Overview

Navigating the world of mortgage loans can feel overwhelming, especially for families looking to upgrade their homes. We understand how challenging this can be, and we’re here to support you every step of the way. This article focuses on five types of mortgage loans designed to assist you in making the best choice for your family’s needs.

Among the options available are:

- Fixed-rate

- Adjustable-rate

- FHA

- VA

- Jumbo financing

Each of these loans has its unique benefits and considerations. It’s essential to assess your financial situation carefully, as this will help you determine which loan type aligns with your goals.

Seeking professional guidance can further empower you to make informed decisions tailored to your family’s specific circumstances. Remember, you don’t have to navigate this process alone; there are experts ready to help you find the right path. By understanding your options and taking actionable steps, you can confidently move forward in your home upgrade journey.

Introduction

Navigating the intricate world of mortgage loans can feel overwhelming for families seeking to improve their living situation. We understand how challenging this can be. It’s crucial to grasp the various types of mortgage options available, as this knowledge empowers you to make informed decisions that align with your financial goals.

What hurdles do families encounter when trying to identify the best mortgage type for their unique circumstances? You’re not alone in this journey. Many face similar challenges, but there are ways to overcome these obstacles. By exploring your options and seeking guidance, you can secure the right financing for your dream home. Remember, we’re here to support you every step of the way.

