Overview

Late mortgage payments can feel overwhelming, and we know how challenging this can be. They can lead to significant consequences, including additional fees, damage to credit scores, and even potential foreclosure if the situation remains unresolved. It’s crucial to understand that you are not alone in this journey.

Understanding grace periods is essential, as they can provide you with some relief during tough times. Additionally, it’s important to recognize the impact late payments can have on your credit ratings. But remember, there are options available to help you navigate this situation.

Exploring solutions like forbearance and loan modification can empower you to manage late payments effectively. We’re here to support you every step of the way, ensuring you have the information and resources needed to make informed decisions. Together, we can work towards a more secure financial future.

Introduction

Navigating the complexities of mortgage payments can be overwhelming, especially when unexpected challenges arise and lead to a late payment. We understand how daunting this situation can feel. It’s essential to grasp the implications of missing a due date, as it can set off a chain reaction of financial consequences, including penalties and a potential dip in your credit score.

This article explores the consequences of late mortgage payments, offering you practical solutions to manage this stressful experience. We know how challenging this can be, and we’re here to support you every step of the way. What steps can you take to mitigate the fallout and prevent future delays? Together, we can ensure your financial stability and peace of mind.

Define a Late Mortgage Payment

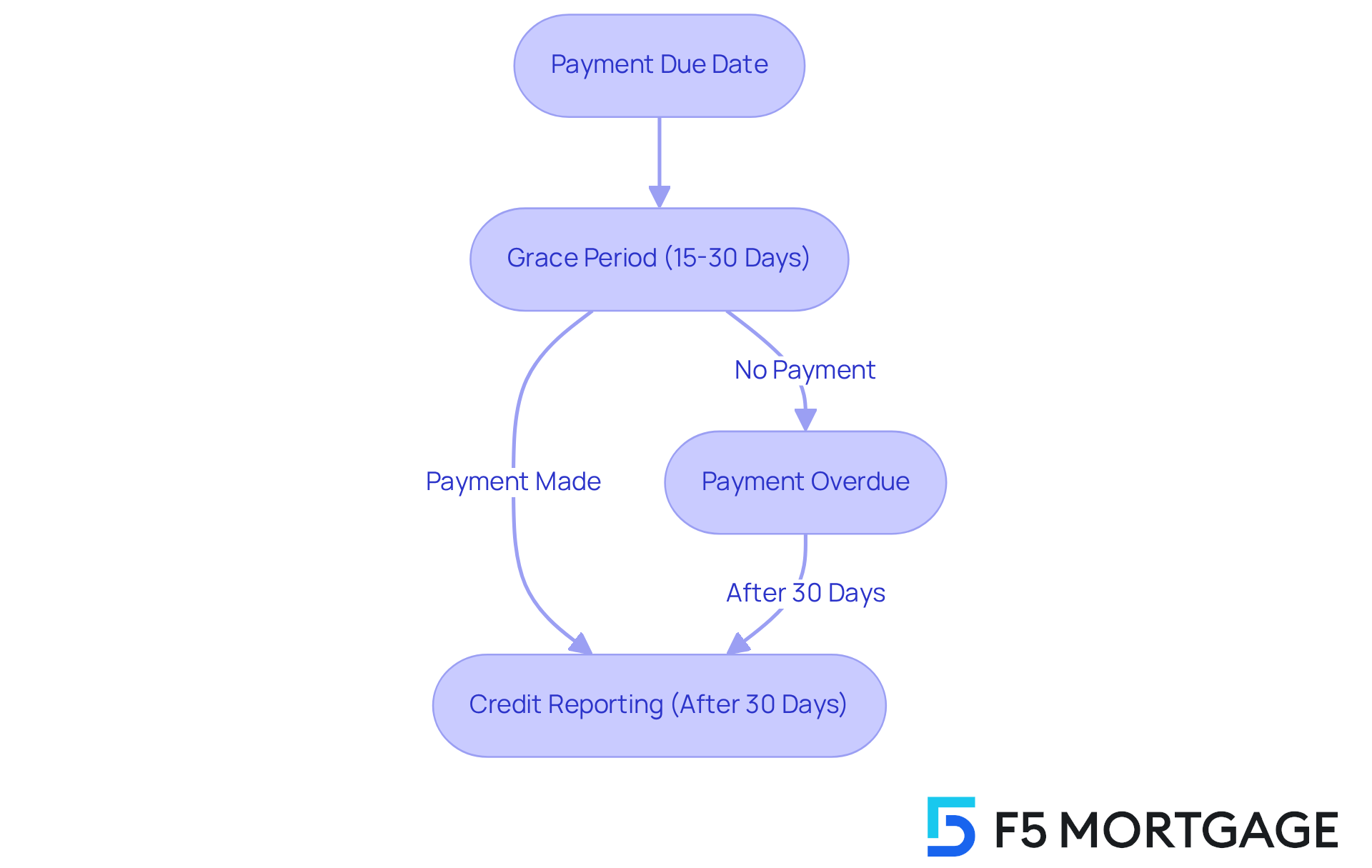

A delayed mortgage installment occurs when a borrower misses their mortgage payment by the due date. We understand how stressful this can be, and most financial institutions offer a grace period—typically around 15 days—allowing borrowers to submit their payments without penalties. If payment is not made by the end of this grace period, it is considered overdue. After 30 days, creditors may report the overdue payment to credit bureaus, which can negatively impact your credit score.

Comprehending these timelines is crucial for homeowners striving to manage their finances effectively. While some lenders may provide a grace period of up to 15 days, others might extend it to 30 days before marking the payment as overdue. Being aware of these details can empower you to navigate your loan obligations with confidence.

When evaluating lenders, consider partnering with F5 Mortgage. They offer competitive rates and personalized service tailored to your needs, ensuring you have the best options available to secure your loan rate. We’re here to support you every step of the way.

