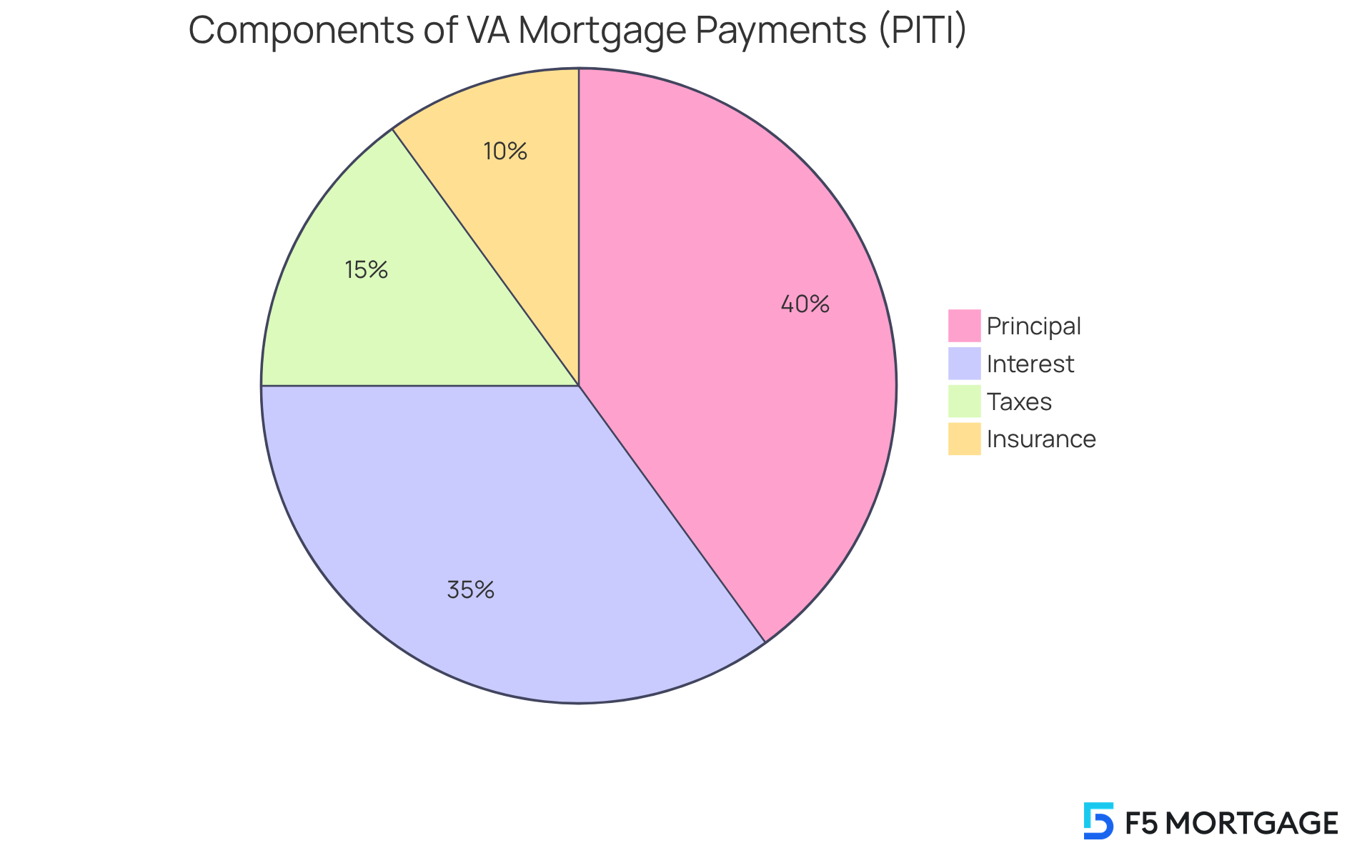

Identify Key Components of VA Mortgage Payments

consist of four essential components, commonly referred to as PITI:

- Principal: This represents the amount borrowed to purchase your home. Each monthly contribution helps to decrease the principal balance over time, which is a step toward .

- Interest: This is the cost associated with borrowing the principal amount, expressed as a percentage. The interest rate plays a crucial role in determining the total sum owed, and it’s important to note that initial contributions typically allocate more toward interest than principal.

- Taxes: , set by local governments, can vary significantly based on your location. For instance, homeowners in more expensive areas might pay $5,000 or more annually in property taxes. These taxes are frequently incorporated into monthly installments and handled through an escrow account, ensuring that you can fulfill your tax responsibilities without financial strain.

