Overview

This article is dedicated to helping you navigate the final walkthrough of your new home with confidence. We know how challenging this can be, and it’s crucial to ensure that everything is in order before closing.

The essential items you should include in your final walkthrough checklist are vital for safeguarding your investment. Start by verifying the property’s condition. Take a moment to check that all agreed-upon repairs have been completed. This step not only protects your investment but also ensures your satisfaction with your purchase.

Next, confirm that all included items are present. This includes appliances, fixtures, and any other elements that were part of your agreement. Document any issues you encounter during this walkthrough. By doing so, you’ll facilitate a smoother transition into homeownership and address any concerns promptly.

Remember, these critical steps empower you to take charge of your home-buying experience. We’re here to support you every step of the way, ensuring that your journey into homeownership is as seamless and satisfying as possible.

Introduction

Navigating the complexities of a home purchase can be daunting. We understand how overwhelming it feels, especially when it comes to the final walkthrough before closing. This crucial step serves as your last opportunity to ensure that everything aligns with your expectations and contractual agreements. By following a well-structured checklist, you can protect your investment and pave the way for a smoother transition into your new home.

But what are the essential items that should never be overlooked during this pivotal moment? Let’s explore this together.

F5 Mortgage: Streamlined Mortgage Solutions for Closing Success

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why we provide a streamlined approach to mortgage solutions, ensuring that you feel thoroughly prepared with the final walkthrough checklist. By prioritizing personalized service, we help you fully comprehend your mortgage terms and conditions, which significantly enhances the finalization process. This commitment to your satisfaction is crucial. Studies show that lenders who engage clients in a hands-on advisory role achieve notably higher satisfaction scores.

Imagine approaching your final walkthrough checklist with confidence, knowing you have a dedicated partner guiding you through the complexities of mortgage financing. Our personalized mortgage services, including expert guidance from seasoned loan officers and tailored loan programs, have been linked to increased customer loyalty. In fact, 51% of clients cite improved service as a key reason for choosing their mortgage provider.

At F5 Mortgage, our focus on education and support alleviates the stress often associated with closing. We foster a sense of trust and reliability, making us a preferred choice for families navigating their home buying journey. As one satisfied client noted, ‘The team at F5 Mortgage was incredibly attentive and made the entire process seamless.’ We’re here to support you every step of the way.

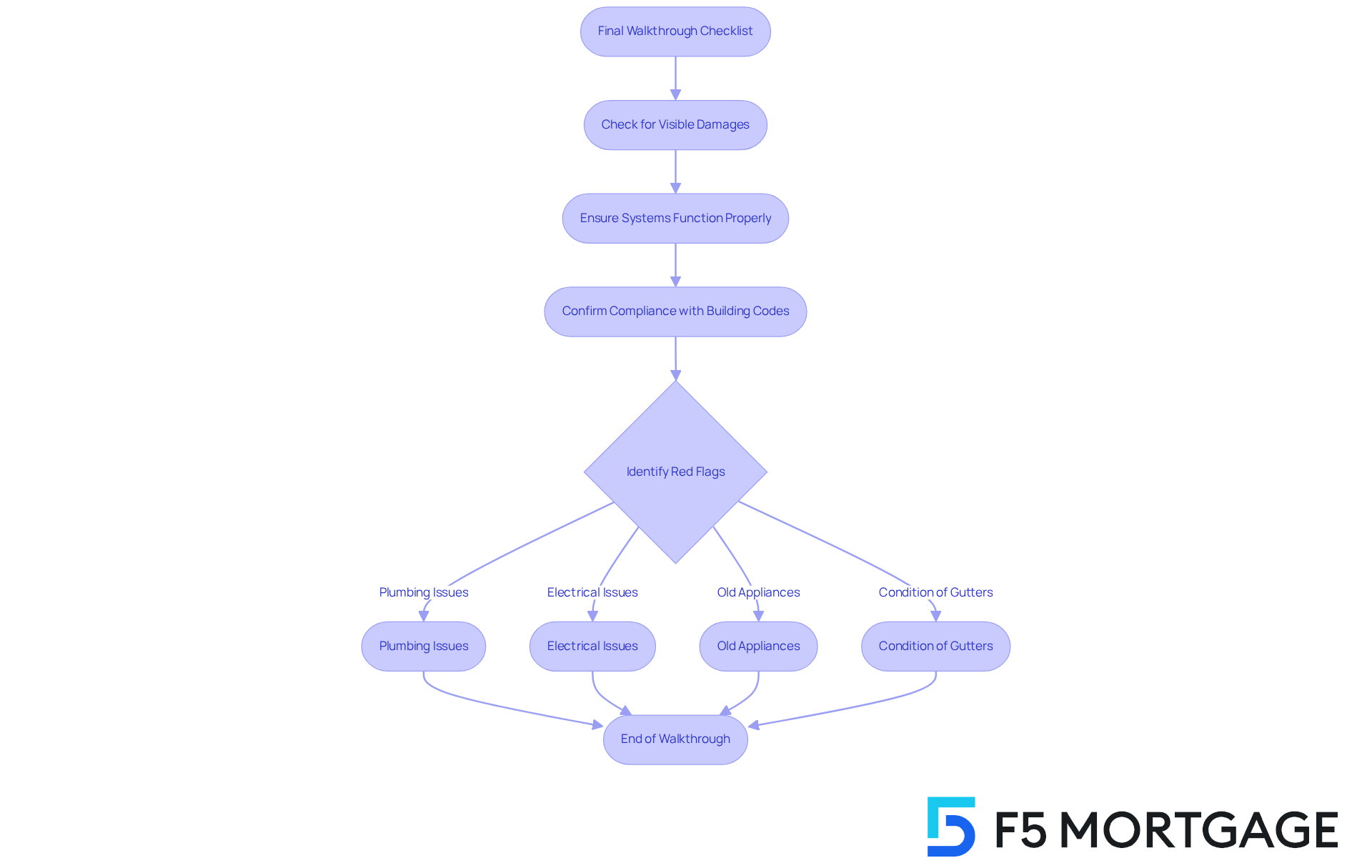

Property Inspection: Verify Condition and Compliance

During the final walkthrough checklist, we know how crucial it is to conduct a thorough inspection of the premises. Take a moment to check for any visible damages. Ensure that all systems are functioning properly and confirm that the property complies with local building codes.