Understand the Consequences of Late Payments

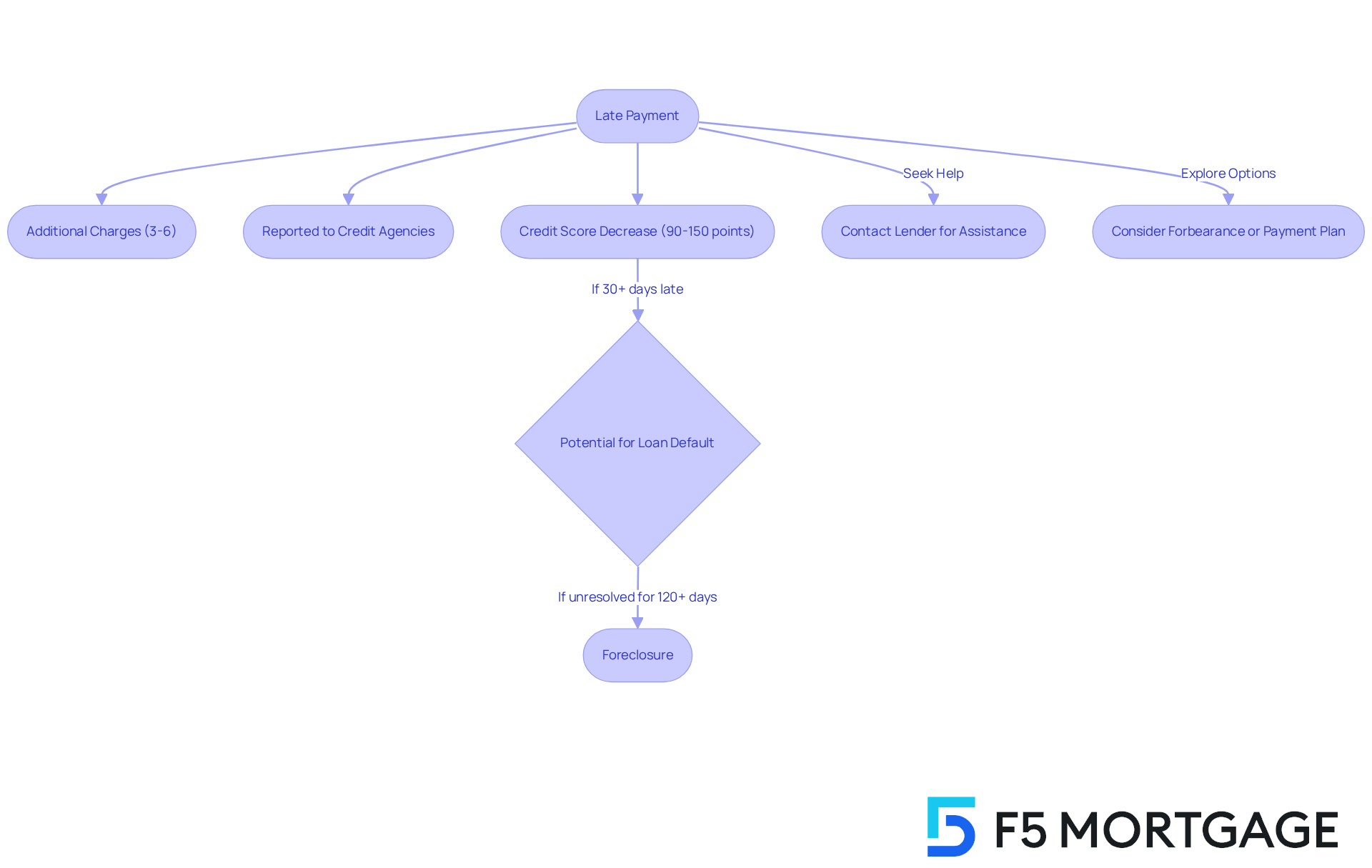

Delaying loan installments can result in serious consequences for borrowers, particularly if it leads to a late mortgage payment, and we understand how challenging this can be. Initially, missed payments often lead to additional charges, typically ranging from 3% to 6% of the outstanding amount. For instance, if your monthly mortgage obligation is $1,000, you could face a fee of $30 to $60 for a missed payment.

If a payment is over 30 days late, it will be reported to credit agencies, which can potentially lower your credit rating by 90 to 150 points. This negative mark can stay on your credit report for up to seven years, making future borrowing more difficult. It’s important to recognize that even a single delayed installment can significantly impact your refinancing options. Lenders usually prefer to see at least 12 months of timely payments before offering favorable terms.

Most loans include a grace period of about 15 days, providing a brief window for you to make your payment without incurring penalties. However, frequent late mortgage payments can increase the risk of loan default, which may ultimately lead to foreclosure if the situation remains unresolved for more than 120 days.

Understanding these repercussions highlights the essential importance of making timely financial contributions. We’re here to support you every step of the way in maintaining economic stability and securing your future credit.

