Overview

Navigating a $200,000 mortgage payment over 30 years can feel overwhelming. We understand how challenging this can be, which is why it’s essential to grasp the four key components: principal, interest, taxes, and insurance (PITI). Together, these elements shape your monthly payment and your overall financial commitment.

It’s important to recognize that various factors—like interest rates, loan terms, down payments, and additional costs such as property taxes and insurance—play a significant role in your mortgage journey. By understanding these aspects, you can make informed decisions that align with your family’s needs.

We’re here to support you every step of the way. Take the time to explore these components, and don’t hesitate to ask questions. With the right knowledge, you can approach homeownership confidently and make choices that benefit your family for years to come.

Introduction

Navigating the complexities of a $200,000 mortgage payment over 30 years can feel overwhelming for many prospective homeowners. We understand how challenging this can be. Grasping the intricate components—principal, interest, taxes, and insurance, collectively known as PITI—is essential for making informed financial decisions. However, with varying interest rates and unexpected costs like property taxes and homeowners insurance, how can one effectively manage these financial obligations?

This guide delves into the critical factors influencing mortgage payments. We’re here to support you every step of the way, offering practical strategies to master the art of home financing.

Understand the Basics of a $200,000 Mortgage Payment

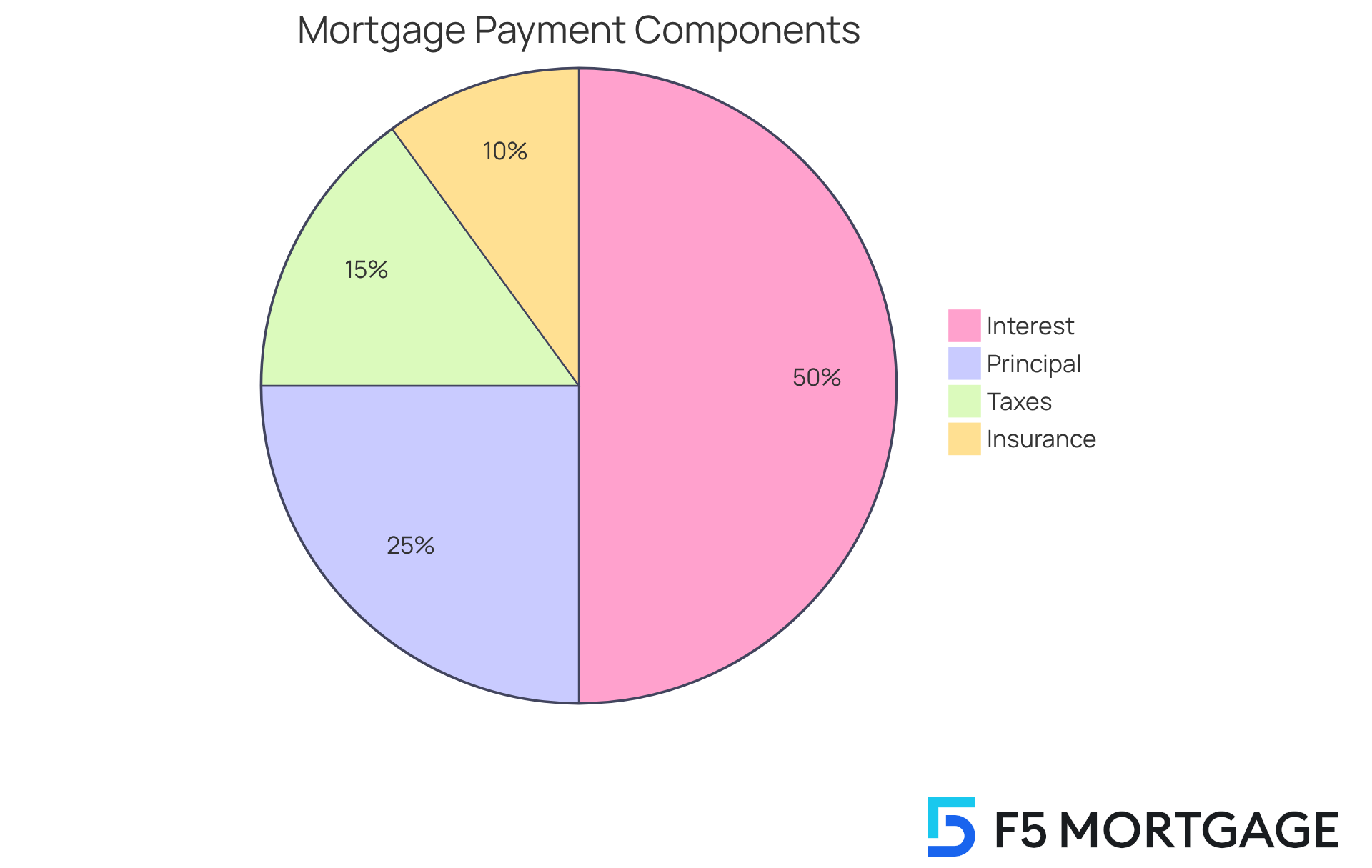

A $200,000 mortgage payment over 30 years includes four essential components: principal, interest, taxes, and insurance—collectively known as PITI. The principal is the amount borrowed, while the interest reflects the cost incurred for borrowing that sum. Understanding these components is crucial, as they significantly influence your monthly payment. For instance, with a 7% interest rate over 30 years, your cost each month would be approximately $1,331. This amount can vary based on changes in interest rates and loan terms, making it vital to familiarize yourself with these factors before moving forward.

