Overview

Navigating the mortgage process can feel overwhelming, especially when considering a home valued at $400,000. We understand how challenging this can be, and we’re here to support you every step of the way. In this guide, we’ll explore key factors that play a vital role in calculating your mortgage, including:

- Loan types

- Interest rates

- Down payments

- Additional costs

To start, it’s essential to recognize that your monthly mortgage payment can be determined using a specific formula. However, this is just the beginning. We want to emphasize that it’s crucial to factor in additional expenses such as property taxes, insurance, and maintenance. These elements are vital in creating a comprehensive budget for homeownership that truly reflects your financial landscape.

By understanding these components, you can approach your mortgage with confidence. Remember, we’re here to help you navigate this journey, ensuring you have the knowledge and resources to make informed decisions. Let’s take this step together towards your dream home.

Introduction

We understand that navigating the financial landscape of homeownership can feel overwhelming, especially when considering a significant investment like a $400,000 house. With various loan types, fluctuating interest rates, and additional costs such as property taxes and insurance, potential homeowners often find themselves facing a complex web of decisions.

This guide is designed to provide a clear, step-by-step approach to demystifying the mortgage process, equipping you with the knowledge needed to make informed choices. As the market evolves and rates change, we know how challenging it can be to ensure you are making the best financial decision for your future.

We’re here to support you every step of the way.

