Overview

This article aims to guide you through the essential steps for preparing a down payment, ensuring your success in obtaining an FHA loan. We understand how challenging this process can be, and we’re here to support you every step of the way.

First, it’s crucial to grasp the basics of FHA loans. By understanding these fundamentals, you can navigate the requirements with greater confidence. Next, assess your financial situation honestly. This self-reflection will help you identify where you stand and what you need to work on.

Implementing effective saving strategies can make a significant difference. Consider setting aside a specific amount each month—small steps can lead to big changes. Additionally, gathering the necessary documentation ahead of time will streamline your application process.

Finally, collaborating with a mortgage broker can provide you with expert guidance tailored to your unique situation. By taking these steps, you’ll be well-prepared for a smoother mortgage application process. Remember, we’re here for you, ready to assist you in achieving your homeownership dreams.

Introduction

Navigating the path to homeownership can often feel like a daunting journey. We know how challenging this can be, especially for those considering an FHA loan. With its lower down payment requirements and flexible credit criteria, this type of mortgage presents a unique opportunity for many aspiring homeowners.

However, the process of preparing for an FHA loan down payment can be fraught with challenges. It’s important to recognize these hurdles and tackle them head-on. What steps can potential borrowers take to ensure they are fully equipped for success in this crucial financial endeavor?

We’re here to support you every step of the way as you embark on this journey.

Understand FHA Loan Basics

FHA mortgages, backed by the Federal Housing Administration, are designed with you in mind, especially if you’re a low-to-moderate-income borrower. We understand how daunting the mortgage process can feel, and these loans can make a significant difference. With a reduced initial deposit requirement—sometimes as low as 3.5%—the down payment for FHA loan and more flexible credit score criteria can open doors that may have seemed closed.

Imagine being able to secure a home without the burden of a hefty down payment for an FHA loan. This is not just a possibility; it’s a path many families have taken. By grasping these fundamentals, you can better decide if an FHA mortgage is the right fit for your home acquisition or refinancing needs. We’re here to support you every step of the way.

