Overview

Calculating the mortgage on a $300,000 house can feel overwhelming, but we’re here to support you every step of the way. First, it’s essential to determine the loan amount after your down payment. For a typical 30-year mortgage at a 6% interest rate, this usually leads to a monthly payment of about $1,438.92. Please note, this figure does not include taxes and insurance, which are important factors to consider.

Understanding the mortgage payment formula can help clarify how these numbers come together. Key elements that influence your payment include:

- Down payment

- Interest rate

- Loan term

- Additional costs like property taxes and insurance

We know how challenging this can be, but with the right information, you can navigate this process with confidence.

Introduction

Navigating the intricacies of home financing can often feel like wandering through a labyrinth. As you consider the purchase of a $300,000 house, it’s natural to encounter a myriad of decisions that will shape your financial future. This guide is designed to demystify the mortgage calculation process and empower you with the knowledge needed to make informed decisions about:

- Down payments

- Interest rates

- Loan terms

We understand how overwhelming this can be, and we’re here to support you every step of the way. With so many variables at play, how can you accurately determine the true cost of a mortgage and avoid common pitfalls along the journey?

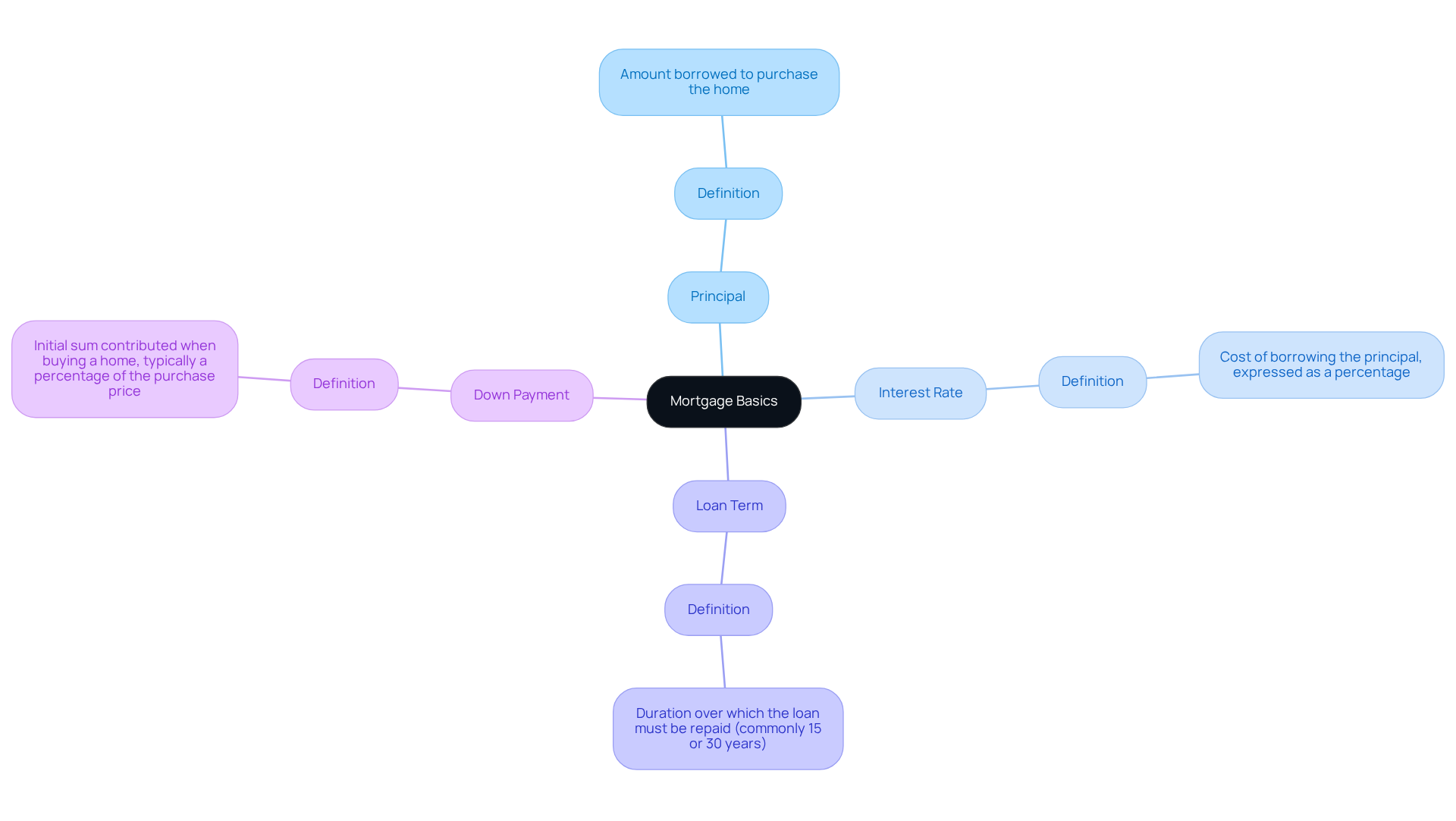

Understand Mortgage Basics

A home loan is a financial advance specifically designed to help you acquire real estate, with the property itself acting as security. We understand how significant this step is in your life, and it’s important to grasp some key terms:

- Principal: This is the amount you borrow to purchase your home.

- Interest Rate: This represents the cost of borrowing the principal, expressed as a percentage.

- Loan Term: This is the duration over which you must repay the loan, commonly 15 or 30 years.

- Down Payment: This is the initial sum you contribute when buying a home, typically expressed as a percentage of the purchase price.

For instance, if you decide to purchase a $300,000 home with a 20% deposit, you would initially pay $60,000, and you might wonder how much is a mortgage on a 300k house for the remaining balance of $240,000 that would be covered through a loan. We know how challenging this can be, but understanding these terms is a vital step towards homeownership, and we’re here to support you every step of the way.

