Overview

California jumbo loans offer valuable benefits for homebuyers, especially in high-value markets. These loans enable you to finance properties that exceed the conforming loan limits, which are set at $806,500 for 2025. We understand that navigating the mortgage landscape can be overwhelming, but we’re here to support you every step of the way.

To secure a jumbo loan effectively, it’s essential to grasp the specific requirements and application steps involved. Understanding the financial landscape and the varying loan limits across different counties is crucial. By acknowledging the challenges you may face, we can explore solutions together that will empower you to make informed decisions.

As you embark on this journey, remember that you are not alone. Many families have successfully navigated these complexities, and with the right guidance, you can too. Take the time to familiarize yourself with the necessary steps, and don’t hesitate to reach out for assistance. Your dream home is within reach, and we’re here to help you achieve it.

Introduction

Navigating the complex landscape of California’s real estate market can feel overwhelming, especially when it comes to understanding jumbo loans. We know how challenging this can be. These loans are essential for financing high-value properties, opening doors to luxury homes that many families dream of owning. However, the process can be daunting. With strict requirements and fluctuating interest rates, it’s easy to feel uncertain.

So, how can prospective homeowners effectively leverage these financing options? By understanding the ins and outs of jumbo loans, you can take confident steps toward securing your dream property in a competitive environment. We’re here to support you every step of the way, helping you navigate this journey with clarity and compassion.

