Overview

Navigating the world of homebuying can feel overwhelming, especially when it comes to understanding preapproval and prequalification. We know how challenging this can be, and it’s essential to clarify these two important steps in the mortgage process. Prequalification serves as a quick and informal assessment of your borrowing potential. In contrast, preapproval involves a thorough review of your financial documents, placing you in a stronger position in the housing market.

This distinction is crucial for homebuyers. When you seek preapproval, you enhance your credibility with sellers, which can significantly improve your chances in competitive markets. Imagine walking into an open house with the confidence that comes from having your finances vetted by a lender. It’s a game-changer.

Understanding the processes, benefits, and ideal situations for each option can empower you to make informed decisions. Preapproval not only strengthens your position but also gives you peace of mind as you embark on this journey. We’re here to support you every step of the way, ensuring that you feel equipped to tackle the challenges ahead.

Introduction

Navigating the complex world of homebuying can feel overwhelming, especially when you’re trying to grasp the intricacies of mortgage processes like preapproval and prequalification. We understand how confusing these terms can be, yet they are essential keys to unlocking your potential in today’s competitive housing market.

By exploring the unique advantages and limitations of each option, you can make informed decisions that not only enhance your purchasing power but also streamline your journey toward homeownership. With so much at stake, it’s important to ask: which path truly offers the best foundation for securing your dream home?

We’re here to support you every step of the way.

