Introduction

Navigating the mortgage landscape can feel overwhelming for families, often filled with confusion and uncertainty. We know how challenging this can be. However, utilizing a mortgage broker service offers a wealth of advantages that can make this journey more manageable and informed. By partnering with a broker, families gain access to personalized consultations, diverse loan options, and expert negotiation strategies, all designed to secure the best possible mortgage terms.

But what if families realize they could be missing out on substantial savings and tailored support by not engaging with a broker? Exploring the ten key benefits of using a mortgage broker service reveals how this choice can significantly enhance the home-buying experience. We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Consultations for Tailored Solutions

At F5 Lending, we understand how challenging navigating the mortgage process can be for families when they seek a mortgage broker service. That’s why we excel in offering tailored loan consultations that take a close look at your household’s unique financial situation, preferences, and long-term goals.

This personalized approach not only boosts your chances of securing favorable mortgage terms and rates through a mortgage broker service but also empowers you to manage the complexities of mortgage financing with confidence. Our dedicated loan officers are here to tackle the unique challenges you face while improving your home, ensuring you feel supported every step of the way.

Clients often share their appreciation for our exceptional communication and problem-solving skills, which contribute to a stress-free experience. By prioritizing your individual needs, we ensure that you receive solutions tailored to your specific circumstances.

Ultimately, our goal is to foster a smoother and more informed home-buying experience through our mortgage broker service for you and your family. We know how important this journey is, and we’re here to support you through it.

Access to Diverse Loan Programs: Unlocking More Options with a Broker

When you engage with a mortgage broker like F5 Mortgage, you open the door to a wide range of loan programs. These include fixed-rate loans, FHA loans, VA loans, and jumbo loans. This variety allows families to find financing options that truly fit their financial situations and homeownership dreams.

We understand how overwhelming this process can be. Brokers excel at connecting clients with lenders who offer the most competitive rates and terms. This ensures that families can make informed choices tailored to their unique needs.

Current trends show that fixed-rate loans are a popular choice for those seeking stability in their monthly payments. FHA loans, with their lower down payment options, make homeownership more accessible for many. For veterans and active-duty service members, VA loans provide significant savings and favorable terms, often leading to lower overall costs. And for those looking to purchase higher-priced homes, jumbo loans offer financing that meets specific needs.

Experts in the lending field emphasize that working with a broker can lead to substantial savings. In fact, families who partner with mortgage brokers save an average of $10,662 over the life of their loans compared to those who go with retail lenders. This financial benefit, combined with personalized service and expert advice, makes brokers invaluable for anyone navigating the complexities of home financing.

We know how challenging this can be, but remember, you don’t have to do it alone. Consider reaching out to a mortgage broker who can guide you every step of the way.