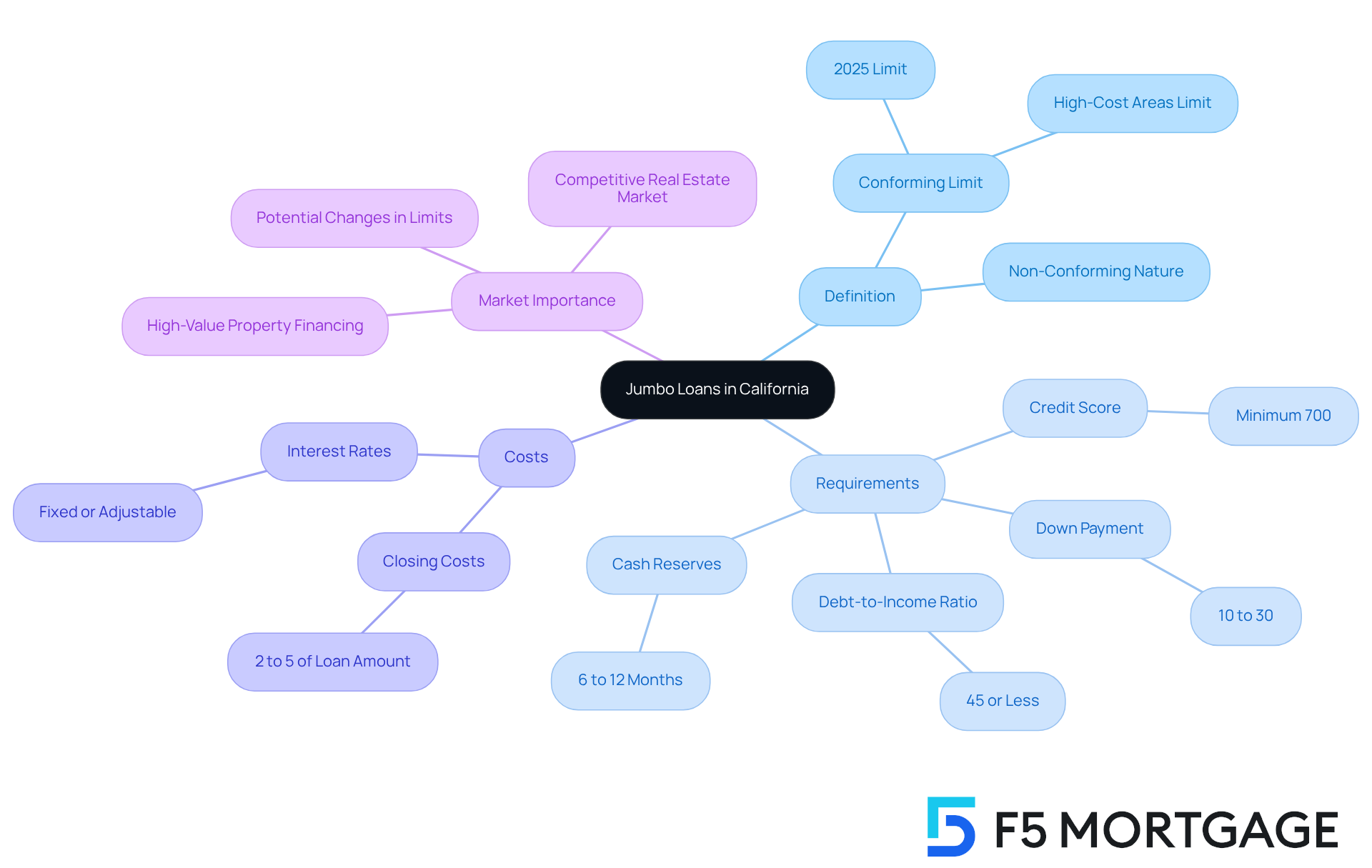

Define Jumbo Loans in California

In California, we understand how overwhelming the mortgage process can be, especially when dealing with California jumbo loans. A large mortgage is one that exceeds the conforming limits set by the Federal Housing Finance Agency (FHFA). As of 2025, the conforming mortgage limit for a single-family home in most areas is set at $806,500. Any borrowing sum that surpasses this threshold is categorized as a large mortgage, which is classified as non-conforming since it cannot be acquired by government-sponsored enterprises like Fannie Mae or Freddie Mac.

Jumbo financing options, such as California jumbo loans, are particularly important in California’s competitive real estate market. They are frequently used to fund high-value properties, serving buyers who are looking for homes in sought-after areas. Given the state’s elevated property values, understanding California jumbo loans is essential for prospective homeowners aiming to navigate the complexities of funding bigger acquisitions.

However, we know how challenging it can be to qualify for a large mortgage due to stricter requirements. These often include the need for substantial cash reserves to cover six to 12 months’ worth of payments. Additionally, homeowners must consider the significant closing costs when refinancing a jumbo mortgage, which generally range from 2% to 5% of the amount. For instance, if your new credit amount is $300,000, you can expect to pay between $6,000 and $15,000 in closing costs.

As the FHFA may raise conforming borrowing limits again for 2026, staying informed about these changes is essential for potential buyers. Moreover, large mortgage interest rates can fluctuate and are influenced by individual borrower factors, being either fixed or adjustable.

To explore your large financing options and benefit from streamlined applications and down payment assistance, we encourage you to start an application for a Large Smart financing with F5 Mortgage today. We’re here to support you every step of the way.

