Overview

Choosing a home finance broker for your mortgage can be a game-changer for families. We know how challenging this can be, and brokers simplify the loan acquisition process, providing access to a wider range of lending options. They can also negotiate better terms on your behalf, ensuring you get the best deal possible.

Imagine saving significant amounts of money and time while receiving personalized support. Brokers, like F5, make the complex mortgage landscape more manageable. They truly enhance your overall satisfaction as a client, guiding you through each step with care.

We’re here to support you every step of the way. By partnering with a knowledgeable broker, you can navigate the mortgage process with confidence and ease. Take that first step towards your dream home today.

Introduction

Navigating the mortgage landscape can often feel like an uphill battle for families. With a myriad of options and complex paperwork looming large, it’s easy to feel overwhelmed. We understand how challenging this can be. That’s where home finance brokers emerge as invaluable allies in this journey.

These professionals offer tailored solutions that simplify the process and potentially save borrowers thousands. As the demand for personalized financial guidance grows, families may wonder: how can they leverage the expertise of these brokers? The answer lies in not only securing the best mortgage terms but also ensuring a smoother home-buying experience.

By reaching out for support, families can transform what feels like a daunting task into a manageable and rewarding adventure. We’re here to support you every step of the way, guiding you through the complexities of home financing with care and understanding.

