Overview

If you’re wondering how much house you can afford on a $100,000 annual income, it’s important to take a close look at your financial situation. Start by calculating your debt-to-income ratio, net income, and monthly expenses. We know how challenging this can be, especially when you also have to consider additional costs like property taxes and homeowners insurance.

Understanding your financial health is crucial. By utilizing tools like mortgage affordability calculators, you can make informed decisions about purchasing a home that fits within your budget. This step-by-step approach will not only help you feel more confident but also empower you to take control of your home-buying journey.

Remember, we’re here to support you every step of the way. Take the time to assess your finances, and you’ll be well on your way to finding a home that meets your needs.

Introduction

Navigating the complex world of home buying can feel overwhelming, especially for those earning a six-figure salary. We understand how challenging this can be. Understanding what house one can afford on a $100,000 income requires a careful assessment of your financial health, including income, expenses, and the additional costs associated with homeownership.

This guide not only breaks down the essential steps to determine affordability but also addresses those often-overlooked expenses that can impact your budget. As you ponder the question of affordability, you may wonder:

- How can you ensure you are making informed decisions in a fluctuating market without falling prey to hidden costs?

We’re here to support you every step of the way.

Understand Your Financial Situation

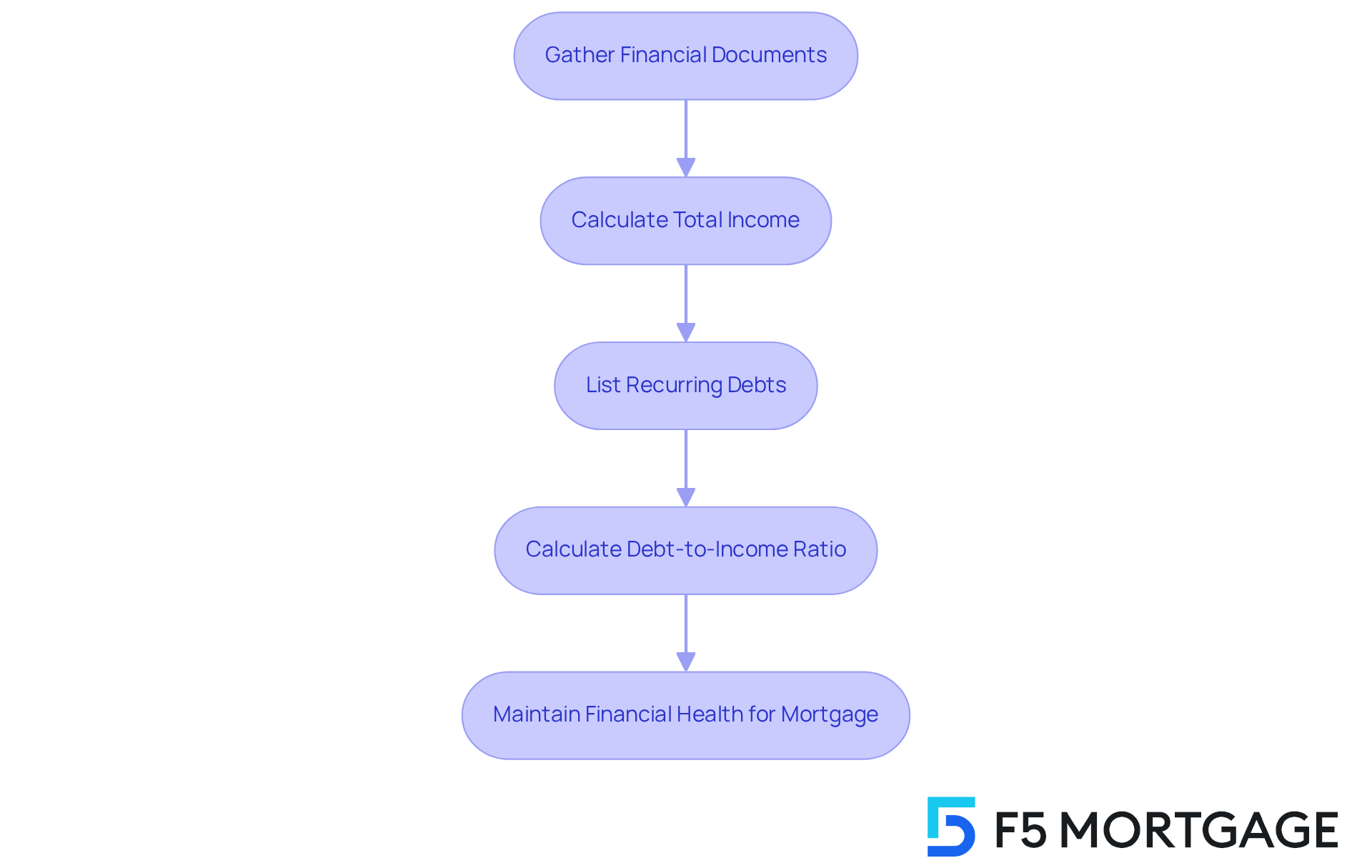

