Overview

Navigating the homebuying process can be daunting, and we understand how challenging this can be. This article sheds light on the key differences between pre-qualification and pre-approval, two important steps for homebuyers.

Pre-qualification offers a quick estimate based on self-reported financial information, requiring minimal documentation. It’s a convenient starting point, but it may not give you the full picture. On the other hand, pre-approval involves a comprehensive review of verified financial documents. This process provides a more accurate assessment of your borrowing capacity, which can significantly enhance your competitiveness in the housing market.

By understanding these differences, you can make informed decisions that align with your homebuying goals. We’re here to support you every step of the way, helping you feel more confident as you embark on this journey.

Introduction

Understanding the mortgage landscape can feel overwhelming for prospective homebuyers. We know how challenging this can be, especially when it comes to the crucial differences between pre-qualification and pre-approval. These two processes are vital stepping stones in securing a home loan, yet they differ significantly in their implications and requirements.

This article explores the ten key differences between pre-qualified and pre-approved status, providing you with a clear roadmap to navigate your homebuying journey. Are you aware of how these distinctions can impact your purchasing power and competitive edge in the housing market?

Exploring these nuances may be the key to unlocking a successful homeownership experience. We’re here to support you every step of the way.

F5 Mortgage: Personalized Guidance on Pre-Qualification and Pre-Approval

At F5 Mortgage LLC, we understand how challenging the mortgage process can be. That’s why we stand out in the industry by offering personalized guidance to clients navigating the complexities of pre-qualified vs pre-approved. We know that each family’s situation is unique, and our emphasis on client satisfaction ensures a hassle-free experience.

Utilizing user-friendly technology, we streamline the mortgage journey, making it easier for you. Our goal is to guide, not to push, providing tailored advice that aligns with your individual financial circumstances. This commitment to individualized service empowers you to make informed decisions throughout your mortgage journey.

Whether you are a first-time homebuyer or a seasoned investor, we’re here to support you every step of the way. With fast loan closings in under three weeks, you can feel confident that your needs are being met. Let us help you turn your homeownership dreams into reality.

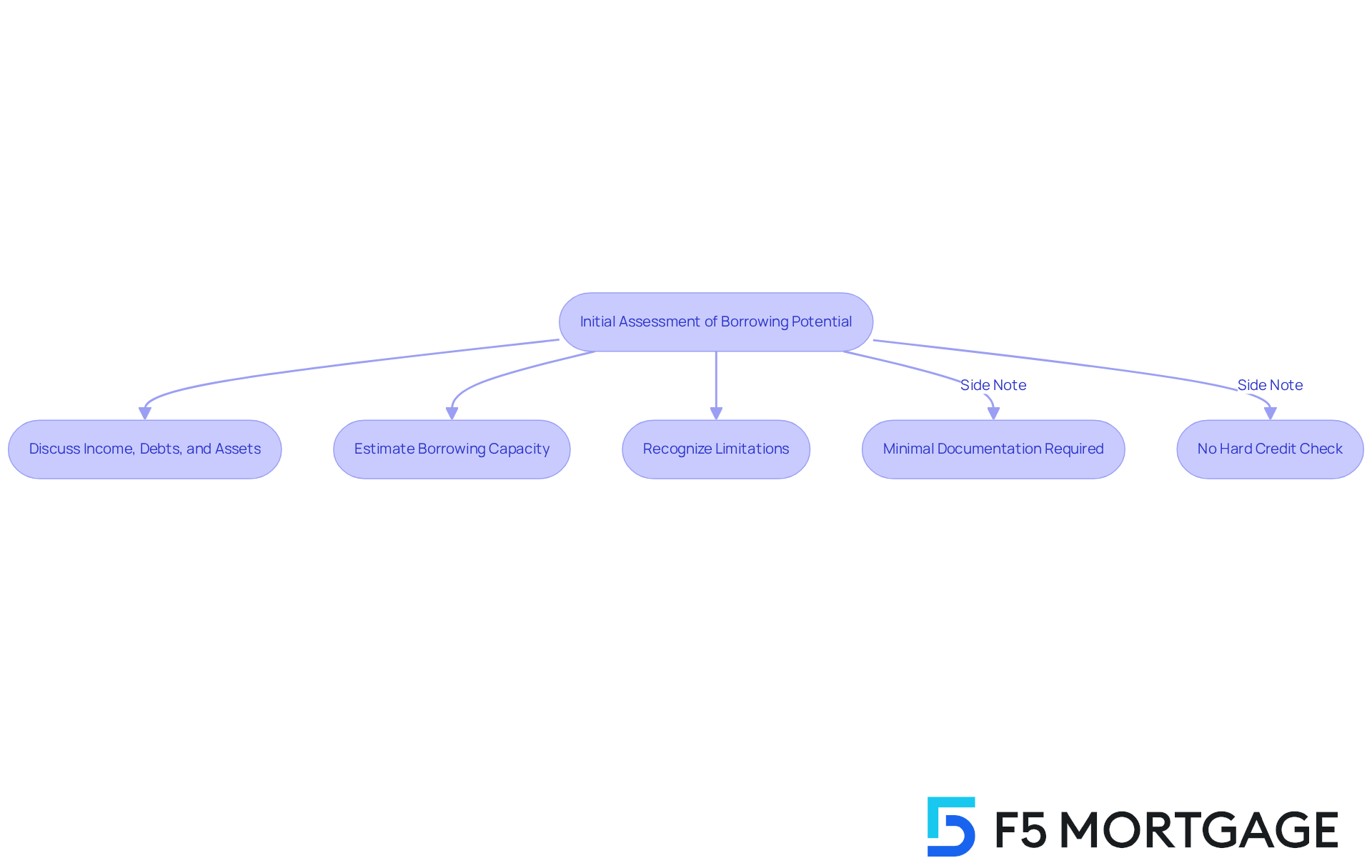

Definition of Pre-Qualification: Initial Assessment of Borrowing Potential

The process of pre-qualified vs pre-approved is an important first step in understanding your borrowing potential. It provides a rough estimate based on the financial information you share, often during a brief conversation with a lender. Here, you discuss your income, debts, and assets. While this initial assessment can be helpful, it’s essential to recognize that it doesn’t involve the thorough examination of your financial records that comes with approval. This means it may not accurately reflect your actual eligibility.