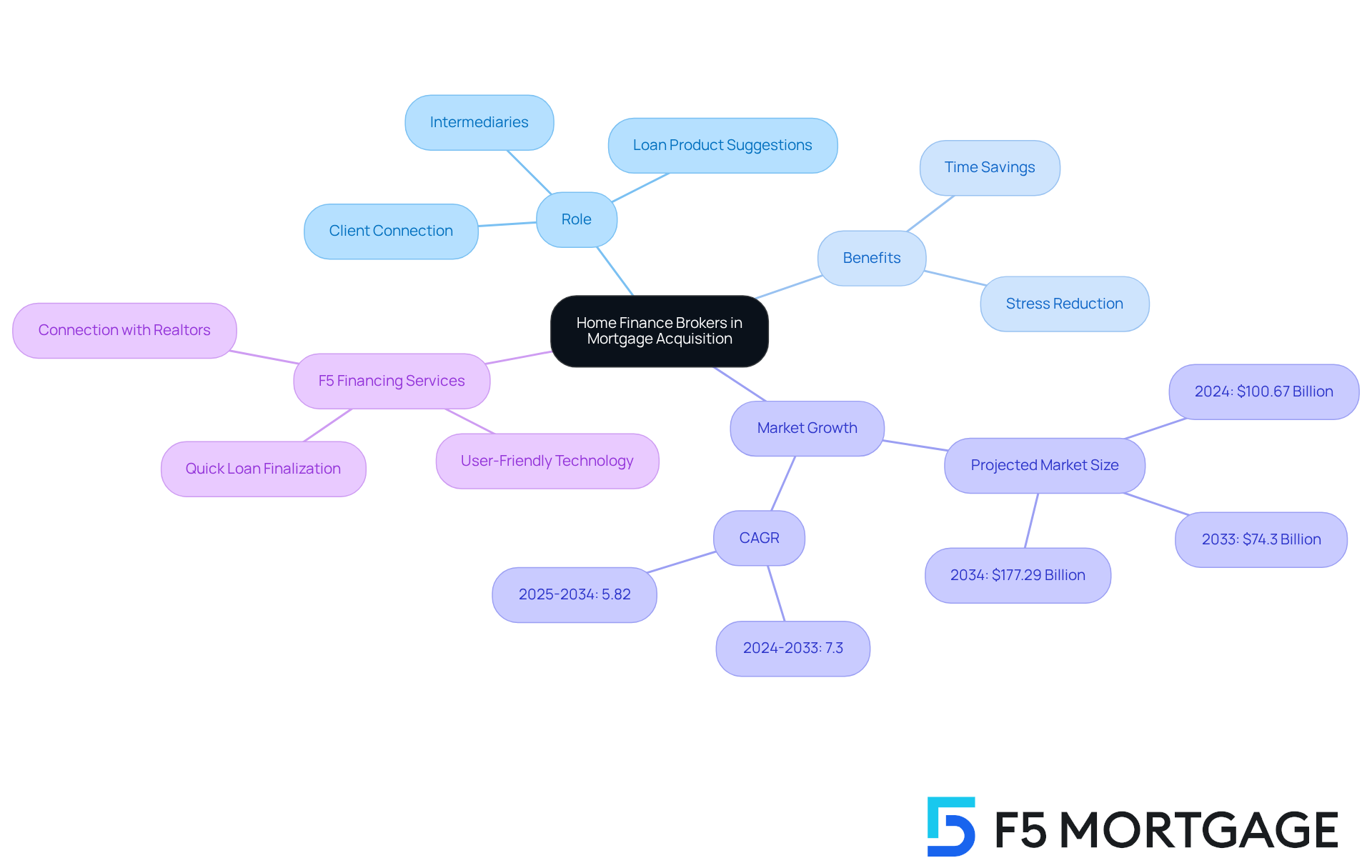

Understand the Role of Home Finance Brokers in Mortgage Acquisition

Navigating home finance can feel overwhelming, but a home finance broker is here to help. Acting as crucial intermediaries between borrowers and lenders, they simplify the loan acquisition process, ensuring you don’t have to face it alone. With their extensive networks, these agents connect individuals to a diverse range of lending options tailored to your unique financial situation.

We understand how important it is to find the right loan. By thoroughly examining your requirements and evaluating your financial profile, agents suggest loan products that align with your goals. In today’s complex market, where time and expertise can be in short supply, their role becomes increasingly vital. The loan brokerage services market is projected to grow significantly, reaching an estimated value of $74.3 billion by 2033. This growth reflects the rising complexity of loan products and the increasing demand for personalized financial guidance.

Imagine saving valuable time and alleviating the stress associated with securing a mortgage. By simplifying the mortgage process, brokers enhance your overall experience. F5 exemplifies this commitment to a stress-free journey through user-friendly technology and a no-pressure approach, ensuring you can choose what feels right for you.

Moreover, F5 Financing connects clients with top realtors, further enriching your home-buying experience. With the ability to finalize most loans in under three weeks, F5 stands out as a dependable partner for families looking to enhance their homes.

As Bias Dey observes, “Loan advisors, with their knowledge and access to various lenders, provide borrowers a simplified and knowledgeable experience, which is precisely what F5 aims to deliver.” We know how challenging this can be, and we’re here to support you every step of the way.