Define Preapproval and Prequalification

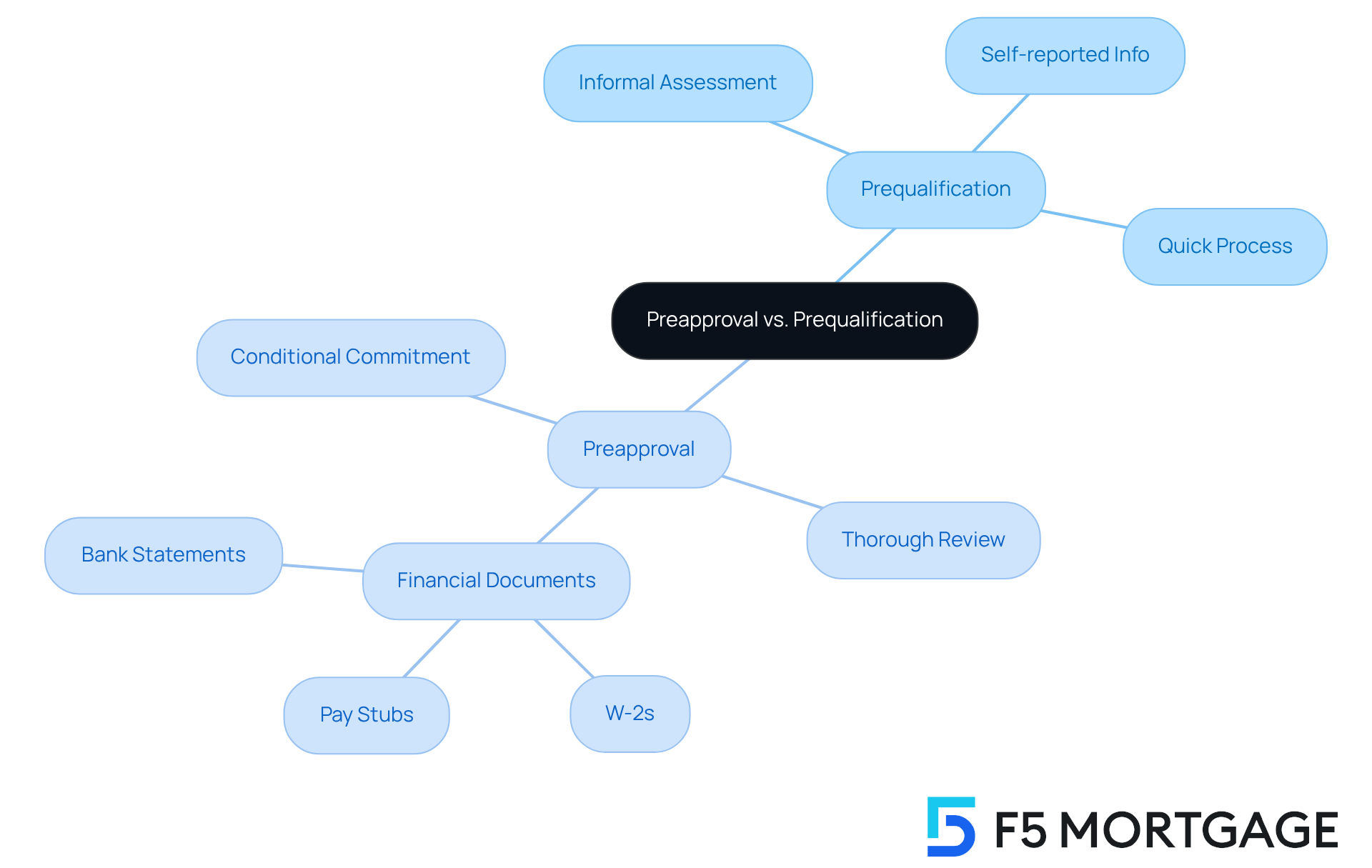

Prequalification serves as an informal assessment of a borrower’s financial situation, relying on self-reported information to estimate borrowing potential, often compared with preapproval vs prequalification. This process typically takes just a few minutes, offering a general idea of how much a borrower may qualify for. This can be particularly helpful for first-time homebuyers as they explore their options.

In contrast, prior approval is a more thorough process that involves a detailed review of the borrower’s financial documents, such as credit history, income verification, and debt assessment. This culminates in a conditional commitment from the lender for a specific loan amount, which greatly enhances the borrower’s credibility in the housing market. A letter of preliminary approval not only indicates readiness to purchase but also strengthens a buyer’s position when making offers. Sellers often prefer buyers who have undergone this comprehensive assessment.

Generally, an approval represents a lender’s decision that you are a suitable candidate for a mortgage based on your financial information. It usually includes an estimate of your loan amount, interest rate, and potential monthly payment.

Statistics indicate that many homebuyers prefer prior approval in the discussion of preapproval vs prequalification, as it provides a clearer understanding of their purchasing power. For instance, numerous mortgage brokers emphasize that having a pre-authorization letter can increase a buyer’s competitiveness in negotiations. One broker noted, ‘A pre-approved buyer is more likely to secure an offer over a less prepared buyer or agent.’

Real-world examples highlight these distinct processes: during the comparison of preapproval vs prequalification, a borrower may simply provide their income and debt levels to receive an estimate of their borrowing capacity. However, in the process of preapproval vs prequalification, they must submit detailed documentation such as W-2s, pay stubs, and bank statements, leading to a more accurate assessment of their financial readiness. Additionally, approval letters are typically valid for 60 to 90 days, underscoring the urgency for buyers to act.

Once a buyer has a pre-authorization letter, they can approach negotiations for their desired home with confidence. If the seller accepts the initial offer, the lender will issue a Loan Estimate outlining the fees and costs associated with the loan, although these figures could change by up to 10% prior to closing. Before closing, the lender will provide a Closing Disclosure that details the final numbers, ensuring transparency throughout the transaction.

It’s also important to note that the advance approval process involves a hard inquiry on the borrower’s credit report, which may temporarily impact their credit score. This distinction of preapproval vs prequalification is vital for homebuyers looking to navigate the complexities of the mortgage landscape effectively. We understand how challenging this can be, and we’re here to .

Contrast Key Differences Between Preapproval and Prequalification

Understanding the can empower you on your homebuying journey. Let’s explore how [preapproval vs prequalification](https://f5mortgage.com/5-steps-to-secure-a-pre-approved-home-loan-successfully) differ and how these differences can impact your experience.

