Overview

Navigating the world of home financing can be overwhelming, but mortgage finance brokers are here to help you every step of the way. They offer personalized service that truly understands your unique needs, providing access to multiple lenders and potential cost savings.

Brokers like F5 Mortgage are dedicated to offering tailored solutions that fit your situation. With expert guidance and long-term support, they enhance your homebuying experience, ensuring you feel confident and informed throughout the process.

We know how challenging this can be, but with the right support, you can achieve better financial outcomes. By choosing to work with a broker, you’re not just getting a service; you’re gaining a partner who is committed to your success. Let’s take this journey together, ensuring that your home financing needs are met with care and expertise.

Introduction

Navigating the labyrinth of home financing can feel overwhelming and uncertain for many prospective homeowners. We understand how challenging this journey can be, and that’s where mortgage finance brokers come in. These professionals offer tailored solutions that not only simplify the process but also enhance your overall experience.

By exploring the top ten reasons to choose mortgage finance brokers, you will discover how they can transform your home-buying journey into a more manageable and rewarding experience. What challenges might arise if you attempt to navigate this complex landscape alone? We’re here to support you every step of the way, providing the necessary guidance to overcome these hurdles.

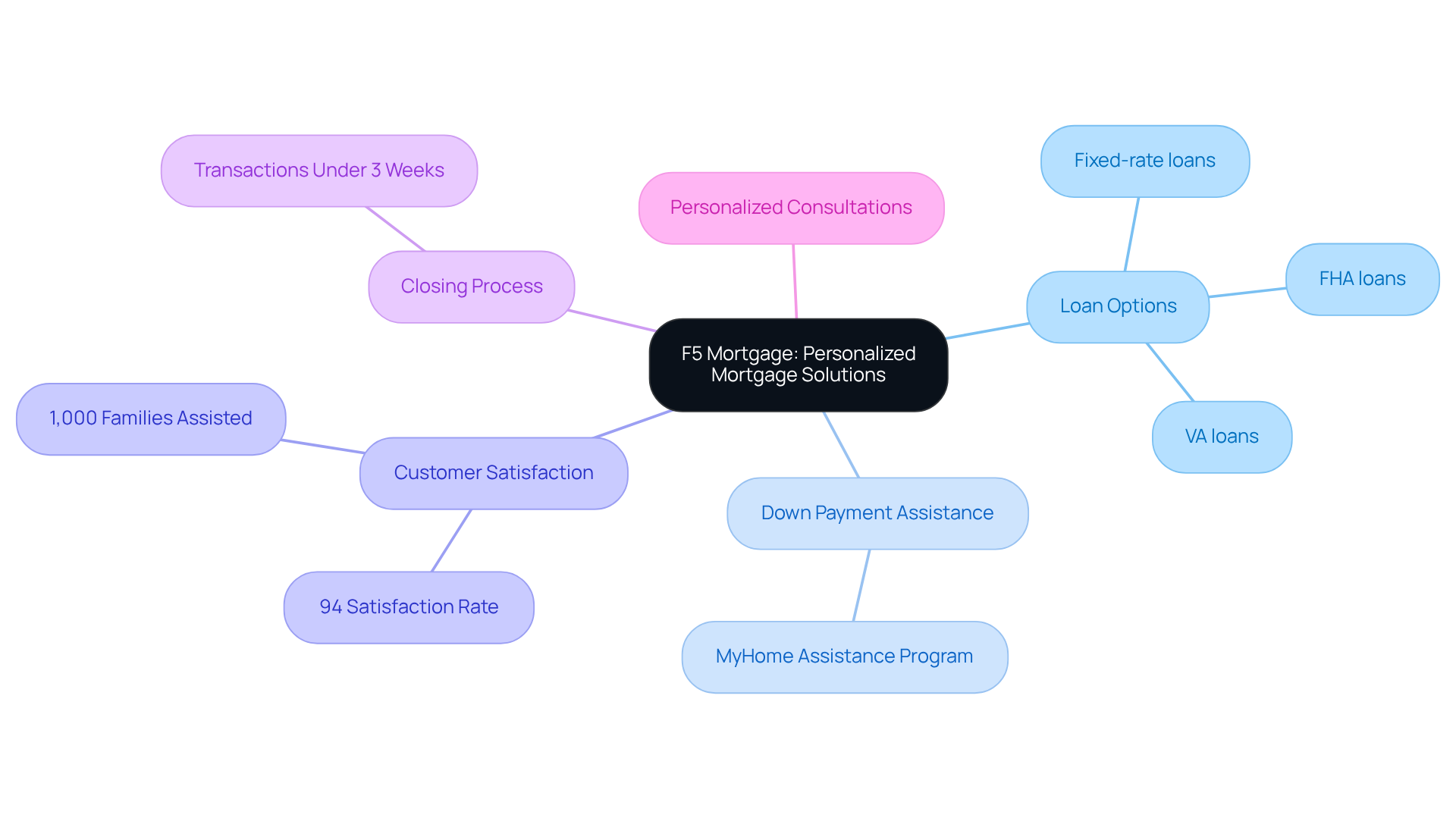

F5 Mortgage: Personalized Mortgage Solutions for Homebuyers

At F5 Mortgage, we understand how challenging the home financing process can be for mortgage finance brokers. That’s why we excel in providing customized loan consultations tailored to your unique needs. By thoroughly assessing your financial circumstances, we can suggest a variety of loan options, including:

- Fixed-rate loans

- FHA loans

- VA loans

This personalized approach not only simplifies the process with mortgage finance brokers but also enhances your satisfaction, ensuring you feel supported and informed every step of the way.

We also offer valuable down payment assistance programs, such as the MyHome Assistance Program in California, which provides up to 3% of the home’s purchase price. This initiative enhances accessibility for families like yours, making homeownership more attainable. With a customer satisfaction rate of 94% and over 1,000 families assisted, our mortgage finance brokers demonstrate the profound impact of customized financing solutions on achieving your homeownership goals.

Our brokerage, in collaboration with mortgage finance brokers, takes pride in a swift and effective closing process, with most transactions concluding in under three weeks. We collaborate with over two dozen leading lenders to provide a varied selection of options. Clients have commended our team for outstanding service, sharing experiences that highlight our dedication to making the financing process as seamless and stress-free as possible. Remember, we’re here to support you every step of the way.