Begin by gathering essential financial documents, including pay stubs, tax returns, and bank statements. We know how challenging this can be, but assessing your total income—factoring in any bonuses or additional sources—is a crucial first step. Next, compile a list of your monthly debts, such as credit card payments, student loans, and car loans. This information is essential for determining your debt-to-income (DTI) ratio, a vital metric that lenders assess when reviewing loan applications. A lower DTI ratio signifies better financial health and enhances your chances of securing a favorable mortgage rate.

- Collect Financial Documents: Gather your pay stubs, tax returns, and bank statements.

- Calculate Total Income: Include all sources of income, not just your salary.

- List Recurring Debts: Write down all regular debt obligations.

- Calculate Debt-to-Income Ratio: Divide your total debts each month by your gross income for that period. Aim for a ratio below 36% for better mortgage options.

Understanding your DTI ratio is vital, as lenders typically prefer a ratio of 36% or lower to minimize risk and improve approval chances. For instance, if your gross monthly earnings are $6,000 and your total monthly debt obligations are $2,000, your DTI ratio would be roughly 33%. This suggests a sustainable level of debt in relation to your income. Additionally, many lenders require homeowners to have at least an 80% home-to-value loan ratio. This means you should have paid down at least 20% of your original loan amount or your home should have increased in value.

It’s prudent to keep a cash reserve to cover several months of housing payments in case of income loss. Also, avoid opening new lines of credit during the homebuying process to help maintain a low DTI. This proactive approach not only prepares you for the mortgage application process but also positions you for better financial outcomes in your homeownership journey. As financial advisors often emphasize, understanding your financial health is crucial before making such significant commitments. We’re here to support you every step of the way.