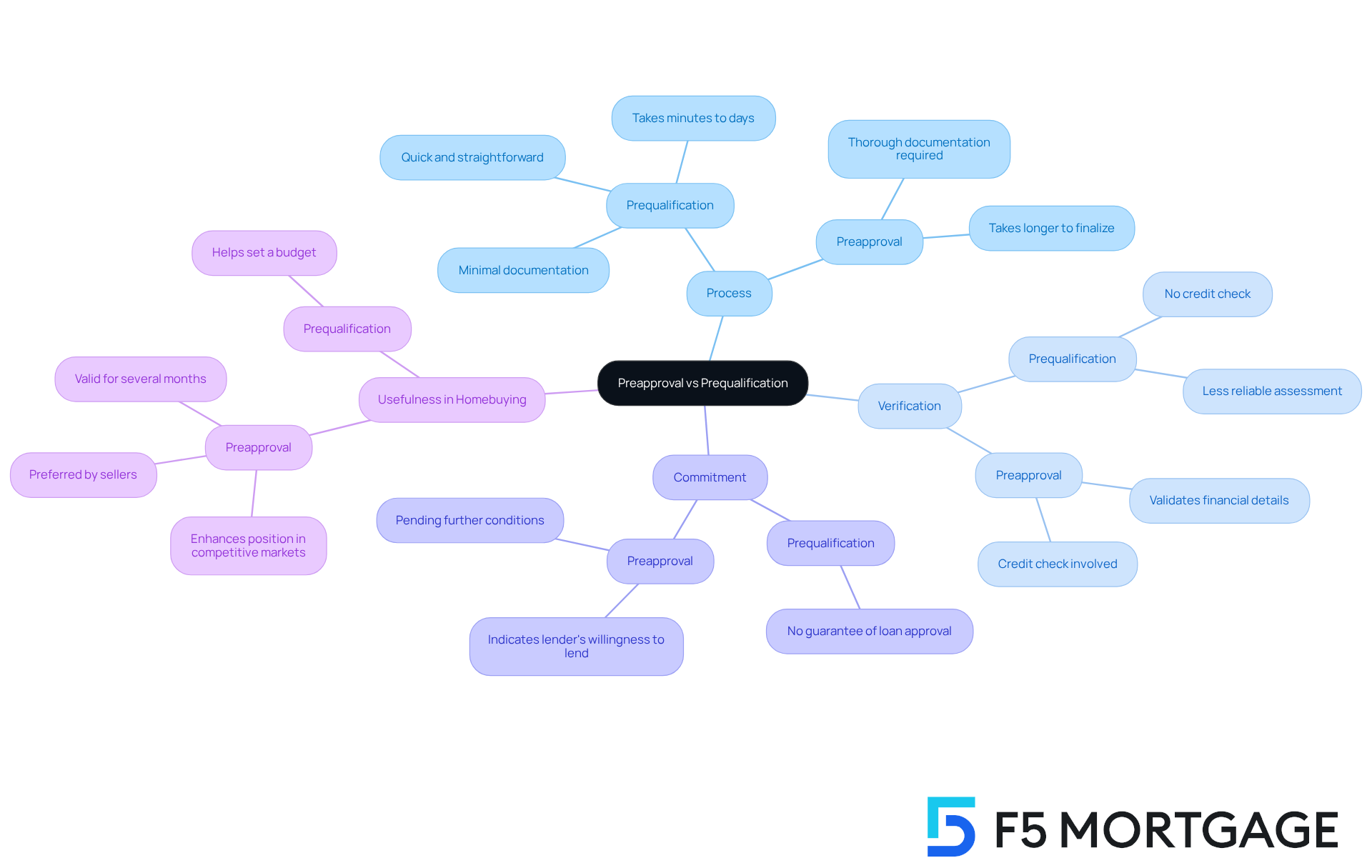

Process: Prequalification is a quick and straightforward process, often completed online with minimal documentation. It typically takes just a few minutes to a couple of days. This step helps you set a budget as a potential homebuyer. On the other hand, when discussing preapproval vs prequalification, it is important to note that preapproval requires thorough financial documentation and may take more time to finalize. However, it can help you secure your dream home more quickly with flexible mortgage rates.

