Overview

Buying your first home can feel overwhelming, but we’re here to support you every step of the way. This article offers a step-by-step guide to help you boost your credit score, which is crucial for securing favorable mortgage terms. We know how challenging this can be, and understanding your credit rating is the first step towards achieving your dream of homeownership.

To enhance your creditworthiness, consider practical strategies that can make a significant difference:

- Start by making timely bill payments, as this habit reflects positively on your credit report.

- Additionally, reducing your credit card balances can improve your score.

- Don’t forget to check your credit reports for errors; correcting these can further enhance your chances of loan approval.

By following these actionable steps, you can empower yourself in the mortgage process. Remember, improving your credit score is not just about numbers; it’s about taking control of your financial future and making your dream home a reality.

Introduction

Understanding credit scores is crucial for first-time homebuyers. These numbers can significantly influence mortgage rates and terms, shaping your financial future. A strong credit score not only opens the door to better opportunities but also empowers you to take control of your homeownership journey.

However, we know how challenging this can be. Many face the daunting task of navigating the complexities of credit management. How can you effectively boost your credit score to secure the best mortgage deals and achieve your dream of homeownership? We’re here to support you every step of the way.

Understand Credit Scores and Their Importance for Homebuyers

Credit ratings are numerical representations of your creditworthiness, typically ranging from 300 to 850. We know how challenging it can be to navigate this aspect of personal finance, but understanding your credit rating is essential. These ratings are determined based on several factors, including payment history, utilization, length of financial history, types of accounts used, and recent inquiries. For first-time home buyers, a higher credit score for first time home buyer can lead to improved mortgage rates and conditions.

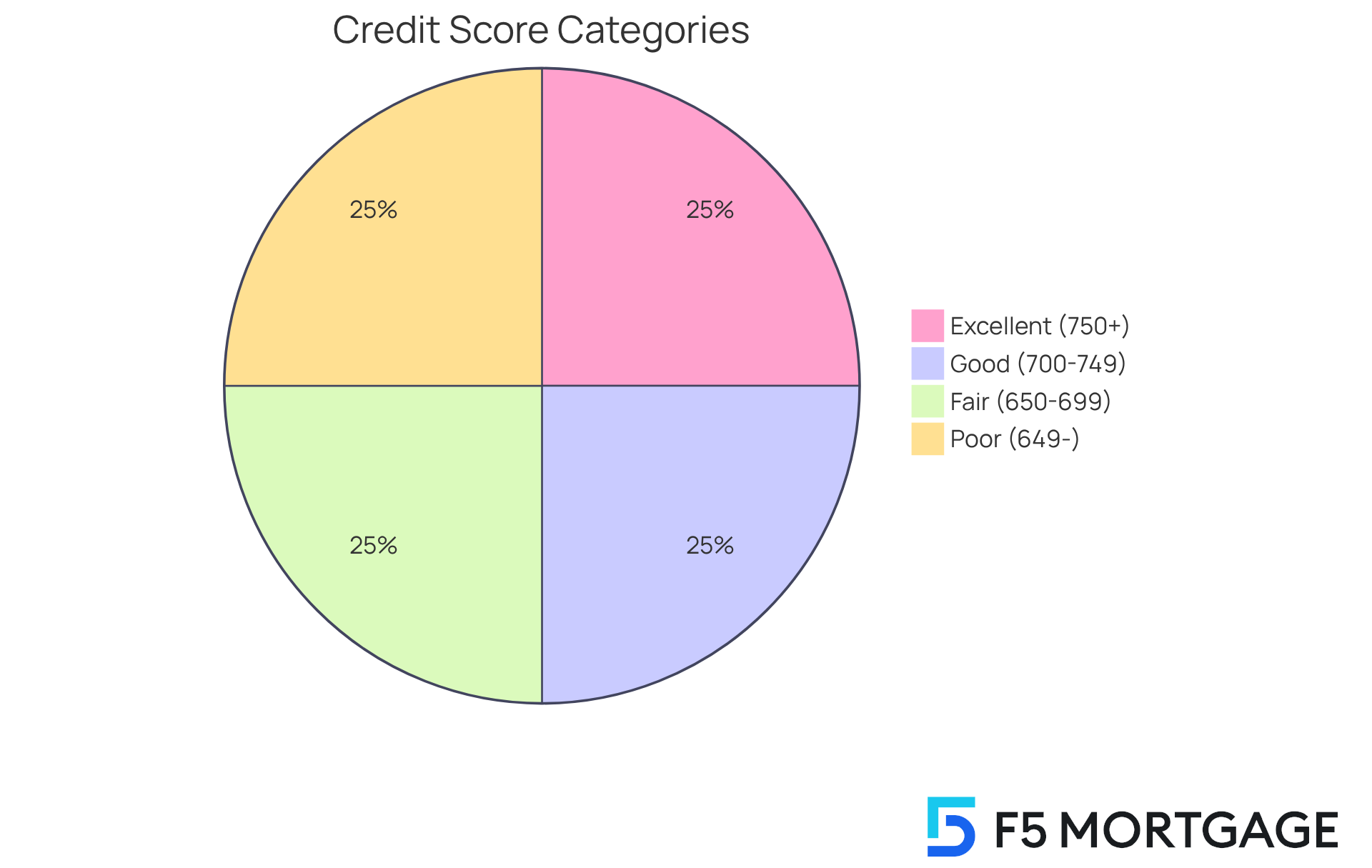

Lenders often categorize scores as follows:

- Excellent (750 and above): Likely to receive the best rates.