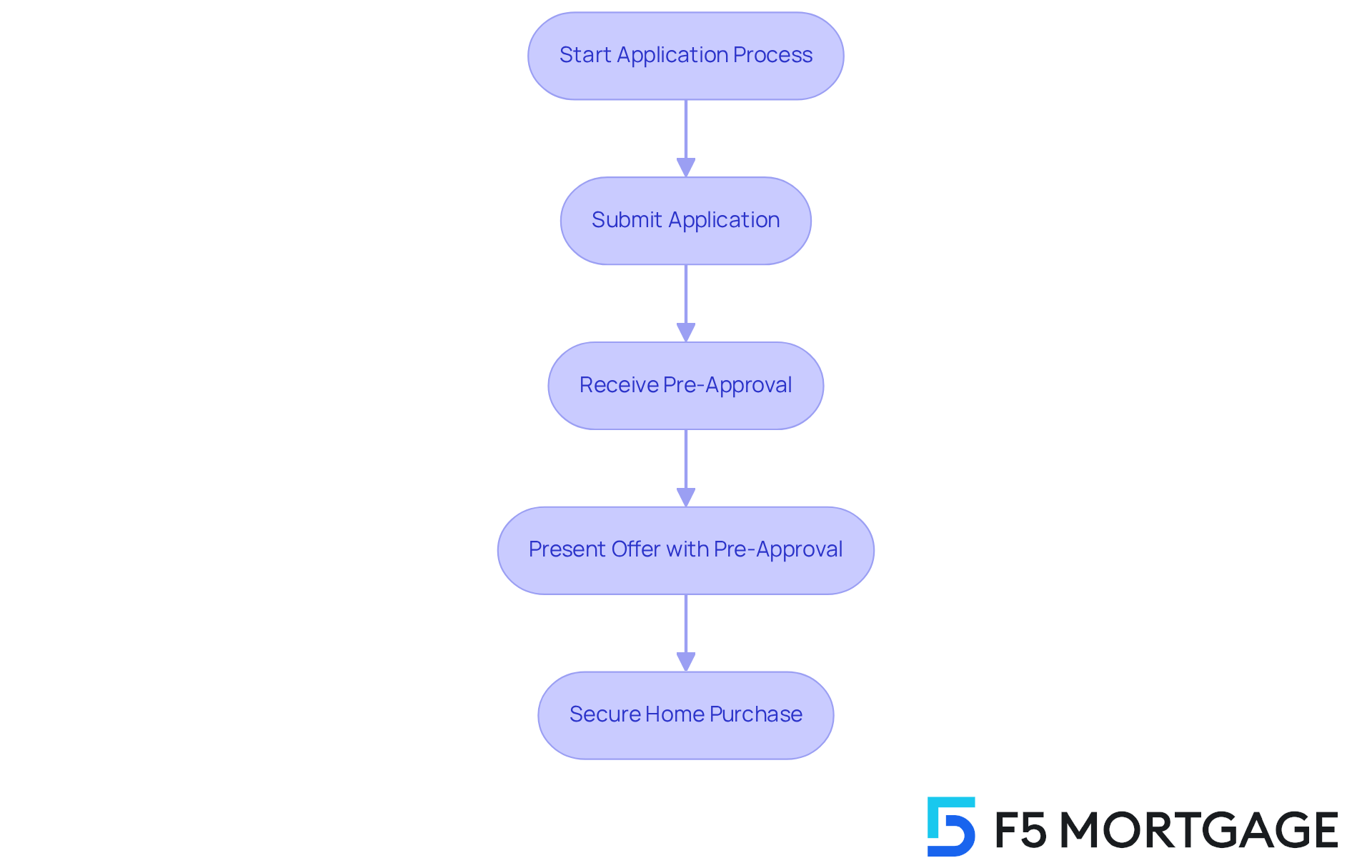

Streamlined Application Process: Fast Pre-Approval for Home Purchases

At F5 Finance, we understand how challenging the home-buying process can be. That’s why we offer a streamlined application process that allows households to obtain pre-approval in under an hour. In today’s competitive housing market, where homes can sell in just days or even hours, this rapid turnaround is crucial.

A pre-approval not only shows that you’re financially ready but also positions you as a serious contender. This significantly enhances your chances of having your offers accepted. Did you know that sellers often overlook offers without a pre-approval attached? This makes it essential for you to act swiftly when you find that perfect home.

By utilizing advanced technology, we make it easier for you to make prompt choices. Buyers with fast pre-approval letters are more likely to have their offers considered. It signals to sellers that you’re prepared to follow through on your commitments. This proactive approach not only saves you valuable time but also helps you navigate the complexities of home buying with confidence.

We’re here to support you every step of the way, ensuring that you feel empowered in your journey to homeownership.