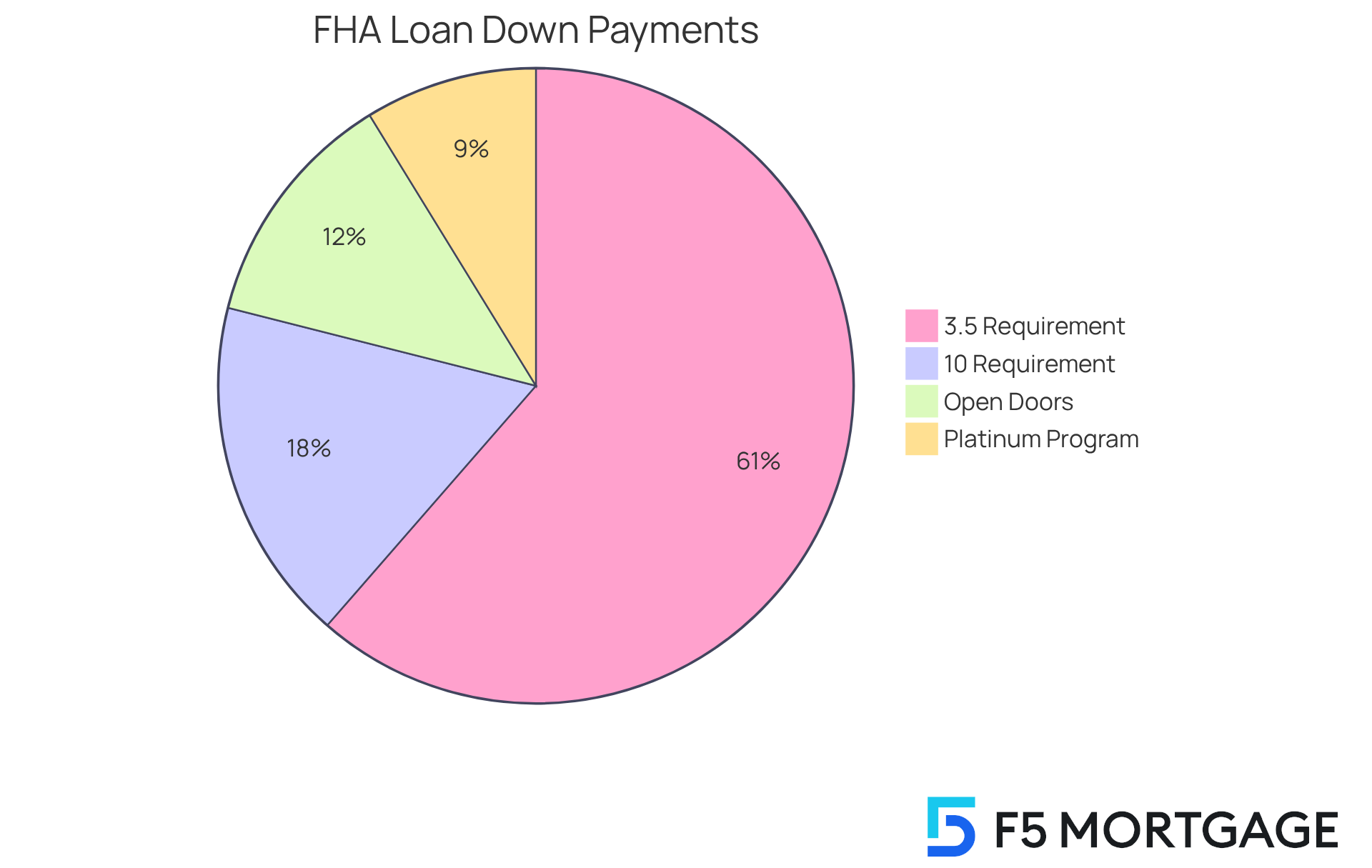

Review FHA Down Payment Requirements

We understand how daunting the process of qualifying for an FHA loan can be. To ease your journey, it’s important to know that borrowers need to provide a down payment for FHA loan of at least 3.5% if their credit score is 580 or higher. If your score falls between 500 and 579, a 10% deposit is required.

But don’t worry; there are several down payment assistance programs available in California to help qualifying applicants with their down payment for FHA loan costs. For instance, the Golden State Finance Authority’s Open Doors program can provide up to 7% of the primary loan amount toward closing costs, while its Platinum Program covers up to 5%.

At F5 Mortgage, we’re here to support you every step of the way. We can assist you in navigating the process of finding suitable programs tailored to your needs for a down payment for FHA loan. Researching these options can significantly ease the financial burden of purchasing a home, especially for first-time buyers and those with low-to-moderate income. Remember, you’re not alone in this journey.