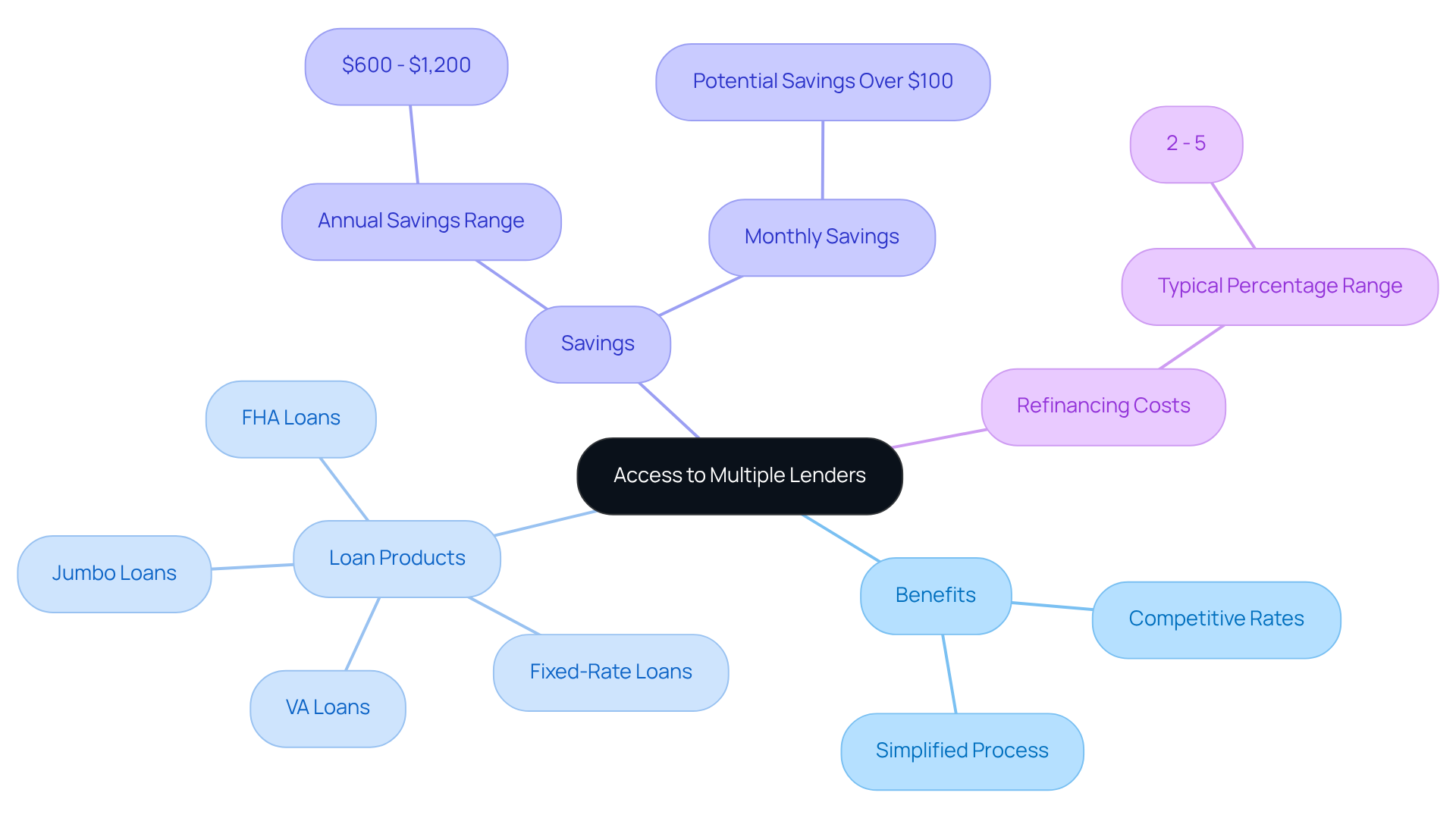

Access to Multiple Lenders: Expanding Your Financing Options

Collaborating with F5 opens the door for mortgage finance brokers to access a vast network of over two dozen top lenders, providing clients with a rich array of loan products and terms. We know how challenging this process can be, but with the assistance of mortgage finance brokers, this extensive access empowers homebuyers to compare offers effectively. You can secure the most competitive rates available without the pressure of hard sales tactics.

F5 Mortgage partners with mortgage finance brokers to utilize advanced technology, simplifying the financing process and ensuring a clear and stress-free experience. Research indicates that borrowers who shop around can save between $600 and $1,200 annually. That translates to significant savings over the life of your mortgage.

Mortgage finance brokers emphasize the importance of contrasting credit products. Even minor variations in interest rates can lead to considerable savings over time when working with mortgage finance brokers. For instance, one expert notes that what may seem like minor rate variations can accumulate to over $100 in monthly savings for those who negotiate and explore multiple options.

Furthermore, understanding the typical refinancing expenses in Colorado, which usually vary from 2% to 5% of the loan amount, can empower you to make informed choices. By utilizing the diverse services available through F5, you can align your choices with your financial goals. We’re here to support you every step of the way, ultimately enhancing your home-buying experience.