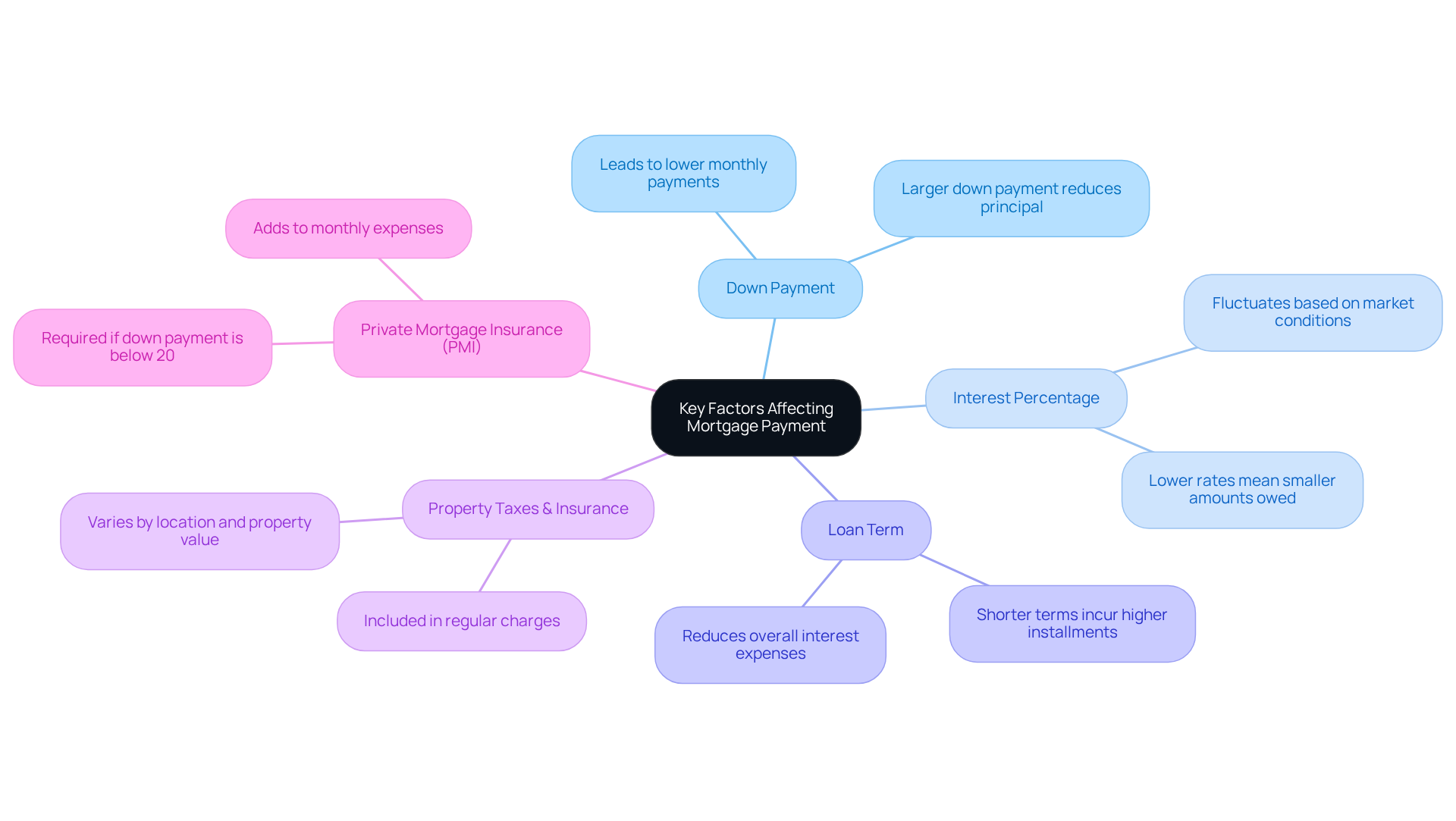

Identify Key Factors Affecting Your Mortgage Payment

Understanding your monthly mortgage payment can feel overwhelming, but we’re here to . Several key factors can significantly impact what you owe each month:

- Down Payment: A larger down payment not only reduces the principal amount borrowed but also leads to lower monthly payments, easing your financial burden.

- Interest Percentage: This percentage can fluctuate based on market conditions and your credit score. Remember, a reduced rate means smaller amounts owed, which can make a big difference.

- Loan Term: While shorter loan durations may incur higher installments, they also reduce overall interest expenses. It’s essential to weigh your options carefully.

- Property Taxes and Insurance: These expenses are often included in your regular charges and can vary significantly depending on your location and property value. Understanding these variables can help you plan better.

- Private Mortgage Insurance (PMI): If your deposit is below 20%, PMI may be necessary, adding to your monthly expenses. Knowing this in advance can help you prepare.

Comprehending these elements will empower you to calculate your loan installment with greater precision, allowing you to make informed decisions that align with your financial goals.

