Overview

Navigating the world of mortgages can be challenging, especially for self-employed individuals and entrepreneurs. A bank statement loan offers a unique solution, allowing you to qualify based on your actual cash flow as shown in your bank statements, rather than relying on traditional income documentation like W-2s or tax returns. This approach provides much-needed flexibility in income verification, making homeownership more accessible for those with variable earnings.

However, it’s important to be aware that these loans typically come with higher interest rates and down payment requirements compared to conventional loans. We understand how daunting this can feel, but we’re here to support you every step of the way. By considering a bank statement loan, you could find a pathway to homeownership that truly reflects your financial situation.

If you’re ready to explore this option further, take the first step today. Reach out to a mortgage professional who can guide you through the process and help you find the best solution for your unique circumstances.

Introduction

Navigating the complexities of mortgage financing can feel overwhelming, especially for self-employed individuals and entrepreneurs. We understand how challenging it can be to prove your income in a traditional lending environment. This is where bank statement loans come into play, offering a tailored solution that allows you to qualify based on your actual cash flow rather than conventional income verification methods.

However, this innovative financing option does raise important questions:

- What about accessibility?

- What are the costs involved?

- What are the long-term implications for your financial future?

It’s essential to consider these factors carefully.

As you explore your options, we’re here to support you every step of the way. What do you need to know to make an informed decision about whether a bank statement loan is right for you? Let’s delve into this together.