Assess Your Income and Monthly Expenses

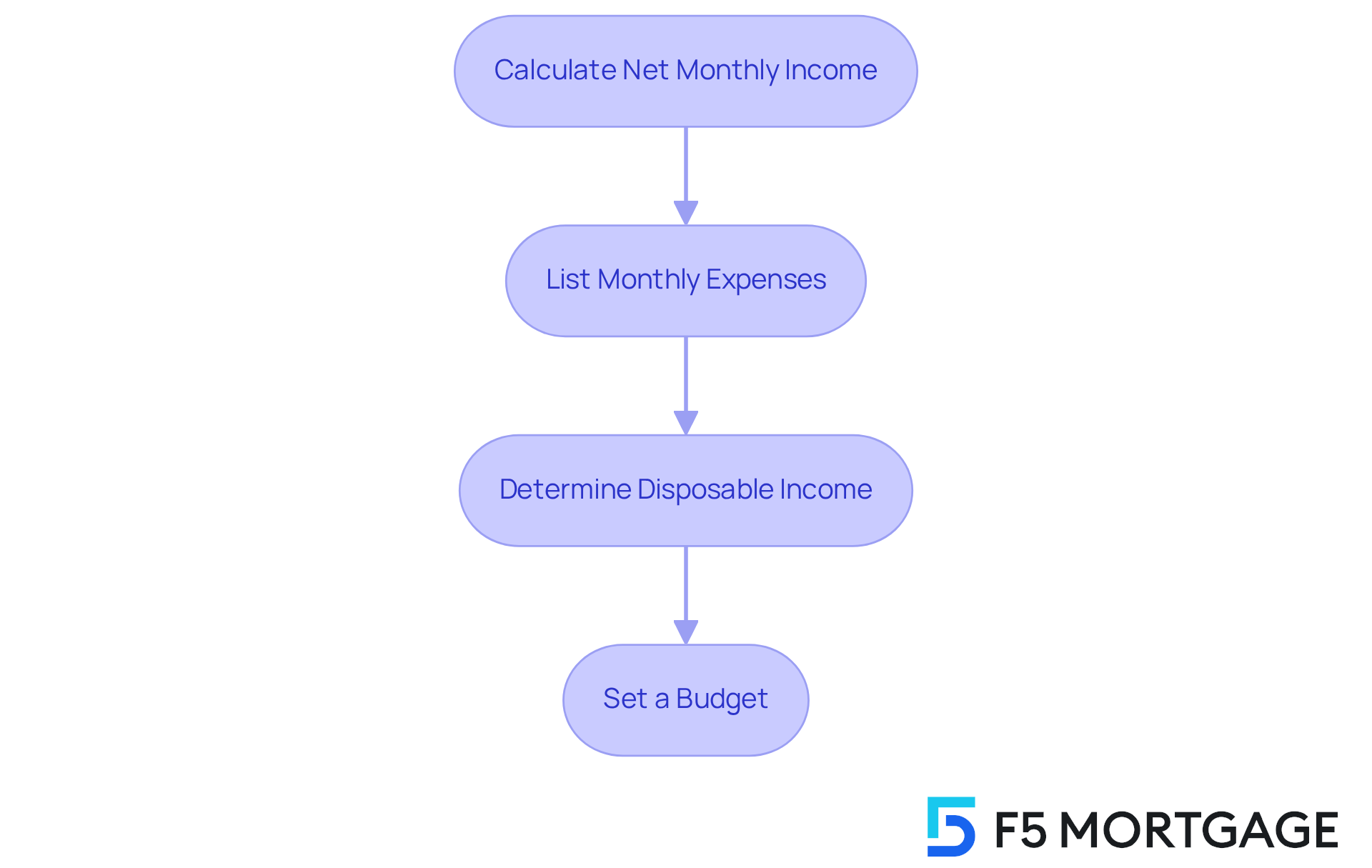

To evaluate your income and expenses effectively, let’s start by calculating your net income each month after taxes. We understand how overwhelming this can be, so take a moment to gather your financial information. Once you have your net income, list all your regular expenses, including utilities, groceries, transportation, and entertainment. This step is crucial in understanding where your money goes.

Next, deduct your total expenses from your net income to find your disposable income. This figure is essential as it helps you see how much you can allocate for housing and other needs.

Here are some steps to guide you:

- Calculate Net Monthly Income: Use your after-tax income for accuracy. We know how important it is to have a clear picture of your finances.

- List Monthly Expenses: Include all necessary living expenses. This will help you understand your financial commitments.

- Determine Disposable Income: Subtract total expenses from net income to find out how much you can allocate for housing. This will empower you to make informed decisions.

- Set a Budget: Aim to keep housing costs within 28% of your gross monthly income, which translates to approximately $2,333 for a $100,000 salary. This guideline can help you maintain a healthy financial balance.

Remember, we’re here to support you every step of the way as you navigate this process.