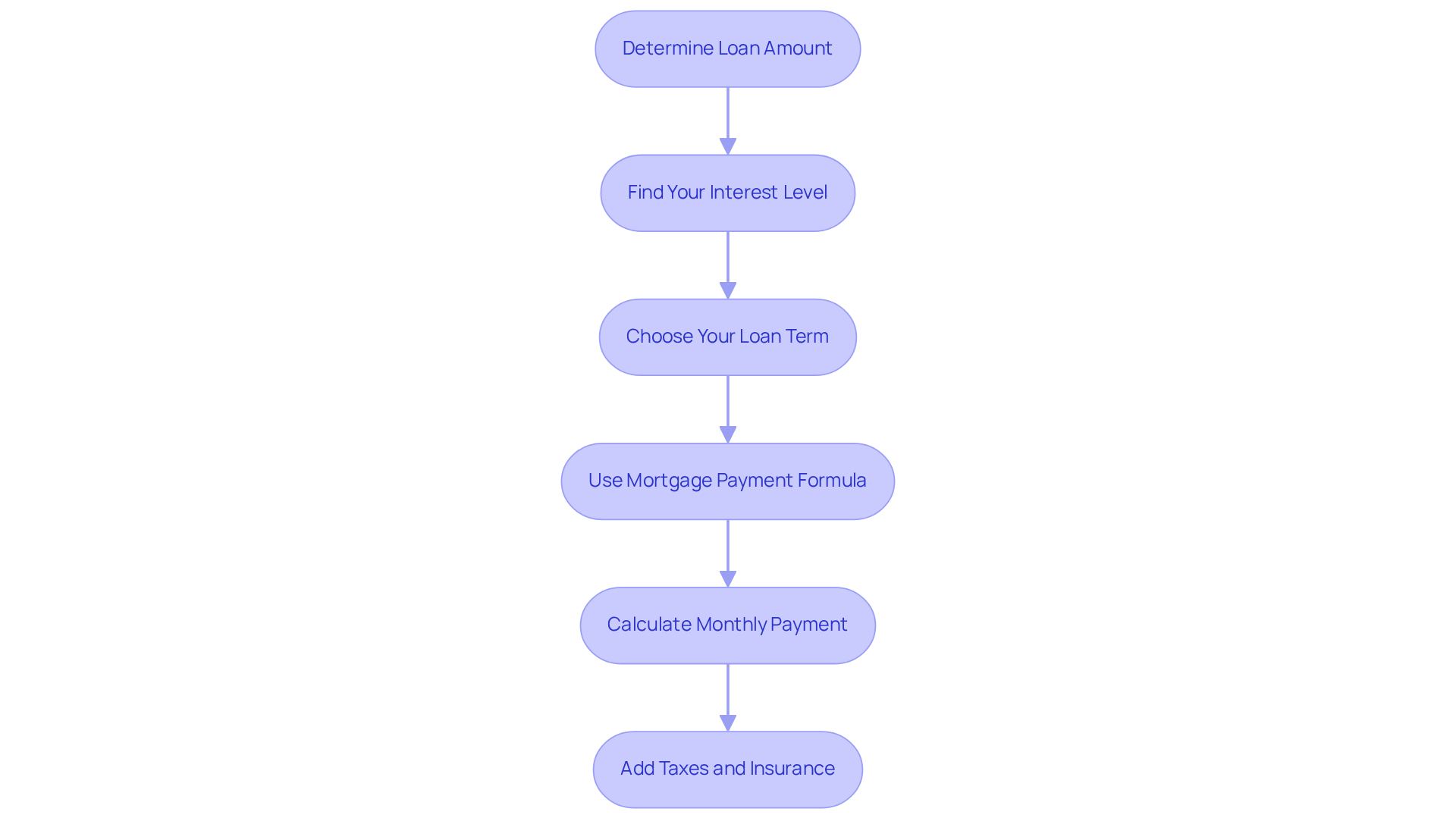

Calculate Your Monthly Mortgage Payment

Calculating your monthly mortgage payment can feel overwhelming, but we’re here to guide you through it step by step. Let’s break it down together.

- Determine the Loan Amount: Start by subtracting your deposit from the purchase price. For example, if you’re trying to figure out how much is a mortgage on a 300k house, making a 20% down payment of $60,000 would result in a loan amount of $240,000. This is the first step toward making your dream home a reality.

- Find Your Interest Level: Next, check the current market figures. If the interest rate is 6%, simply convert it to a decimal by dividing by 100, which gives you 0.06. Understanding this will help you grasp the costs involved.

- Choose Your Loan Term: Think about how long you want to take to pay off your home. A common choice is a 30-year term, which can make your monthly payments more manageable.