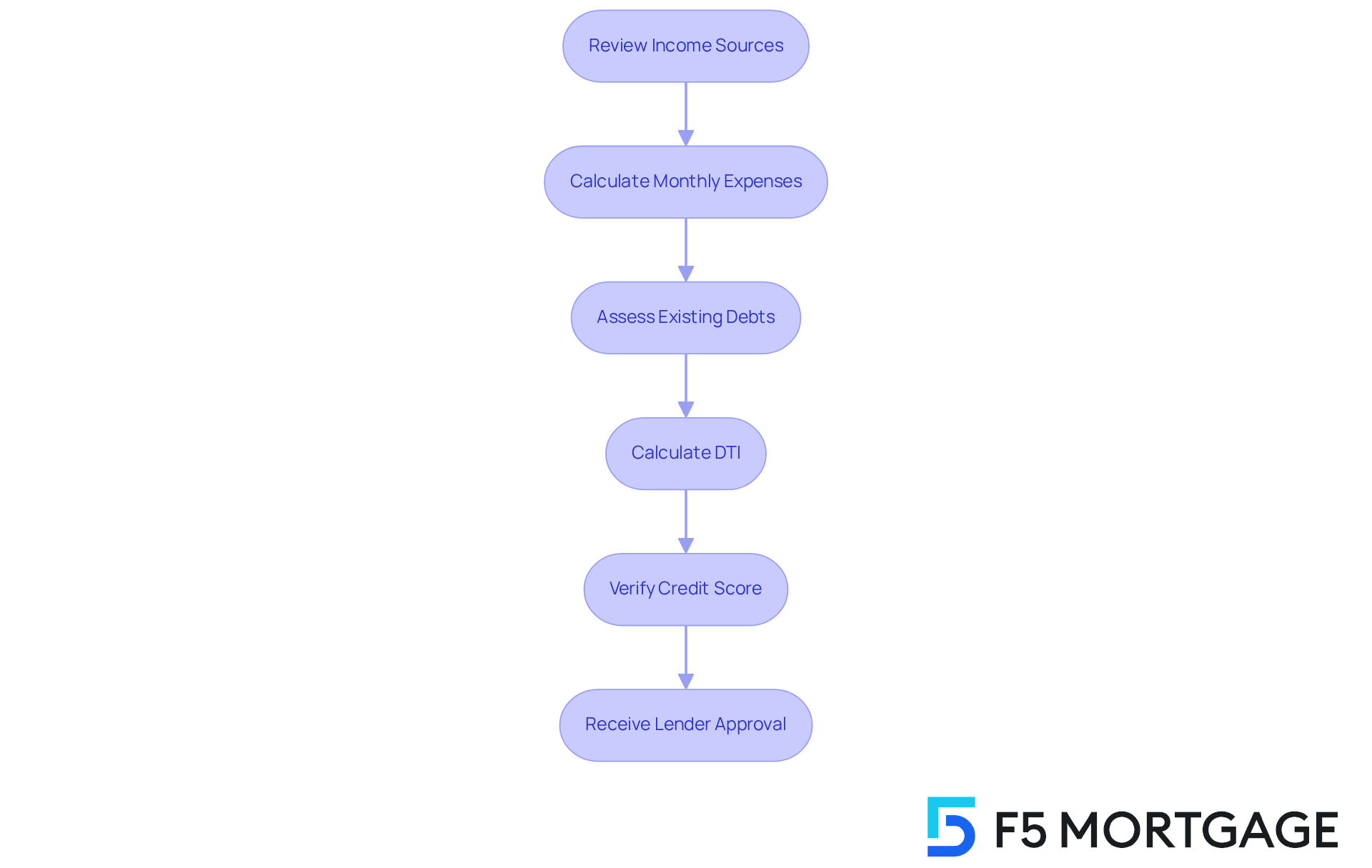

Assess Your Financial Situation

As you embark on this journey, it’s essential to begin by reviewing your income sources, monthly expenses, and any existing debts. Take a moment to calculate your debt-to-income ratio (DTI) by dividing your total monthly debt payments by your gross monthly income. Remember, a DTI of 43% or lower is generally preferred by lenders, which can significantly impact your options.

Next, it’s important to verify your credit score. This score plays a crucial role in determining your eligibility for an FHA mortgage, including the down payment for FHA loan and the interest rates you may be offered. Understanding your financial situation is vital, as it directly influences your mortgage approval.

When you receive an approval, it signifies that a lender believes you are a strong candidate for a mortgage based on your financial information, including your DTI and credit score. However, keep in mind that the approval process can vary between lenders. We know how challenging this can be, and it’s crucial to understand how these factors relate to your financing choices.

By taking these steps, you empower yourself with the knowledge needed to navigate the mortgage process confidently. We’re here to support you every step of the way.

