Overview

This article serves as a caring guide for veterans considering the VA Interest Rate Reduction Refinance Loan (IRRRL). We understand how challenging it can be to manage existing VA-backed mortgages, and our goal is to help you secure lower interest rates and reduced monthly payments. By exploring the benefits of the IRRRL program, we aim to provide clarity on how it can ease your financial burdens.

We delve into the factors that influence IRRRL rates, ensuring you have all the information you need to make informed decisions. The step-by-step application process is laid out clearly, making it easier for you to navigate this important journey. We also address common concerns that many veterans face, reinforcing our commitment to supporting you every step of the way.

With this comprehensive overview, we hope to empower you to take action towards achieving financial relief through refinancing. Remember, we’re here to support you as you explore your options and work towards a brighter financial future.

Introduction

Understanding the intricacies of refinancing can indeed feel overwhelming, especially for veterans who are striving to ease their financial burdens. We know how challenging this can be.

The VA Interest Rate Reduction Refinance Program (IRRRL) presents a valuable opportunity to secure lower interest rates and simplify the refinancing process. Yet, with rates fluctuating and various factors influencing eligibility, many may wonder: how can one navigate this complex landscape to truly maximize their benefits?

This article aims to delve into the essentials of VA IRRRL rates, offering insights and guidance designed to empower veterans on their refinancing journey.