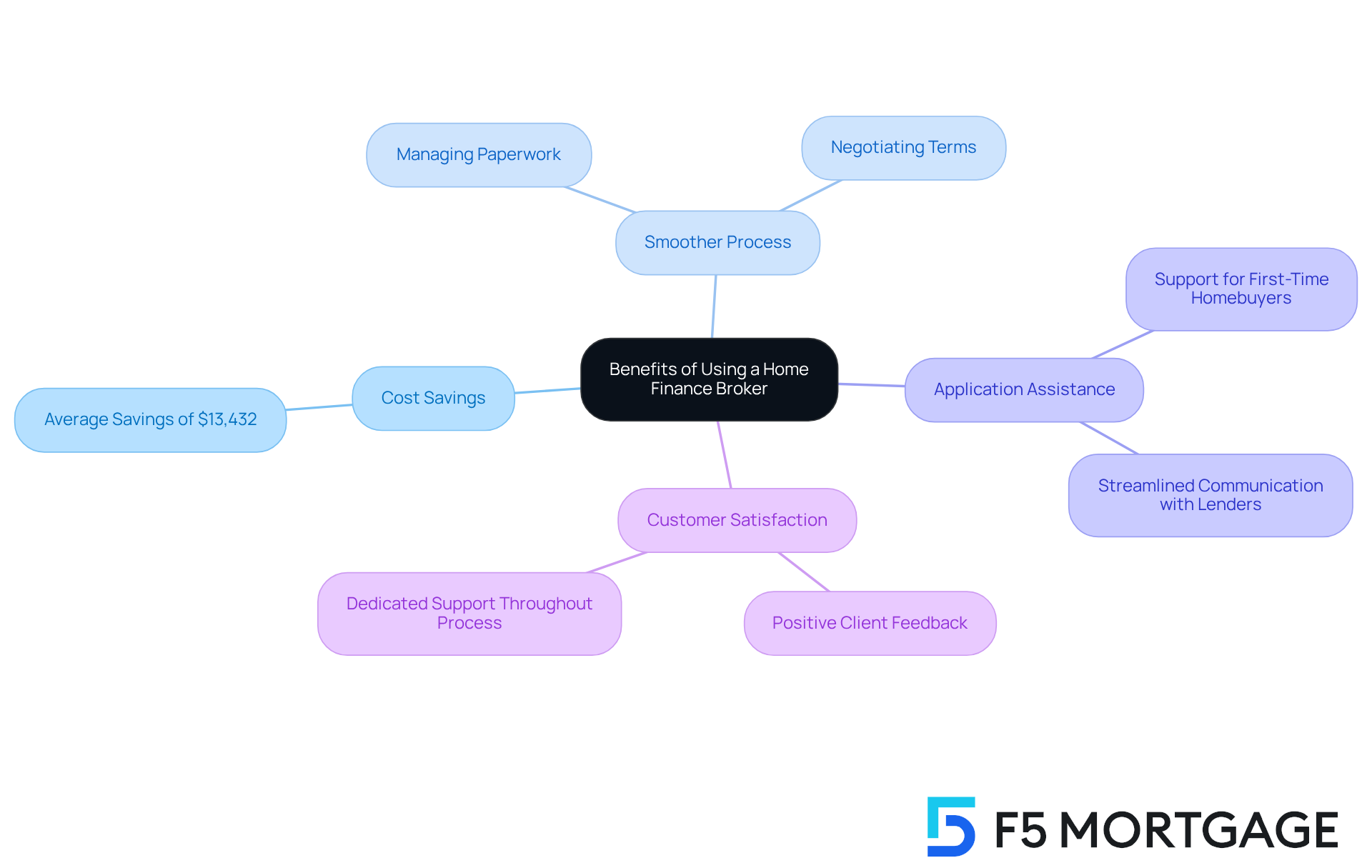

Explore the Key Benefits of Using a Home Finance Broker

Navigating the world of home financing can feel overwhelming, but a home finance broker like F5 can provide you with the support you need. Imagine having access to a wider selection of loan products and potentially lower fees. A home finance broker often has established relationships with various lenders, which means they can negotiate better terms on your behalf, making the process smoother and more beneficial for you.

With F5, families can enjoy rapid and flexible financing options, helping them achieve homeownership sooner and at competitive rates. Research indicates that borrowers save an average of $13,432 per loan when they work with an independent loan broker instead of retail lenders. This significant saving can make a real difference in your financial journey.

F5 Home Loan also simplifies the application process by managing all the paperwork and communication with lenders. This is particularly helpful for first-time homebuyers who may feel daunted by the complexities of financing a home with the assistance of a home finance broker. We’re here to support you every step of the way, ensuring that you feel confident throughout the process.

Additionally, F5 Home Loans offers down payment assistance programs, including options for no money down or low down payments. These programs can help you create more competitive offers, reduce loan amounts, and lower mortgage payments, enhancing your home buying opportunities.

Content clients have expressed their satisfaction with F5, sharing feedback like, ‘Everything went very smoothly!’ and ‘I highly recommend the F5 Mortgage team!’ We know how challenging this can be, but with F5, you have a partner dedicated to making your homeownership dreams a reality.

