Overview

This article highlights the various down payment assistance programs available for homebuyers in North Carolina, recognizing their crucial role in making homeownership a reality for first-time buyers. We understand how challenging this process can be, and we’re here to support you every step of the way.

Among the specific programs discussed are the NC 1st Home Advantage and the eligibility criteria that accompany these initiatives. These programs not only alleviate financial burdens but also enhance access to housing, providing a pathway to homeownership for many families.

By participating in these initiatives, you can contribute positively to your community and the state’s housing market. We encourage you to explore these options and take the first step towards your dream of owning a home.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for first-time buyers in North Carolina who often encounter significant financial challenges. We understand how daunting this journey can be. Down payment assistance programs exist to ease some of these burdens, providing essential support that makes the dream of owning a home more achievable. Yet, many potential buyers remain unaware of the various options available or the eligibility requirements that could unlock these opportunities.

What key insights can empower you to take advantage of these valuable resources and successfully navigate the complexities of down payment assistance in NC? We’re here to support you every step of the way.

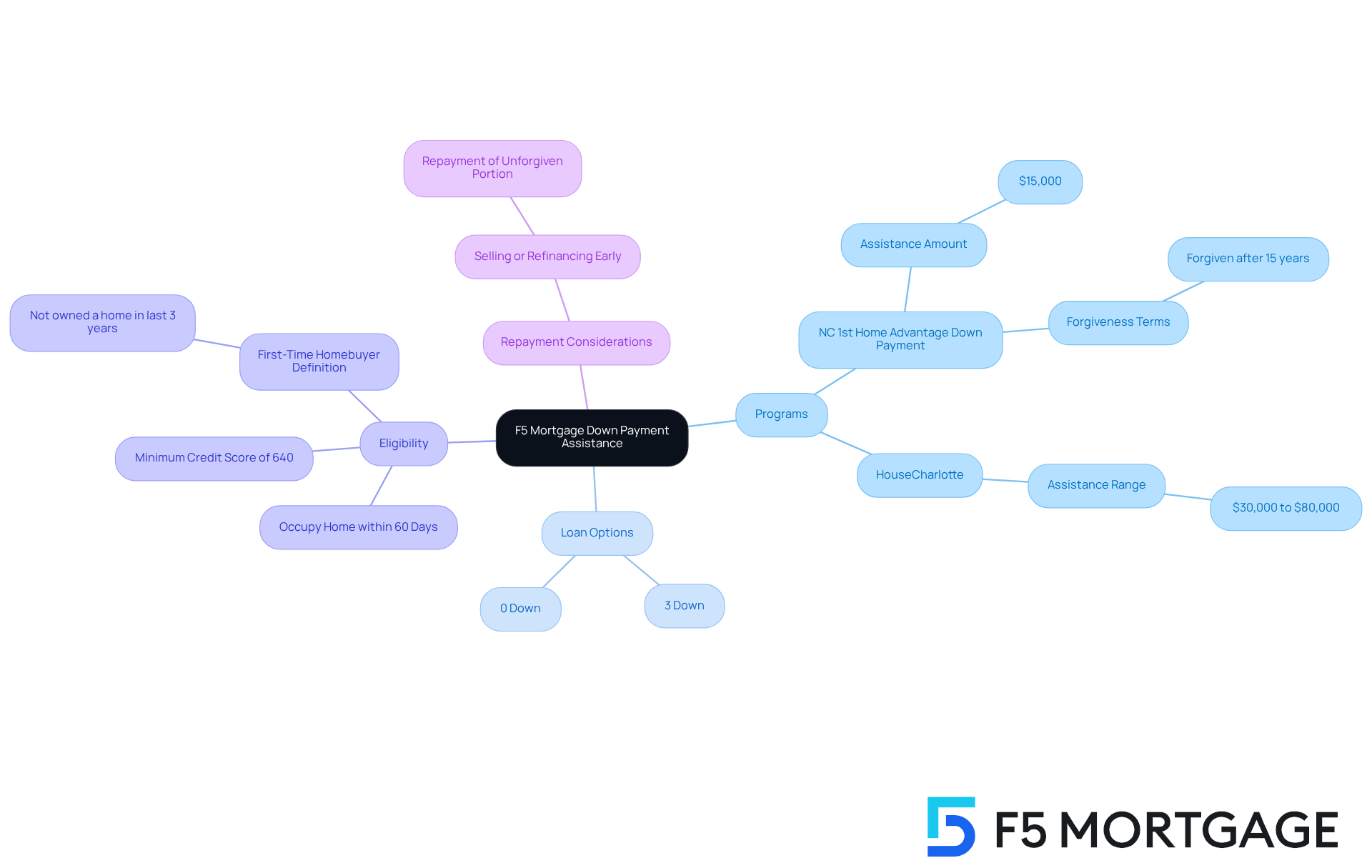

F5 Mortgage: Comprehensive Down Payment Assistance Programs for First-Time Homebuyers

At F5 Mortgage, we understand how daunting the journey to homeownership can be, especially for first-time buyers in North Carolina seeking down payment assistance NC. That’s why we offer a variety of down payment assistance NC options designed specifically with your needs in mind. One standout program for down payment assistance NC, the NC 1st Home Advantage Down Payment program, provides qualified buyers with up to $15,000 in assistance. This significant support can help alleviate some of the initial financial burdens associated with purchasing a home.

We also recognize that many families are looking for affordable loan options. With choices that require as little as 3% down—and some even at 0% down—we’re committed to making homeownership more accessible for you. To qualify, you simply need to occupy the home as your principal residence within 60 days of closing, along with a minimum credit score of 640.

We know how challenging this can be, especially when considering that first-time homebuyers in North Carolina often benefit from down payment assistance NC, with an average down payment of $37,412 in 2024. This highlights the financial hurdles many face. However, at F5 Mortgage, we are dedicated to providing a stress-free mortgage process. Our user-friendly technology and personalized consultations ensure you receive guidance tailored to your unique financial situation, enhancing your chances of securing the right mortgage solution.

It’s important to keep in mind that if a homeowner sells or refinances early, they may need to repay a portion of the support received. This assistance is structured as a deferred second mortgage, which helps clarify how the initiative works and its long-term implications. Remember, we’re here to support you every step of the way, ensuring you feel confident in your homebuying journey.