Verification: One important distinction is in the verification process. Prequalification does not involve a credit check, which makes it less reliable. In contrast, the differences between preapproval vs prequalification include that preapproval involves a credit check and validation of your financial details. This offers a more accurate assessment of your borrowing ability. Keep in mind that hard inquiries from preapproval can temporarily affect your credit score, though the impact is usually minor and short-lived.

Commitment: It’s essential to understand the level of commitment involved. A prequalification letter does not guarantee loan approval since documentation hasn’t been provided. Conversely, a preapproval letter illustrates the difference in preapproval vs prequalification, as it signifies that the lender is willing to lend you a specific amount, pending further conditions. This commitment can give you a clearer understanding of your financial readiness and empower your decision-making.

Usefulness in Homebuying: In competitive markets, preapproval carries significant weight. It shows sellers that you are serious and financially capable. Real estate professionals often emphasize that having a preapproval letter can greatly enhance your position, especially in multiple offer situations. Many sellers prefer offers from buyers who have preapproval vs prequalification, as it indicates a higher level of financial readiness. Additionally, pre-approval letters are generally valid for several months, providing you with a clear timeframe for your home search.

By comprehending these distinctions, you can navigate the home acquisition process more efficiently. This understanding ensures you are well-equipped to make informed choices, backed by the exceptional support and competitive rates offered by F5 Mortgage. We know how challenging this can be, and testimonials from satisfied customers highlight our commitment to providing a smooth experience. Choosing F5 Mortgage means choosing a partner dedicated to your home financing needs.