Negotiating Competitive Rates: How Brokers Secure Better Deals

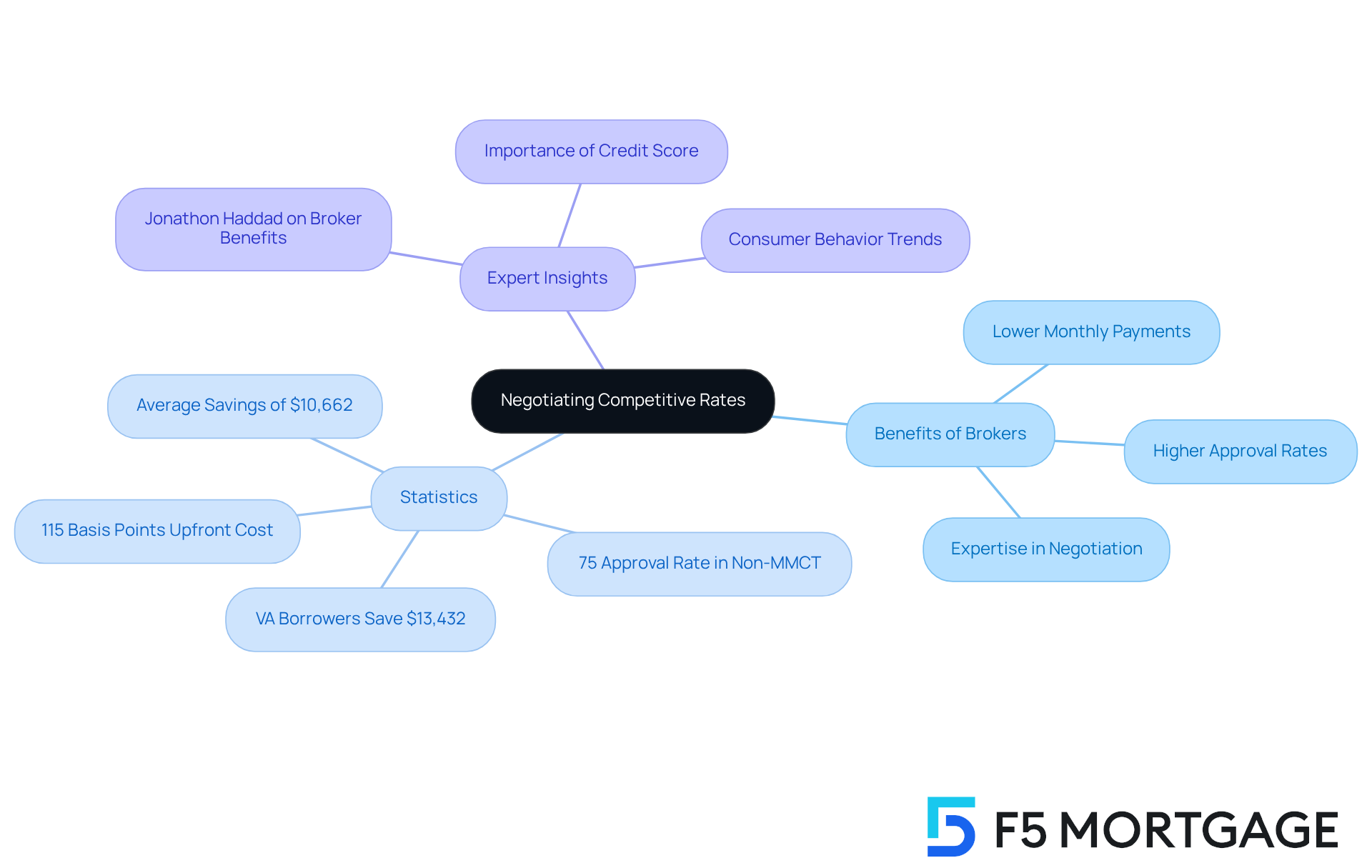

Navigating the world of loans can be overwhelming, and we know how challenging this can be. That’s where a mortgage broker service like F5 Finance comes in, providing invaluable expertise in negotiating favorable rates for individuals. With established relationships across a diverse array of lenders, brokers can leverage these connections to secure better deals for you.

Imagine lowering your monthly payments and reducing overall loan costs – this is not just a dream, but a reality that can make homeownership significantly more affordable for families. With F5 Home Loans, you can enjoy flexible rates and a streamlined process that allows for pre-qualification in just 10 minutes, all without any commitment or hidden costs.

Statistics from a study by Polygon Research reveal that consumers save an average of $10,662 over the life of their loans when utilizing mortgage broker services compared to nonbank retail lenders. This is a substantial saving that can ease financial burdens.

Moreover, brokers achieve a higher approval rate in the wholesale channel. In non-Majority Minority Census Tracts (MMCT), 75% of applications are approved, compared to just 64% for retail lenders. This means more families can access the financing they need.

Financial experts emphasize that having a good credit score and strong financial standing can enhance your negotiating power, allowing you to secure even better rates. As Jonathon Haddad, CEO of the Association of Independent Loan Experts, points out, mortgage broker services like F5 Lending not only provide better offers but also successfully connect with minority communities.

By nurturing solid connections with lenders, F5 Financing empowers families to navigate the complexities of loan financing with confidence. We’re here to support you every step of the way, ensuring you find the best possible solutions for your home financing needs.

Educational Resources: Empowering Clients with Knowledge and Support

At F5, we understand how challenging it can be to navigate the mortgage broker service process. That’s why we offer a wide range of educational resources, including detailed home buyer’s guides and refinancing materials. These tools are designed to equip you with the essential knowledge you need to navigate the complexities of financing with confidence.

Imagine being able to explore different loan options and understand the intricacies of home purchasing. With F5 Mortgage, you’re not just informed; you’re empowered to make sound financial choices. This educational approach significantly boosts your confidence, allowing you to embark on your financial journey with clarity and certainty.

The availability of our guides plays a crucial role in shaping your decisions when using our mortgage broker service. They provide the necessary tools to grasp your financial commitments and explore the options that suit your needs best. We’re here to support you every step of the way, ensuring that you feel prepared and knowledgeable.

Ultimately, our dedication to educating customers fosters a nurturing environment where families can thrive in their quest for homeownership. Let us help you take the next step toward your dream home.

Personalized Service: Tailoring Solutions to Individual Client Needs

At F5 Mortgage, we understand how challenging the process can be when utilizing a mortgage broker service. That’s why our mortgage broker service focuses on providing personalized service at the heart of what we do. Each customer benefits from customized loan solutions that take into account their unique financial situations, preferences, and goals. This tailored approach not only boosts customer satisfaction but also fosters lasting relationships, as families feel valued and understood throughout their financing journey with the mortgage broker service.

