Overview

Navigating the mortgage process can feel overwhelming, and we understand how challenging this can be. One of the best ways to ease this journey is by effectively working with mortgage loan brokers. These professionals serve as intermediaries, connecting you with a variety of lenders who can meet your needs.

It’s essential to leverage their access to diverse lending options. By maintaining clear communication about your expectations and any associated fees, you can foster a productive relationship. Choosing the right broker is also crucial; look for someone with a solid reputation and a range of services tailored to your situation.

These practices not only simplify the home financing process but also significantly enhance your chances of securing favorable loan terms. Many families have found success and satisfaction through this approach, as highlighted by positive client testimonials and successful case studies. Remember, we’re here to support you every step of the way as you embark on this important journey.

Introduction

Navigating the world of home financing can often feel like traversing a complex maze, especially for first-time buyers. We know how challenging this can be. Mortgage loan brokers serve as invaluable guides in this journey, bridging the gap between borrowers and lenders while simplifying the loan process. This article delves into four key practices that can enhance collaboration with these professionals. By doing so, homebuyers can access a wider array of financing options and secure the most favorable terms available.

However, with the increasing reliance on brokers, how can prospective homeowners ensure they choose the right partner? In a landscape filled with choices and potential pitfalls, it’s essential to approach this decision with care and consideration. We’re here to support you every step of the way.