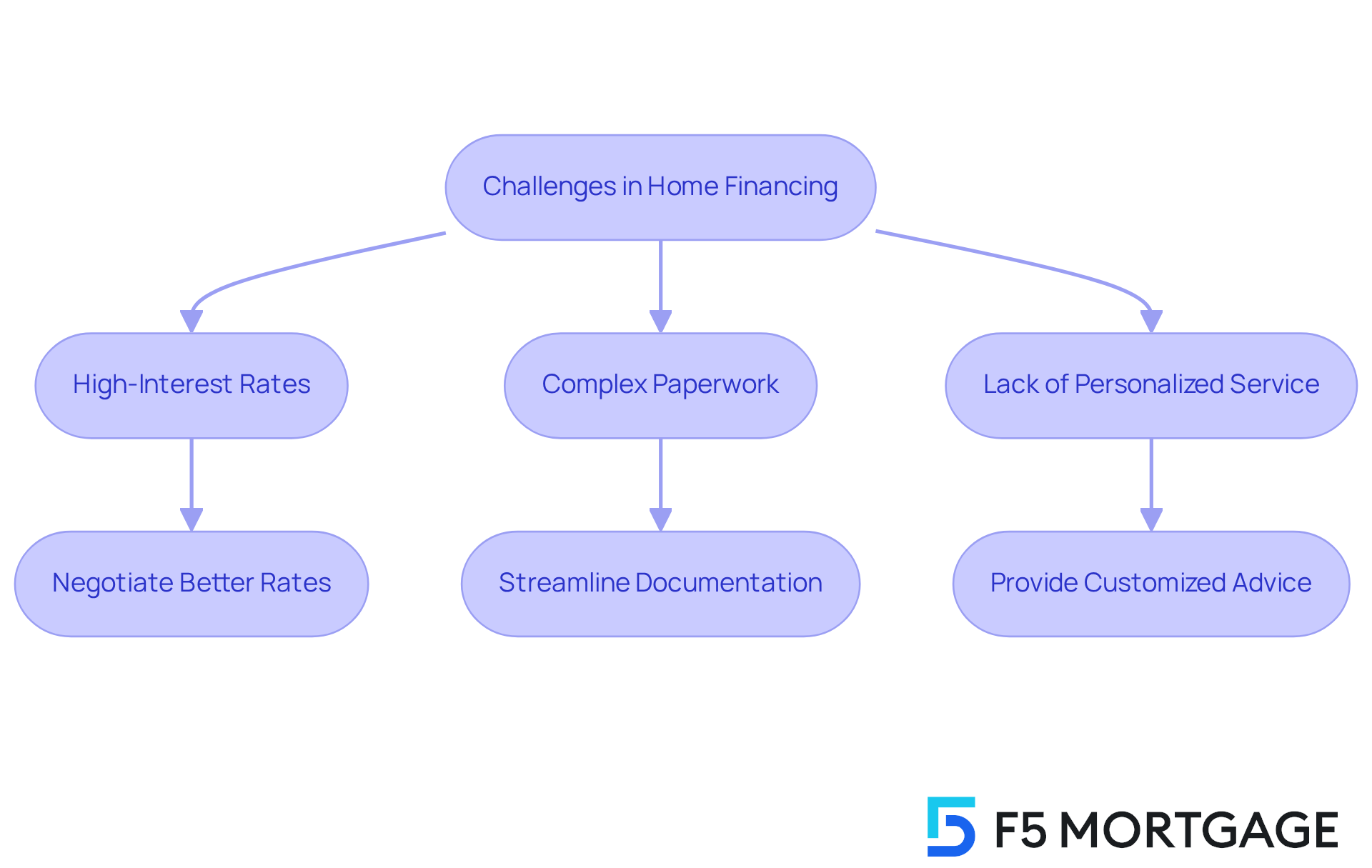

Address Common Challenges in Home Financing with Broker Support

Families often encounter significant hurdles in the mortgage landscape. High-interest rates, complex paperwork, and a lack of personalized service can be overwhelming. We know how challenging this can be. Home finance brokers are here to help you navigate these difficulties.