If you’re not working with an agent, don’t hesitate to contact the seller’s agent to schedule a viewing. Completing the final walkthrough checklist is an essential step before making an offer. Be mindful of potential red flags, such as:

- Plumbing and electrical issues

- Old appliances

- The condition of gutters

These factors can complicate your mortgage agreement and affect your refinancing options down the line.

This verification not only protects your investment but also helps you avoid hidden problems. Remember, we’re here to support you every step of the way.

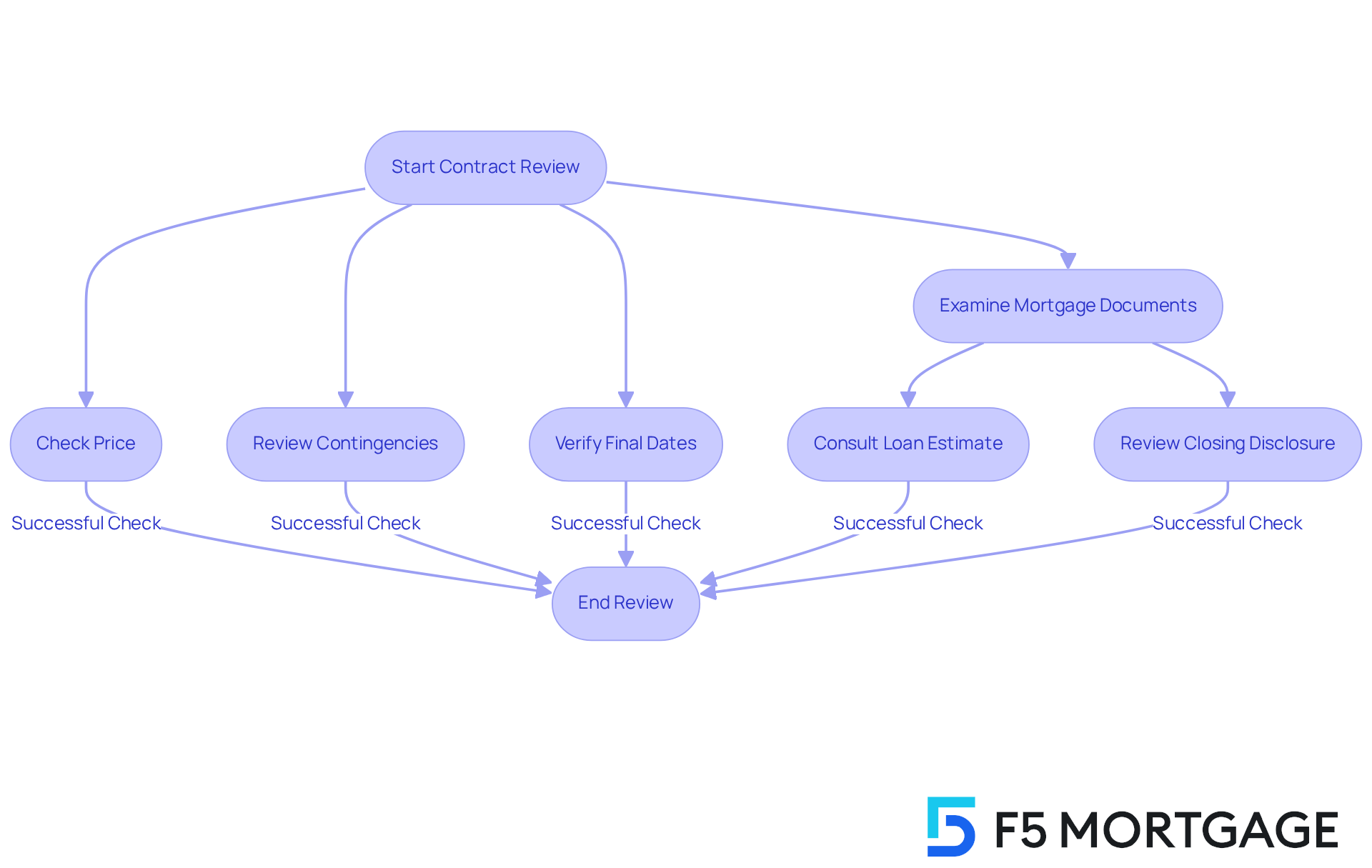

Contract Review: Confirm Terms and Conditions

Before finalizing your home purchase, we know how crucial it is to conduct a comprehensive review of the contract. Ensure that all terms and conditions—such as price, contingencies, and final dates—are accurately documented. This meticulous review not only prevents last-minute surprises but also confirms that your mortgage aligns with your expectations.

Statistics show that a significant percentage of homebuyers encounter discrepancies in their contracts. This highlights the necessity of this step. For instance, thorough reviews have resolved various contract disputes, allowing buyers to address issues proactively. It’s also common for buyers to request repairs or upgrades from the seller during negotiations. Understanding how to effectively negotiate these requests can significantly impact your overall purchase experience.

By verifying mortgage terms and conditions before completion, including examining the Loan Estimate and Closing Disclosure from your lender, you can navigate the intricacies of the transaction with assurance. This ensures a more seamless transition into homeownership, empowering you every step of the way.

