Introduction

Navigating the path to homeownership can feel overwhelming, especially for families striving for financial stability in a changing housing market. We understand how challenging this can be. FHA loans, backed by the Federal Housing Administration, provide a vital lifeline with their appealing features, like low down payments and flexible credit standards.

Yet, the intricacies of the FHA loan application process can pose their own set of challenges. How can families effectively tackle these hurdles? By streamlining their online application, they can take significant steps toward achieving their dream of owning a home. We’re here to support you every step of the way.

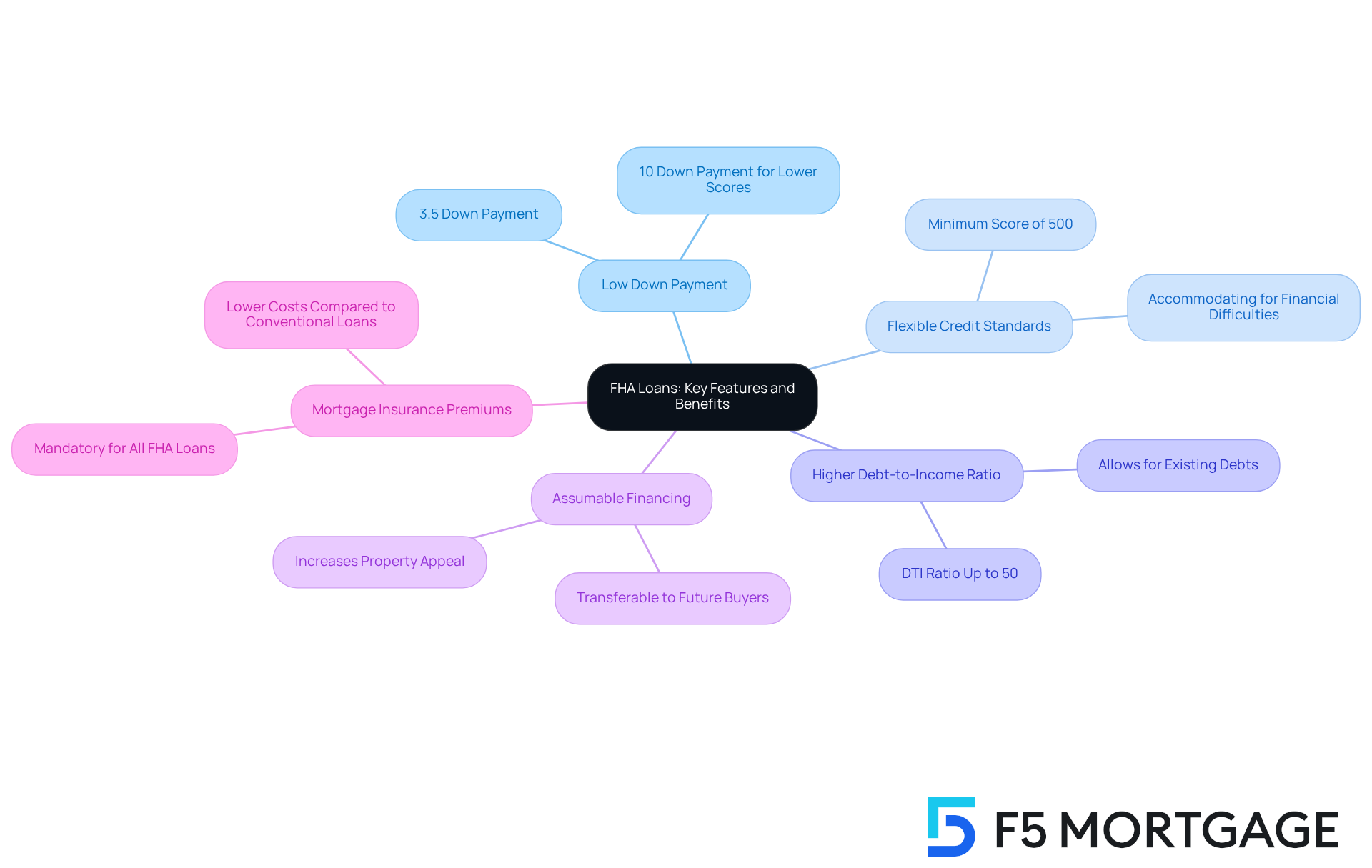

Understand FHA Loans: Key Features and Benefits

FHA mortgages, backed by the Federal Housing Administration, are here to help families achieve their dream of homeownership with more favorable terms. We know how challenging this can be, so let’s explore some key features and benefits that make FHA loans a great option:

Low Down Payment: With a minimum down payment of just 3.5% for borrowers with a credit score of 580 or higher, homeownership becomes significantly more attainable. Even if your score is between 500 and 579, you can still qualify with a larger down payment of 10%. This opens doors for many families.

Flexible Credit Standards: Unlike traditional financing, FHA options are more accommodating. If your credit score is as low as 500, you can still qualify, as long as you meet the down payment criteria. This flexibility is especially beneficial for families who have faced financial difficulties.

Higher Debt-to-Income Ratio: FHA financing allows a debt-to-income (DTI) ratio of up to 50%. This means that families with existing debts can qualify more easily, making it a crucial feature for those balancing multiple financial obligations while seeking homeownership.

Assumable Financing: One unique aspect of FHA mortgages is that they can be assumed by future buyers. This can make your property more attractive if you decide to sell, giving you an edge in a competitive real estate market.

Mortgage Insurance Premiums: While FHA mortgages do require mortgage insurance, the overall costs can still be lower compared to traditional financing, especially for borrowers with lower scores. This makes FHA financing a financially feasible choice for families looking to buy their first home or refinance an existing mortgage.

Looking ahead to 2025, we anticipate that the average score for FHA applicants will reflect these flexible requirements, allowing even more families to benefit from the program’s accessibility. Case studies show that many households who once faced credit challenges have successfully obtained FHA financing, helping them realize their homeownership dreams. With these advantages, FHA mortgages remain a favored option for families navigating the complexities of the housing market. We’re here to support you every step of the way!