Consider this: in analyzing a typical monthly payment, you might notice that a substantial portion goes toward interest in the early years of the mortgage. For example, in the first year of a $200,000 mortgage payment 30 years at 7%, over $13,000 could be allocated for interest costs alone. As time progresses, the distribution shifts, with a larger portion of your payment directed toward reducing the principal balance.

Financial specialists emphasize the importance of understanding PITI in loan costs. As one advisor noted, “PITI is essential for evaluating housing affordability and loan eligibility.” This understanding empowers potential homeowners to assess their financial readiness for homeownership, leading to more informed decisions.

Additionally, property taxes and homeowners insurance can vary widely based on location and property value. For example, in New Jersey, the average property tax rate is 2.08%, which can significantly increase your monthly costs. In contrast, Hawaii has a much lower average rate of 0.26%. Therefore, when calculating your overall loan cost, it’s crucial to consider these factors to avoid unexpected issues down the road.

When discussing the purchase of a home, buyers often request sellers to perform repairs or enhancements, which can impact the final purchase price and, consequently, the loan installment. If the seller counters your initial offer or declines it, your agent can assist in negotiating terms, including the move-in date and other contingencies. This negotiation process is vital to keep in mind, as it can affect your overall financial commitment. Remember, if an agreement cannot be reached, it’s perfectly acceptable to walk away and explore other opportunities.

Identify Key Factors Affecting Your Monthly Payment

Several key factors significantly influence your monthly mortgage payment:

-

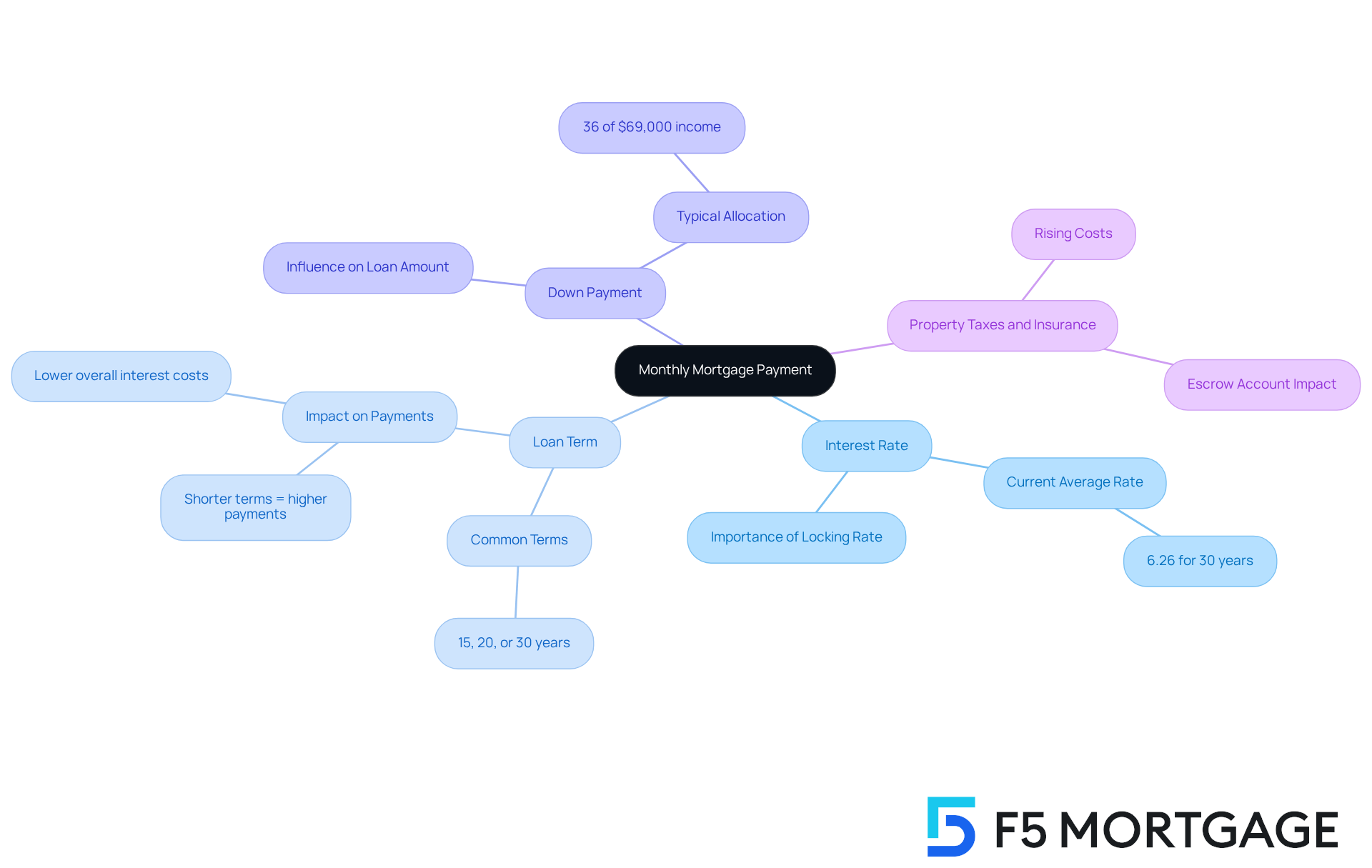

Interest Rate: We understand how overwhelming it can be to navigate the world of loans. The percentage charged on the loan amount plays a crucial role in your monthly payment. A lower interest rate can substantially ease your financial burden. Currently, the average rate for a $200,000 mortgage payment over 30 years is approximately 6.26%. At F5 Financing, we stress the importance of locking in your loan rate to secure the best possible terms for your future.

-

Loan Term: The duration over which you repay the loan is another vital consideration. Common terms include 15, 20, or 30 years. While shorter durations typically involve higher monthly payments, they also lead to reduced overall interest costs throughout the life of a $200,000 mortgage payment over 30 years. At F5 Mortgage, we offer flexible financing options tailored to your needs, helping you choose the right term for your financial situation.

-

Down Payment: We know how challenging it can be to save for a home. The initial amount you pay upfront directly influences your loan amount. A larger down payment not only decreases the principal but can also lower your monthly installments. For instance, a standard household earning $69,000 would need to allocate about 36% of their income each month to cover the $200,000 mortgage payment over 30 years. This highlights the importance of a substantial down payment. Our loan specialists at F5 Mortgage are here to support you in determining the best deposit strategy for your goals.

-

Property Taxes and Insurance: These costs can be included in your monthly payment if you have an escrow account, affecting the total amount owed each month. As property taxes have risen significantly in many areas, understanding their impact on your overall payment is essential. At F5 Mortgage, we provide personalized assistance to help you navigate these additional expenses effectively.

By understanding these factors and utilizing the expertise and resources provided by F5 Mortgage, you can make informed financial decisions regarding your home loan. We’re here to support you every step of the way, ultimately leading to better management of your home financing.

