Introduction

Navigating the path to homeownership can feel overwhelming, especially for first-time buyers in Iowa. We understand how challenging this can be. The housing market presents both opportunities and hurdles, making it essential to grasp the nuances of FHA loans. This article shares ten vital insights about FHA loans in Iowa, designed to empower you with the knowledge needed to make informed decisions.

As the landscape of home financing evolves, what key factors should Iowans consider to enhance their chances of securing an affordable mortgage? We’re here to support you every step of the way.

F5 Mortgage: Your Partner for FHA Loans in Iowa

F5 Mortgage LLC is here for you, standing out as a leading independent mortgage brokerage in the state. We understand how challenging the mortgage process can be, especially when it comes to obtaining an FHA loan in Iowa. That’s why we prioritize personalized consultations, ensuring you feel supported every step of the way.

With a wide selection of financing options, we make it easy for you to access competitive rates and exceptional service. Our deep understanding of the complexities of FHA financing, particularly the fha loan iowa, positions us as an essential partner for homebuyers like you, who are looking for budget-friendly options.

As the market for independent mortgage brokers continues to grow, we remain committed to empowering you through tailored support and expert guidance. We know that buying a home is a significant step, and we’re here to make the process smoother and more accessible for you.

FHA Loan Requirements in Iowa: What You Need to Qualify

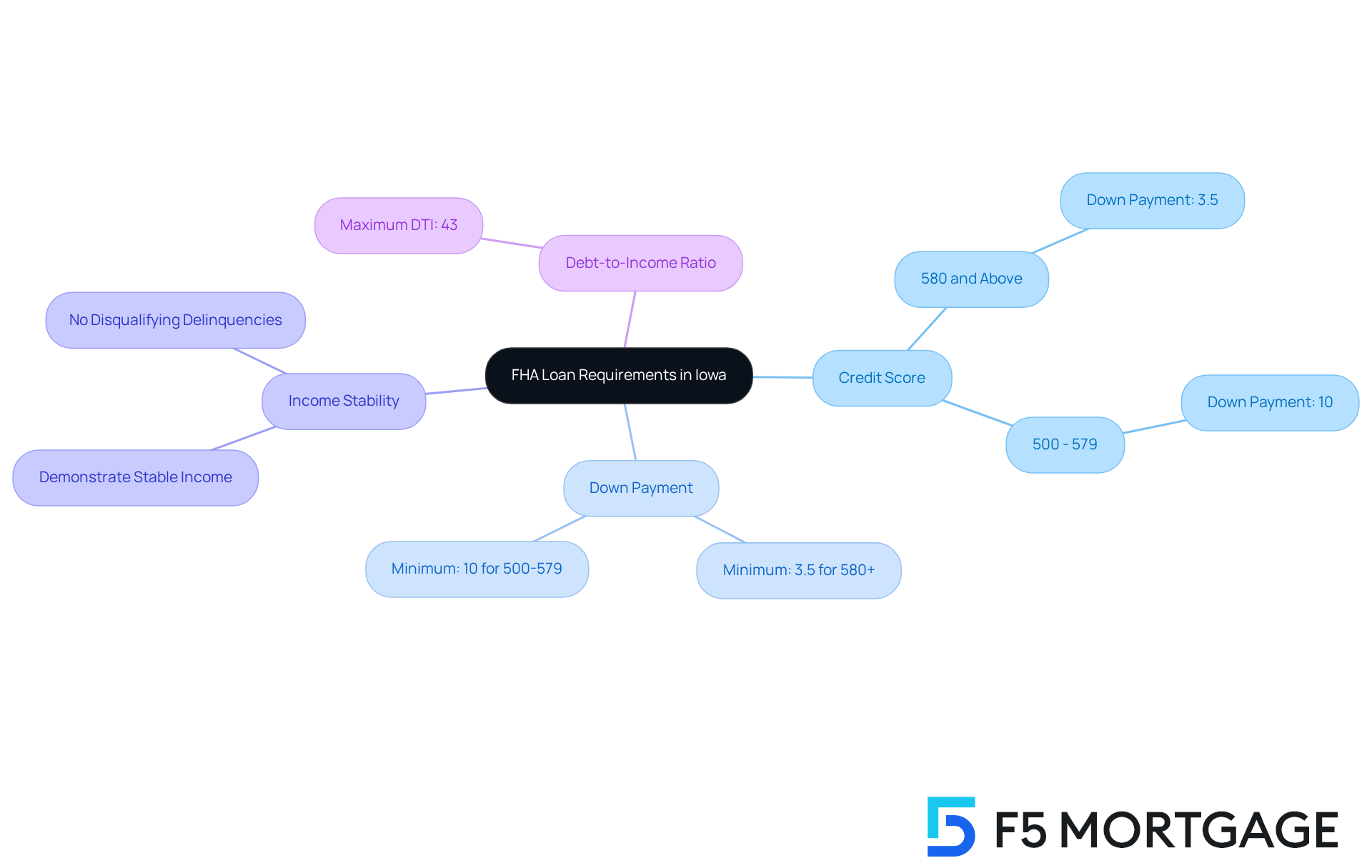

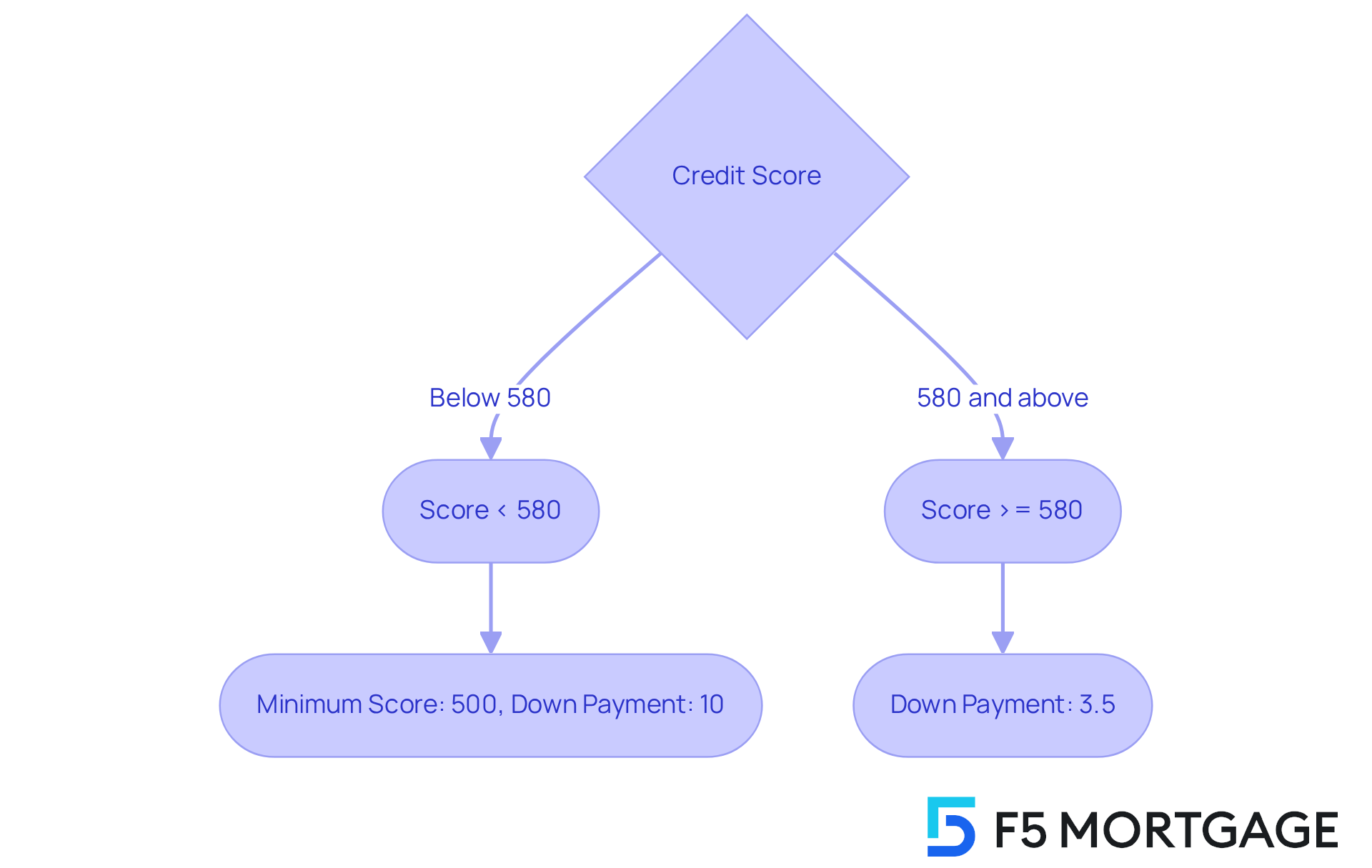

In Iowa, navigating the FHA loan Iowa process can be quite challenging. Meeting the criteria for an FHA mortgage typically requires a minimum credit score of 580, allowing for a down payment as low as 3.5%. If your score falls between 500 and 579, you’ll need to prepare for a larger down payment of 10%.

It’s essential to demonstrate a stable income and keep your debt-to-income (DTI) ratio below 43%. These requirements are crucial for many Iowans dreaming of homeownership, especially in a market where the median home price hovers around $223,000, and an FHA loan Iowa can be a valuable option.

FHA loan Iowa is especially advantageous for first-time homebuyers. It opens the door to homeownership with lower initial costs and flexible qualification criteria.

At F5 Mortgage, we’re here to support you every step of the way. We can help you understand these requirements and guide you through the application process, ensuring you meet the necessary criteria for FHA financing.