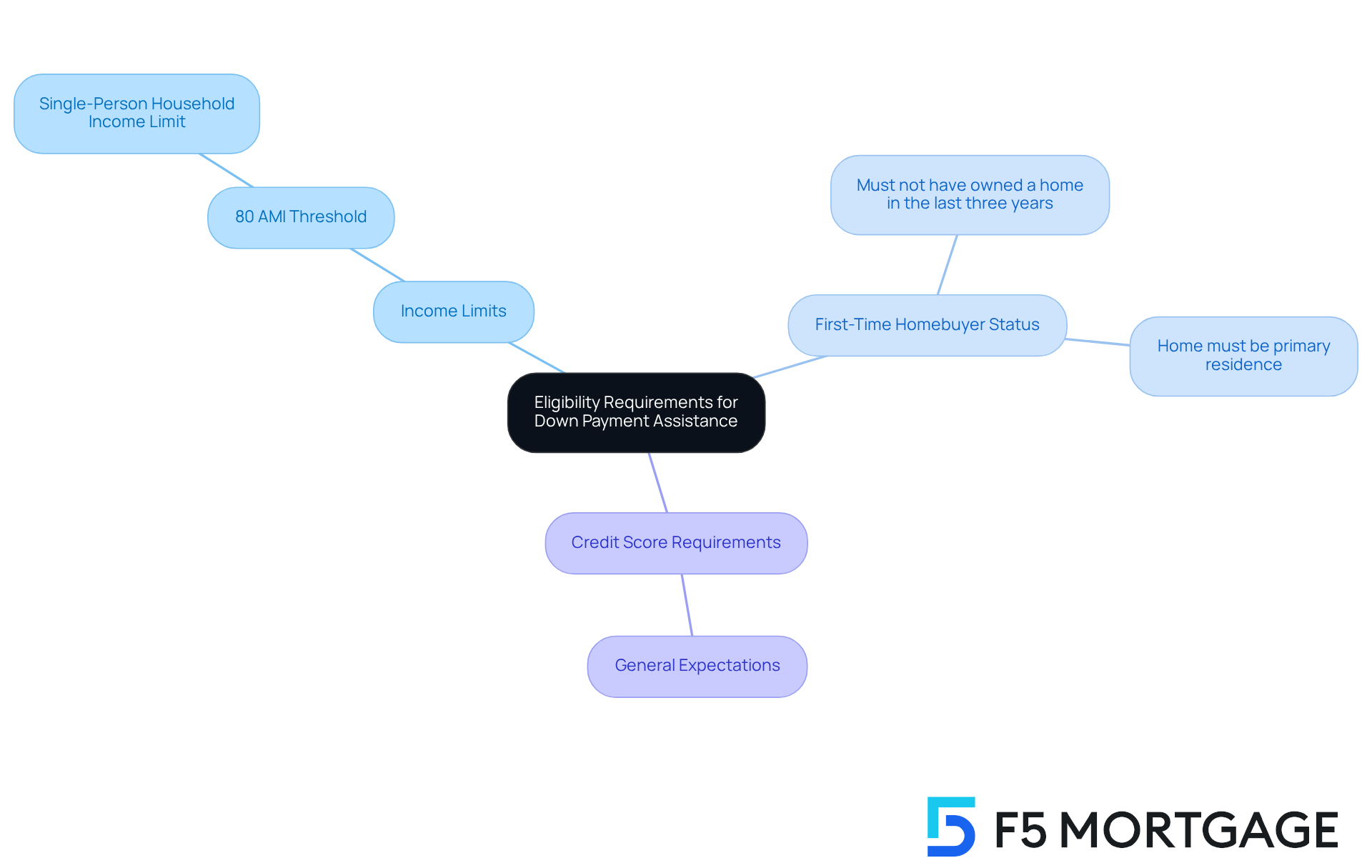

Eligibility Requirements for Down Payment Assistance in North Carolina

Navigating the path to homeownership can be challenging, but understanding the down payment support programs in North Carolina can make a significant difference. To qualify, applicants must meet specific criteria, primarily focusing on:

- Income limits

- First-time homebuyer status

- Credit score requirements

Typically, household income should not exceed 80% of the area median income (AMI), which is around $64,750 for a single-person household. This threshold ensures that support is directed toward those who need it most.

We know how important it is to demonstrate a consistent income, and candidates may also be required to complete a buyer education program. This program is designed to enhance your understanding of the purchasing process, empowering you to make informed decisions.

Real-life stories highlight the positive impact of these initiatives: families earning within the specified income thresholds have successfully qualified for support, enabling them to purchase homes they might not have otherwise been able to afford. For example, eligible homebuyers can apply for up to $80,000 in support through approved lenders, with funding available on a first-come, first-served basis until the total of $5.7 million is depleted.

Understanding these requirements is crucial for potential buyers. By knowing what to expect, you can determine your eligibility and prepare the necessary documentation effectively. Remember, we’re here to support you every step of the way as you embark on this important journey.

