Overview

This article is here to help families like yours effectively upgrade your homes within a budget of $120,000. We understand how challenging this can be, and by following structured steps, you can make informed decisions that enhance your living spaces without exceeding your financial limits.

Start by assessing your finances. Knowing where you stand is crucial. Next, prioritize your improvements based on your family’s needs and desires. Coordinating with contractors can feel daunting, but we’re here to support you every step of the way. Don’t forget to explore financing options that may be available to you.

By taking these essential steps, you can transform your home while staying within budget. Remember, each decision you make is a step toward creating a space that reflects your family’s unique needs and aspirations.

Introduction

Transforming a home into a comfortable sanctuary is a dream for many families. Yet, we know how overwhelming the path to achieving that vision can feel. With a budget of $120,000, homeowners have a unique opportunity to make significant upgrades that enhance both functionality and aesthetics. However, navigating the complexities of budgeting, prioritizing projects, and coordinating with contractors can lead to uncertainty. How can families ensure they maximize their investment while avoiding common pitfalls in the home improvement journey?

We’re here to support you every step of the way. By understanding your challenges and providing empathetic guidance, we can help you create a beautiful and functional space that truly feels like home.

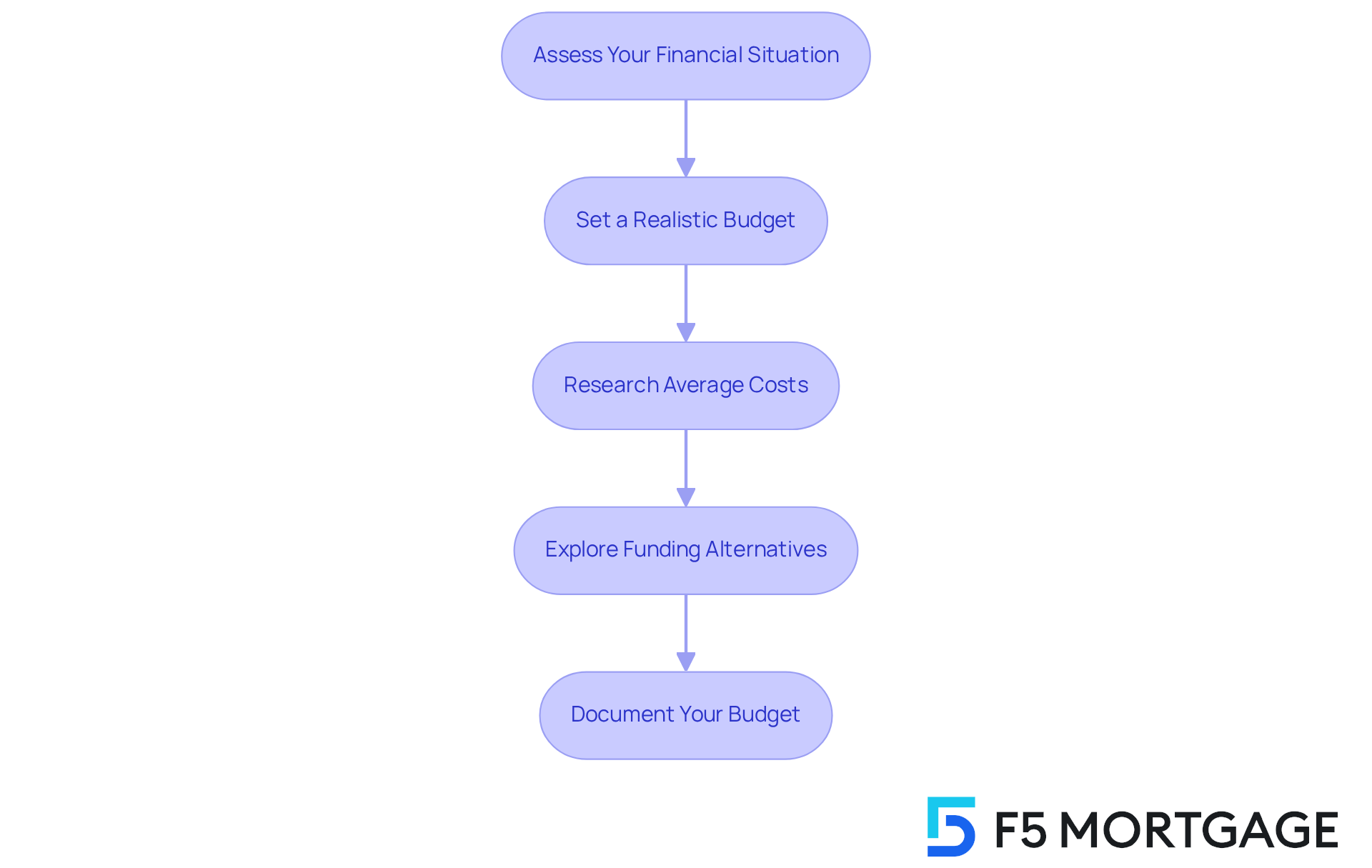

Establish Your Home Upgrade Budget

-

