Overview

If you’re a family grappling with bad credit, there are hopeful options available for qualifying for a mortgage. Consider exploring loans like FHA, VA, and USDA, which often come with more lenient requirements tailored to your situation. We understand how daunting this process can feel, but there are essential steps you can take to improve your chances.

- Start by checking your credit reports and addressing any inaccuracies.

- Next, focus on improving your debt-to-income ratios, which can significantly impact your loan eligibility.

- Additionally, saving for a larger down payment can make a difference in your mortgage application.

Remember, taking proactive measures can greatly enhance your chances of securing a loan, even with a challenging financial history.

We’re here to support you every step of the way, guiding you through this journey with understanding and compassion. You’re not alone in this process, and by taking these steps, you can pave the way towards homeownership.

Introduction

Navigating the world of mortgages can feel overwhelming, especially for families facing the difficulties of bad credit. We understand how challenging this can be. Subprime loans, designed for borrowers with credit scores typically below 620, come with their own set of hurdles and opportunities that can profoundly influence financial futures.

This guide aims to illuminate practical steps families can take to qualify for a bad credit mortgage. We’re here to support you every step of the way as we uncover essential strategies and options that can lead you toward homeownership.

So, how can families effectively navigate this complex landscape to secure financing and fulfill their dream of owning a home, despite their credit history?