As Ruth Vest shared, “F5 delivered… my loan officer, Jeff worked out an acceptable loan package.” This highlights our team’s unwavering commitment to providing exceptional mortgage broker service. In fact, studies reveal that borrowers who receive personalized guidance are 2.3 times more likely to return for future loans. This underscores the importance of tailored solutions in building client loyalty.

Jeff Bozimowski, one of our dedicated loan officers, brings over 10 years of experience in crafting loan solutions that meet diverse financial needs. He ensures that every family receives the support they deserve. By focusing on the specific requirements of households, including exploring down payment assistance programs, F5 Mortgage ensures a nurturing and empowering mortgage broker service. We aim to make the complex loan process more manageable and less stressful for you.

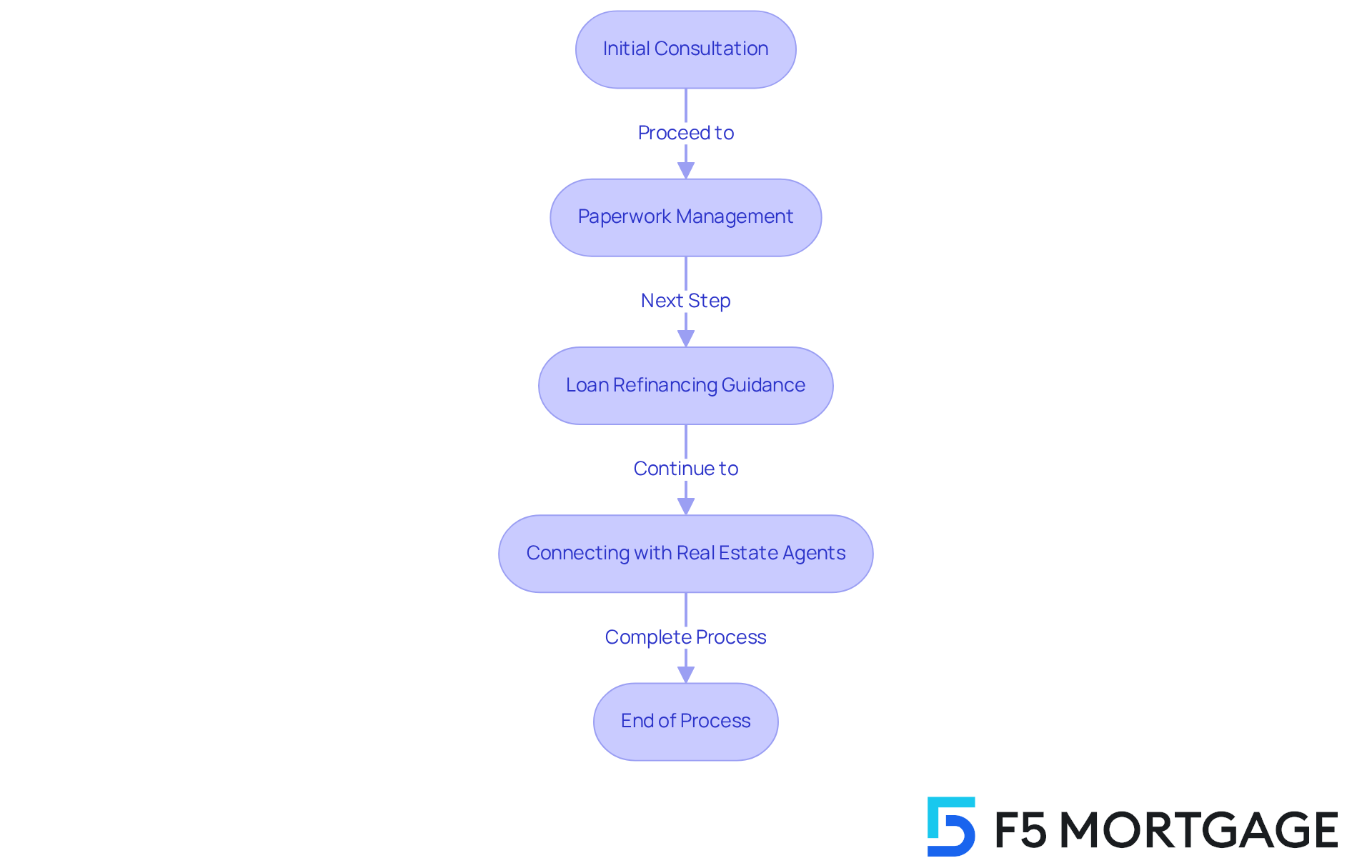

Simplifying Complex Processes: Reducing Paperwork and Stress

At F5 Mortgage, we understand how challenging the lending process can be. It often feels overwhelming, but we’re here to support you every step of the way. Our mortgage broker service manages the paperwork and administrative tasks, significantly lessening the burden on families and allowing you to focus on discovering your ideal home. This streamlined approach not only reduces stress but also clears up confusion, enhancing your overall experience with the mortgage broker service.