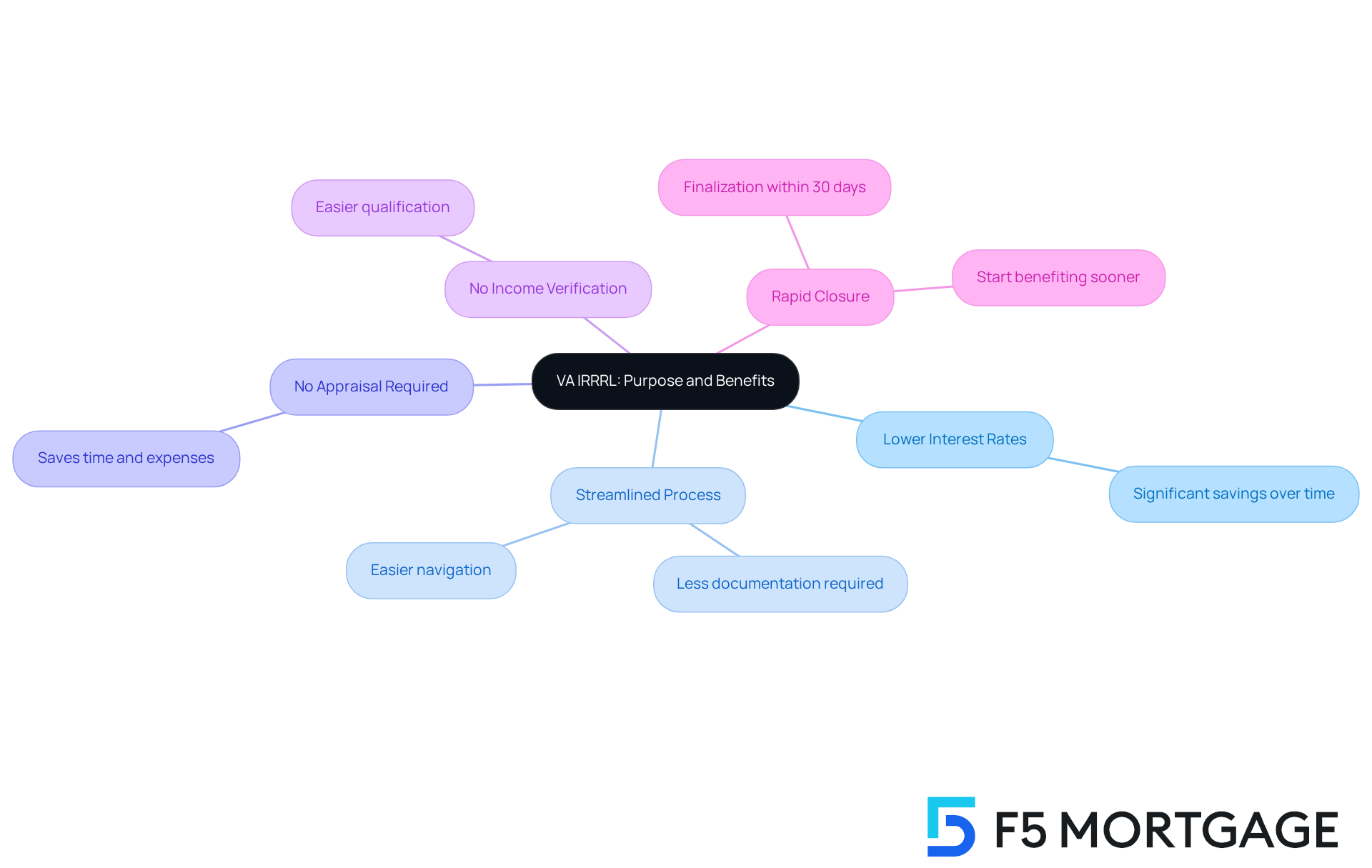

Define VA IRRRL: Purpose and Benefits

The VA Interest Rate Reduction Refinance Program is designed with service members in mind, specifically those who already have a VA-backed mortgage. We understand how important it is for former service members to find ways to reduce their financial burden. This program aims to assist you in refinancing your current loans, allowing you to secure lower interest costs and decrease monthly payments.

Key benefits of the VA IRRRL include:

- Lower Interest Rates: Typically, IRRRLs offer lower rates compared to conventional refinancing options, leading to significant savings over time.

- Streamlined Process: The application procedure is made simpler, often needing less documentation than conventional refinancing, making it easier for you to navigate.

- No Appraisal Required: In most situations, you won’t need to undergo a new appraisal, saving both time and expenses.

- No Income Verification: Many lenders, including those at F5 Mortgage, do not require income verification, making it easier for you to qualify.

- Rapid Closure: The IRRRL process is designed to finalize swiftly, often within 30 days, allowing you to start benefiting from your new VA IRRRL rates sooner.

At F5 Mortgage, we are dedicated to offering you devoted assistance throughout the refinancing process. We want to ensure you can access the advantages of your VA loans effortlessly. As an independent broker with an extensive network of lenders, we are well-positioned to help you find the best refinancing options tailored to your needs. We know how challenging this can be, and we’re here to support you every step of the way.