- Good (700-749): Generally favorable terms.

- Fair (650-699): May face higher rates and limited options.

- Poor (649 and below): Often leads to higher interest rates or loan denial.

Understanding your credit score for first time home buyers is the first step in preparing for homeownership. It affects not only your loan approval—which indicates that a lender views you as a suitable candidate for a mortgage based on your financial details—but also the total expense of your mortgage. We’re here to support you every step of the way as you navigate this process.

This approval process may also involve terms like ‘preapproval’ or ‘prequalification,’ which can clarify your loan options. An approval usually contains an estimate of your loan sum, interest rate, and possible monthly dues, all greatly influenced by your creditworthiness. Understanding these factors empowers you to take control of your financial future.

Implement Strategies to Enhance Your Credit Score

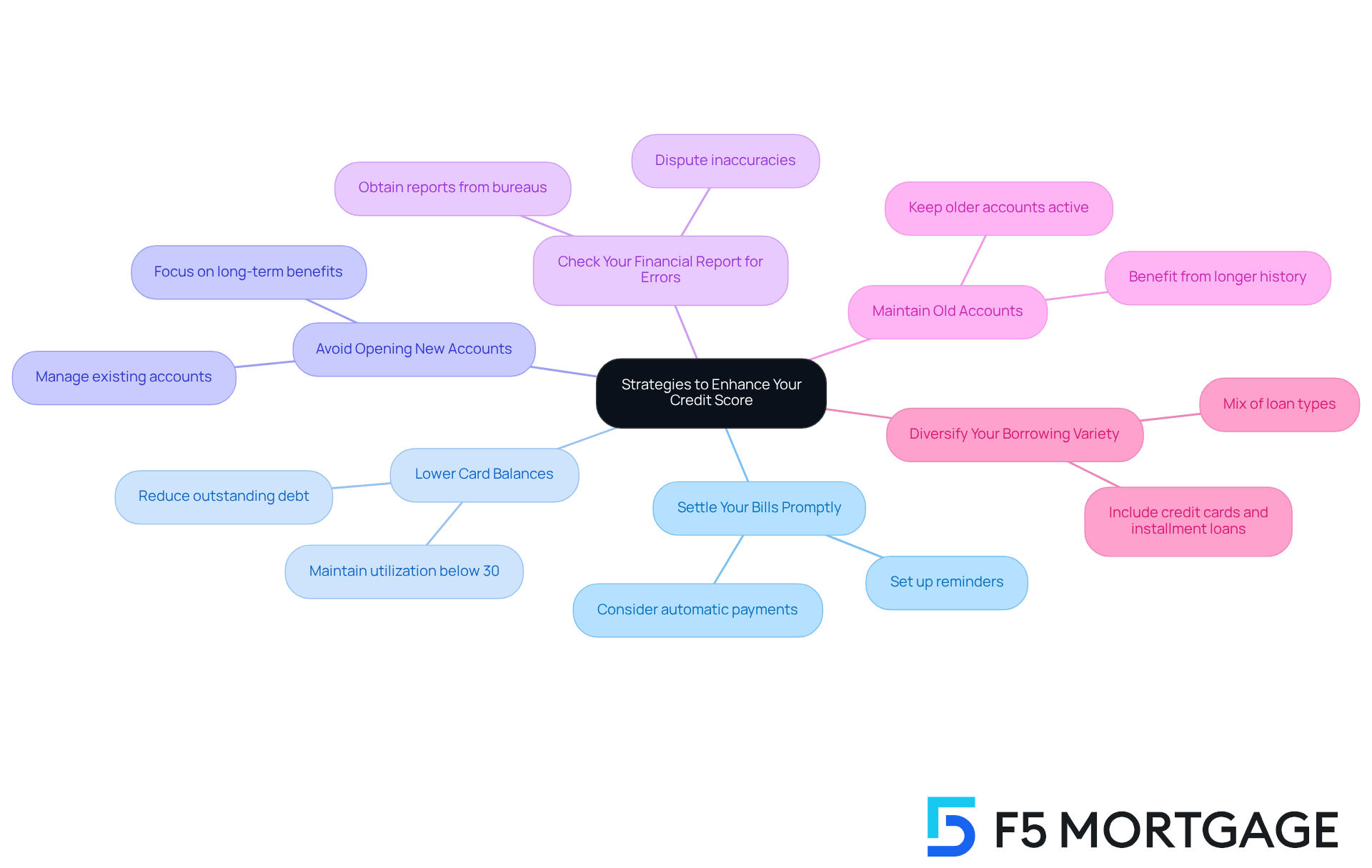

Improving your credit score for first time home buyers requires a proactive strategy, and we understand how challenging this can be. Here are several compassionate strategies to help you improve your score:

- Settle Your Bills Promptly: We know that delayed transactions can greatly affect your score. Consider setting up reminders or automatic payments to ensure timely payments.