We know that navigating loan refinancing can be daunting. That’s why F5 Mortgage provides a thorough step-by-step guide through their mortgage broker service, ensuring you comprehend your options – from researching lenders to finalizing your new financing. We’re committed to making this journey as smooth as possible for you.

Moreover, F5 Lending connects you with leading real estate agents who can provide tailored assistance during the application process. Whether you prefer to reach out online, by phone, or through chat, we simplify the process of obtaining the best loan offers. Let us help you take the next step toward your dream home.

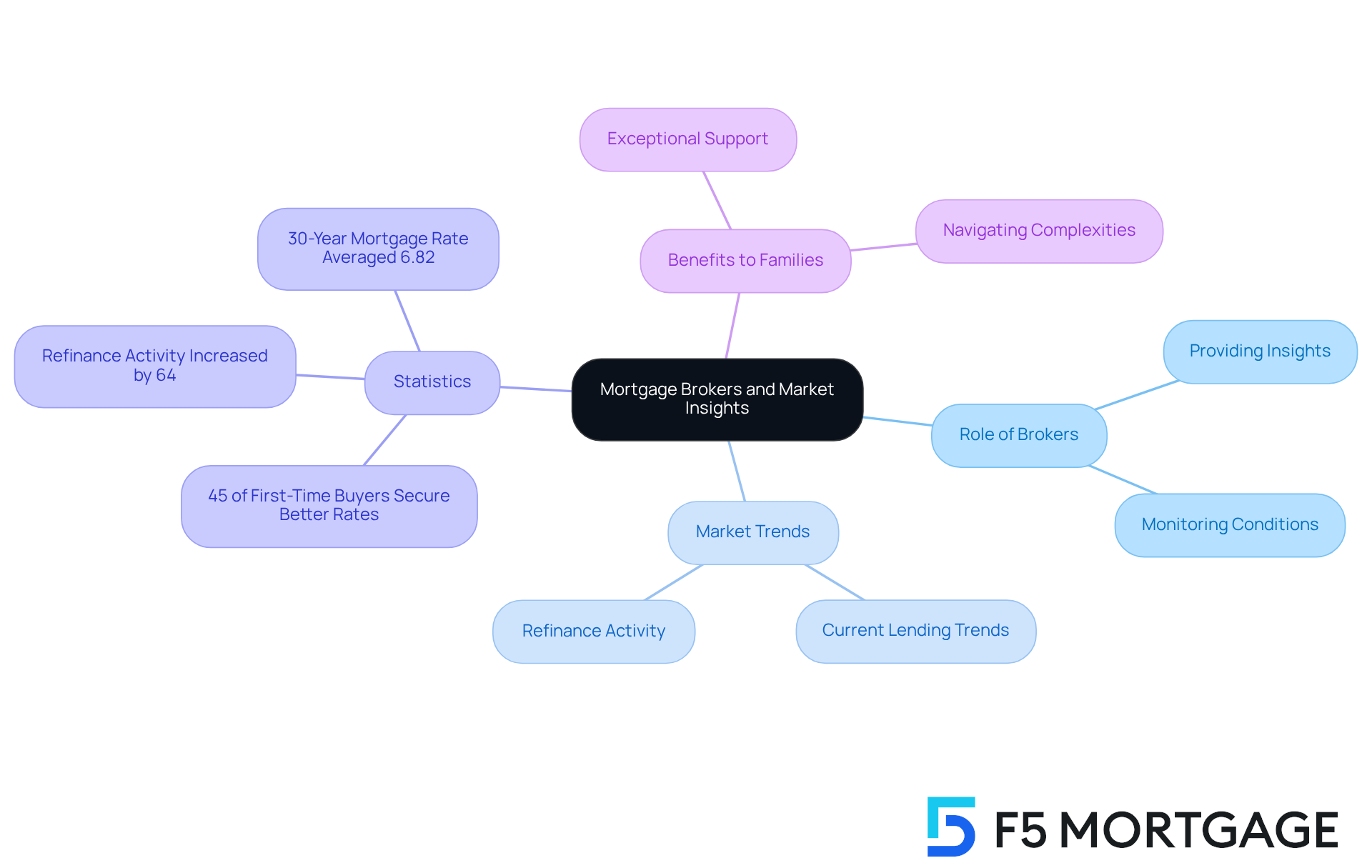

Market Insights: Brokers Provide Valuable Information for Informed Choices

Navigating the mortgage landscape can feel overwhelming, but our mortgage broker service, like F5 Loan, is here to help. They provide households with vital insights into current lending trends and practices, making the process clearer and more manageable. As one of the leading independent loan brokers in the country, F5 Mortgage prioritizes serving customers over investors, ensuring that families receive exceptional support throughout their financing journey.