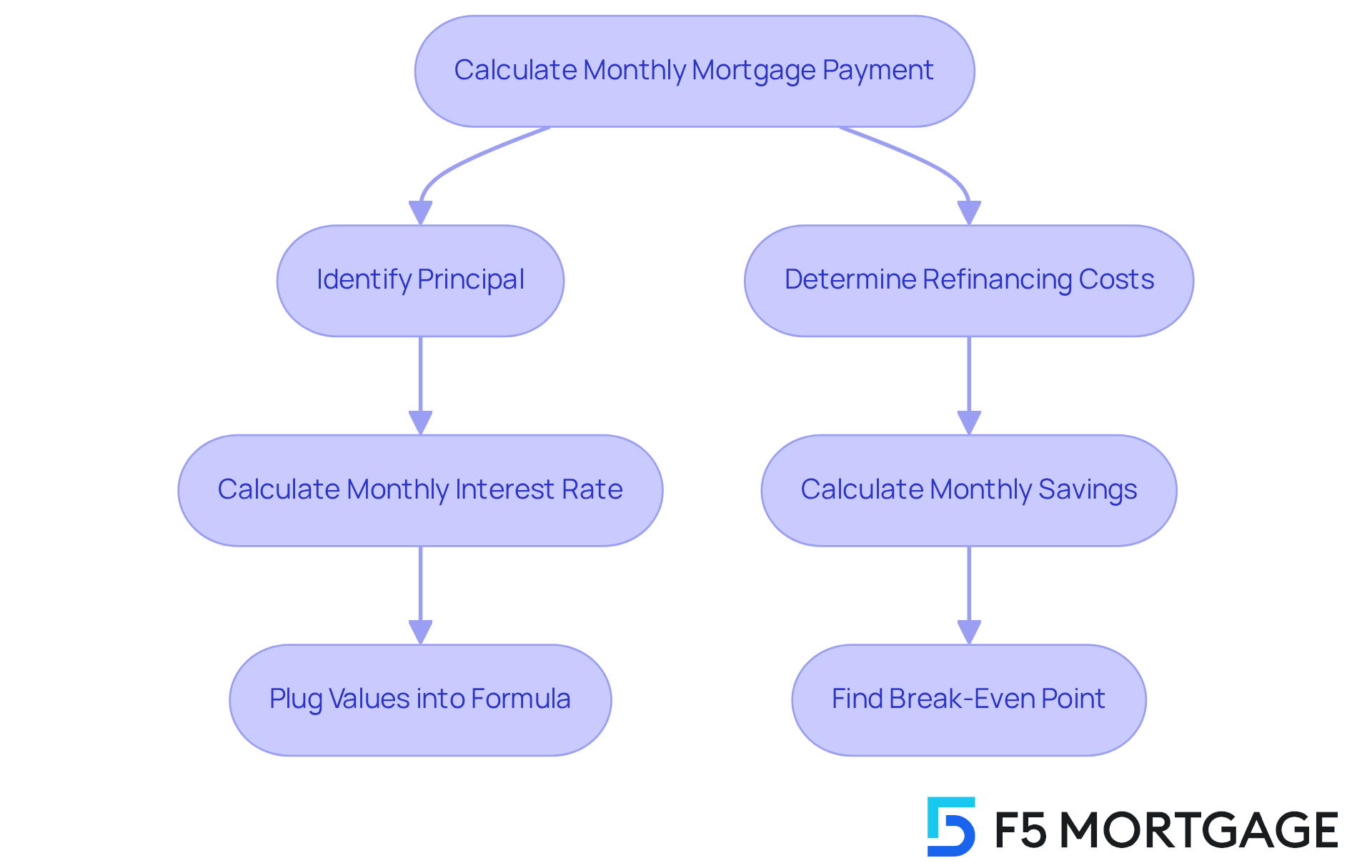

Calculate Your Monthly Payment Using the Formula

To determine your monthly mortgage payment, you can use the following formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- M = total monthly mortgage payment

- P = principal loan amount (e.g., $200,000)

- r = monthly interest rate (annual rate divided by 12)

- n = total number of payments (loan term in months)

For instance, if you take out a $200,000 mortgage at a 7% annual interest rate for 30 years, here’s how it works:

- First, convert the annual interest rate to a monthly rate: 7% / 12 = 0.005833.

- Next, calculate the total number of installments: 30 years x 12 months = 360.

- Plugging these values into the formula gives you a monthly payment of roughly $1,331.

This formula allows you to adjust the principal, interest rate, or loan duration to see how these elements affect your monthly payment. For example, with a reduced interest rate of 6%, your monthly payment would drop to approximately $1,199. This clearly demonstrates how significantly interest rates can impact housing affordability.

Understanding these calculations is vital, especially as the median mortgage cost reached $2,100 in August 2025. This highlights the importance of budgeting effectively in today’s housing market.

If you’re considering refinancing, knowing your break-even point can help you understand how long it will take to recover the costs of refinancing through savings in monthly payments or interest rates. To calculate your break-even point, follow these three steps:

- Determine your refinancing costs, which include all closing fees and charges associated with refinancing, such as origination fees and appraisal costs.

- Calculate your monthly savings by subtracting your new payment from your current payment.

- Finally, divide your refinancing costs by your monthly savings to find out how many months it will take to break even.

For instance, if your refinancing costs are $4,000 and your savings each month are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months). For your refinance to make sense, you would need to stay in your home long enough to reach this break-even point.