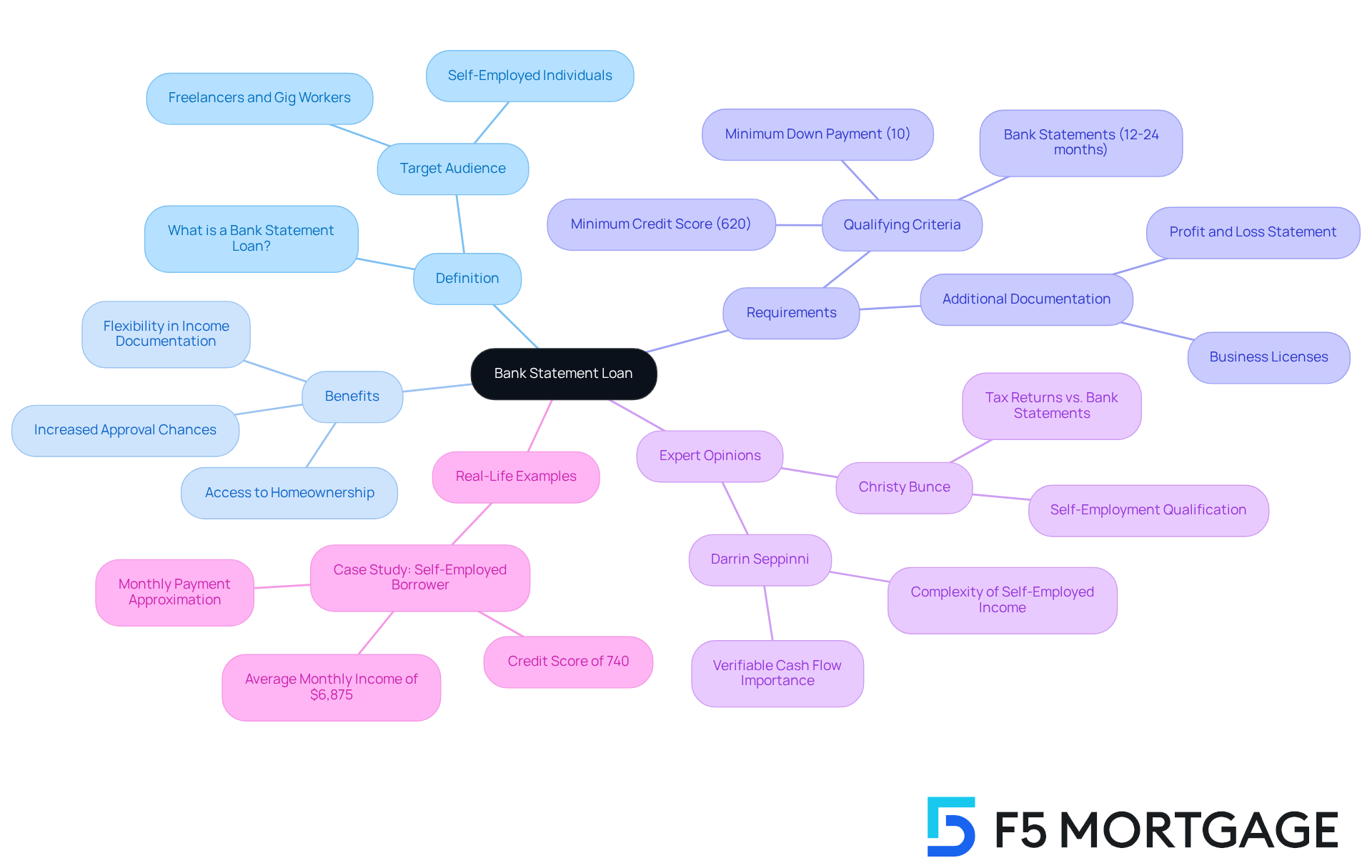

Define Bank Statement Loan

Navigating the world of mortgages can be overwhelming, especially for self-employed individuals and entrepreneurs. A financial institution document mortgage offers a specialized option that helps explain what is a bank statement loan, allowing you to qualify based on your financial records rather than traditional income documentation like W-2s, pay stubs, or tax returns. This unique credit solution is particularly beneficial for those with variable earnings or significant deductions that might lower their taxable income. By analyzing your financial records over the past 12 to 24 months, lenders can gain a clearer picture of your cash flow, helping them understand your economic well-being and ability to repay.

However, it’s essential to approach financial institution financing with caution. This option is often seen as a last resort due to higher rates, fees, and down payment requirements compared to traditional financing. Generally, a minimum credit score of 620 is needed to qualify for these financial products, which is a crucial detail for anyone considering this path.

Industry specialists recognize the value of financial documents for self-employed borrowers. Darrin Seppinni, a mortgage expert, notes that these financial products “acknowledge the complexity — and strength — of self-employed income,” allowing you to use your actual cash flow for mortgage qualification. Christy Bunce, president at New American Funding, encourages self-employed individuals to qualify based on their tax returns when possible, as it often leads to lower interest rates. Many self-employed individuals are now choosing financial options based on their records, especially when traditional methods fall short.

Real-life examples highlight the effectiveness of financial documents for business owners. For instance, if you’re self-employed with a credit score of 740 and an average monthly income of $6,875, you could qualify for a mortgage with a monthly payment of around $2,295, assuming a debt-to-income ratio of up to 45 percent. It’s important to note that a minimum down payment of 10% is typically required for financial documentation options. This flexibility in income documentation, specifically what is a bank statement loan, not only boosts your chances of approval but also opens doors to homeownership for those who might otherwise struggle to secure financing. Just keep in mind that bank account financing may take longer to finalize than traditional financing, which could affect your decision-making process.

We understand how challenging this journey can be, and we’re here to support you every step of the way.