- Insurance: safeguards against potential damages to your property and is generally required by lenders. Similar to taxes, insurance premiums are usually incorporated into monthly charges and managed through escrow.

Understanding these elements is essential for families as they determine their overall and budget efficiently. We know how challenging this can be, but families can utilize to accurately, considering these elements to ensure they are financially ready for homeownership. Furthermore, it’s essential to recognize that the initial is due one complete month after the closing date, which should be taken into account when budgeting. We’re here to support you every step of the way.

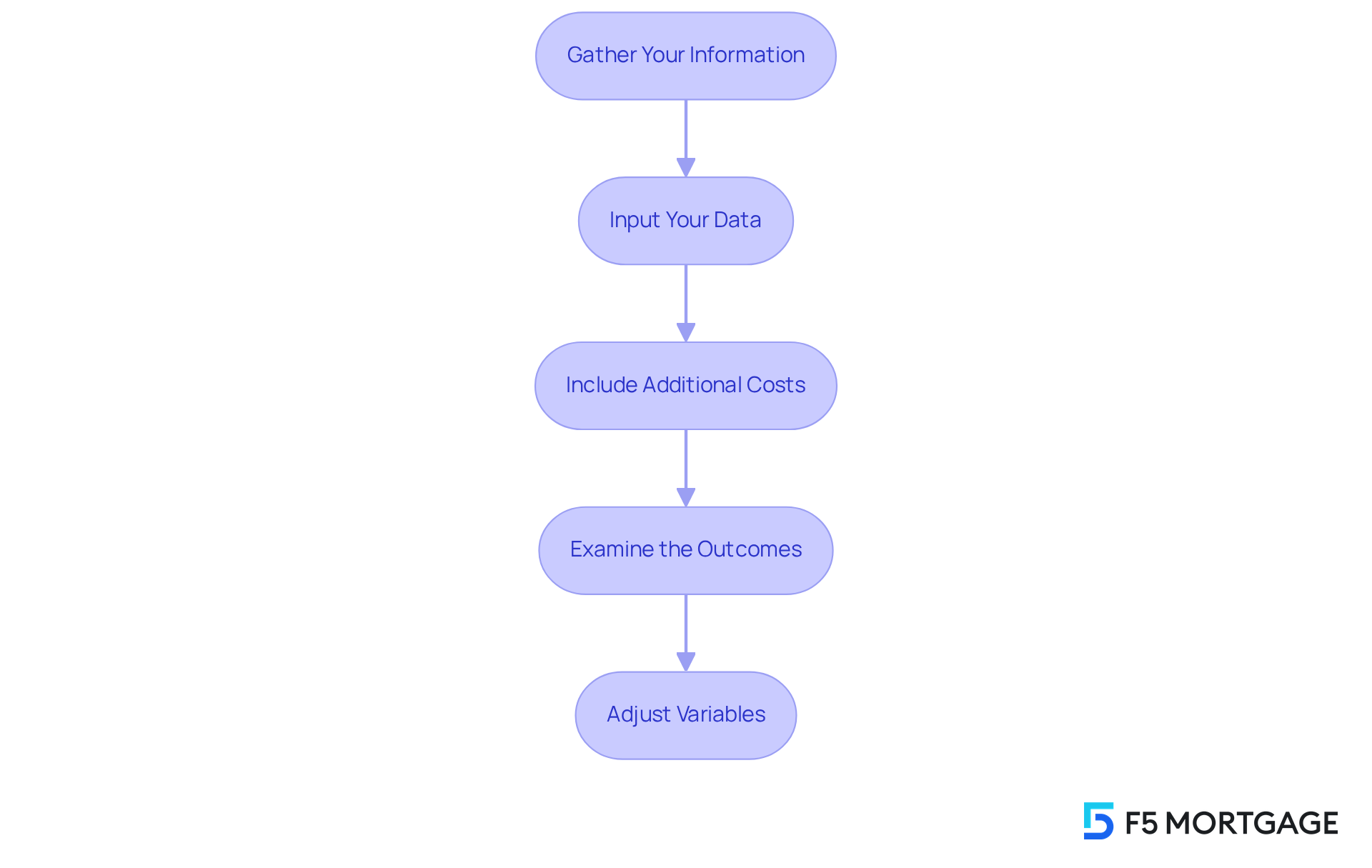

Use a VA Mortgage Calculator Effectively

To effectively use a , follow these steps:

- Gather Your Information: We know how challenging this can be, so start by collecting , down deposit amount (if applicable), rate, and duration (in years).