Understand the Role of Mortgage Brokers in Home Financing

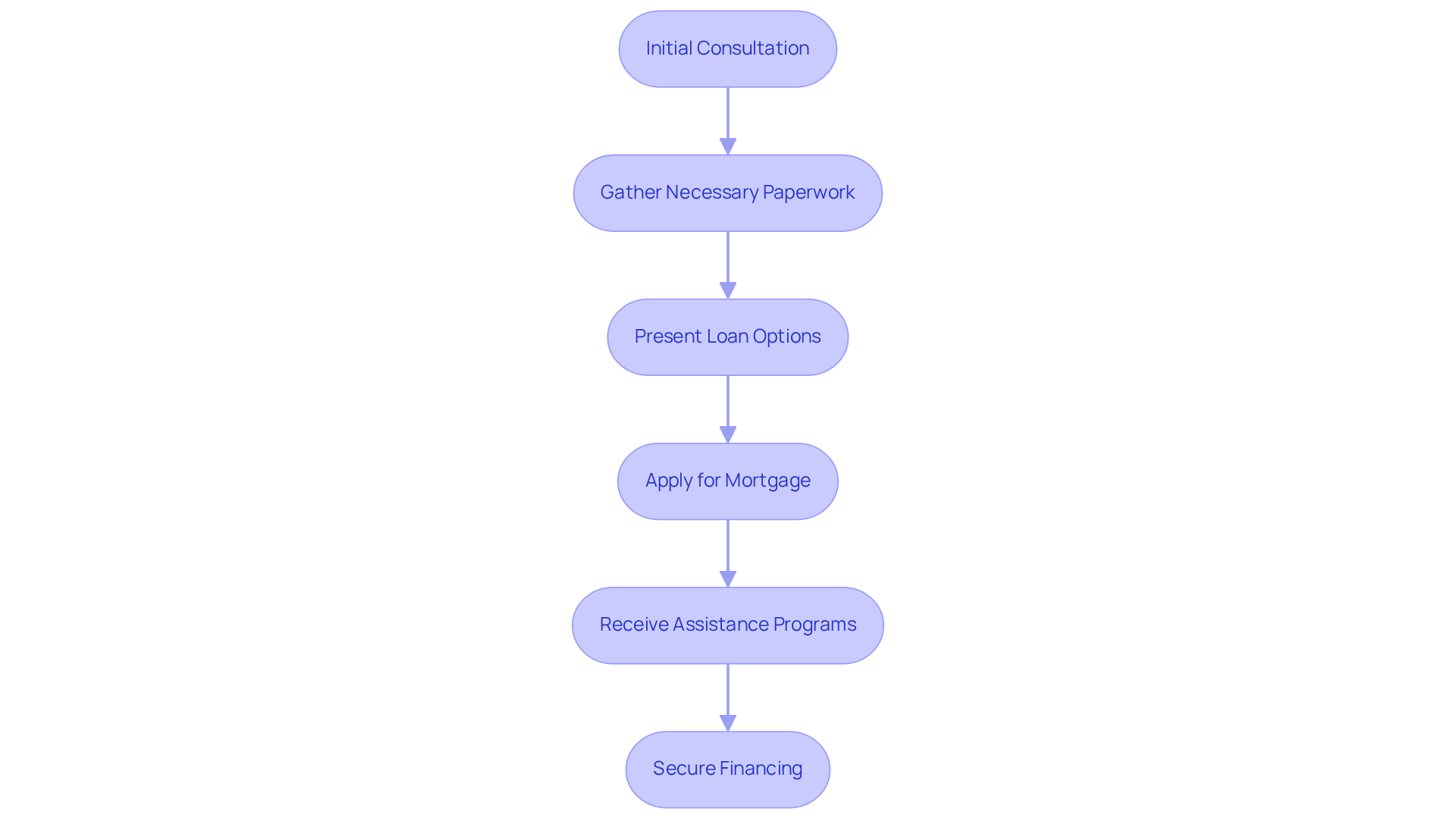

Mortgage loan brokers play an essential role as intermediaries between borrowers and lenders, simplifying the loan process by connecting individuals with suitable financing options. We understand how overwhelming this journey can be, so we assess your financial circumstances, gather the necessary paperwork, and present a variety of loan options from different providers. This crucial intermediary role allows you to access a broader range of options than you might find on your own, often leading to more favorable rates and conditions. In 2025, many homebuyers are expected to utilize mortgage loan brokers, reflecting a growing recognition of their value in navigating the complexities of home financing.

Brokers provide vital support during the application process, helping you grasp the intricacies of home financing, which can be particularly daunting for first-time buyers. We’re here to inform you about various mortgage options, including those that don’t require a 20% down payment, dispelling common myths along the way. This educational approach empowers you to make informed decisions about your financing options, ensuring you understand your overall housing payment capabilities and avoid becoming ‘house poor.’

At F5 Lending, we offer a range of down payment assistance programs tailored to meet the needs of homebuyers in California, Texas, and Florida. For example:

- The MyHome Assistance Program in California provides up to 3% of the home’s purchase price.

- Texas offers the My Choice Texas Home program, which includes up to 5% for down payment and closing assistance.

- In Florida, programs like the Florida Assist Second Mortgage Program can provide up to $10,000 to help with upfront costs.

These options significantly enhance home buying opportunities for families looking to upgrade their homes, reducing the initial financial burden and making homeownership more attainable.

Strong partnerships between clients and mortgage loan brokers often stem from a focus on long-term goals and personalized support. Case studies illustrate how agents assist first-time homebuyers in overcoming challenges posed by rising home prices and complex paperwork, ultimately leading to successful homeownership experiences. Testimonials from satisfied clients highlight the exceptional support provided by F5 Mortgage, showcasing our commitment to customer satisfaction and our ability to connect you with top realtors and secure the best financing deals. Moreover, we can link you with trusted realtors in your area to further streamline your home buying journey. Financial experts emphasize the importance of mortgage loan brokers as reliable consultants, advocating for their role in delivering customized solutions that align with each client’s unique financial situation. By leveraging their expertise and access to a diverse array of lenders, agents enhance the overall financing experience, making them indispensable partners on the path to homeownership.

