Introduction

Navigating the complexities of mobile home mortgages can feel overwhelming, especially as the housing market changes and more families explore this affordable housing option. We understand how challenging this can be. It’s essential to grasp the unique financing mechanisms available for mobile homes, as this knowledge empowers prospective buyers to make informed decisions.

However, with a significant percentage of mortgage applications being rejected, you might wonder: what are the real challenges and opportunities when seeking a mortgage on a mobile home? This article aims to shed light on these questions. We’ll delve into the various types of loans, eligibility requirements, and the pros and cons of mobile home financing. By the end, you’ll be equipped with the insights you need to confidently explore your options and take the next steps toward securing your dream home.

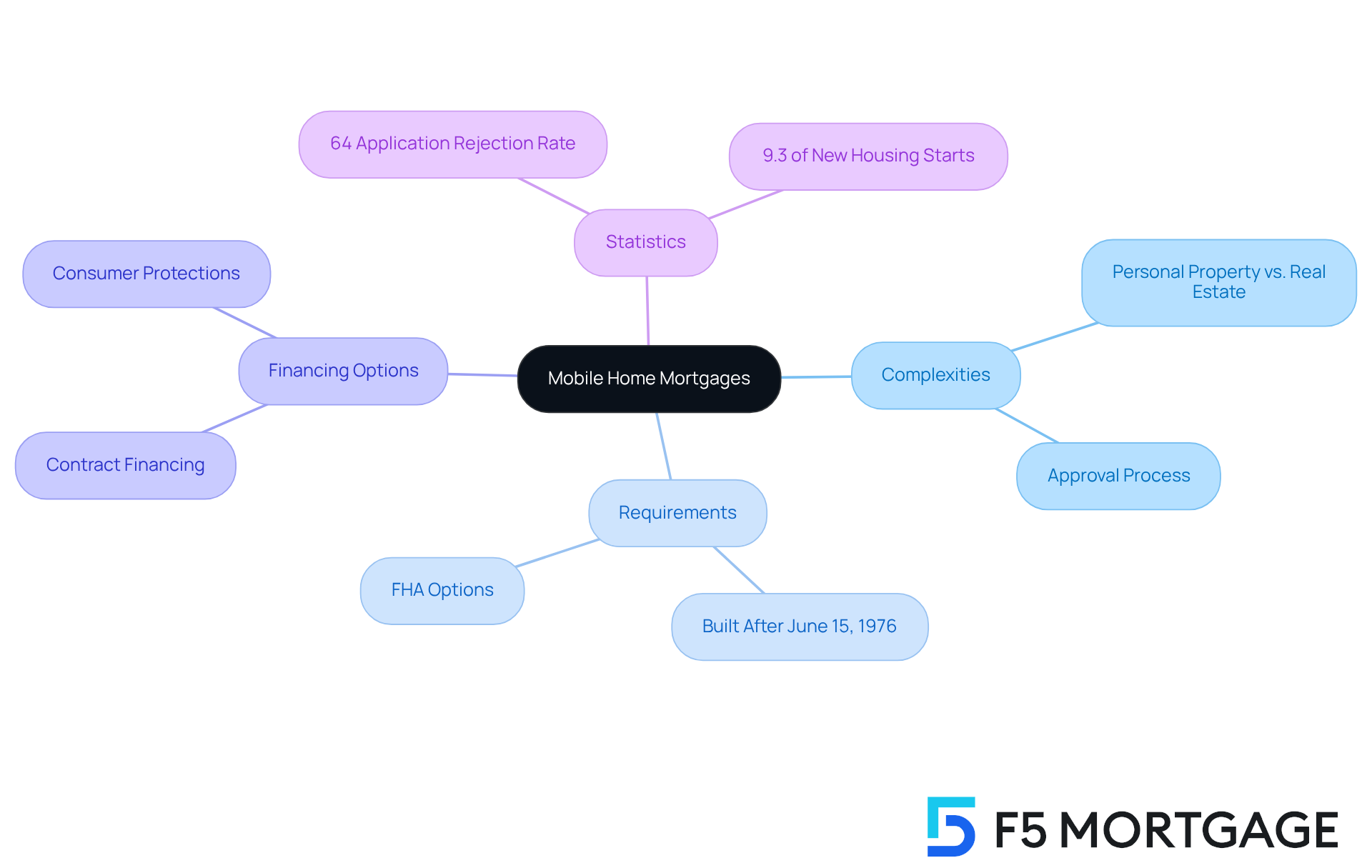

Understanding Mobile Home Mortgages

Navigating the world of mortgages for prefabricated residences can feel overwhelming, especially when considering questions like can you get a mortgage on a mobile home, and we understand how challenging this can be. These specialized financial products are designed for acquiring transportable or manufactured structures, but they come with their own set of complexities. Unlike conventional mortgages, which are backed by real estate, financing for manufactured homes often categorizes the dwelling as personal property. This distinction can significantly impact your financing options, the terms of your agreements, and the overall approval process.

For instance, did you know that manufactured residences typically need to meet specific standards, such as being built after June 15, 1976, to qualify for certain financing programs, including FHA options? It’s crucial to be aware of these requirements. In fact, around 20% of borrowers in the manufactured property sector rely on contract financing, which unfortunately lacks the consumer protections found in traditional mortgages. This makes it essential for you to fully understand your choices before moving forward.

Moreover, the question of can you get a mortgage on a mobile home can be quite challenging. In 2021, approximately 64% of housing-related applications were rejected, underscoring the importance of navigating this landscape with care. As mortgage experts emphasize, grasping these subtleties is vital for prospective buyers. Remember, manufactured residences account for 9.3% of all new single-family housing starts, highlighting their growing significance in the real estate market.

We’re here to support you every step of the way, ensuring you feel empowered and informed as you explore your options.