For example, you might estimate your borrowing capacity at around $400,000 based on what you report. However, this figure may change once you go through the pre-qualified vs pre-approved process, which verifies your information. We know how challenging this can be, and financial advisors often emphasize that while this initial assessment can assist you in creating a practical budget, it shouldn’t be the only factor when making significant financial decisions.

Looking ahead to 2025, homebuyers can expect the pre-qualification process to remain straightforward. Typically, it requires minimal documentation and no hard credit check, allowing for quick estimates within a day or two. However, it’s crucial to understand that this initial assessment is merely a preliminary step when considering the differences between pre-qualified vs pre-approved. By recognizing its limitations, you can navigate the mortgage landscape more effectively, ensuring you’re well-prepared for the journey ahead.

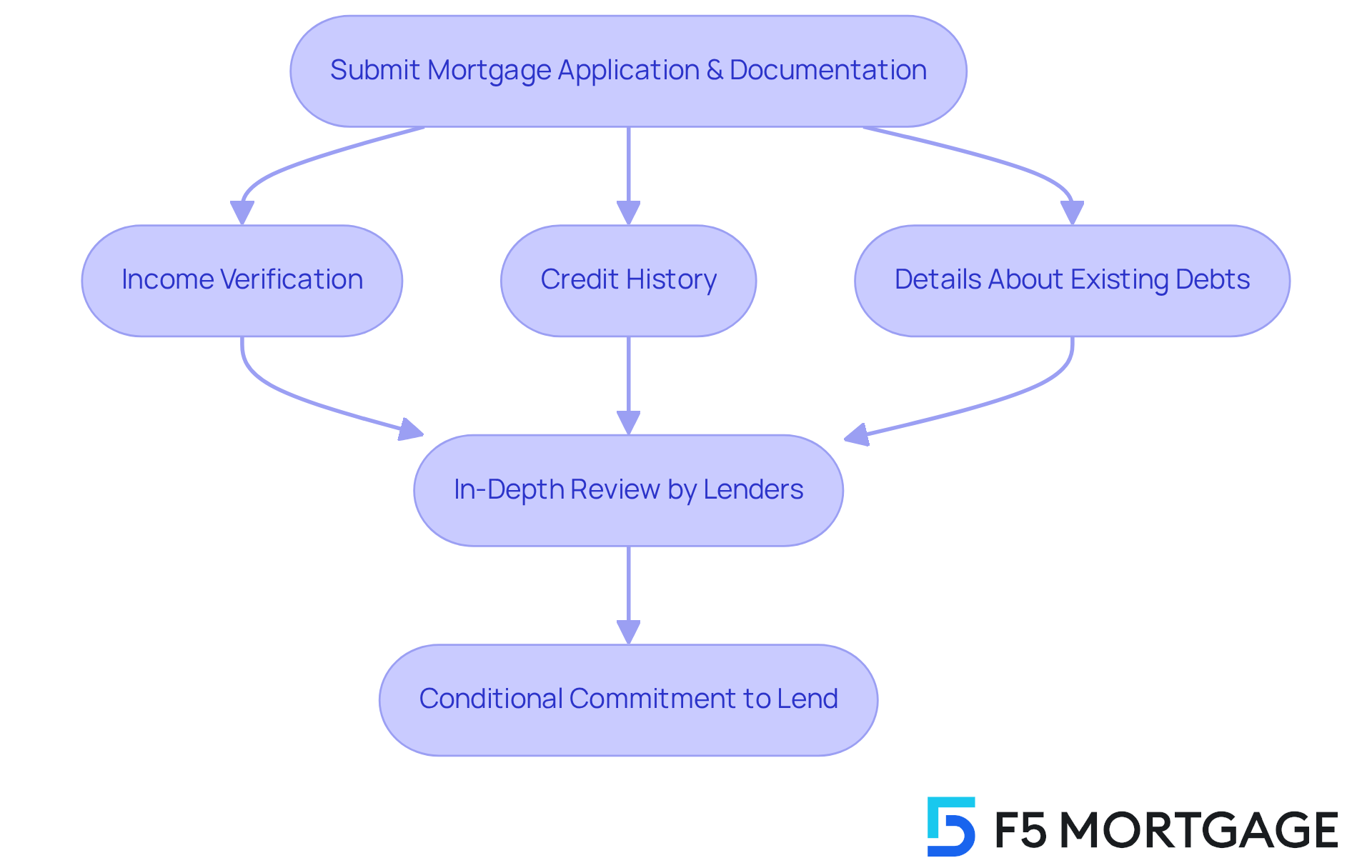

Definition of Pre-Approval: Comprehensive Evaluation for Serious Buyers

Understanding the difference between pre-qualified vs pre-approved is important, as pre-approval is more than just a step in the mortgage process; it represents a thorough evaluation of your financial profile, offering a clear understanding of your borrowing capacity. We know how challenging navigating this can be, and that’s why this process is designed to support you. To begin, you’ll need to submit a mortgage application along with essential documentation, such as:

- Income verification

- Credit history

- Details about existing debts

Lenders will conduct an in-depth review of these materials, leading to a conditional commitment to lend a specified amount. This advance approval can be an invaluable asset for serious homebuyers. Not only does it clarify your financial standing, but understanding the differences between pre-qualified vs pre-approved also enhances your negotiating power in a competitive market.

With prior authorization, you can act quickly when you discover a suitable residence. You’ll understand precisely how much you can afford and the conditions of your potential loan. Plus, pre-approval letters generally remain valid for one to two months. This timeframe allows you to interact confidently with sellers and real estate agents alike, knowing you have the support you need to make informed decisions.