Understand Mortgage Basics for a $400,000 Home

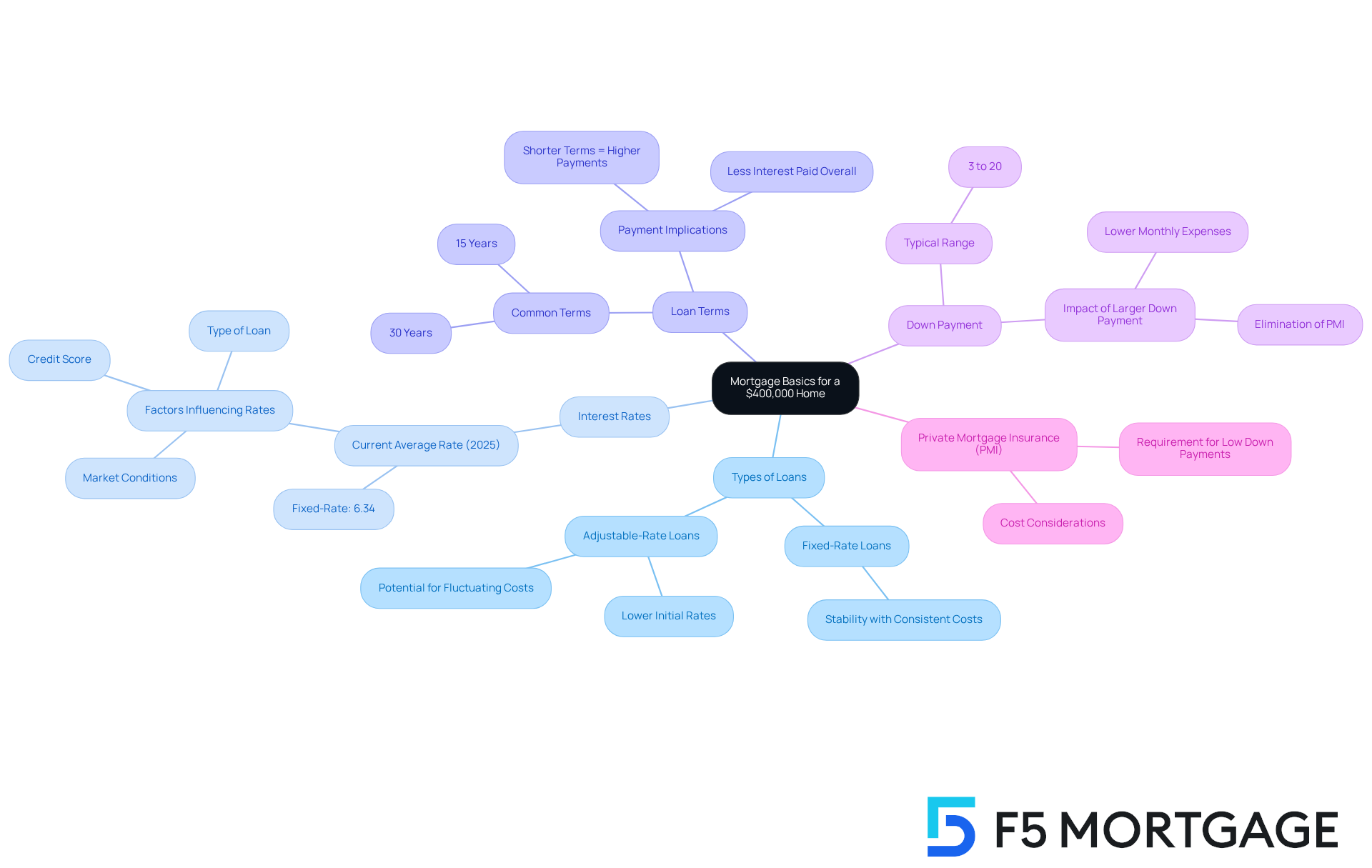

To begin, let’s take a moment to understand some key mortgage concepts that can make this journey easier for you:

-

Types of Loans: It’s important to know the difference between fixed-rate and adjustable-rate loans. Fixed-rate loans provide stability with consistent costs, while adjustable-rate loans may start lower but can fluctuate over time, potentially increasing your expenses.

-

Interest Rates: The interest rate plays a significant role in determining your monthly payment. As we look ahead to 2025, average rates for fixed-rate loans are around 6.34%. Adjustable-rate loans might offer lower initial rates, but remember, these can change based on market conditions, your credit score, and the type of loan you choose.

-

Loan Terms: Common mortgage terms are 15 years and 30 years. A shorter term often means higher regular payments but less interest paid overall. It’s essential to evaluate your financial situation and choose what works best for you.

-

Down Payment: This is the initial amount you pay upfront, typically ranging from 3% to 20% of the home’s price. A larger down payment can significantly lower your monthly expenses and eliminate private mortgage insurance (PMI), which is usually required if your down payment is less than 20%.

-

Private Mortgage Insurance (PMI): If your down payment is below 20%, lenders often require PMI to protect themselves in case of default. Understanding this cost is crucial for planning your overall housing expenses.

By grasping these fundamentals, you can navigate the financing landscape with greater confidence and prepare for the next steps in understanding how much is a mortgage on a 400k house. We know how challenging this can be, and we’re here to support you every step of the way.