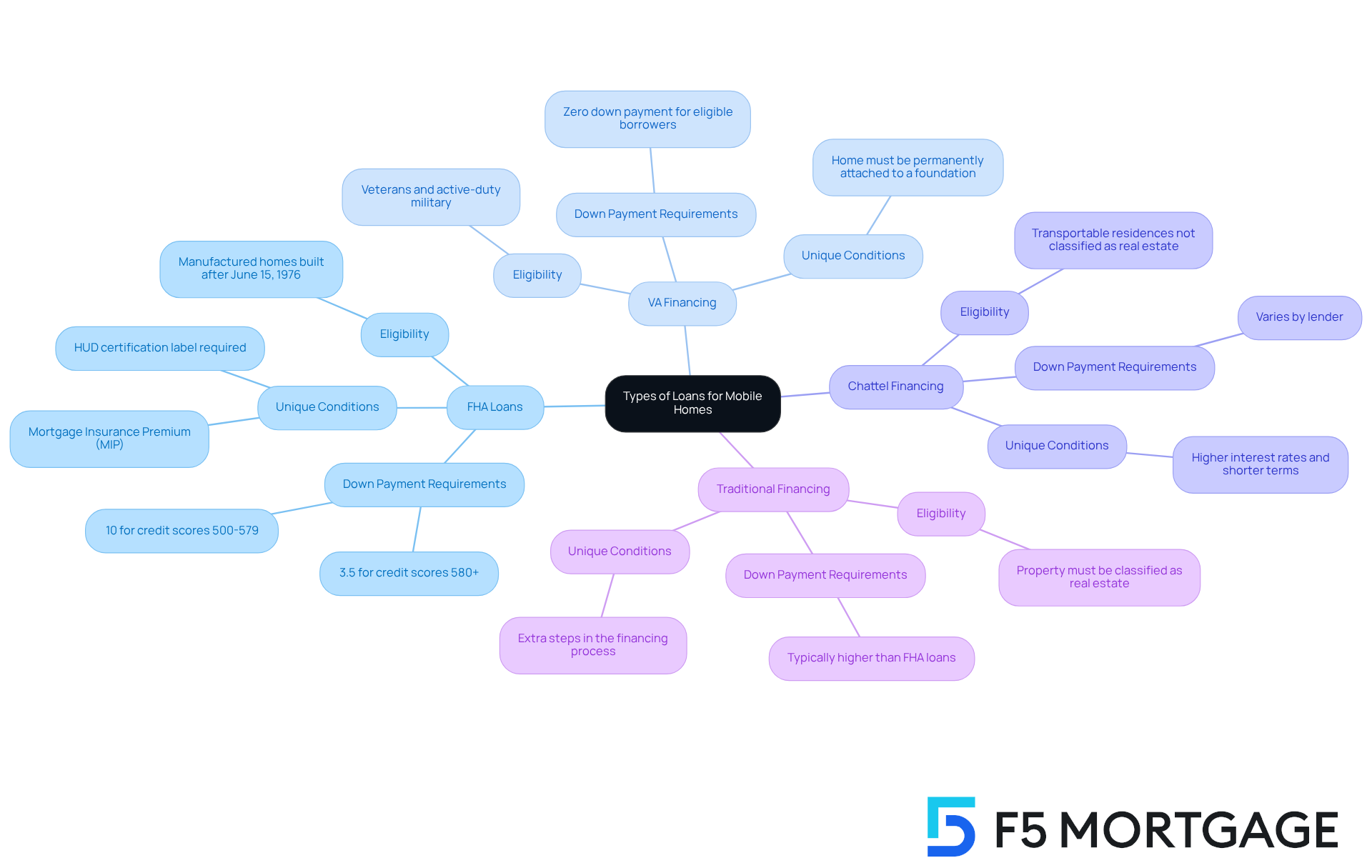

Types of Loans for Mobile Homes

Navigating financing options for mobile residences can feel overwhelming, especially when considering can you get a mortgage on a mobile home, but we’re here to support you every step of the way. There are various categories of financing available, each designed to meet distinct needs and situations. Let’s explore some common options:

FHA Loans: Backed by the Federal Housing Administration, these loans are available for manufactured homes built after June 15, 1976. They typically require a lower down payment, making them accessible for buyers with lower credit scores. This can be a great relief for many families.

VA Financing: If you’re a veteran or active-duty military personnel, VA financing is a wonderful option. It can be used to fund manufactured residences that are permanently attached to a foundation, providing you with a stable home.

Chattel Financing: This type of financing is specifically for transportable residences that aren’t classified as real estate. While it often comes with higher interest rates and shorter terms compared to traditional mortgages, it can still be a viable option for those in need.

Traditional Financing: Some lenders offer traditional financing for manufactured residences, but these typically require the property to be classified as real estate. This means there may be extra steps in the financing process, especially when considering if you can get a mortgage on a mobile home, which can feel daunting.

We know how challenging this can be, but understanding your options is the first step toward making an informed decision. Take your time to consider what works best for your family.

