Overview

Navigating the world of VA loans can feel overwhelming, but you might be relieved to know that you can have two VA loans at the same time, provided you meet certain eligibility criteria. This includes having sufficient remaining entitlement and designating each property as a primary residence.

We understand that factors like Permanent Change of Station (PCS) orders, financial stability, and the ability to manage additional mortgage payments can weigh heavily on your mind. These elements play crucial roles in determining whether you can successfully manage multiple VA loans.

We’re here to support you every step of the way as you explore your options. Remember, it’s important to assess your situation carefully and consider how these factors will impact your financial future. With the right guidance, you can navigate this process with confidence.

Introduction

Navigating the complexities of VA loans can feel overwhelming, especially for veterans and service members who may be concerned about the possibility of holding multiple loans simultaneously. We understand how challenging this can be. With the unique benefits that come with VA financing, it’s essential to know how to maximize these opportunities for your family’s financial future through real estate.

But the question remains: can one truly manage two VA loans at the same time? This article will explore the intricacies of eligibility and entitlement restoration, providing practical scenarios that empower veterans to make informed decisions about their mortgage options. We’re here to support you every step of the way, addressing the challenges that may arise along the journey.

F5 Mortgage: Your Partner for Managing Multiple VA Loans

F5 Mortgage LLC is a caring partner for families navigating the complexities of multiple VA mortgages, addressing the question of can you have 2 VA loans at the same time. We understand how challenging this can be, and with our commitment to personalized consultations, we empower you to grasp your VA financing eligibility, including answering the question of can you have 2 VA loans at the same time and entitlement restoration. This expertise enables families to make informed decisions about their mortgage options, whether you are purchasing a new home or refinancing an existing mortgage. By leveraging a strong network of top lenders, F5 Mortgage delivers customized solutions tailored to your unique financial situation, ensuring a smoother and more efficient process.

Key Services Offered:

- Personalized Mortgage Consultations: We provide tailored advice based on your individual financial circumstances, ensuring that every family receives the red carpet treatment.

- Access to Various Financing Programs: Explore a wide range of VA financing options designed to meet different needs, including specialized programs for self-employed individuals.

- Streamlined Application Process: Experience quick pre-approval and efficient closing times, with most financing agreements concluding in less than three weeks, minimizing stress through user-friendly technology.

We’re here to support you every step of the way, helping you confidently navigate the complexities of VA financing. Together, we can assist you in accumulating wealth through real estate while effectively managing your financial obligations.

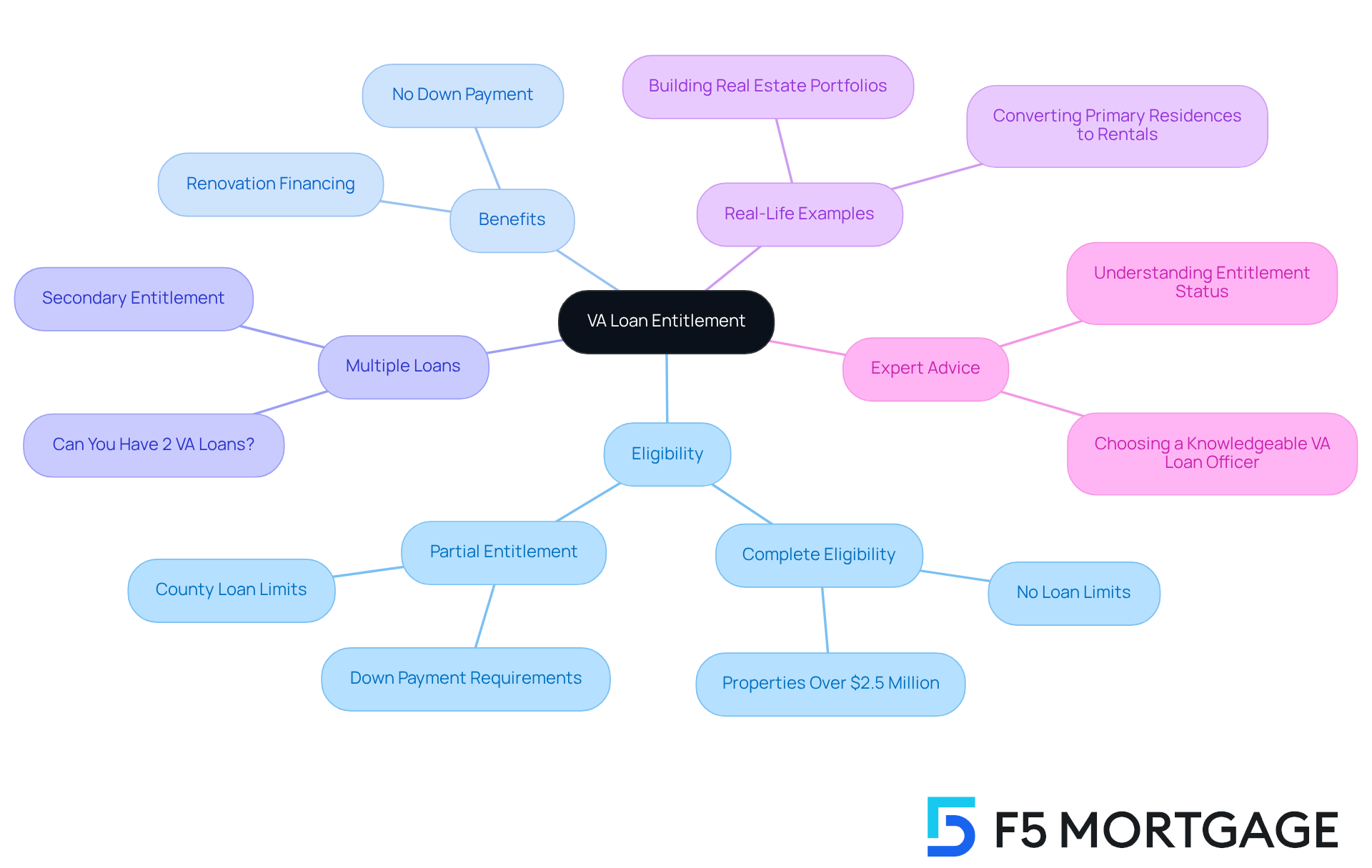

VA Loan Entitlement: What You Need to Know

Understanding VA financing eligibility is vital for service members looking to secure funding for home purchases. It directly impacts how much the Department of Veterans Affairs backs on a mortgage, influencing a veteran’s ability to buy a home. Typically, each former service member starts with a basic benefit of $36,000, which can increase based on the loan amount and specific county limits. For veterans aiming to buy multiple properties or refinance existing mortgages, it is crucial to understand if can you have 2 VA loans at the same time.