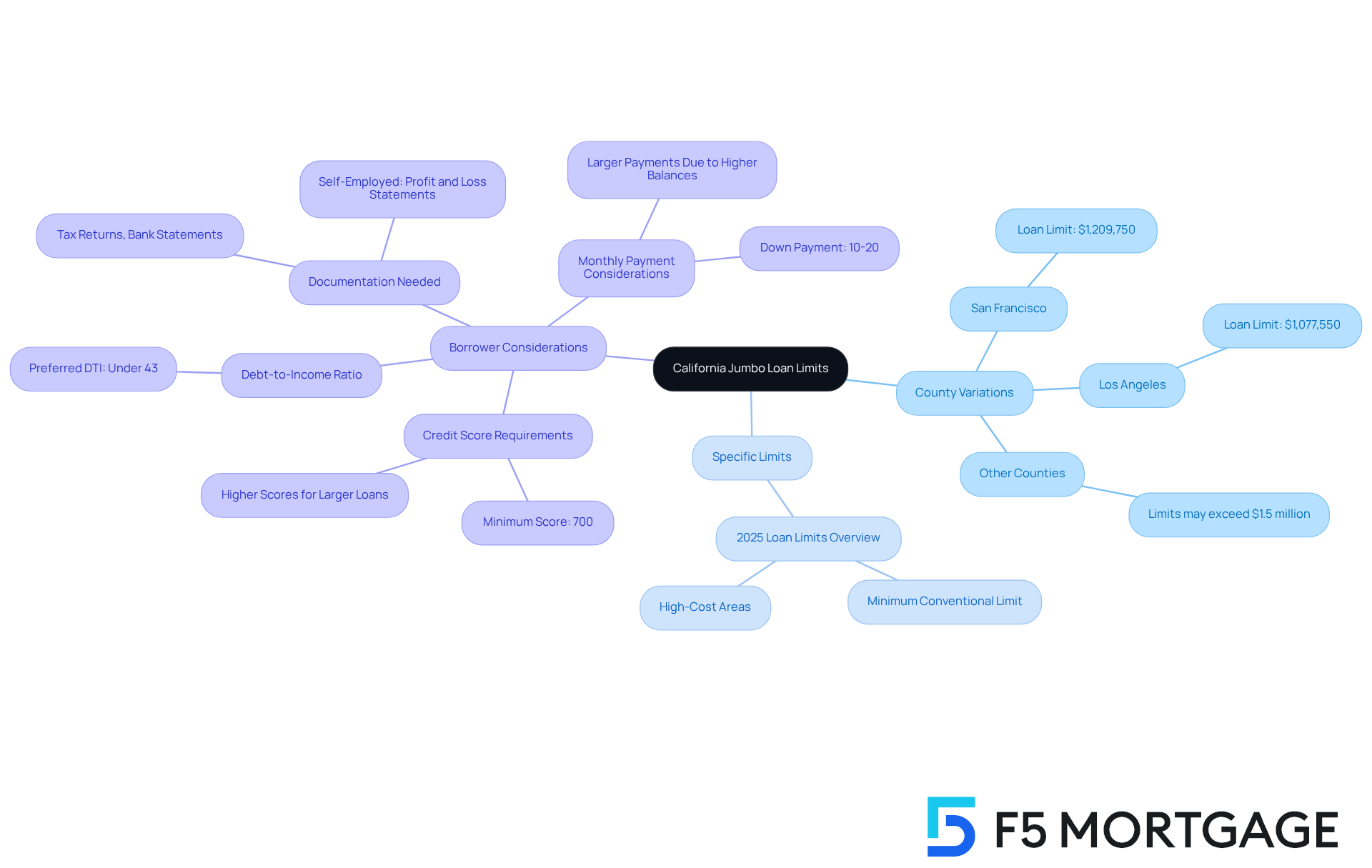

Explore California Jumbo Loan Limits

In California, we understand how challenging it can be to navigate the limits of California jumbo loans. It’s important to know that these limits are not uniform; they vary significantly by county, reflecting the diverse real estate landscape of the state. For families looking in high-expense regions like San Francisco and Los Angeles, California jumbo loans offer large borrowing limits that can reach as high as $1,209,750 and $1,077,550, respectively, as of 2025. In some counties, the California jumbo loans limits may even exceed $1.5 million, catering to the high property values typical of these areas.

Understanding these limits is crucial for potential borrowers of California jumbo loans, as they directly impact financing options and the types of properties available for purchase. We encourage you to confirm the specific large mortgage limits for your desired location. This knowledge empowers you to make informed choices in your home-buying journey.

Furthermore, it’s essential to consider your personal financial situation. Maneuvering through the intricacies of large-scale financing requires careful assessment of factors such as credit ratings and debt-to-income ratios. These elements are vital for obtaining favorable conditions. Remember, we’re here to support you every step of the way as you navigate this process.