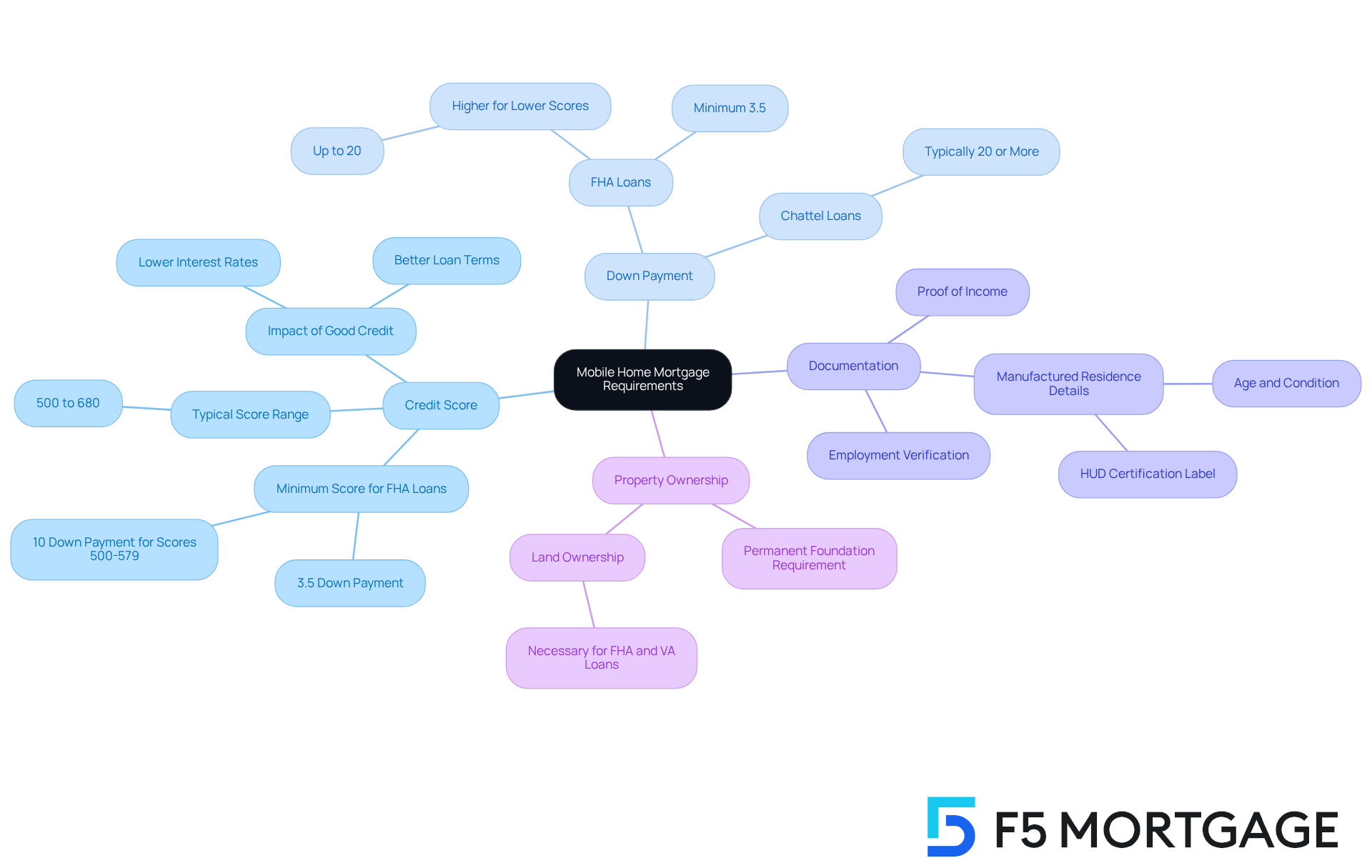

Requirements for Securing a Mobile Home Mortgage

Navigating the world of mobile home mortgages can feel overwhelming, but understanding the specific requirements can help you determine how you can get a mortgage on a mobile home. We know how challenging this can be, and we’re here to support you every step of the way. Here are some key requirements to consider:

Credit Score: Most lenders typically prefer a minimum credit score of 620. However, some may accept lower scores, especially for FHA mortgages, which can permit scores as low as 580 with a down payment of just 3.5%. This flexibility can greatly impact your ability to secure financing, particularly if you’re a first-time buyer.

Down Payment: Down payment requirements can vary widely. For FHA loans, it’s as low as 3.5%, while chattel loans might require 20% or more. The exact percentage often depends on your creditworthiness and the lender’s policies. If your credit score is lower, you might face higher down payment demands, sometimes reaching up to 20%.

Documentation: You’ll typically need to provide proof of income, employment verification, and details about the manufactured residence, including its age and condition. For FHA financing, a certification label confirming that the residence meets HUD standards is also necessary.

Property Ownership: For certain financing options, especially FHA and VA loans, the manufactured dwelling must be permanently attached to a foundation, and you must own the land where it’s located. This requirement is crucial for qualifying for more favorable loan terms and conditions.

