Overview

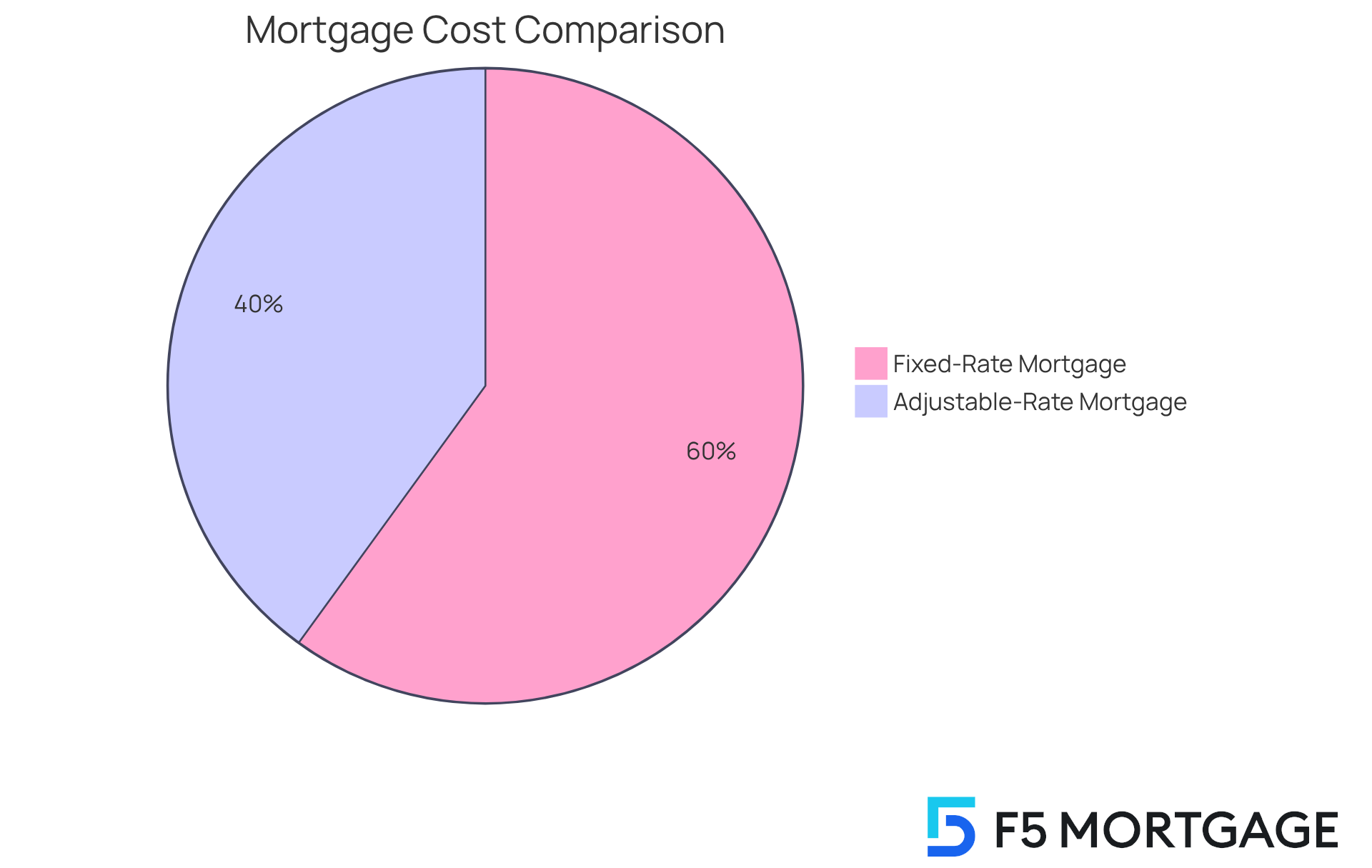

Navigating the world of mortgages can be overwhelming, and we understand how challenging this can be for families. This article explores the two main types of mortgages—fixed-rate and adjustable-rate—helping you determine which option best suits your family’s needs.

Fixed-rate mortgages offer stability and predictability, making them an ideal choice for families planning to settle down long-term. Imagine knowing exactly what your monthly payment will be for years to come; it brings peace of mind, doesn’t it?

On the other hand, adjustable-rate mortgages can provide lower initial payments, which might be suitable if you expect to move or refinance before potential rate increases. This flexibility can be appealing, especially for families who anticipate changes in their living situation.

Ultimately, the right choice depends on your family’s unique circumstances. We’re here to support you every step of the way as you consider your options and make the best decision for your future.