Include Additional Homeownership Costs

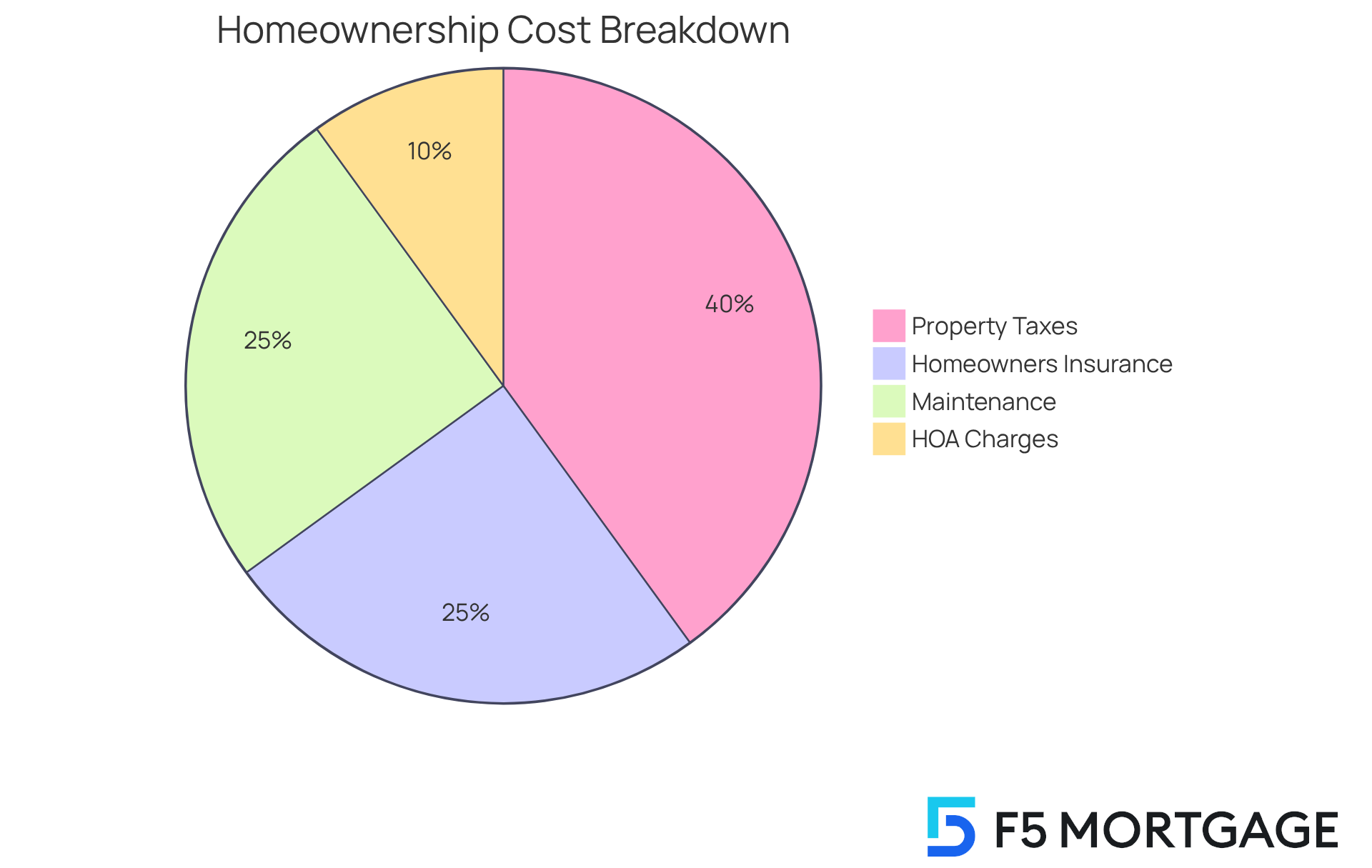

When considering homeownership, it’s important to understand the various costs beyond just the mortgage payment, especially when asking what house can I afford on 100k a year. These include property taxes, homeowners insurance, maintenance, and potential homeowners association (HOA) fees. Understanding these expenses is crucial for determining what house can I afford on 100k a year and grasping your overall financial commitment.

-

Estimate Property Taxes: We know how challenging it can be to navigate local tax rates, which vary significantly by location. For instance, New Jersey has the highest average property tax at $10,485 annually, while West Virginia boasts the lowest at just $1,063. By calculating your estimated property tax based on your residence’s value, you will have a clearer understanding of what house can I afford on 100k a year regarding your annual costs.

-

Calculate Homeowners Insurance: Homeowners insurance costs can also differ widely. In 2025, the average premium per month across the U.S. is roughly $244, influenced by factors such as location and property age. For example, residences built in 1980 average $210 per month for insurance, while newer properties generally face lower premiums due to reduced risk. For a property valued at $450,000, the average monthly premium is $288 with a $500 deductible, $279 with a $1,000 deductible, and $233 with a $5,000 deductible.