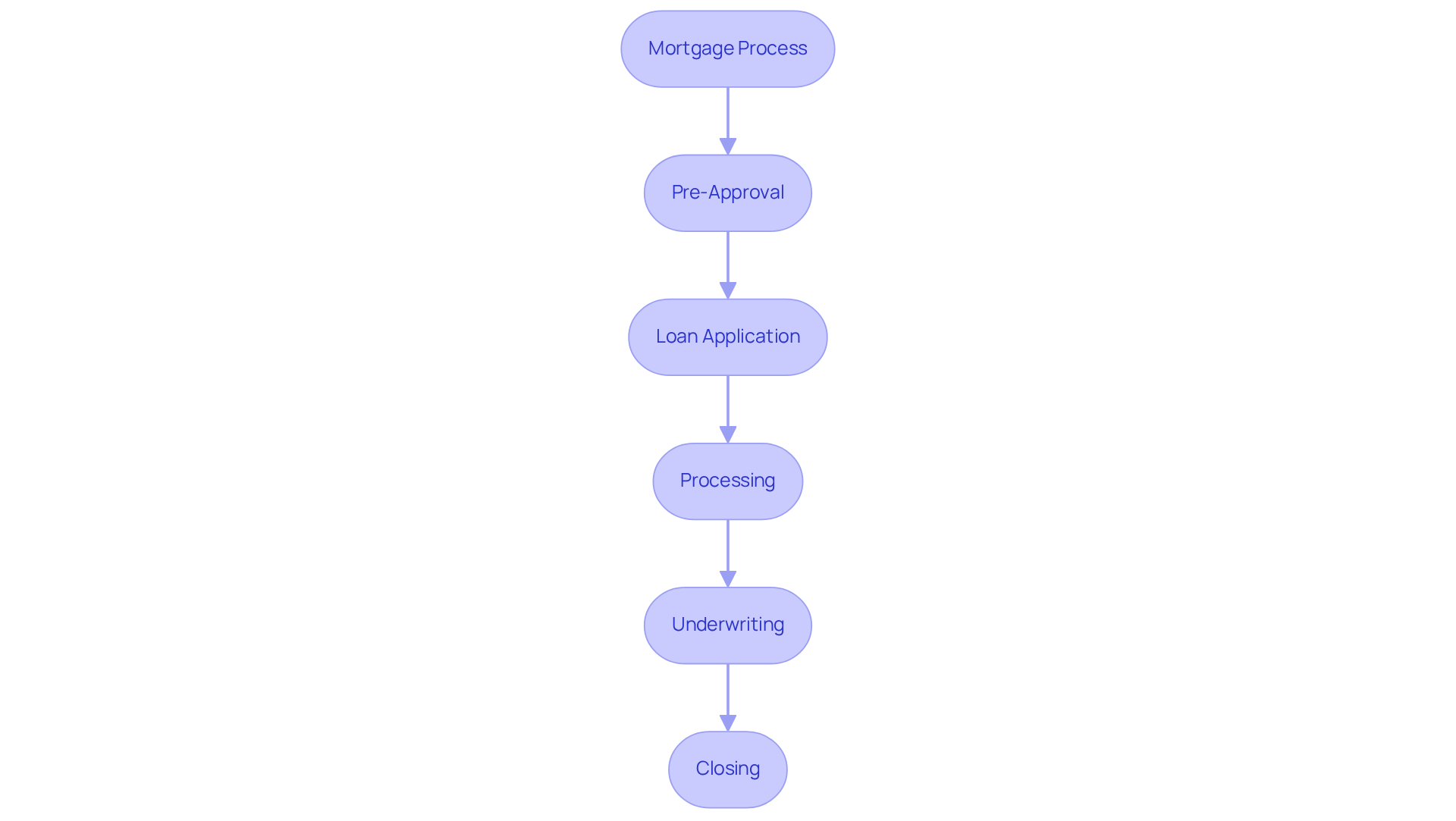

Expert Guidance: Navigating the Mortgage Process with Confidence

Navigating the loan process can feel overwhelming, especially for first-time homebuyers. At F5 Mortgage, we understand how challenging this can be, and we are here to support you every step of the way. Our expert team provides guidance throughout every stage, from pre-approval to closing. We are dedicated to addressing your questions, explaining loan terms, and ensuring you fully comprehend your options.

This level of support not only fosters confidence but also empowers you to make informed decisions about your loans. Clients have praised F5 for our outstanding service. One client shared, ‘F5 managed my financial needs remarkably well,’ while another highlighted our team’s patience and attention to detail, which is especially vital for first-time buyers.

With 88% of first-time homebuyers viewing homeownership as a wise long-term investment, having a trusted advisor can significantly influence your journey. It’s important to note that approximately 38% of prospective homeowners mistakenly believe that excellent credit is necessary to obtain a loan. In reality, most lenders only require a score of 620.

By clarifying these misconceptions, F5 Mortgage helps individuals navigate the complexities of home loan financing through mortgage finance brokers. We ensure you are well-prepared to realize your homeownership aspirations, guiding you toward a brighter future.