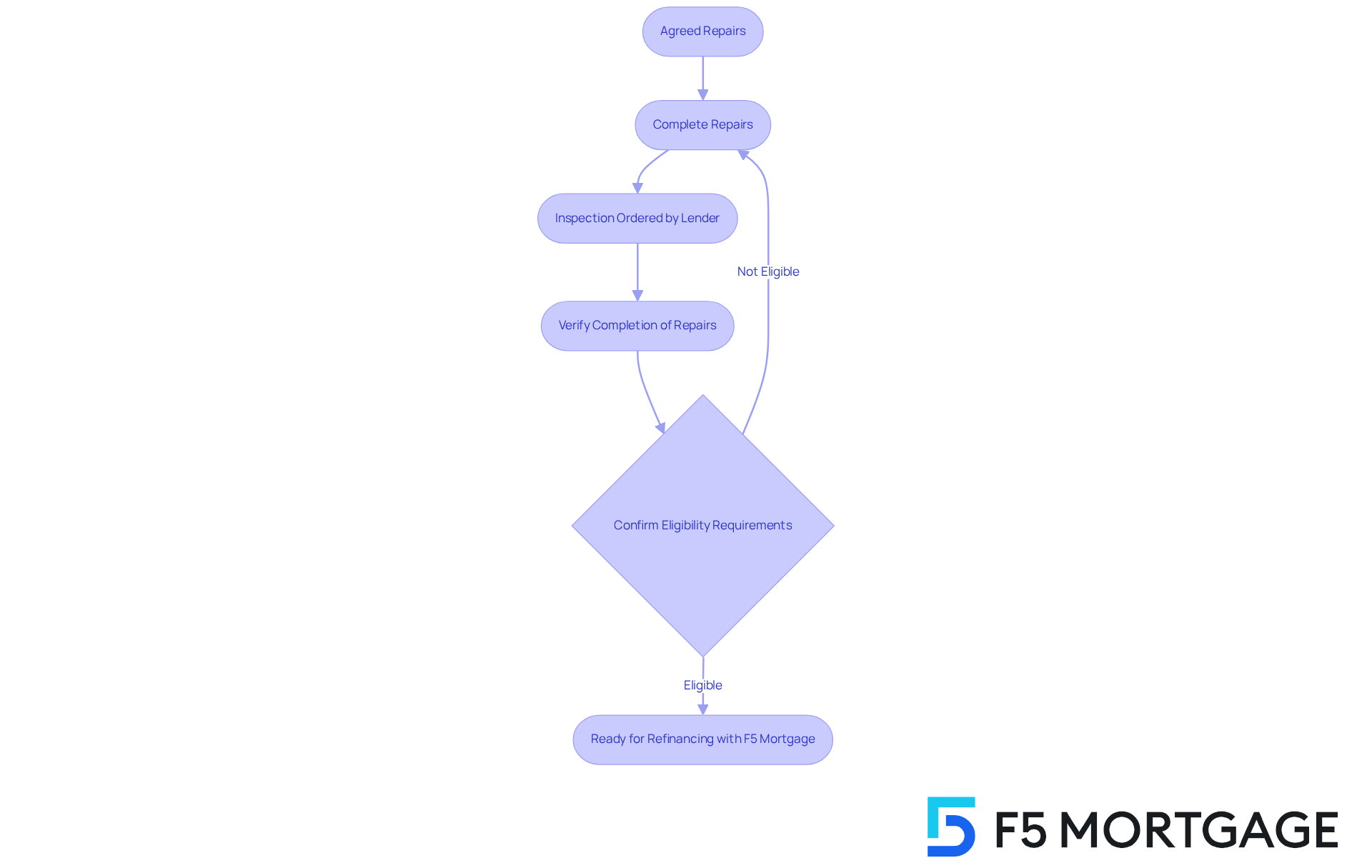

Repair Verification: Ensure Agreed Fixes Are Completed

It’s important to ensure that all repairs agreed upon during negotiations have been completed satisfactorily. This includes any fixes related to inspections or negotiations. Completing these repairs not only safeguards you from unforeseen expenses after closing but also guarantees that the premises are in the condition you anticipated.

We understand how challenging this process can be, and it’s reassuring to know that the lender may also order an inspection to verify these repairs. This step is crucial for maintaining your refinancing options. Furthermore, please be mindful that eligibility and requirements may differ based on the type of real estate. For instance, refinancing investment or holiday residences may have stricter criteria than a primary home.

Confirming that all agreed-upon repairs are completed is essential for your refinancing options with F5 Mortgage. We’re here to support you every step of the way, ensuring that you feel confident and prepared as you navigate this important process.