Benefits of FHA Loans in Iowa: Affordable Homeownership Options

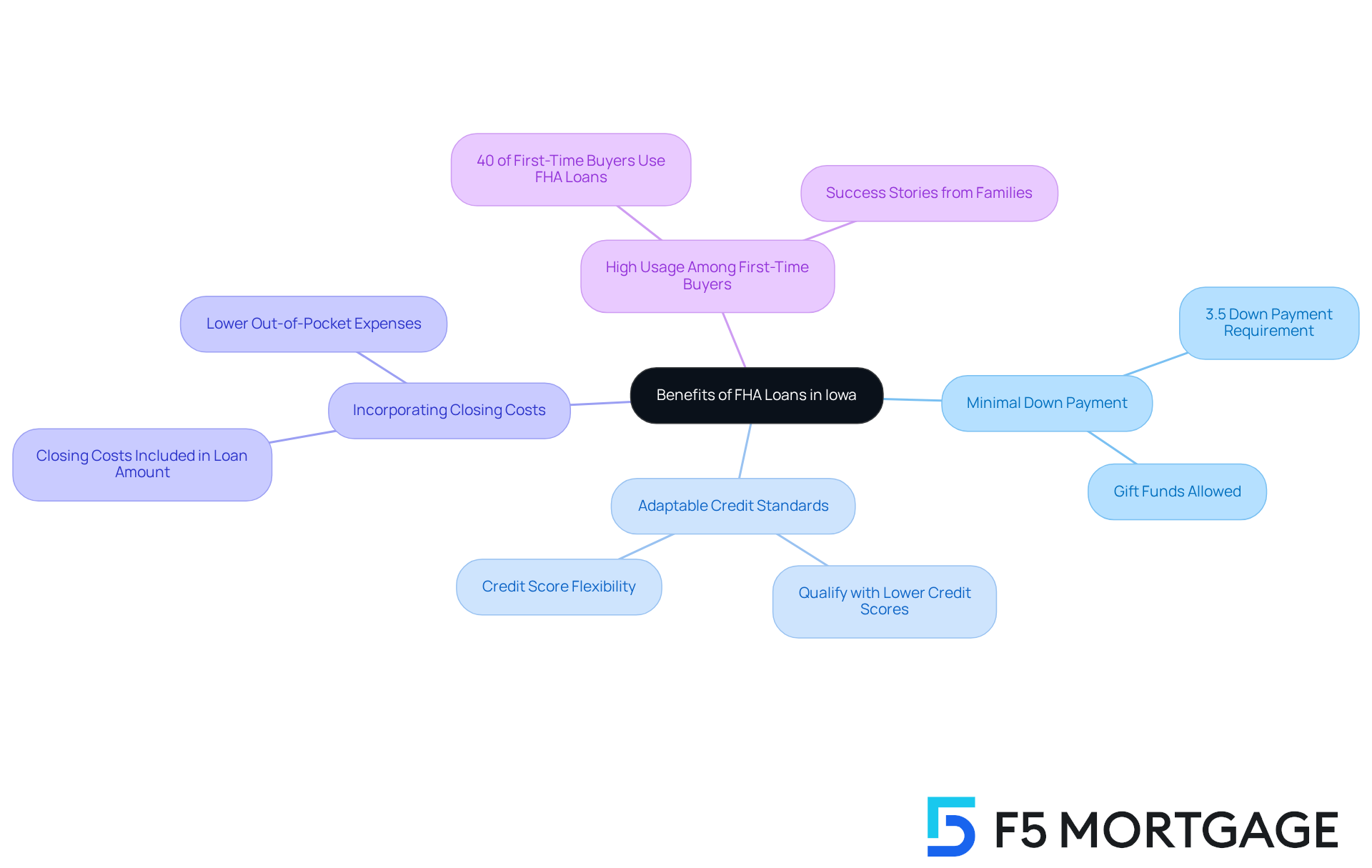

FHA loan Iowa offers numerous advantages that can truly make a difference for Iowans looking to own a home. We know how challenging this can be, especially for first-time homebuyers or those with limited savings. With a minimal down payment requirement of just 3.5%, these financial options are particularly beneficial.

What’s more, the adaptable credit standards linked to FHA programs allow individuals with less-than-perfect credit histories to qualify. This means that homeownership is within reach for a wider audience, which is a comforting thought for many. Additionally, the option to incorporate closing expenses into the mortgage amount enhances overall affordability, making FHA mortgages a feasible choice for numerous families in the state.

Recent statistics show that around 40% of first-time homebuyers in Iowa utilize an FHA loan Iowa for their financing. This highlights how effective these programs are in facilitating affordable homeownership. Expert opinions consistently emphasize the importance of the FHA loan Iowa in making homeownership a reality for many Iowans.

Success stories abound, with families sharing their positive experiences of securing homes through FHA financing. These stories reinforce the status of the FHA loan Iowa as a cornerstone of affordable housing options in the region. We’re here to support you every step of the way as you navigate this journey.