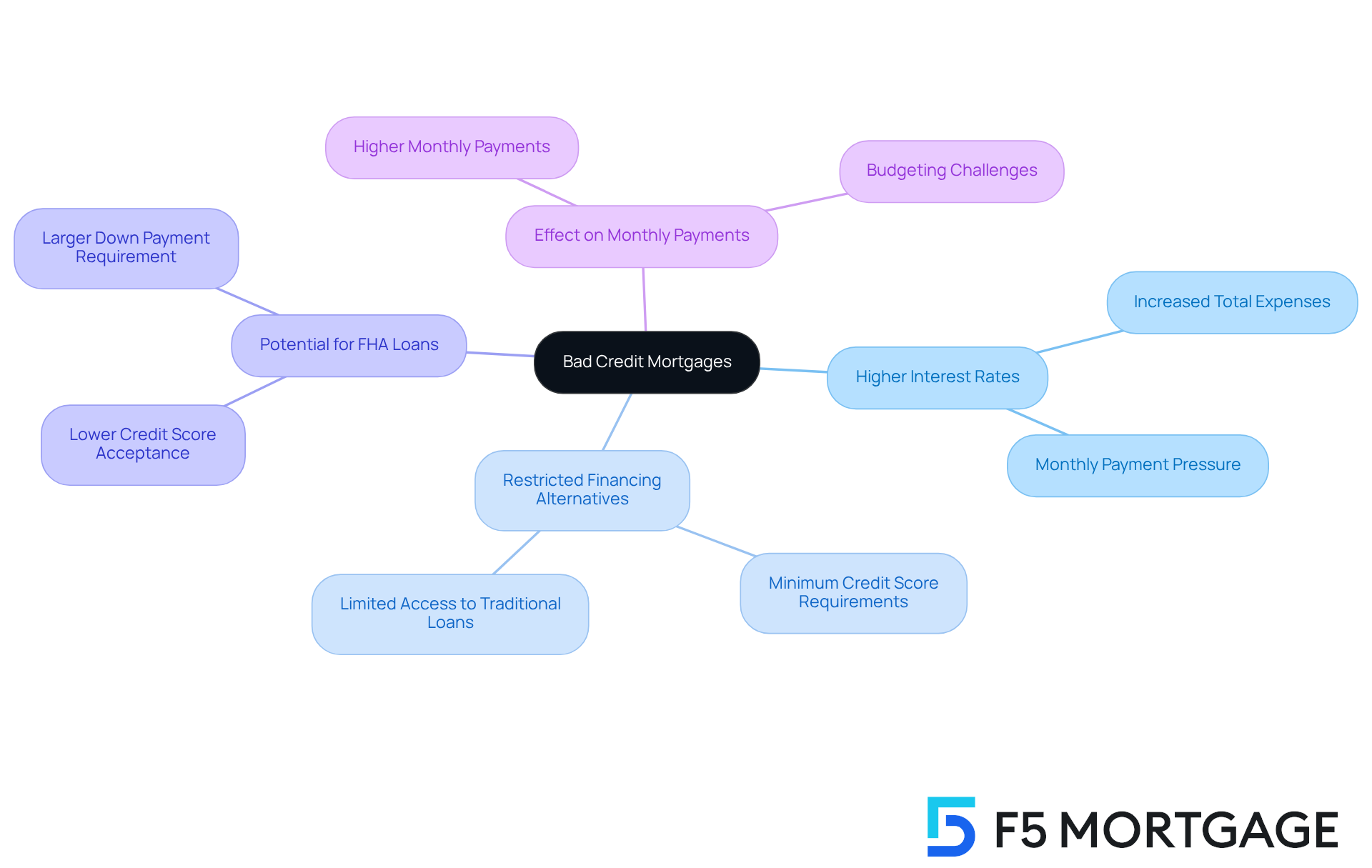

Understand Bad Credit Mortgages and Their Implications

Subprime loans cater to borrowers with scores usually under 620, presenting unique challenges and opportunities. We know how challenging this can be, and understanding the implications of poor financial standing is essential for families seeking to obtain a mortgage. Here are some key considerations to keep in mind:

- Higher Interest Rates: Lenders often impose elevated interest rates to mitigate the perceived risk associated with lending to borrowers with poor credit. This can lead to considerably greater total expenses throughout the duration of the financing.

- Restricted Financing Alternatives: Many traditional financing options establish a minimum rating requirement, making it difficult for individuals with poor financial history to qualify. For instance, traditional financing supported by Fannie Mae and Freddie Mac typically demands a minimum rating of 620 or above.

- Potential for FHA Loans: The Federal Housing Administration (FHA) offers loans that are more attainable for individuals with lower financial ratings, allowing qualifications with scores as low as 500, provided a larger down payment is made. This adaptability can be a lifeline for families facing financial difficulties.

- Effect on Monthly Payments: The elevated interest rates linked to poor financial history can result in higher monthly payments, which may put pressure on a family’s budget and overall affordability.

Practical instances show that families can effectively obtain financing despite a poor financial history by considering alternatives such as FHA loans or finding co-signers to enhance their application. Financial consultants emphasize that while elevated interest rates are a typical result of poor financial history, proactive measures like improving credit ratings and effective budgeting can enhance loan eligibility and affordability. By comprehending these elements, families can more effectively explore their choices and prepare for the loan application process. We’re here to support you every step of the way.