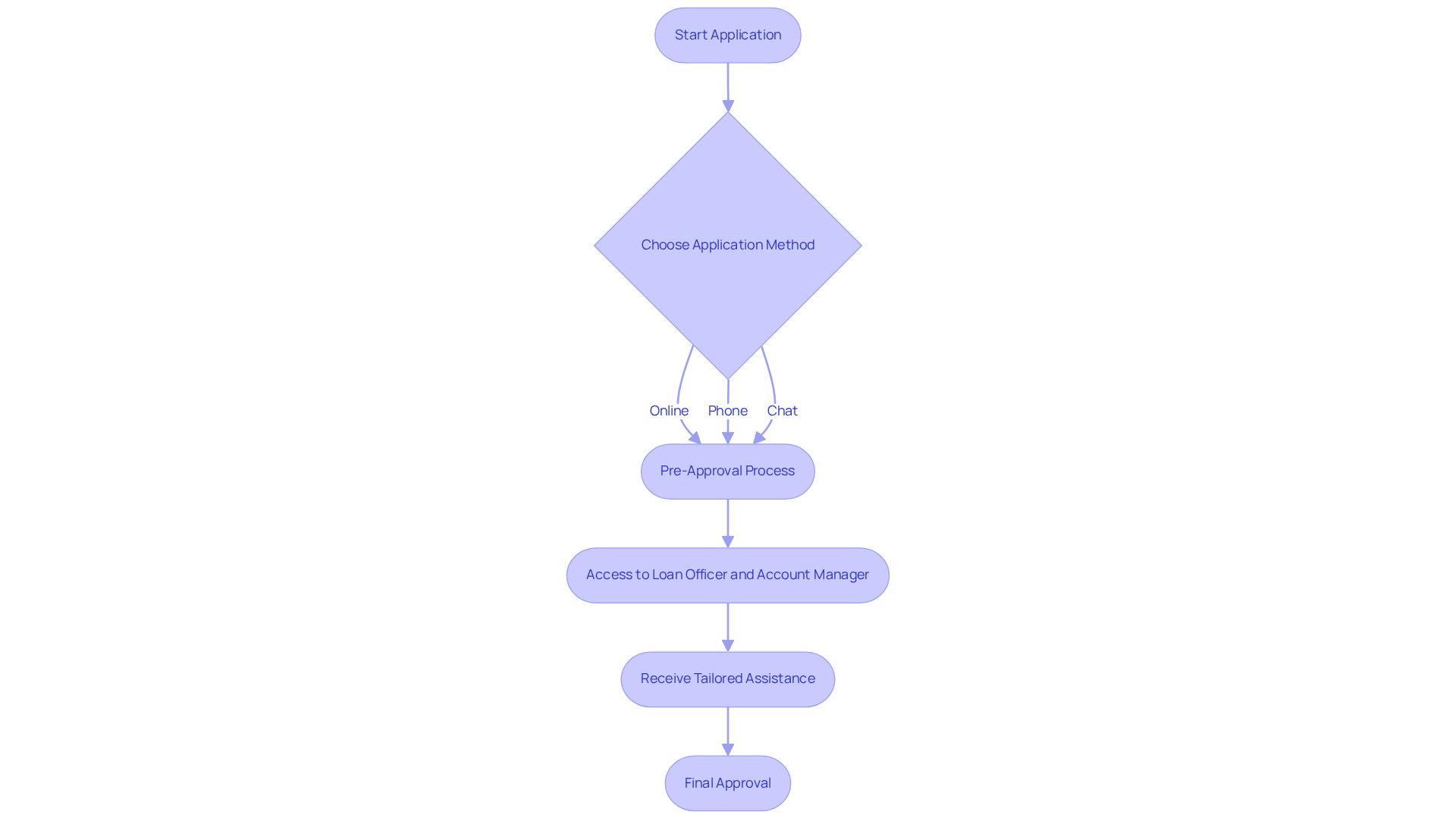

Time Efficiency: Streamlining Your Mortgage Application Process

At F5 Home Loans, we understand how overwhelming the loan application process can feel. That’s why we excel in providing a streamlined experience, ensuring pre-approval in under an hour. By leveraging cutting-edge technology and standardized workflows, we significantly reduce paperwork and accelerate approval timelines. This efficiency is crucial for families needing to act swiftly in today’s competitive housing market.

Moreover, our dedicated team strategy means you won’t navigate this journey alone. You’ll have access to both a loan officer and an account manager, ensuring you receive tailored assistance every step of the way. We know how challenging this can be, and we’re here to support you throughout the process.

You can apply online, by phone, or via chat, making the experience accessible and customized to your individual needs. With F5, you can maneuver through the intricacies of home financing with confidence, knowing that we prioritize your time and requirements.

Cost Savings: Lower Fees Through Broker Negotiation

We know how challenging navigating the mortgage process can be, but collaborating with F5 Financial can lead to significant cost reductions for you and your family. Our strong negotiation capabilities empower us to advocate effectively for lower fees and more favorable loan terms on your behalf. By leveraging established connections with over two dozen leading lenders, we can often secure exclusive offers that individual borrowers might not access, ultimately lowering your overall loan expenses.

For instance, borrowers who utilized brokers saved an average of $10,662 compared to those working with nonbank retail lenders. This illustrates the financial benefits of partnering with mortgage finance brokers. With our expertise and market knowledge as mortgage finance brokers, we are dedicated to negotiating better rates and terms, supporting you throughout your mortgage journey. We’re here to help you every step of the way.