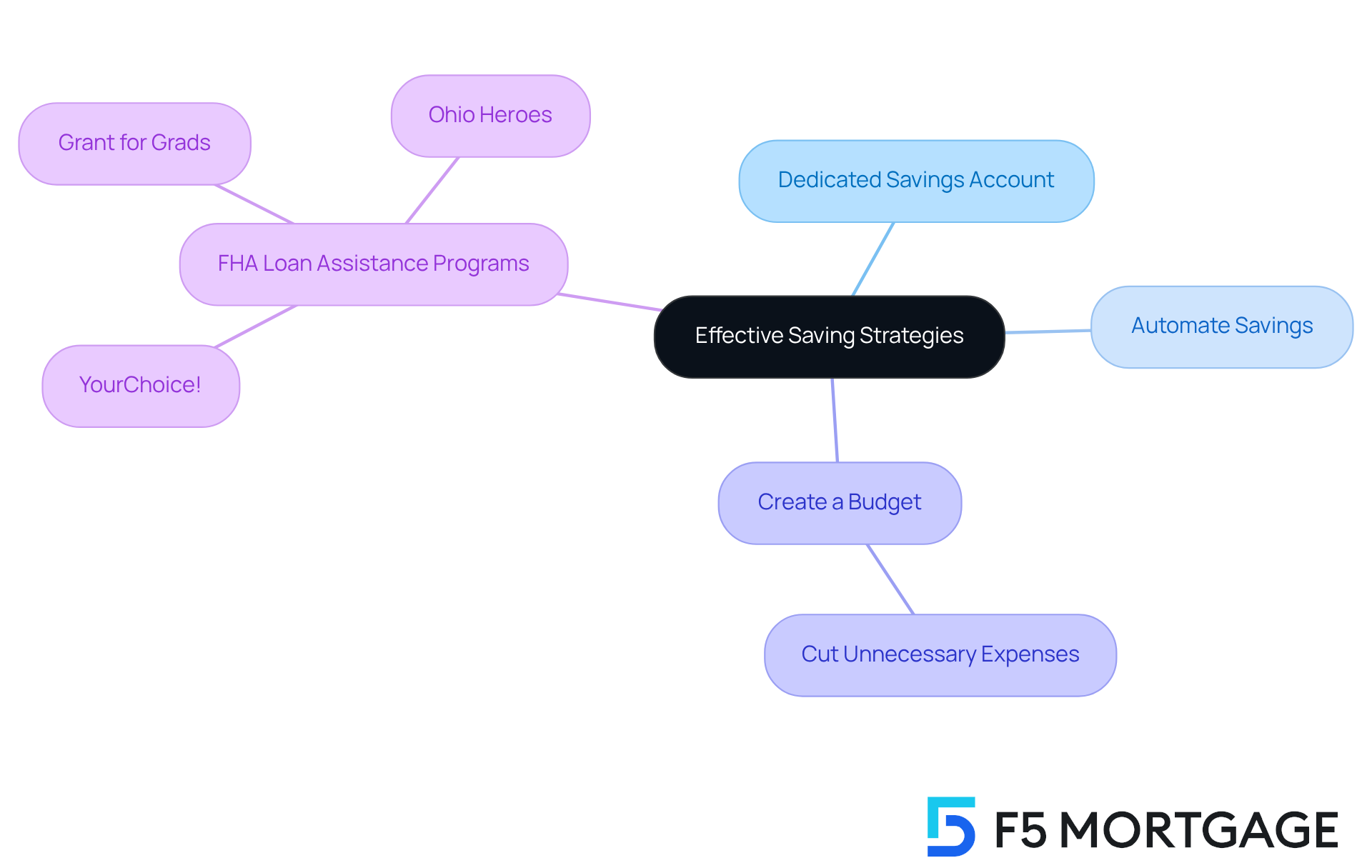

Implement Effective Saving Strategies

To save efficiently for your deposit, we know how challenging this can be, so consider establishing a dedicated savings account solely for this purpose. Automate your savings by scheduling regular transfers from your checking account. Additionally, create a budget that prioritizes saving by cutting unnecessary expenses.

Explore specific initiatives for down payment for FHA loan assistance offered in Ohio, such as:

- YourChoice!