When considering what house can I afford on 100k a year, it’s advisable to budget around 1% of your property’s value annually for maintenance. This means that for a $450,000 property, you should plan to allocate approximately $4,500 each year for repairs and upkeep. The average annual maintenance cost is around $8,808, which can help you avoid unexpected financial strain.

-

Consider HOA Charges: If your new home is part of a community with an HOA, it’s important to include any regular or annual fees in your budget. The typical condo or HOA charge was $135 in 2024, which can significantly contribute to your total housing expenses.

-

Total Additional Costs: Finally, sum these additional costs to your monthly housing budget. This comprehensive approach ensures that you can determine what house can I afford on 100k a year without being caught off guard by hidden expenses. By planning for these factors, you’re empowered to make informed decisions and avoid the common pitfalls that lead many homeowners to regret their purchases due to unforeseen costs.

Utilize a Mortgage Affordability Calculator

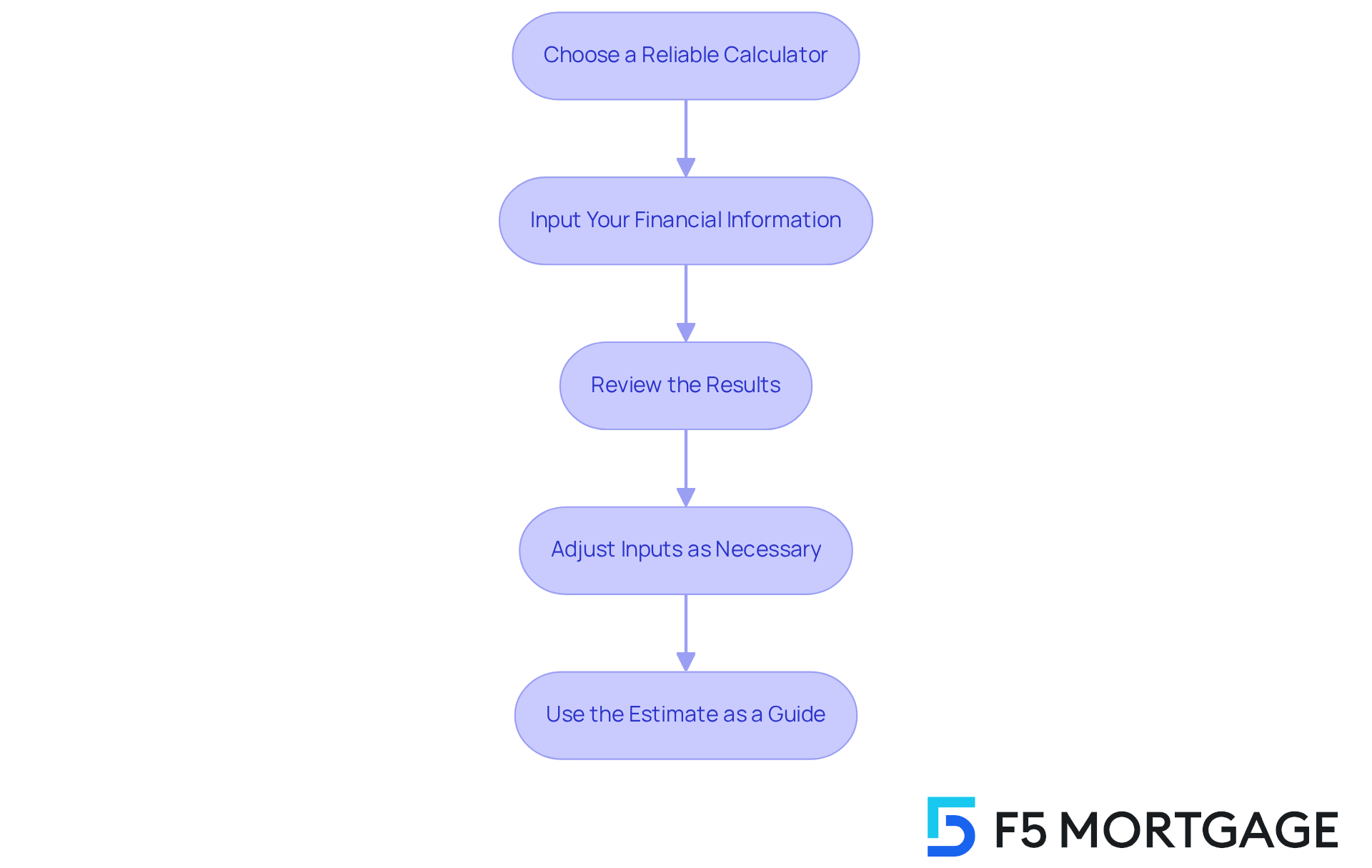

Using a mortgage affordability calculator is crucial for assessing how much home you can afford based on your income, debts, and initial contribution. By entering your financial details, you can obtain an estimate of your highest property price and recurring charge, which acts as a useful starting point in your property purchasing journey.

- Choose a Reliable Calculator: We know how challenging this can be, so opt for tools from reputable sources such as Zillow or Bankrate, known for their accuracy and comprehensive data.

- Input Your Financial Information: Enter your yearly income, recurring debts, and deposit amount. For families earning $100,000, it is essential to understand what house can I afford on 100k a year, especially considering that the average property price in the U.S. is roughly $418,489.

- Review the Results: The calculator will offer an estimated home price and recurring cost, assisting you in assessing your affordability.

- Adjust Inputs as Necessary: Experiment with different down deposit amounts or interest rates to see how they influence your affordability. For example, a 20% down deposit can greatly reduce your monthly housing cost, making homeownership more achievable.

- Use the Estimate as a Guide: While calculators provide a reliable estimate, it’s wise to consult with a loan broker for tailored advice. As noted by industry experts, the lender’s loan estimate is often more accurate than online calculators, providing a clearer picture of your financial obligations.

Real-world examples illustrate the effectiveness of these calculators. For instance, a family utilizing a loan calculator discovered that modifying their down payment from 10% to 20% enabled them to purchase a residence in a more appealing area. This highlights the importance of understanding how different financial scenarios can impact your home-buying options.

In summary, utilizing a loan affordability calculator can help you understand what house you can afford on 100k a year, enabling you to make informed choices that ensure your property purchase aligns with your financial capabilities. We’re here to support you every step of the way.