Leverage the Benefits of Using a Mortgage Broker

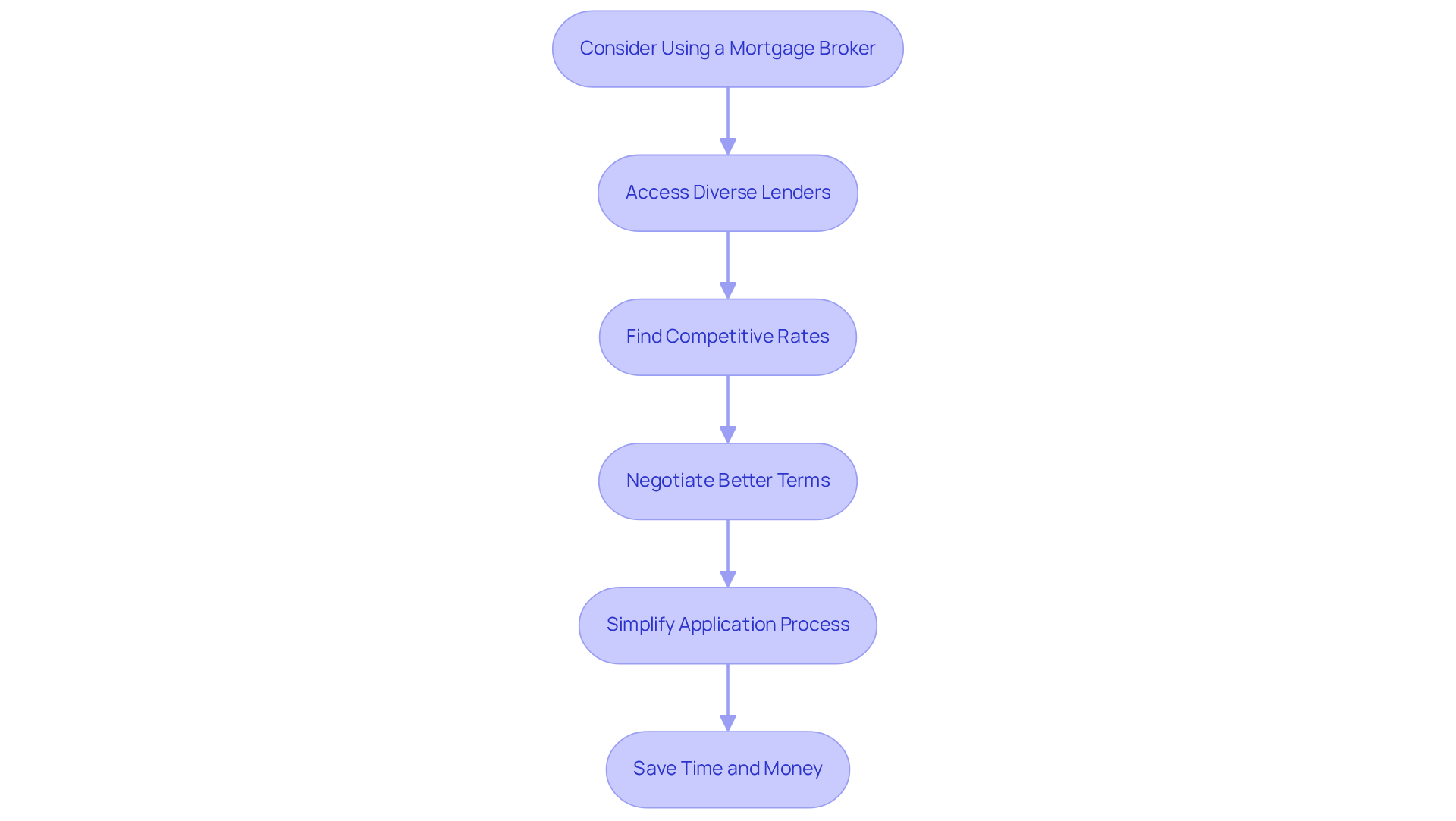

If you’re feeling overwhelmed by the complexities of refinancing in Colorado, know that you’re not alone. Employing mortgage loan brokers like F5 Financing can make this process much easier and more beneficial for you. Mortgage loan brokers provide access to a diverse range of lenders and loan products, often leading to more competitive rates. Typically, the expense to refinance in Colorado falls between 2% and 5% of the overall loan sum. However, with F5’s expertise and connections, you may discover more economical options, including down payment assistance programs that can significantly lower your initial costs.

We understand how important it is to secure favorable terms. Mortgage loan brokers use their established relationships with lenders to negotiate better terms on your behalf. Plus, F5 Home Loans saves you valuable time by simplifying the application process and managing the paperwork, allowing you to focus on other important aspects of purchasing your home.

Consider the experience of a recent F5 customer who secured a lower interest rate than expected, thanks to the negotiator’s skills and lender connections. This real-life example illustrates the tangible benefits of collaborating with mortgage loan brokers. If you’re considering refinancing, we’re here to support you every step of the way. Contact F5 Mortgage today to explore your options and find the best deal tailored to your needs.