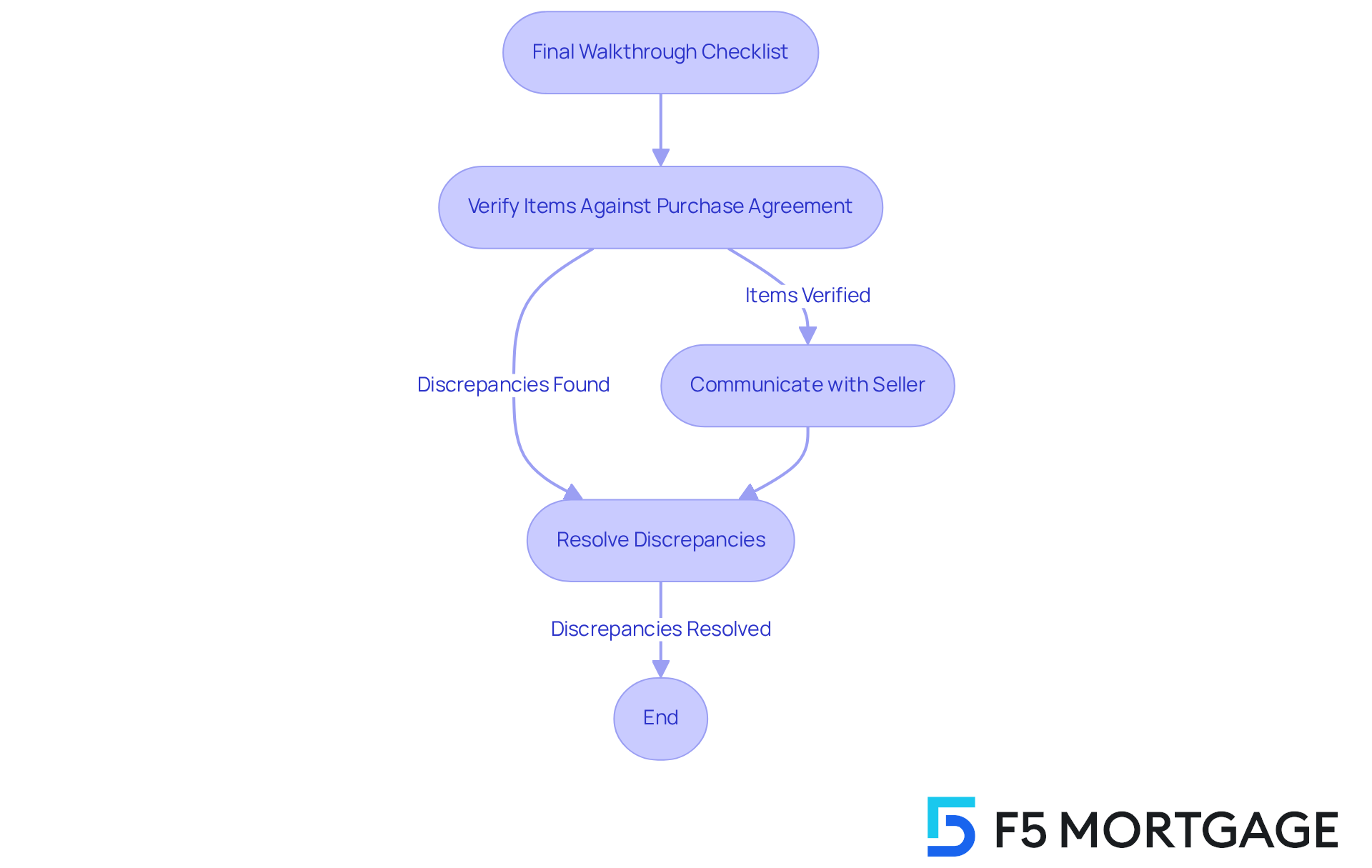

Personal Property Check: Confirm Included Items

During the final walkthrough checklist, we know how crucial it is to verify that all personal property items included in the sale—such as appliances, fixtures, and furniture—are present. This step not only ensures that you receive everything promised in the sale agreement but also helps prevent disputes with the seller. It’s surprising to note that a significant percentage of homebuyers overlook this verification, leading to misunderstandings post-sale.

To prevent such challenges, it’s essential for purchasers to carefully check the items specified in the purchase agreement against the final walkthrough checklist to confirm what is actually available in the property. Real estate agents emphasize that clear communication about included items can significantly reduce the likelihood of disputes. For instance, imagine the frustration if a seller removes an appliance that was part of the agreement; this can lead to complications and dissatisfaction.

Therefore, we recommend bringing a copy of the contract and any amendments to the walkthrough. This allows for immediate resolution of any discrepancies, ensuring that you feel secure in your new home. By taking these precautions, you can pave the way for a smoother transition into your new residence. Remember, we’re here to support you every step of the way.