We know how challenging this can be, especially when making informed choices about financing options and timing. Recent statistics reveal that 45% of first-time home buyers who engage with multiple lenders secure better rates. This underscores the importance of having a comprehensive understanding of the market. Brokers continuously monitor market conditions, allowing them to advise clients on the best times to secure loans and identify a wide range of mortgage products tailored to their unique financial situations.

With refinance activity increasing by 64% year-over-year in Q1 2025, families can greatly benefit from the mortgage broker service expertise. They help navigate the complexities of the mortgage process, ensuring families are well-prepared to seize advantageous opportunities. We encourage families to consult with F5 to explore their options based on these current market trends. Together, we can leverage personalized support and extensive lender partnerships to find the best solutions for your needs.

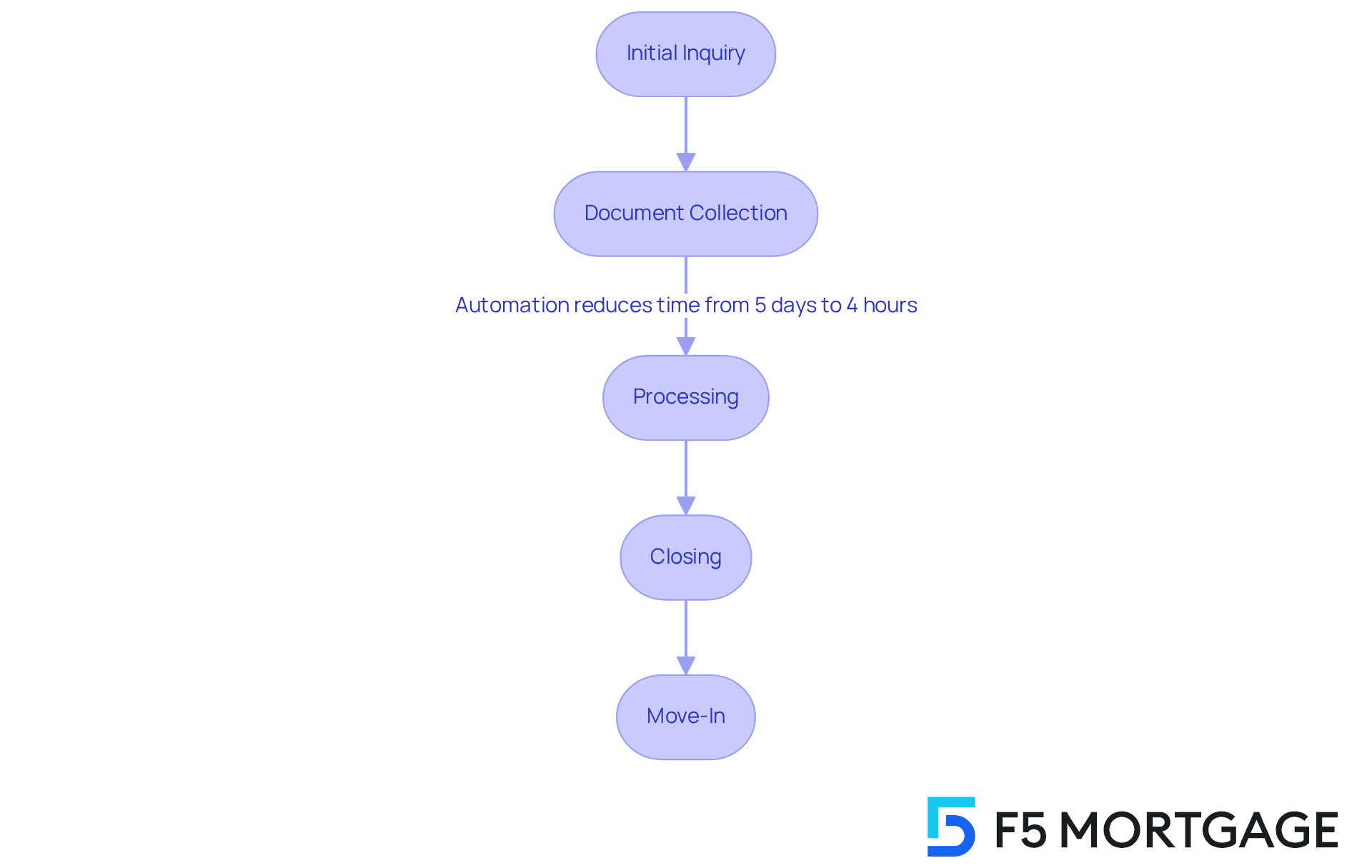

Faster Closings: How Brokers Expedite the Mortgage Process

At F5 Financing, we understand how overwhelming the mortgage process can be, especially when navigating it without a mortgage broker service. That’s why we pride ourselves on our swift and effective closing process, with most loans completed in less than three weeks. This impressive speed is made possible through meticulous communication and coordination with lenders, ensuring that all required documentation is processed without delay. For families eager to settle into their new homes, this expedited closing process offers a considerable advantage, allowing for a smooth and quick transition.

Imagine being able to move into your new home without the usual stress. Statistics show that brokers using automated document retrieval systems report spending 70% less time on document collection. This means the time from initial inquiry to complete documentation is reduced from five days to just four hours!

We’re here to support you every step of the way. F5 Financing operates Monday through Friday from 8:30 am to 11:00 pm (EST) and Saturday from 8:30 am to 5:00 pm (EST), providing ample opportunity for you to reach out for assistance. Mike Boggiano, national sales manager for Silver Hill Funding, emphasizes that effective communication is essential for successful closings, which further underscores the benefits of utilizing a mortgage broker service.

Our dedication to outstanding client satisfaction shines through in our 5-star ratings on platforms like Lending Tree, Google, and Zillow. Clients consistently commend our team’s expertise and assistance throughout the loan process. By streamlining the mortgage experience, we not only alleviate the stress associated with home purchases but also empower families to move forward with confidence and ease.