- Grant for Grads

- Ohio Heroes

These programs can provide grants or financial support to help cover the down payment for an FHA loan. Understand the eligibility criteria for these programs and gather all necessary documentation, such as proof of income and tax returns.

We’re here to support you every step of the way. Collaborating with a knowledgeable lender, like F5 Mortgage, can assist you in navigating the application process, ensuring you have everything prepared for submission.

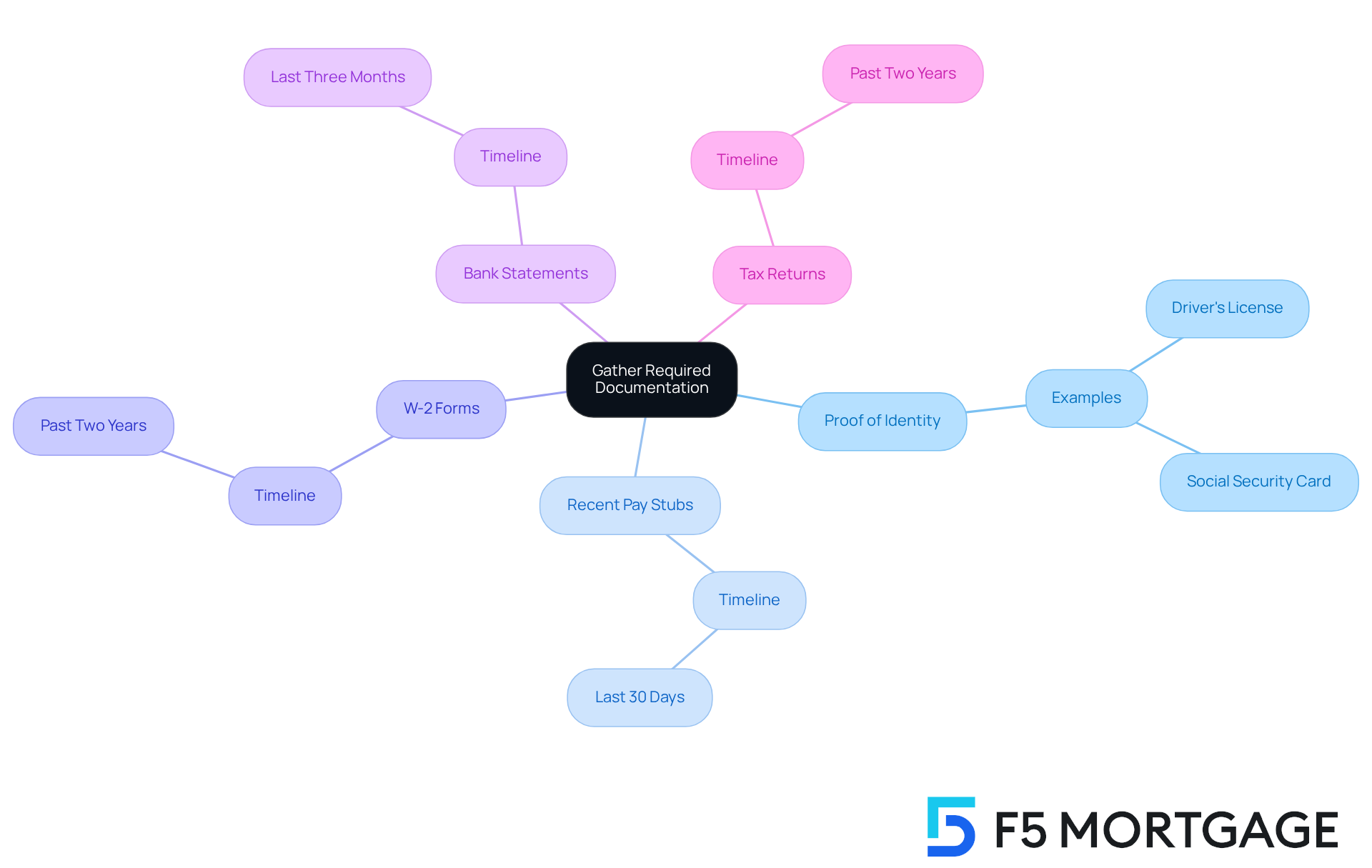

Gather Required Documentation

When applying for an FHA loan, we understand how overwhelming it can feel, especially regarding the down payment for FHA loan. To ease your journey, you’ll need to gather several key documents, including:

- Proof of identity (e.g., driver’s license, Social Security card)

- Recent pay stubs (last 30 days)

- W-2 forms for the past two years

- Bank statements for the last three months

- Tax returns for the past two years

Gathering these documents in advance will not only streamline your application process but also empower your mortgage broker to assist you more effectively.

Additionally, it’s important to consider the benefits of longer versus shorter mortgage terms. A longer term may lower your monthly payments, allowing you to allocate funds towards these documents and other financial evaluations. On the other hand, a shorter term can help you build equity faster.

Being prepared with the necessary documentation not only expedites your application but also positions you to make informed choices about your mortgage options. Remember, we’re here to support you every step of the way.

Collaborate with a Mortgage Broker

Navigating the mortgage process can feel overwhelming, but working with a mortgage broker can provide you with the tailored assistance you need. Clients have shared their positive experiences with F5 Mortgage, highlighting the exceptional service they received. One client said, “Jeff and his team are outstanding to work with. They made the procedure simple and worry-free.”

A broker can help you understand your options, compare different lenders, and negotiate terms on your behalf. Another satisfied customer reflected, “Alyssa & Jorge were both very patient with me & got me secured at rates I couldn’t believe.” This kind of support can make a significant difference, especially when you’re facing potential challenges in your application.

Brokers can identify issues and provide solutions to overcome them, leading to a smoother experience and potentially better loan terms. Many clients appreciate the attention to detail and the guidance they receive throughout the process. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Preparing for an FHA loan can be a transformative step towards homeownership, especially for those with low-to-moderate incomes. We understand how challenging this process can be, but by grasping the essentials of FHA loans—like down payment requirements and available assistance programs—you can navigate the mortgage journey with greater confidence and clarity. When equipped with the right knowledge and resources, the path to securing a home becomes much less daunting.

Throughout this article, we’ve highlighted key insights that underscore the importance of:

- Assessing your financial situation

- Implementing effective saving strategies

- Gathering necessary documentation

- Collaborating with a knowledgeable mortgage broker

Each of these steps is designed to empower you in your quest for homeownership, ensuring you are well-prepared to meet the FHA loan requirements and make informed financial decisions.

Ultimately, taking proactive steps toward preparing for an FHA loan can significantly enhance your chances of success. Embracing these strategies not only simplifies the mortgage application process but also opens doors to opportunities that may have once seemed out of reach. If you’re considering an FHA loan, the time to act is now. Equip yourself with the resources and support needed to turn your homeownership dreams into reality. We’re here to support you every step of the way.

Frequently Asked Questions

What is an FHA loan?

An FHA loan is a mortgage backed by the Federal Housing Administration, designed for low-to-moderate-income borrowers, making home buying more accessible.

What are the down payment requirements for an FHA loan?

Borrowers need to provide a down payment of at least 3.5% if their credit score is 580 or higher. If the credit score is between 500 and 579, a 10% deposit is required.

Are there assistance programs for FHA loan down payments?

Yes, there are several down payment assistance programs available, such as the Golden State Finance Authority’s Open Doors program, which can provide up to 7% of the primary loan amount toward closing costs, and the Platinum Program, which covers up to 5%.

How can I find suitable down payment assistance programs?

At F5 Mortgage, assistance is available to help navigate the process of finding down payment assistance programs tailored to your needs.

Who can benefit from FHA loans?

FHA loans are particularly beneficial for first-time buyers and those with low-to-moderate income, as they offer lower down payment requirements and more flexible credit score criteria.