By comparing offers from various lenders, a home finance broker can help secure competitive interest rates, leading to substantial savings. In fact, borrowers who work with independent agents save an average of over $10,000 throughout the duration of their loans, compared to those who go through retail lenders. This can make a real difference for families.

Home finance brokers streamline the documentation process by organizing and submitting necessary paperwork. This drastically reduces the time and effort required from borrowers, allowing you to focus on what matters most. Furthermore, a home finance broker provides customized advice, ensuring you fully understand your options and feel supported every step of the way.

This personalized approach is especially beneficial for families with unique financial situations, like self-employed individuals or those looking to upgrade their homes. By leveraging their expertise, these professionals empower families to navigate the mortgage process with confidence and ease. Remember, we’re here to support you through this journey.

Recognize the Value of Personalized Service and Client Satisfaction

Personalized service is a defining characteristic of working with a home finance broker. We know how challenging navigating home financing can be, and that’s why brokers prioritize customer satisfaction by tailoring their services to meet individual needs. They dedicate time to understanding each customer’s financial circumstances, preferences, and long-term goals, allowing them to suggest the most suitable loan options.

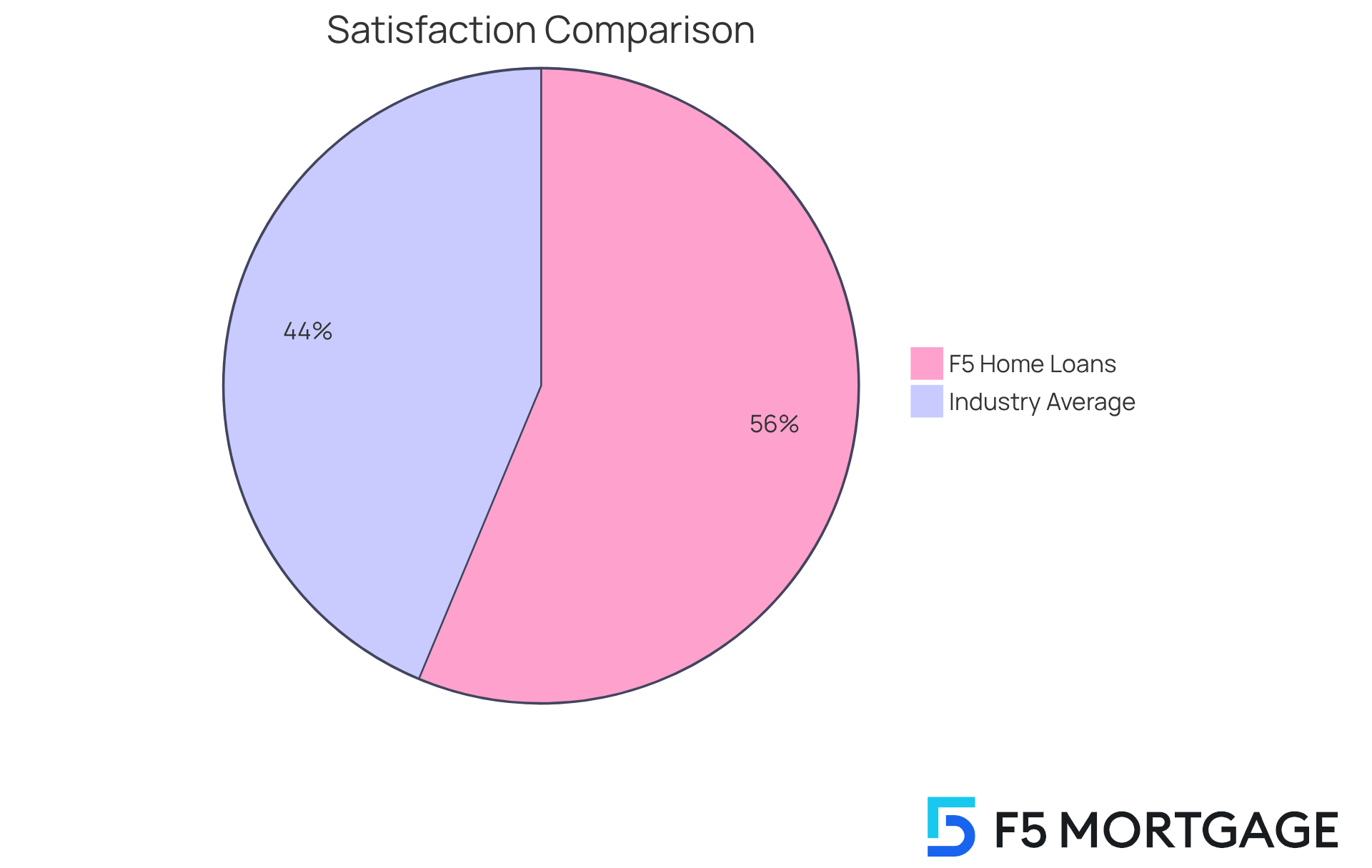

This tailored approach not only fosters trust and confidence but also significantly enhances client satisfaction rates. For instance, F5 Home Loans boasts an impressive customer satisfaction rate of 94%, highlighting the positive impact of personalized service on the overall loan experience. Clients like Ruth Vest and Artie Kamarhie have shared their experiences, praising the team’s exceptional financial expertise, patience, and attention to detail.

By choosing a service like F5, families can expect a more supportive and interactive experience, enabling them to make informed choices that align with their financial objectives. It’s important to note that the overall customer satisfaction score in the home loan industry is 727 on a 1,000-point scale. This indicates that while F5 Mortgage excels, there are still areas for improvement across the sector.

Furthermore, customers should be mindful that the knowledge and skill of agents can differ, which may influence the quality of service provided. Case studies, such as the experiences shared by satisfied clients, illustrate how personalized service can enhance the mortgage experience, ensuring clients feel supported throughout their journey. By opting for a broker, families can navigate the complexities of home financing with greater confidence.