Introduction

Choosing the right mortgage can significantly impact your family’s financial future. We know how challenging this decision can be. Many families find themselves torn between the security of fixed-rate loans and the initial savings offered by adjustable-rate mortgages (ARMs).

Fixed-rate mortgages provide peace of mind with stable payments, making budgeting straightforward over the long term. Imagine knowing exactly what your monthly payment will be, allowing you to plan for your family’s needs without worry. Conversely, ARMs entice homeowners with lower initial rates. However, the potential for future rate increases introduces an element of uncertainty that can be daunting.

As you weigh these options, consider this important question: which mortgage truly aligns with your unique financial circumstances and long-term goals? We’re here to support you every step of the way as you navigate this important decision.

Define Fixed-Rate and Adjustable-Rate Mortgages

When considering an arm vs fixed-interest loan, the fixed-interest option offers you the comfort of a stable interest rate and consistent monthly payments throughout the entire loan duration, which typically spans from 15 to 30 years. This predictability allows homeowners to budget effectively, alleviating worries about fluctuating payments.

On the other hand, when considering arm vs fixed, an adjustable-rate mortgage (ARM) starts with a lower initial interest rate that can change after a set period. While this may lead to lower initial payments, it can also result in increases later on. ARMs usually feature stable periods of 5, 7, or 10 years before adjustments based on market conditions, introducing a level of unpredictability into long-term financial planning.

Starting in 2025, many property owners are drawn to adjustable-rate mortgages due to their appealing lower initial costs. However, it is crucial to consider the risks of potential future increases against the desire for financial stability. While fixed-rate loans provide a sense of security, the discussion of arm vs fixed reveals that ARMs can be advantageous for those planning to relocate or refinance before the adjustment period begins.

When exploring these options, it’s vital to assess prices, expenses, and terms from various lenders. At F5 Mortgage, we understand how overwhelming this process can be. We pride ourselves on offering attractive terms and personalized support, ensuring that families can find the best solution for their financial needs while recognizing the importance of securing favorable loan conditions. Remember, we’re here to support you every step of the way.

Evaluate Pros and Cons of Each Mortgage Type

Fixed-rate loans are often favored for their reliability and consistency, making them particularly suitable for families planning to stay in their homes for a long time. While these loans typically come with higher initial interest rates compared to adjustable-rate options, this can deter some buyers. On the other hand, ARMs usually offer lower initial payments, appealing to families who anticipate moving or refinancing within a few years. For instance, a family purchasing a $550,000 home might find that a 10/1 ARM at 6% results in monthly payments of about $2,640, compared to $2,930 for a 30-year fixed-rate loan at 7%. This initial savings can alleviate financial pressure, especially for first-time buyers or those on tighter budgets. At F5 Mortgage, we understand your unique needs and offer flexible mortgage options, allowing families to get pre-qualified in just 10 minutes with no commitment or hidden costs.

However, it’s important to consider the potential drawbacks of ARMs, particularly the risk of payment increases after the initial fixed period ends. Families should be prepared for the possibility of rising costs, which can strain their budgets if not managed carefully. Financial advisors often recommend that households reflect on their long-term housing plans and financial stability before making a choice. For example, families planning to stay in their homes for an extended period may benefit more from the security of fixed-interest loans, while those looking to sell or refinance before the initial adjustment could find ARMs to be more advantageous. F5 Mortgage is here to provide personalized support, helping families navigate these options and understand the importance of securing their loan rate.

Ultimately, the decision regarding ARM vs fixed-rate mortgages depends on individual circumstances, including financial goals, risk tolerance, and the expected length of homeownership. By understanding these factors, families can make informed decisions that align with their financial futures. With over 1,000 households assisted, F5 Mortgage is dedicated to making homeownership a more attainable goal for you.