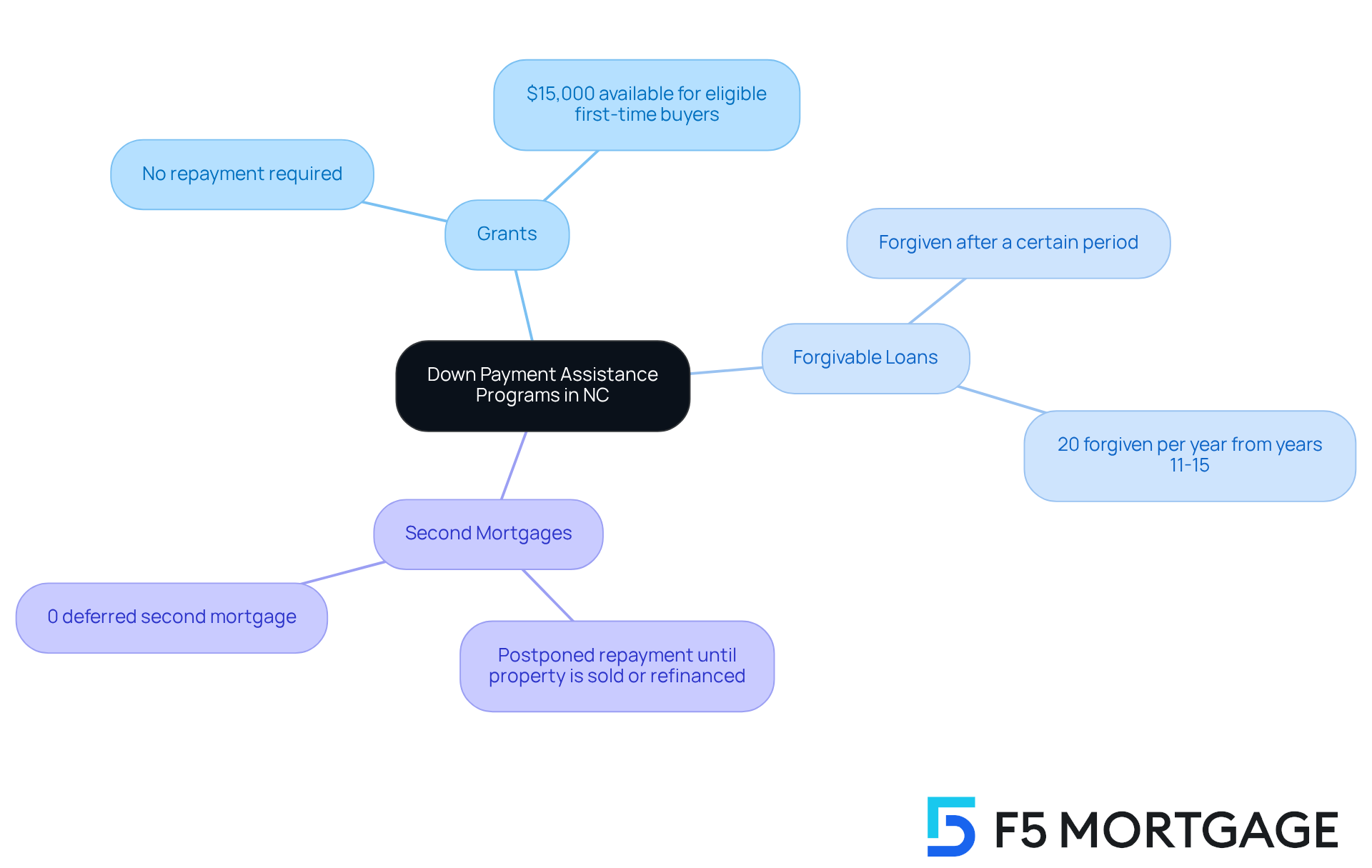

Types of Down Payment Assistance Programs Offered in NC

In North Carolina, we understand how challenging it can be to navigate the path to homeownership. That’s why there are various forms of down payment assistance NC programs available to help you. These include:

- Grants

- Forgivable loans

- Second mortgages

Each designed to ease your journey.

Grants provide you with funds that do not need to be repaid, offering a sense of relief as you take this important step. Forgivable loans may also be available; these can be forgiven after a certain period, provided you remain in your home. Additionally, secondary loans can assist in covering your initial deposit, often postponed until the property is sold or refinanced, giving you peace of mind.

Programs like the NC 1st Home Advantage and local city initiatives offer tailored solutions, specifically crafted to meet the unique needs of first-time buyers like you, including down payment assistance NC. We’re here to support you every step of the way, ensuring that you have the resources necessary to turn your homeownership dreams into reality.

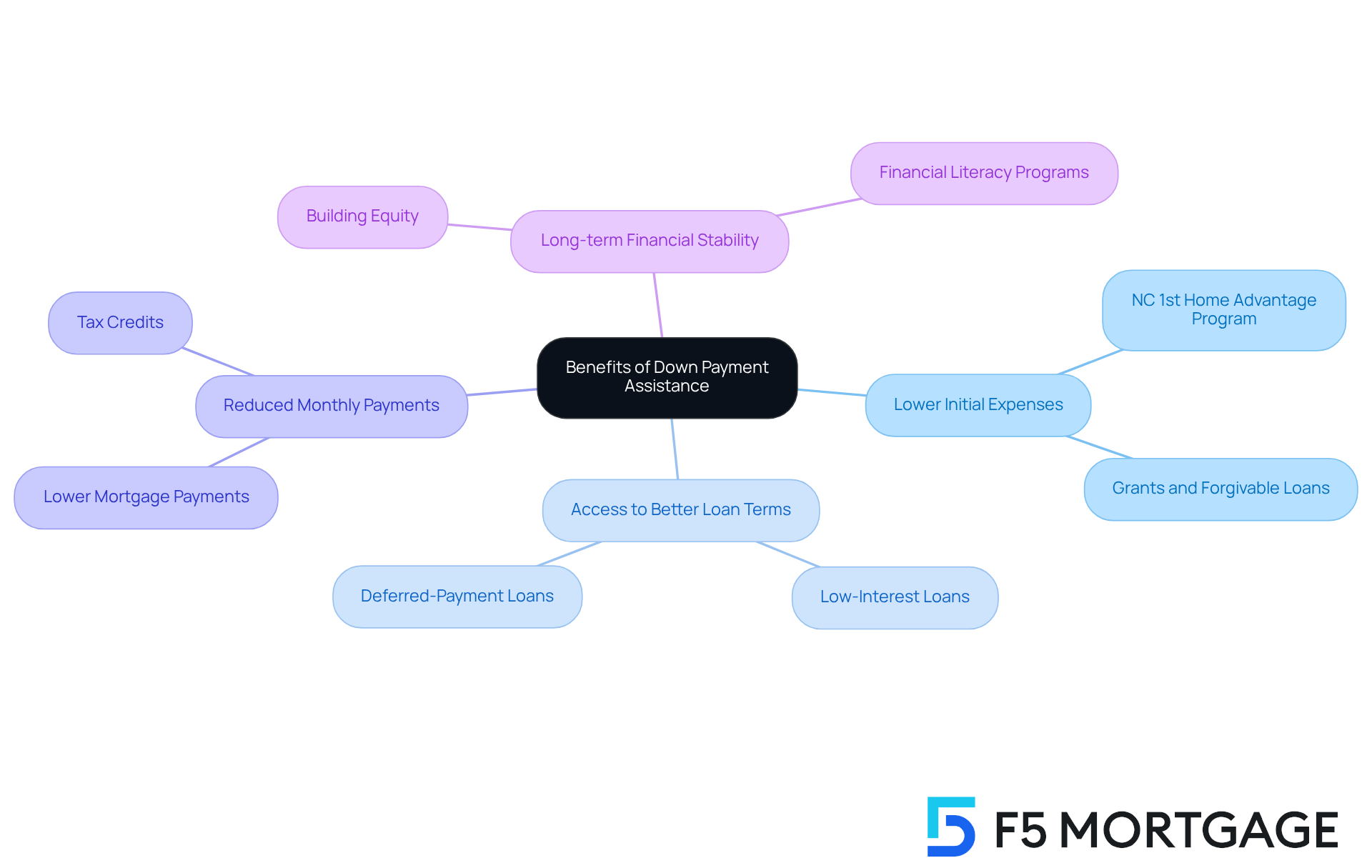

Benefits of Utilizing Down Payment Assistance for Homeownership

Navigating the path to homeownership can be daunting, and we know how challenging this can be. Utilizing down payment assistance NC can significantly alleviate the financial challenges associated with purchasing a property. These initiatives are designed to lower initial expenses, making homeownership achievable for families who might struggle to save for a conventional deposit.

Take, for instance, the NC 1st Home Advantage program, which provides down payment assistance NC of up to $15,000. This enables qualified first-time purchasers and military veterans to obtain their residences with minimal initial investment.