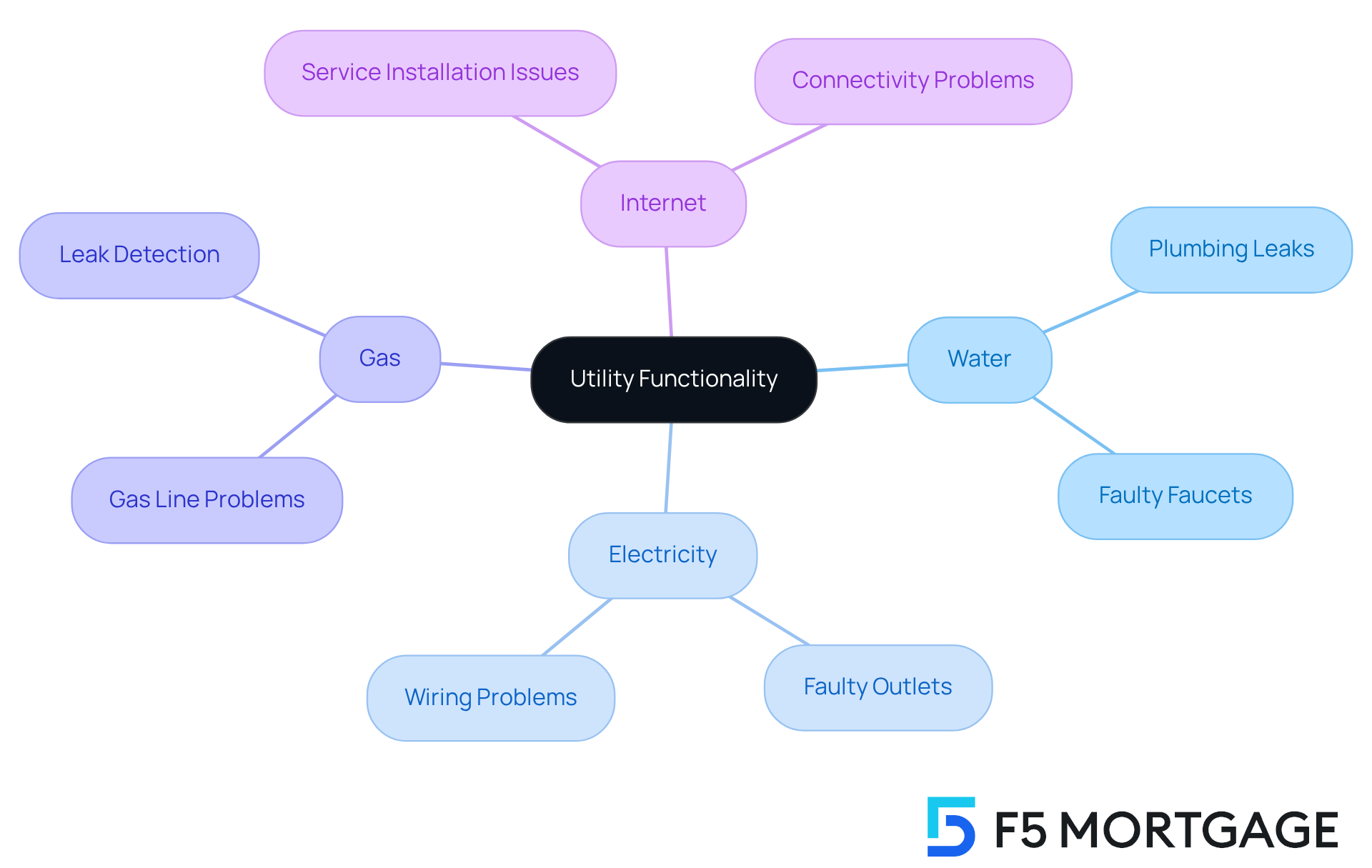

Utility Functionality: Test All Services

Before you move into your new home, it’s essential to ensure that all utilities—water, electricity, gas, and internet—are fully operational. We know how challenging this can be, but evaluating these services is crucial to prevent inconveniences and to ensure a smooth transition. Surprisingly, about 30% of homebuyers overlook this important step in their final walkthrough checklist. This oversight can lead to unforeseen complications after moving in.

Common issues found during residential inspections include:

- Faulty electrical outlets

- Plumbing leaks

- Gas line problems

These issues can jeopardize both safety and livability. Home inspectors emphasize that a thorough check of these utilities not only safeguards against potential hazards but also enhances your overall moving experience. Imagine the peace of mind you’ll feel knowing everything is in working order!

Being present during your property inspection allows you to ask questions and gain valuable insights from the inspector. This interaction can help clarify any concerns you may have. Typically, property evaluations range from $200 to $500, depending on the inspector and the size of the property. By prioritizing utility functionality and understanding the inspection process, you can ensure that your new residence is ready for you from day one.

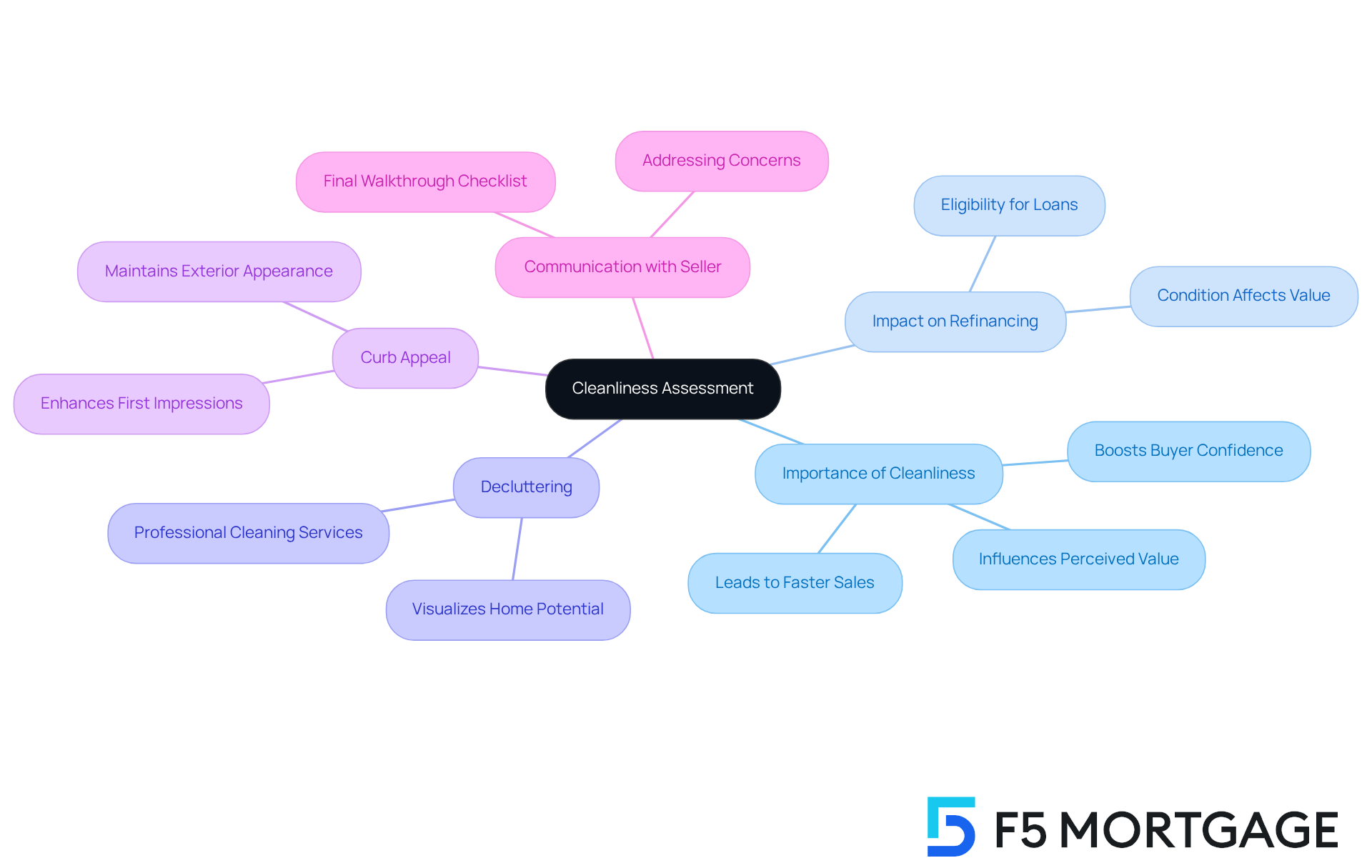

Cleanliness Assessment: Evaluate Property Condition

During your final walkthrough checklist, it is important to thoroughly evaluate the cleanliness and overall condition of the premises. A tidy residence not only fosters a friendly environment but also reflects the seller’s commitment to maintaining the property. We know how challenging it can be to navigate these decisions, and it’s essential to recognize that buyers often form opinions based on cleanliness before considering other design aspects. For example, a well-maintained property can attract more potential buyers and facilitate quicker sales, as cleanliness signals quality care.