Explore Options for Managing Late Payments

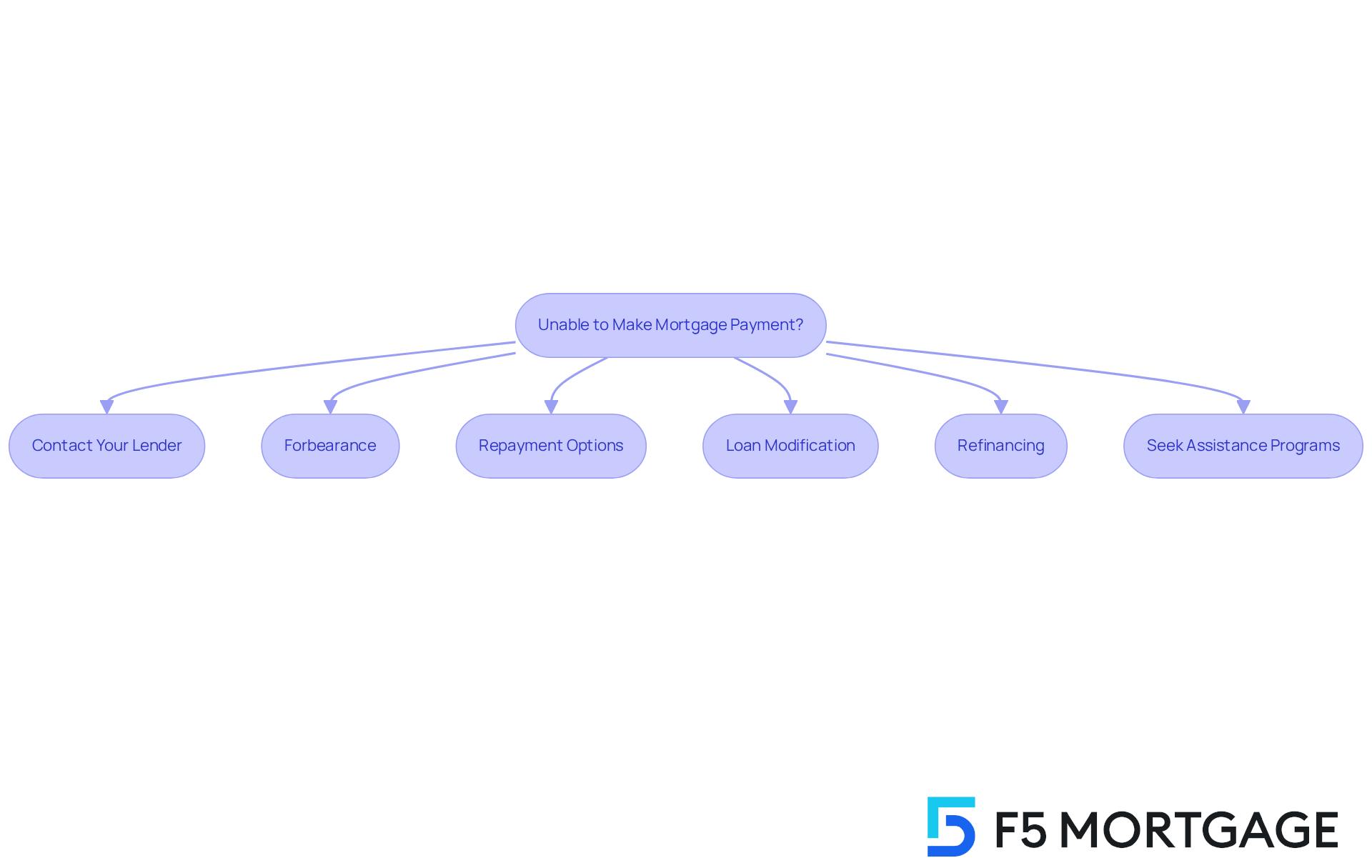

If you find yourself unable to make a mortgage payment on time, it’s important to know that you have options available to help you through this challenging time:

-

Contact Your Lender: As soon as you realize you might be delayed, reach out to your loan servicer. Many financial institutions, including F5 Mortgage, are committed to helping you find a solution. They may offer repayment plans, temporary forbearance, or structured repayment options. Keep in mind that once you’re 30 days overdue, your loan provider may report the late mortgage payment to credit agencies, which can significantly impact your credit rating.

-

Forbearance: This option allows you to temporarily stop or reduce your mortgage payments without facing penalties. However, it’s essential to understand that you will need to repay the missed amounts later, which may result in a late mortgage payment, typically through a repayment plan.

-

Repayment Options: Some lenders may allow you to catch up on missed payments over a set period, spreading the overdue amount across several months. This can help ease financial pressure while keeping your loan in good standing.

-

Loan Modification: If you are experiencing long-term financial difficulties, consider modifying your loan terms. This could mean extending the loan term or adjusting the interest rate, making repayment more manageable.

-

Refinancing: If interest rates have dropped or your financial situation has improved, refinancing your loan with F5 Mortgage could lower your monthly payments, making it easier to stay on track. In Colorado, there are various refinancing options available, including conventional loans, FHA loans, VA loans, and streamline refinance loans, all of which can offer competitive rates and tailored solutions.