For prospective purchasers, understanding these criteria is essential, especially when considering if they can get a mortgage on a mobile home. They can significantly affect the financing process and the overall affordability of owning a manufactured residence. By grasping these requirements, you empower yourself to make informed decisions on your journey to homeownership.

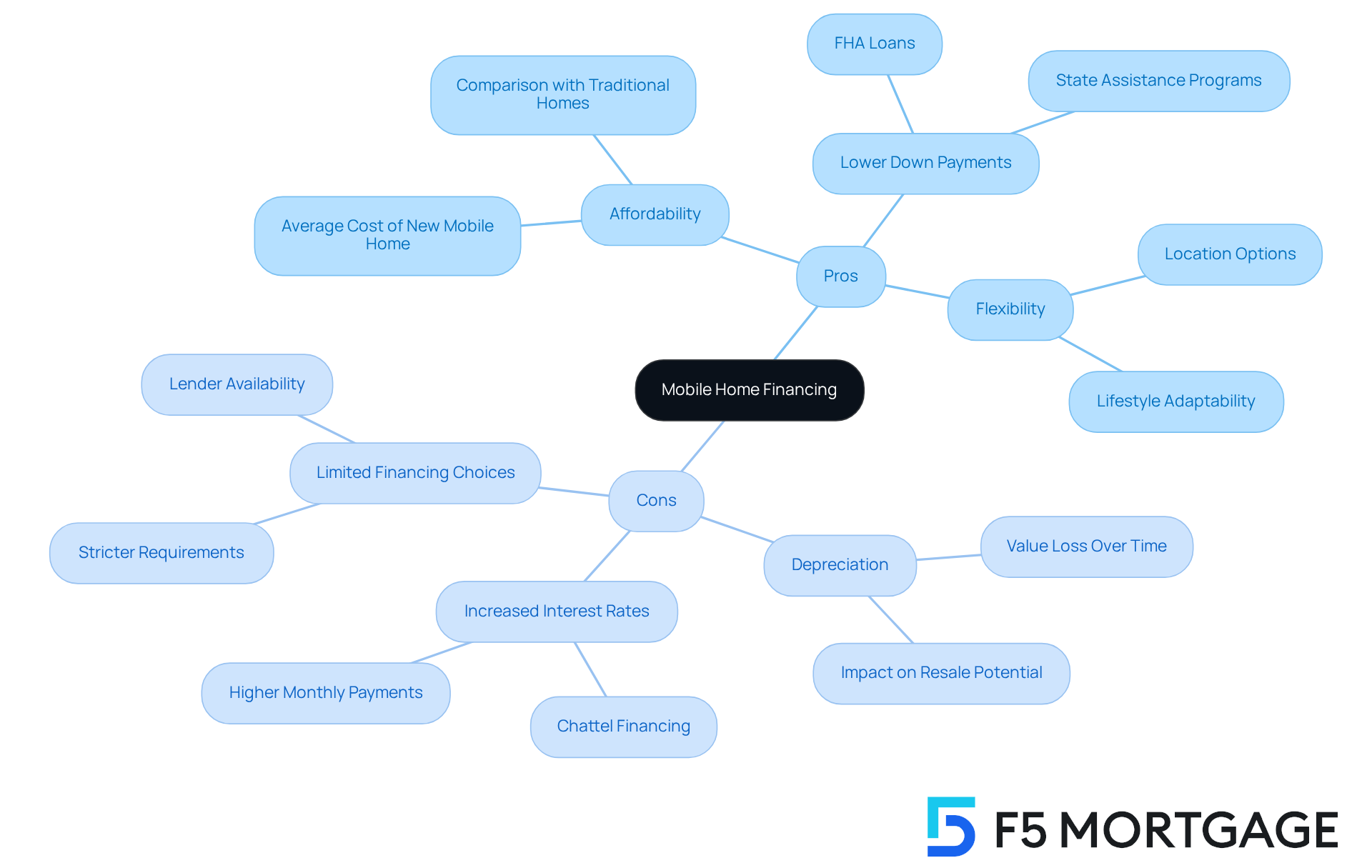

Pros and Cons of Mobile Home Financing

When considering financing options, one may wonder, can you get a mortgage on a mobile home, as it can be a journey filled with both opportunities and challenges. We understand how important it is to make informed decisions, so let’s explore the pros and cons together.