Contextualize Bank Statement Loans in Mortgage Financing

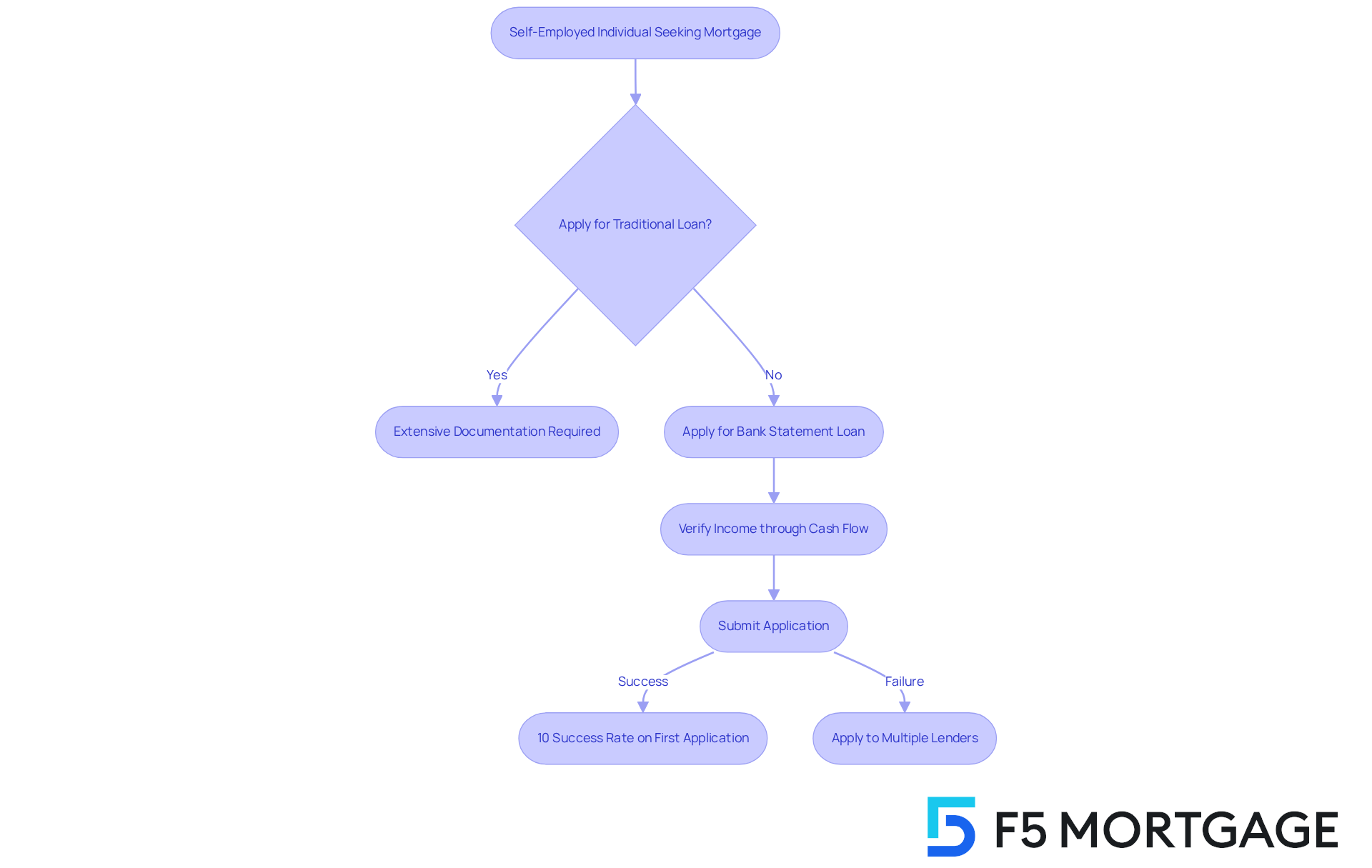

Navigating the world of mortgage financing can be particularly challenging for self-employed individuals and those with unconventional income sources. Traditional mortgage options often demand extensive documentation, which can feel overwhelming. As the gig economy continues to grow, lenders are beginning to recognize the need for more flexible financing solutions that truly accommodate diverse financial situations.

These innovative financial agreements, which are examples of what is a bank statement loan, allow borrowers to verify their income through actual cash flow, rather than relying solely on potentially misleading tax documents. This shift reflects a significant trend in mortgage financing, highlighting the increasing demand for products that cater to the unique needs of today’s workforce.

In 2025, the impact of the gig economy on mortgage financing is profound. Nearly two-thirds of gig workers have reported applying to multiple lenders before securing credit, with only 10% succeeding on their first application. This statistic underscores the importance of financial documents that provide a pathway to homeownership for those who may struggle to meet conventional lending requirements.

As industry leaders recognize, developing mortgage offerings that explain what is a bank statement loan is essential in meeting the needs of a transforming workforce. We know how challenging this can be, and we’re here to support you every step of the way, ensuring that more people can access the funding they need to achieve their dream of homeownership.