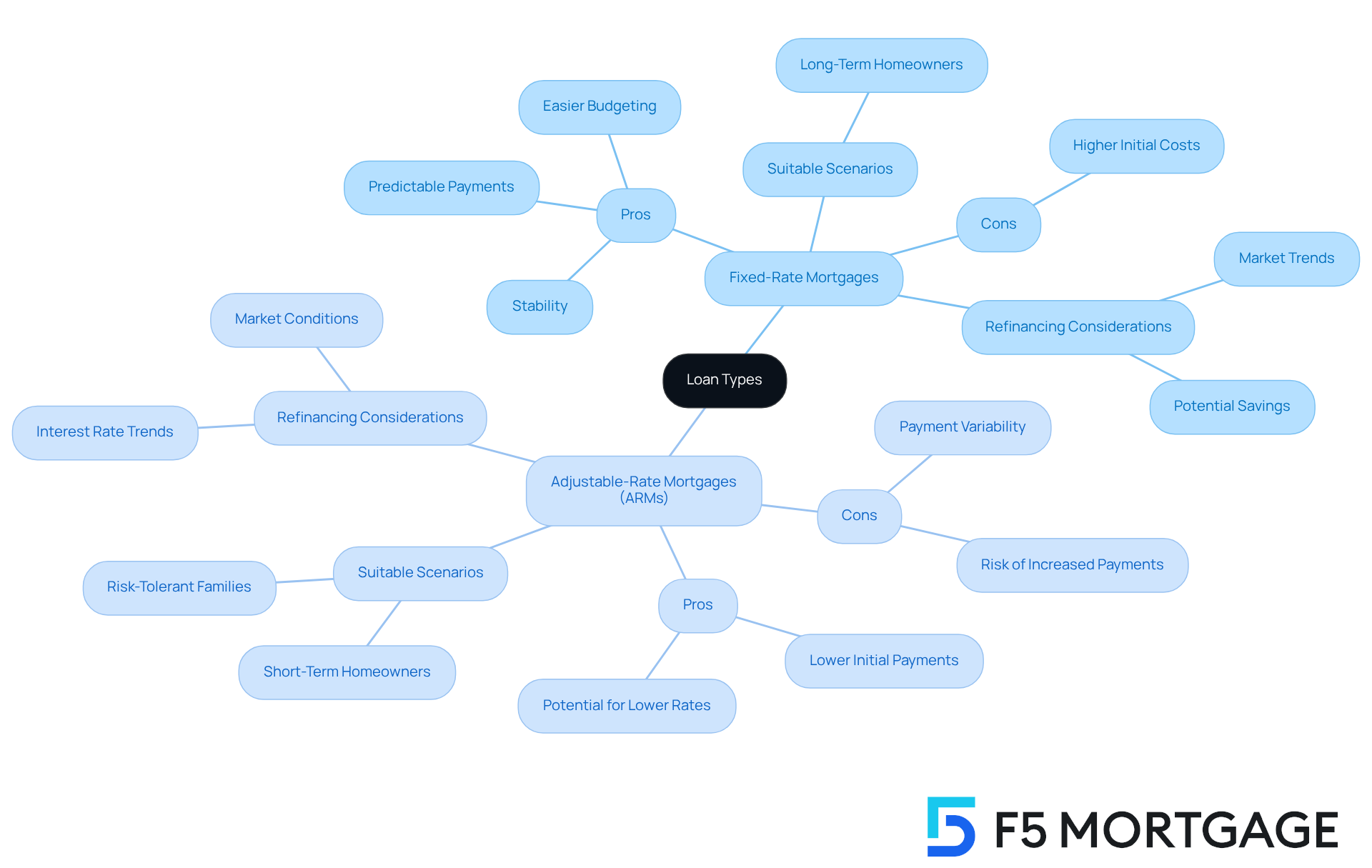

Identify Suitable Scenarios for Fixed vs. Adjustable Rates

Fixed-rate loans offer a sense of stability that can be incredibly reassuring for households planning to stay in their homes for an extended period. This predictability not only helps in budgeting but also allows families to organize their finances without the worry of rising expenses. On the other hand, adjustable-rate home loans might appeal to families who anticipate relocating within a few years or those who are comfortable with some level of risk in exchange for lower initial payments. For instance, in a declining interest rate environment, adjustable-rate mortgages can provide homeowners the opportunity to benefit from reduced rates without the need for refinancing.

Pros and Cons Summary:

- Fixed-Rate Mortgages:

- Pros: Stability, predictable payments, easier budgeting.

- Cons: Potentially higher initial costs compared to adjustable-rate mortgages.

- Adjustable-Rate Mortgages (ARMs):

- Pros: Lower initial payments, possibility for lower rates in a declining market.

- Cons: Payment variability, risk of increased payments in the future.

We understand that many households typically remain in their residences for an average of 8 to 10 years before moving, making ARMs a viable option for those expecting a shorter stay. Additionally, homeowners with loans at 7.5 percent may find it beneficial to refinance into more affordable debt, which is an essential consideration for families evaluating their options. However, it’s important to be aware that some lenders in Colorado require homeowners to maintain their existing loan for a minimum period before refinancing. For example, the FHA’s Streamline Refinance program mandates at least six months of on-time payments. Moreover, the appraisal process significantly impacts refinancing eligibility; if the property does not appraise for the desired loan amount, the application may be declined.

