Overview

Securing a home loan can feel overwhelming, especially for low-income families. We understand how challenging this can be, and that’s why we’ve outlined five essential steps to help you navigate this process with confidence.

- First, it’s crucial to understand your financial situation. Take a moment to assess your income and expenses, as this will lay the groundwork for your journey.

- Next, improving your credit score is vital. Small changes can make a big difference, so consider checking your credit report and addressing any discrepancies.

- Exploring loan options is the third step. There are various programs available that cater specifically to low-income families, and we’re here to support you in finding the right fit.

- Additionally, budgeting for down payments is essential. Utilizing down payment assistance programs can lighten the financial load, making homeownership more attainable.

- Finally, navigating the mortgage application process can be daunting, but you don’t have to do it alone. Maintaining accurate documentation and seeking guidance from professionals can empower you to take this final step with ease.

Together, these steps will enhance your chances of successful homeownership, bringing you closer to the dream of having a place to call your own.

Introduction

Navigating the world of home loans can feel overwhelming, especially for low-income families. We know how challenging this can be, particularly as financial landscapes evolve and new regulations come into play. Understanding the intricacies of securing a mortgage not only opens the door to homeownership but also empowers families to build a stable future.

However, with various eligibility criteria, credit requirements, and assistance programs available, how can one effectively maneuver through this complex process? This guide offers a comprehensive roadmap, outlining essential steps to secure home loans for low-income families in 2025.

Together, we can ensure that financial barriers do not stand in the way of achieving the dream of homeownership.