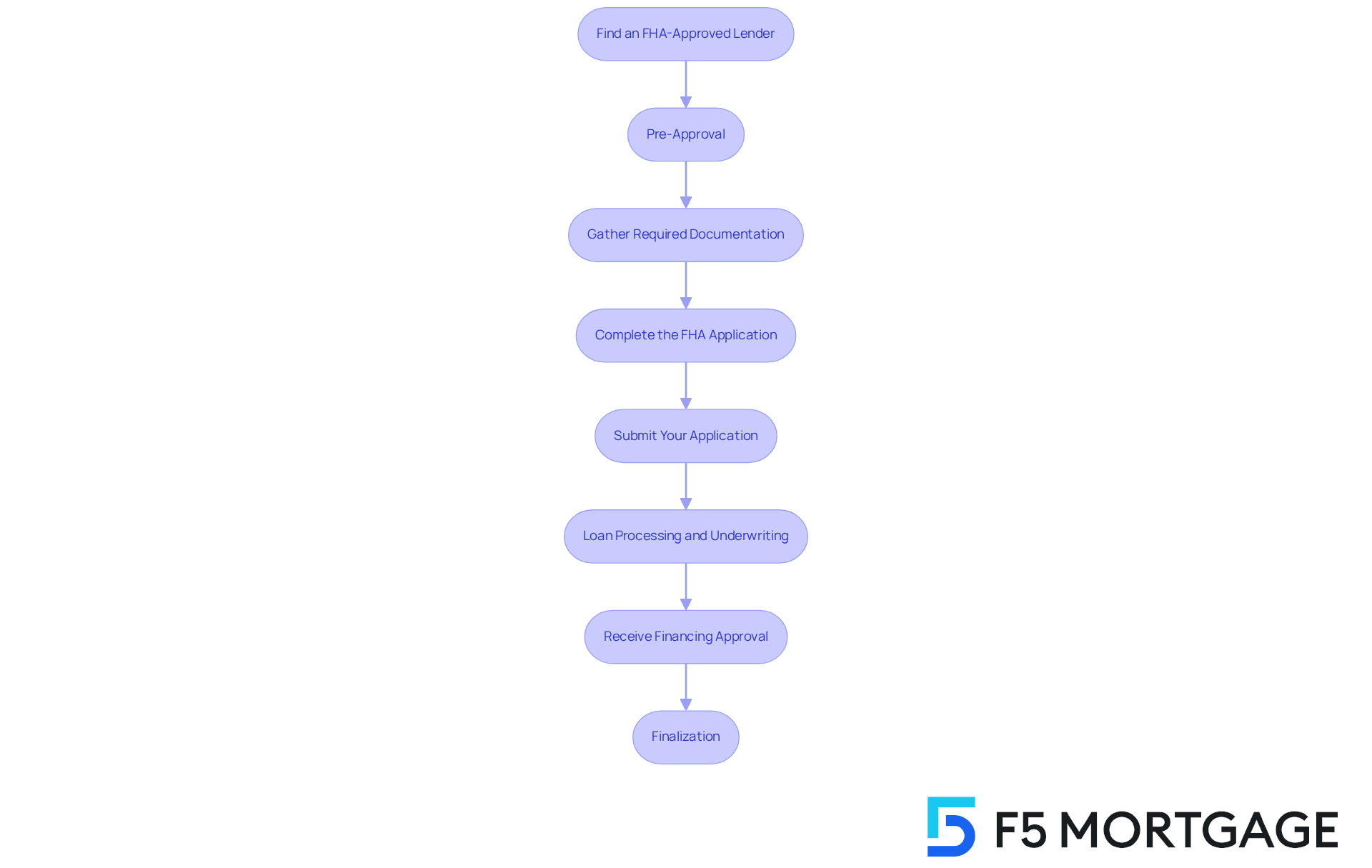

Follow the FHA Loan Application Process: Step-by-Step Instructions

Applying for an FHA mortgage can feel overwhelming, but we’re here to support you every step of the way. Here’s a straightforward guide to help you navigate the process with confidence:

Find an FHA-Approved Lender: Start by researching and selecting a lender approved by the FHA. You can find a comprehensive list of approved lenders on the HUD website, ensuring you choose a reliable partner for your mortgage journey.

Pre-Approval: Next, submit a pre-approval application to your chosen lender. This step typically requires you to provide financial information, including your income, debts, and credit history. On average, it takes about 30 to 45 days to obtain pre-approval for an FHA mortgage, so it’s essential to begin early. Remember, a maximum Debt-to-Income (DTI) ratio of 43% is usually necessary for home financing, which can impact your mortgage rates.

Gather Required Documentation: Prepare the necessary documents to support your application. This may include:

- Recent pay stubs

- W-2 forms from the last two years

- Bank statements

- Tax returns

- Identification (e.g., driver’s license, Social Security card)

Complete the FHA Application: Fill out the FHA application form provided by your lender. Make sure all information is accurate and complete to avoid any delays in processing.

Submit Your Application: Once your application is complete, submit it along with your documentation to your lender for review. This submission kicks off the financing processing and underwriting phase.

Loan Processing and Underwriting: After submission, your lender will process your application, verifying your financial information and assessing your creditworthiness. FHA financing generally allows credit scores as low as 580, making it accessible to a wider range of borrowers. Understanding your DTI can also help you qualify for better mortgage rates.

Receive Financing Approval: If approved, you’ll receive a financing estimate outlining the terms of your financing, including interest rates and closing costs. This estimate is crucial for understanding your financial commitment.

Finalization: Finally, attend the closing meeting to sign the necessary documents and complete your financing. This step marks the culmination of your efforts and the beginning of your homeownership journey.

By following these steps, you can streamline your FHA application process and apply for FHA loan online, helping you move closer to achieving your homeownership goals. We know how challenging this can be, but with the right guidance, you can make it happen.