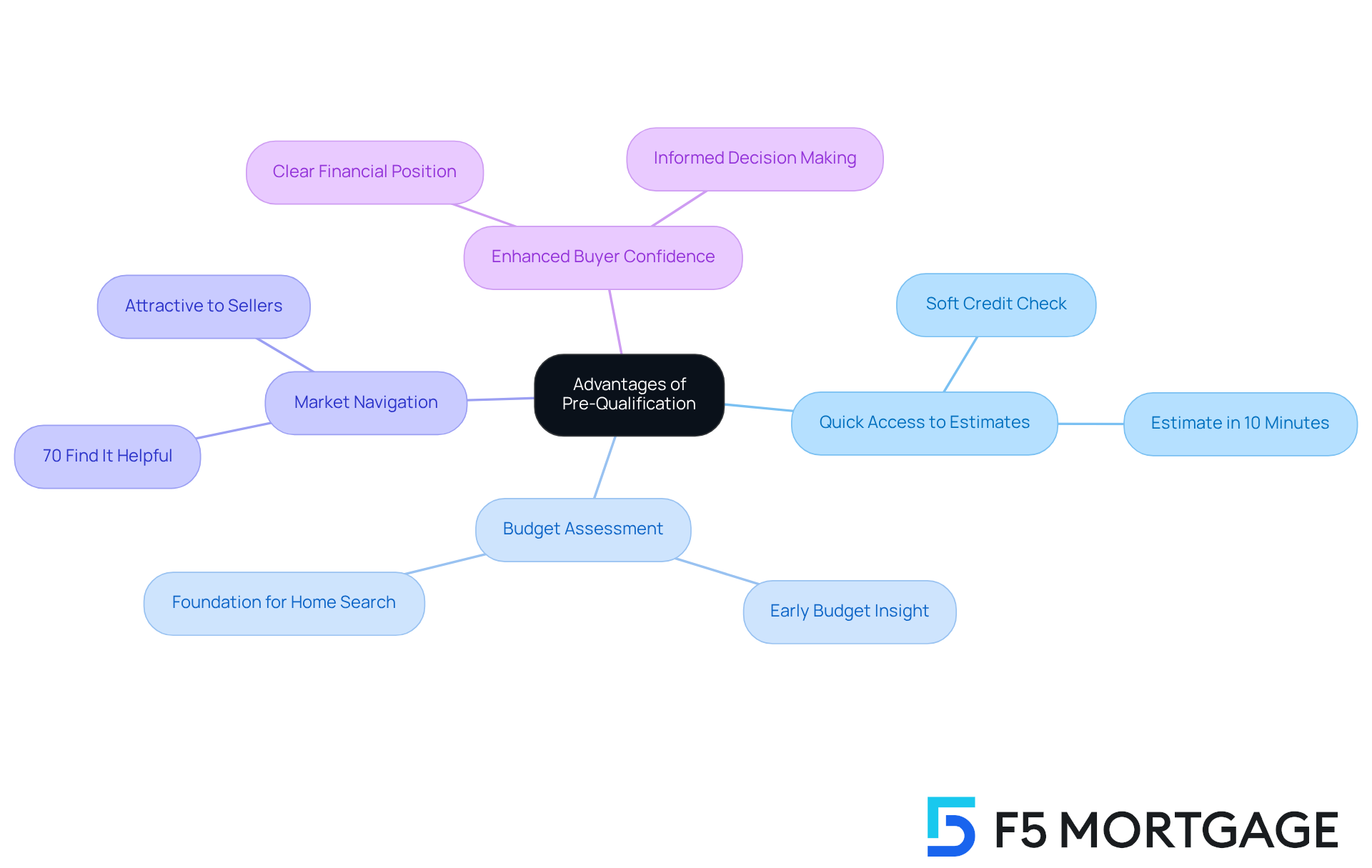

Advantages of Pre-Qualification: Quick and Easy Access to Loan Estimates

The comparison of pre-qualified vs pre-approved highlights significant advantages, particularly its speed and simplicity. We know how challenging the homebuying journey can be, and with F5 Mortgage, homebuyers can swiftly obtain an estimate of their borrowing potential—often within just 10 minutes—without the need for extensive documentation. This typically involves a soft credit check that does not impact credit scores.

Such a swift procedure allows you to assess your budget early in your home acquisition journey, enabling you to focus on properties that align with your financial capabilities. The initial qualification process can take as little as a few minutes or extend up to several days, depending on the lender’s method. Moreover, this initial qualification acts as a confidence enhancer, providing you with clearer insight into your financial position.

Approximately 70% of homebuyers find pre-qualification helpful in navigating the market, as it empowers them to make informed decisions (source: Bankrate). Real estate agents often highlight that clients who are pre-qualified vs pre-approved are more attractive to sellers, as it signifies a serious intent to purchase. For first-time homebuyers, this initial step is crucial. It lays a solid foundation for a successful home search and enhances your overall experience in the competitive housing market.

Preparing documents in advance can also ensure a smoother pre-qualification process. Thanks to F5 Mortgage’s exceptional service and flexible mortgage rates, families can achieve their dream of homeownership faster and with personalized support. We’re here to support you every step of the way.