Highlight Key Features of Bank Statement Loans

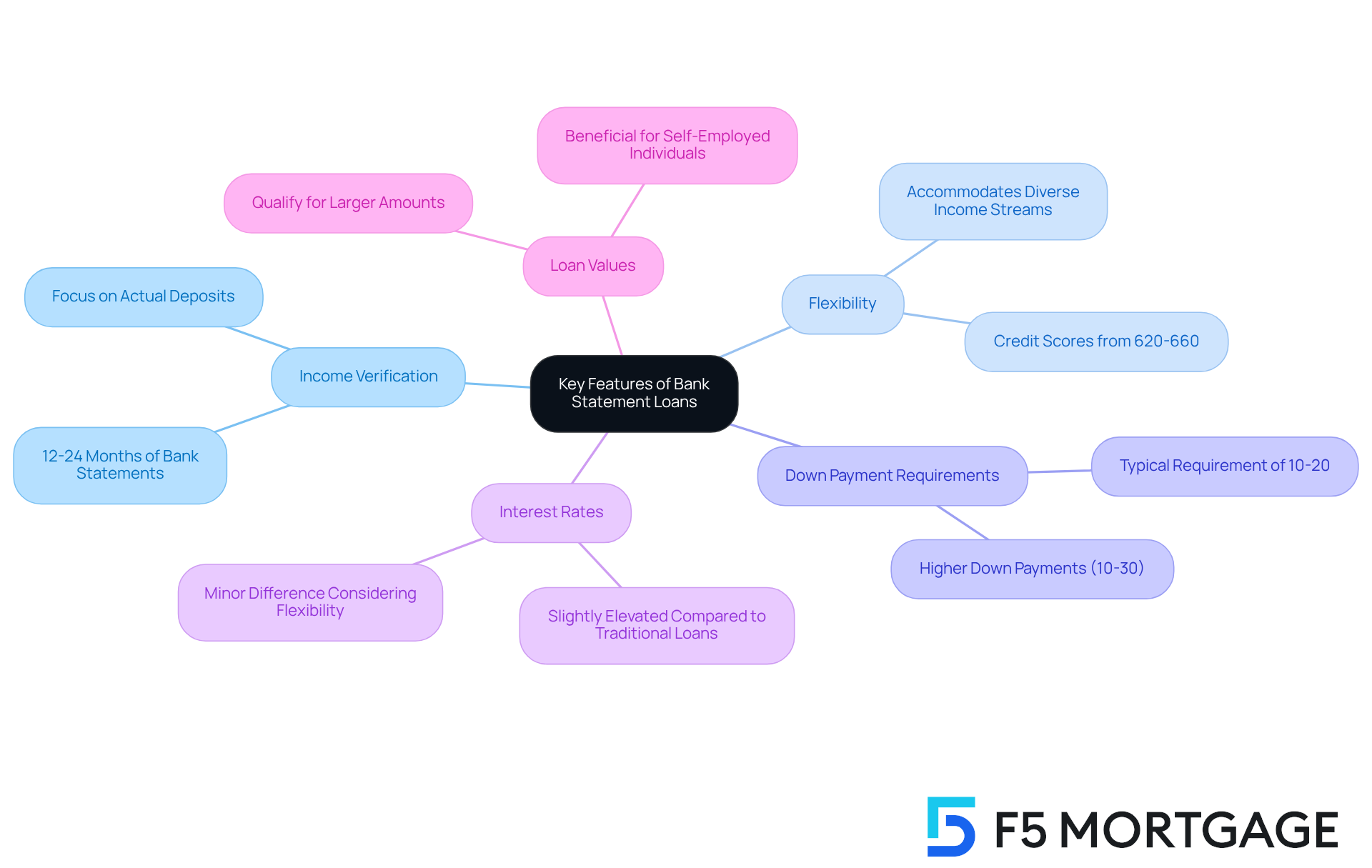

Key features of bank statement loans include:

-

Income Verification: We understand how challenging traditional income documentation can be, especially for self-employed individuals and freelancers. Lenders utilize what is a bank statement loan instead, focusing on actual deposits and cash flow over a period of 12 to 24 months. This method offers a clearer view of a client’s financial health, helping you feel more confident in your financial journey.

-

Flexibility: Tailored specifically for self-employed individuals, freelancers, and entrepreneurs, these financial products accommodate diverse income streams. This means you can qualify based on your cash flow rather than traditional income verification, which is relevant to understanding what is a bank statement loan. Many lenders accept credit scores starting from 620-660, which raises the question of what is a bank statement loan as an attractive option for prospective borrowers.

-

Down Payment Requirements: It’s important to note that bank statement mortgages generally require a higher down payment compared to traditional financing, often ranging from 10% to 30%. Many programs particularly necessitate a down payment of 10-20%, reflecting the heightened risk that lenders associate with these types of financing.

-

Interest Rates: While borrowers may encounter slightly elevated interest rates compared to conventional financing, this is primarily due to the perceived risk involved in understanding what is a bank statement loan. However, the difference is typically minor when considering the flexibility provided by what is a bank statement loan, which can outweigh this drawback for many individuals.