- Complete Eligibility: If you’ve never utilized your VA benefits or have fully settled previous debts, you may have full eligibility. This means you can purchase homes without VA financing limits, allowing for properties valued over $2.5 million with no down payment, as long as you meet income and credit qualifications. The Blue Water Navy Vietnam Veterans Act of 2019 supports this by eliminating borrowing limits for those with full benefits.

If you have an existing VA mortgage, you may wonder, can you have 2 VA loans at the same time, or would you only have partial entitlement? This can restrict your ability to secure additional financing without a down payment, leading to the question of whether you can have 2 VA loans at the same time, as you need to consider county borrowing limits. For instance, in 2025, the standard VA loan limit is projected to be $806,500, with some counties allowing higher limits up to $1,209,750.

Real-life examples highlight the importance of understanding your rights. Veterans who effectively manage their benefits can leverage them to build real estate portfolios, turning primary residences into rental properties after living in them for at least a year. This approach not only maximizes VA benefits but also enhances wealth-building potential. Additionally, VA renovation financing is available for home improvements, addressing the needs of an aging housing market, which is particularly relevant for families considering upgrades.

Industry experts emphasize the importance of accurate benefit calculations, as many lenders may not fully understand the intricacies of VA financing. Choosing a knowledgeable VA loan officer can help avoid complications regarding benefits, ensuring a smoother home-buying experience. As one expert noted, “Understanding your eligibility status can give you greater confidence as you prepare for your next home purchase.” By staying informed about your benefits, you can understand if can you have 2 VA loans at the same time and navigate the complexities of financing multiple properties with assurance.

Eligibility for Two VA Loans: Key Conditions Explained

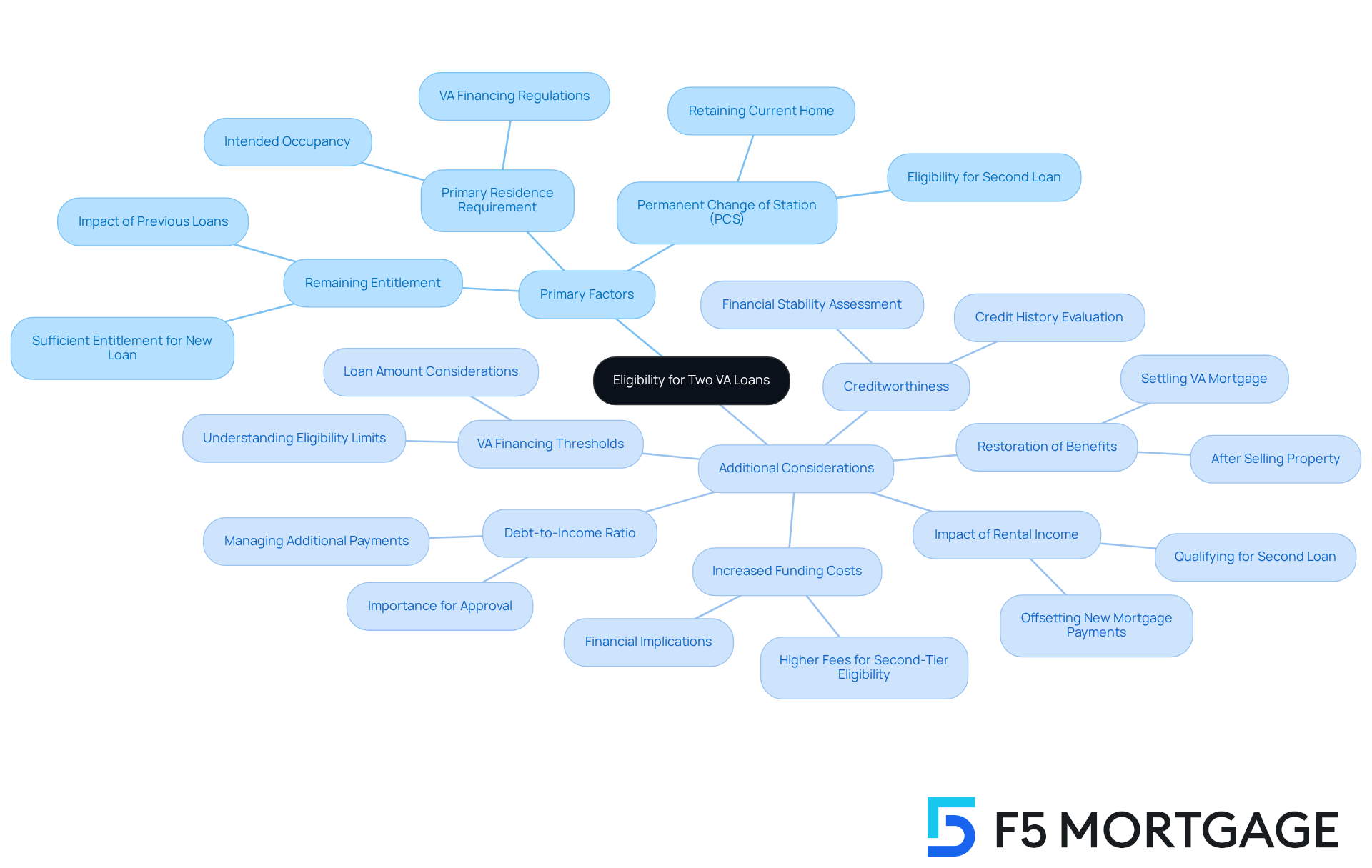

Veterans often wonder, can you have 2 VA loans at the same time under specific conditions, and we understand how this can feel overwhelming. Here are the primary factors to consider:

- Remaining Entitlement: Veterans must have sufficient remaining entitlement to cover the new loan amount. This entitlement acts as a guarantee from the VA, allowing financing without a down payment if fully utilized.

- Primary Residence Requirement: Each VA mortgage must be designated for a primary residence, meaning the borrower must intend to occupy the property. This ensures adherence to VA financing regulations.

- Permanent Change of Station (PCS): Active-duty service members may be eligible for a second VA loan if they receive PCS orders. This provision allows them to keep their current home while purchasing a new one, raising the question of can you have 2 VA loans at the same time, which makes military relocations smoother.