Navigate Challenges and Considerations in Broker Relationships

Collaborating with mortgage loan brokers can provide considerable benefits, but we understand that managing possible difficulties is important. Effective communication is essential; we encourage you to express your needs and expectations freely. Comprehending the fee structure is equally vital, as intermediaries may charge upfront fees or obtain commissions from lenders. For instance, a survey showed that 94% of customers who clearly expressed their financial requirements reported greater satisfaction with their representative’s services. Conversely, a lack of clarity can lead to unforeseen costs. One customer, unaware of a financial intermediary’s fee arrangement, faced unexpected expenses during the closing process. This underscores the importance of transparency and proactive discussions about fees and services in relationships with mortgage loan brokers. Furthermore, with F5, you won’t make payments directly to the broker, as F5 operates solely as an intermediary. Payments will be directed to the lender with whom the loan closes. Remember, you can always reach out to F5 Mortgage for assistance after closing if you have questions or need guidance on payment processes.

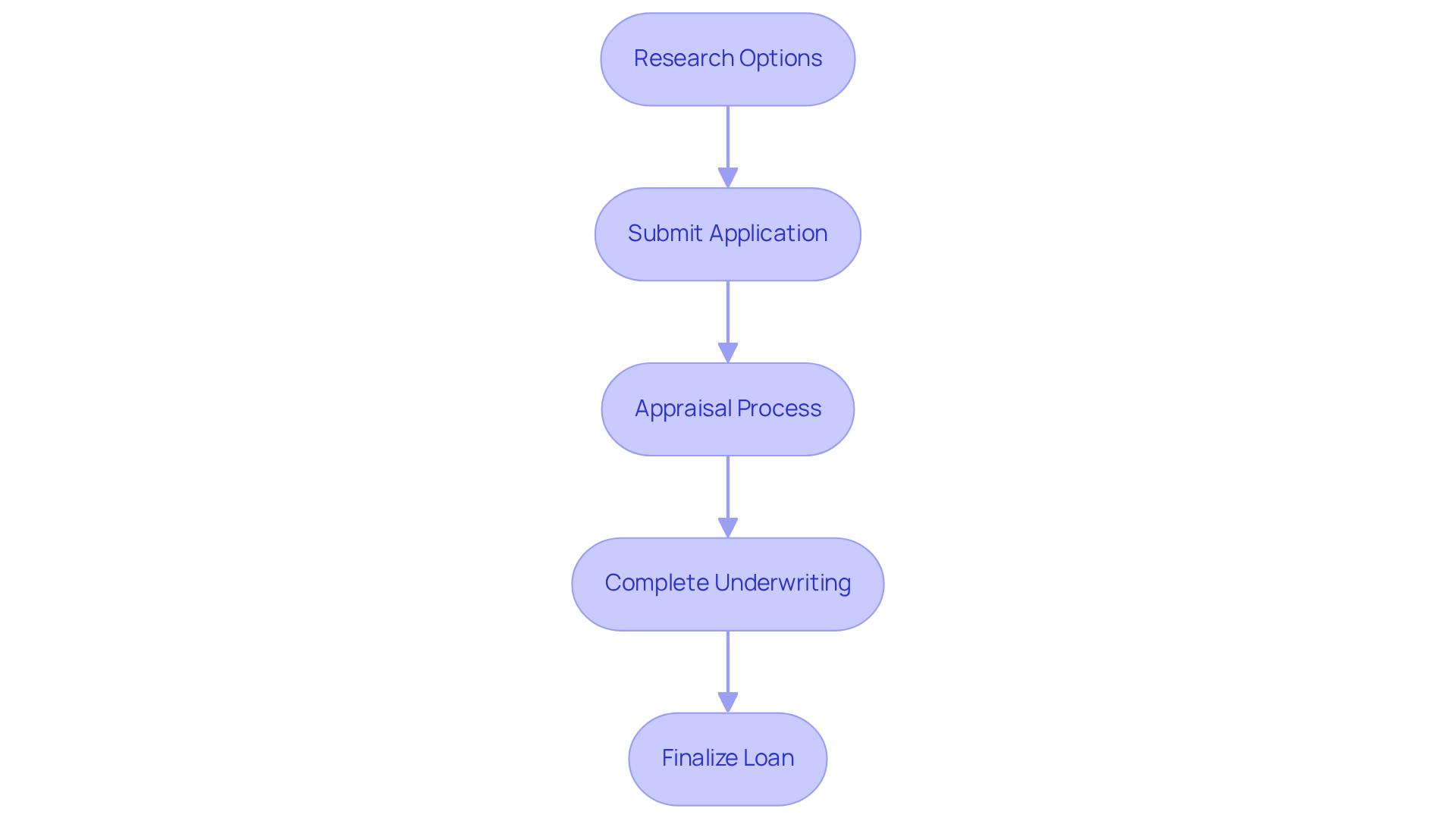

To ensure a smooth refinancing experience, we recommend following these steps:

- Research your options by comparing multiple lenders.