Understand the Basics of Mortgage Loans

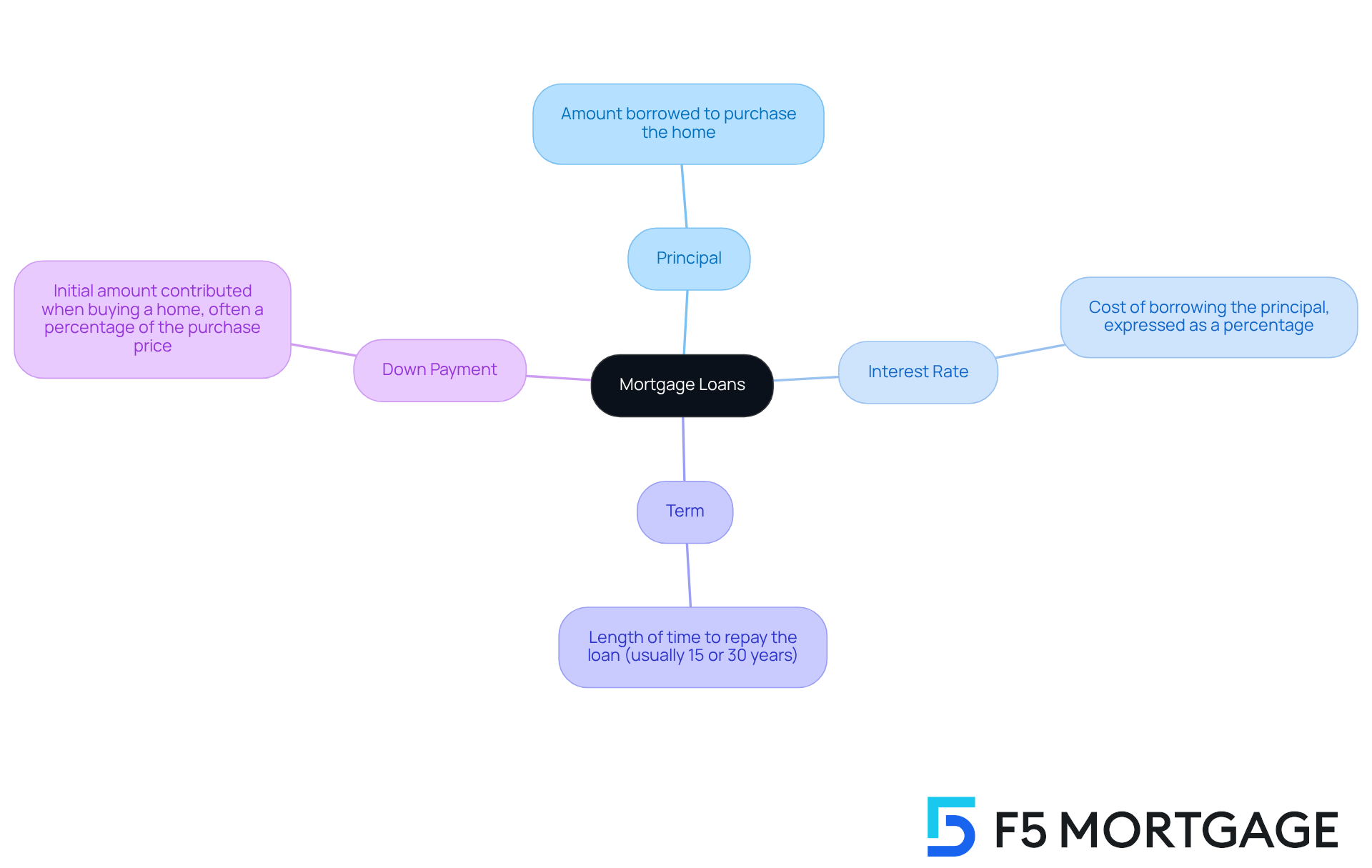

Before we dive into the specifics of financing, let’s take a moment to understand the basics of this type of mortgage loans. A type of mortgage loans is a financial agreement that helps you acquire real estate, with the property itself serving as collateral. We know how challenging this can be, so let’s clarify some key terms that will guide you through this journey:

- Principal: This is the amount you borrow to purchase your home.

- Interest Rate: Think of this as the cost of borrowing the principal, expressed as a percentage.

- Term: This refers to the length of time you have to repay the loan, usually 15 or 30 years.

- Down Payment: This is the initial amount you contribute when buying a home, often represented as a percentage of the purchase price.

Understanding the different type of mortgage loans is crucial. It will empower you to navigate the financial landscape more effectively and make informed choices as you explore your options. Remember, we’re here to support you every step of the way.