Moreover, down payment assistance NC can lead to lower monthly mortgage payments, which is crucial for many families. By financing a larger portion of the home price, buyers can access better loan terms, enhancing the sustainability of their investment. In North Carolina, families benefiting from down payment assistance NC frequently report substantial decreases in their monthly responsibilities. This allows them to direct money toward other necessary expenses, creating a more balanced financial situation.

Expert insights emphasize that these support programs not only facilitate homeownership but also contribute to long-term financial stability. By reducing the upfront financial burden, families can invest in their homes without the stress of overwhelming debt. This ultimately fosters a more secure future for them and their loved ones.

As the housing market continues to evolve, down payment assistance NC remains an essential resource for those working to achieve their homeownership aspirations. We’re here to support you every step of the way.

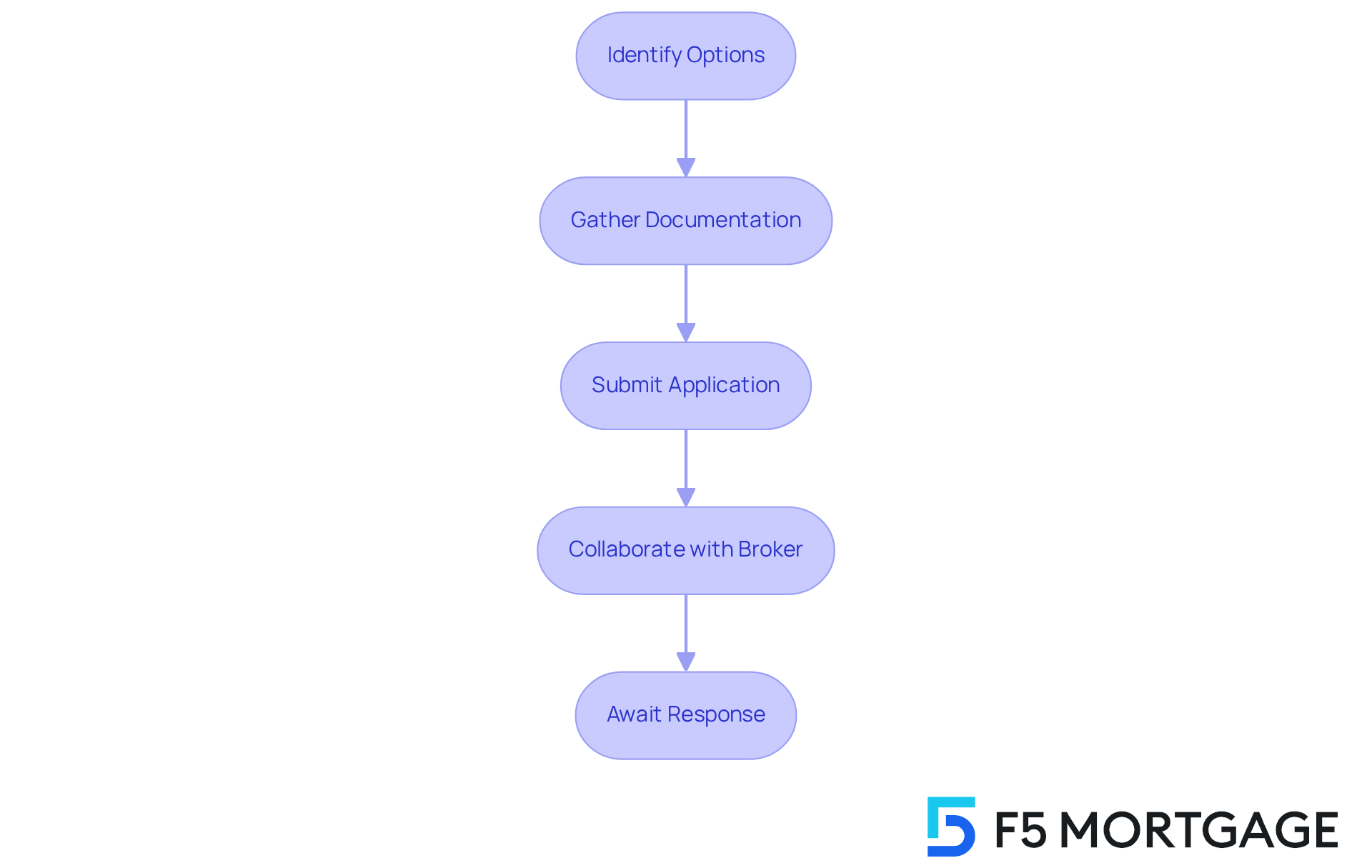

How to Apply for Down Payment Assistance in North Carolina

Applying for down payment assistance NC can feel overwhelming, but we’re here to support you every step of the way. It’s essential to take a systematic approach to ensure your eligibility and a successful application. First, we know how challenging it can be to navigate the various options available, as each may have different eligibility criteria. By thoroughly investigating these options, you can find the one that best suits your needs.

Once you’ve identified a suitable application, the next step is gathering the essential documentation. This typically includes:

- Proof of income

- Credit history

- Any required educational certificates

These documents are crucial for demonstrating your financial stability and readiness, which can ease some of the stress during this process.

After compiling the necessary documents, you can submit your application through approved lenders or local housing agencies. Collaborating with a mortgage broker, such as F5 Mortgage, can significantly streamline this process. Brokers possess the expertise to navigate the complexities of the application, increasing the likelihood of approval.

In North Carolina, the typical duration for handling down payment assistance NC requests can vary, but many initiatives strive to offer a reply within a few weeks. Successful applications often hinge on the completeness of your documentation and your proactive engagement with your mortgage broker throughout the process. By following these steps and leveraging expert guidance, you can enhance your chances of securing the financial support you need to achieve homeownership.