- Submit a refinancing application with necessary financial documents.

- Undergo the appraisal process for property valuation.

- Complete underwriting, where the lender reviews your application.

- Finalize your new loan by signing documents and covering closing expenses.

Moreover, as the reliance on loan advisors continues to grow, we must emphasize transparent communication to ensure you are fully aware of your financial obligations.

Choose the Right Mortgage Broker for Your Needs

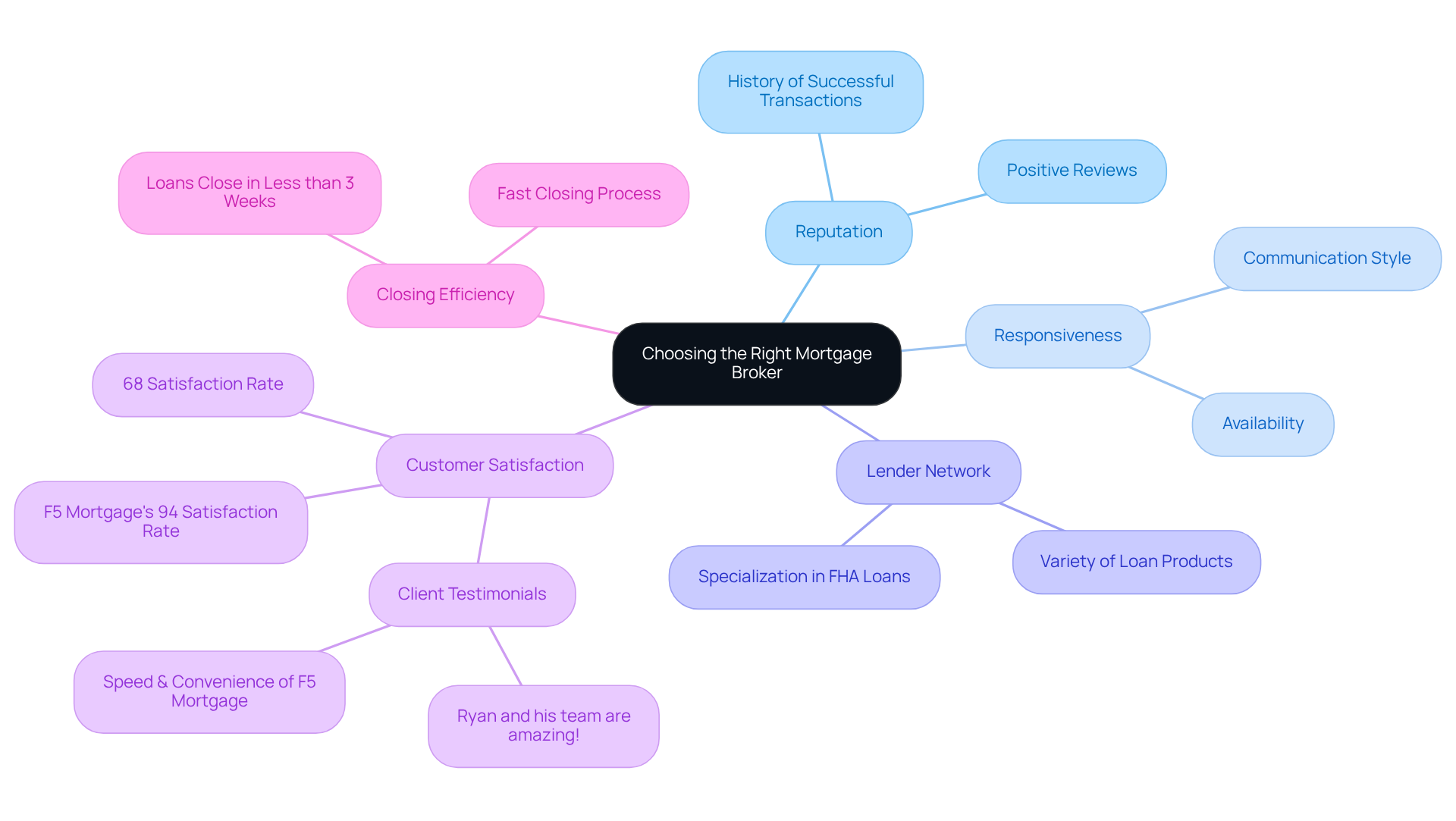

Choosing the right mortgage loan brokers is essential for a successful home financing experience. We know how challenging this can be, so it’s important to prioritize agents with a solid reputation, evidenced by positive reviews and a history of successful transactions. A responsive agent can significantly ease the process, so evaluating their communication style and availability is crucial.