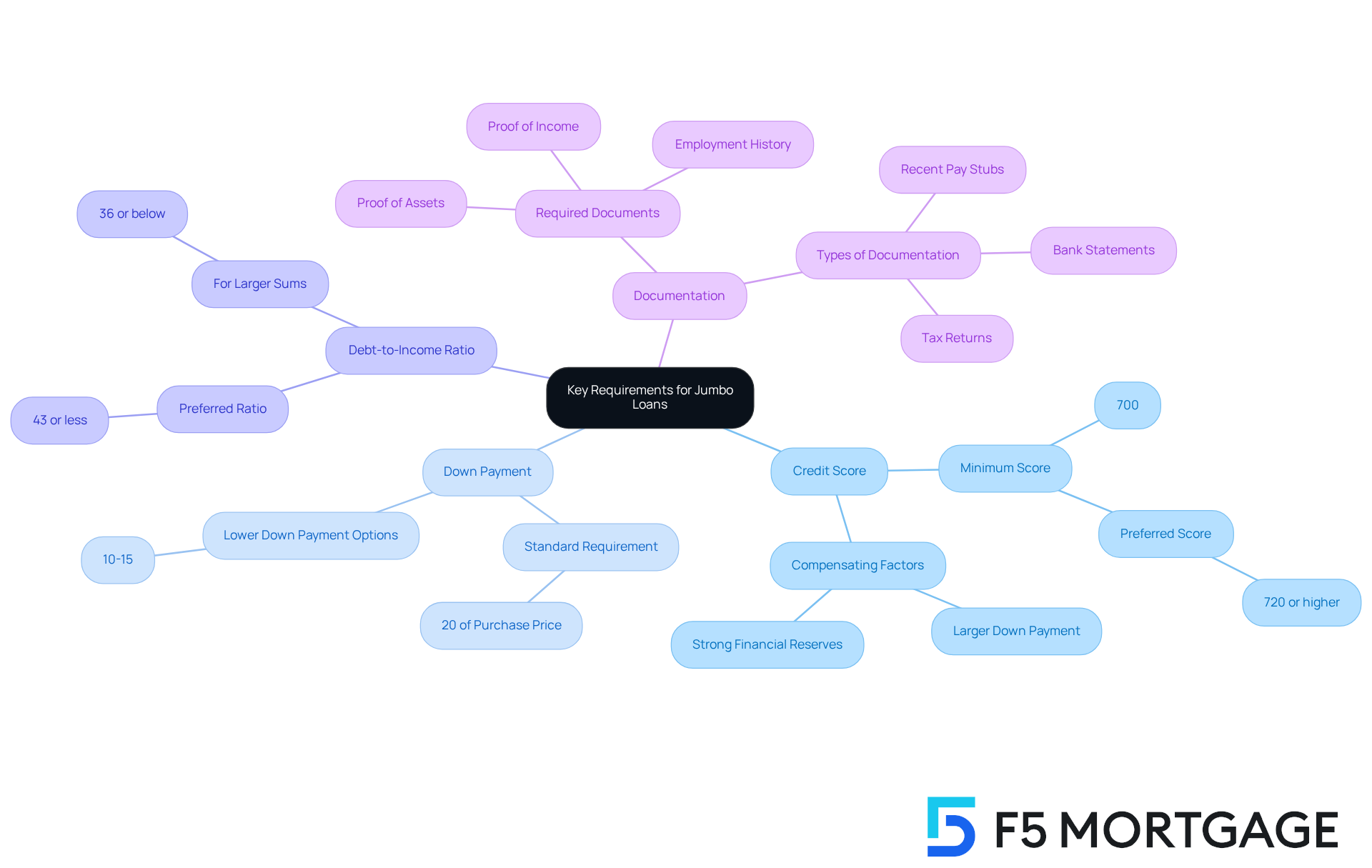

Identify Key Requirements for Jumbo Loans

Navigating the world of California jumbo loans can feel overwhelming, but understanding the key requirements can empower you on this journey. Here’s what you need to know:

- Credit Score: Most lenders typically look for a minimum credit score of 700, with many preferring scores of 720 or higher to offer the best rates. While some institutions may accept lower scores, having compensating factors—like a larger down payment or strong financial reserves—can help mitigate risks.