Assess Your Financial Situation: We know how challenging it can be to manage finances. Begin by evaluating your current income, expenses, and savings. This evaluation will help you understand how much you can allocate for home improvements without compromising your financial stability. Financial advisors recommend a thorough review to ensure you can comfortably manage any new expenses.

-

Set a Realistic Budget: After assessing your finances, it’s important to establish a budget that aligns with your financial capacity. Consider including a buffer for unexpected costs—typically around 10-20% of your total budget—to accommodate any surprises that may arise during the renovation process. This way, you can feel more secure as you move forward.

-

Research Average Costs: Understanding the average costs associated with the upgrades you are considering can alleviate some stress. For instance, kitchen renovations can vary from $14,500 to $40,500, while smaller tasks like bathroom upgrades may be under $5,000. Knowing these costs will help you prioritize your projects effectively and make informed decisions.

-

Explore Funding Alternatives: If your budget feels tight, don’t hesitate to explore financing options like equity loans or personal loans. With 61% of homeowners planning to borrow money for renovations in 2025, consulting with F5 Mortgage can provide insights into the best mortgage solutions tailored to your needs. We’re here to support you every step of the way.

-

Document Your Budget: Finally, create a detailed budget document that outlines all expected costs, including materials, labor, and permits. This roadmap will assist you in staying on track financially and ensure that your home improvement project remains within budget. Remember, taking these steps can empower you to create the home you envision.