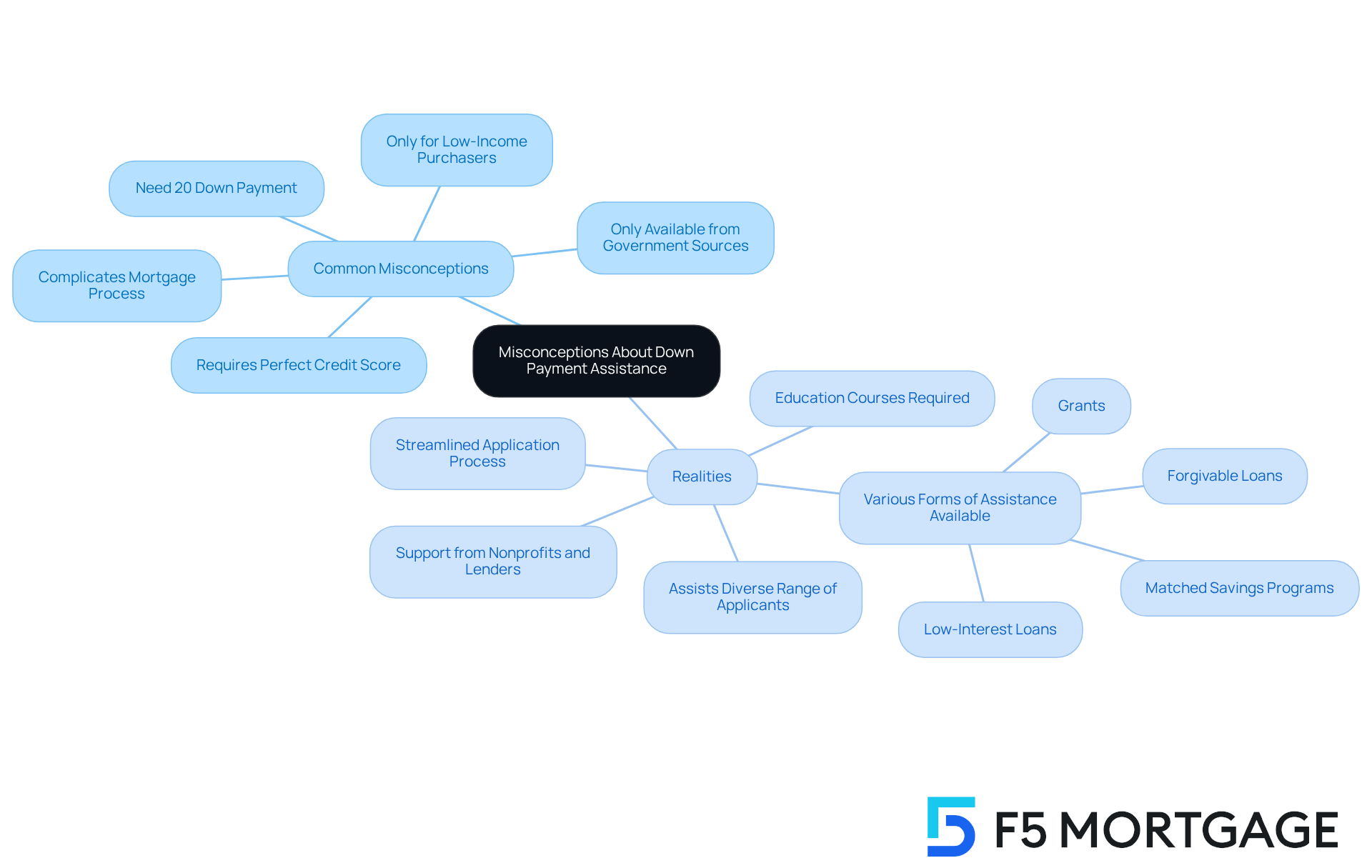

Common Misconceptions About Down Payment Assistance Programs

Many misunderstandings can obscure the comprehension of down financing aid offerings. It’s common to think these programs are solely for low-income purchasers or that they complicate the mortgage process. However, we know how challenging this can be, and in truth, these programs cater to a diverse range of applicants, including those with moderate incomes.

For instance, many programs offering down payment assistance NC are designed to assist individuals who may lack considerable savings. This greatly reduces the obstacles to owning a home. Furthermore, the application process is often streamlined, especially when working with experienced mortgage brokers who can guide you through the necessary steps.

By dispelling these myths, we can empower more homebuyers to explore the various support options available. This exploration ultimately broadens their chances for homeownership, and we’re here to support you every step of the way.

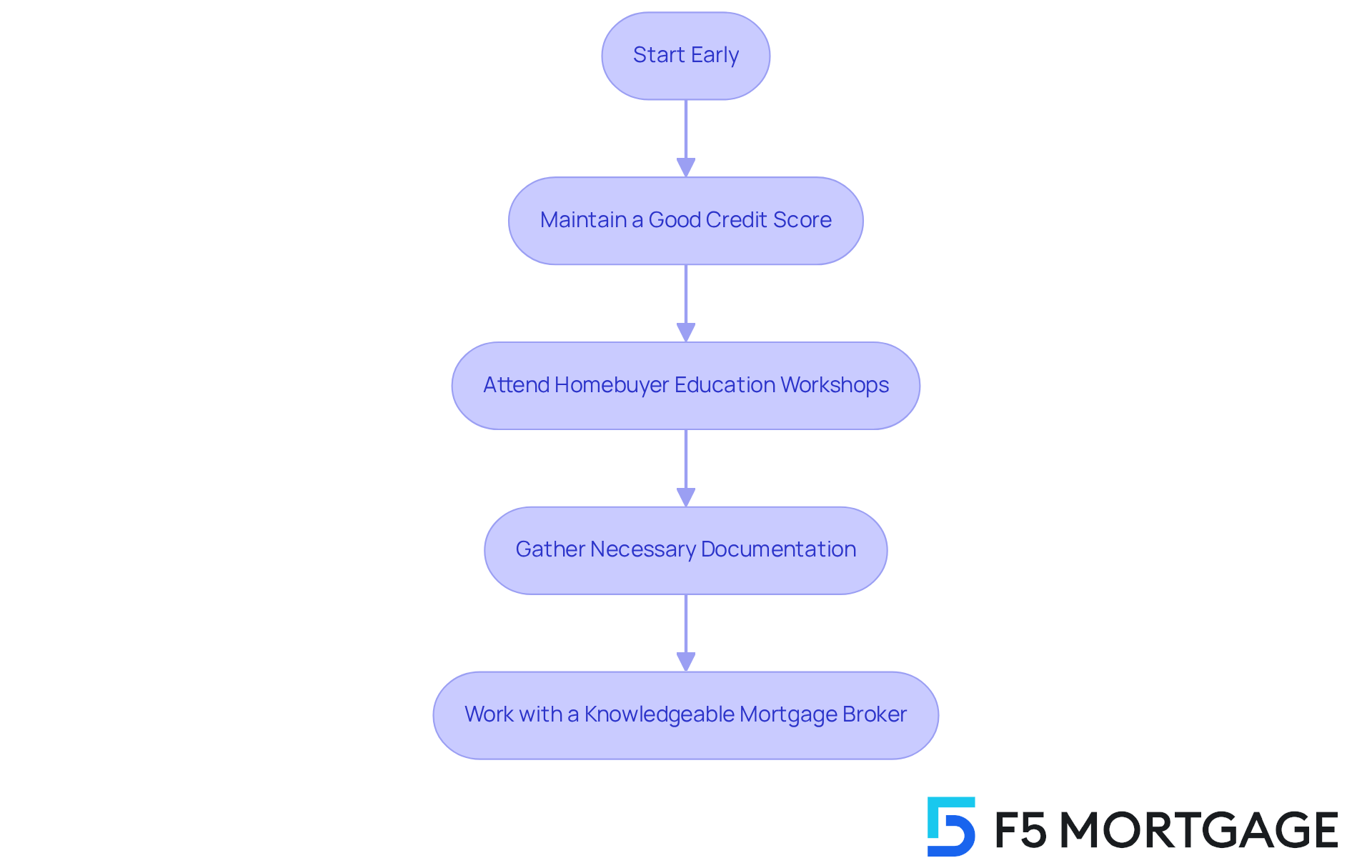

Essential Tips for First-Time Homebuyers Seeking Down Payment Assistance

If you’re a first-time homebuyer looking for down payment assistance NC, we understand how overwhelming this process can feel. Here are some essential tips to help you navigate this journey with confidence:

-

Start Early: Investigate available options and their specific requirements well in advance of your home purchase. Many initiatives have limited funding and may require early submissions due to waiting lists. By starting early, you can avoid unnecessary stress later on.