- Down Payment: A substantial down payment is often necessary, usually around 20% of the purchase price. However, you may find certain programs that allow down payments as low as 10-15%, depending on your financial profile and the lender’s policies.

- Debt-to-Income Ratio: Lenders generally favor a debt-to-income (DTI) ratio of 43% or less, ensuring that you can comfortably manage your mortgage payments alongside other financial responsibilities. For those looking to borrow larger sums, many institutions prefer a DTI of 36% or below.

- Documentation: Extensive documentation is required to verify your financial stability. Be prepared to provide proof of income, assets, and employment history, including recent pay stubs, tax returns, and bank statements. This thorough evaluation helps lenders assess your ability to manage the elevated monthly payments associated with larger loans.

We understand how challenging this process can be, especially in California’s competitive real estate market, where California jumbo loans are often essential for purchasing high-value properties. By grasping these requirements, you can take confident steps toward securing the home of your dreams.

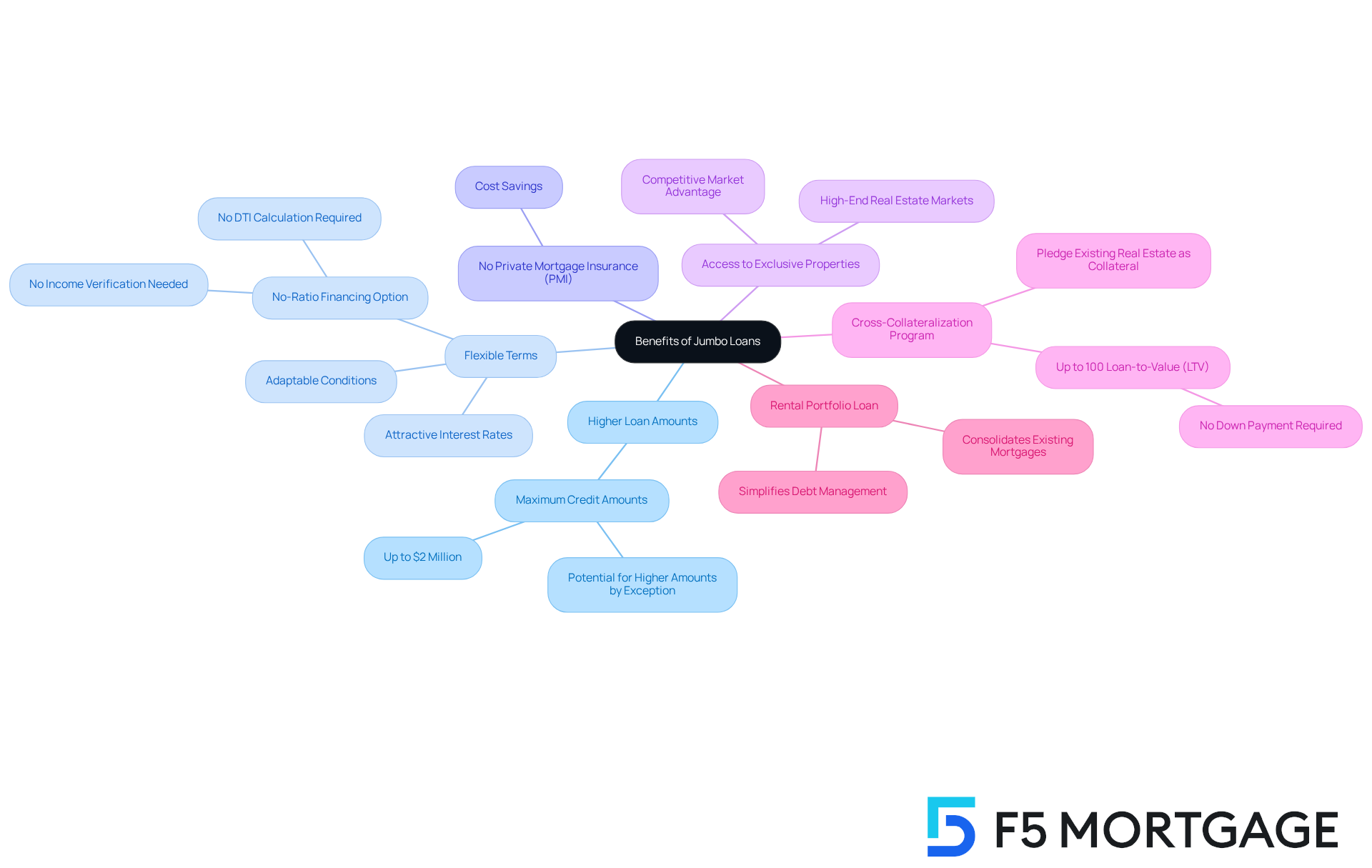

Understand the Benefits of Jumbo Loans

Jumbo loans, specifically California jumbo loans, offer numerous advantages for homebuyers in California, especially in high-demand markets like Los Angeles County.

-

Higher Loan Amounts: Jumbo loans empower borrowers to finance properties that exceed conforming loan limits. This makes them ideal for purchasing luxury homes that may be out of reach with conventional loans. With maximum credit amounts reaching up to $2 million, and potentially higher by exception, these financing options cater to the needs of affluent buyers.

-