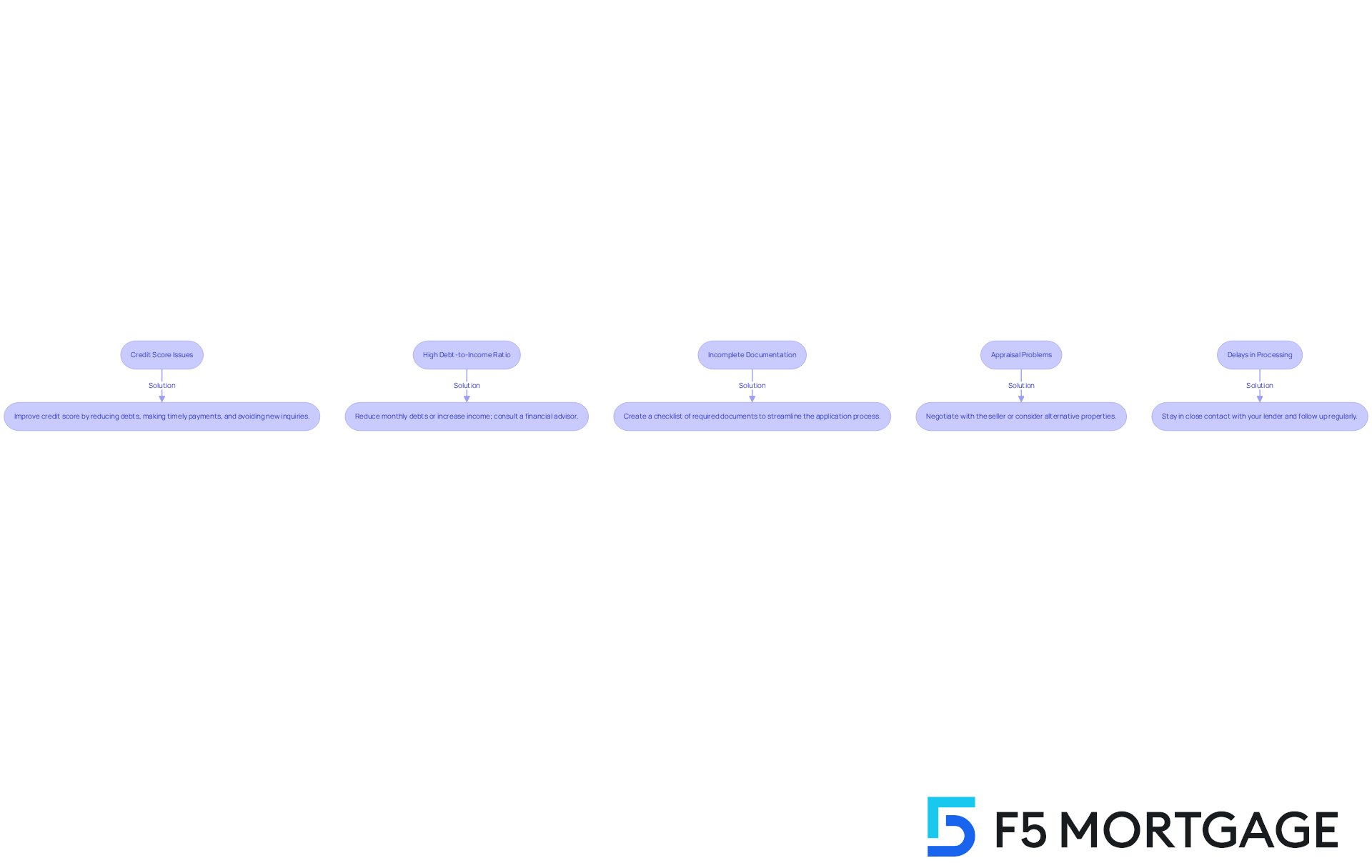

Overcome Common FHA Loan Application Challenges: Tips and Solutions

Applying for an FHA loan can feel overwhelming, and we know how challenging this can be. Many applicants encounter common hurdles, but with the right strategies, you can navigate these obstacles successfully. Here are some issues you might face and how to overcome them:

Credit Score Issues: If your credit score is below 580, it’s a good idea to focus on improving it before applying. Concentrate on reducing debts, making timely payments, and steering clear of new loan inquiries. A stronger credit score can significantly enhance your chances of securing favorable financing conditions.