-

Loan Values: To understand what is a bank statement loan, it can enable you to qualify for larger amounts based on your cash flow, making it easier to acquire higher-value properties. This is especially beneficial for self-employed individuals who may have significant financial activity but lower reported taxable income, which is relevant to understanding what is a bank statement loan.

Many self-employed individuals have successfully used bank statements to answer the question of what is a bank statement loan in order to obtain their dream homes, showcasing the value of this funding choice. For instance, a freelance graphic designer utilized their regular monthly deposits to qualify for a larger mortgage, allowing them to buy a home that met their family’s needs. Furthermore, gig economy workers and entrepreneurs have found that what is a bank statement loan serves as a practical solution, illustrating the adaptability in income verification that has opened doors for many who might otherwise face challenges with conventional mortgage approvals.

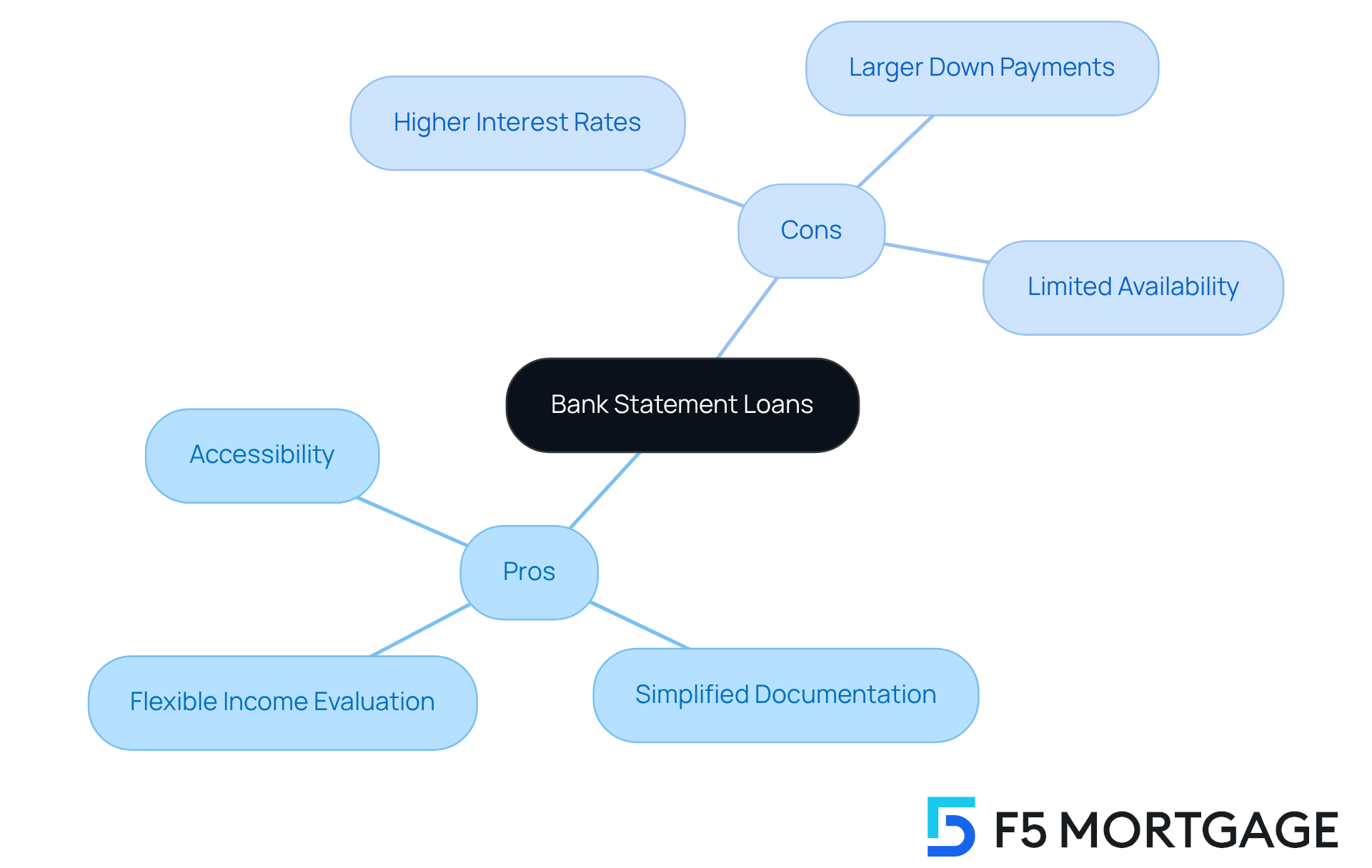

Examine Pros and Cons of Bank Statement Loans

Pros of bank statement loans include:

- Accessibility: We understand how challenging it can be for self-employed individuals to navigate traditional income verification. At F5 Mortgage, we provide tailored solutions for those asking what is a bank statement loan, giving you a pathway to homeownership and helping you achieve your dream home faster.