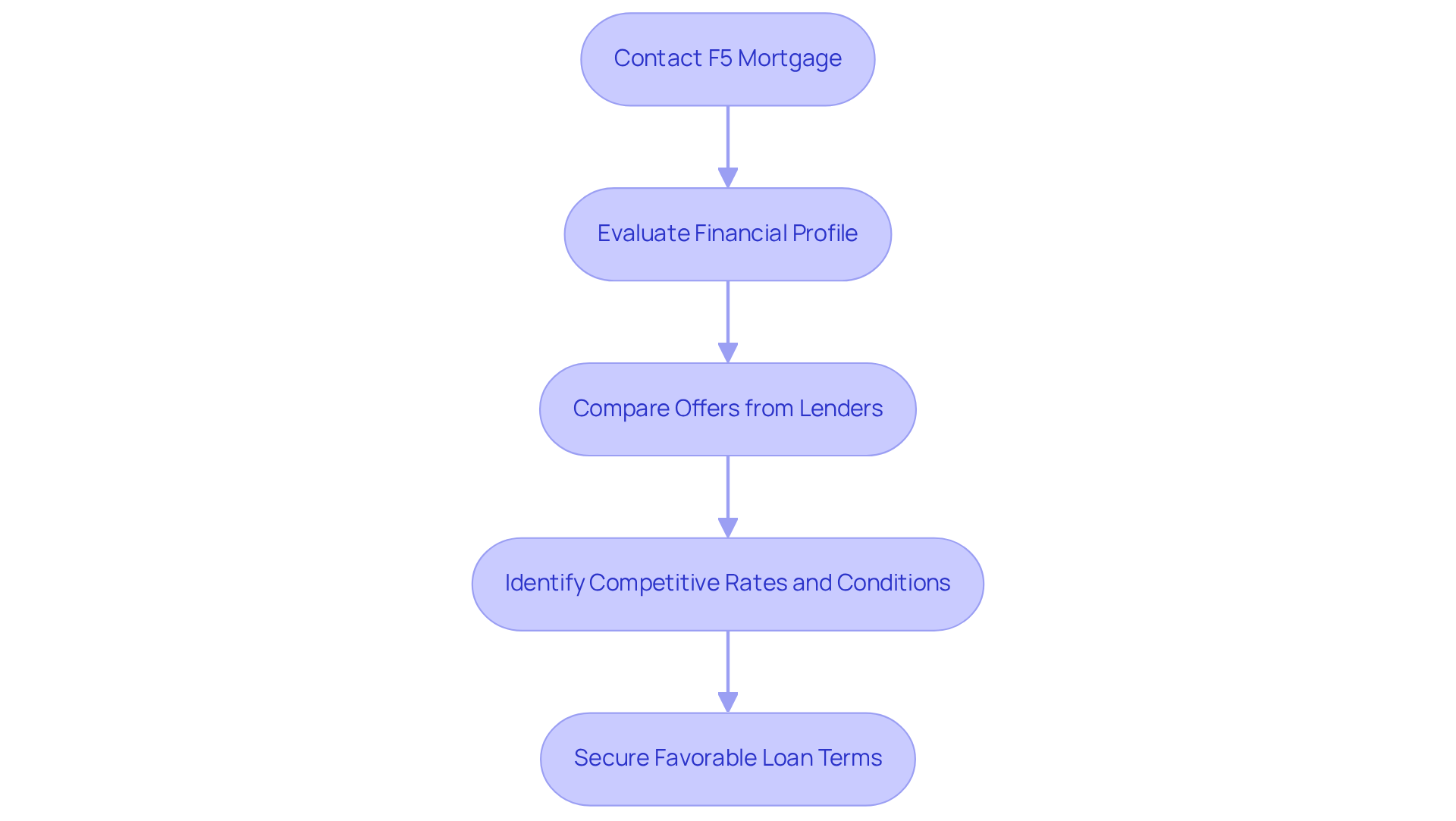

Better Loan Terms: Securing Competitive Rates and Conditions

At F5 Mortgage, we understand how challenging navigating the world of financing can be. That’s why we are dedicated to obtaining the best financing terms for you, utilizing our broad network of over two dozen leading lenders. This strategic approach allows us to compare offers and identify competitive interest rates and advantageous conditions tailored to your unique financial profile.

Statistics reveal that borrowers who collaborate with mortgage finance brokers often secure more favorable financing conditions than those who reach out to lenders directly. This can result in savings that total thousands over the duration of your financing.

By enabling a comprehensive evaluation of loan proposals, F5 empowers you to make informed choices, leading to lower monthly payments and decreased overall expenses. Many customers have reported substantial savings by choosing F5 Home Loans, which not only streamlines the loan process but also enhances their financial well-being.