Explore Different Types of Mortgage Loans

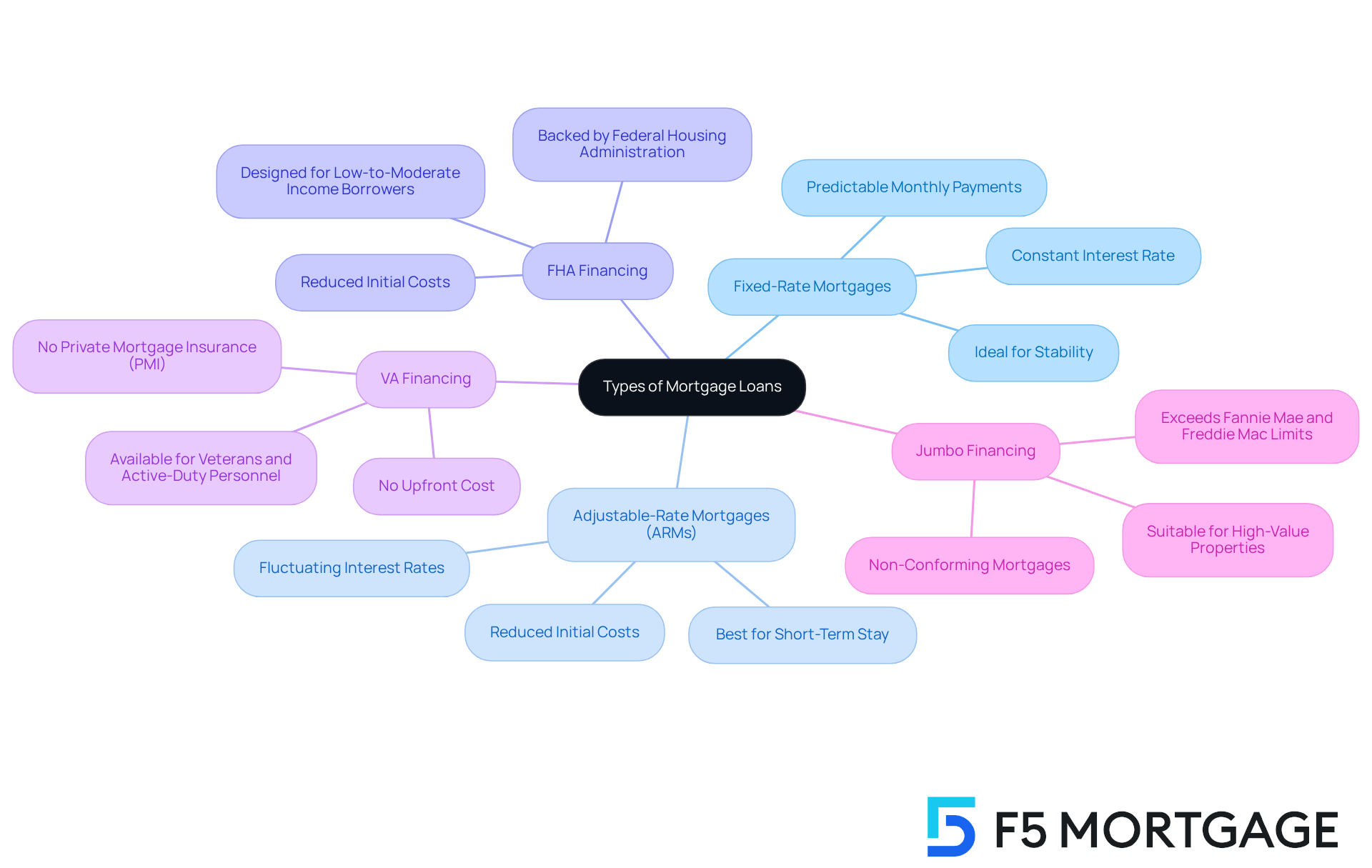

Navigating the world of mortgage loans can feel overwhelming, but understanding the options available can empower your family. Here are several types of mortgage loans designed to meet different needs:

- Fixed-Rate Mortgages: These loans come with a constant interest rate and monthly payments that never change. They are ideal for families seeking stability. If you’re looking for predictability, consider switching from an adjustable-rate mortgage to a fixed-rate one to lock in a lower rate.

- Adjustable-Rate Mortgages (ARMs): These financial products feature interest rates that may fluctuate periodically based on market conditions. While they can lead to reduced initial costs, they may rise over time. ARMs can be beneficial if you don’t plan to stay in your home long or intend to refinance multiple times.

- FHA Financing: Backed by the Federal Housing Administration, these options are designed for low-to-moderate-income borrowers. They require reduced initial costs, making them accessible for many families.

- VA Financing: Available to veterans and active-duty military personnel, these financial options offer advantageous conditions, including no upfront cost and no private mortgage insurance (PMI).

- Jumbo Financing: These are non-conforming mortgages that exceed the limits set by Fannie Mae and Freddie Mac, making them suitable for acquiring high-value properties.

Additionally, various down payment assistance programs are available through F5 Mortgage in states like California, Texas, and Florida. These programs can help ease the financial burden of buying a home. We know how challenging this can be, and understanding these options will help you determine which type aligns best with your family’s financial goals. We’re here to support you every step of the way.