- Use the Mortgage Payment Formula: Here’s where the math comes in. The formula to calculate your monthly payment (M) is:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- P = loan amount ($240,000)

- r = monthly interest rate (annual rate / 12 months)

- n = number of payments (loan term in years x 12)

For a 30-year mortgage at 6%, you would calculate:

- Monthly interest rate = 0.06 / 12 = 0.005

- Number of payments = 30 x 12 = 360

Plugging in these numbers:

M = 240,000[0.005(1 + 0.005)^360] / [(1 + 0.005)^360 - 1]

This leads to a monthly payment of approximately $1,438.92. Understanding how much is a mortgage on a 300k house can help you budget effectively.

- Add Taxes and Insurance: Finally, remember to include property taxes and homeowners insurance in your total monthly cost. This ensures you have a complete picture of your financial commitment.

We know how challenging this process can be, but by following these steps, you’ll be well on your way to . Remember, we’re here to support you every step of the way.

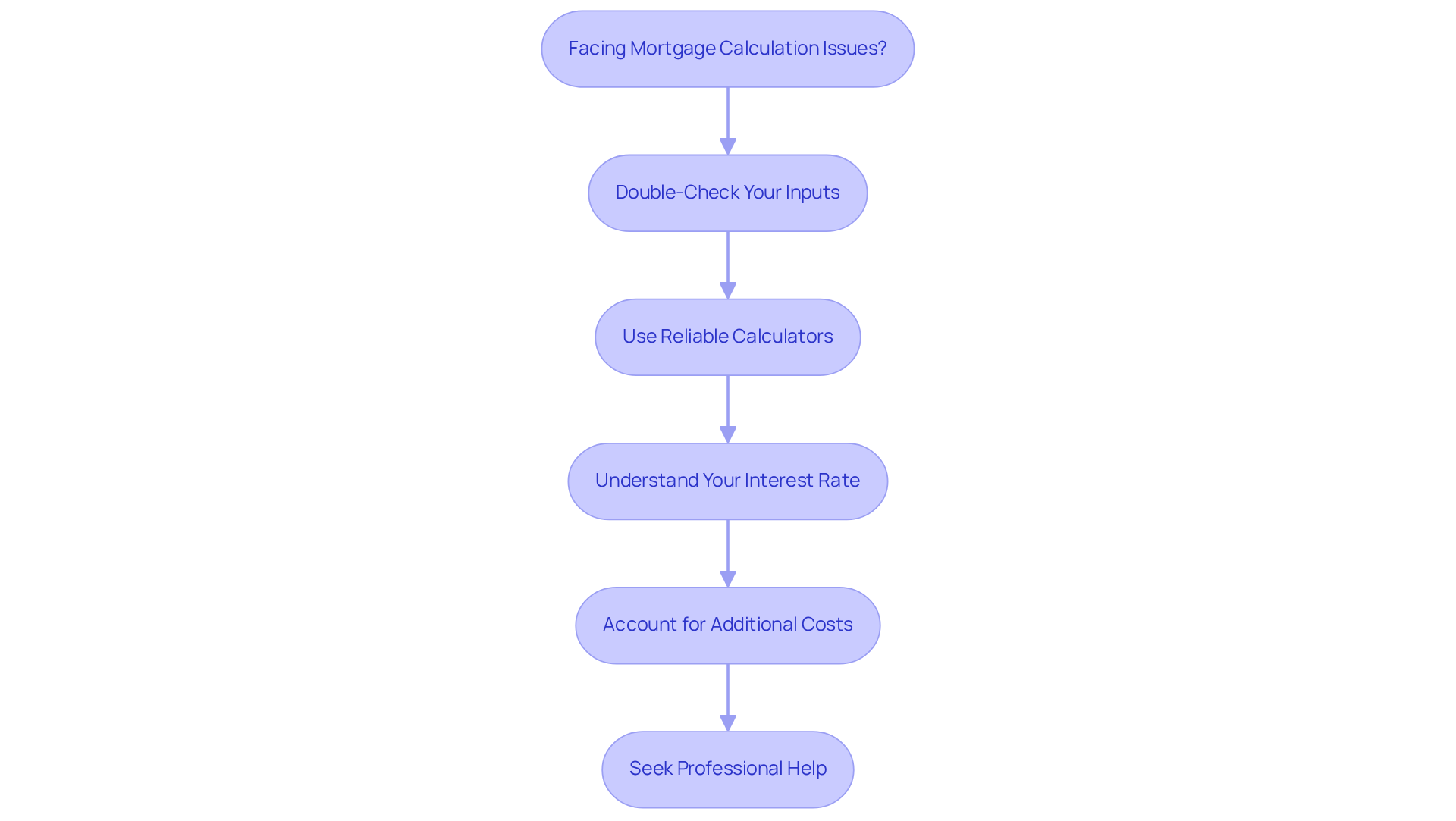

Troubleshoot Common Mortgage Calculation Issues

If you find yourself facing challenges while calculating your mortgage payment, know that you’re not alone. Here are some helpful tips to guide you through the process:

- Double-Check Your Inputs: We understand how easy it is to make minor mistakes. Ensure that you have entered the correct loan amount, interest rate, and loan term, as even small errors can lead to significant differences in your compensation.

- Use Reliable Calculators: Online mortgage calculators can simplify your experience. Be sure to use trustworthy sources like Fannie Mae or Bankrate to ensure accuracy.

- Understand Your Interest Rate: If your interest rate is adjustable, it’s important to be aware of how it may change over time. Understanding these fluctuations can help you anticipate how they might .

- Account for Additional Costs: Remember to include property taxes, insurance, and PMI if applicable. These additional expenses can significantly impact your total monthly payment, and we want you to be prepared.

- Seek Professional Help: If you’re still feeling uncertain, consider reaching out to a mortgage broker or financial advisor. They can provide personalized assistance tailored to your unique situation, ensuring you feel supported every step of the way.

Conclusion