Evaluate Benefits and Drawbacks of Each Option

Evaluate Benefits and Drawbacks of Each Option

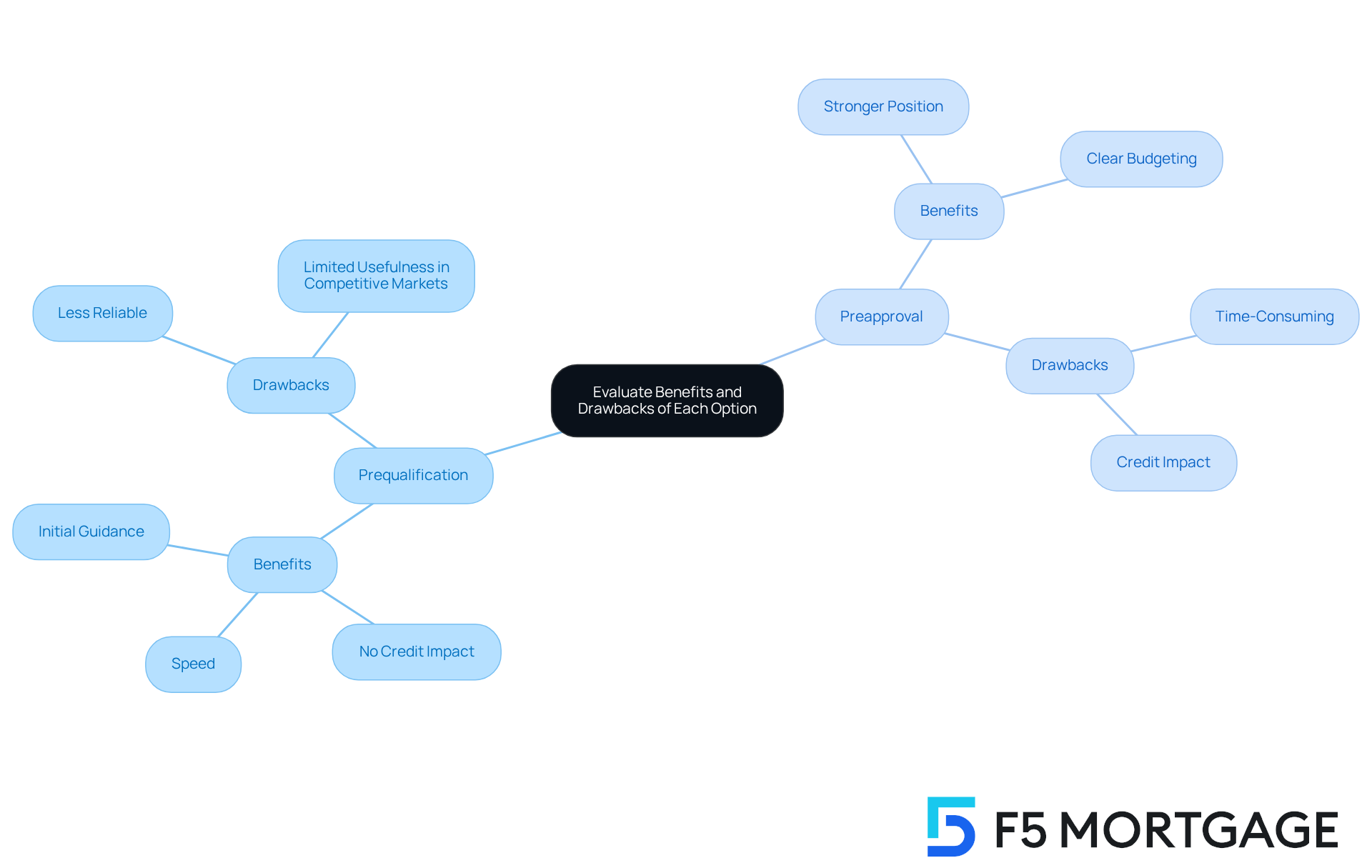

- Speed: We understand that time is of the essence. The prequalification process is typically quick, often completed in just a few minutes or even in one phone call to a Loan Officer at F5 Mortgage. This allows prospective purchasers to assess their borrowing ability without delay, helping them understand the key differences between preapproval vs prequalification as they move closer to acquiring their dream home.

- No Credit Impact: We know how important your credit score is. Since prequalification does not involve a credit check, it does not affect the borrower’s credit score, making it a risk-free initial step.

- Initial Guidance: This procedure provides a rough estimate of how much a borrower could afford, assisting them in establishing a realistic budget for their home search. Plus, prequalification letters do not expire as long as the borrower’s financial situation remains unchanged, offering reassurance to those looking to buy.

Drawbacks of Prequalification:

- Less Reliable: It’s essential to be aware that prequalification is based on unverified information, which may not accurately reflect the borrower’s true borrowing capacity. This could lead to potential disappointments later in the process.

- Limited Usefulness in Competitive Markets: In a competitive housing market, sellers may not take preapproval vs prequalification seriously, as prequalification does not demonstrate a strong commitment from lenders. This can put prequalified individuals at a disadvantage.

- Stronger Position: Obtaining preapproval significantly enhances a buyer’s credibility with sellers, signaling that the buyer is serious. This makes their offers more attractive and competitive, especially in markets where is common. F5 Mortgage’s personalized support ensures that purchasers are well-prepared to make competitive offers.

- Clear Budgeting: Preapproval offers a defined loan sum, enabling buyers to budget efficiently and focus their home search on properties within their monetary capacity, backed by F5 Mortgage’s adaptable mortgage rates.

Drawbacks of Preapproval:

- Time-Consuming: We understand that waiting can be frustrating. The preapproval process can be more time-consuming due to the need for extensive documentation and verification of financial information, typically taking 7 to 10 days.

- Credit Impact: Unlike preapproval vs prequalification, obtaining approval involves a credit check, which can temporarily reduce the borrower’s credit score. This is a crucial factor for those intending to make substantial purchases shortly. It’s also important to note that preapproval does not guarantee loan approval due to possible changes in a borrower’s economic condition.