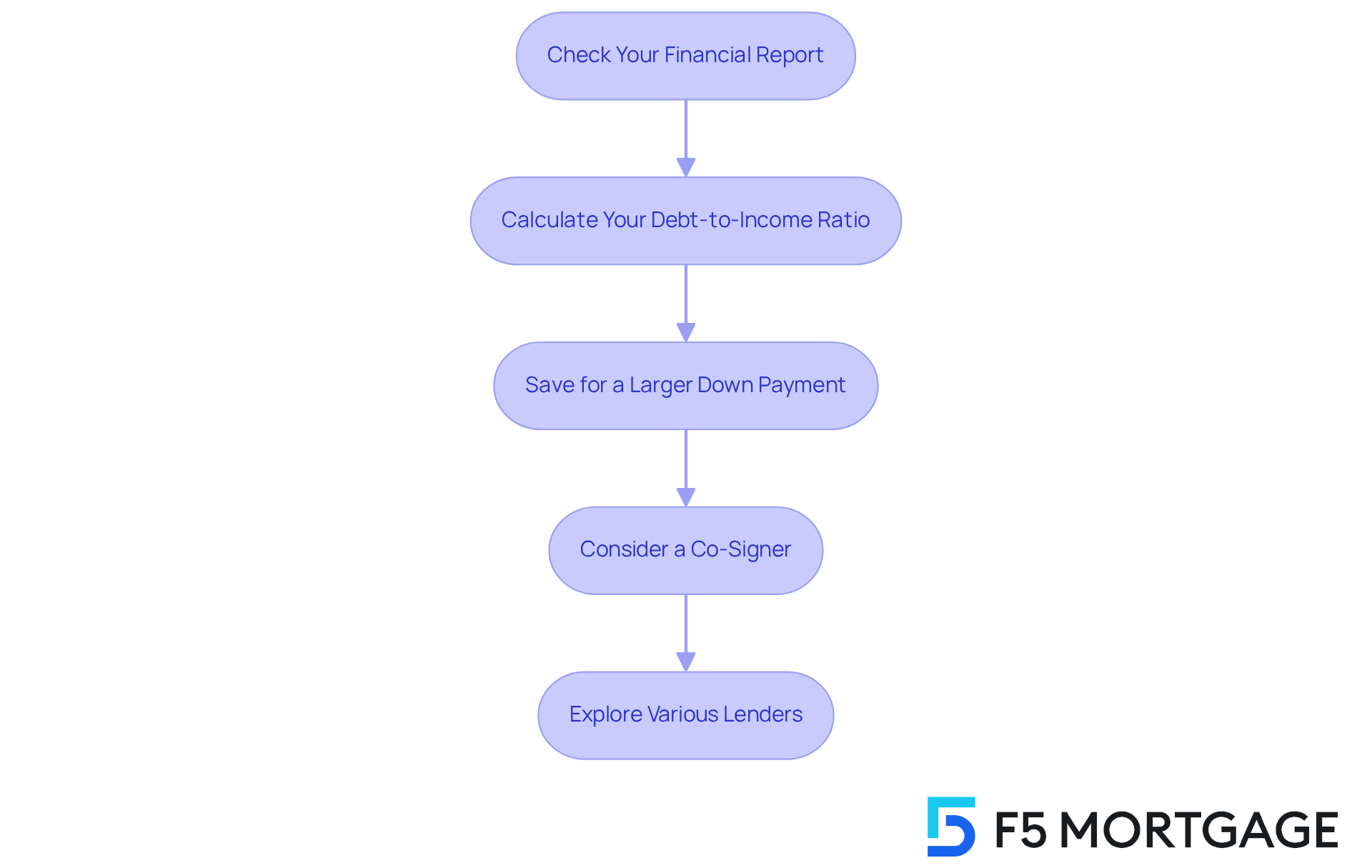

Follow Key Steps to Qualify for a Bad Credit Mortgage

To qualify for a bad credit mortgage, families can take these essential steps to improve their chances:

-

Check Your Financial Report: Start by obtaining copies of your financial report from all three major bureaus—Equifax, Experian, and TransUnion. We know how challenging it can be to navigate this process, but consistently examining your reports helps spot mistakes or discrepancies that could negatively impact your score. It’s recommended to check your credit reports at least once a year to ensure accuracy.

-

Calculate Your Debt-to-Income Ratio (DTI): Lenders generally prefer a DTI ratio of 43% or lower. This ratio compares your monthly debt payments to your gross monthly income. Reducing existing debt can significantly improve your DTI, thereby enhancing your chances of mortgage approval. Remember, every small step counts!

-

Save for a Larger Down Payment: A larger down payment can help mitigate the lender’s risk and may lead to more favorable loan terms. If your borrowing score is below 580, aim for at least a 10% down payment to enhance your application. This proactive step can make a significant difference.

-

Consider a Co-Signer: If possible, enlist a co-signer with a better financial profile. This can bolster your application and potentially lower your interest rate, making it easier to secure financing. It’s always good to have support on your side.

-

Explore Various Lenders: Different financiers have diverse standards for poor loan applicants. Research and compare multiple options to find a lender willing to accommodate your financial situation. In 2025, a considerable portion of lenders demand report evaluations for loan applications, making it essential to comprehend your financial status.

By diligently following these steps, families can enhance their likelihood of securing a bad credit mortgage, even with a poor financial history. We’re here to support you every step of the way!