Calculate Monthly Payments on a $400,000 Mortgage

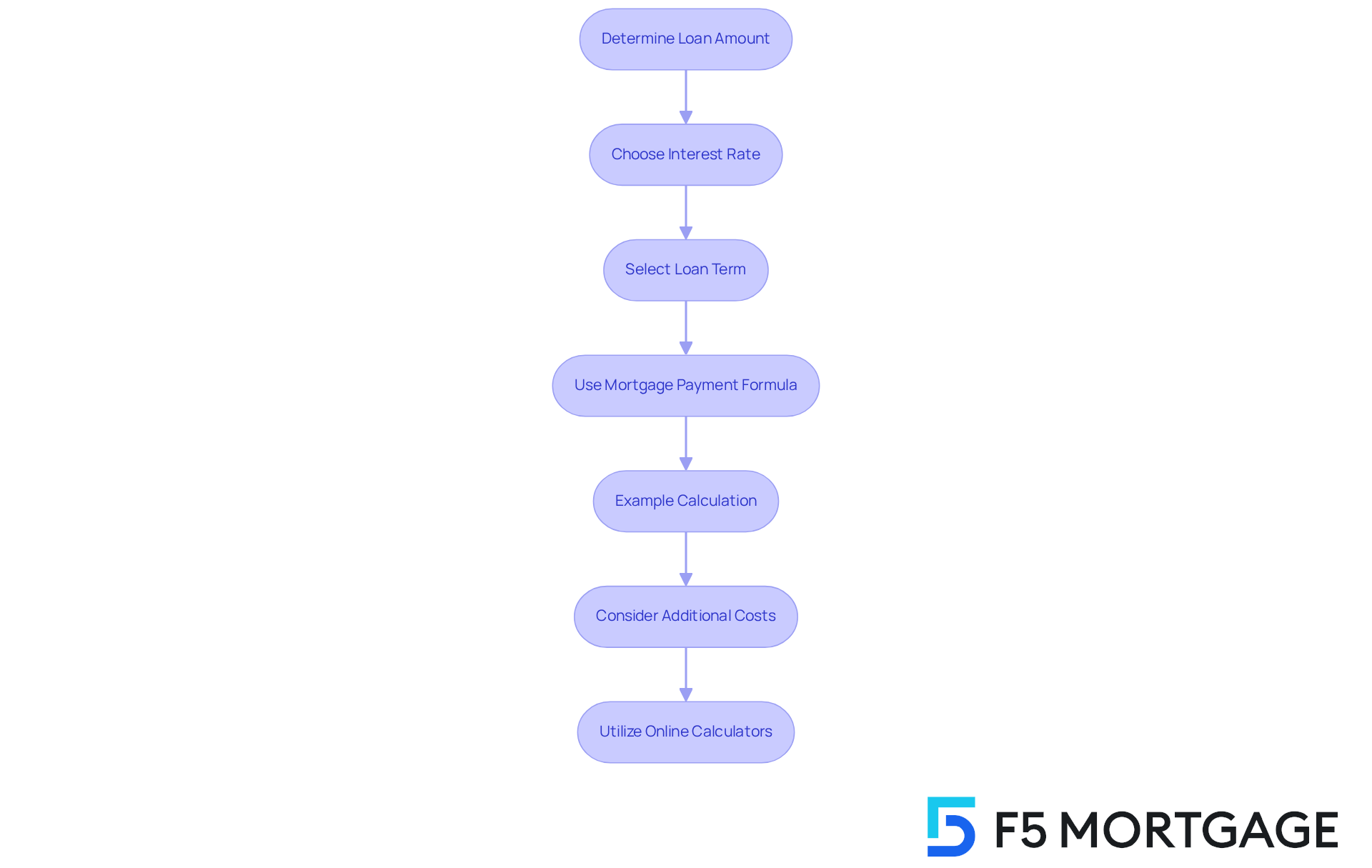

Calculating how much is a mortgage on a 400k house for your monthly payment can feel daunting, but we’re here to support you every step of the way. Follow these simple steps to gain clarity on your financial commitment:

-

Determine Your Loan Amount: Start by subtracting your down payment from the home price. For instance, if you put down 20% ($80,000), your loan amount would be $320,000.

-

Choose Your Interest Rate: It’s important to research current home loan rates. As of October 2025, the average rate for a 30-year loan is around 6.75%. This information can help you make informed decisions.

-

Select Your Loan Term: Consider whether a 30-year or 15-year mortgage is best for your situation. A 30-year term generally results in lower monthly payments, while a 15-year term allows for quicker repayment but comes with higher monthly costs.

-

Use the Mortgage Payment Formula: To calculate your monthly payment (M), you can use the following formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]Where:

- P = loan amount ($320,000)

- r = monthly interest rate (annual rate / 12 months)

- n = number of payments (loan term in months)

-

Example Calculation: For a $320,000 loan at 6.75% over 30 years:

- Monthly interest rate = 0.0675 / 12 = 0.005625

- Number of payments = 30 * 12 = 360

- Plugging these values into the formula gives a monthly payment of approximately $2,073.

-

Consider Additional Costs: It’s crucial to remember that additional costs, such as property taxes and homeowners insurance, can significantly affect your total monthly payment. For example, the average property tax paid per household in the U.S. was $1,889 in 2023, and homeowners insurance averages around $2,554 annually. Additionally, many lenders expect homeowners to maintain a debt-to-income (DTI) ratio of no more than 43%, which can influence your loan options and rates. Many lenders also require a minimum home-to-value loan ratio of 80%.

-

Utilize Online Calculators: If you’re feeling overwhelmed, consider using online loan calculators to simplify this process. Websites like Bankrate or Zillow offer user-friendly tools that help you calculate your regular expenses quickly, taking into account these extra costs and helping you understand how your DTI ratio and equity requirements can impact your financing options.

By following these steps and considering all relevant factors, including property equity requirements and DTI ratios, you can gain a clearer understanding of how much is a mortgage on a 400k house for your potential monthly loan payment. At F5 Mortgage, we are dedicated to providing quick and adaptable mortgage solutions, empowering you with tailored support throughout your purchasing journey.