Assess Your Financial Situation and Goals

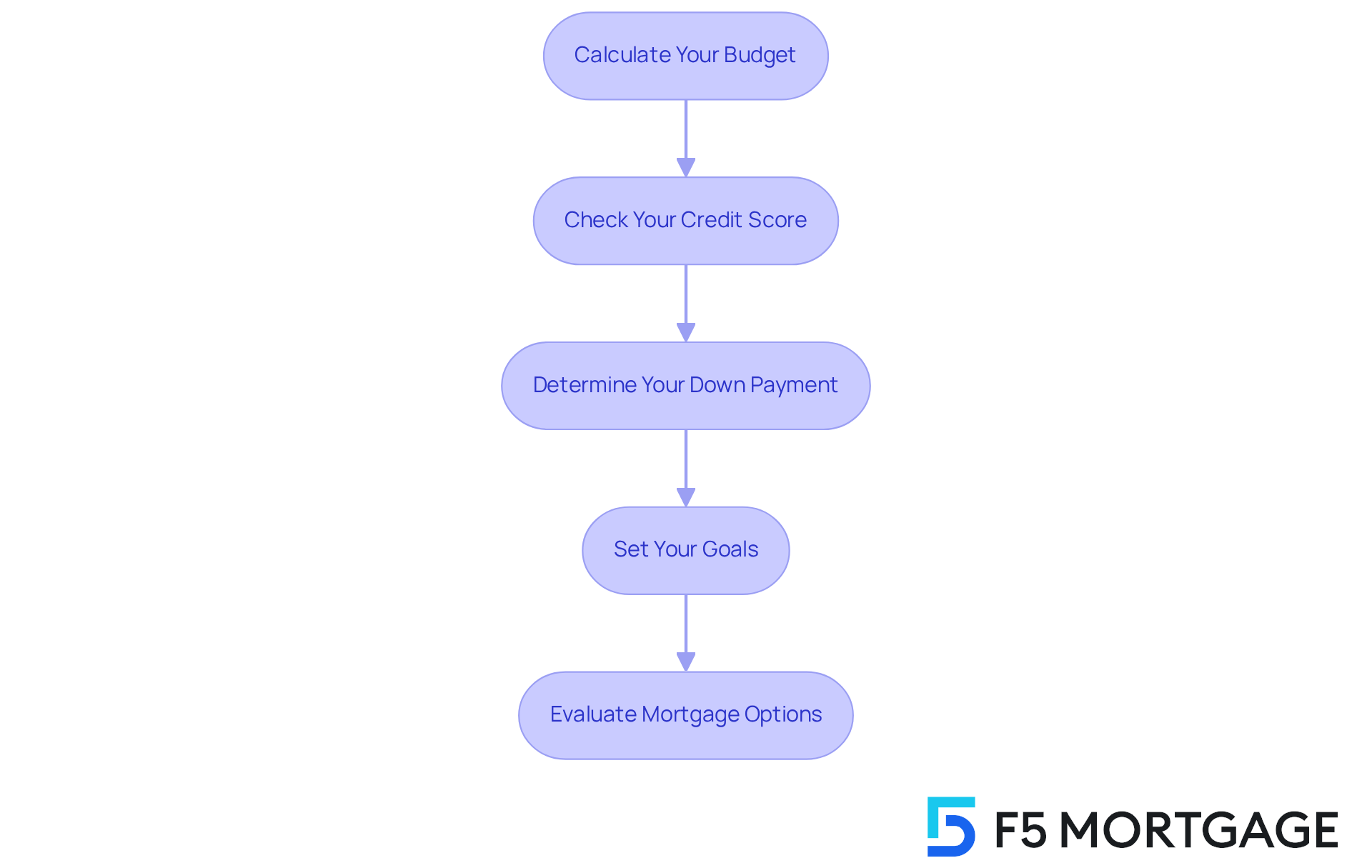

Making informed decisions about the different types of mortgage loans can feel overwhelming, but you’re not alone. We understand how important it is for families to assess their financial situation and goals. Here are some steps to guide you through the process:

-

Calculate Your Budget: Start by determining how much you can afford for a monthly mortgage payment. Take a close look at your income, expenses, and existing debts to find a comfortable range.

-

Check Your Credit Score: Your credit score plays a crucial role in securing favorable loan terms. Obtain your credit report, and if you notice any discrepancies, address them promptly to improve your score.

-

Determine Your Down Payment: Think about how much you can put down upfront. A larger down payment can significantly lower your monthly payments and help you avoid private mortgage insurance (PMI).

-

Set Your Goals: Reflect on your long-term plans. How long do you envision staying in your new home? Are there any anticipated changes in your financial situation that might affect your decision?

By thoroughly evaluating these factors, you can gain a clearer understanding of the different types of mortgage loans available to you. Remember, we’re here to support you every step of the way, helping you make decisions that truly align with your family’s needs.