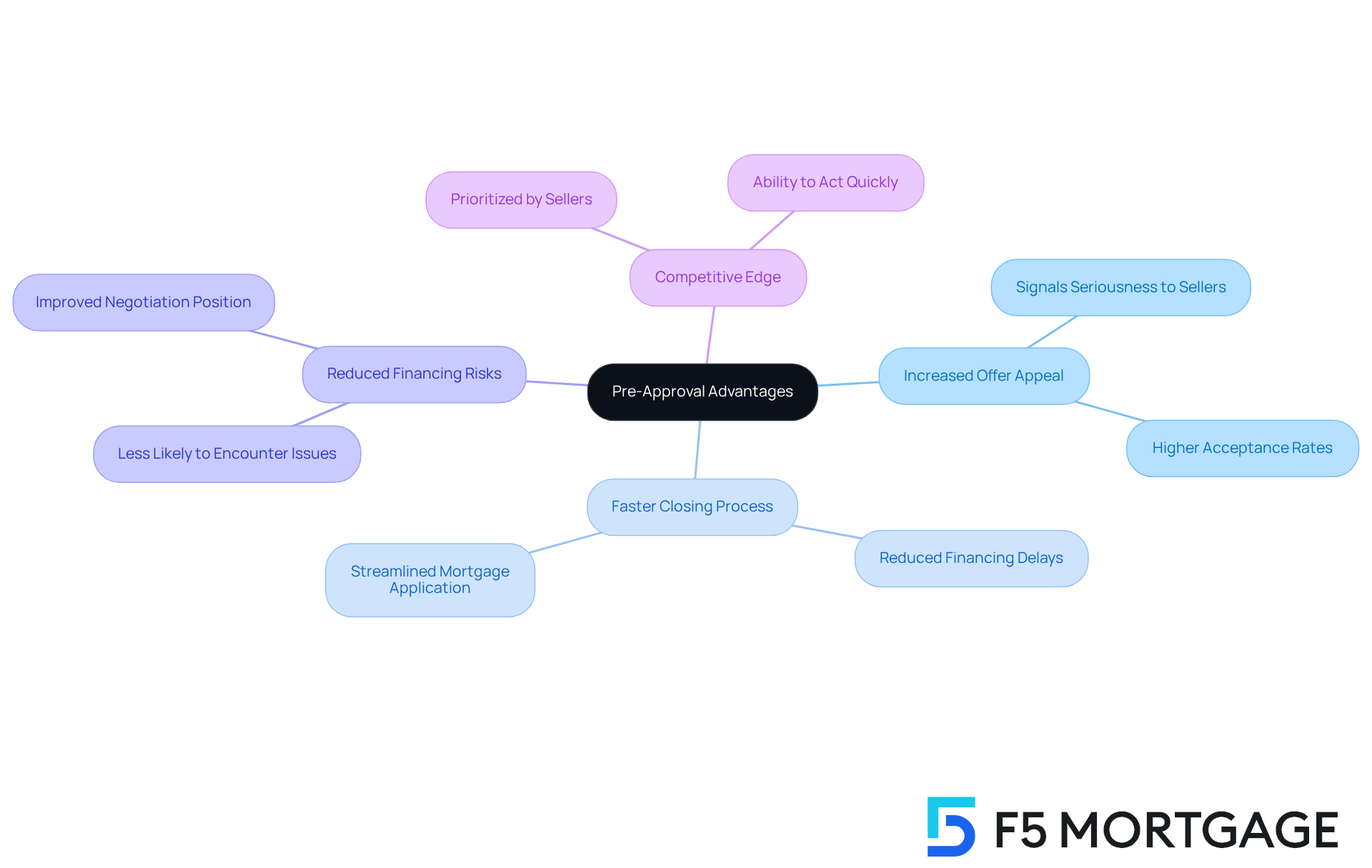

Advantages of Pre-Approval: Strengthening Your Offer in a Competitive Market

The differences between pre-qualified vs pre-approved offer substantial advantages, especially in competitive real estate markets where inventory is limited and demand is high. We know how challenging it can be to navigate these situations. A preliminary approval letter not only shows sellers that a purchaser is serious and financially capable, but it also enhances the appeal of their proposal. In scenarios where numerous offers are typical, having prior authorization can truly be a game-changer. It indicates to sellers that the purchaser is ready to move forward without financing delays.

Moreover, pre-approval can significantly expedite the closing process. Since much of the financial vetting is completed upfront, purchasers can act swiftly when they identify the right property. This speed is crucial in fast-moving markets, where hesitation can lead to missed opportunities. Real estate professionals often observe that sellers are more inclined to consider offers from purchasers when comparing the differences between pre-qualified vs pre-approved buyers. This reduces the risk of financing issues and increases the likelihood of a successful transaction.

Statistics show that individuals with approval letters are prioritized in competitive situations, resulting in more straightforward negotiations and faster closings. In fact, many sellers favor proposals supported by prior authorization, as it signifies a purchaser’s readiness and commitment. By obtaining pre-approval, buyers not only clarify their budget but also gain a competitive edge, making their offers stand out in a crowded marketplace. We’re here to support you every step of the way as you explore this important process.