Furthermore, understanding the state of the asset can influence your refinancing eligibility with F5 Mortgage. If the residence requires significant repairs, it may not qualify for refinance loans, particularly for investment or vacation units, which often have stricter standards compared to primary dwellings.

Before you dive into deep cleaning, consider decluttering the space. This allows potential buyers to visualize the home’s full potential. Additionally, curb appeal plays a crucial role; maintaining the exterior of the building can enhance first impressions and overall attractiveness. If you notice areas that are not up to standard, it’s wise to address these concerns with the seller by referring to the final walkthrough checklist before closing. Taking this proactive approach ensures that the property meets your expectations and helps prevent any unpleasant surprises after reviewing the final walkthrough checklist.

Remember, a tidy living space boosts buyer confidence and can lead to a smoother transaction process. Consider hiring professional cleaning services to focus on high-impact areas like kitchens and bathrooms, ensuring that every corner of the home is inviting and well-presented. We’re here to support you every step of the way.

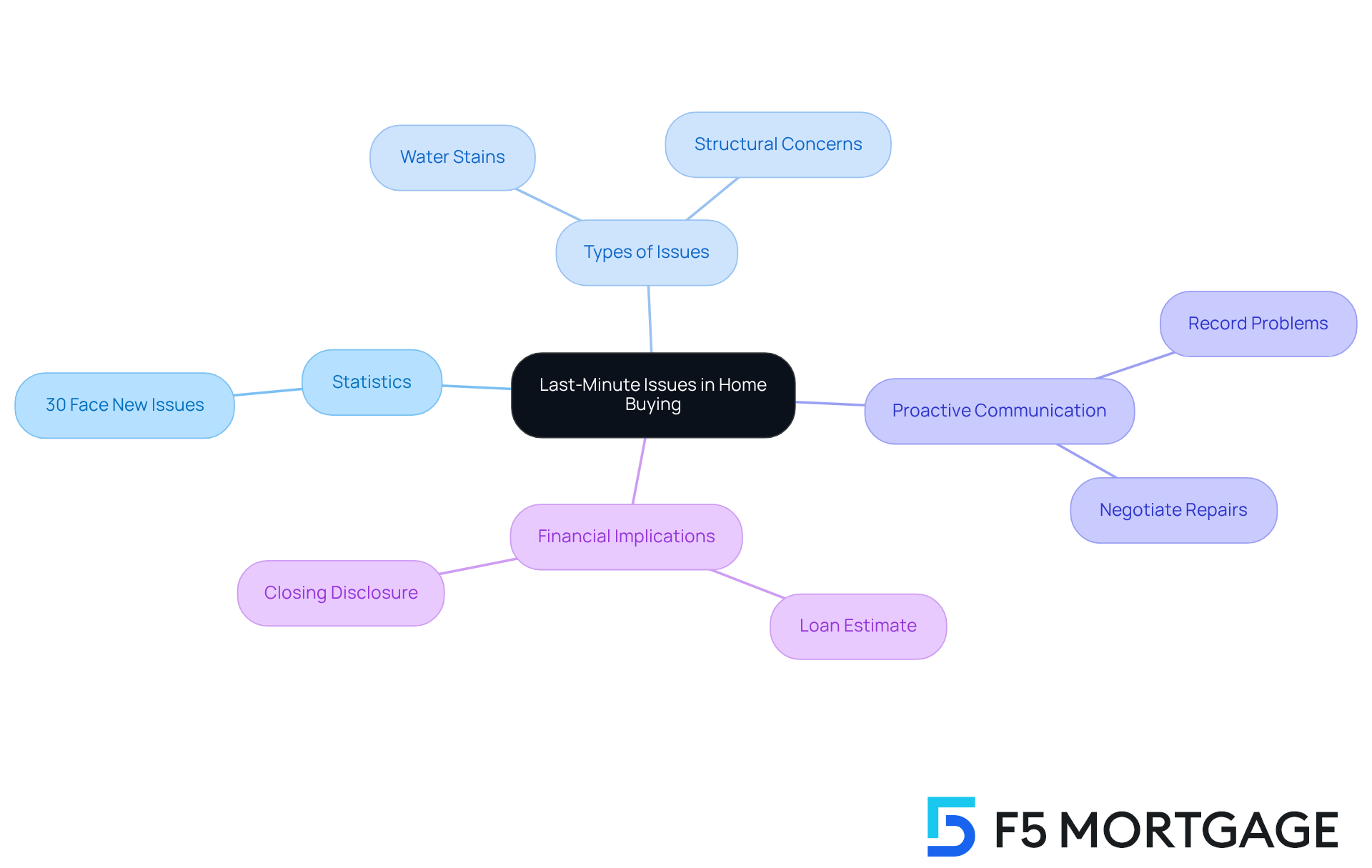

Last-Minute Issues: Identify New Concerns

During the final walkthrough checklist, we know how challenging it can be to stay alert for any last-minute problems that may arise. Statistics suggest that roughly 30% of homebuyers face new issues right before finalizing, often connected to unforeseen repairs or alterations in the property’s state. For instance, new damages may be uncovered, such as water stains or structural concerns that were not previously observed. Addressing these concerns promptly is essential to prevent complications during the closing process.

Real estate agents emphasize the importance of proactive communication when unexpected problems arise. One agent noted, “The key is to approach these situations with a solution-oriented mindset. Record any problems and convey them to your agent promptly.” This aligns with the common practice of asking sellers to make repairs as a contingency for purchasing the home. If new issues are identified, you can utilize this documentation in discussions for repairs or credits prior to finalizing, which may also involve negotiating other aspects of your offer, such as the move-in date.