Understanding how to calculate a mortgage on a $300,000 house is essential for prospective homeowners. We know how challenging this can be, but by grasping the fundamental concepts of mortgage basics—including principal, interest rates, loan terms, and down payments—you can navigate the often complex world of home financing with confidence. This knowledge not only demystifies the mortgage process but also empowers you to make informed financial decisions.

Key factors affecting your monthly mortgage payments include:

- The down payment amount

- Interest rates

- Loan duration

- Property taxes

- Insurance costs

Each element plays a critical role in determining the overall financial commitment associated with homeownership. By carefully considering these factors and utilizing the mortgage payment formula, you can accurately estimate your monthly payments and plan your budget accordingly.

Ultimately, being well-informed about mortgage calculations and the various elements at play can significantly ease your journey to homeownership. As you embark on this important financial milestone, taking the time to educate yourself on how mortgages work and seeking professional guidance when needed can lead to more successful outcomes. Embracing this knowledge will not only enhance your financial literacy but also pave the way for a fulfilling homeownership experience.

Frequently Asked Questions

What is a home loan?

A home loan is a financial advance specifically designed to help you acquire real estate, with the property itself acting as security.

What is the principal in a mortgage?

The principal is the amount you borrow to purchase your home.

What does the interest rate represent?

The interest rate represents the cost of borrowing the principal, expressed as a percentage.

What is the loan term?

The loan term is the duration over which you must repay the loan, commonly 15 or 30 years.

What is a down payment?

A down payment is the initial sum you contribute when buying a home, typically expressed as a percentage of the purchase price.

How much would a 20% down payment be on a $300,000 home?

A 20% down payment on a $300,000 home would be $60,000.

How much would be covered through a loan if I make a 20% down payment on a $300,000 home?

If you make a 20% down payment on a $300,000 home, the remaining balance of $240,000 would be covered through a loan.