Understand Your Financial Situation and Eligibility Criteria

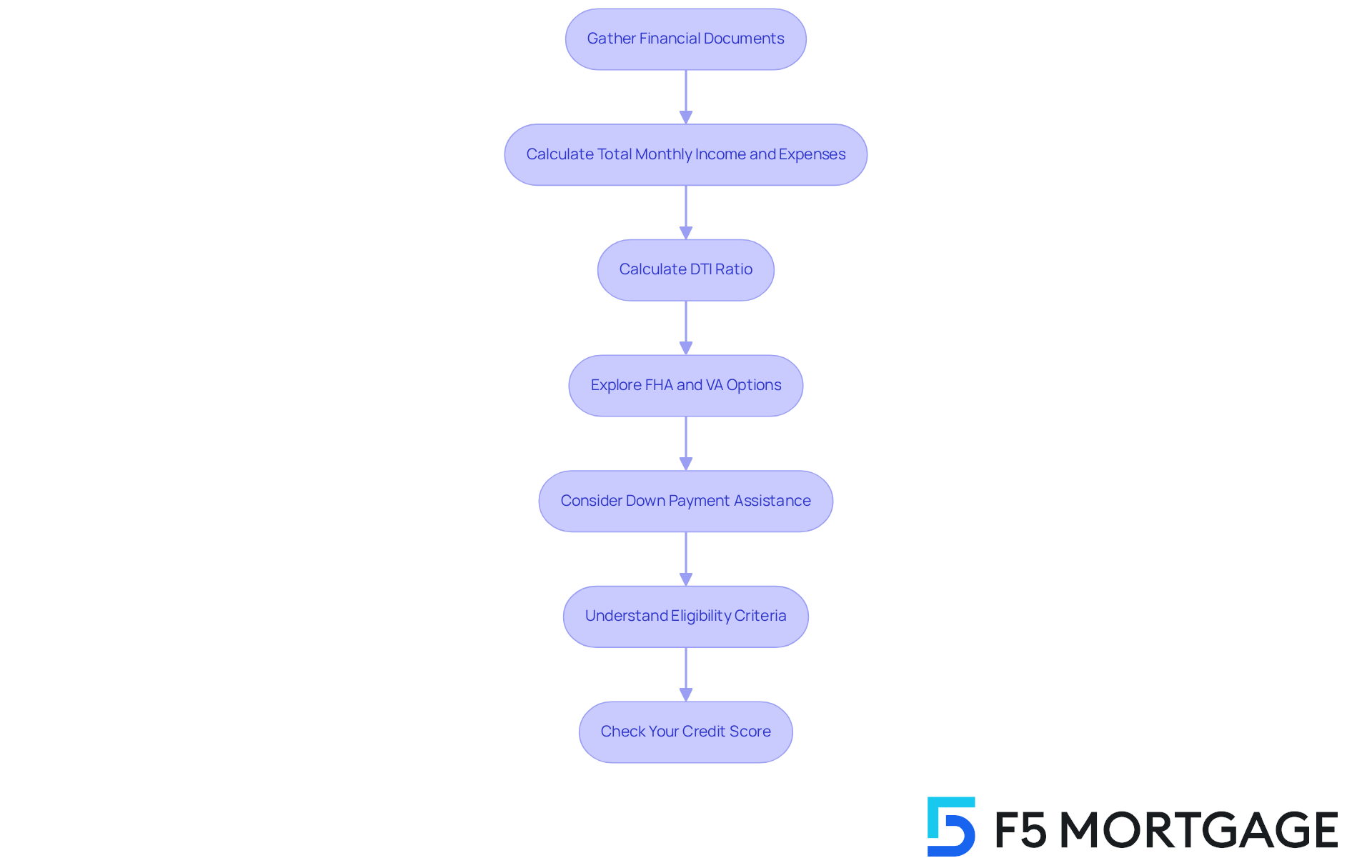

Start by gathering essential financial documents such as pay stubs, tax returns, and bank statements. We know how overwhelming this process can be, but taking these initial steps is crucial. Next, calculate your total monthly income and itemize all monthly expenses, including debts. This procedure will assist you in calculating your debt-to-income (DTI) ratio, an essential measure that lenders utilize to assess your capacity to repay a debt. For 2025, a DTI ratio below 43% is generally preferred for mortgage approval.

Furthermore, it’s important to become acquainted with the present income thresholds for FHA financing. These thresholds differ by area and can significantly influence your eligibility. Additionally, consider VA options, which provide low upfront costs and adaptable credit criteria. Exploring down payment assistance programs available in your area, such as YourChoice!, Grant for Grads, and Ohio Heroes, can provide valuable financial help for your home purchase.

Understanding the eligibility criteria for these programs is crucial, especially since many have income limits designed to assist first-time homebuyers and those looking for home loans for low income. We’re here to support you every step of the way. Employ online calculators or seek advice from a financing expert to gain insights into your choices and ensure you comprehend the criteria for various types of financing.

Checking your score before applying for an FHA loan is essential. A positive financial history can enhance your likelihood of approval. This proactive approach to financial planning is vital for low-income families aiming to secure home loans for low income. Remember, you are not alone in this journey; there are resources and support available to help you navigate the process.