As you navigate this process, additional considerations come into play:

- Creditworthiness: Lenders will evaluate your credit history and overall financial stability to determine eligibility.

- Debt-to-Income Ratio: A favorable debt-to-income ratio is crucial for approval, as it reflects your ability to manage additional mortgage payments.

- Restoration of Benefits: You can regain your benefits after selling a property or settling a VA mortgage, which makes one wonder, can you have 2 VA loans at the same time while managing multiple mortgages effectively?

- Impact of Rental Income: Earnings from your first property can be utilized to qualify for a second VA mortgage, offering you financial flexibility.

- Increased Funding Costs: Using second-tier eligibility while having an active mortgage results in elevated funding costs, something to consider when applying for multiple VA mortgages.

- VA Financing Thresholds: Understanding the question of can you have 2 VA loans at the same time is crucial. They relate to your remaining eligibility and the financial implications of qualifying for two mortgages.

We know how challenging this can be, but we’re here to support you every step of the way. Consider these factors carefully as you explore your options.

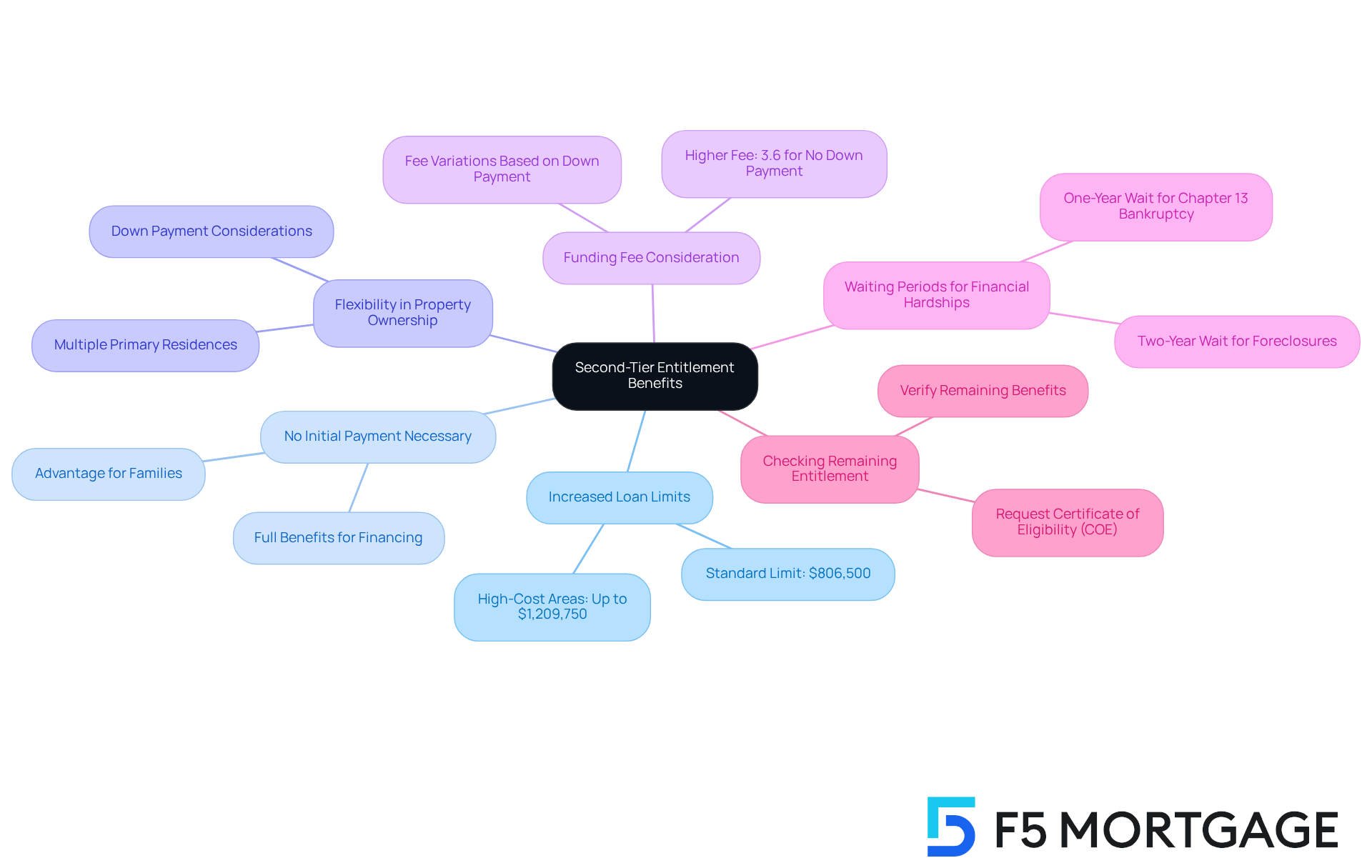

Second-Tier Entitlement: Unlocking Additional VA Loan Benefits

Second-tier benefits provide veterans with the opportunity to access additional VA financing advantages, even if they have previously utilized their benefits. This feature is especially helpful for those considering the purchase of a second property or refinancing an existing mortgage, particularly in a market where home appreciation raises the question, can you have 2 VA loans at the same time, which can significantly impact financial strategies.

Key Features of Second-Tier Entitlement:

- Increased Loan Limits: Veterans can exceed standard loan limits when they possess sufficient second-tier entitlement. In 2025, the revised borrowing limit for VA mortgages is set at $806,500, with the possibility of reaching up to $1,209,750 in high-cost regions. This allows service members to explore substantial financing options.

- No Initial Payment Necessary: With full benefits, former service members can secure financing without an initial payment, simplifying their journey to homeownership. This is particularly advantageous for families aiming to enhance their living situation without the stress of upfront costs.

- Flexibility in Property Ownership: The question of can you have 2 VA loans at the same time is addressed by second-tier privileges, which enable former service members to maintain multiple primary residences under specific conditions. For instance, if a veteran has already utilized part of their benefits for a $300,000 home, it raises the question, can you have 2 VA loans at the same time if they still qualify for a new mortgage on a $500,000 property, with a down payment determined by the remaining benefits?

- Funding Fee Consideration: It’s essential to note that second-tier qualification comes with a higher funding fee of 3.6% for financing with no down payment. Families should consider this when planning their finances.

- Waiting Periods for Financial Hardships: Veterans who have faced financial difficulties, such as foreclosures or bankruptcies, must adhere to waiting periods before becoming eligible for a second VA mortgage. Understanding these timelines is vital for effective planning.