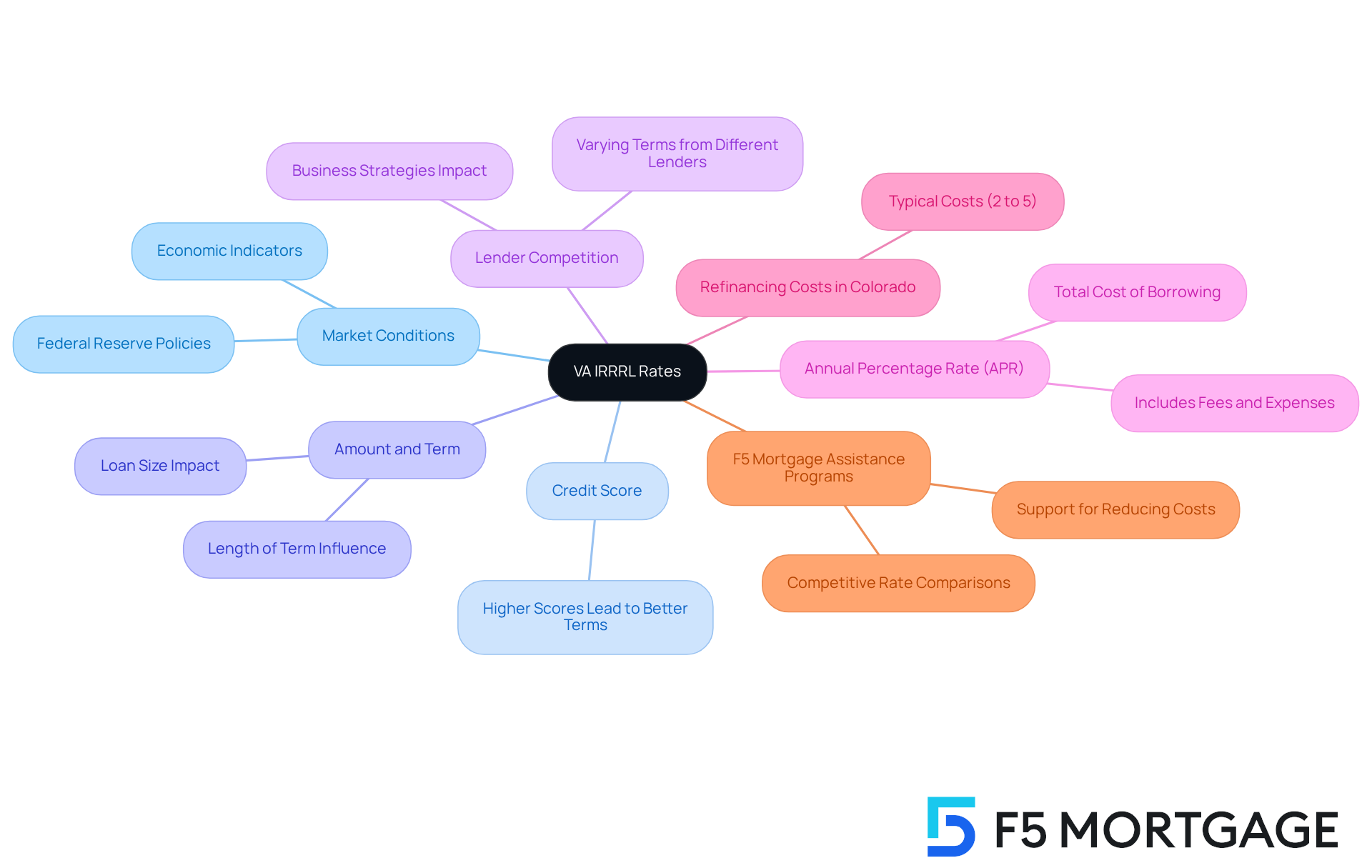

Explore VA IRRRL Rates: Factors and Comparisons

The variation in VA IRRRL rates can be attributed to several factors that we understand can be overwhelming. Here are some key aspects to consider:

- Market Conditions: Economic indicators, such as inflation and the Federal Reserve’s interest rate policies, can significantly influence overall mortgage rates.

- Credit Score: While VA mortgages are generally more lenient than traditional ones, having a higher credit score can still lead to better terms for your situation.

- Amount and Term: The size of the loan and the length of the term can also impact the interest percentage you receive.

- Lender Competition: Different lenders may offer varying terms based on their unique business strategies and market positioning.

When evaluating VA IRRRL rates, it’s essential to consider the Annual Percentage Rate (APR) as well. This figure encompasses fees and other expenses linked to the financing, giving you a clearer picture of the total cost of borrowing. In Colorado, refinancing typically incurs costs ranging from 2% to 5% of the total loan amount.

We know how challenging this can be, but F5 Mortgage is here to support you every step of the way. They offer specific assistance programs designed to help families reduce these costs, making homeownership more attainable. By utilizing F5 Mortgage’s competitive rate comparisons, you can discover the most affordable refinancing options tailored to your needs, ensuring a smoother path to achieving your dream home.