Additionally, if you have an FHA loan, you may be eligible for the FHA Streamline Refinance program. This program simplifies the refinancing process and can lead to lower monthly payments. It requires less documentation and may not necessitate income or credit checks, making it an appealing option for many homeowners in California. Understanding these refinancing options can significantly impact your financial planning and long-term savings. We know how challenging this can be, and we’re here to support you every step of the way.

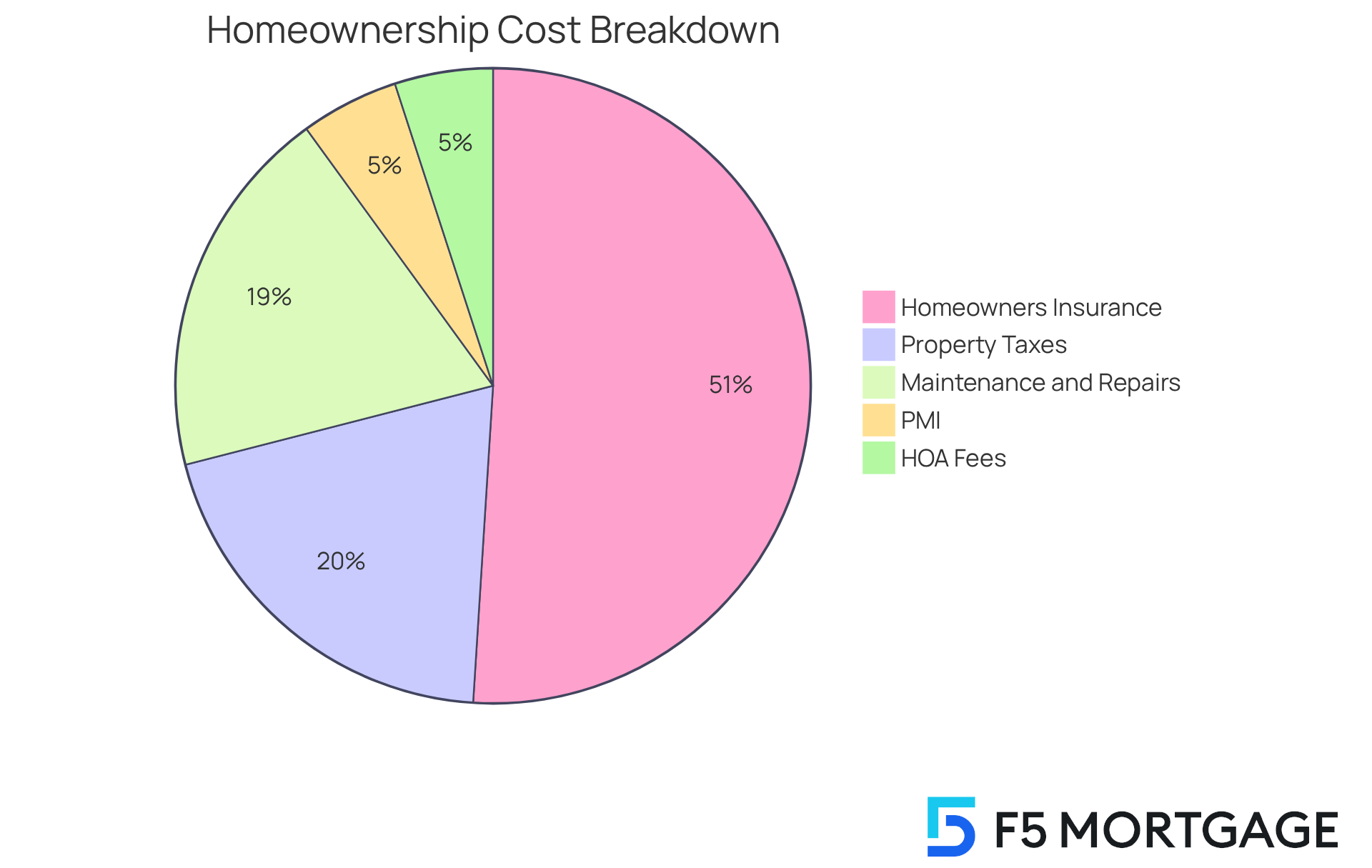

Consider Additional Costs Beyond the Mortgage Payment

In addition to your monthly mortgage payment, several other costs must be factored into your budget:

-

Property Taxes: We know how overwhelming it can be to manage expenses, and property taxes are a significant part of that. Typically assessed annually, these taxes can vary widely based on location. In 2025, the national average for property taxes is approximately $4,316, but homeowners in New Jersey face the highest property taxes in the nation, averaging $10,485. For certain homeowners, these taxes can represent more than 33% of their regular expenses. If you possess an escrow account, these taxes might be part of your regular contribution, making budgeting a little easier.