Documentation for Pre-Qualification: Minimal Requirements for Quick Assessment

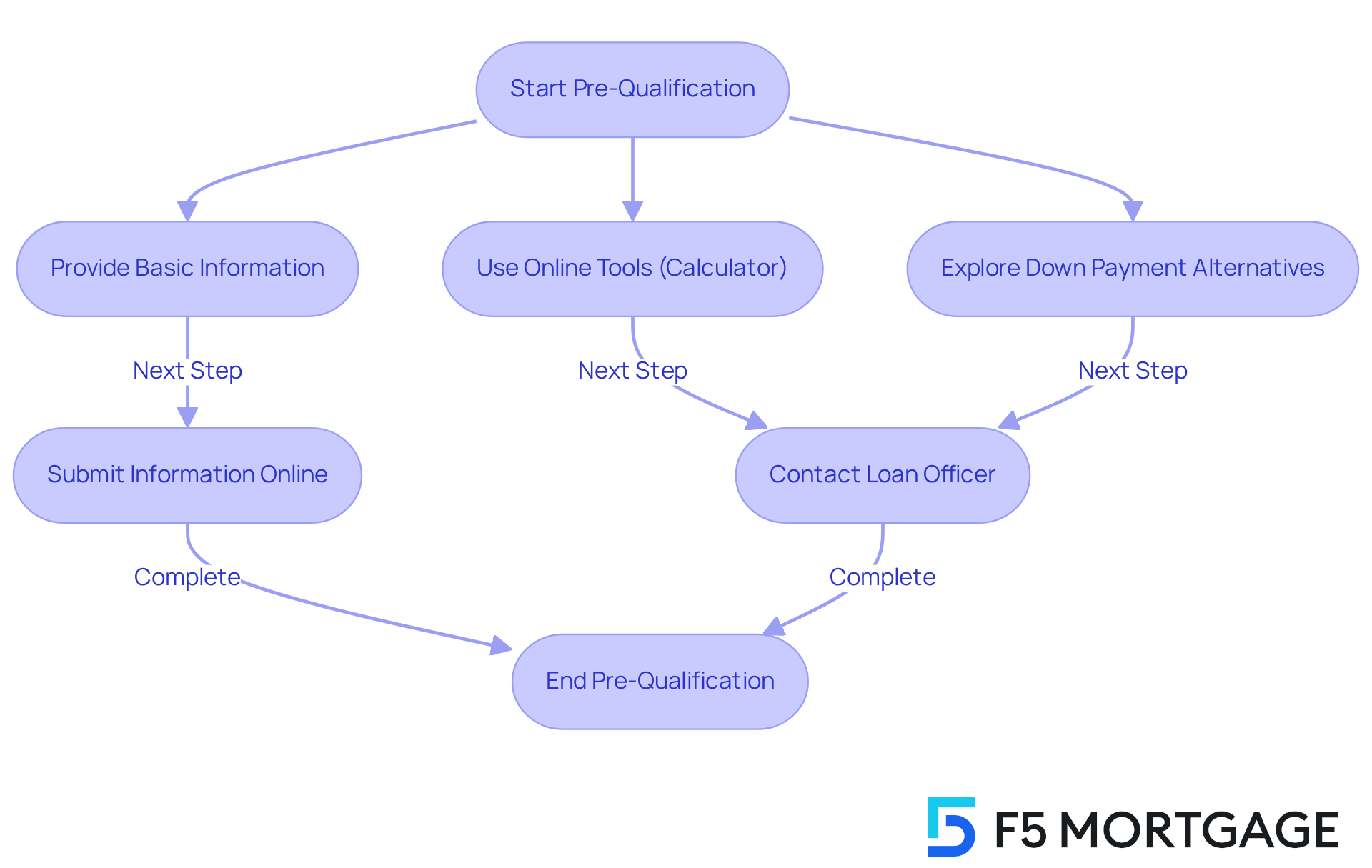

At F5 Mortgage, we understand how daunting the mortgage process can feel. That’s why our initial assessment is designed to be simple and user-friendly, requiring minimal paperwork from potential homebuyers. Typically, we only ask for basic information about your income, debts, and assets—details that can often be shared verbally or submitted through a straightforward online form.

By utilizing our online, phone, or chat options, you can benefit from a tailored loan solution that aligns with your unique goals. This approach significantly enhances your qualification experience in the context of pre-qualified vs pre-approved methods compared to traditional methods. With such a low barrier to entry, pre-qualification can be completed in just a few minutes, allowing you to embark on your home search without unnecessary delays.

Many lenders recommend using mortgage calculators to help you estimate your potential monthly payments before you meet with a loan officer. This not only saves time but also empowers you to make informed decisions. With the average mortgage rate currently at 6.09%, understanding these preliminary steps is crucial as you navigate the housing market.

Furthermore, exploring down payment alternatives is essential. Confirming the origin of your down payment funds is a key aspect of the initial qualification process, and we’re here to support you every step of the way.

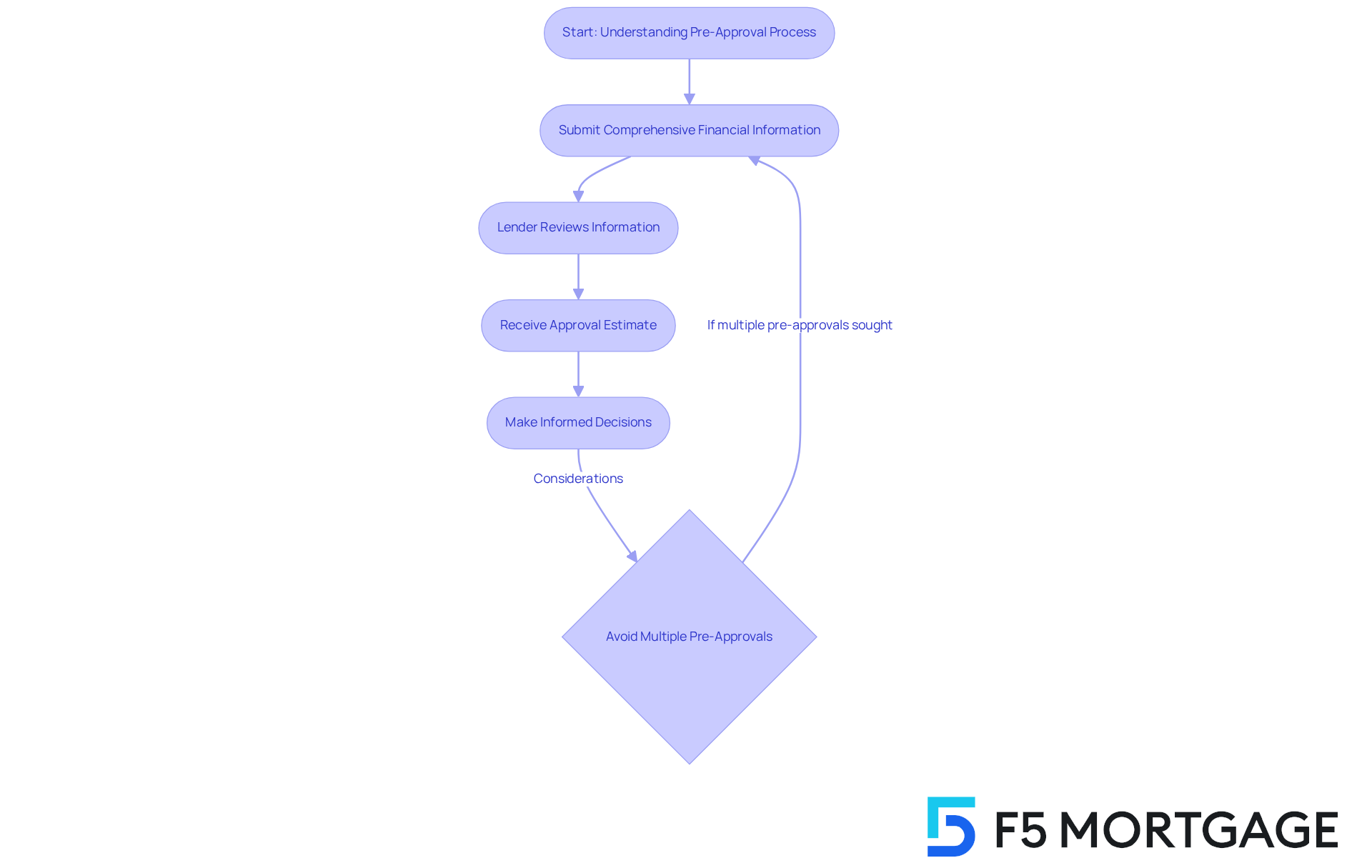

Documentation for Pre-Approval: Comprehensive Financial Information Required

Securing prior approval can feel daunting, but understanding the process is the first step toward achieving your dream home. This procedure involves a detailed documentation process that distinguishes it from the concepts of pre-qualified vs pre-approved. To move forward, borrowers must submit a comprehensive array of financial information, including recent pay stubs, tax returns, bank statements, and proof of assets. This thorough review allows lenders to accurately assess your financial health and establish a specific loan amount tailored to your situation.