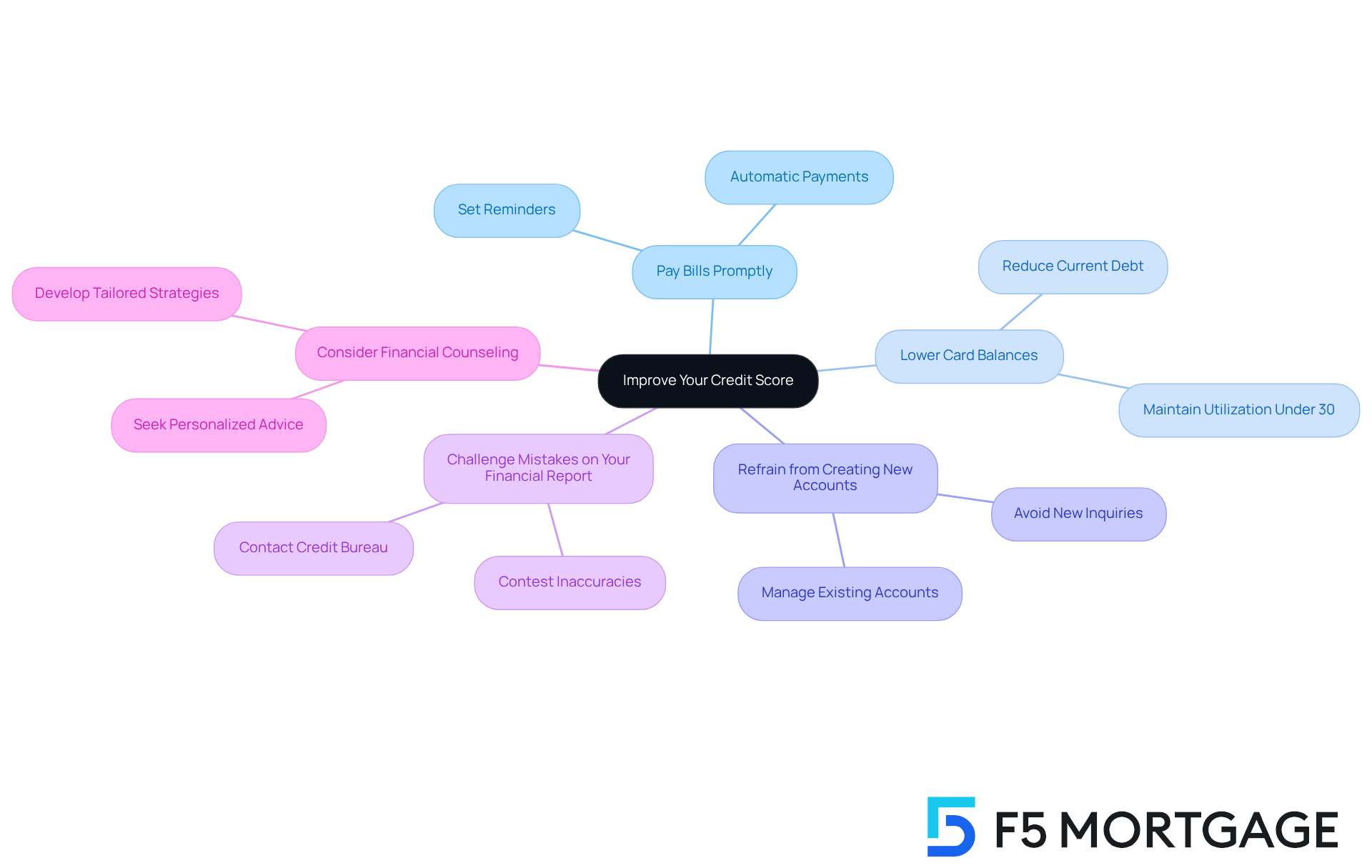

Implement Strategies to Improve Your Credit Score

Improving your credit score before applying for a bad credit mortgage can feel overwhelming, but we’re here to support you every step of the way. By implementing a few thoughtful strategies, you can enhance your financial standing and make yourself a more appealing candidate for a bad credit mortgage from loan providers.

-

Pay Bills Promptly: We know how challenging it can be to keep track of payments. Regularly making payments on time is crucial for your credit rating. Consider setting up reminders or automatic payments to help you never miss a due date.

-

Lower Card Balances: Striving to maintain your credit utilization ratio under 30% can significantly benefit your score. Reducing your current card debt not only helps your rating but also eases financial stress, which is crucial when applying for a bad credit mortgage.

-

Refrain from Creating New Accounts: Every new inquiry can temporarily decrease your score, adding to your concerns. Focus instead on managing your existing accounts, which can lead to more stable credit health.