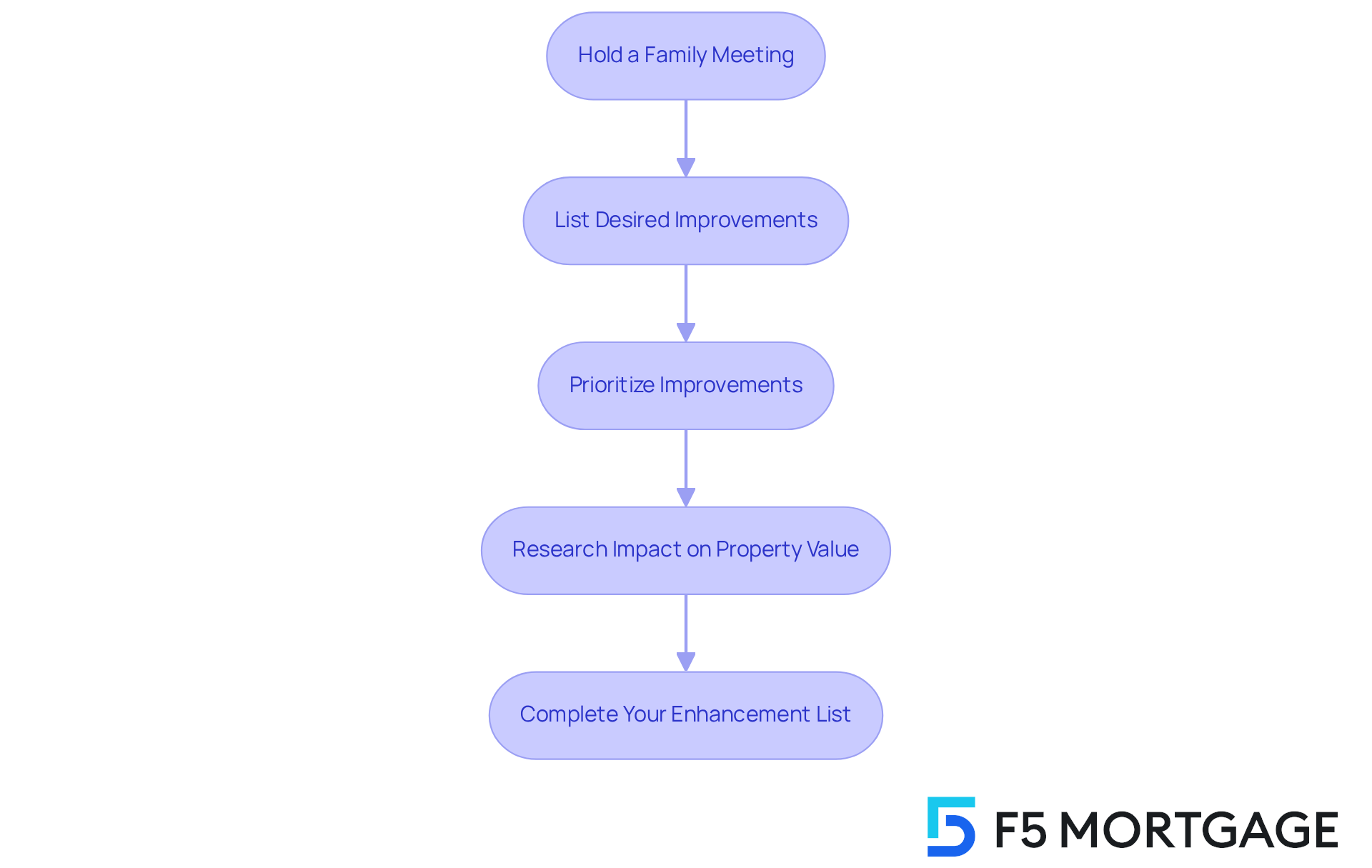

Identify Your Family’s Upgrade Needs and Priorities

-

Hold a Family Meeting: Gather all family members to discuss which improvements matter most to you. This collaborative approach ensures that everyone’s needs and preferences are acknowledged, fostering a sense of ownership in the improvement journey.

-

List Desired Improvements: Compile a thorough list of potential enhancements, including kitchen renovations, bathroom updates, or energy-efficient installations. Think about incorporating features like smart home technology, which is increasingly popular—77% of millennial homeowners are opting for smart security features. Additionally, consider energy-saving upgrades such as insulated siding and energy-efficient doors, which are gaining traction among homeowners.

-

Prioritize Improvements: Rank these enhancements based on necessity, their potential impact on daily life, and your budget. Focus on improvements that will elevate comfort and functionality, such as adding a new bathroom, which offers a 63% return on investment (ROI), or upgrading to energy-efficient windows with an ROI of 67.1% to 74%. Don’t overlook the value of installing a deck, which can yield an ROI between 68.2% and 82.9%.

-

Research Impact on Property Value: Delve into which upgrades can truly enhance your property’s value. Kitchen remodels, for instance, are among the most sought-after projects, with 30% of homeowners undertaking them in 2022, illustrating a strong investment in both aesthetics and functionality. Furthermore, keep in mind that nearly 19% of home enhancement efforts focus on improving outdoor spaces, which can significantly boost your home’s appeal.

-

Complete Your Enhancement List: Refine your list to the top improvements that fit within your budget and resonate with your family’s needs. This focused approach will guide your project forward, ensuring your renovations not only enhance your living space but also contribute to long-term value. Remember, it’s crucial to address essential repairs, like roof and plumbing issues, before diving into cosmetic enhancements to prioritize safety and structural integrity.