Pros:

- Affordability: Mobile homes often come with a significantly lower price tag than traditional homes. With the average cost of a new mobile home around $124,000, compared to over $400,000 for single-family homes, this option can be especially appealing for first-time buyers or those facing financial constraints.

- Lower Down Payments: Financing options like FHA loans can allow down payments as low as 3.5%. This makes homeownership more accessible for many. Plus, programs like the MyHome Assistance Program in California can provide up to 3% of the purchase price, while Texas offers up to 5% through the My Choice Texas program. In Florida, the Florida Assist Second Mortgage Program can help with up to $10,000 in upfront costs.

- Flexibility: Mobile homes can be placed in various locations, giving buyers the freedom to choose living arrangements that best suit their lifestyle and preferences.

Cons:

- Depreciation: One significant concern is that mobile homes can depreciate in value over time, much like vehicles. For instance, a $150,000 double-wide trailer might lose over $50,000 in value within just five years, which can impact resale potential.

- Increased Interest Rates: Financing for mobile properties, particularly chattel financing, often comes with higher interest rates compared to traditional mortgages. This can lead to increased monthly payments and overall financing costs.

- Limited Financing Choices: Not all lenders provide loans for manufactured homes, and those that do may have stricter requirements. This can make it challenging for some individuals to secure financing, especially if they have unique financial situations.

In summary, while mobile homes can offer an affordable path to homeownership, it’s crucial to ask, can you get a mortgage on a mobile home, and weigh the benefits against the potential risks of depreciation and financing challenges. We’re here to support you every step of the way as you navigate this important decision.

Conclusion

Navigating the mortgage landscape for mobile homes can feel overwhelming, and we understand how challenging this can be. However, grasping the various financing options and requirements is essential for prospective buyers. The key takeaway is that while securing a mortgage for a mobile home is indeed possible, it comes with unique considerations that differ from traditional home financing.

Let’s explore some key insights. There are different types of loans available, such as:

- FHA

- VA

- Chattel financing

Each is designed to meet specific needs and circumstances. Understanding the requirements – like credit scores, down payments, and property ownership – is crucial for successful financing. It’s important to weigh the pros and cons: mobile homes can be affordable and flexible, but they may also face depreciation and limited financing choices.

Ultimately, the journey to homeownership through mobile home financing can be rewarding. It requires careful thought and informed decision-making. By exploring the available options and understanding the implications of each choice, you can empower yourself to make the best financial decisions for your future. Remember, taking the time to research and ask the right questions will pave the way for a successful mortgage experience in the mobile home market. We’re here to support you every step of the way.

Frequently Asked Questions

Can you get a mortgage on a mobile home?

Yes, you can get a mortgage on a mobile home, but the financing options are different from conventional mortgages, as manufactured homes are often categorized as personal property rather than real estate.

What are the key differences between mobile home mortgages and conventional mortgages?

The main differences include the classification of the dwelling as personal property for mobile homes, which affects financing options, terms of agreements, and the approval process.

What standards must manufactured homes meet to qualify for certain financing programs?

Manufactured homes typically need to be built after June 15, 1976, to qualify for specific financing programs, including FHA options.

What percentage of borrowers in the manufactured property sector rely on contract financing?

Approximately 20% of borrowers in the manufactured property sector rely on contract financing, which lacks the consumer protections found in traditional mortgages.

What was the rejection rate for housing-related applications in 2021?

In 2021, about 64% of housing-related applications were rejected, highlighting the importance of understanding the mortgage landscape for mobile homes.

How significant are manufactured residences in the real estate market?

Manufactured residences account for 9.3% of all new single-family housing starts, indicating their growing importance in the real estate market.