Improve Your Credit Score and Financial Health

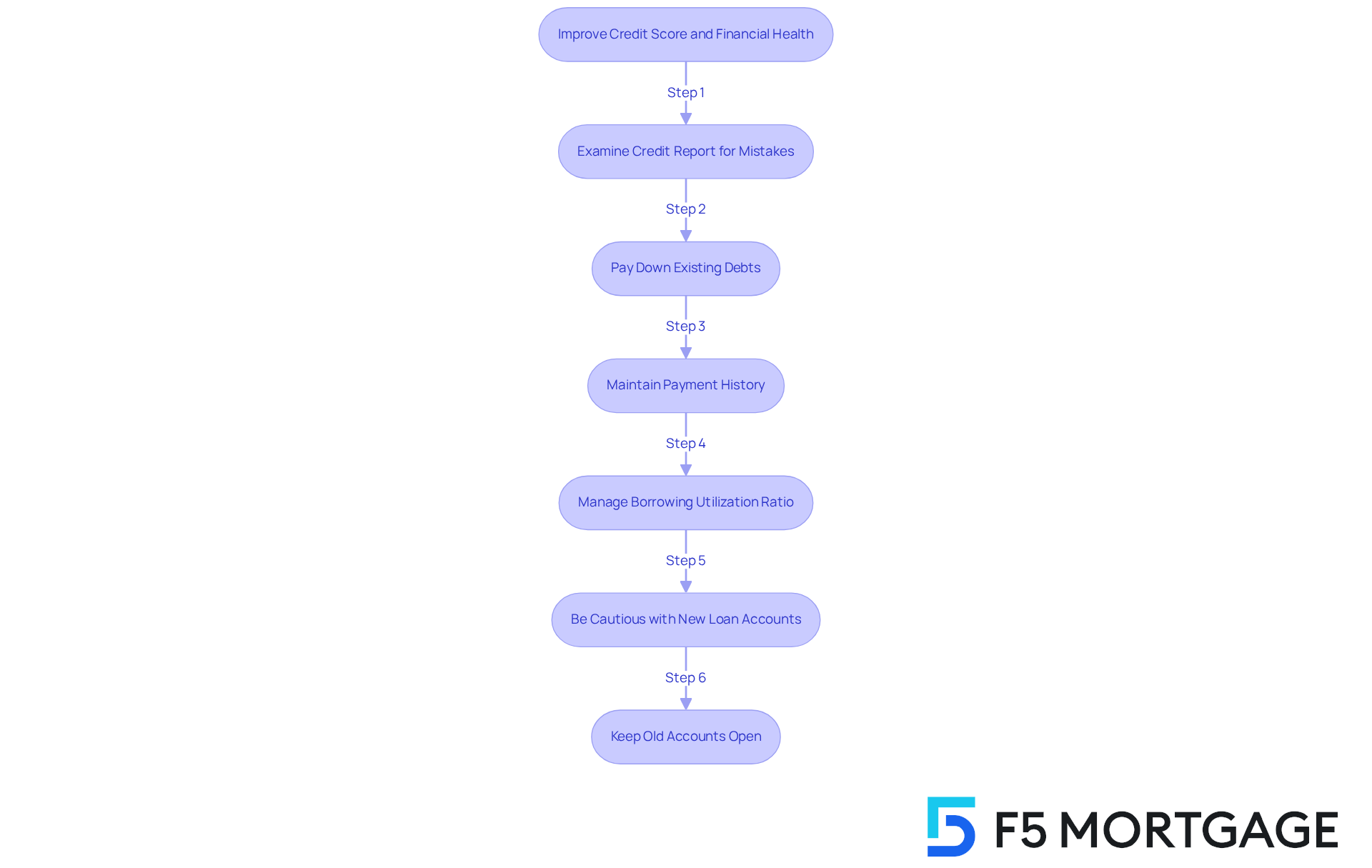

To improve your score, we know how important it is to start by examining your report for any mistakes and contesting inaccuracies. Prioritize paying down existing debts, especially those with high interest rates, as this can significantly enhance your financial standing. Remember, prompt payments are vital; your payment history represents 35% of your rating, making it essential to uphold a flawless record. Using financial monitoring services can assist you in tracking your progress effectively.

Furthermore, strive to maintain your borrowing utilization ratio below 30%, and preferably under 10%. This means not maxing out your cards and managing your balances wisely. For instance, families who have effectively improved their financial health before purchasing a home often concentrate on lowering their card balances and keeping low utilization rates, which positively influences their chances of securing home loans for low income. Moreover, be cautious about opening new loan accounts in the months leading up to your housing application, as new inquiries can represent 10% of your score and may temporarily decrease it. Finally, keeping old accounts can enhance your history, which is beneficial for your overall financial profile. By following these steps, you can significantly enhance your financial profile and increase your chances of securing favorable home loans for low income.