Flexible Terms: Many lenders provide adaptable conditions and attractive interest rates for large-scale financing. This flexibility enables individuals to tailor their financial solutions to align with their goals. For those with substantial assets who choose not to disclose their income, the no-ratio financing option further enhances flexibility.

-

No Private Mortgage Insurance (PMI): Unlike traditional financing options that require PMI for down payments under 20%, jumbo mortgages typically do not impose this additional cost. This can lead to significant savings, improving overall financial positions.

-

Access to Exclusive Properties: Jumbo loans open doors to high-end real estate markets, allowing buyers to acquire properties that might otherwise be unattainable. This access is especially beneficial in competitive markets where luxury homes are prevalent.

Real estate case studies illustrate these advantages effectively. For instance, the cross-collateralization program enables individuals to pledge existing real estate as collateral, allowing them to secure up to 100% loan-to-value (LTV) with no down payment. This strategy simplifies the purchasing process and enhances the borrower’s ability to invest in premium properties. Additionally, rental portfolio financing consolidates multiple mortgages into a single jumbo-sized option, streamlining debt management for investors with extensive rental properties.

In summary, California jumbo loans offer various advantages that can greatly improve the homebuying experience in California. They are an attractive choice for individuals seeking to invest in luxury real estate. Given the current market circumstances, including the departure of significant banks and restricted credit, these financial options offer unique opportunities for homebuyers aiming to navigate the luxury sector. We know how challenging this can be, and we’re here to support you every step of the way.