Conclusion

Choosing a home finance broker for mortgage acquisition is not just a strategic decision; it’s a step towards easing the complexities of home financing. We know how challenging this can be, and brokers serve as essential intermediaries, providing families with tailored loan options and invaluable support throughout the mortgage process. By leveraging their expertise and extensive networks, home finance brokers simplify the acquisition journey and empower families to make informed financial decisions.

Throughout this article, we’ve highlighted the numerous advantages of working with a home finance broker. From saving time and money through competitive interest rates and reduced fees to offering personalized services that cater to unique financial situations, brokers like F5 exemplify how dedicated support can truly transform the home-buying experience. The impressive customer satisfaction rates achieved by F5 further underscore the positive impact of personalized service in fostering trust and confidence among clients.

In a landscape where home financing challenges are prevalent, enlisting the help of a broker can be a game-changer. We encourage families to recognize the value of this partnership—not only for navigating the intricacies of mortgages but also for achieving their homeownership dreams with greater ease and assurance. Embracing the benefits of home finance brokers is a proactive step towards a smoother, more rewarding mortgage experience. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of a home finance broker in mortgage acquisition?

A home finance broker acts as an intermediary between borrowers and lenders, simplifying the loan acquisition process and connecting individuals to a variety of lending options tailored to their financial situation.

How do home finance brokers help borrowers?

Brokers evaluate borrowers’ requirements and financial profiles to suggest loan products that align with their goals, saving time and reducing stress in securing a mortgage.

What is the projected growth of the loan brokerage services market?

The loan brokerage services market is projected to grow significantly, reaching an estimated value of $74.3 billion by 2033, reflecting the increasing complexity of loan products and demand for personalized financial guidance.

How does F5 Financing enhance the mortgage process?

F5 Financing simplifies the mortgage process through user-friendly technology and a no-pressure approach, allowing clients to choose what feels right for them. They also connect clients with top realtors and can finalize most loans in under three weeks.

What benefits do loan advisors provide to borrowers?

Loan advisors offer borrowers a simplified and knowledgeable experience by leveraging their expertise and access to various lenders, which enhances the overall mortgage acquisition process.