Explore Loan Options and Assistance Programs for Low-Income Buyers

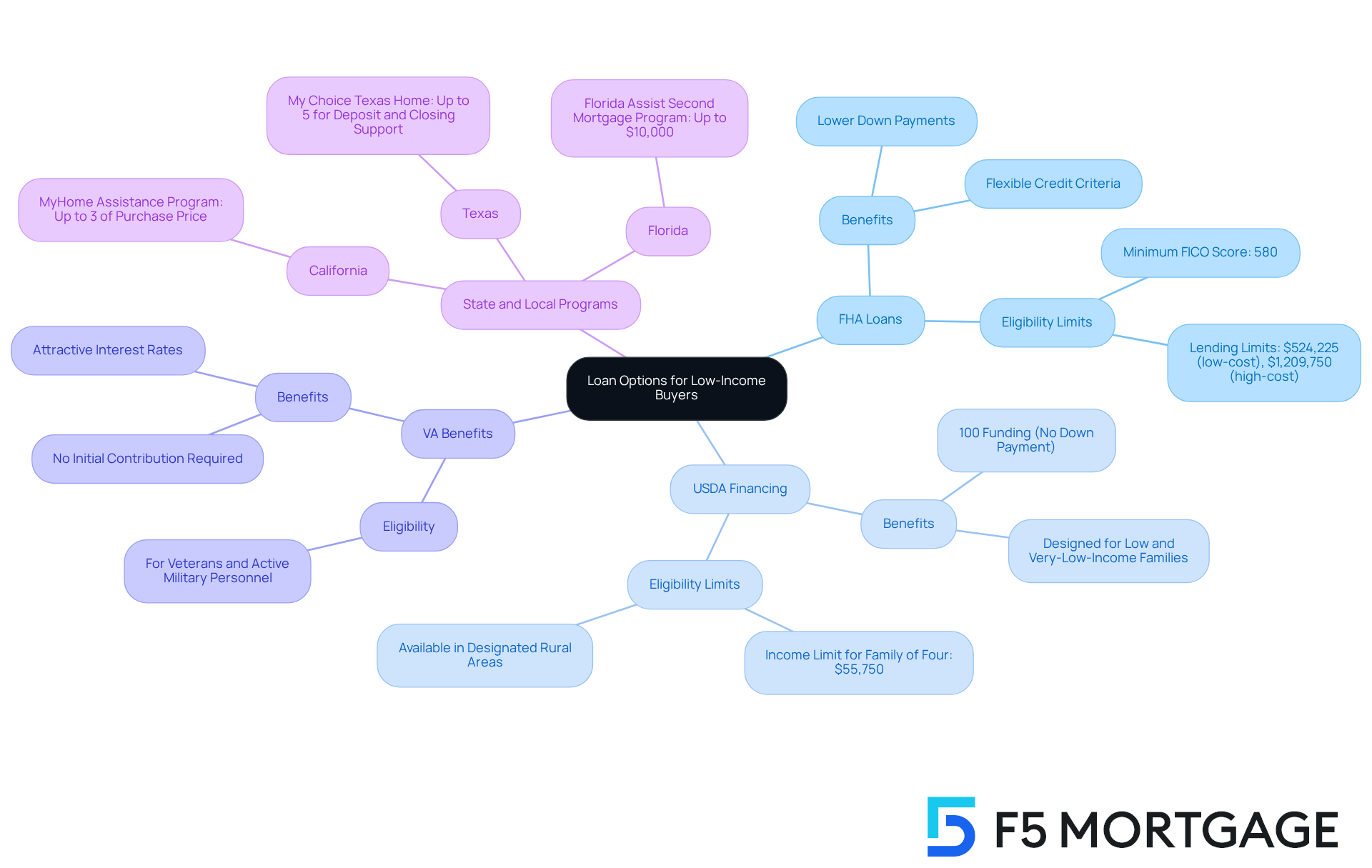

When considering home loans for low income families, it’s important to acknowledge the challenges that may be faced. Several programs stand out for their accessibility and advantages, especially those related to home loans for low income individuals, offering hope and support in your journey toward homeownership.