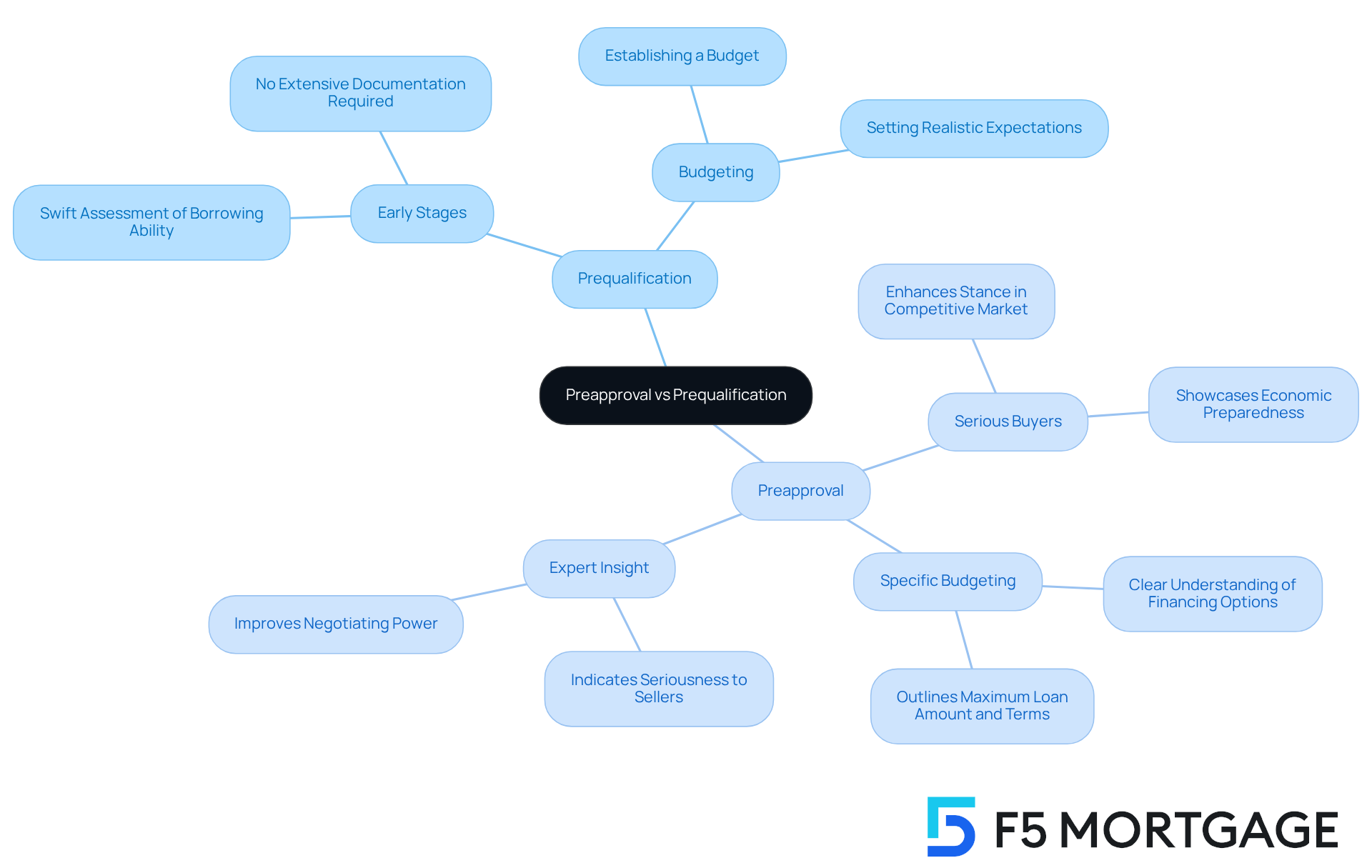

Determine When to Choose Preapproval or Prequalification

Determine When to Choose Preapproval or Prequalification

When to Choose Prequalification:

- Early Stages: We know how challenging it can be for who are just beginning to explore their options. Prequalification is particularly beneficial at this stage. It offers a swift assessment of possible borrowing ability, helping you evaluate your financial preparedness without the need for extensive documentation.