FHA Loan Limits in Iowa: Understanding Your Borrowing Capacity

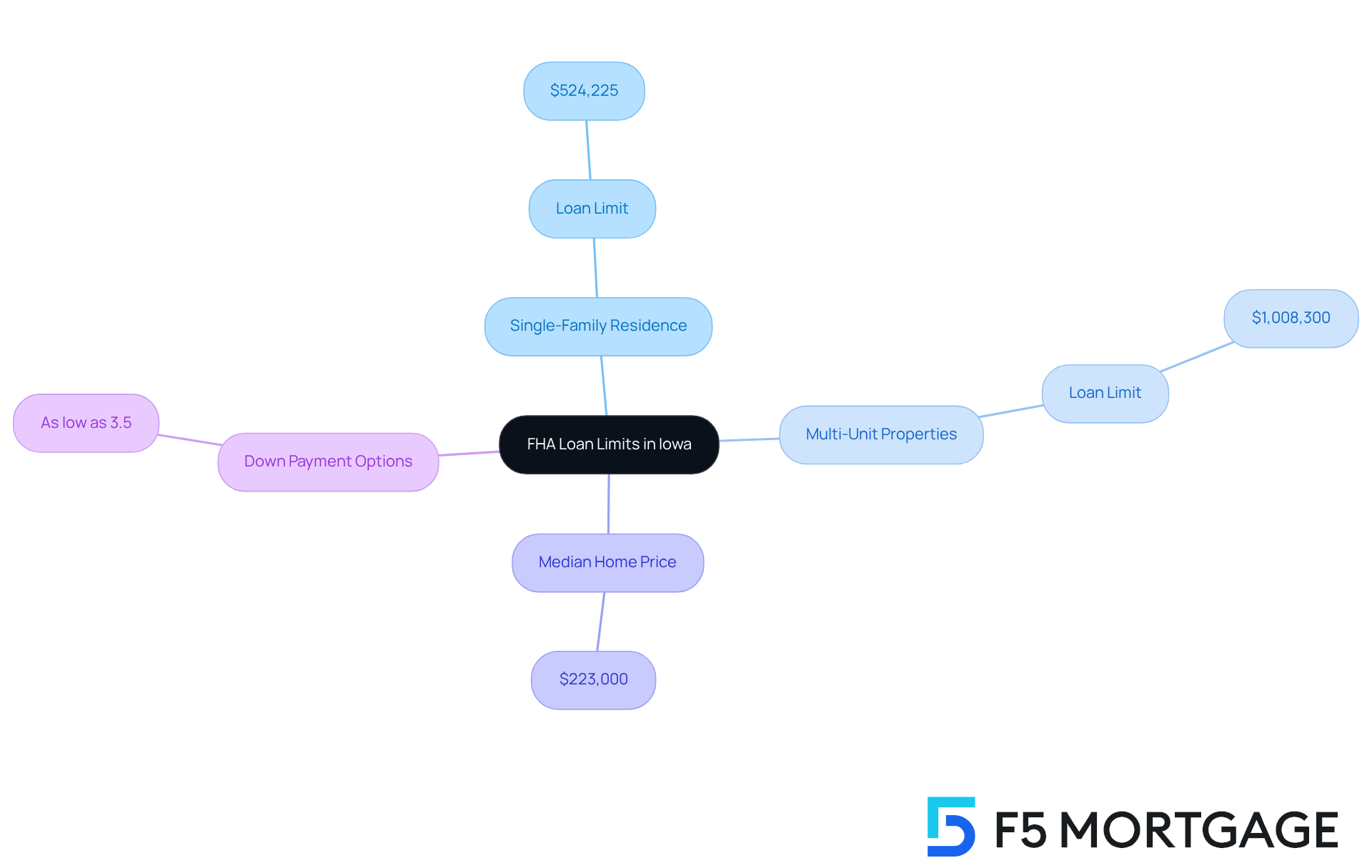

Navigating the world of home buying can feel overwhelming, but understanding the FHA loan Iowa borrowing limits can make a significant difference. In our state, the FHA borrowing cap for a single-family residence is set at $524,225 for 2025, a consistent figure across all counties. This uniformity provides a clear benchmark for your purchasing power, helping you feel more confident in your decisions.

If you’re considering multi-unit properties, there’s good news! The borrowing capacity increases significantly, allowing financing up to $1,008,300 for four-unit residences. These limits are crucial for potential homebuyers like you, as they directly influence the types of properties you can consider. With the median home price in Iowa hovering around $223,000, many buyers can leverage FHA loan Iowa limits to secure homes that truly meet their needs.

And let’s not forget about the low down payment options available, which can be as low as 3.5%. We know how challenging this can be, but understanding these parameters not only aids in budgeting but also empowers you to navigate the competitive real estate market effectively. Remember, we’re here to support you every step of the way as you embark on this journey.

Down Payment Requirements for FHA Loans in Iowa: What to Expect

Navigating the world of FHA loan Iowa mortgages can feel overwhelming, especially when it comes to understanding down payment requirements. For those with a credit score of 580 or above, the minimum down payment is just 3.5%. But if your score falls between 500 and 579, you’ll need to prepare for a 10% down payment. We know how challenging this can be, but this flexibility allows many families to step into homeownership with a lower initial investment compared to traditional financing options.

As you embark on this journey, remember that negotiating with sellers about repairs or upgrades is a common part of the homebuying process. Understanding these strategies can significantly enhance your experience and help you feel more confident in your decisions.

At F5 Mortgage, we’re here to support you every step of the way. We provide a variety of financing programs, including FHA loan Iowa and both standard and nontraditional options, ensuring you have access to the best financial solutions tailored to your needs. Let’s work together to make your dream of homeownership a reality.

Credit Score Requirements for FHA Loans in Iowa: Know Your Score

If you’re considering a FHA loan in Iowa, it’s important to understand the eligibility requirements. We understand how challenging this can be, especially when it comes to credit scores. To qualify, borrowers need a minimum score of 500. However, if you aim for the more favorable down payment option of just 3.5%, you’ll need a score of at least 580. For those with scores between 500 and 579, while you can still qualify, a 10% down payment may feel like a significant hurdle.

Improving your credit score can open up better financing options and conditions. That’s why it’s essential to regularly review your credit reports and take steps to elevate your scores. Many individuals who have successfully increased their scores to 580 or higher have not only enjoyed reduced down payments but also gained access to improved interest rates. This shows the tangible benefits of proactive financial management.

Statistics reveal that numerous borrowers who focus on enhancing their scores can qualify for an FHA loan in Iowa. This creates opportunities for homeownership that might otherwise remain out of reach. As highlighted by the Department of Housing and Urban Development, FHA mortgages are designed to be more lenient regarding past financial challenges, helping more families achieve their homeownership dreams. Remember, we’re here to support you every step of the way.