An approval signifies that, based on the financial information provided, the lender believes you are a strong candidate for a mortgage. In this approval, borrowers typically receive an estimate of their loan amount, interest rate, and potential monthly payment. While this method may take a bit longer, it ultimately enhances your position in the mortgage application process, providing a competitive edge in the housing market. In fact, statistics show that the duration of pre-qualified vs pre-approved options usually lasts for 120 days, which can significantly enhance your preparedness and chances of success in a competitive environment.

As financial expert Andrew D. White wisely states, “Your clients don’t need more noise. They need clarity. They need confidence.” This comprehensive vetting procedure not only reassures lenders of a buyer’s capability but also empowers you to make informed decisions during your home search. Remember, it’s advisable to avoid seeking multiple pre-approvals, as each inquiry can negatively impact your credit score. We’re here to support you every step of the way.

Timeline for Pre-Qualification vs. Pre-Approval: Understanding the Process Duration

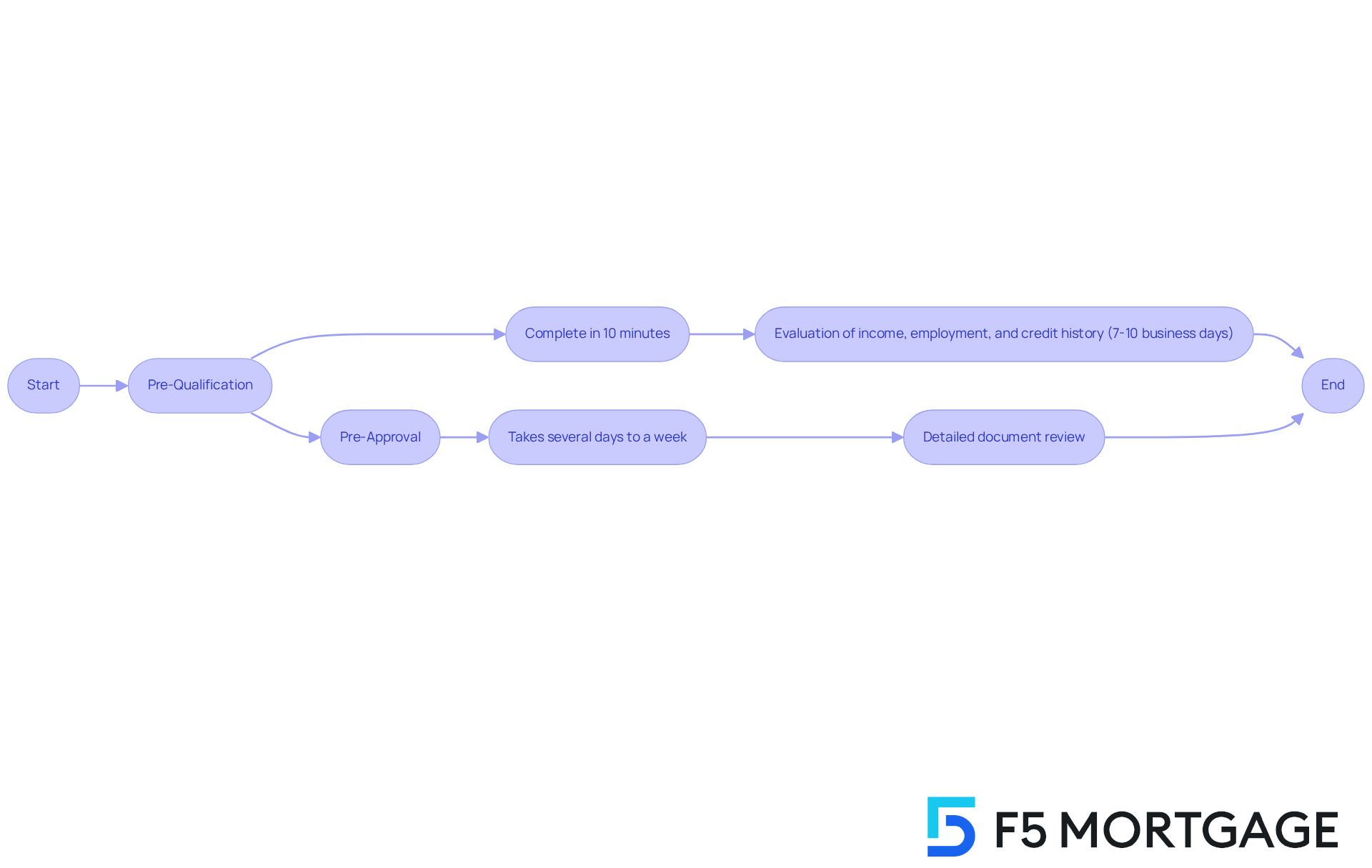

Navigating the mortgage process can feel overwhelming, especially when it comes to understanding timelines. We know how challenging this can be. The schedule for initial qualification is notably shorter when comparing pre-qualified vs pre-approved processes. Buyers can often complete pre-qualification in just a few minutes, providing a quick estimate of their borrowing potential. In contrast, prior authorization usually takes several days to a week, depending on the lender’s processing times and the thoroughness of the documentation provided.

For instance, the mortgage pre-qualification procedure typically requires between 7 and 10 business days. This timeframe allows lenders to perform comprehensive evaluations of income, employment, and credit history. At F5 Mortgage, we offer a streamlined pre-qualification process, enabling potential homeowners to get pre-qualified within just 10 minutes. This quick turnaround is crucial for those looking to act swiftly in a competitive housing market.

Moreover, conditional offers are typically valid for 60 to 90 days, highlighting the significance of acting quickly. Comprehending these timelines is essential for purchasers to manage their expectations efficiently and organize their home search accordingly. Statistics suggest that many purchasers anticipate a quick procedure, yet the reality of the differences between pre-qualified vs pre-approved can entail a more thorough examination, which is vital for gaining a competitive advantage in the real estate market.

As noted by mortgage professionals at F5 Mortgage, managing these expectations is key to a successful home buying experience. With our exceptional service and competitive rates, we’re here to support you every step of the way, helping families achieve their dream of homeownership faster.