High Debt-to-Income Ratio: Ideally, your debt-to-income (DTI) ratio should be 43% or lower for FHA applications. If your DTI exceeds this, consider ways to reduce monthly debts or boost your income. Many families have successfully managed high DTI ratios by consolidating debts or exploring additional income sources, like part-time work or freelance opportunities. Consulting a financial advisor can also provide personalized strategies tailored to your unique situation.

Incomplete Documentation: It’s crucial to gather and organize all required documents before submission. Create a checklist to track necessary items, such as proof of income, bank statements, and tax returns. This preparation can help prevent delays and streamline your application process.

Appraisal Problems: FHA mortgages require a property appraisal to ensure the home meets safety and value standards. If the appraisal comes in lower than expected, be ready to negotiate with the seller or consider alternative properties. Understanding the local market can empower you to make informed decisions during negotiations.

Delays in Processing: Stay in close contact with your lender throughout the process. Regular follow-ups can help expedite your application and address any issues promptly. Being proactive can make a significant difference in the timeline of your financing approval.

By anticipating these challenges and preparing accordingly, you can enhance your chances when you apply for FHA loan online. Remember, we’re here to support you every step of the way as you pave the path to homeownership.

Conclusion

FHA loans offer a wonderful opportunity for families eager to achieve homeownership. These loans provide accessible financing options tailored to various financial situations. By understanding key features like low down payments, flexible credit standards, and higher debt-to-income ratios, families can approach the mortgage process with greater confidence.

In this article, we’ve shared essential insights to help demystify the FHA loan application process. Key steps include:

- Obtaining pre-approval

- Gathering necessary documentation

- Recognizing potential challenges such as credit score issues and high debt-to-income ratios

Each of these components is vital for ensuring a smooth application experience, empowering families to overcome obstacles and realize their dreams of homeownership.

The significance of FHA loans is immense, especially as more families seek to take advantage of these favorable conditions in the years ahead. By embracing the guidance provided and preparing thoroughly for the application process, families can turn their aspirations into reality. Taking that first step toward homeownership is a journey worth embarking on, and with the right support, success is truly within reach.

Frequently Asked Questions

What is an FHA loan?

An FHA loan is a mortgage backed by the Federal Housing Administration, designed to help families achieve homeownership with more favorable terms.

What is the minimum down payment required for an FHA loan?

The minimum down payment for an FHA loan is 3.5% for borrowers with a credit score of 580 or higher. Borrowers with a credit score between 500 and 579 can qualify with a larger down payment of 10%.

How do FHA loans accommodate borrowers with low credit scores?

FHA loans have flexible credit standards, allowing borrowers with credit scores as low as 500 to qualify, provided they meet the down payment requirements.

What is the maximum debt-to-income ratio allowed for FHA loans?

FHA financing allows a debt-to-income (DTI) ratio of up to 50%, making it easier for families with existing debts to qualify for a mortgage.

What is assumable financing in relation to FHA loans?

Assumable financing means that FHA mortgages can be assumed by future buyers, which can make a property more attractive in a competitive real estate market.

Are there mortgage insurance premiums associated with FHA loans?

Yes, FHA loans require mortgage insurance premiums, but the overall costs can be lower compared to traditional financing, especially for borrowers with lower credit scores.

How are FHA loans expected to change by 2025?

By 2025, it is anticipated that the average credit score for FHA applicants will reflect the program’s flexible requirements, allowing even more families to benefit from FHA financing.

Who can benefit from FHA loans?

FHA loans are beneficial for families, especially those who have faced financial difficulties or have lower credit scores, helping them achieve their dream of homeownership.