- Simplified Documentation: The application process is often quicker and requires less paperwork than traditional financing. With F5 Mortgage, you can get pre-qualified within just 10 minutes, making your journey to homeownership smoother and more manageable.

- Flexible Income Evaluation: Lenders focus on real cash flow, which can be particularly advantageous for those with fluctuating incomes when understanding what is a bank statement loan. At F5 Mortgage, our competitive rates—sometimes as low as X%—along with our personalized support, empower you to navigate this process effectively.

Cons of bank statement loans include:

- Higher Interest Rates: We know that due to the increased risk for lenders, borrowers may face higher interest rates compared to traditional mortgages, typically ranging from 0.5% to 1.5% higher. However, F5 Mortgage strives to offer competitive rates to help ease concerns regarding what is a bank statement loan.

- Larger Down Payments: The requirement for a larger down payment, often between 10% to 20%, can be a barrier for some individuals. We’re here to provide guidance to help you understand your options and make informed decisions.

- Limited Availability: Not all lenders provide what is a bank statement loan, which can restrict options for those seeking this type of financing. F5 Mortgage stands out by providing accessible solutions tailored to your unique needs.

Conclusion

Understanding the intricacies of bank statement loans reveals a vital financing option tailored for self-employed individuals and those with non-traditional income sources. We know how challenging it can be to secure financing, and this unique approach allows borrowers to utilize their actual cash flow rather than conventional income verification methods. This makes homeownership more accessible for those who may otherwise struggle.

The article highlights several key features of bank statement loans, including:

- Their flexibility in income evaluation

- Simplified documentation process

- The ability to qualify for larger loan amounts based on real cash flow

However, it’s important to be aware of the associated drawbacks, such as:

- Higher interest rates

- Larger down payment requirements

- Limited availability among lenders

These factors are critical to consider when determining if this financing option aligns with your individual financial situation.

Ultimately, bank statement loans represent an innovative solution in the evolving landscape of mortgage financing. As the gig economy expands and traditional income verification becomes increasingly challenging for many, these loans provide a pathway to homeownership for self-employed individuals. Embracing this financing option can empower you to achieve your dreams of owning a home. We’re here to support you every step of the way, highlighting the importance of understanding what a bank statement loan can offer in today’s diverse economic environment.

Frequently Asked Questions

What is a bank statement loan?

A bank statement loan is a specialized mortgage option that allows self-employed individuals and entrepreneurs to qualify based on their financial records instead of traditional income documentation like W-2s, pay stubs, or tax returns. This type of loan analyzes financial records over the past 12 to 24 months to assess cash flow and repayment ability.

Who can benefit from a bank statement loan?

Bank statement loans are particularly beneficial for self-employed individuals or those with variable earnings and significant deductions that may lower their taxable income. This option helps them qualify for a mortgage based on actual cash flow.

What are the qualification requirements for a bank statement loan?

Generally, a minimum credit score of 620 is required to qualify for bank statement loans. Additionally, a minimum down payment of 10% is typically needed.

What are the potential drawbacks of bank statement loans?

Bank statement loans are often seen as a last resort due to higher rates, fees, and down payment requirements compared to traditional financing. They may also take longer to finalize than conventional loans.

How do lenders assess eligibility for a bank statement loan?

Lenders evaluate financial records from the past 12 to 24 months to understand the borrower’s cash flow and economic well-being, which helps them determine the ability to repay the loan.

Are there any recommendations for self-employed individuals seeking a mortgage?

Industry specialists suggest that self-employed individuals should try to qualify based on their tax returns when possible, as this often results in lower interest rates. However, many are opting for bank statement loans when traditional methods are inadequate.

Can you provide an example of how a bank statement loan works?

For instance, a self-employed individual with a credit score of 740 and an average monthly income of $6,875 could qualify for a mortgage with a monthly payment of around $2,295, assuming a debt-to-income ratio of up to 45 percent.