How to Apply for an FHA Loan in Iowa: A Step-by-Step Guide

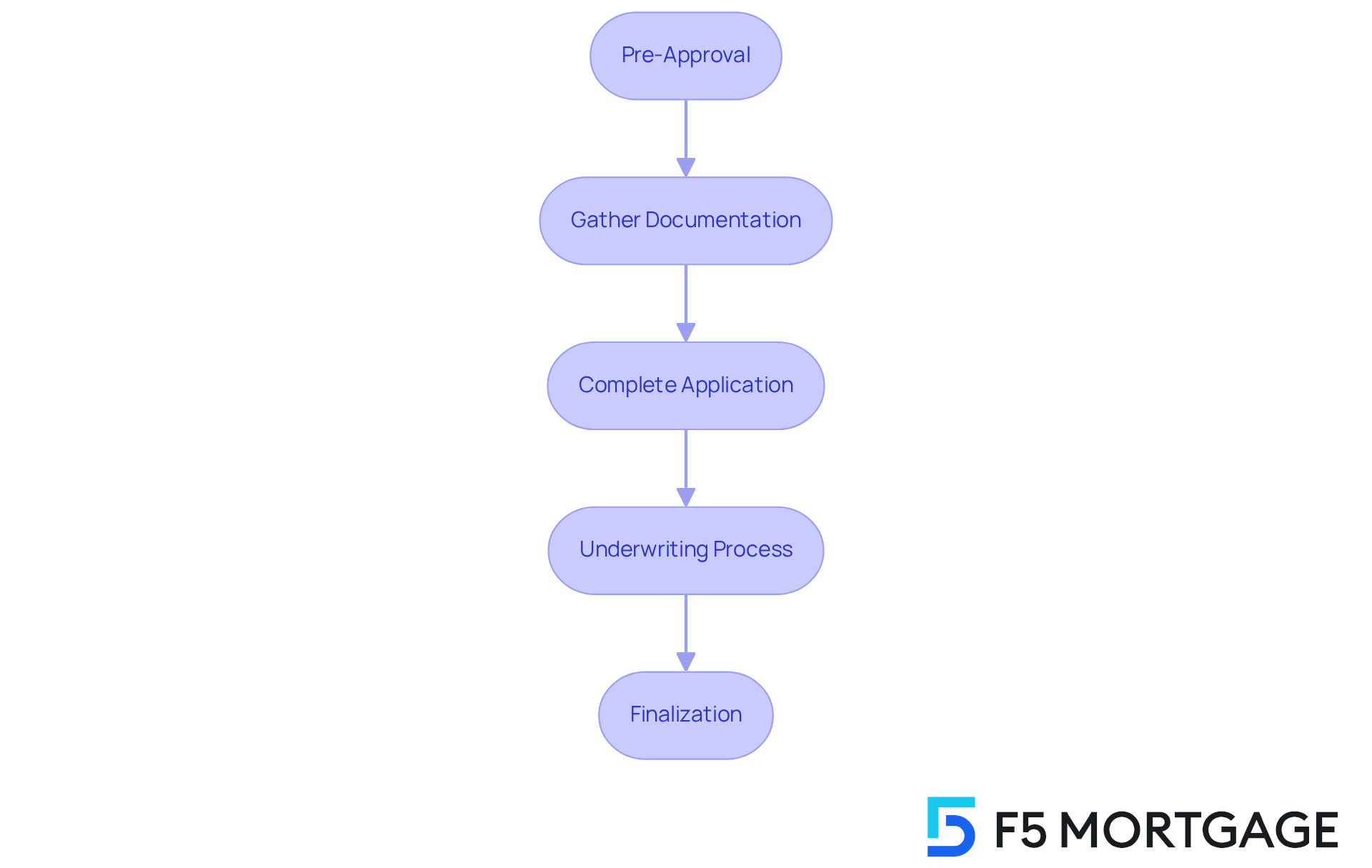

Applying for an FHA loan in Iowa can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps to make the process smoother for you and your family:

Pre-Approval: Start by obtaining pre-approval from a lender like F5 Mortgage. This crucial first step helps you understand your borrowing capacity and sets the stage for your home search.

Gather Documentation: Next, collect necessary documents such as proof of income, tax returns, and your financial history. These documents are vital for your application and will help your lender assess your situation accurately.

Complete the application for the FHA loan in Iowa: Once you have your documents ready, fill out the FHA financing application with your lender. Make sure all required information is provided accurately to avoid any delays.

Underwriting Process: Your lender will then review your application and documentation to determine your eligibility. This process typically involves evaluating your credit score, income stability, and debt-to-income ratio.

Finalization: If approved, you’ll move on to the closing stage. Here, you’ll complete the agreement and receive the funds to buy your home.

In Iowa, the typical duration to finalize FHA mortgages is impressively efficient, often taking under three weeks. This is thanks to streamlined procedures and dedicated lender assistance.

Success stories from families who have gone through this process highlight the effectiveness of working with experienced lenders. They guide you through each step, making the journey to homeownership more accessible and less stressful. Remember, we know how challenging this can be, but with the right support, you can achieve your dream of owning a home.