-

Maintain a Good Credit Score: A strong credit score is crucial, as it significantly impacts your eligibility and loan terms. Borrowers with scores above 700 are more likely to secure favorable mortgage rates, while those below 580 may face challenges in obtaining financing. We know how challenging it can be to maintain a good score, but it’s an important step toward your dream home.

-

Attend Homebuyer Education Workshops: Participating in these workshops not only offers valuable knowledge about the homebuying process but may also meet criteria for down payment support. These sessions can empower you with the information you need to make informed decisions.

-

Gather Necessary Documentation: Prepare all required documentation ahead of time, including proof of income and assets. This preparation can streamline your application process, helping you avoid delays and ensuring a smoother experience.

-

Work with a Knowledgeable Mortgage Broker: Collaborating with an experienced mortgage broker, such as F5 Mortgage, can provide guidance through the various options available and help identify the best fit for your financial situation. They can also assist you in navigating the intricacies of down payment assistance nc initiatives.

By implementing these strategies, you can improve your likelihood of qualifying for financial support, ultimately making homeownership more achievable. Remember, we’re here to support you every step of the way.

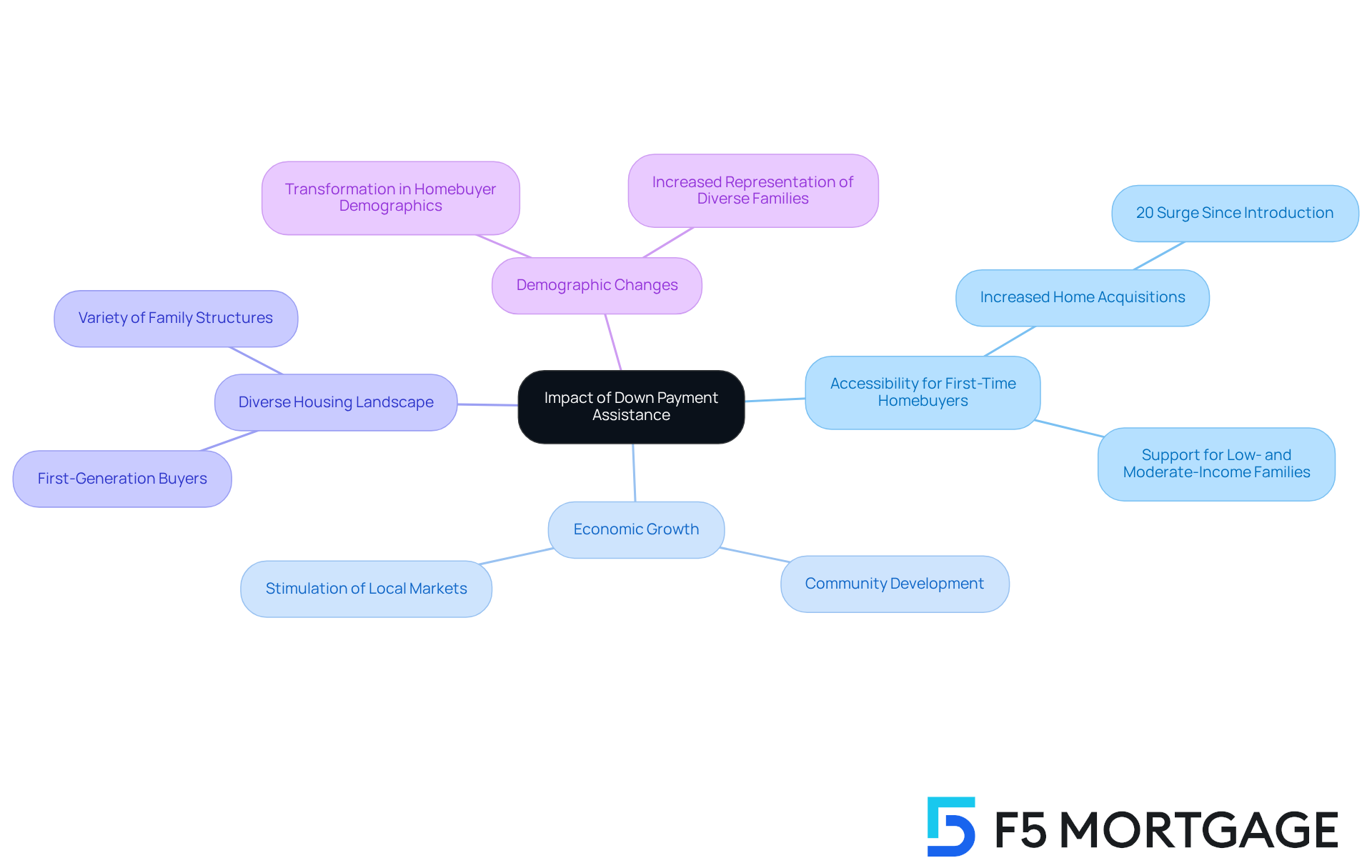

Impact of Down Payment Assistance on North Carolina’s Housing Market

Down payment assistance NC initiatives are vital in shaping North Carolina’s housing market, especially for first-time homebuyers. We know how challenging it can be to enter the housing market, and these initiatives significantly improve accessibility for families. By stimulating demand among low- and moderate-income households, they contribute to a more diverse and stable housing landscape.

As more individuals find the opportunity to purchase homes, the economic vitality of our communities flourishes, fostering growth and development. These initiatives are particularly important as they help address the challenges posed by rising property values, offering essential financial support to those who might otherwise feel excluded from the market.

Indeed, recent data shows that home acquisitions in North Carolina have surged by over 20% since the introduction of down payment assistance NC options. This highlights their effectiveness in bridging the affordability gap. Moreover, we are witnessing a transformation in the demographic landscape of homebuyers, with a notable increase in first-generation buyers and diverse family structures benefiting from these initiatives. Ultimately, this enriches the fabric of our communities, and we’re here to support you every step of the way.