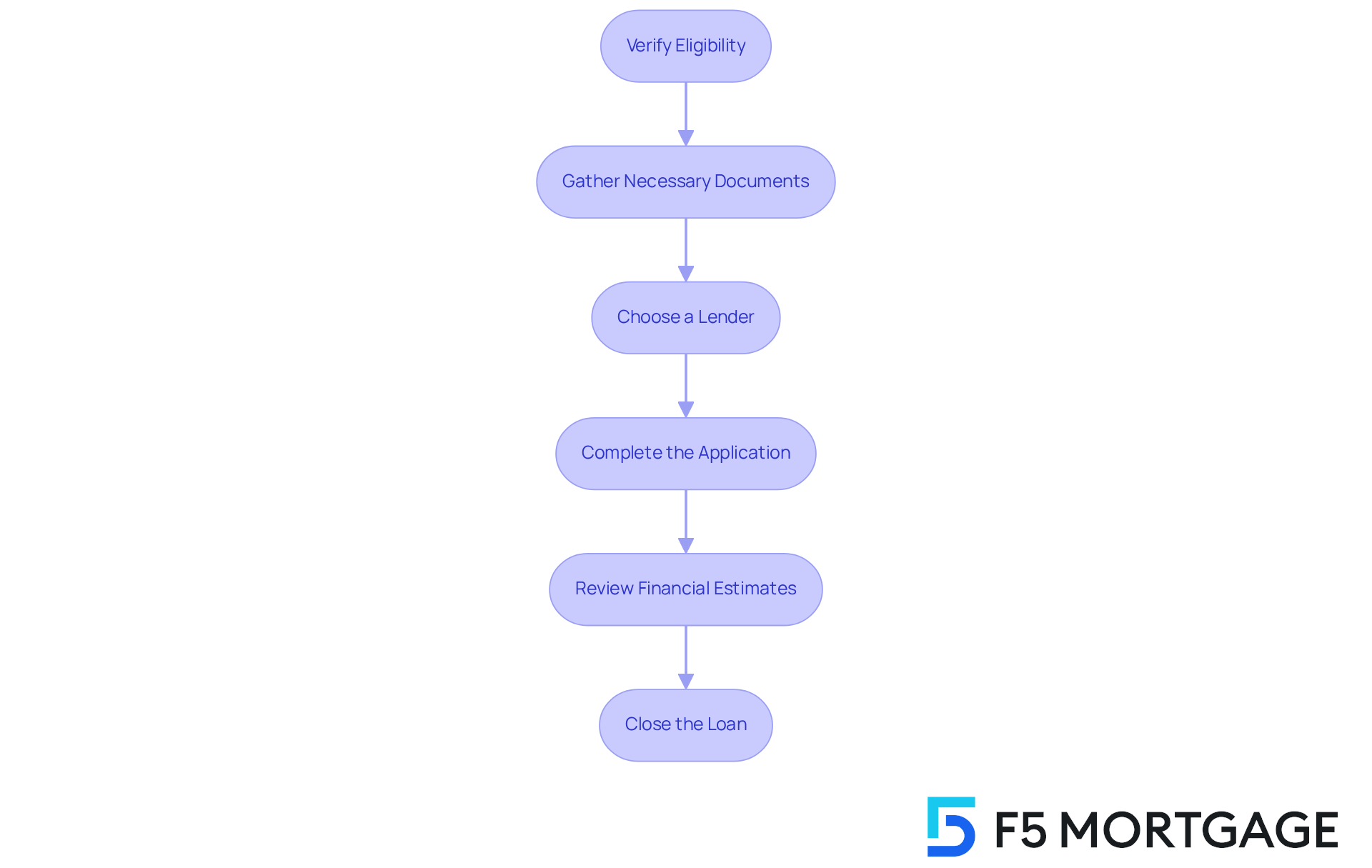

Navigate the VA IRRRL Application Process: A Step-by-Step Guide

Navigating the VA IRRRL rates application process can feel overwhelming, but we’re here to support you every step of the way. Here are some key steps to help you through:

- Verify Eligibility: First, ensure you have an existing VA mortgage that is current, with no late payments in the past 12 months. We know how important it is to stay on track.