Pros and Cons of FHA Loans in Iowa: Weighing Your Options

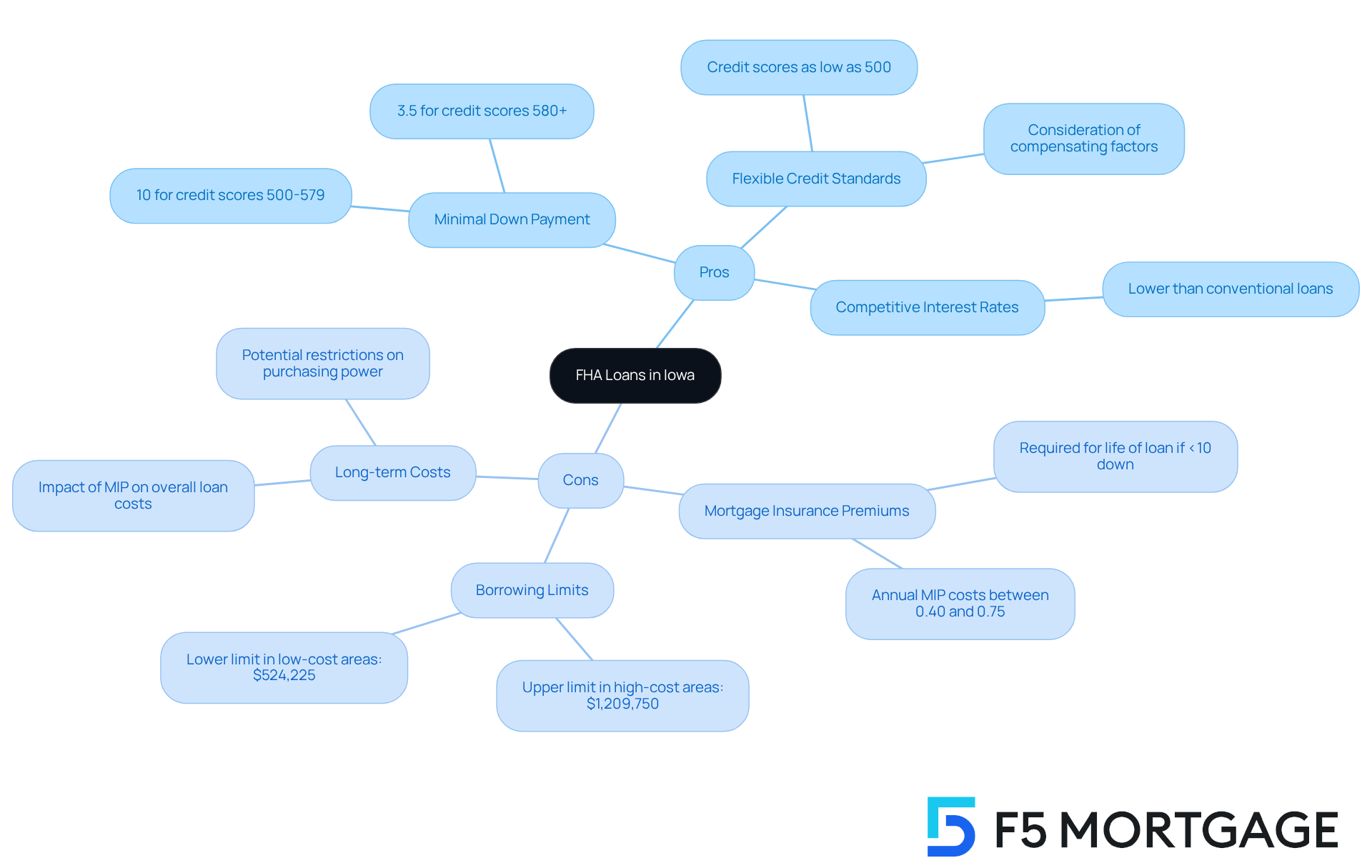

FHA loan Iowa provides a range of benefits that can make homeownership more accessible for many families. One of the standout advantages is the minimal down payment requirement, which can be as low as 3.5% for borrowers with a credit score of 580 or higher. We know how challenging it can be to save for a home, and this accessibility is especially helpful for first-time homebuyers or those with limited savings.

Moreover, FHA mortgages come with more flexible credit standards, allowing individuals with credit scores as low as 500 to qualify, though this requires a higher down payment of 10%. This flexibility can open doors for many who might otherwise feel discouraged.

In addition to these benefits, FHA mortgages typically feature competitive interest rates compared to conventional options. For instance, average interest rates for an FHA loan in Iowa are often lower than those for traditional financing, making it a cost-effective choice for many buyers. However, it’s important to be aware of the potential drawbacks associated with FHA financing.

One significant concern is the mandatory mortgage insurance premiums (MIP), which are required for the life of the loan if the down payment is less than 10%. The yearly MIP usually costs between 0.40% and 0.75% of the borrowed amount, and this can impact long-term financial planning. We encourage you to consider how this might affect your budget.

Additionally, the FHA loan Iowa has borrowing limits that may not be sufficient for higher-priced homes, especially in more expensive areas. For example, the maximum limit for FHA mortgages in high-cost counties can reach up to $1,209,750, while in lower-cost areas, it starts at $524,225. This limitation can restrict purchasing power for families looking to buy in popular neighborhoods.

In summary, while FHA financing provides a valuable pathway to homeownership for many, it’s crucial to weigh these advantages against the potential long-term costs and limitations. Understanding these factors will help you decide if an FHA mortgage aligns with your financial goals and homeownership dreams. Remember, we’re here to support you every step of the way.