Account for Additional Costs in Home Ownership

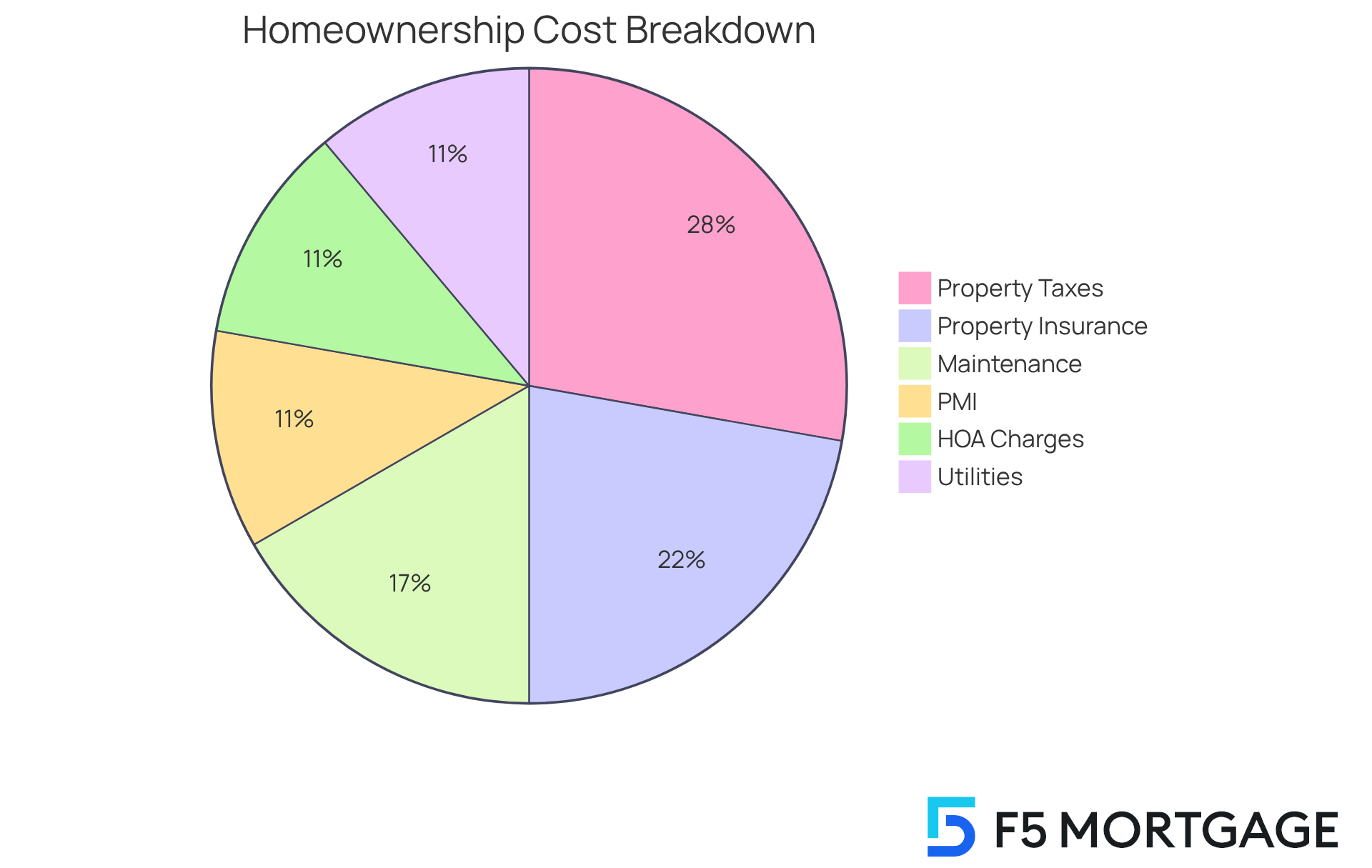

When budgeting for a $400,000 home, it is important to understand how much is a mortgage on a 400k house, as this can help you consider the various additional costs that significantly impact your financial planning. Here are some key expenses to keep in mind:

-

Property Taxes: Property tax rates differ significantly by area, usually fluctuating between 0.5% and 2.23% of the property’s assessed value each year. When considering how much is a mortgage on a 400k house, this equates to an estimated yearly fee ranging from $2,040 (in South Carolina) to $9,541 (in New Jersey), where the effective property tax rate stands as the highest in the U.S. at 2.23%.

-

Property Insurance: Safeguarding your residence and possessions is essential. Typical property insurance expenses can vary from $800 to $2,000 each year. In states like Florida, the average premium is approximately $5,735, reflecting a recent 9% decrease due to legislative efforts aimed at controlling costs. However, homeowners in high-risk areas, such as Nebraska and Louisiana, may face premiums exceeding $6,000 per year. As Douglas Heller noted, “American homeowners are facing unprecedented premium hikes,” which underscores the importance of budgeting for these rising costs.