Additionally, your lender will provide a Loan Estimate outlining the fees and costs associated with your loan, which may change up to 10% prior to closing. Before you close, you will receive a Closing Disclosure detailing your final numbers, ensuring you understand exactly what you’re paying for. Another agent added, “Being thorough during the walkthrough can save you from headaches later on. Always take notes and photos of any discrepancies you find.” By being thorough and proactive, homebuyers can use a final walkthrough checklist to navigate these last-minute challenges effectively, ensuring a smoother transition into their new home.

Remember, if negotiations with the seller become challenging, it’s okay to walk away; there will always be another house that meets your needs.

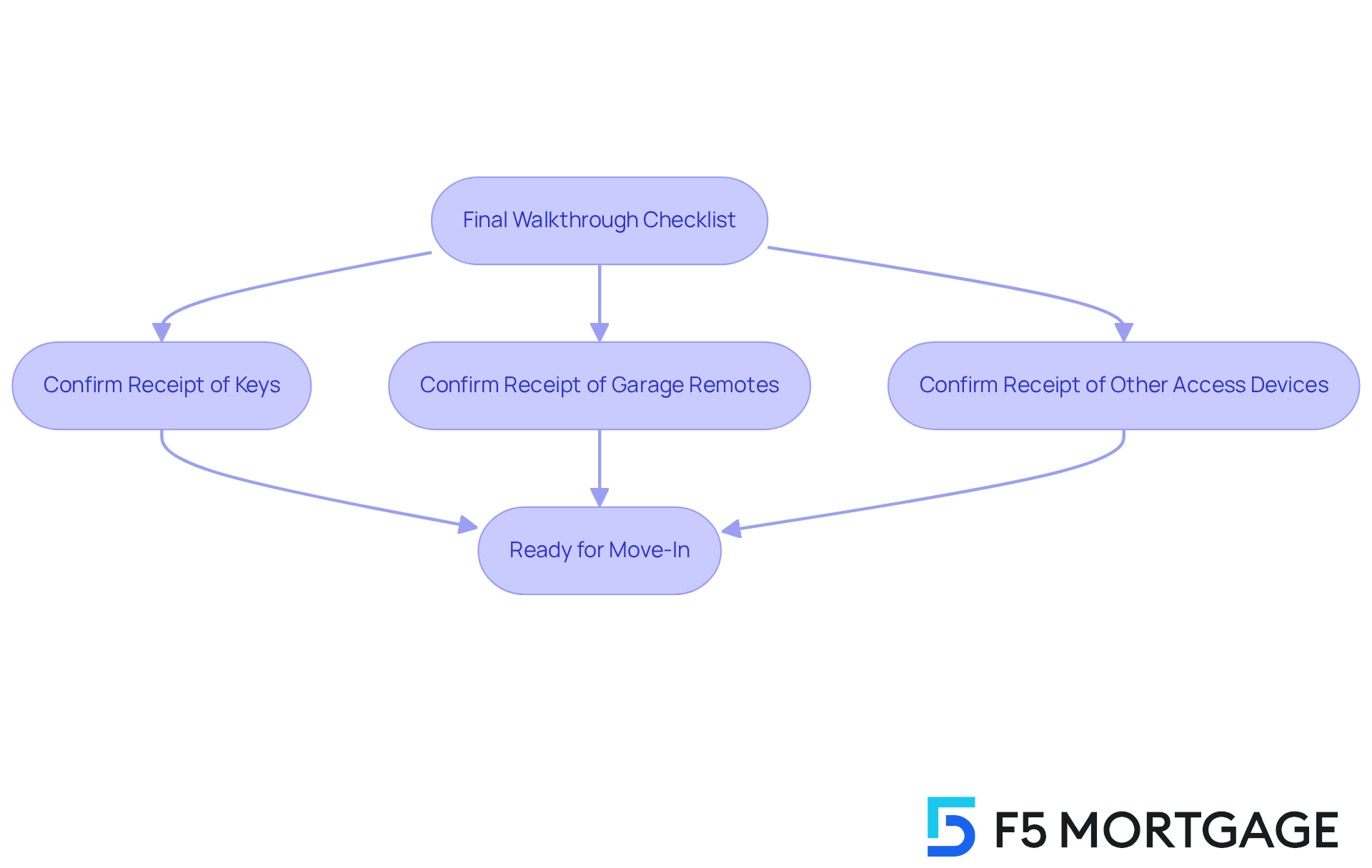

Key and Remote Check: Ensure Access to Property

We understand how important it is to complete your final walkthrough checklist to ensure everything is in place for your move. Please confirm that you have received all keys, garage remotes, and any other access devices for the property. Ensuring you have everything you need for access is crucial. By using the final walkthrough checklist, it not only makes your move-in experience smoother but also helps avoid any delays on moving day. We’re here to support you every step of the way!