FHA mortgages are particularly beneficial, requiring lower down payments—sometimes as low as 3.5%—and providing more flexible credit criteria. This makes them a viable option for many first-time homebuyers. For 2025, FHA lending limits are set at $524,225 for single-family home financing in low-cost regions and $1,209,750 in high-cost regions. Understanding these limits is essential for potential borrowers as it provides clarity on the maximum funding amounts available.

USDA financing presents a remarkable opportunity for qualifying rural properties, offering 100% funding, which means no down payment is needed. This program is designed to assist low- and very-low-income families in obtaining home loans for low income, with income limits varying by household size. For example, a family of four must earn no more than $55,750 to qualify. In 2025, a significant percentage of low-income families are expected to benefit from home loans for low income through USDA financing, reflecting its increasing importance in rural homeownership. As stated by USDA Rural Development, the Section 502 Direct Loan Program provides home loans for low income and very-low-income families living in rural areas, offering them a path to homeownership.

For veterans and active military personnel, VA benefits offer another excellent alternative. These financial products generally require no initial contribution and feature attractive interest rates, making homeownership more achievable for those who have served our nation. As of September 1, 2025, the interest rate for home loans for low income and very low-income borrowers, specifically Single Family Housing Direct home loans, is set at 5.125%, further assisting in making homeownership feasible.

Additionally, state and local support programs can provide valuable resources, including down payment assistance or grants. For instance, F5 Mortgage offers several options, such as:

- The MyHome Assistance Program in California, which supplies up to 3% of the home’s purchase price

- The My Choice Texas Home program, providing up to 5% for deposit and closing support

- In Florida, programs like the Florida Assist Second Mortgage Program can offer up to $10,000 for upfront costs

Websites like USAGov and local housing authorities are excellent starting points for finding information on these programs. We encourage you to consult with a mortgage broker, as they can help navigate the various options and identify the best fit for your individual financial situation. Remember, we’re here to support you every step of the way.