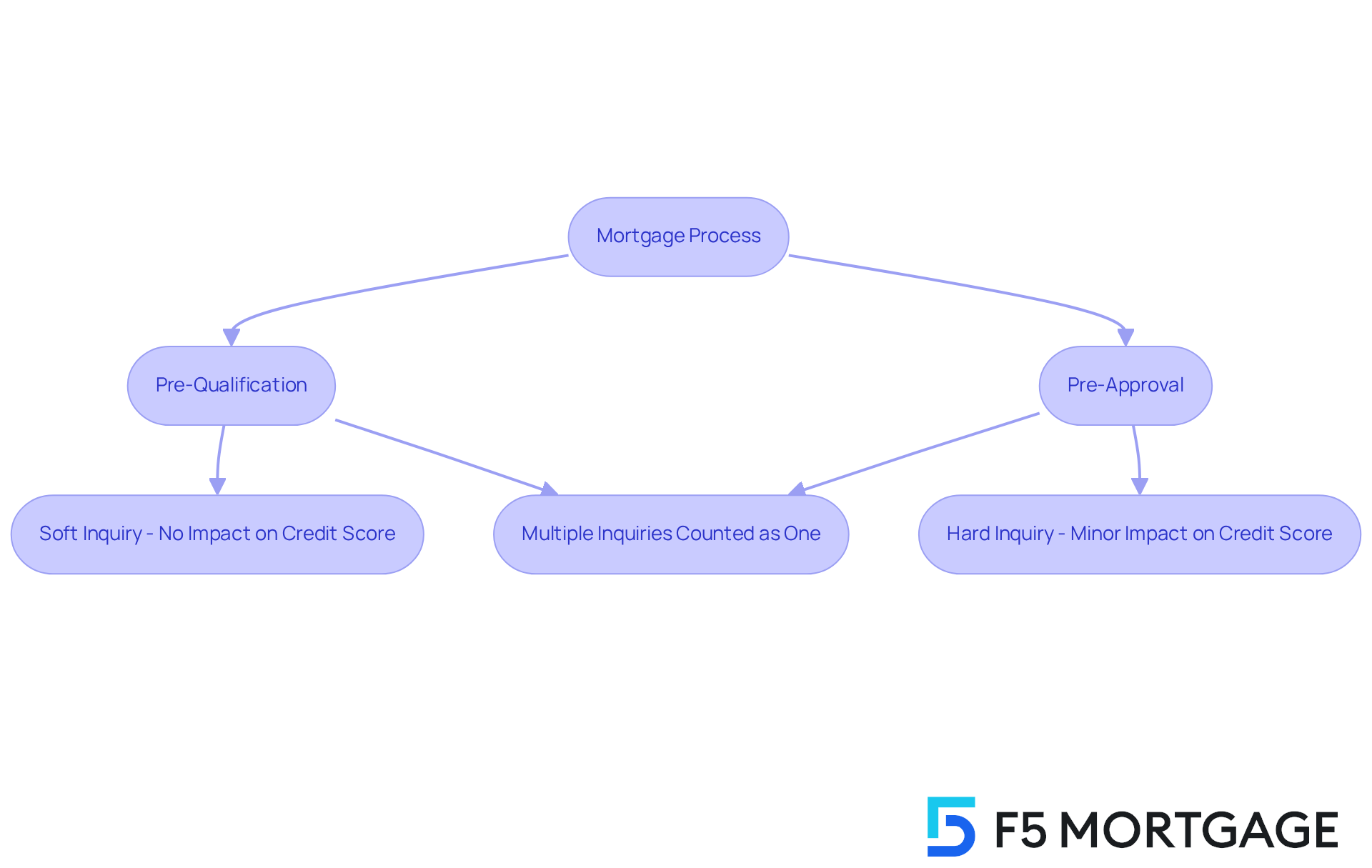

Impact on Credit Score: How Pre-Qualification and Pre-Approval Affect Your Credit

We understand how challenging the mortgage process can be, especially when it comes to your credit score. When considering pre-qualified vs pre-approved, it’s important to note that pre-qualification typically does not affect your credit score, as it involves a soft inquiry. This means you can explore your options without the worry of damaging your credit. On the other hand, when discussing pre-qualified vs pre-approved, it’s important to note that prior approval requires a hard inquiry, which might lead to a minor, short-lived dip in your credit score—usually just a few points.

Despite this slight impact, the advantages of obtaining an advance approval letter far outweigh the drawbacks. It not only strengthens your position when making an offer but also facilitates a quicker closing process, since much of the financial vetting is already done.

Experts note that multiple mortgage application inquiries within a short timeframe are often considered as a single inquiry. This helps to minimize any negative effects on your credit score. Overall, while prior authorization may cause a temporary decrease in your score, the understanding of pre-qualified vs pre-approved ultimately enhances your credibility in the competitive housing market. We’re here to support you every step of the way.

Key Differences Between Pre-Qualification and Pre-Approval: A Quick Reference Guide