FHA Refinance Options in Iowa: Enhancing Your Financial Flexibility

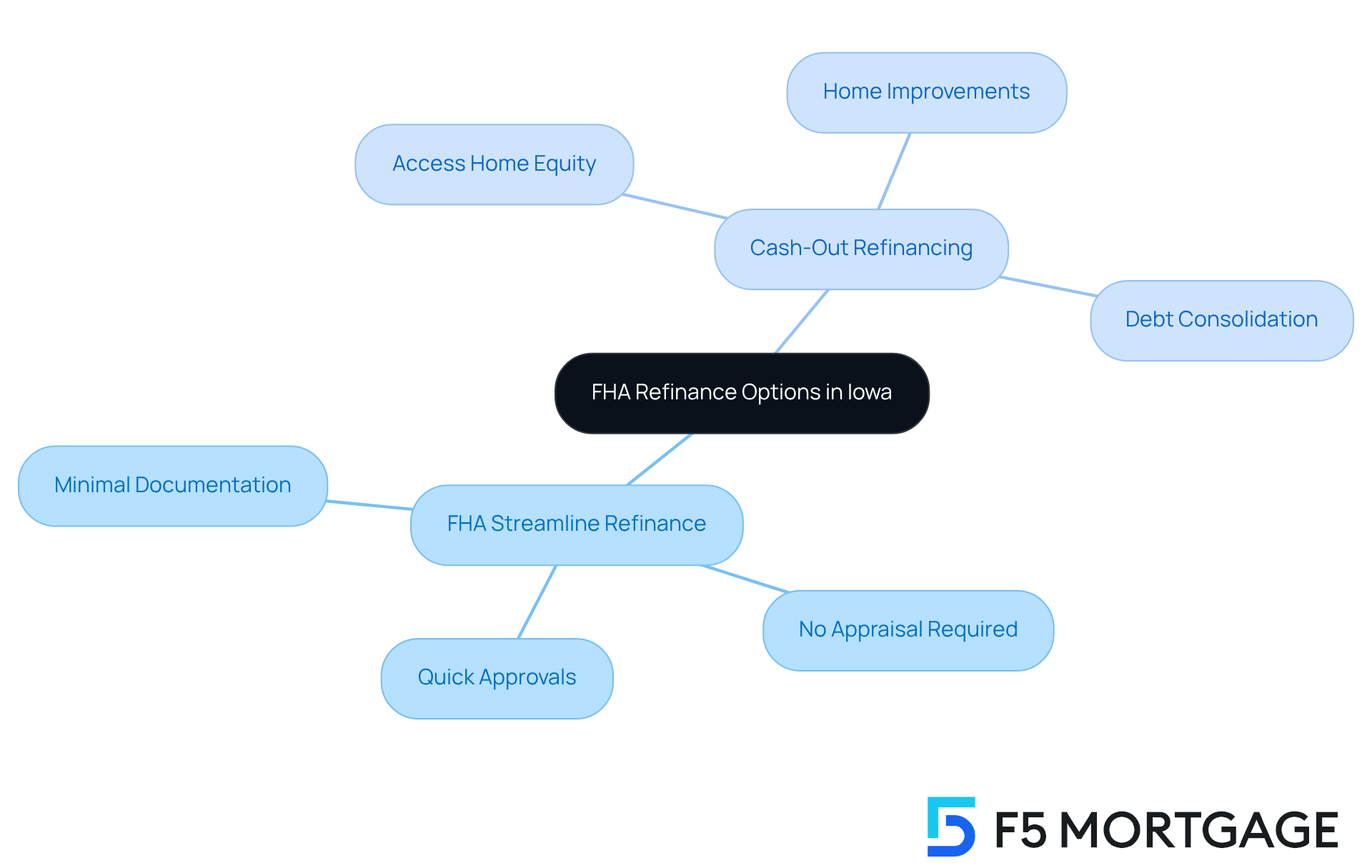

If you’re a homeowner in our state with an existing FHA loan Iowa, you might be feeling the weight of financial decisions. We understand how challenging this can be, but there are refinancing options available that can help improve your financial flexibility.

One standout choice is the FHA Streamline Refinance program. This option is designed for efficiency, allowing you to refinance with minimal documentation and no appraisal requirement. Imagine getting quicker approvals – sometimes as fast as three weeks from application to closing!

You might also want to consider cash-out refinancing. This option lets you tap into the equity of your home, providing funds for important needs like home improvements or debt consolidation. Understanding these refinancing choices, such as the FHA loan Iowa, is crucial for making informed decisions that align with your financial goals.

With the current average FHA loan Iowa refinance rate at 6.625%, now could be the perfect time to explore these options. Many homeowners could see reduced monthly payments and better terms. We’re here to support you every step of the way as you navigate this process.