- Checking Remaining Entitlement: Veterans should request a Certificate of Eligibility (COE) from the VA to verify their remaining entitlement, ensuring they can make the most of their benefits.

Moreover, former service members who acquired their properties through traditional financing and contributed less than 20% may want to consider refinancing to eliminate private mortgage insurance (PMI). Given the high property appreciation rates in California, refinancing can help reduce the loan-to-value (LTV) ratio, potentially removing PMI and maximizing equity. By consulting with knowledgeable lenders, former service members can explore these options and make informed decisions regarding their financing needs, ensuring they fully leverage their VA benefits. We understand how challenging this can be, and grasping the nuances of second-tier benefits and their relation to refinancing choices is crucial for maximizing VA advantages, particularly in today’s competitive housing market.

Selling Your Home: How It Affects Your VA Loan Options

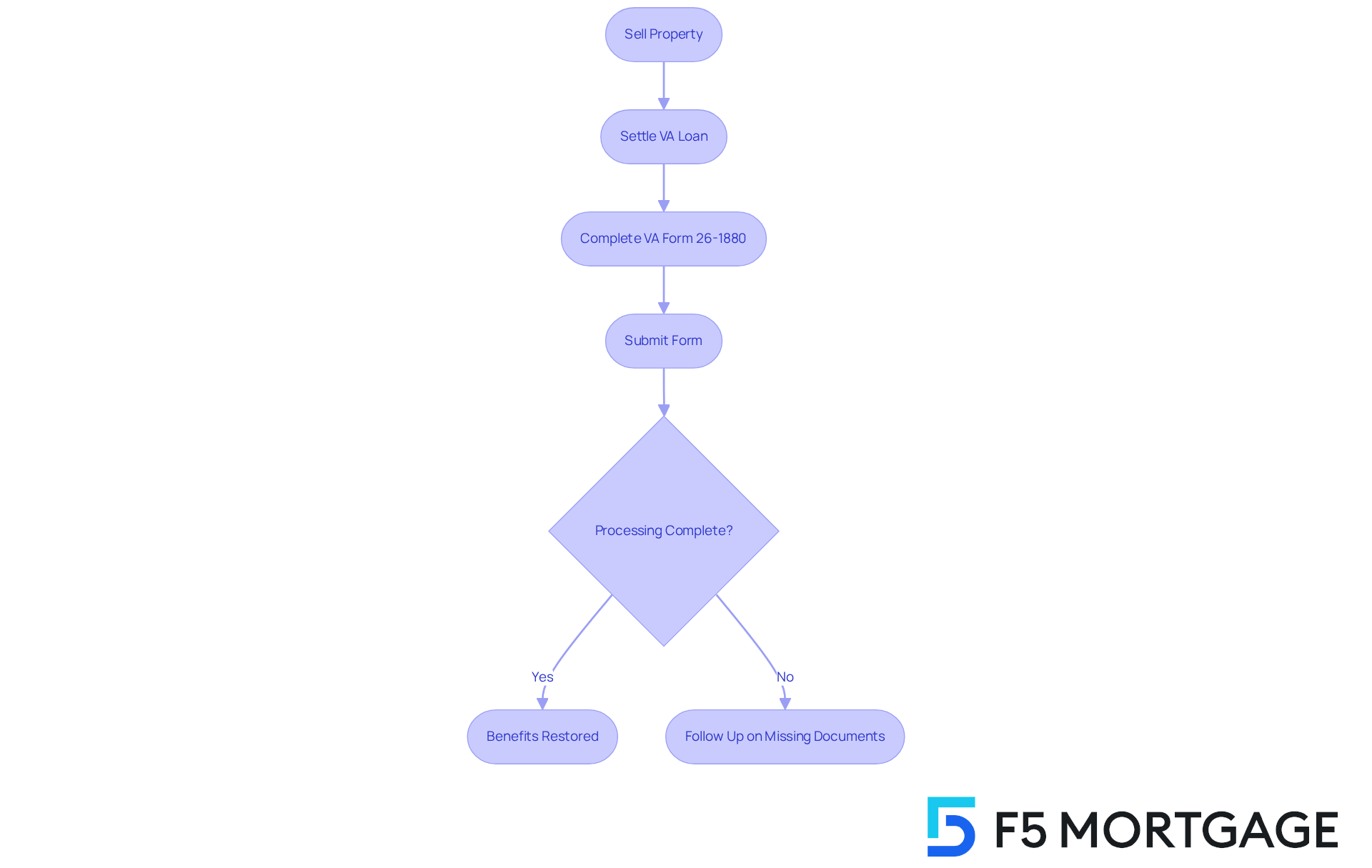

Selling a property financed with a VA mortgage can greatly impact a service member’s future financing options. After selling their property and completely settling the VA loan, former service members can regain their benefits, enabling them to access their VA loan advantages for a new acquisition.

Important Considerations:

-

Entitlement Restoration Process: To initiate the restoration, veterans must complete VA Form 26-1880. This form is crucial for requesting the reinstatement of rights after the sale of a property. The projected processing duration for submitting this form is generally about 1-2 weeks, whereas the complete restoration process requires approximately 2-4 weeks. It’s important for service members to act swiftly to ensure a smooth transition.

-

Effect on Future Acquisitions: After the property is sold and the loan is resolved, former service members recover complete eligibility. This allows them to buy another residence without the typical limitations linked to partial eligibility. In today’s competitive housing market, having complete rights can significantly enhance purchasing power, making it a vital consideration.

-

Real-World Examples: Many veterans have successfully regained their benefits after selling their properties. For instance, some have sold their properties, settled their VA loans, and promptly applied for new loans, enabling them to acquire new residences on the same day. This seamless transition underscores the importance of understanding the restoration process.

-

Expert Advice: Specialists suggest that veterans actively seek restoration of benefits after selling their properties, as this procedure does not happen automatically. Levi Rodgers, a real estate specialist and former U.S. Army Green Beret, emphasizes, “Restoring your privileges allows you to access these benefits again.” Consulting with a VA-approved lender can simplify the process and ensure that all necessary documentation is submitted correctly, avoiding common pitfalls that could delay restoration.

-

Common Mistakes: Veterans should be aware of frequent errors in the benefits restoration process, such as forgetting to request restoration after selling their home or omitting necessary documents. By being proactive and understanding lender requirements, former servicemembers can avoid these pitfalls.