- Gather Necessary Documents: While the process is streamlined, you will still need to provide certain documents, such as your current mortgage statement and Certificate of Eligibility (COE). Having these ready can ease your mind.

- Choose a Lender: Take the time to research and select a VA-approved lender who offers competitive IRRRL rates. Finding the right partner can make a significant difference.

- Complete the Application: Fill out the application form provided by your lender, ensuring all information is accurate. This step is crucial for a smooth process.

- Review Financial Estimates: After submitting your application, examine the financial estimates provided by your lender. Understanding the terms and costs can empower you to make informed decisions.

- Close the Loan: Once approved, you will proceed to closing, where you will sign the necessary documents and finalize the loan. This is the moment you’ve been working towards!

By following these steps, former service members can efficiently navigate the application process and secure favorable refinancing terms, giving you peace of mind and financial relief.

Address Common Concerns: FAQs About VA IRRRLs

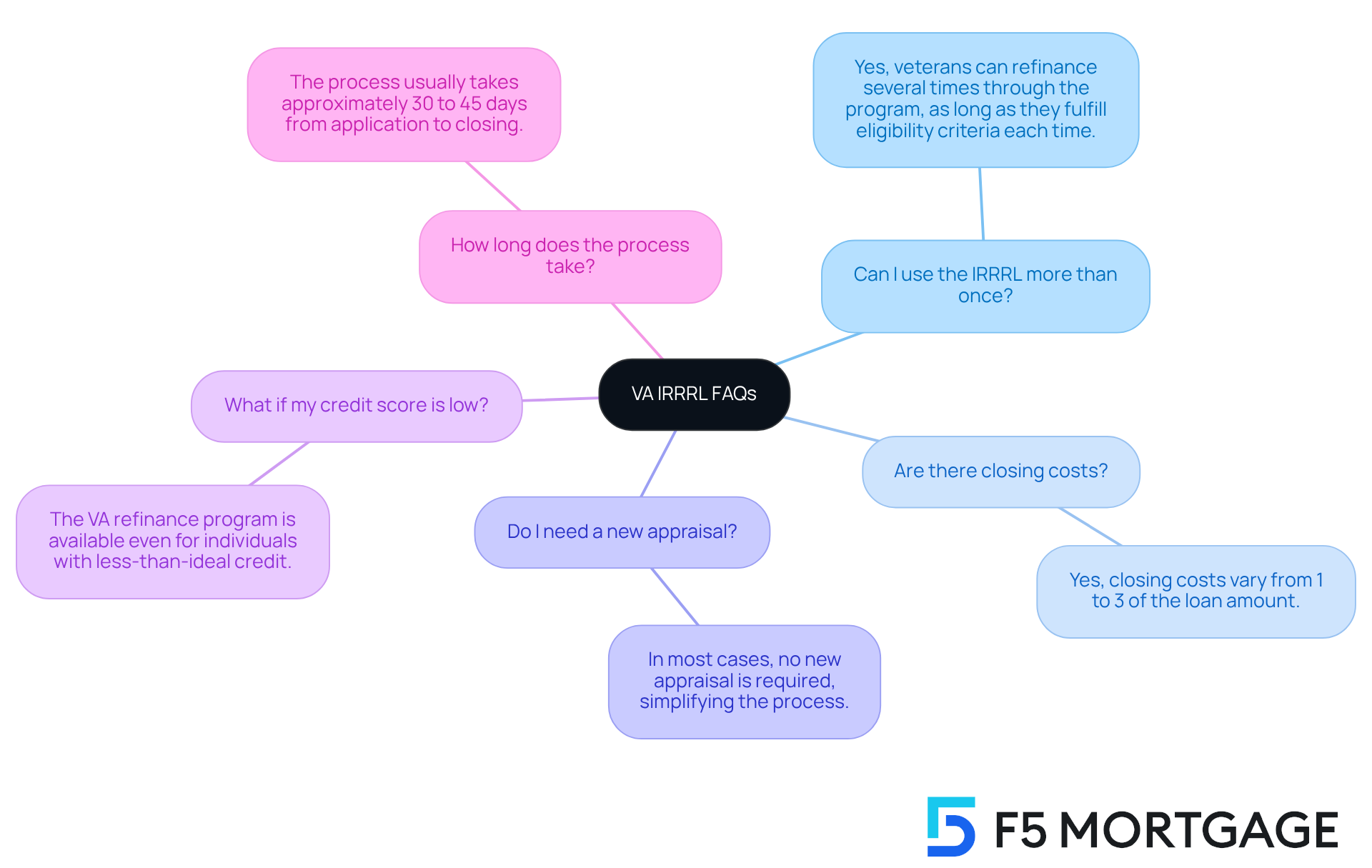

Here are some frequently asked questions about VA IRRRLs:

- Can I use the IRRRL more than once? Yes, veterans can refinance several times through the program, as long as they fulfill eligibility criteria each time.

- Are there closing costs? Yes, although the refinancing process is simplified, there are still closing costs associated, usually varying from 1% to 3% of the loan amount.

- Do I need a new appraisal? In most cases, no new appraisal is required, which simplifies the process.

- What if my credit score is low? While a higher credit score can assist in obtaining improved rates, the VA refinance program is intended to be available, even for individuals with less-than-ideal credit.

- How long does the process take? The refinancing process usually requires approximately 30 to 45 days from application to closing, depending on the lender.

These FAQs aim to provide clarity and reassurance for veterans considering the VA IRRRL rates option. We understand how important it is to navigate this process with confidence, and we’re here to support you every step of the way.

Conclusion

Understanding the VA Interest Rate Reduction Refinance Program (IRRRL) is essential for service members looking to alleviate their financial burdens. This program offers veterans a chance to secure lower interest rates and reduced monthly payments, all while streamlining the refinancing process to make it accessible and efficient. With benefits like no appraisal or income verification required, the VA IRRRL stands out as a truly advantageous option for those seeking financial relief.