Resources for First-Time Homebuyers in Iowa: Getting Started with FHA Loans

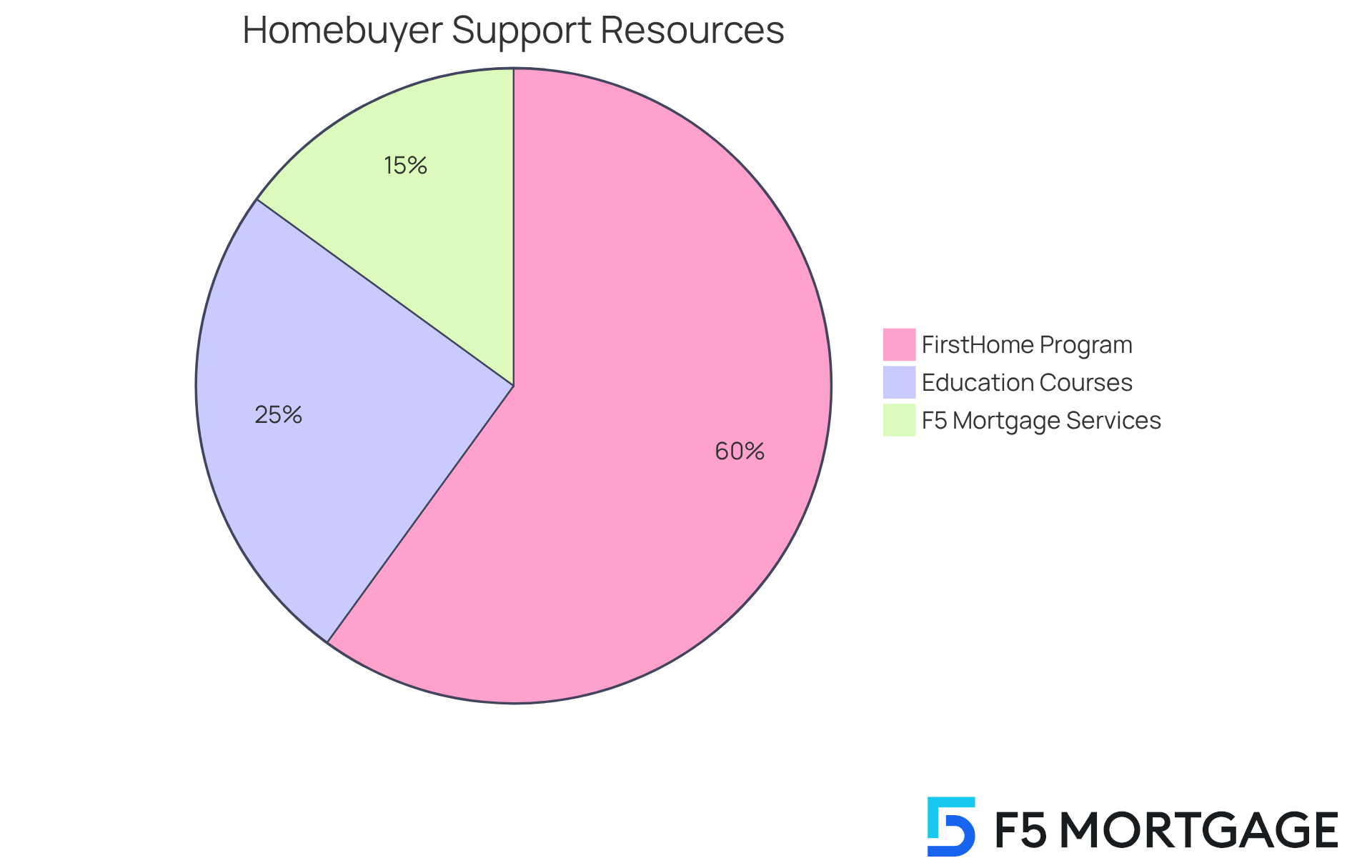

If you’re a first-time homebuyer in Iowa, we know how challenging this journey can be. Thankfully, there are many resources available to help you confidently navigate the FHA loan Iowa process. One standout option is the Iowa Finance Authority’s FirstHome program, which offers down payment assistance of up to $5,000 for eligible service members and veterans. Alongside this, you can access essential homebuyer education courses that empower you with knowledge.

In fiscal year 2025, over 2,900 Iowans benefited from these programs, receiving nearly $23 million in assistance. This showcases the significant impact these resources have on homeownership in our state. It’s heartening to see how many families are finding their way to their dream homes with this support.

Moreover, F5 Mortgage is here to enhance your experience. They provide comprehensive guides and personalized consultations, ensuring you fully understand your options. By leveraging these resources, you can navigate the complexities of the home buying process with an FHA loan in Iowa, making informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

FHA loans in Iowa offer a wonderful opportunity for homebuyers, especially those stepping into homeownership for the first time. We understand how daunting this journey can be, but with accessible down payment options and flexible credit requirements, these loans are crafted to help make your dream of owning a home a reality.

In this article, we’ve explored essential insights, including:

- The eligibility criteria for FHA loans

- The benefits they provide

- The steps to apply

Knowing the minimum credit score requirements and down payment expectations can significantly ease your homebuying experience. Plus, working with experienced lenders like F5 Mortgage can make a world of difference. And for existing homeowners, the potential for refinancing options adds another layer of financial flexibility.

By leveraging the insights shared here, you can empower yourself to make informed decisions that align with your financial goals. As the landscape of FHA loans evolves, staying informed about current trends and available resources is crucial. Remember, we’re here to support you every step of the way. By taking proactive steps and seeking guidance, you can confidently embark on your journey to homeownership, turning your dreams of owning a home into a tangible reality.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent mortgage brokerage in Iowa that specializes in helping clients obtain FHA loans. They prioritize personalized consultations and provide a wide selection of financing options, competitive rates, and expert guidance throughout the mortgage process.

What are the requirements to qualify for an FHA loan in Iowa?

To qualify for an FHA loan in Iowa, you typically need a minimum credit score of 580, which allows for a down payment as low as 3.5%. If your credit score is between 500 and 579, a larger down payment of 10% is required. Additionally, you must demonstrate stable income and maintain a debt-to-income (DTI) ratio below 43%.

Who can benefit from FHA loans in Iowa?

FHA loans in Iowa are particularly beneficial for first-time homebuyers and individuals with limited savings or less-than-perfect credit histories. They offer lower initial costs and flexible qualification criteria, making homeownership more accessible for a wider audience.

What are the advantages of FHA loans in Iowa?

FHA loans in Iowa provide several advantages, including a minimal down payment requirement of just 3.5%, adaptable credit standards, and the ability to include closing costs in the mortgage amount. These features enhance overall affordability, making FHA loans a viable option for many families.

How prevalent are FHA loans among first-time homebuyers in Iowa?

Approximately 40% of first-time homebuyers in Iowa utilize FHA loans for their financing, indicating their effectiveness in facilitating affordable homeownership in the state.

How does F5 Mortgage assist clients in the FHA loan process?

F5 Mortgage supports clients by helping them understand the FHA loan requirements and guiding them through the application process to ensure they meet the necessary criteria for FHA financing.