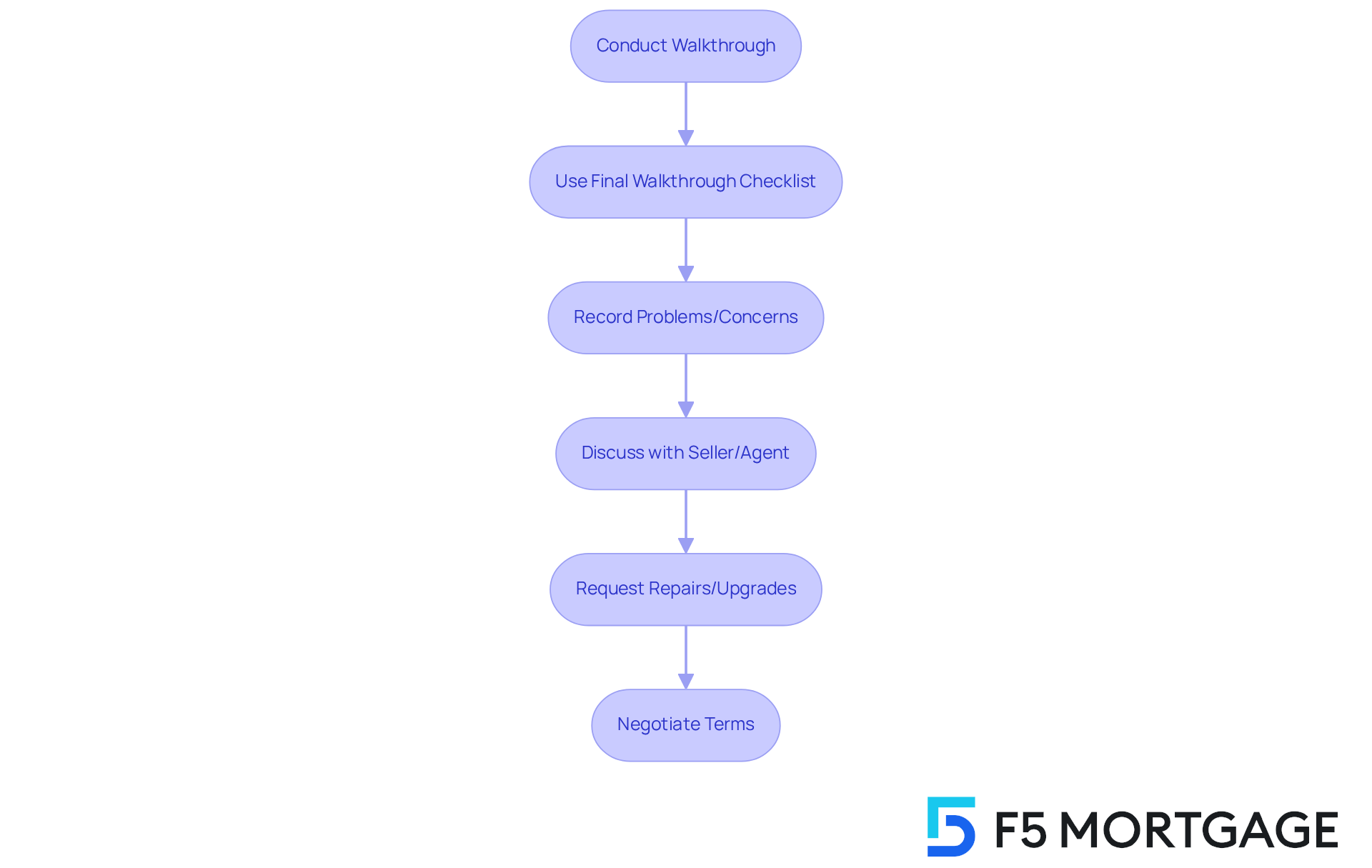

Documentation of Issues: Record Findings for Follow-Up

As you embark on your walkthrough, we encourage you to use the final walkthrough checklist to record any problems or concerns you encounter. This record will be invaluable for follow-up discussions with the seller or your real estate agent. It’s especially important if you need to request repairs or upgrades as part of your negotiation strategy.

Addressing these issues promptly after closing is key to ensuring that your new home meets your expectations and is in the condition you anticipated. We know how challenging this can be, but remember, if the seller counters your initial offer or rejects it, your agent is there to assist you. They can negotiate not just the purchase price but also any necessary repairs, ensuring you secure the best deal possible.

We’re here to support you every step of the way, helping you navigate these important discussions with confidence.

Conclusion

Completing a final walkthrough checklist is an essential step in the home-buying process, ensuring that everything is in order before you make that important commitment. We understand how overwhelming this journey can be, so it’s crucial to highlight the essential items to consider. From verifying the property’s condition and compliance to confirming all included personal property, each step is vital in safeguarding your investment and ensuring a smooth transition into homeownership.

Key insights reveal the importance of thorough inspections, meticulous contract reviews, and proactive communication with sellers. Addressing potential problems before closing can prevent complications down the line. By carefully documenting your findings, you equip yourself with the necessary information for negotiations. Following these guidelines allows you to approach your final walkthrough with confidence, knowing you have taken the necessary precautions.

Ultimately, the final walkthrough is not just a formality; it is your opportunity to ensure that your new home meets your expectations and is ready for the next chapter of your life. Embracing this process with diligence and attention to detail can significantly enhance your home-buying experience. It ensures that the transition into your new living space is as seamless as possible. Taking these steps not only protects your investment but also fosters peace of mind, allowing you to focus on making your new house a home.

Frequently Asked Questions

What is F5 Mortgage’s approach to the mortgage process?

F5 Mortgage provides a streamlined approach to mortgage solutions, focusing on personalized service to help clients understand their mortgage terms and conditions, enhancing the finalization process.

How does F5 Mortgage ensure client satisfaction?

F5 Mortgage prioritizes personalized service and hands-on advisory roles, which studies show lead to higher satisfaction scores among clients.

What services does F5 Mortgage offer to support clients?

F5 Mortgage offers personalized mortgage services, including expert guidance from seasoned loan officers and tailored loan programs, which contribute to increased customer loyalty.

Why is the final walkthrough checklist important?

The final walkthrough checklist is crucial for conducting a thorough inspection of the property, verifying its condition, and ensuring compliance with local building codes before finalizing the purchase.

What should buyers look for during the property inspection?

Buyers should check for visible damages, ensure all systems are functioning properly, and be mindful of potential red flags such as plumbing and electrical issues, old appliances, and the condition of gutters.

What is the importance of contract review before finalizing a home purchase?

Conducting a comprehensive review of the contract ensures that all terms and conditions are accurately documented, preventing last-minute surprises and confirming that the mortgage aligns with the buyer’s expectations.

What can buyers do if they find discrepancies in their contracts?

Buyers can address discrepancies proactively through thorough reviews, which may also allow them to request repairs or upgrades from the seller during negotiations.

What documents should buyers examine before completing their mortgage?

Buyers should examine the Loan Estimate and Closing Disclosure from their lender to navigate the intricacies of the transaction with assurance.