Create a Realistic Budget and Save for a Down Payment

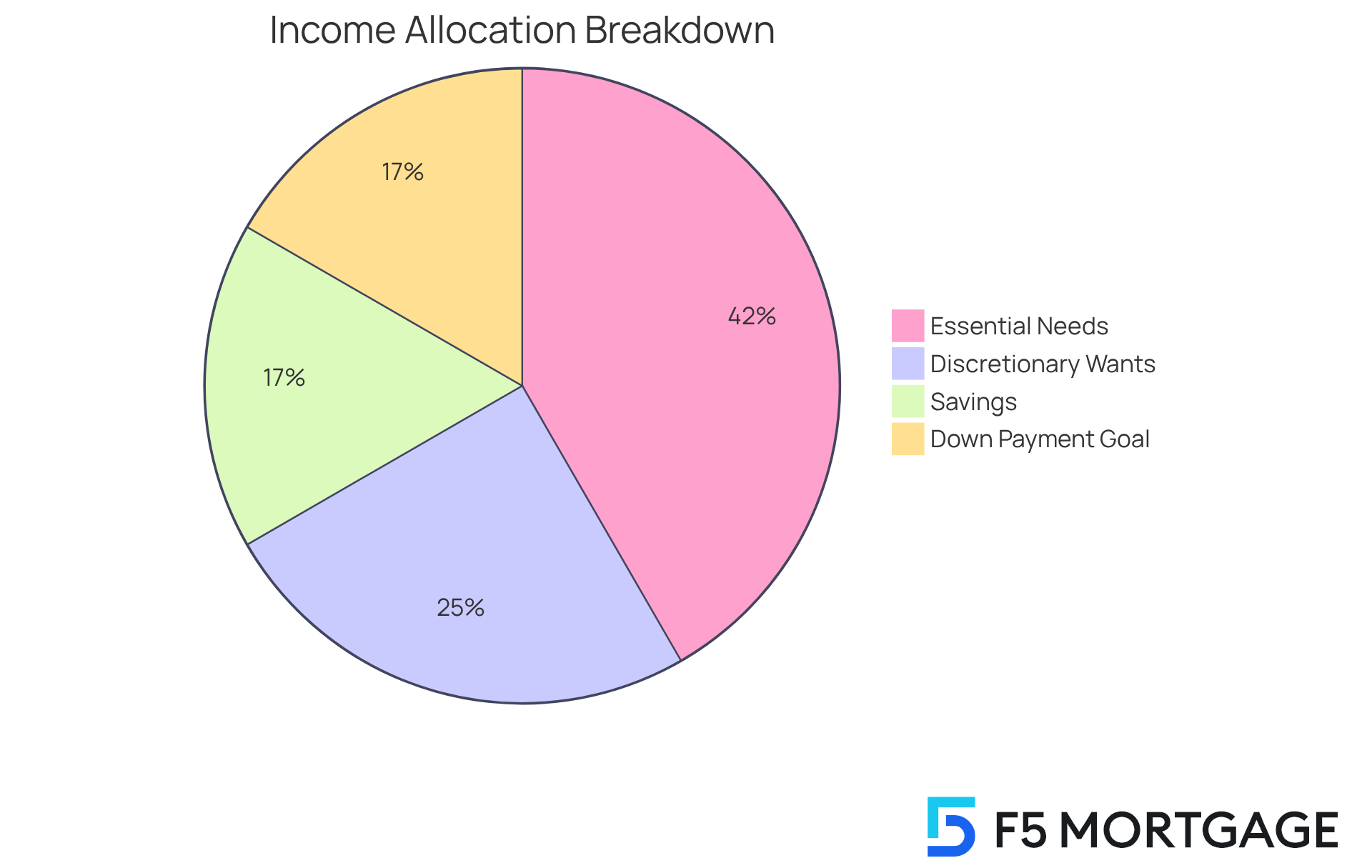

Start by cataloging all sources of income alongside your monthly expenses. We know how challenging this can be, but utilizing the 50/30/20 budgeting rule can help. Allocate 50% of your income to essential needs, 30% to discretionary wants, and 20% to savings. This framework not only helps in identifying potential areas for reducing discretionary spending but also increases your savings rate.

Set a specific savings goal for your down payment, which usually varies from 3% to 20% of the home’s purchase cost, depending on the loan type. For instance, if you’re targeting a $400,000 house, a 20% deposit would require saving $80,000. This may seem daunting, but breaking it down into manageable steps can make it achievable.

Open a dedicated high-yield savings account for your deposit to keep these funds separate from your daily expenses. Consider automating transfers from your checking account to this savings account to ensure consistent contributions. This strategy simplifies the saving process, allowing you to reach your goal more efficiently. Additionally, leveraging budgeting apps can assist you in tracking your progress and making necessary adjustments to your budget as you work towards homeownership.

Financial planners emphasize the importance of setting clear savings goals and maintaining discipline in your spending habits. It’s also important to acknowledge that 52% of prospective homeowners view down fees and closing costs as major barriers to homeownership. By following a structured savings strategy and considering down assistance programs available for first-time homebuyers—such as YourChoice!, Grant for Grads, and Ohio Heroes—low-income families can effectively navigate the journey to homeownership through home loans for low income, even amidst financial difficulties.

Partnering with an experienced lender like F5 Mortgage can provide valuable guidance throughout this process. Furthermore, understanding additional costs beyond the down payment, such as closing costs and maintenance expenses, is crucial for comprehensive financial planning. Remember, we’re here to support you every step of the way.