This commitment to discovering the best offers underscores our role as mortgage finance brokers, serving as a reliable ally in managing the complexities of financial lending. We’re here to support you every step of the way, ensuring that you feel confident and informed in your decisions.

Stress Reduction: Simplifying the Mortgage Experience

Navigating the loan process can often feel daunting, and we understand how challenging this can be. At F5 Mortgage, we are dedicated to transforming this experience into a manageable journey for those we serve. By skillfully handling the complex documentation, facilitating communication with lenders, and providing ongoing assistance, we alleviate the pressure typically associated with obtaining a loan. This streamlined method allows individuals to focus on what truly matters: discovering their dream home.

The benefits of a streamlined loan process are clear. Clients experience reduced anxiety and gain a clearer understanding of their options, ultimately leading to more informed decision-making. For instance, F5 Home Loans offers accessible application choices—whether online, by phone, or through chat—allowing customers to select the method that best suits their needs. Additionally, our mortgage finance brokers not only guide individuals through the application process but also provide educational materials, such as detailed home buyer’s guides and loan calculators, to enhance their understanding of various financing options.

Real-world examples highlight the effectiveness of our approach. Many customers express feeling more assured and supported during their home purchasing journey, thanks to the personalized consultations and tailored solutions we provide. One satisfied customer shared, “F5 Mortgage handled my financial needs exceptionally well,” while another remarked, “The team’s amazing attention to detail was particularly beneficial for first-time home buyers.”

Our commitment to customer satisfaction is reflected in our impressive customer satisfaction rate of 94%, showcasing our ability to meet diverse needs effectively. A case study titled “Building Long-Term Relationships for Ongoing Success” illustrates how this satisfaction translates into ongoing support and market updates for our clients.

Industry experts emphasize the importance of streamlining the loan process. As noted by Connect Mortgages, mortgage finance brokers are skilled at finding the right mortgage and helping improve your chances of approval. This proactive support not only reduces stress but also fosters long-term relationships, as customers often return for future services, knowing they have a reliable advisor by their side.

Educational Resources: Empowering Homebuyers with Knowledge

At F5 Mortgage, we understand that knowledgeable customers are empowered customers. That’s why we offer an extensive array of educational resources designed to support you on your journey. With detailed home buyer’s guides, refinancing guides, and tailored down payment assistance programs, we aim to clarify the home financing landscape for mortgage finance brokers. Our goal is to provide you with the understanding needed to navigate your home purchasing experience with confidence.

Research shows that when individuals engage with educational materials, they are significantly more likely to make informed choices about their financing options. This insight is especially crucial in today’s market, where mortgage finance brokers can help grasp the nuances of various loan programs to achieve better financial outcomes.

The positive impact of mortgage education is evident in the experiences of our clients. Many share that they feel more secure in their decisions, resulting in higher satisfaction rates. In fact, F5 Financing proudly boasts a customer satisfaction rate of 94%, reflecting the effectiveness of our educational initiatives. As one satisfied client, Bryce Leonard, expressed in a Google review, “Awesome work. I appreciated receiving assistance with my loan through F5. Highly recommend to anyone who is looking for true experts.”

Empowering individuals with knowledge not only enhances decision-making abilities but also fosters a sense of ownership over financial futures. By prioritizing education, F5 Home Loans ensures that you are well-prepared to tackle the complexities of homeownership. We’re here to support you every step of the way, paving the path for successful and confident homebuying experiences.

Personalized Service: Tailoring Solutions to Your Unique Needs

At F5, we understand how essential tailored service is to your experience. We dedicate time to thoroughly grasp your unique financial circumstances and homeownership aspirations. By customizing financing solutions to meet your personal requirements, F5 Mortgage works with mortgage finance brokers to provide the most suitable choices and significantly enhance your satisfaction. With an impressive customer satisfaction rate of 94% and having assisted over 1,000 families, our approach has proven successful in building trust and loyalty among our patrons.

Clients like Ruth Vest have praised our team for their exceptional service, noting how we navigated the complexities of the financing process with ease. Similarly, Debbie and Ken Freeborn expressed heartfelt gratitude for the outstanding support that helped them achieve financial stability. These testimonials underscore our commitment to crafting solutions that resonate with you, resulting in a smoother and more satisfying loan experience.

We work with mortgage finance brokers to offer a variety of services, including:

- Refinancing options

- Assistance for first-time homebuyers

Ensuring that you receive the support you need throughout your loan journey. We know how challenging this can be, and we’re here to support you every step of the way.