-

Homeowners Insurance: This insurance protects your home and belongings from damage or loss. As of 2025, the average annual homeowners insurance premium has surged to nearly $11,000, reflecting a 52% increase since 2020. In certain areas, such as New Orleans and several cities in Florida, homeowners are paying upwards of 80% more for insurance, highlighting significant regional disparities. Similar to property taxes, this expense can also be incorporated into your regular charge, making it crucial to consider when determining your total housing outlays.

-

Private Mortgage Insurance (PMI): If your down payment is less than 20%, you may be required to pay PMI, which protects the lender in case of default. This extra expense can greatly affect your budget each month, so it’s essential to include it if relevant.

-

Homeowners Association (HOA) Fees: If your home is part of a community governed by an HOA, you may incur monthly or annual fees for maintenance and amenities. These charges can vary significantly, so understanding your community’s specific expenses is crucial.

-

Maintenance and Repairs: Budgeting for ongoing maintenance and unexpected repairs is vital for homeowners. In 2025, home upkeep expenses are projected to average over $8,800 each year, making it the largest part of concealed homeownership expenditures. This figure underscores the necessity of setting aside funds for upkeep to avoid financial strain. Financial consultants stress that homeowners ought to prepare for these expenses, as they can greatly influence overall affordability and economic stability.

By taking into account these extra expenses, you can better prepare for the financial obligations of homeownership, such as the $200,000 mortgage payment over 30 years, and ensure that your budget accommodates all necessary outlays. Notably, 21% of homeowners in New Haven, Conn, pay more for taxes and insurance than their mortgage each month, illustrating the financial burden these costs can impose. Remember, we’re here to support you every step of the way.

Conclusion

Mastering a $200,000 mortgage payment over 30 years is crucial for achieving long-term financial stability and success in homeownership. We understand how overwhelming this process can feel, but grasping the components of your mortgage—principal, interest, taxes, and insurance—empowers you to make informed decisions. Recognizing how factors like interest rates, loan terms, and down payments influence your monthly payment can significantly shape your financial journey.

Key insights from this guide highlight the importance of accurately calculating your monthly payment using the provided formula. Don’t forget to consider additional costs such as property taxes, homeowners insurance, and maintenance expenses. These elements collectively shape your overall financial commitment and can often be more substantial than the mortgage payment itself.

Reflecting on these insights, it becomes clear that proactive financial planning is essential. By taking the time to understand and manage your mortgage payment and its related costs, you can navigate the complexities of homeownership with confidence. We know how challenging this can be, and it is crucial to engage with financial professionals and utilize available resources to ensure a sound investment in your future.

Frequently Asked Questions

What are the four essential components of a $200,000 mortgage payment?

The four essential components are principal, interest, taxes, and insurance, collectively known as PITI.

How does the interest rate affect the monthly mortgage payment?

The interest rate significantly influences the monthly payment amount. For instance, with a 7% interest rate over 30 years, the monthly payment would be approximately $1,331, but this amount can vary based on changes in interest rates and loan terms.

How is the distribution of payments between principal and interest structured over time?

In the early years of a mortgage, a substantial portion of the payment goes toward interest. For example, in the first year of a $200,000 mortgage at 7%, over $13,000 could be allocated for interest costs alone. As time progresses, a larger portion of the payment will be directed toward reducing the principal balance.

Why is understanding PITI important for potential homeowners?

Understanding PITI is crucial for evaluating housing affordability and loan eligibility, allowing potential homeowners to assess their financial readiness for homeownership and make informed decisions.

How can property taxes and homeowners insurance impact monthly mortgage costs?

Property taxes and homeowners insurance can vary widely based on location and property value. For example, New Jersey has an average property tax rate of 2.08%, while Hawaii has a much lower rate of 0.26%. These variations can significantly affect the overall monthly costs of a mortgage.

What should buyers consider when negotiating with sellers?

Buyers should consider that requests for repairs or enhancements can impact the final purchase price and loan installment. If the seller counters or declines an offer, the buyer’s agent can assist in negotiating terms, including the move-in date and other contingencies.

What should a buyer do if an agreement cannot be reached with the seller?

If an agreement cannot be reached, it is acceptable for the buyer to walk away and explore other opportunities.