-

Private Mortgage Insurance (PMI): If your down payment is under 20%, PMI will probably be necessary, increasing your payment by an extra $100 to $300.

-

Homeowners Association (HOA) Charges: If your new residence is part of a community managed by an HOA, charges can vary from $200 to $500 each month, based on the amenities provided.

-

Maintenance and Repairs: It’s wise to budget for ongoing maintenance, which averages about 1% of your property’s value annually. For a $400,000 property, understanding how much is a mortgage on a 400k house means setting aside approximately $4,000 each year for repairs and maintenance.

-

Utilities: Monthly utility costs, including electricity, water, gas, and internet, can add another $200 to $400 to your budget.

By accounting for these additional costs, you can create a more accurate budget and ensure that you can comfortably afford your new home. Understanding these financial obligations is crucial for maintaining a stable household budget, especially in the face of rising insurance premiums and property taxes influenced by local market conditions. Additionally, programs like Florida’s ‘My Safe Florida Home’ initiative aim to help homeowners mitigate insurance costs, further emphasizing the importance of being informed about available resources. We’re here to support you every step of the way as you navigate these financial considerations.

Navigate the Mortgage Application Process

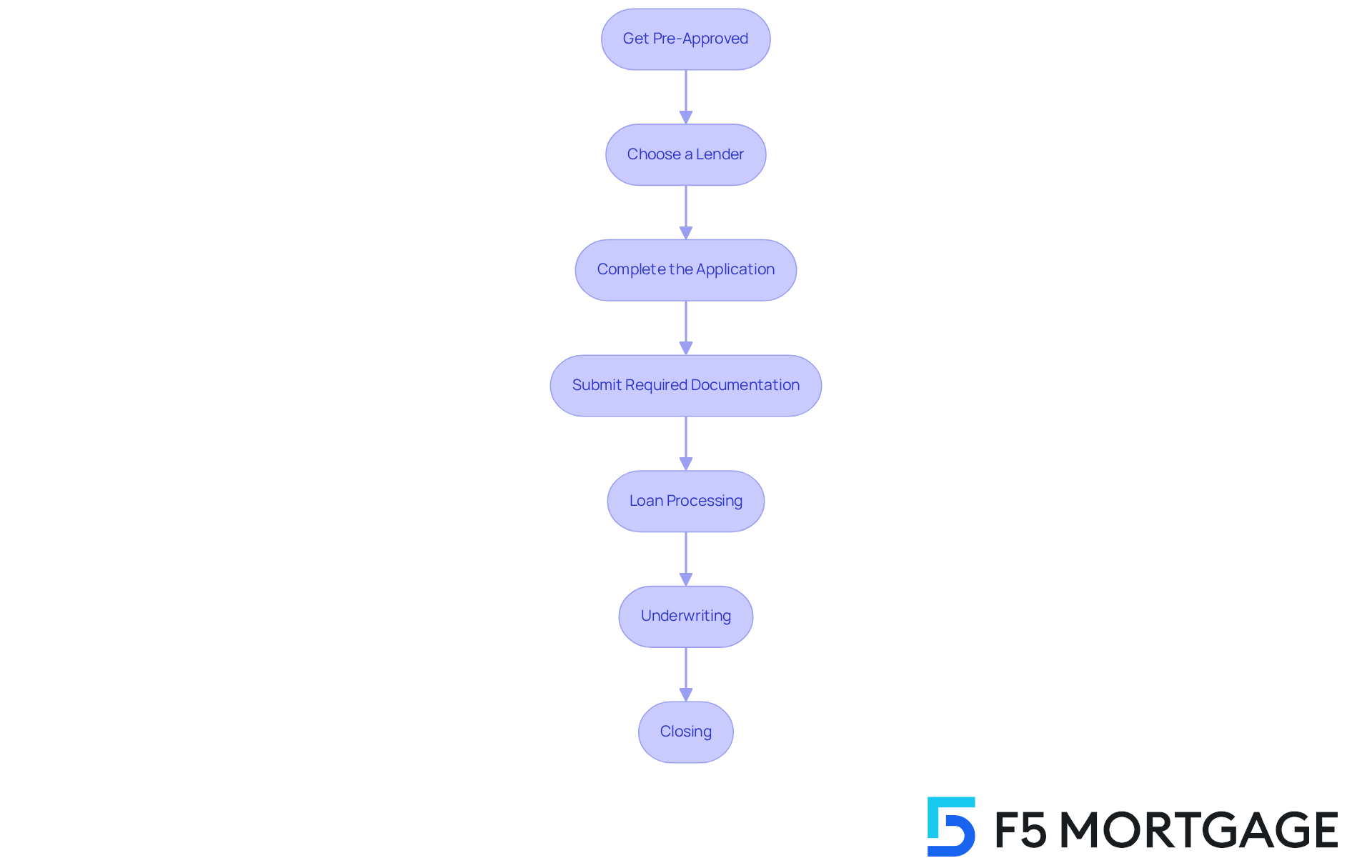

Navigating the mortgage application process can feel overwhelming, but with F5 Mortgage, you can find the support you need. Here’s how to approach it with confidence:

-

Get Pre-Approved: Start by obtaining a pre-approval from F5 Mortgage. This step involves submitting important financial documents like W-2s, pay stubs, and bank statements. We know how challenging it can be to assess your borrowing capacity, and pre-approval provides clarity on how much you can borrow.

-

Choose a Lender: Take the time to research and compare lenders. Finding the best rates and terms is crucial. Consider F5 Mortgage, which offers a variety of loan options tailored to your unique needs, along with a no-pressure guidance approach to help you feel at ease.

-

Complete the Application: When you’re ready, fill out the loan application form with your personal and financial information. You can apply online, by phone, or through chat, making it convenient to get started. Be prepared to share details about your employment, income, debts, and assets. Remember, we’re here to support you every step of the way.

-

Submit Required Documentation: Along with your application, submit necessary documents such as tax returns, bank statements, and proof of assets. Ensuring all information is accurate helps avoid delays, and we’re here to guide you through this process.

-

Loan Processing: After submission, F5 Mortgage will process your application. Utilizing user-friendly technology, they simplify the process and guide you through each step, alleviating some of the stress you may feel.

-

Underwriting: The underwriter will review your application and documentation to determine if you qualify for the loan. They may request additional information during this stage, but don’t worry—this is a normal part of the process.

-