Long-Term Support: Building Lasting Relationships with Your Broker

At F5 Home Loans, we understand how challenging the journey to homeownership can be. That’s why we are dedicated to fostering lasting connections with our customers, having successfully supported over 1,000 families along the way. Our commitment doesn’t end once the mortgage process is complete; we provide ongoing support, ensuring you have continuous access to guidance and assistance whenever you need it.

This long-term commitment fosters trust and loyalty, making F5 a reliable partner throughout your homeownership journey. In a sector where personal connections are vital, our approach significantly enhances customer retention rates, which are essential for ongoing success. By prioritizing ongoing communication—like sending holiday cards and newsletters—mortgage finance brokers exemplify how they can effectively nurture relationships that lead to repeat business and referrals.

Moreover, our quick and effective closing procedure, with most loans concluding in under three weeks, boosts customer satisfaction and strengthens our standing as a reliable partner. Clients have consistently commended our team for their outstanding service, expressing how they felt directed and supported throughout the process. This reflects our dedication to ethical standards and transparency.

We know that building relationships can be challenging, which is why F5 Mortgage works with mortgage finance brokers to actively implement strategies to overcome these hurdles. We ensure that you feel valued and supported at every stage of your journey. Remember, we’re here to support you every step of the way.

Conclusion

Choosing to work with mortgage finance brokers, like F5 Mortgage, means homebuyers gain access to personalized support and resources that cater to their unique financial situations. This approach simplifies the often complex mortgage process and ensures that clients receive the most suitable loan options, competitive rates, and expert guidance throughout their journey to homeownership.

We understand how overwhelming this process can feel. The article highlights several key advantages of utilizing mortgage finance brokers, including:

- Access to a diverse range of lenders

- Streamlined application processes

- Significant cost savings through effective negotiation

- Educational resources that empower clients

With a customer satisfaction rate of 94% and a commitment to long-term relationships, F5 Mortgage exemplifies how personalized service can lead to a smoother and more informed home-buying experience.

Ultimately, engaging with mortgage finance brokers can transform the daunting task of securing a home loan into a manageable and rewarding journey. By prioritizing education, efficiency, and tailored support, brokers enhance client satisfaction and foster lasting relationships that continue beyond the closing of a loan.

For anyone considering homeownership, the value of partnering with knowledgeable and dedicated mortgage finance brokers cannot be overstated. We know how challenging this can be, so take the first step toward achieving homeownership with confidence by exploring the benefits of personalized mortgage solutions today.

Frequently Asked Questions

What services does F5 Mortgage provide for homebuyers?

F5 Mortgage offers personalized loan consultations tailored to individual needs, including options like fixed-rate loans, FHA loans, and VA loans. They also provide down payment assistance programs, such as the MyHome Assistance Program in California.

How does F5 Mortgage assist with down payment assistance?

F5 Mortgage offers programs like the MyHome Assistance Program, which provides up to 3% of the home’s purchase price to enhance accessibility for families looking to achieve homeownership.

What is the customer satisfaction rate at F5 Mortgage?

F5 Mortgage has a customer satisfaction rate of 94% and has assisted over 1,000 families, highlighting their commitment to providing effective and personalized financing solutions.

How quickly can transactions be closed through F5 Mortgage?

Most transactions with F5 Mortgage conclude in under three weeks, ensuring a swift and effective closing process.

What advantages do mortgage finance brokers gain by collaborating with F5 Mortgage?

Mortgage finance brokers gain access to a vast network of over two dozen top lenders, allowing them to offer clients a rich array of loan products and competitive rates without hard sales tactics.

How can homebuyers save money by comparing loan offers?

Research indicates that borrowers who shop around can save between $600 and $1,200 annually, which can lead to significant savings over the life of a mortgage.

What is the typical refinancing expense range in Colorado?

Typical refinancing expenses in Colorado usually vary from 2% to 5% of the loan amount.

How does F5 Mortgage support first-time homebuyers?

F5 Mortgage provides expert guidance throughout the loan process, from pre-approval to closing, ensuring that first-time homebuyers have their questions answered and understand their options.

What misconceptions do prospective homeowners have about obtaining a loan?

Approximately 38% of prospective homeowners mistakenly believe that excellent credit is necessary to obtain a loan, while most lenders only require a score of 620.

How does F5 Mortgage help clarify misconceptions about home loans?

F5 Mortgage educates clients on the loan process and clarifies common misconceptions, empowering them to make informed decisions and navigate the complexities of home financing effectively.