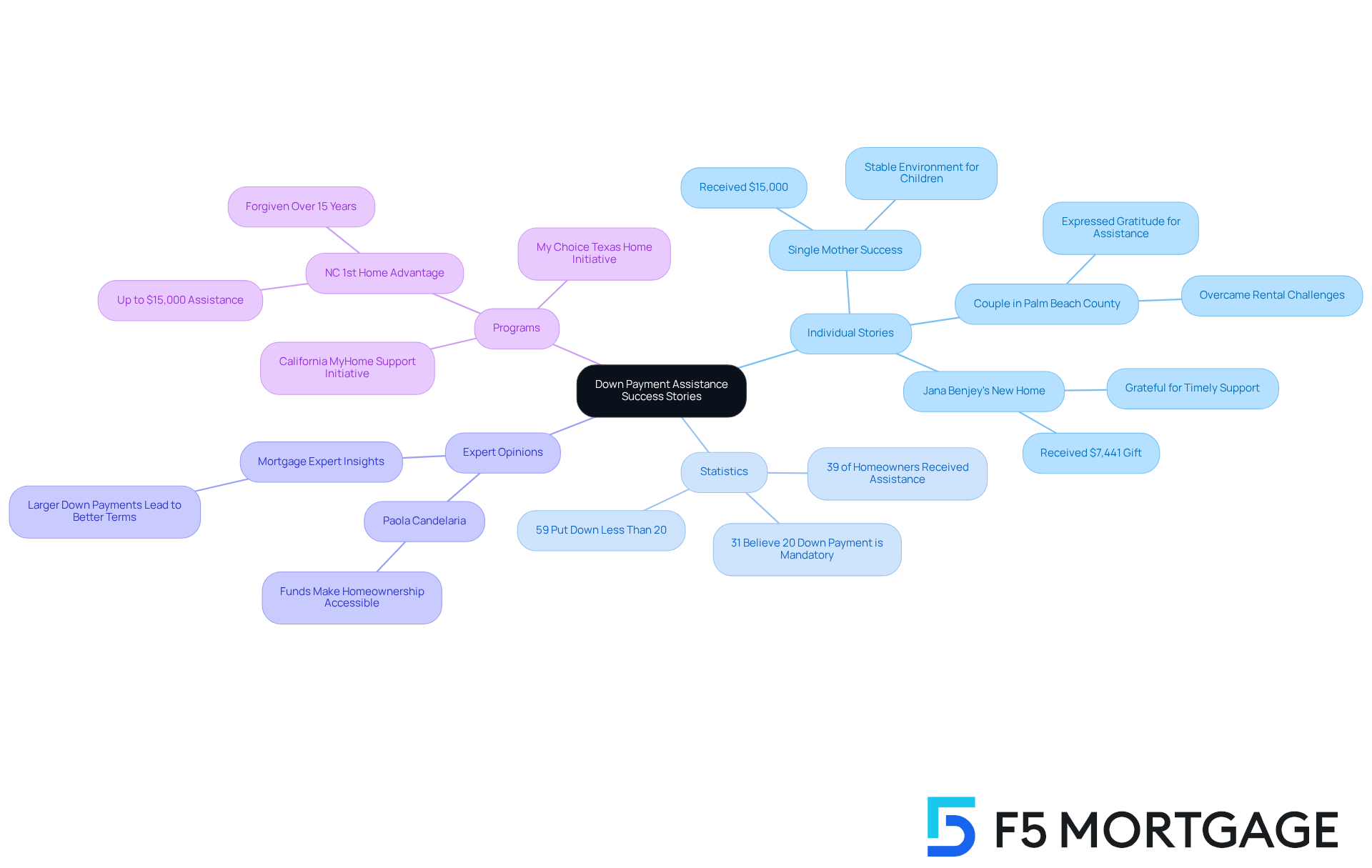

Success Stories: How Down Payment Assistance Changed Lives

In North Carolina, down payment assistance NC initiatives have been essential in helping many families realize their dreams of homeownership. One inspiring story is of a single mother of two who took advantage of down payment assistance NC through the NC 1st Home Advantage Down Payment program, receiving $15,000 in support. This financial boost not only enabled her to purchase her first home but also provided a stable environment for her children, allowing her to build equity and security for their future.

Such success stories highlight the transformative impacts of down payment assistance NC, encouraging others to explore these invaluable resources. With 39% of homeowners having received financial assistance, it is clear that these programs play a crucial role in making homeownership attainable, especially for those facing financial difficulties.

Experts emphasize that down payment assistance NC initiatives significantly lessen the financial strain of acquiring a home, enabling families to transition from renting to owning, often at lower monthly costs compared to their previous rental expenses. As Paola Candelaria, Chief Programs Officer, stated, “These funds are helping make homeownership more accessible for families… significantly reducing the financial burden of purchasing a home.”

Clients of F5 Mortgage have shared their positive experiences, with Bryce Leonard praising the team for their expertise, stating, “Awesome work. I enjoyed getting help with my loan through F5 Mortgage. Highly recommend to anyone who is looking for true experts.” Alley Cohen noted the smooth experience facilitated by Ryan and his team, saying, “Everything went very smoothly!”

As more families share their success stories, the message is clear: down payment assistance NC can transform lives and create opportunities for homeownership. Furthermore, initiatives like the My Choice Texas Home initiative and the California MyHome Support Initiative further illustrate the extensive benefits of down payment support across the nation.