- Input Your Data: Enter the gathered information into the calculator. Most calculators will include sections for the purchase cost, down deposit, rate, and loan duration.

- Include Additional Costs: If the calculator allows, input estimates for property taxes and homeowners insurance. This will offer a more precise , as these costs can significantly affect your overall budget.

- Examine the Outcomes: After submitting your details, check the , encompassing principal, fees, taxes, and insurance. Some calculators also offer a detailed account of . It’s essential to recognize that standard calculators frequently presume a 20% initial contribution, which is not relevant for VA financing that usually permits no upfront contribution. This can result in a miscalculated monthly charge of approximately $2,510, while the actual cost for VA loan users would be around $3,150.

- Adjust Variables: Experiment with different scenarios by adjusting the purchase price, interest rate, or to see how these changes affect your monthly payment.

Using a can help households calculate , visualize their financial obligations, and make informed choices regarding their . Additionally, understanding that the can add 1.4% to 3.6% to your loan amount is crucial for budgeting accurately. By ensuring you input data accurately and consider all housing costs, we’re here to support you every step of the way, helping you avoid common pitfalls and make sound financial decisions.

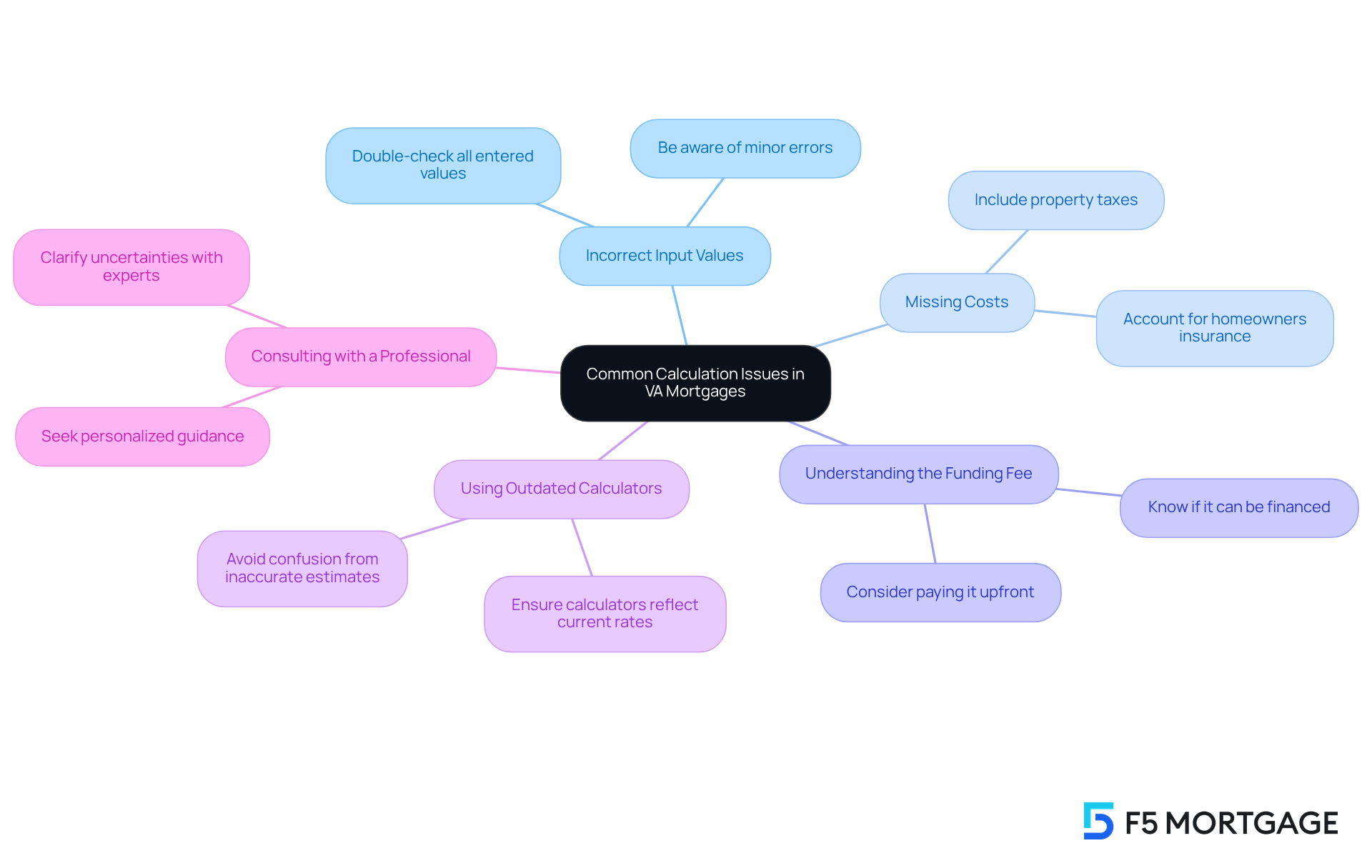

Troubleshoot Common Calculation Issues

For families, navigating how to calculate can be challenging, but you’re not alone. Here are some common issues you might encounter and how to address them:

- Incorrect Input Values: We know how easy it is to make a small mistake. Double-checking all entered values for accuracy is essential, as even a minor error in the purchase cost or interest rate can lead to significant differences in the projected amount.

- Missing Costs: It’s crucial to ensure that all relevant expenses, such as property taxes and homeowners insurance, are included in your calculations. Omitting these can result in an underestimation of your monthly payments, which can be stressful.

- Understanding the Funding Fee: VA mortgages often come with a funding fee. This fee can be financed into the amount borrowed or paid upfront. Remember to include this fee in your calculations to get a complete picture of your financial obligations.

- Using Outdated Calculators: It’s important to use a calculator that reflects current interest rates and VA loan guidelines. Using outdated tools can lead to , which might create confusion.

- Consulting with a Professional: If uncertainties persist, don’t hesitate to reach out to a for assistance. They can provide personalized guidance and help clarify any confusion regarding your calculations.

By addressing these common issues, families can gain clarity on their potential mortgage payments and avoid surprises down the line. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how to calculate a VA mortgage payment is pivotal for families aiming to achieve homeownership. We know how challenging this can be, and the insights provided throughout this guide highlight the unique benefits of VA loans. These include:

- No down payment

- No private mortgage insurance

- Competitive interest rates

- Flexible credit requirements

These advantages not only simplify the home-buying process but also empower families to make informed financial decisions that align with their long-term goals.

Key components of VA mortgage payments—principal, interest, taxes, and insurance—play a critical role in determining overall monthly expenses. By effectively using a VA mortgage calculator and addressing common calculation issues, families can gain clarity on their financial obligations and avoid unexpected surprises. Remember, accuracy in input values and the inclusion of all relevant costs are essential to ensure that families are well-prepared for the journey ahead.

Ultimately, leveraging the benefits of VA loans and understanding the intricacies of mortgage payments can transform the path to homeownership for veterans and their families. We’re here to support you every step of the way, encouraging families to take proactive steps toward realizing their dreams of owning a home. Embracing these insights can lead to a brighter financial future and a place to call home.

Frequently Asked Questions

What is a VA loan?

A VA loan is a mortgage option supported by the U.S. Department of Veterans Affairs, designed to assist veterans, active-duty personnel, and certain members of the National Guard and Reserves in achieving homeownership.

What are the key benefits of VA loans?

The key benefits of VA loans include no down payment requirement, no private mortgage insurance (PMI), competitive interest rates, limited closing costs, and flexible credit requirements.

Do VA loans require a down payment?

No, eligible borrowers can purchase a home without a down payment, significantly lowering the barrier to homeownership.

Is private mortgage insurance (PMI) required for VA loans?

No, VA mortgages do not require PMI, which can save borrowers hundreds of dollars each month.

How do VA loan interest rates compare to traditional financing?

VA mortgages generally offer lower interest rates compared to traditional financing, leading to significant savings over the life of the loan.

Are there limits on closing costs for VA loans?

Yes, the VA sets restrictions on the closing costs that lenders can impose, which helps decrease the total expense of securing financing.

What are the credit requirements for VA loans?

VA financing has more lenient credit criteria, allowing a wider range of households to qualify for a mortgage.

What is the anticipated usage of VA financing among veterans in 2025?

It is anticipated that roughly 20% of veterans will make use of VA financing in 2025.

Is there a funding fee associated with VA loans?

Yes, VA benefits incur a funding fee that ranges from 0.5% to 3.3%, which helps sustain the program.

Can properties purchased with a VA loan be used for investment purposes?

No, the property acquired with a VA mortgage must be the borrower’s main residence, ensuring the mortgage benefits are utilized for homeownership.