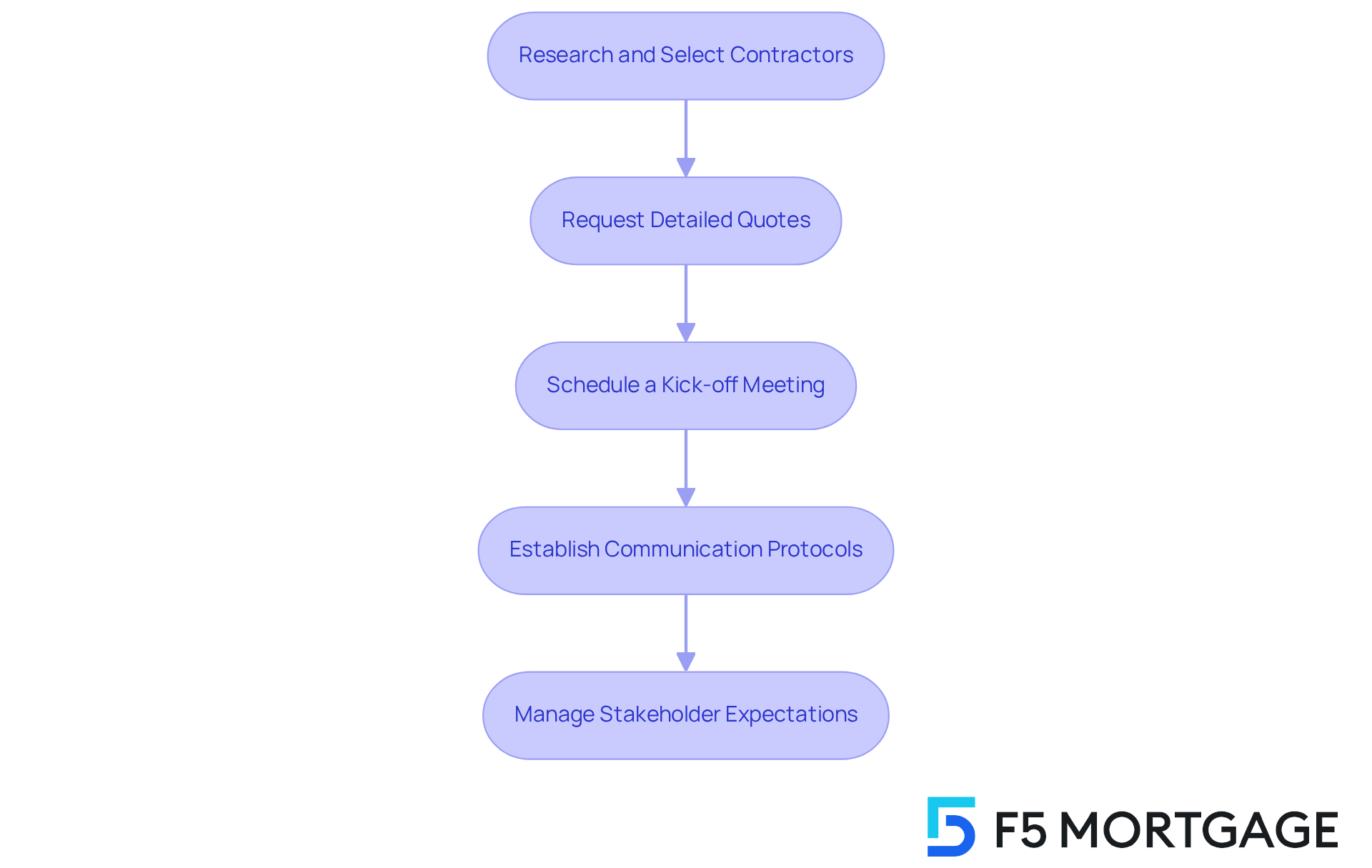

Coordinate with Contractors and Manage Stakeholders

-

Research and Select Contractors: We know how challenging it can be to find the right help for your home upgrades. Start by identifying reputable contractors who specialize in the specific improvements you plan to undertake. Look for those with proven experience and positive reviews, and don’t hesitate to seek recommendations from trusted friends or family members.