-

Challenge Mistakes on Your Financial Report: If you find inaccuracies on your report, don’t hesitate to contest them with the bureau. Fixing these mistakes can lead to an immediate increase in your score, relieving some of the pressure you may feel.

-

Consider Financial Counseling: If managing your debt feels daunting, seeking assistance from a financial counseling service can be a great step. They can provide personalized advice and strategies tailored to your unique situation.

By applying these approaches, you can take control of your credit score, which may help you qualify for a bad credit mortgage and pave the way for a brighter financial future.

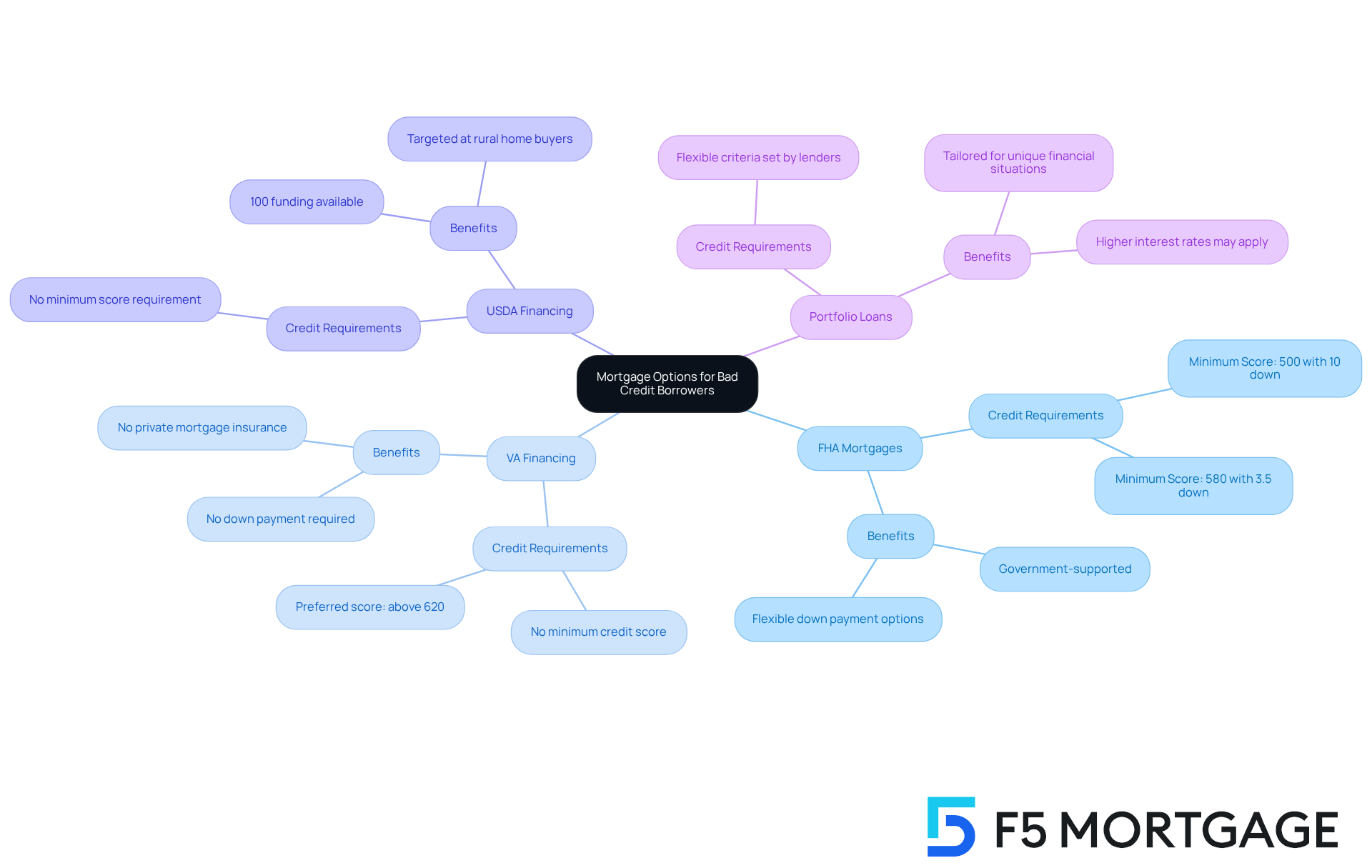

Explore Mortgage Options for Bad Credit Borrowers

Families facing challenges due to bad credit mortgage often feel overwhelmed, but there are several options available to help you achieve your homeownership dreams. Here’s a closer look at some of these possibilities:

-

FHA Mortgages: These government-supported financing options are designed for low-to-moderate-income borrowers. In 2025, you can qualify with a credit rating as low as 500 with a 10% down payment or 580 with a 3.5% down payment. This flexibility makes homeownership more attainable for many families.

-

VA Financing: Exclusively for veterans and active-duty personnel, VA financing does not impose a minimum credit rating requirement. While lenders often prefer ratings above 620, many families have successfully secured VA financing by finding lenders willing to consider their unique financial situations. We know how challenging this can be, but shopping around can open doors.

-

USDA Financing: Targeted at rural home buyers, USDA financing offers 100% funding with no minimum score requirement. This makes it an appealing choice for eligible families looking to purchase homes in designated rural areas.

Some lenders specialize in bad credit mortgages tailored for borrowers with poor credit. While these loans typically come with higher interest rates, they can provide a pathway to homeownership for those who may not qualify for traditional financing.

- Portfolio Loans: These loans are retained by lenders rather than sold on the secondary market, giving them the flexibility to set their own criteria. This can be advantageous for borrowers with unique financial circumstances, as lenders may be more open to considering individual situations.

By exploring these diverse options, families can identify mortgage products that best align with their financial circumstances and homeownership aspirations. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the landscape of bad credit mortgages can feel overwhelming for families. We understand how challenging this can be, but knowing the available options and strategies can significantly enhance the chances of securing financing. The journey begins with recognizing the unique challenges posed by subprime loans, such as higher interest rates and limited financing alternatives. However, with proactive steps and informed decisions, families can turn their financial situations around and work towards homeownership.

Key steps outlined in this article—like checking credit reports, calculating debt-to-income ratios, saving for larger down payments, and exploring various lenders—are essential tools for families. Additionally, strategies to improve credit scores, such as making timely bill payments and reducing credit card balances, can further boost eligibility for bad credit mortgages. By being diligent and resourceful, families can discover pathways to financing that may have once seemed out of reach.

Ultimately, the significance of this article lies in the empowerment it offers to families facing financial hurdles. By arming themselves with knowledge and taking actionable steps, families can overcome the stigma of bad credit and work towards achieving their dream of homeownership. The journey may be challenging, but with the right support and resources, it is entirely possible to secure a mortgage and build a brighter financial future.

Frequently Asked Questions

What are bad credit mortgages?

Bad credit mortgages, also known as subprime loans, cater to borrowers with credit scores usually under 620, presenting unique challenges and opportunities for obtaining financing.

What are the implications of having bad credit when applying for a mortgage?

Borrowers with bad credit may face higher interest rates, restricted financing alternatives, and potentially higher monthly payments, which can impact their overall budget and affordability.

Why do lenders charge higher interest rates for bad credit mortgages?

Lenders impose elevated interest rates to mitigate the perceived risk associated with lending to borrowers with poor credit histories, leading to greater total expenses over the loan duration.

What financing options are available for individuals with bad credit?

Many traditional financing options require a minimum credit score of 620 or above, making it difficult for individuals with poor credit to qualify. However, the Federal Housing Administration (FHA) offers loans that can be obtained with scores as low as 500, provided a larger down payment is made.

How do bad credit mortgages affect monthly payments?

The elevated interest rates associated with bad credit mortgages can result in higher monthly payments, which may place additional pressure on a family’s budget.

What alternatives exist for families with poor credit to secure financing?

Families can consider alternatives such as FHA loans or finding co-signers to enhance their mortgage application. Additionally, improving credit ratings and effective budgeting can enhance loan eligibility and affordability.

How can families prepare for the loan application process with bad credit?

Understanding the implications of bad credit, exploring financing options like FHA loans, and taking proactive measures to improve credit ratings can help families effectively prepare for the loan application process.