Moreover, understanding the agent’s network of lenders and the variety of loan products they provide is vital. For instance, a client focused on FHA loans discovered an agent who specialized in this area, allowing them to obtain favorable terms tailored to their financial needs. Statistics show that 68% of homebuyers who worked with mortgage loan brokers reported satisfaction with their experiences, highlighting the importance of expert assistance in navigating mortgage options.

Additionally, F5 Lending has assisted more than 1,000 families and boasts a customer satisfaction rate of 94%, reinforcing its reliability as one of the leading mortgage loan brokers. Clients have praised F5 for its exceptional service, with testimonials emphasizing the team’s responsiveness and expertise. One customer remarked, “Ryan and his team are amazing! I was pretty confused at the start of all this, but they helped me so much along the way.” Another highlighted the speed and convenience of collaborating with F5, stating, “If you’re looking for speed & convenience, F5 Mortgage is for you.”

Clients can also expect a fast closing process when working with mortgage loan brokers, as most loans close in less than three weeks, showcasing the efficiency of a reputable broker. By considering these factors, you can make informed decisions that align with your homeownership goals. We’re here to support you every step of the way.

Conclusion

Navigating the complexities of home financing can feel overwhelming, but partnering with a mortgage loan broker can truly lighten the load. These professionals act as essential guides, connecting you with a variety of lenders and loan options, which can lead to better rates and terms. By understanding their role and tapping into their expertise, you can make informed decisions that align with your financial aspirations.

In this article, we’ve highlighted key practices for working effectively with mortgage brokers. From grasping their responsibilities and the benefits they provide to recognizing potential challenges and selecting the right broker, these insights empower you to enhance your financing journey. Clear communication, understanding fee structures, and choosing a reputable broker are vital elements for a successful partnership, and we cannot emphasize this enough.

As the world of home financing evolves, the role of mortgage loan brokers remains crucial. Embracing their support not only simplifies the loan process but also increases your chances of achieving favorable financing outcomes. If you’re considering a home purchase or refinance, taking the time to research and engage with a knowledgeable mortgage broker can unlock financial opportunities and help you secure the home of your dreams. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of mortgage brokers in home financing?

Mortgage brokers act as intermediaries between borrowers and lenders, simplifying the loan process by connecting individuals with suitable financing options and presenting a variety of loan choices from different providers.

How do mortgage brokers benefit homebuyers?

Brokers provide access to a broader range of financing options, often resulting in more favorable rates and conditions. They also support homebuyers throughout the application process, helping them understand the complexities of home financing.

What assistance do mortgage brokers offer to first-time buyers?

Mortgage brokers help first-time buyers grasp the intricacies of home financing, educate them about various mortgage options, and dispel common myths, ensuring they make informed decisions and avoid becoming ‘house poor.’

What down payment assistance programs are available through F5 Lending?

F5 Lending offers several down payment assistance programs, including: – The MyHome Assistance Program in California, providing up to 3% of the home’s purchase price. – The My Choice Texas Home program, offering up to 5% for down payment and closing assistance in Texas. – The Florida Assist Second Mortgage Program, which can provide up to $10,000 to help with upfront costs in Florida.

How do mortgage brokers help clients overcome challenges in the home buying process?

Mortgage brokers focus on long-term goals and personalized support, helping clients navigate rising home prices and complex paperwork, ultimately leading to successful homeownership experiences.

What testimonials exist regarding F5 Mortgage’s services?

Satisfied clients have highlighted the exceptional support provided by F5 Mortgage, emphasizing their commitment to customer satisfaction and their ability to connect clients with top realtors and secure the best financing deals.

Why are mortgage brokers considered reliable consultants?

Mortgage brokers are seen as reliable consultants because they deliver customized solutions that align with each client’s unique financial situation and leverage their expertise and access to a diverse array of lenders to enhance the financing experience.