Guide to Applying for a Jumbo Loan

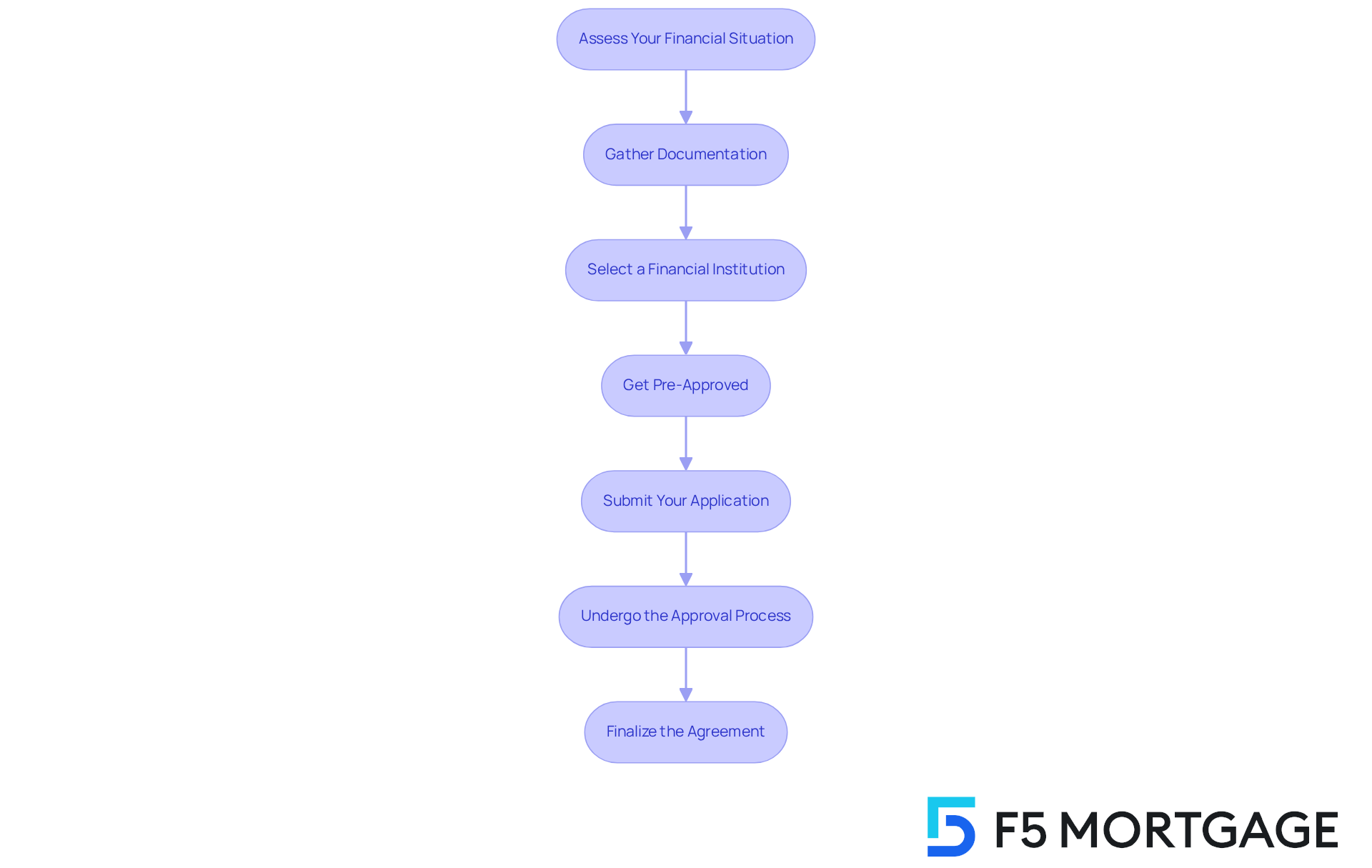

Applying for California jumbo loans can feel overwhelming, but by taking it step by step, you can navigate the process with confidence. Here are some essential steps to help you along the way:

-

Assess Your Financial Situation: Start by reviewing your credit score, income, and existing debts. It’s important to confirm that you meet the requirements of the financial institution. In California, california jumbo loans generally start at $766,551, so understanding your financial situation is key.

-

Gather Documentation: Compile necessary documents such as tax returns, pay stubs, bank statements, and proof of assets to support your application. If you’re considering the asset depletion program, ensure you have documentation of your substantial assets ready.