- Lower Card Balances: Aim to maintain your utilization below 30%. Reducing outstanding debt can swiftly enhance your rating, making a significant difference.

- Avoid Opening New Accounts: Each new application can lower your score temporarily. Instead, focus on managing your existing accounts, which can be more beneficial in the long run.

- Check Your Financial Report for Errors: Obtain a free financial report from each of the three major bureaus (Equifax, Experian, TransUnion) and dispute any inaccuracies. It’s important to ensure your report reflects your true financial standing.

- Maintain Old Accounts: The duration of your financial history matters. Keeping older accounts active can help you benefit from a longer borrowing history, which is crucial for your score.

- Diversify Your Borrowing Variety: If possible, having a mix of loan types—like credit cards and installment loans—can positively affect your rating.

Applying these strategies may take time, but remember, persistent effort will lead to improvements in your financial standing. Improving your credit score for first time home buyers will make you a more appealing candidate for mortgage lenders, and we’re here to support you every step of the way.

Troubleshoot Common Credit Score Issues for Homebuyers

Even with the best intentions, financial rating problems can arise, and we understand how challenging this can be. Here are some common issues you might face, along with compassionate solutions to help you navigate them:

-

Low Credit Rating: If your rating is lower than you expected, take a moment to examine your credit report for mistakes or high utilization rates. Implement the strategies we’ve discussed earlier to enhance your results.

-

Recent Late Payments: If you’ve experienced late payments, consider reaching out to your creditors to negotiate a goodwill adjustment, especially if your payment history has been good otherwise. We’re here to support you every step of the way.

-

Too Many Hard Inquiries: If you’ve applied for several financial accounts recently, it’s wise to pause further applications until your score stabilizes. Focus on enhancing your current financial standing during this time.

-

Restricted Financial History: If you’re new to borrowing, think about becoming an authorized user on a responsible person’s credit card to help build your history.

-

Debt Collection Accounts: If you have accounts in collections, work on settling these debts. Once settled, kindly request that the lender updates your financial report to reflect the payment.

By proactively addressing these issues, you can enhance your credit profile and positively impact your credit score for first time home buyer, thereby improving your chances of securing a mortgage. Remember, you’re not alone in this journey.

Conclusion

Understanding and improving credit scores is crucial for first-time homebuyers who aspire to secure favorable mortgage rates and terms. We know how challenging this can be, but by grasping the significance of credit ratings, you can take proactive steps to enhance your financial profile, ultimately leading to a more successful home buying experience.

Key strategies for boosting credit scores include:

- Timely bill payments

- Managing credit card balances

- Addressing any inaccuracies in credit reports

- Maintaining older accounts

- Diversifying credit types

Additionally, recognizing and troubleshooting common credit issues, such as late payments and high utilization rates, empowers you to take control of your financial journey.

In conclusion, the journey to homeownership begins with a solid understanding of credit scores and the commitment to improving them. We encourage you to implement the strategies outlined in this guide, as doing so not only enhances your credit profile but also increases your chances of securing the best mortgage options available. Taking these steps today can pave the way for a brighter financial future and the dream of homeownership.

Frequently Asked Questions

What is a credit score and why is it important for homebuyers?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It is important for homebuyers because it affects loan approval and the terms of the mortgage, including interest rates.

What factors determine a credit score?

Credit scores are determined based on several factors, including payment history, credit utilization, length of financial history, types of accounts used, and recent inquiries.

How are credit scores categorized by lenders?

Lenders categorize credit scores as follows: – Excellent (750 and above): Likely to receive the best rates. – Good (700-749): Generally favorable terms. – Fair (650-699): May face higher rates and limited options. – Poor (649 and below): Often leads to higher interest rates or loan denial.

How does a higher credit score benefit first-time homebuyers?

A higher credit score for first-time homebuyers can lead to improved mortgage rates and conditions, making homeownership more affordable.

What is the difference between loan approval, preapproval, and prequalification?

Loan approval indicates that a lender views you as a suitable candidate for a mortgage based on your financial details. Preapproval and prequalification are terms that clarify your loan options, with preapproval usually providing an estimate of your loan sum, interest rate, and possible monthly dues.

How can understanding my credit score empower me in the home-buying process?

Understanding your credit score enables you to take control of your financial future by knowing how it affects your loan approval and the total expense of your mortgage. This knowledge helps you make informed decisions as you navigate the home-buying process.