-

Request Detailed Quotes: It’s important to gather comprehensive quotes from multiple contractors. Experts recommend obtaining at least three estimates before embarking on a significant home project. Each quote should clearly outline costs, timelines, and materials involved. This transparency is essential for making informed decisions and avoiding unexpected expenses, especially since average renovation costs can range from $19,484 to $88,364.

-

Schedule a Kick-off Meeting: After you’ve chosen a contractor, organizing a meeting is a crucial step. This initial discussion will help you all align on the scope, timelines, and expectations. It’s an opportunity to ensure everyone shares a common understanding of the objectives and deliverables.

-

Establish Communication Protocols: Regular check-ins with your contractor can make a significant difference. These meetings allow you to monitor progress, address any concerns, and make necessary adjustments along the way. Utilizing management tools can enhance effective communication, keeping everyone informed about the status of the project.

-

Manage Stakeholder Expectations: Keeping all stakeholders, including family members, informed about the initiative’s progress is vital. Transparency throughout the remodeling process fosters trust and satisfaction, ensuring that everyone is aligned with the project’s objectives. As Rachel Hoffman observes, a thorough quote guarantees that everyone’s expectations are in sync, which is essential for a seamless remodeling experience.

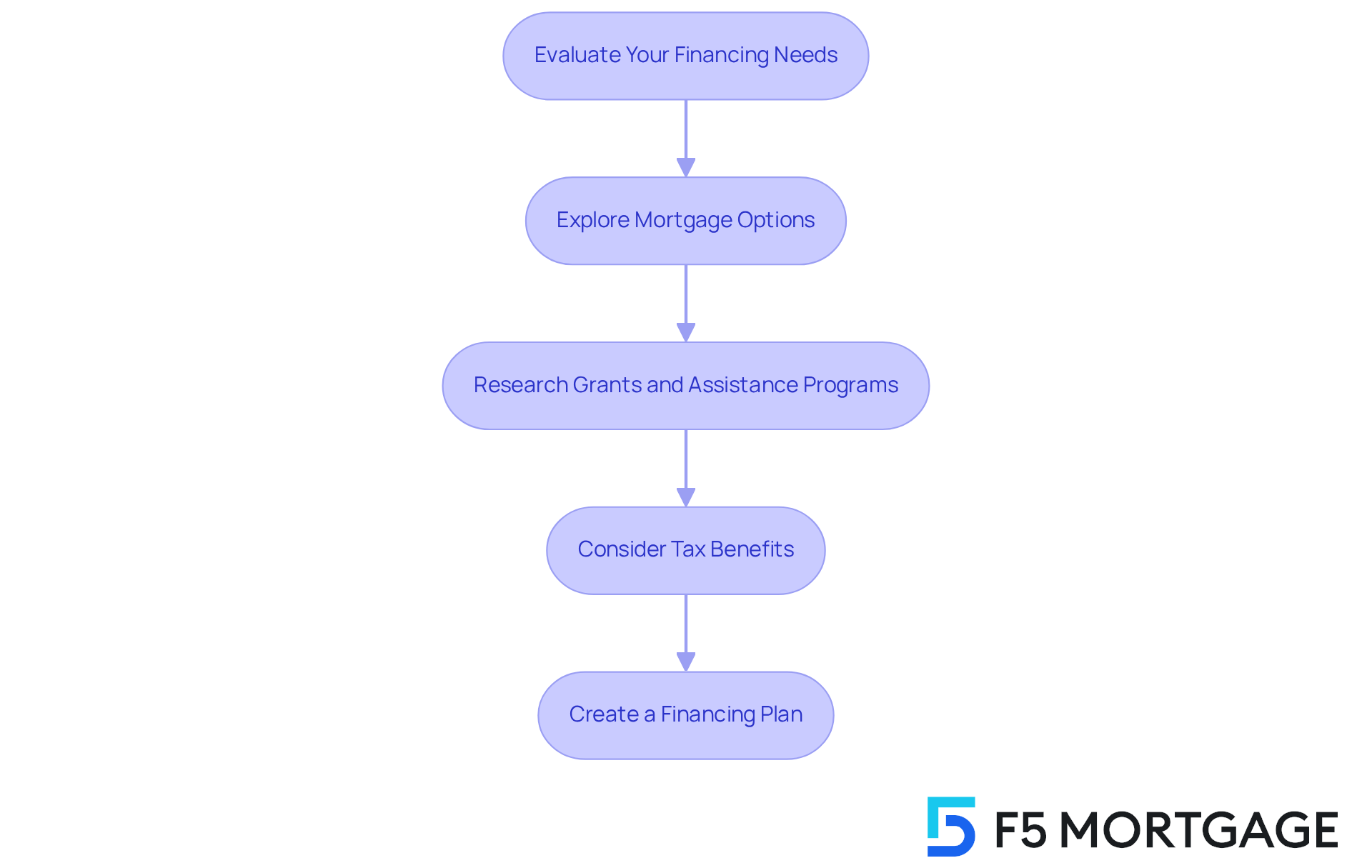

Explore Financing Options and Resources for Your Upgrade

-

Evaluate Your Financing Needs: We understand how daunting it can be to assess your total funding requirements. Take a moment to evaluate what you need beyond your existing budget; this will help you identify suitable financing options for your renovations.

-

Explore Mortgage Options: Collaborating with F5 Mortgage can be a valuable step in your journey. Together, you can examine various mortgage solutions, including equity loans, cash-out refinancing, and personal loans. F5 Mortgage offers a range of loan programs tailored to meet different needs, ensuring you have access to the best options available for your improvement projects.

-

Research Grants and Assistance Programs: We encourage you to seek out local and state initiatives that provide grants or financial support for residential improvements, especially those focused on energy efficiency. Many homeowners, just like you, have successfully utilized these resources to offset renovation costs.

-

Consider Tax Benefits: It’s important to look into potential tax deductions or credits associated with home improvements. Understanding what qualifies can significantly reduce your overall expenses, making your upgrades more affordable and accessible.

-

Create a Financing Plan: Formulating a detailed financing strategy is essential. Outline how you will fund your renovations, incorporating loans, grants, and personal savings. This structured approach will help you maintain your budget while achieving your home improvement objectives. Remember, we’re here to support you every step of the way.