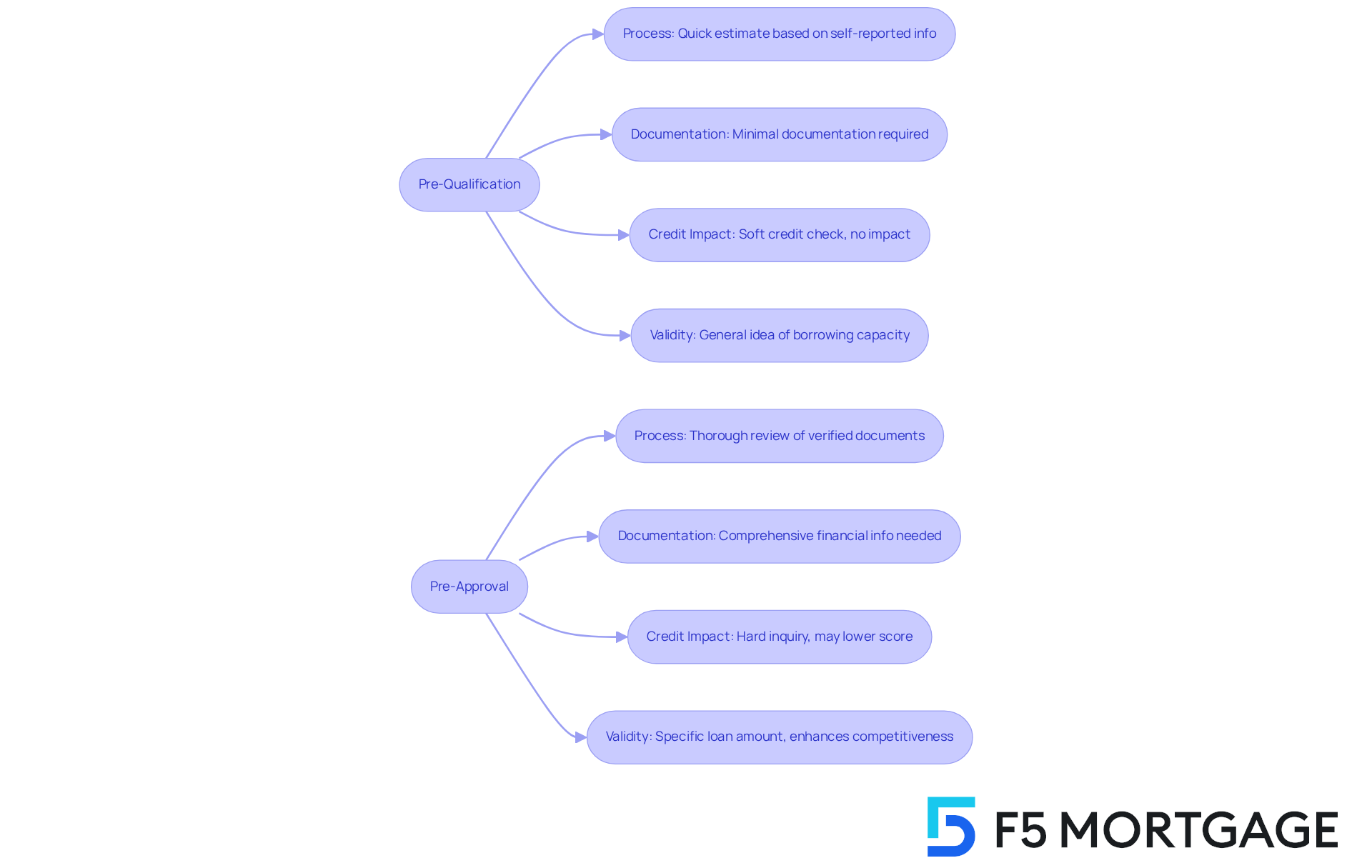

Navigating the mortgage process can feel overwhelming, and understanding the differences between pre-qualified vs pre-approved is essential. Here’s a quick reference guide to help you:

-

Process: Pre-qualification provides a quick estimate based on self-reported financial information, while pre-approval involves a thorough review of verified financial documents. This ensures a more accurate assessment of your borrowing capacity.

-

Documentation: Pre-qualification requires minimal documentation, making it a straightforward process. In contrast, when discussing pre-qualified vs pre-approved, the latter necessitates comprehensive financial information, including income verification, bank statements, and credit history.

-

Credit Impact: Typically, pre-qualification involves a soft credit check that does not affect your credit score. Conversely, pre-approval requires a hard inquiry, which may slightly lower your score, indicating the lender’s commitment to evaluating your financial situation.

-

Validity: While the concept of pre-qualified vs pre-approved gives you a general idea of your borrowing capacity, pre-approval clarifies a specific loan amount and greatly enhances your competitiveness in the housing market. Sellers often prefer buyers with approval letters, as they signify serious intent and financial readiness.

We know how challenging this can be for homebuyers. Many purchasers begin with pre-qualified vs pre-approved processes to gauge their budget before moving on to formal approval. This progression can lead to a smoother transaction once an offer is made. As industry leaders emphasize, having a pre-approval letter can provide you with a competitive edge when making an offer on a home. Remember, we’re here to support you every step of the way in the mortgage process.

Conclusion

Understanding the distinctions between pre-qualified and pre-approved home loans is essential for any homebuyer looking to navigate the mortgage landscape effectively. We know how challenging this can be, and while both terms may seem similar, they represent different levels of commitment and assessment from lenders. Pre-qualification offers a preliminary estimate based on self-reported financial information, whereas pre-approval involves a comprehensive review of documented financial data, providing a clearer picture of your borrowing capacity.

Throughout this article, we’ve highlighted key differences, including the documentation requirements, the impact on credit scores, and the advantages each process offers. Pre-qualification is quick and easy, allowing buyers to get a rough estimate of their borrowing potential. In contrast, pre-approval strengthens a buyer’s position in a competitive market by demonstrating serious intent and financial readiness. The timeline for each process also varies significantly; pre-qualification is much faster, making it an attractive first step for many homebuyers.

Ultimately, the journey toward homeownership can be daunting, but grasping the nuances of pre-qualification and pre-approval can empower you to make informed decisions. Whether you opt for the speed of pre-qualification or the robust assurance of pre-approval, understanding these processes is vital for successfully navigating the housing market. As you embark on this journey, remember that leveraging personalized guidance from trusted mortgage professionals can further enhance your experience, ensuring you are well-prepared to turn your homeownership dreams into reality.

Frequently Asked Questions

What is the difference between pre-qualification and pre-approval in the mortgage process?

Pre-qualification is an initial assessment of your borrowing potential based on financial information you provide, typically through a brief conversation with a lender. In contrast, pre-approval involves a comprehensive evaluation of your financial profile, including a mortgage application and essential documentation, leading to a conditional commitment to lend a specified amount.

How does the pre-qualification process work?

The pre-qualification process provides a rough estimate of your borrowing capacity based on your reported income, debts, and assets. It typically requires minimal documentation and no hard credit check, allowing for quick estimates within a day or two. However, it is important to note that this initial assessment does not involve a thorough examination of your financial records.

What does the pre-approval process entail?

The pre-approval process requires you to submit a mortgage application along with essential documentation such as income verification, credit history, and details about existing debts. Lenders will conduct an in-depth review of these materials, which leads to a conditional commitment to lend a specified amount.

What are the benefits of obtaining pre-approval?

Pre-approval clarifies your financial standing and enhances your negotiating power in a competitive market. With a pre-approval letter, you can act quickly when you find a suitable property, knowing exactly how much you can afford and the conditions of your potential loan. Pre-approval letters typically remain valid for one to two months.

How does F5 Mortgage assist clients in the mortgage process?

F5 Mortgage provides personalized guidance to clients navigating the complexities of pre-qualification and pre-approval. They emphasize client satisfaction and utilize user-friendly technology to streamline the mortgage journey, aiming to empower clients to make informed decisions throughout the process.

How long does it take to close a loan with F5 Mortgage?

F5 Mortgage aims for fast loan closings in under three weeks, ensuring that clients’ needs are met efficiently.