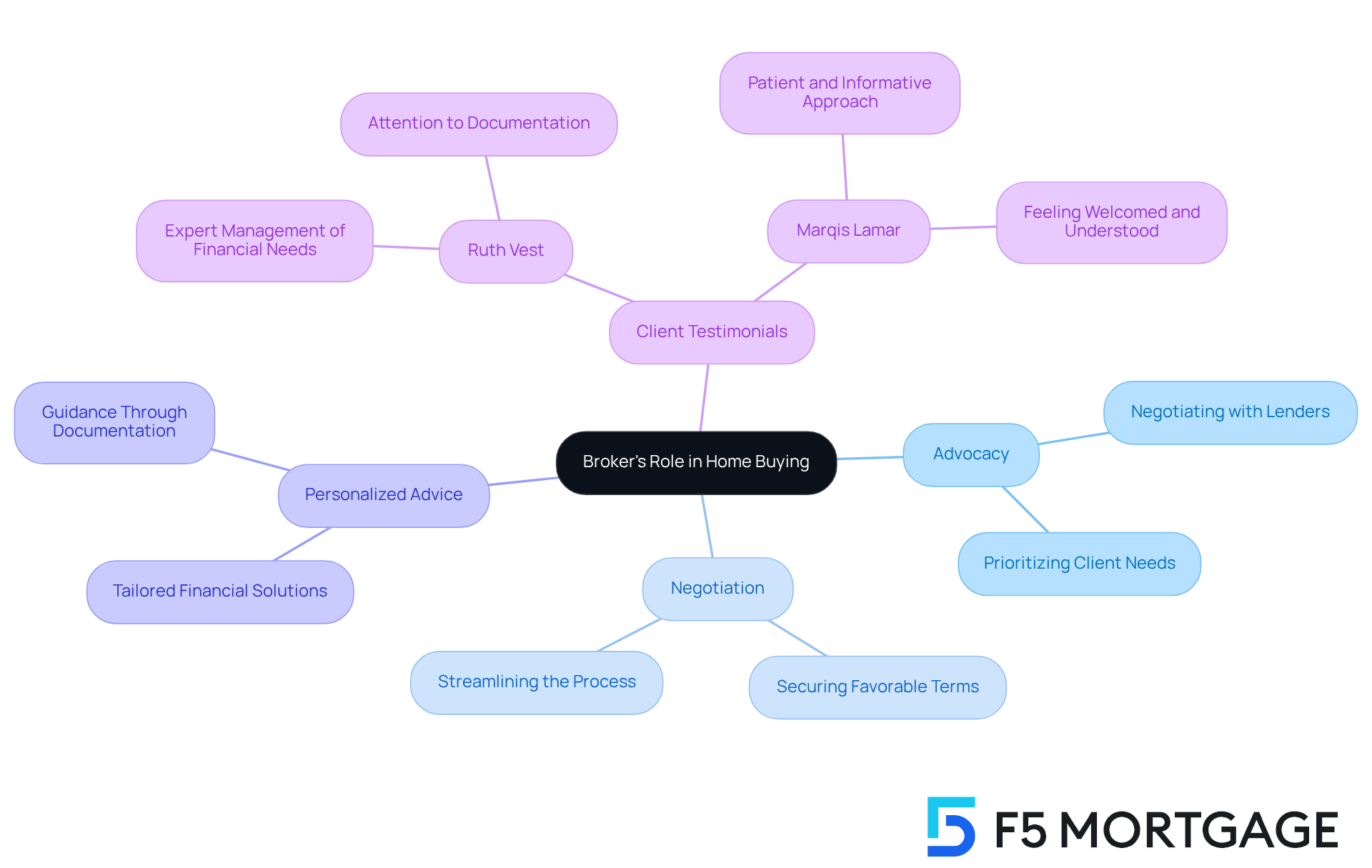

Dedicated Advocacy: The Broker’s Role in Your Home Buying Journey

Home loan brokers are here to support families every step of the way, guiding them through the often overwhelming house purchasing process. We know how challenging this can be, and that’s why brokers advocate for you by negotiating with lenders, offering personalized advice, and ensuring your needs are prioritized.

At F5 Financial, our customers have expressed heartfelt gratitude for the exceptional assistance they received. For example, Ruth Vest shared how our team expertly managed her financial needs, with loan officer Jeff ensuring all documentation was perfectly in order. Similarly, first-time homebuyer Marqis Lamar praised John Cagle for his patient and informative approach, making him feel welcomed and understood throughout the journey.

Moreover, Ryan’s outreach and the quick closing times highlighted by other customers further emphasize F5’s commitment to your satisfaction. By acting in the best interests of families, brokers like those at F5 Mortgage strive to provide a smoother and more successful mortgage broker service. We connect clients with top realtors to provide the best mortgage broker service, ensuring you feel supported and empowered in your decisions.

Conclusion

Engaging the services of a mortgage broker can truly enhance the home-buying experience for families. We understand how overwhelming this process can be, and that’s where personalized consultations come in. With access to a variety of loan programs and expert negotiation skills, mortgage brokers like F5 Mortgage empower families to navigate the complexities of financing with confidence and ease. The tailored solutions they provide ensure that each family’s unique financial situation and goals are met, leading to a more satisfying journey toward homeownership.

Throughout this article, we’ve highlighted key benefits of working with a mortgage broker. From streamlined application processes to valuable educational resources and dedicated advocacy, families can save substantial amounts over the life of their loans. Brokers leverage their expertise to secure competitive rates and favorable terms, making the daunting task of securing a mortgage feel much more manageable. The emphasis on personalized service fosters lasting relationships, enhancing overall satisfaction.