-

Select a Financial Institution: Take the time to investigate providers who specialize in large loans. Compare their rates, terms, and customer service to find the best fit for your needs. Consider working with F5 Mortgage, which offers competitive rates, personalized service, and specializes in California jumbo loans. Their deep understanding of the local market ensures you receive tailored advice and support throughout the process. As David A. Krebs points out, the exit of major banks has created new opportunities in the super jumbo mortgage landscape, making it essential to choose wisely.

-

Get Pre-Approved: Submit your financial details to the financial institution for pre-approval. This step will provide clarity on your borrowing capacity and help you understand how much you can afford.

-

Submit Your Application: Fill out the financing request with your chosen provider, ensuring all necessary documentation is included.

-

Undergo the Approval Process: The financial institution will review your application, conduct an appraisal, and verify your financial details to assess your eligibility. It’s crucial to understand the importance of home appraisals in determining property value and equity during this stage.

-

Finalize the Agreement: Once approved, carefully review the closing documents. Sign them and complete the process to secure your new home.

By following these steps and considering the current market dynamics, you can approach the California jumbo loans application process with confidence. Remember, we’re here to support you every step of the way, ensuring you are well-prepared to meet the requirements of lenders in California.

Conclusion

Understanding California jumbo loans is essential for homebuyers navigating the state’s competitive real estate market. We know how challenging this can be, and these loans, which exceed the conforming limits set by the FHFA, are tailored for those looking to purchase high-value properties. With unique benefits and specific application steps, California jumbo loans offer a viable path for buyers aiming to secure their dream homes.

Key insights into California jumbo loans reveal the importance of knowing the varying loan limits across counties, the stringent qualification requirements, and the distinct advantages they provide. From higher borrowing limits and flexible terms to the absence of private mortgage insurance, these loans are designed to meet the needs of affluent buyers. Furthermore, the application process can be streamlined by following essential steps, including:

- Assessing financial situations

- Gathering documentation

- Selecting the right lender

Ultimately, California jumbo loans represent not just a financial tool, but a gateway to the luxury real estate market. For prospective homeowners, understanding these loans can empower informed decisions and enhance their purchasing power in a challenging market. By staying informed about current limits and requirements, buyers can confidently navigate their home-buying journey and seize the opportunities available in California’s vibrant real estate landscape. We’re here to support you every step of the way.

Frequently Asked Questions

What are California jumbo loans?

California jumbo loans are large mortgages that exceed the conforming limits set by the Federal Housing Finance Agency (FHFA). As of 2025, the conforming limit for a single-family home in most areas is $806,500, and any amount above this is considered a jumbo loan.

Why are jumbo loans important in California?

Jumbo loans are crucial in California’s competitive real estate market as they are often used to finance high-value properties in sought-after areas, accommodating the state’s elevated property values.

What are the qualifications for obtaining a California jumbo loan?

Qualifying for a California jumbo loan typically requires stricter criteria, including substantial cash reserves to cover six to 12 months of payments, as well as consideration of significant closing costs, which range from 2% to 5% of the loan amount.

What are the closing costs associated with jumbo loans?

Closing costs for refinancing a jumbo mortgage generally range from 2% to 5% of the loan amount. For example, on a $300,000 loan, closing costs could be between $6,000 and $15,000.

How do California jumbo loan limits vary?

California jumbo loan limits vary by county, reflecting the diverse real estate landscape. For example, in high-expense regions like San Francisco and Los Angeles, limits can reach as high as $1,209,750 and $1,077,550, respectively, and may even exceed $1.5 million in some counties.

How can borrowers find out the specific jumbo loan limits for their area?

Borrowers should confirm the specific jumbo loan limits for their desired location, as these limits directly impact financing options and the types of properties available for purchase.

What factors should potential borrowers consider when applying for a jumbo loan?

Potential borrowers should carefully assess their personal financial situation, including credit ratings and debt-to-income ratios, as these factors are vital for obtaining favorable loan conditions.

What should I do if I want to explore jumbo financing options?

If you’re interested in exploring jumbo financing options, you can start an application for a Large Smart financing with F5 Mortgage, which offers support throughout the process.