Grasping the benefit restoration process is crucial for former service members seeking to reinvest in property and utilize their VA financing advantages efficiently. By following the proper steps and seeking expert guidance, veterans can maximize their homeownership opportunities. We know how challenging this can be, and we’re here to support you every step of the way.

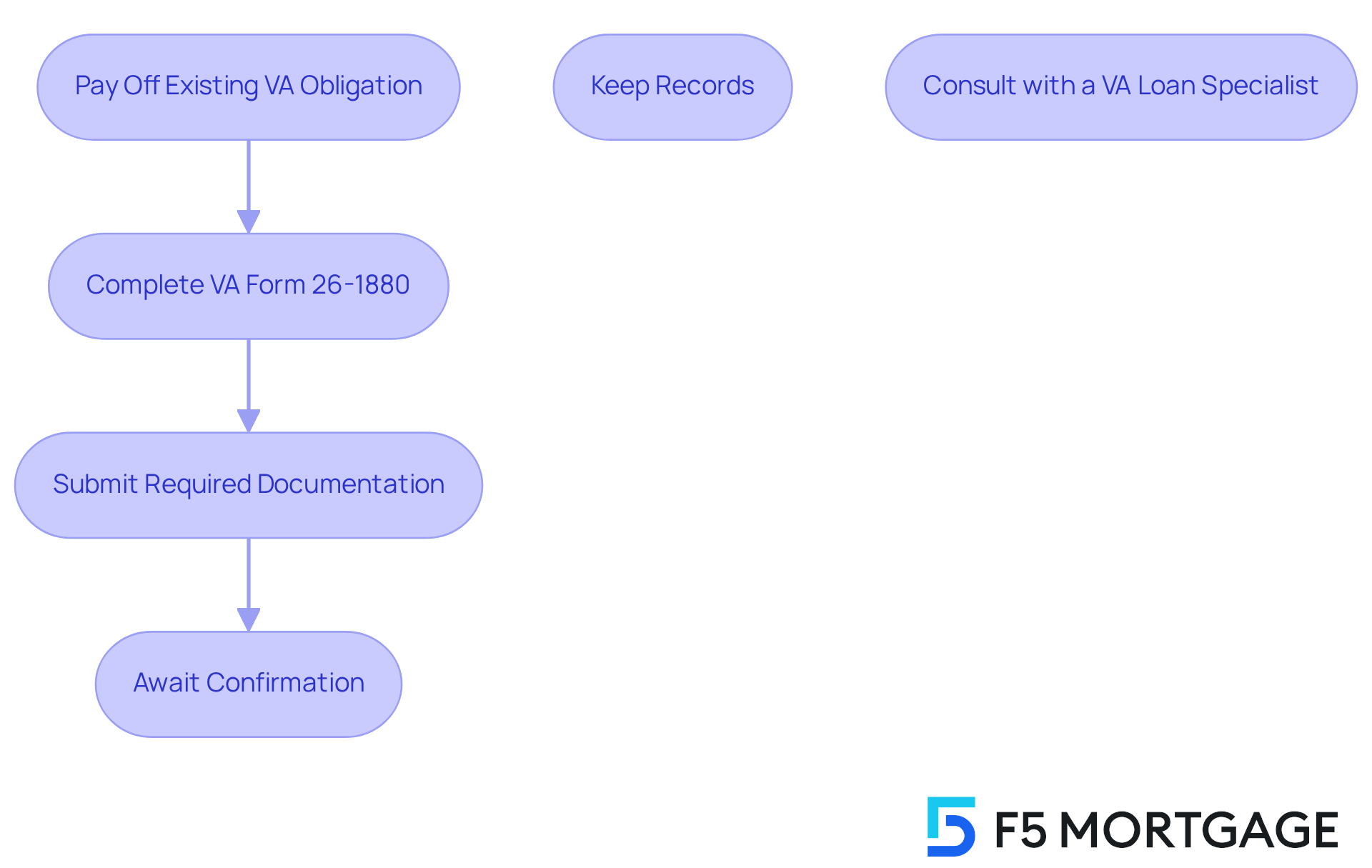

Restoring VA Loan Entitlement: Steps to Take After Selling

Restoring your VA loan entitlement after selling a home can feel daunting, but we’re here to guide you through the essential steps:

- Pay Off the Existing VA Obligation: Make sure that your obligation is fully settled through the sale of your property. This is a crucial first step.

- Complete VA Form 26-1880: This form is necessary to request the restoration of your benefits, and it’s important to fill it out accurately.

- Submit Required Documentation: You’ll need to provide proof of the sale and debt payoff to the VA. This includes necessary supporting documents such as the closing statement and payoff letter.

- Await Confirmation: After submitting your request, the VA will verify the reinstatement of your benefits, enabling you to apply for new financing.

Additional Tips:

- Keep Records: It’s wise to maintain documentation of the sale and loan payoff for future reference. This can be crucial for any subsequent transactions.

- Consult with a VA Loan Specialist: Engaging with a knowledgeable broker can streamline the restoration process. As Chris Birk, Vice President of Mortgage Insight, emphasizes, “Each case varies, so it’s crucial to consult a VA-approved lender who can examine your service record, benefits history, and financial situation to assist you moving ahead.”

The average processing time for VA Form 26-1880 submissions in 2025 is estimated to take about 1-2 weeks for initial submission and an additional 2-4 weeks for final approval. However, delays can occur due to incomplete applications or missing documentation. Many veterans who have successfully navigated this process highlight the importance of thorough documentation and timely communication with their lenders.

We know how challenging this can be, but understanding the subtleties of benefit restoration can greatly improve homeownership prospects for former military personnel. Additionally, it’s important to be aware of the one-time restoration option, which allows you to restore entitlement without selling your original property, providing more flexibility in your homeownership journey.