Navigate the Mortgage Application Process Successfully

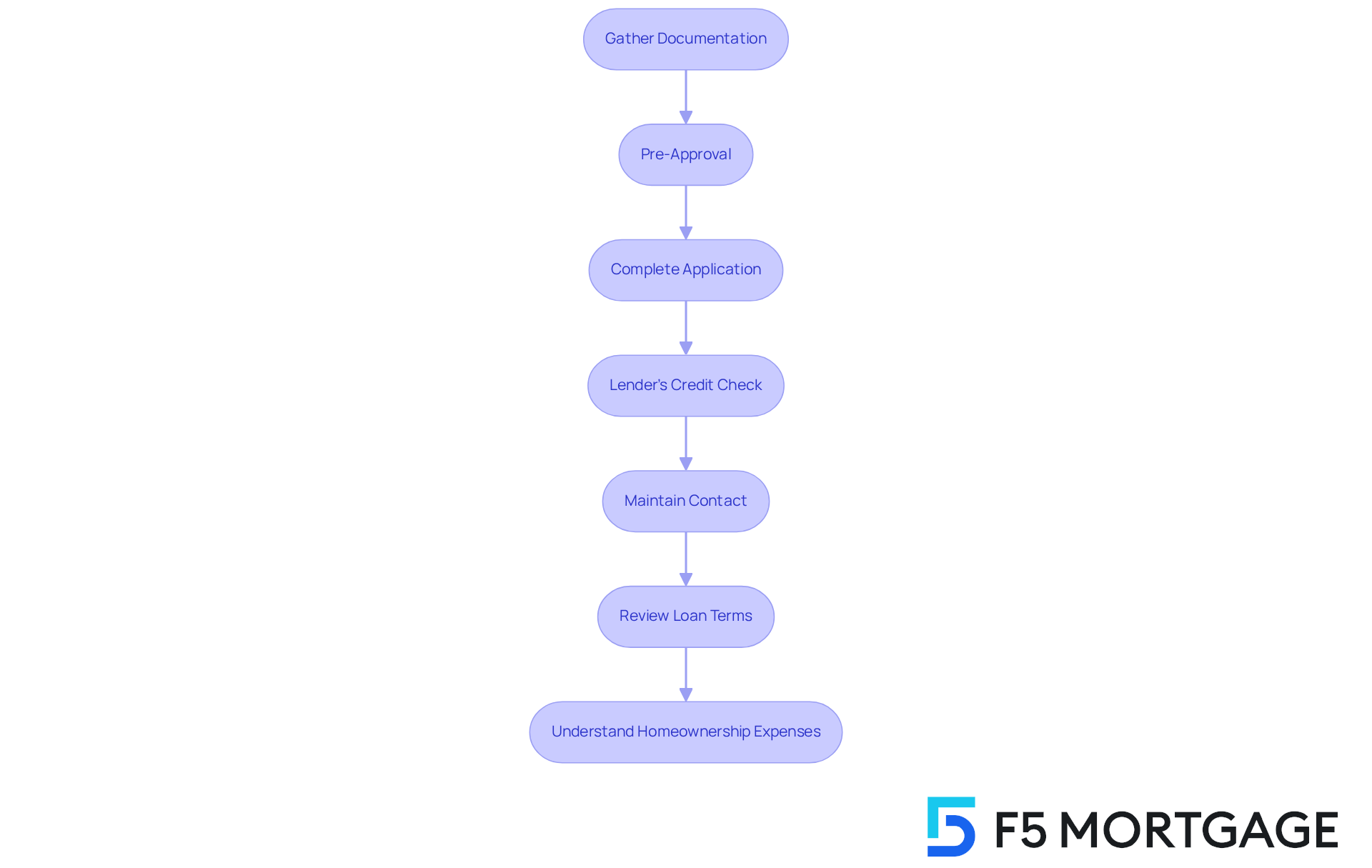

Starting the loan application process can feel overwhelming, but we’re here to support you every step of the way. Begin by gathering all necessary documentation, such as:

- Proof of income

- Tax returns

- Bank statements

- Identification

If you’re self-employed, consider bank statement loans, where your income is assessed based on your business cash flow over 12 or 24 months of bank statements.