In conclusion, if you’re a family looking to buy a home, consider the invaluable support that mortgage brokers offer. By simplifying the mortgage process, reducing stress, and providing critical market insights, brokers play a pivotal role in helping families make informed decisions. Embracing the advantages of working with a mortgage broker can lead to a smoother path toward homeownership, ensuring that families not only find their dream home but also thrive in the journey to achieve it. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers personalized mortgage consultations that consider your household’s unique financial situation, preferences, and long-term goals, helping you secure favorable mortgage terms and rates.

How does F5 Mortgage support clients during the mortgage process?

F5 Mortgage provides dedicated loan officers who tackle unique challenges, offer exceptional communication, and problem-solving skills, ensuring a stress-free experience and tailored solutions for each client.

What types of loan programs are available through F5 Mortgage?

F5 Mortgage offers a variety of loan programs including fixed-rate loans, FHA loans, VA loans, and jumbo loans, allowing families to find financing options that fit their financial situations and homeownership dreams.

What are the benefits of working with a mortgage broker like F5 Mortgage?

Working with a mortgage broker can lead to substantial savings, with families saving an average of $10,662 over the life of their loans compared to retail lenders. Brokers also provide personalized service and expert advice tailored to your needs.

How does F5 Mortgage streamline the application process?

F5 Mortgage offers a streamlined application process that allows households to obtain pre-approval in under an hour, which is crucial in today’s competitive housing market.

Why is obtaining a pre-approval important when buying a home?

A pre-approval shows that you’re financially ready and positions you as a serious contender, significantly enhancing your chances of having your offers accepted by sellers.

How does F5 Mortgage utilize technology in the pre-approval process?

F5 Mortgage uses advanced technology to facilitate prompt choices, allowing buyers to quickly obtain pre-approval letters, which signals to sellers that they are prepared to follow through on their commitments.