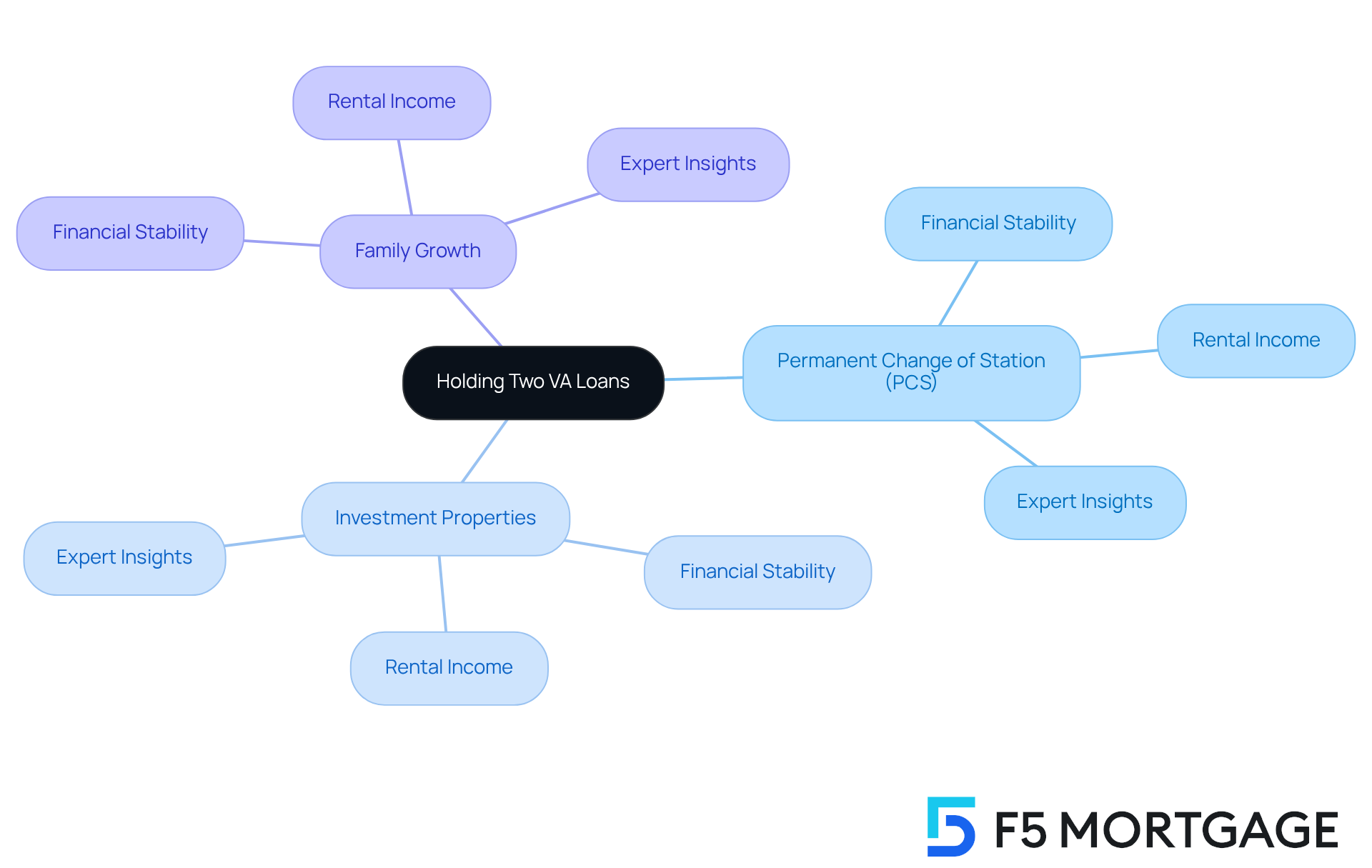

Common Scenarios for Holding Two VA Loans

Veterans often encounter several situations where holding two VA loans can be beneficial:

- Permanent Change of Station (PCS): Active-duty service members frequently face relocation due to military orders. This allows them to retain their current residence while acquiring a new one, making efficient use of their VA benefits.

- Investment Properties: Some veterans opt to keep their first home as a rental property. This strategy raises the question of can you have 2 VA loans at the same time, as it enables them to utilize a second VA mortgage for a new primary residence, providing both investment income and housing stability.

- Family Growth: As families expand, the need for a larger home may arise. Veterans can transition to a bigger property while maintaining their existing home, leading to the question: can you have 2 VA loans at the same time?

Considerations for Each Scenario:

- Financial Stability: It’s essential for veterans to evaluate their financial situation to ensure they can manage an additional loan. To answer the question, can you have 2 VA loans at the same time, it’s essential to have a strong credit profile, with a minimum FICO score of 580 required for VA Standard financing, and stable income to secure a second VA mortgage.

- Rental Income: If a servicemember retains a property as a rental, potential rental income should be factored into the application. Having a tenant can significantly aid in managing two debts, enhancing the borrower’s financial profile and easing qualification for new credit.

- Expert Insights: Financial specialists recommend that veterans carefully assess their debt-to-income ratio and residual income needs when juggling multiple debts. As emphasized by Veterans United, meeting these financial criteria is crucial, particularly when considering the question, can you have 2 VA loans at the same time while balancing two mortgage payments.

By understanding these scenarios and considerations, former service members can make informed decisions about leveraging their VA benefits to meet their housing needs. Additionally, it’s advisable for veterans to verify their remaining benefits before applying for new credit, ensuring they fully understand their eligibility for multiple VA financing opportunities.