- Budgeting: This process is useful for establishing a budget before diving deeper into the homebuying journey. It enables you to comprehend how much you could potentially obtain, which is essential for setting realistic expectations.

When to Choose Preapproval:

- Serious Buyers: If you’re ready to make an offer on a home, preapproval is essential. It enhances your stance in a competitive market by showcasing your economic preparedness to sellers and real estate agents.

- Specific Budgeting: If you’ve identified a property, prior approval offers a clear understanding of your financing options. This step is critical before proceeding with an offer, as it outlines the maximum loan amount and terms based on verified financial documentation.

- Expert Insight: Mortgage specialists advise obtaining preapproval before searching for a home. This indicates to sellers that you are serious and ready. This proactive method can significantly improve your negotiating power in a competitive environment.

In fact, many first-time homebuyers utilize prequalification as a stepping stone to understanding their financial capabilities, particularly when considering preapproval vs prequalification. By leveraging prequalification effectively, you can navigate the complexities of the mortgage process with greater confidence and clarity. We’re here to support you every step of the way.

Conclusion

Understanding the differences between preapproval and prequalification is crucial for homebuyers navigating the mortgage landscape. We know how challenging this can be. Prequalification offers a quick and informal assessment of a borrower’s financial situation, while preapproval provides a more detailed and reliable evaluation. This distinction results in a stronger position when making offers on homes, significantly influencing a buyer’s experience in the competitive housing market.

The article highlights several key points, including:

- The speed and simplicity of prequalification versus the thoroughness and credibility of preapproval.

- Prequalification is beneficial for early-stage homebuyers looking to establish a budget.

- On the other hand, preapproval is essential for serious buyers ready to make offers.

- Additionally, the potential impact on credit scores and the level of commitment from lenders are critical factors to consider when choosing between these options.

Ultimately, making an informed decision about whether to pursue preapproval or prequalification can empower homebuyers in their journey. By understanding these processes and their implications, buyers can enhance their negotiating power and increase their chances of securing their dream home. As the housing market continues to evolve, we’re here to support you every step of the way. Staying informed and seeking expert guidance can lead to a more successful homebuying experience.

Frequently Asked Questions

What is prequalification in the context of mortgage borrowing?

Prequalification is an informal assessment of a borrower’s financial situation based on self-reported information, providing a general estimate of how much they may qualify to borrow.

How does preapproval differ from prequalification?

Preapproval is a more thorough process that involves a detailed review of a borrower’s financial documents, leading to a conditional commitment from the lender for a specific loan amount, which enhances the borrower’s credibility in the housing market.

Why is preapproval beneficial for homebuyers?

Preapproval provides a clearer understanding of a buyer’s purchasing power and strengthens their position when making offers, as sellers often prefer buyers who have undergone this comprehensive assessment.

What documents are required for preapproval?

The preapproval process requires detailed documentation such as W-2s, pay stubs, and bank statements to accurately assess the borrower’s financial readiness.

How long is a preapproval letter typically valid?

A preapproval letter is usually valid for 60 to 90 days, indicating that buyers should act promptly.

What happens after a buyer receives a pre-authorization letter?

Once a buyer has a pre-authorization letter, they can negotiate confidently for their desired home. If the seller accepts their offer, the lender will issue a Loan Estimate outlining the associated fees and costs.

What is the significance of the Closing Disclosure?

The Closing Disclosure provides detailed final numbers related to the loan, ensuring transparency throughout the transaction before closing.

Does the preapproval process affect the borrower’s credit score?

Yes, the preapproval process involves a hard inquiry on the borrower’s credit report, which may temporarily impact their credit score.

What is the general preference among homebuyers regarding preapproval and prequalification?

Many homebuyers prefer preapproval over prequalification, as it offers a more accurate understanding of their borrowing potential and increases competitiveness in negotiations.