Evaluate and Compare Mortgage Options

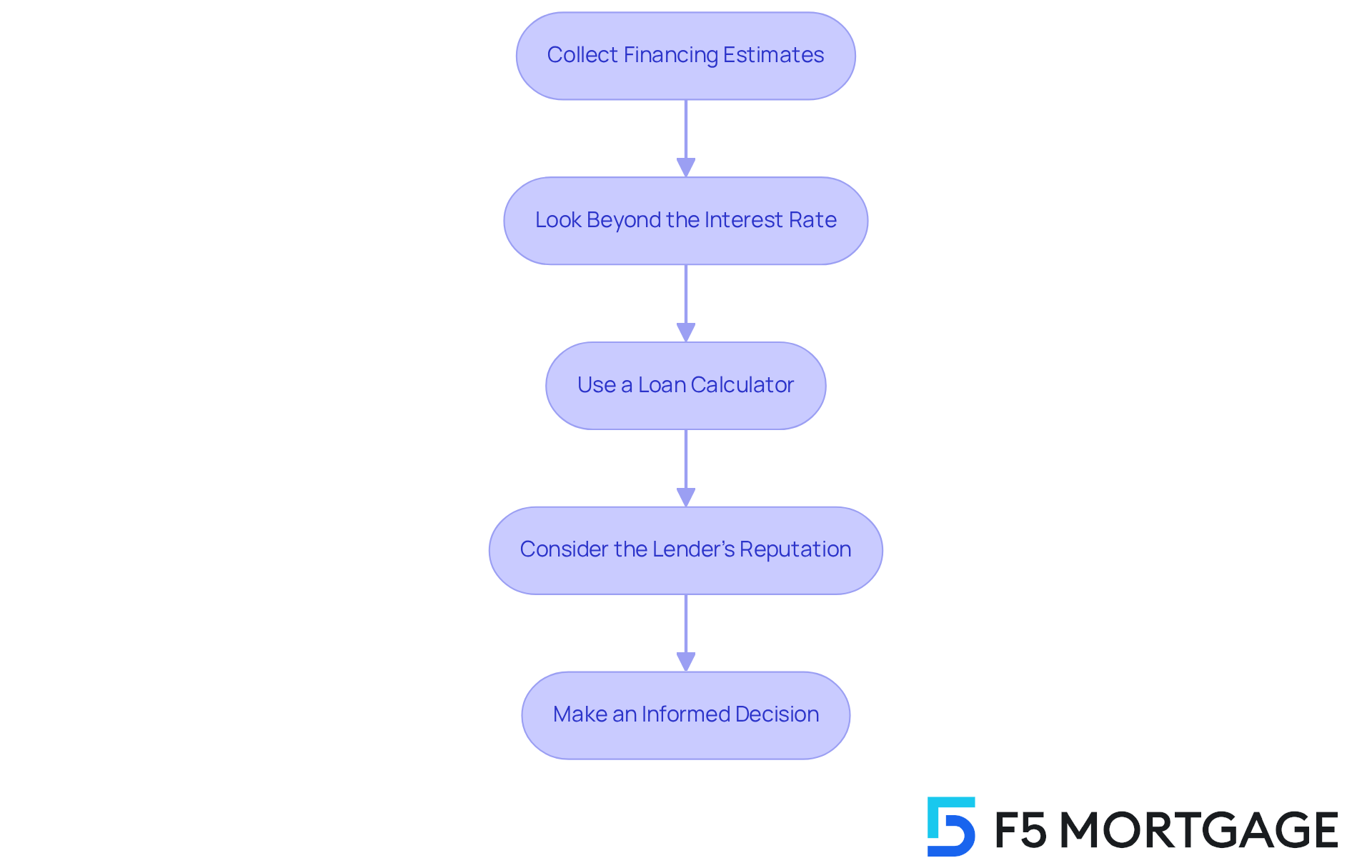

Once you have assessed your financial situation, we know how important it is to evaluate and compare various types of mortgage loans. Here are some steps to guide you:

-

Collect Financing Estimates: Request funding estimates from various lenders, including F5, to compare interest rates, fees, and terms. F5 Lending is recognized for providing competitive rates and tailored service, making it a strong contender in your search.

-

Look Beyond the Interest Rate: It’s essential to consider other factors such as closing costs, financing terms, and any potential penalties for early repayment. F5 Financing can help clarify these aspects, ensuring you make an informed decision.

-

Use a Loan Calculator: Utilize online loan calculators to estimate monthly payments based on different amounts and interest rates. This tool can help you visualize how various options impact your budget.