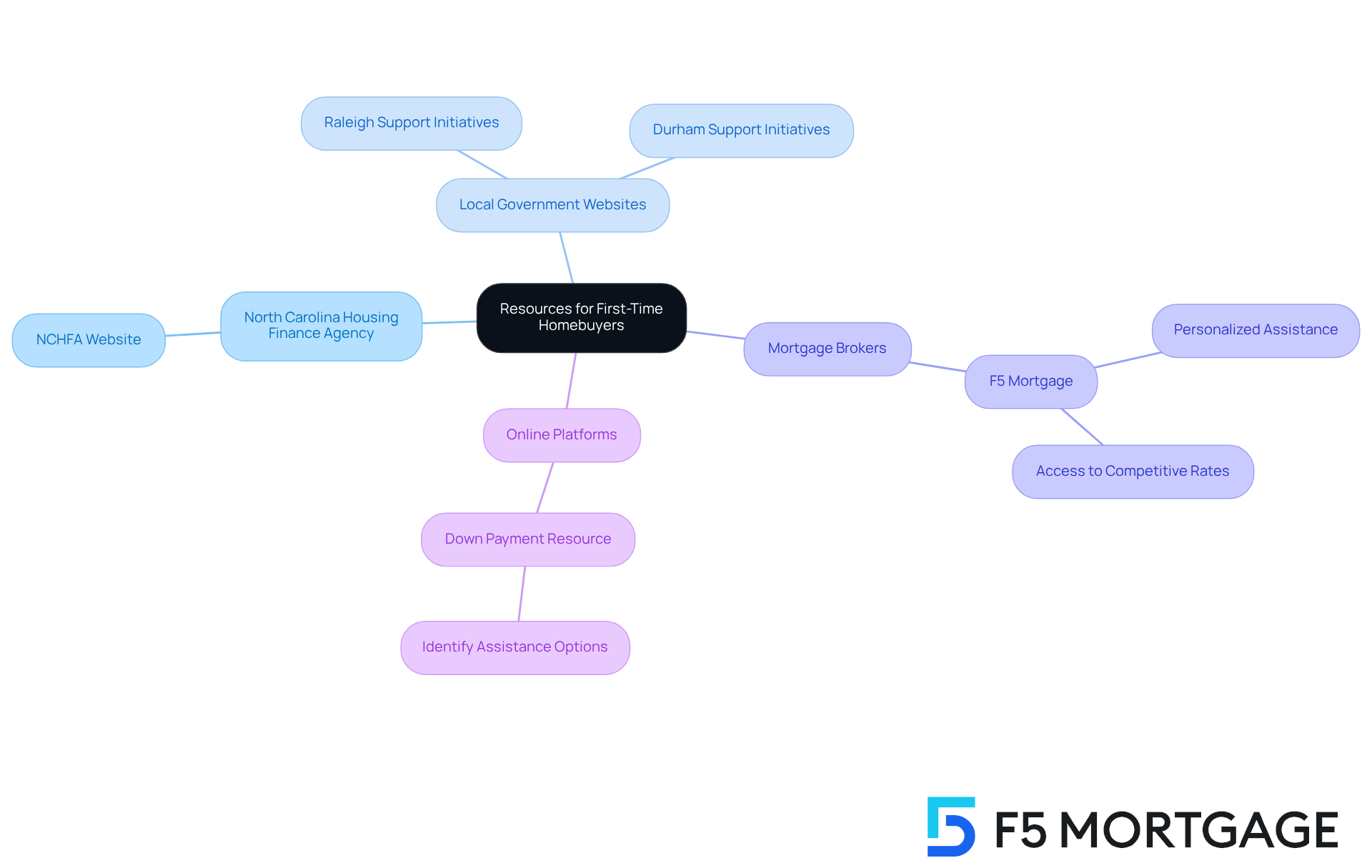

Resources for First-Time Homebuyers: Where to Find More Information on Down Payment Assistance

If you’re a new homebuyer seeking down payment assistance NC, there are numerous resources available to help you navigate this journey. The North Carolina Housing Finance Agency (NCHFA) website is a fantastic starting point, offering a wealth of information on down payment assistance NC options tailored to your needs. With over 2,000 homeownership initiatives available across the country, including down payment support that accounts for 75% of all options, you truly have a multitude of opportunities at your fingertips.

Local government websites, such as those for Raleigh and Durham, also provide specific details on city-based support initiatives. By collaborating with a mortgage broker like F5 Mortgage, you can receive personalized assistance and access a broader range of options designed specifically for your situation. As Barbara Marquand wisely points out, ‘Requirements for down payment support initiatives differ.’ This highlights the importance of understanding eligibility standards, which can vary significantly.

F5 Mortgage stands out as one of the top independent mortgage brokers in the country, dedicated to finding the best deal for you. They leverage partnerships with over two dozen top lenders to ensure you have access to competitive rates and options. Additionally, online platforms like Down Payment Resource are invaluable tools that help buyers identify down payment assistance NC options based on their unique circumstances and financial situations. Many of these programs are particularly geared towards low- and moderate-income residents, making it essential for potential homebuyers to explore these resources thoroughly.

We know how challenging this process can be, but remember, you’re not alone. We’re here to support you every step of the way as you explore these opportunities for down payment assistance NC.

Conclusion

Down payment assistance in North Carolina serves as a crucial lifeline for first-time homebuyers, transforming the landscape of homeownership by making it more accessible and affordable. We know how challenging it can be to save for a down payment. By providing substantial financial support, such as grants and forgivable loans, these programs enable individuals and families to overcome the significant barriers posed by high down payment requirements. The various assistance options available underscore the commitment to fostering homeownership among diverse income groups.

Understanding eligibility requirements, such as income limits and credit scores, is vital for potential buyers. This knowledge can empower families to take the next step toward homeownership. Additionally, the impact of down payment assistance extends beyond individual home purchases; it contributes to a more vibrant housing market and community stability. By facilitating homeownership, these initiatives help families secure their financial future while enhancing the overall economic vitality of North Carolina.

The significance of down payment assistance programs cannot be overstated. They empower individuals to transition from renting to owning, fostering a sense of stability and community. As more families share their success stories, it becomes increasingly clear that these resources are instrumental in changing lives. For those seeking to embark on the journey of homeownership, exploring available down payment assistance options is a critical step toward achieving that dream. We’re here to support you every step of the way.

Frequently Asked Questions

What is the NC 1st Home Advantage Down Payment program?

The NC 1st Home Advantage Down Payment program provides qualified first-time homebuyers in North Carolina with up to $15,000 in down payment assistance to help alleviate financial burdens associated with purchasing a home.

What are the down payment options available through F5 Mortgage?

F5 Mortgage offers down payment options that require as little as 3% down, with some options available at 0% down, making homeownership more accessible for first-time buyers.

What are the eligibility requirements for down payment assistance in North Carolina?

To qualify for down payment assistance in North Carolina, applicants must meet specific criteria, including income limits (typically not exceeding 80% of the area median income), first-time homebuyer status, and a minimum credit score of 640.

What is the average down payment for first-time homebuyers in North Carolina?

The average down payment for first-time homebuyers in North Carolina is $37,412 in 2024.

Do applicants need to complete any educational programs to qualify for assistance?

Yes, candidates may be required to complete a buyer education program designed to enhance their understanding of the home purchasing process.

What types of down payment assistance programs are available in North Carolina?

The types of down payment assistance programs available in North Carolina include grants, forgivable loans, and second mortgages, each designed to help ease the journey to homeownership.

How do grants work in down payment assistance programs?

Grants provide funds that do not need to be repaid, offering financial relief to homebuyers.

What happens if a homeowner sells or refinances early after receiving assistance?

If a homeowner sells or refinances early, they may need to repay a portion of the support received, as the assistance is structured as a deferred second mortgage.

How much funding is available for down payment assistance programs in North Carolina?

Eligible homebuyers can apply for up to $80,000 in support through approved lenders, with funding available on a first-come, first-served basis until the total of $5.7 million is depleted.