-

Seek Assistance Programs: There are numerous state and federal programs designed to help homeowners facing financial challenges. Take the time to research local resources, including community programs and housing authorities. As Mary Babinski, a senior loan officer at F5 Mortgage, wisely advises, ‘You should not fear communicating with your financial institution.’ Don’t hesitate to pick up the phone and discuss your options.

Understanding these alternatives can empower you to take proactive steps in managing your loan obligations and minimizing potential impacts on your credit rating. Remember, effective communication with your lender is key; being open about your situation can lead to more flexible solutions tailored to your needs.

Implement Strategies to Prevent Future Late Payments

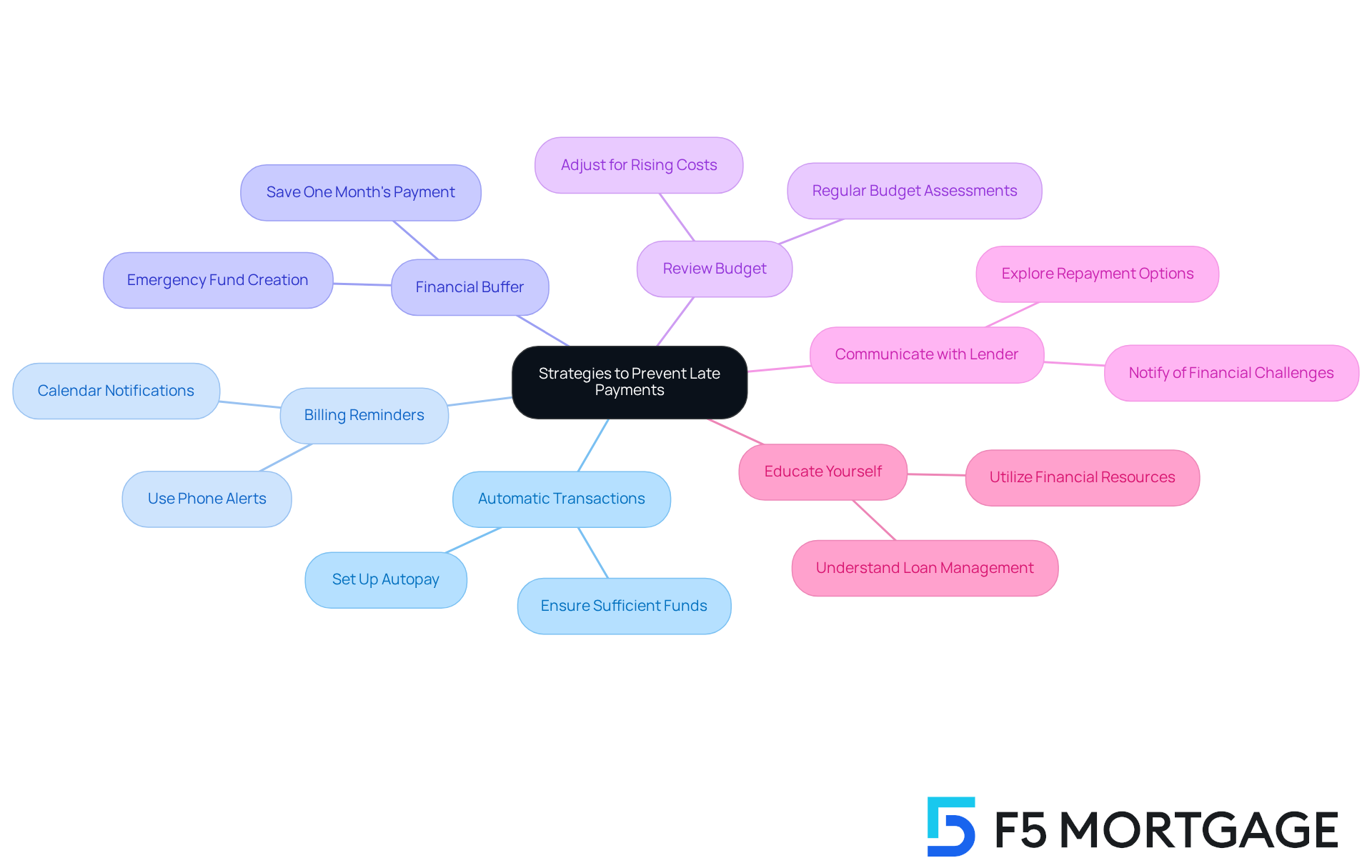

To effectively prevent future late mortgage payments, we recognize the importance of having a plan in place. Here are some caring strategies to consider:

-

Establish Automatic Transactions: Automating your loan disbursements ensures punctual transfers every month, greatly decreasing the chances of overlooked transactions. This way, you can focus on other important aspects of your life.

-

Create Billing Reminders: If you prefer manual transactions, setting reminders on your phone or calendar a few days before the due date can help ensure you don’t forget. We know how hectic life can get, and these small reminders can make a big difference.

-

Maintain a Financial Buffer: Retaining an additional month’s housing cost in your account serves as a financial safety net. This allows you to address unforeseen expenses without compromising your housing responsibilities, providing peace of mind during tough times.

-

Review Your Budget: Regularly assessing your financial situation is crucial. Modify your budget as necessary to emphasize your housing expense, especially considering the increasing costs that have impacted many families. As Tim Jordan emphasizes, “Budgeting, when done correctly, gives you incredible freedom, and shows you how to do it the right way for you.”

-

Communicate with Your Lender: If you anticipate financial challenges, proactively notifying your lender can lead to possible solutions, such as repayment plans or temporary forbearance. This step can assist you in avoiding late fees and alleviate some stress.

-

Educate Yourself: Utilize resources like F5 Mortgage’s home buyer’s guide to enhance your understanding of loan management and financial planning. Knowledge is empowering and can help you make informed decisions.

By adopting these practices, you can better manage your mortgage payments and maintain financial stability. We recognize that many homeowners are facing increasing costs and unpredictable monthly expenses. The case study ‘Preventing Future Late Mortgage Payments’ illustrates how these strategies can effectively help individuals avoid late mortgage payments and stay ahead of their financial obligations.

Conclusion

Navigating the complexities of late mortgage payments can feel overwhelming, and we understand how challenging this can be. However, grasping the implications and solutions available is vital for your financial well-being. Missing a payment can lead to additional fees and negatively impact your credit score, which underscores the importance of managing your mortgage in a timely manner. It’s essential to be proactive in addressing any delays to prevent long-term consequences.

In this article, we’ve outlined various key strategies to help you manage late payments effectively:

- Reaching out to lenders for support

- Exploring forbearance options

- Implementing practical measures like automatic payments

- Budgeting

These insights are designed to empower you during financial challenges. By understanding the timeline of late payments and the options at your disposal, you can take informed steps to mitigate risks.

Ultimately, the importance of making timely mortgage payments cannot be overstated. By adopting proactive strategies and maintaining open communication with your lenders, you can navigate financial difficulties with greater confidence. Remember, staying informed and prepared is crucial, ensuring that your journey of homeownership remains a positive and secure experience. Taking control of your mortgage obligations today can pave the way for a more stable financial future.

Frequently Asked Questions

What is a late mortgage payment?

A late mortgage payment occurs when a borrower misses their mortgage payment by the due date.

Is there a grace period for late mortgage payments?

Yes, most financial institutions offer a grace period, typically around 15 days, allowing borrowers to submit their payments without penalties.

What happens if the payment is not made by the end of the grace period?

If payment is not made by the end of the grace period, it is considered overdue.

How does a late payment affect my credit score?

After 30 days of non-payment, creditors may report the overdue payment to credit bureaus, which can negatively impact your credit score.

Are grace periods consistent among lenders?

No, while some lenders may provide a grace period of up to 15 days, others might extend it to 30 days before marking the payment as overdue.

How can understanding these timelines help homeowners?

Comprehending these timelines is crucial for homeowners striving to manage their finances effectively and navigate their loan obligations with confidence.