Getting pre-approved by a lender is a crucial step. It helps you understand how much you can borrow and shows sellers that you are a serious buyer. When completing the mortgage application, accuracy is vital. Ensure all information aligns with your documentation to avoid delays in the process.

Be prepared for the lender to conduct a credit check and verify your financial information. After you submit your application, maintain close contact with your lender. This will help you address any questions or additional documentation they may require. If you’re receiving financial assistance for a down payment, remember that a ‘gift letter’ is necessary to confirm that the funds are a gift and do not need to be repaid.

Once you’re approved, take the time to review the loan terms carefully before signing. It’s important to understand all fees and obligations, including potential closing costs, which can range from 3% to 6% of the home purchase price. Additionally, reviewing and correcting any mistakes on your credit report before applying for a loan can significantly enhance your chances of approval.

Understanding the overall expenses of homeownership, beyond just the loan payment, is crucial for effective budgeting and financial planning. Remember, a little planning before applying for a mortgage can boost your confidence — and your chances of getting approved.

Conclusion

Securing a home loan as a low-income family can feel overwhelming, but we want you to know that with the right knowledge and preparation, it is entirely within reach. Understanding your financial situation and eligibility criteria is the first step in laying a solid foundation for your mortgage application. By taking proactive measures to improve your credit score and overall financial health, exploring different loan options and assistance programs, creating a realistic budget, and navigating the mortgage application process, families can significantly boost their chances of achieving homeownership.

Throughout this journey, we’ve shared key insights, such as:

- The importance of calculating your debt-to-income ratio

- Utilizing resources for down payment assistance

- Recognizing the unique benefits of FHA, USDA, and VA loans

Each step, from assessing your financial documents to maintaining good credit practices, is crucial in preparing for a successful mortgage application. The focus on budgeting and saving for a down payment underscores the importance of financial discipline in reaching your homeownership goals.

Ultimately, the path to securing home loans for low-income families is paved with knowledge, support, and thoughtful planning. By leveraging available resources and programs, families can turn their dream of homeownership into a reality. We encourage you to take action today—start gathering your financial documents, work on improving your credit score, and explore loan options—to ensure a brighter future and a place you can truly call home.

Frequently Asked Questions

What initial steps should I take to understand my financial situation for mortgage eligibility?

Start by gathering essential financial documents such as pay stubs, tax returns, and bank statements. Calculate your total monthly income and itemize all monthly expenses, including debts, to determine your debt-to-income (DTI) ratio, which is crucial for lenders.

What is the preferred DTI ratio for mortgage approval in 2025?

For 2025, a DTI ratio below 43% is generally preferred for mortgage approval.

How can FHA financing income thresholds affect my eligibility?

FHA financing income thresholds vary by area and can significantly influence your eligibility for a mortgage.

What are VA options and how do they benefit homebuyers?

VA options provide low upfront costs and flexible credit criteria, making them an attractive choice for eligible homebuyers.

What down payment assistance programs are available?

Programs like YourChoice!, Grant for Grads, and Ohio Heroes offer valuable financial help for home purchases.

Why is it important to check my credit score before applying for an FHA loan?

Checking your credit score is essential because a positive financial history can enhance your likelihood of approval.

What steps can I take to improve my credit score?

Examine your credit report for mistakes, contest inaccuracies, pay down existing debts, and maintain a payment history with no missed payments. Additionally, keep your borrowing utilization ratio below 30%, ideally under 10%.

How does my payment history impact my credit score?

Your payment history represents 35% of your credit score, making it essential to maintain a flawless record of timely payments.

What should I avoid doing in the months leading up to my housing application?

Be cautious about opening new loan accounts, as new inquiries can temporarily decrease your credit score.

How can maintaining old accounts benefit my financial profile?

Keeping old accounts can enhance your credit history, which is beneficial for your overall financial profile and can improve your chances of securing favorable home loans for low income.