Closing: If approved, you’ll receive a Closing Disclosure outlining the final loan terms. Take your time to review it carefully before signing. At closing, you’ll pay closing costs and sign the loan documents, marking a significant step towards securing your new home.

By following these steps and utilizing F5 Mortgage’s personalized loan solutions, you can navigate the mortgage application process with confidence and find out how much is a mortgage on a 400k house. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how much a mortgage on a $400,000 house will cost can feel overwhelming. It involves more than just the principal and interest; it requires a comprehensive grasp of various mortgage types, interest rates, and the associated costs that come with homeownership. We know how challenging this can be, but by familiarizing yourself with these elements, you can make informed decisions that align with your financial goals.

In this article, we highlight essential aspects such as:

- The types of loans available

- The significance of interest rates

- The impact of down payments

We also cover the hidden costs of homeownership, including:

- Property taxes

- Insurance

- Maintenance

Each of these factors plays a crucial role in determining your monthly payment and overall financial commitment. Navigating the mortgage application process with the right support can simplify what may seem like an overwhelming task.

Ultimately, being well-informed about mortgage basics and understanding all associated costs empowers potential homeowners to budget effectively and avoid unexpected financial burdens. As you embark on the journey of purchasing a home, consider utilizing available resources like mortgage calculators and professional guidance. These proactive steps not only enhance your confidence but also set the foundation for a successful homeownership experience. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are the main types of mortgage loans?

The main types of mortgage loans are fixed-rate loans, which provide stability with consistent costs, and adjustable-rate loans, which may start with lower rates but can fluctuate over time, potentially increasing expenses.

How do interest rates affect my mortgage payments?

Interest rates significantly influence your monthly payment. As of 2025, average rates for fixed-rate loans are around 6.34%. Adjustable-rate loans may offer lower initial rates, but these can change based on market conditions, your credit score, and the type of loan you select.

What are the common loan terms for mortgages?

Common mortgage terms are 15 years and 30 years. A shorter term typically results in higher regular payments but less interest paid overall.

What is a down payment, and how does it affect my mortgage?

A down payment is the initial amount paid upfront when purchasing a home, usually ranging from 3% to 20% of the home’s price. A larger down payment can lower your monthly expenses and may eliminate private mortgage insurance (PMI) if it is 20% or more.

What is private mortgage insurance (PMI)?

Private mortgage insurance (PMI) is a cost that lenders often require if your down payment is below 20%. It protects the lender in case of default, making it important to understand for overall housing expense planning.