-

Consider the Lender’s Reputation: Research lenders’ customer service ratings and reviews to ensure you choose a reputable partner. F5 Financing takes pride in client satisfaction and a clear process, offering peace of mind during your financing journey.

By thoroughly assessing and contrasting your choices, including the proposals from F5, you can confidently select a type of mortgage loans that aligns with your family’s financial objectives and situation. Remember, we’re here to support you every step of the way.

Seek Professional Guidance for Your Mortgage Journey

Navigating the type of mortgage loans landscape can be complex, and we know how challenging this can be. Seeking professional guidance is invaluable, particularly with a team like F5 Mortgage that offers various types of mortgage loans and prioritizes a stress-free process through user-friendly technology and personalized support.

- Consult a Mortgage Broker: A broker can help you understand your options, negotiate better terms, and streamline the application process. At F5 Finance, our team is committed to assisting you in choosing the right type of mortgage loans without pressure, ensuring you select what feels appropriate for you.

- Ask Questions: Don’t hesitate to ask your broker or lender questions about anything you don’t understand. In this process, knowledge is power, and our friendly team is here to provide clear answers and support regarding the type of mortgage loans.

- Stay Informed: Keep yourself updated on market trends and changes in loan rates, as these can impact your decision. F5 Lending provides resources to help you stay informed and make knowledgeable decisions regarding the type of mortgage loans available.

- Utilize Resources: Take advantage of resources provided by your broker, such as home buyer’s guides and refinancing tools, to enhance your understanding. Our clients have commended our focus on detail and the thorough assistance we provide during the financing process for different types of mortgage loans.

By seeking professional guidance from F5 Mortgage, you can navigate the type of mortgage loans process with confidence. We’re here to support you every step of the way, ensuring you make the best decisions for your family’s future. Our commitment to exceptional service and fast loan closing—often in under three weeks—means you can focus on what truly matters: finding your dream home.

Conclusion

Navigating the complexities of mortgage loans can feel overwhelming for families looking to upgrade their living situation. We understand how challenging this can be. By grasping the various types of mortgage loans available—from fixed-rate and adjustable-rate mortgages to FHA, VA, and jumbo financing—you empower yourself to make informed decisions that align with your financial goals. Each loan type offers unique benefits, and knowing these options allows you to connect them with your personal circumstances and long-term plans.

It’s crucial to assess your financial situation, including budgeting, credit scores, and down payment capabilities. We’re here to support you every step of the way. Evaluating and comparing mortgage options is essential, taking into account not just interest rates but also closing costs and lender reputations. Seeking professional guidance from mortgage brokers can streamline this process, ensuring you receive tailored support and resources to navigate your mortgage journey.

Ultimately, understanding and effectively managing the mortgage landscape can lead to a more secure and fulfilling home-buying experience. We encourage families to take proactive steps in evaluating their options, seeking clarity from professionals, and staying informed about market trends. By doing so, you can confidently choose the right mortgage that aligns with your financial aspirations and enhances your quality of life.

Frequently Asked Questions

What is a mortgage loan?

A mortgage loan is a financial agreement that helps you acquire real estate, with the property itself serving as collateral.

What are the key terms associated with mortgage loans?

Key terms include:

- Principal: The amount you borrow to purchase your home.

- Interest Rate: The cost of borrowing the principal, expressed as a percentage.

- Term: The length of time you have to repay the loan, usually 15 or 30 years.

- Down Payment: The initial amount you contribute when buying a home, often represented as a percentage of the purchase price.

What are the different types of mortgage loans available?

The different types of mortgage loans include:

- Fixed-Rate Mortgages: Loans with a constant interest rate and monthly payments that never change.

- Adjustable-Rate Mortgages (ARMs): Loans with interest rates that may fluctuate periodically based on market conditions.

- FHA Financing: Loans backed by the Federal Housing Administration, designed for low-to-moderate-income borrowers.

- VA Financing: Loans available to veterans and active-duty military personnel, offering advantageous conditions.

- Jumbo Financing: Non-conforming mortgages that exceed the limits set by Fannie Mae and Freddie Mac, suitable for high-value properties.

What are down payment assistance programs?

Down payment assistance programs are available to help ease the financial burden of buying a home, offered through various lenders in states like California, Texas, and Florida.