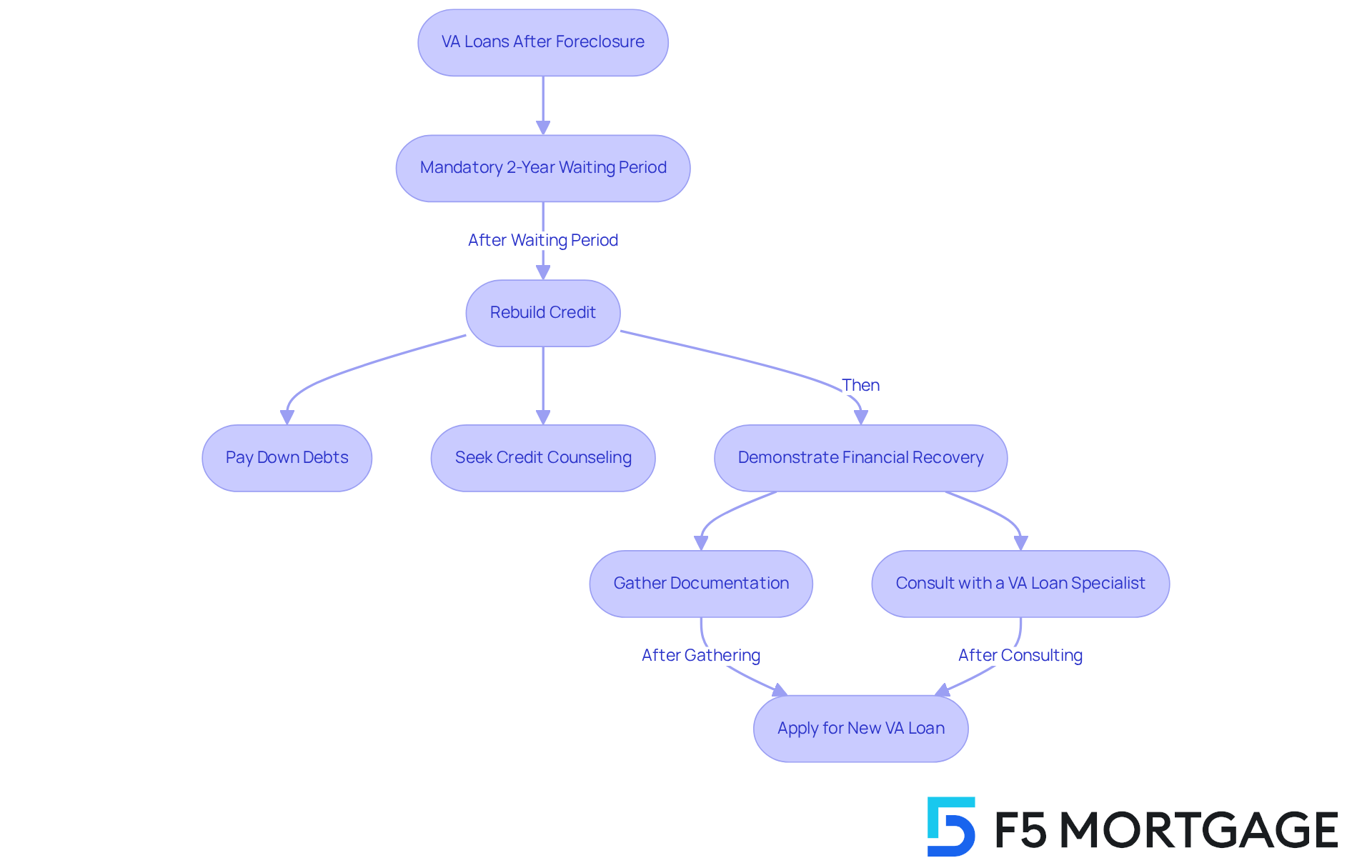

VA Loans After Foreclosure: What You Should Know

Veterans can qualify for VA loans even after experiencing foreclosure, provided they meet certain conditions.

Waiting Period: A mandatory two-year waiting period is required after a foreclosure before applying for a new VA loan. This timeframe allows former service members to stabilize their financial situation.

Rebuilding Credit: During this waiting period, it is crucial for individuals to focus on improving their credit scores. Many veterans can recuperate considerably quicker than those pursuing traditional financing, thanks to the VA program’s more adaptable credit criteria.

Demonstrating Financial Recovery: Lenders will evaluate proof of financial stability and recovery, such as consistent income and improved credit scores, before granting new credit. According to Chris Birk, Vice President of Mortgage Insight, “Veterans can qualify for a VA mortgage after foreclosure if they meet the required waiting period and demonstrate financial recovery.”

Key Steps to Take:

- Consult with a VA Loan Specialist: Engaging with a specialist can provide tailored guidance on navigating the post-foreclosure landscape.

- Gather Documentation: Prepare necessary documents that showcase your financial recovery and stability, such as pay stubs, bank statements, and credit reports. These are essential for approval. Referencing the case study on ‘VA Loan Eligibility After Foreclosure’ can provide insights into how service members have successfully navigated this process.

- Improve Your Credit Score: Focus on paying down debts, making timely payments, and possibly seeking credit counseling to enhance your credit profile.

We know how challenging this can be, but with the right steps, you can move forward confidently. We’re here to support you every step of the way.