Conclusion

Upgrading a home within a $120,000 budget can be a transformative journey for families, enabling them to create a space that meets their needs and enhances their quality of life. We know how challenging this can be, but by carefully assessing financial situations, prioritizing upgrade needs, and coordinating effectively with contractors, families can navigate the complexities of home renovations while staying within budget.

This article outlines essential steps for a successful home upgrade. Start by:

- Establishing a realistic budget

- Identifying necessary improvements through family discussions

- Selecting the right contractors

Thorough planning and open communication are vital, along with exploring financing options to ensure that families can achieve their renovation goals without compromising their financial stability.

Ultimately, embarking on this home improvement journey is not just about enhancing aesthetic appeal; it’s about creating a comfortable and functional living space that reflects family values and aspirations. By taking the time to plan, prioritize, and communicate effectively, families can turn their vision into reality while maximizing their investment in their home. Embrace this opportunity to transform your living space and create a home that truly feels like your own.

Frequently Asked Questions

How should I begin establishing a budget for home upgrades?

Start by assessing your financial situation, which includes evaluating your current income, expenses, and savings. This will help you determine how much you can allocate for home improvements without compromising your financial stability.

What is a realistic budget for home renovations?

After assessing your finances, establish a budget that aligns with your financial capacity. It is advisable to include a buffer for unexpected costs, typically around 10-20% of your total budget, to accommodate any surprises during the renovation process.

How can I find out the average costs for home upgrades?

Researching the average costs associated with the upgrades you are considering can help alleviate stress. For example, kitchen renovations can range from $14,500 to $40,500, while smaller tasks like bathroom upgrades may cost under $5,000.

What funding alternatives are available for home renovations?

If your budget feels tight, consider exploring financing options such as equity loans or personal loans. Many homeowners plan to borrow money for renovations, so consulting with a mortgage advisor can provide insights into the best solutions tailored to your needs.

How should I document my home improvement budget?

Create a detailed budget document that outlines all expected costs, including materials, labor, and permits. This roadmap will help you stay on track financially and ensure your home improvement project remains within budget.