We know how challenging navigating finances can be, especially for our service members. Throughout this article, we’ve highlighted key factors influencing VA IRRRL rates, including:

- Market conditions

- Credit scores

- Loan amounts

- Lender competition

Additionally, we’ve provided a step-by-step guide to navigating the application process, ensuring that veterans are well-equipped to take full advantage of this program. Addressing common concerns through FAQs empowers service members with the knowledge they need to make informed decisions regarding their refinancing options.

Ultimately, the VA IRRRL program represents a vital resource for veterans aiming to improve their financial situations. By understanding the benefits and navigating the application process effectively, service members can unlock significant savings and achieve greater financial stability. It is crucial to explore current VA IRRRL rates and consult with experienced lenders. Remember, we’re here to support you every step of the way, paving the path towards a more secure future.

Frequently Asked Questions

What is the VA Interest Rate Reduction Refinance Program (IRRRL)?

The VA IRRRL is a program designed to assist service members who already have a VA-backed mortgage in refinancing their current loans to secure lower interest rates and decrease monthly payments.

What are the key benefits of the VA IRRRL?

Key benefits include lower interest rates compared to conventional refinancing options, a streamlined application process with less documentation, no appraisal required in most cases, no income verification needed, and rapid closure of the refinancing process, often within 30 days.

Do I need to provide income verification to qualify for a VA IRRRL?

Many lenders, including those at F5 Mortgage, do not require income verification, making it easier for you to qualify for the program.

Is a new appraisal necessary when refinancing through the VA IRRRL?

In most situations, a new appraisal is not required, which saves both time and expenses during the refinancing process.

How quickly can I expect the VA IRRRL process to be completed?

The VA IRRRL process is designed for rapid closure, often finalizing within 30 days, allowing you to start benefiting from the new rates sooner.

How can F5 Mortgage assist with the VA IRRRL process?

F5 Mortgage offers dedicated assistance throughout the refinancing process and has an extensive network of lenders to help you find the best refinancing options tailored to your needs.