Financial specialists encourage families to thoughtfully evaluate their long-term strategies and risk tolerance when deciding between arm vs fixed options. The right decision can profoundly influence their financial well-being. Presently, lending costs in Colorado have seen a decline, creating an opportune moment for refinancing. As Dr. Anthony O. Kellum, president and CEO of Kellum Mortgage, notes, ‘While volatility is always possible, especially if unexpected economic reports surface, the overall momentum feels tilted toward slightly lower rates in the near term.’ This insight underscores the importance of staying informed about market trends as families navigate their financing choices. We’re here to support you every step of the way.

Compare Financial Implications: Payments and Long-Term Costs

Choosing the right mortgage can feel overwhelming, and we understand how challenging this can be. When considering arm vs fixed options, fixed-rate loans offer the comfort of consistent monthly payments, making budgeting easier for families. However, this stability often comes with a higher overall cost when considering an arm vs fixed comparison, as the initial interest rates are typically greater for fixed-rate mortgages.

On the other hand, when considering arm vs fixed loans, adjustable-rate loans start with lower monthly payments, which can be appealing for families looking to manage their immediate housing expenses. Yet, it’s important to recognize the risk: when comparing arm vs fixed loans, if interest rates rise, these loans can become significantly more expensive over time. Families should carefully evaluate the total cost of each loan type, particularly in terms of arm vs fixed options, throughout its duration, keeping in mind potential interest changes and how long they plan to stay in their home.

For instance, while the average monthly payment for a 30-year fixed-rate loan in 2025 is projected to be around $1,800, adjustable-rate loans might begin at approximately $1,500 but could increase sharply after the initial fixed term. Additionally, when comparing arm vs fixed-rate mortgages, qualifying for an adjustable-rate mortgage can be more challenging than for a fixed-rate loan, and some ARMs include caps on interest to limit how much costs can rise after the initial period.

To navigate these complexities effectively, we encourage families to compare lenders to find the best offers, costs, and terms that meet their needs. Working with F5 Mortgage can provide access to competitive rates and personalized service, ensuring families make informed decisions that align with their financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Choosing between an adjustable-rate mortgage (ARM) and a fixed-rate mortgage is a pivotal decision that can significantly affect your family’s financial future. We understand how challenging this can be, and it’s essential to grasp the unique benefits and potential drawbacks of each mortgage type. This understanding will empower you to make an informed choice that aligns with your individual circumstances and long-term goals.

Fixed-rate mortgages provide stability and predictable payments, making them ideal for families planning to stay in their homes for an extended period. In contrast, adjustable-rate mortgages offer lower initial payments, which can be appealing if you anticipate relocating or refinancing before the adjustment period. It’s crucial to weigh these factors against your personal financial situation, risk tolerance, and housing plans, as the implications of each mortgage type can vary widely.

Ultimately, this decision is not just about immediate costs but also about your long-term financial health. We encourage you to assess your unique situation, stay informed about market trends, and seek personalized support from mortgage professionals. By doing so, you can navigate the complexities of mortgage options and secure a loan that best fits your needs. Together, we can ensure a more stable and prosperous financial future for your family.

Frequently Asked Questions

What is a fixed-rate mortgage?

A fixed-rate mortgage offers a stable interest rate and consistent monthly payments throughout the entire loan duration, which typically spans from 15 to 30 years. This predictability allows homeowners to budget effectively without worrying about fluctuating payments.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage (ARM) starts with a lower initial interest rate that can change after a set period. While it may lead to lower initial payments, it introduces the possibility of increased payments later on, as ARMs adjust based on market conditions.

How long do ARMs typically have stable interest rates before adjustments?

ARMs usually feature stable periods of 5, 7, or 10 years before the interest rate adjusts based on market conditions.

Why might homeowners choose an ARM over a fixed-rate mortgage?

Homeowners might choose an ARM due to its appealing lower initial costs. It can be advantageous for those planning to relocate or refinance before the adjustment period begins.

What should homeowners consider when choosing between a fixed-rate mortgage and an ARM?

Homeowners should assess the risks of potential future increases in payments with ARMs against the desire for financial stability provided by fixed-rate loans. It’s also important to evaluate prices, expenses, and terms from various lenders.

How can F5 Mortgage assist homeowners in choosing a mortgage?

F5 Mortgage offers attractive terms and personalized support, helping families find the best solution for their financial needs while ensuring they secure favorable loan conditions.