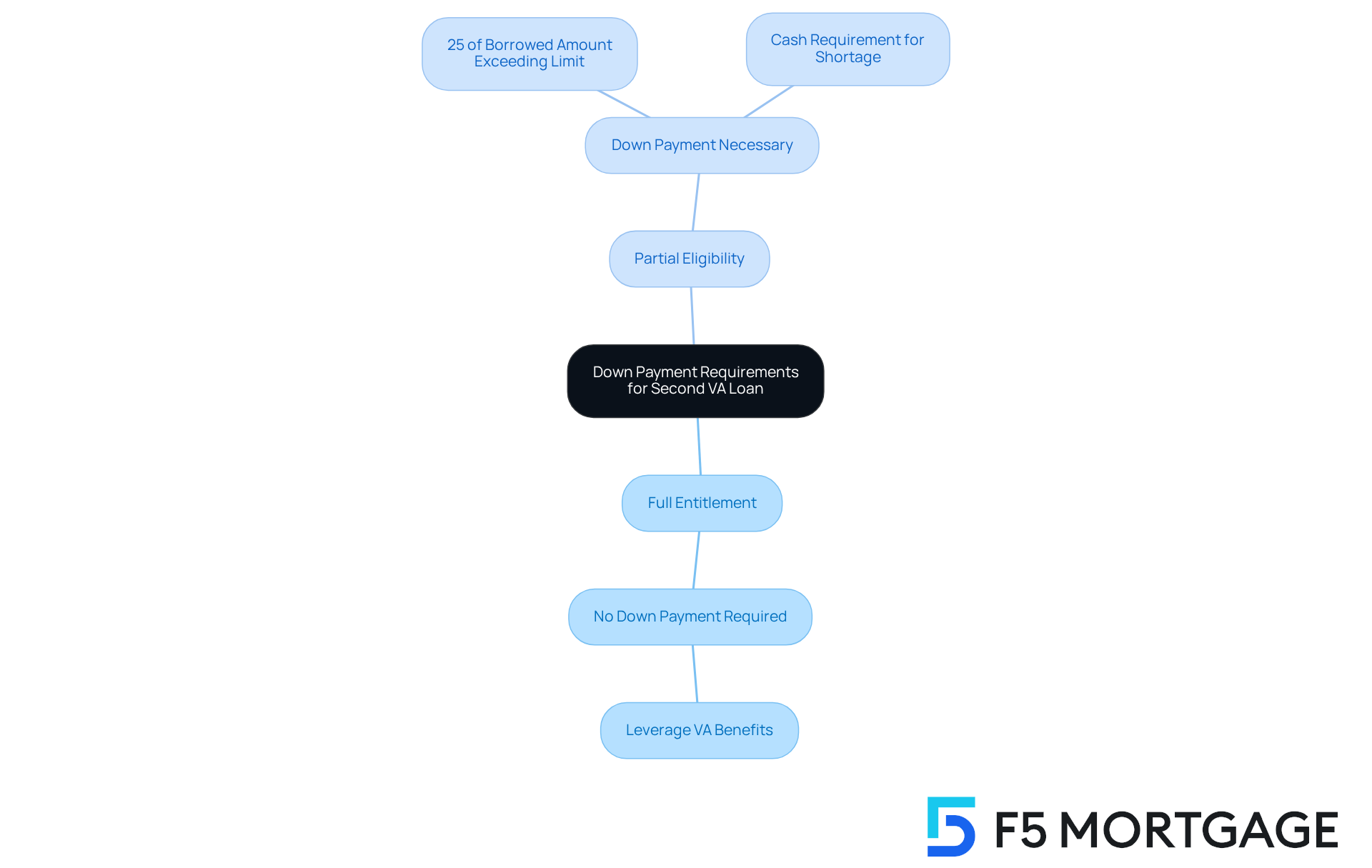

Down Payment Requirements for Your Second VA Loan

When applying for a second VA loan, many veterans may ask, can you have 2 VA loans at the same time, as understanding the down payment requirements can feel overwhelming while navigating their options. Here’s what you need to know about your entitlement status:

-

Full Entitlement: If you have full entitlement, you can secure a second VA loan without needing a down payment. This is a wonderful opportunity to fully leverage your benefits, making home purchases more accessible and less stressful for you and your family.

-

Partial Eligibility: For those who have utilized some of their benefits, a down payment may be necessary. Typically, this down payment is 25% of the borrowed amount that exceeds your remaining limit. As Kenneth Schwartz notes, “The VA expects total guaranty coverage equal to twenty-five percent of your new loan amount.”

Imagine this scenario: if a servicemember’s second home acquisition surpasses their available benefits, they will need to provide a down payment to cover the difference. This step is essential to meet lender requirements and ensure a smooth process. It’s important to acknowledge that many veterans with partial benefits face these down payment needs, which can complicate their home-buying journey.

Understanding these requirements is crucial for effective financial planning. As Laurie Richards highlights, “There’s no limit to how many times you can utilize a VA benefit, as long as you’re eligible and meet the lender’s qualifications, which raises the question: can you have 2 VA loans at the same time?” This flexibility underscores the importance of recognizing your eligibility status when managing various VA financing options. We know how challenging this can be, but rest assured, we’re here to support you every step of the way.

FAQs About VA Loans: Answers to Common Questions

Here are some frequently asked questions about VA loans that many veterans and their families have:

-

Can I have more than one VA loan at a time? Yes, if veterans meet eligibility criteria and have enough remaining benefits. This flexibility is particularly beneficial for military families who may need to relocate frequently due to service commitments.

-

What occurs to my rights if I sell my house? Selling your property and settling the VA debt allows for the reinstatement of your entitlement, making it available for future use. This process is crucial for veterans looking to leverage their benefits for new home purchases.

-

Is there a limit to how many times I can use my VA benefit? There is no limit on the number of times you can use your VA benefit, provided you meet the eligibility criteria each time. This means that former service members can benefit from VA financing throughout their lives, accommodating their changing housing needs.

Data suggests that almost 70% of former service members successfully regain their entitlement after selling their properties, enabling them to access VA financing again without major obstacles. This capability underscores the program’s design to support veterans in achieving homeownership, regardless of their circumstances.

For personalized answers and guidance tailored to your situation, we encourage you to consult with a VA loan specialist. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the complexities of VA loans can feel overwhelming, especially when considering the possibility of holding two loans at the same time. We understand how challenging this can be. It’s essential to grasp the eligibility requirements, entitlement restoration, and the various scenarios in which having multiple VA loans may be beneficial for veterans and their families. With the right knowledge and support, financing multiple properties can transform into a manageable and strategic approach to homeownership.

Key insights include:

- The importance of remaining entitlement

- The conditions under which a second VA loan can be secured

- The advantages of second-tier entitlement

Real-life examples show how veterans can effectively leverage their benefits—whether through relocating for military orders, investing in rental properties, or upgrading their family homes. Additionally, understanding the restoration process after selling a property is vital for regaining full eligibility. This ensures that veterans can continue to access their benefits as their housing needs evolve.

Ultimately, grasping the intricacies of VA loan regulations and eligibility empowers veterans to make informed decisions about their financial futures. Engaging with knowledgeable mortgage partners, like F5 Mortgage, can provide personalized guidance and streamline the process of managing multiple VA loans. By taking proactive steps and staying informed, veterans can fully utilize their VA benefits, paving the way for successful homeownership and wealth accumulation through real estate.

Frequently Asked Questions

Can you have two VA loans at the same time?

Yes, veterans can have two VA loans at the same time under specific conditions, such as having sufficient remaining entitlement and meeting other eligibility criteria.

What is VA loan entitlement?

VA loan entitlement is the amount the Department of Veterans Affairs backs on a mortgage, which influences a veteran’s ability to secure funding for home purchases. Each service member typically starts with a basic benefit of $36,000, which can increase based on the loan amount and county limits.

What factors determine eligibility for multiple VA loans?

Key factors include having sufficient remaining entitlement, designating each VA mortgage for a primary residence, and receiving Permanent Change of Station (PCS) orders for active-duty service members.

How does creditworthiness impact obtaining a second VA loan?

Lenders will evaluate your credit history and overall financial stability to determine your eligibility for a second VA loan.

What is the significance of the debt-to-income ratio for VA loans?

A favorable debt-to-income ratio is crucial for approval, as it reflects your ability to manage additional mortgage payments.

How can rental income affect eligibility for a second VA mortgage?

Earnings from your first property can be utilized to qualify for a second VA mortgage, providing financial flexibility.

What happens to VA benefits after selling a property or settling a VA mortgage?

You can regain your VA benefits after selling a property or settling a VA mortgage, which may allow you to qualify for additional VA loans.

What are the projected VA loan limits for 2025?

The standard VA loan limit for 2025 is projected to be $806,500, with some counties allowing higher limits up to $1,209,750.

How does F5 Mortgage assist families with multiple VA loans?

F5 Mortgage provides personalized consultations, access to various financing programs, and a streamlined application process to help families navigate the complexities of multiple VA loans efficiently.