Explore Mortgage Options and Next Steps

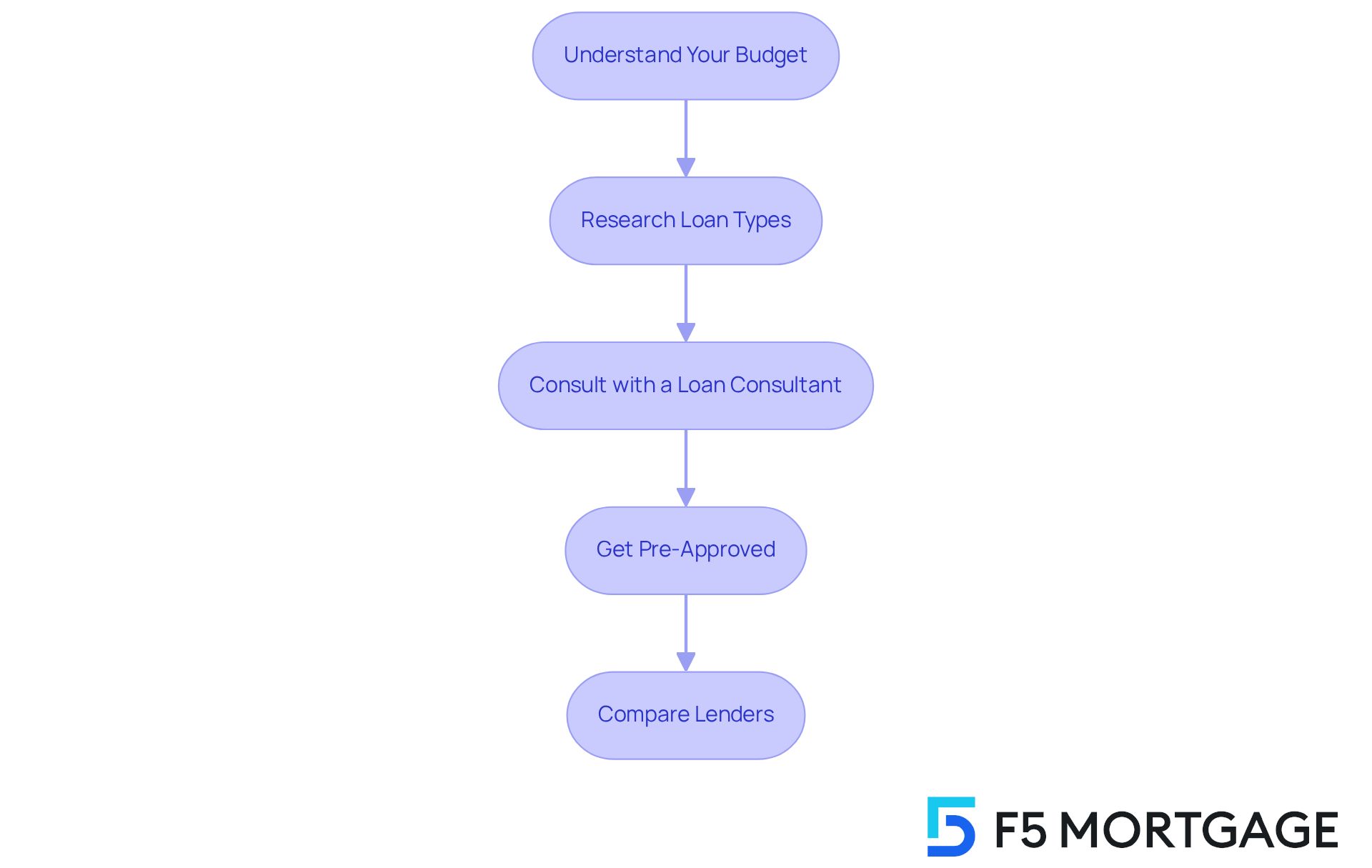

Understanding your budget and what house can I afford on 100k a year is just the beginning. The next step is to explore various loan options that are tailored to your unique financial situation. Different types of loans, such as fixed-rate, adjustable-rate, FHA, and VA options, each come with their own advantages and requirements, which can significantly impact your home purchasing journey.

-

Research Loan Types: It’s important to familiarize yourself with the differences between fixed-rate and adjustable-rate loans. Fixed-rate mortgages provide stability with consistent monthly payments, while adjustable-rate mortgages may offer lower initial rates that can change over time. FHA loans, which require as little as 3.5% down and a minimum credit score of 580, are particularly beneficial for buyers with lower credit scores. For veterans and active-duty personnel, VA loans are an excellent option, offering zero upfront costs. At F5 Mortgage, we provide a variety of low down payment options, including specific programs designed to help you achieve homeownership without the stress of a large upfront cost.

-

Consult with a Loan Consultant: Engaging with a loan consultant can be incredibly helpful. Brokers have access to a wide array of lenders and can guide you through the complexities of financing options. As Erika Giovanetti wisely notes, “The suitable loan for you relies on your distinct financial objectives and home purchasing circumstances.” A broker can offer personalized advice, helping you choose the most appropriate loan type for your needs while simplifying the process to save you time and effort.

-

Get Pre-Approved: Once you’ve selected a mortgage type, seeking pre-approval is a crucial next step. This not only clarifies your budget but also strengthens your position when you evaluate what house can I afford on 100k a year while making offers on properties.

-

Compare Lenders: Take the time to investigate various lenders to discover the most competitive rates and favorable terms. Some lenders may offer low down payment options, while others might provide better interest rates or closing timelines. At F5 Mortgage, we are dedicated to delivering exceptional customer service and flexible loan options tailored to your needs.

To prepare for your property search, consider what house can I afford on 100k a year; with pre-approval in hand, you can confidently begin focusing on options that fit within your budget. This preparation is vital, allowing you to act swiftly in a competitive market.

Real-life examples highlight the benefits of working with brokers. Many clients have successfully navigated the mortgage process with personalized guidance from F5 Mortgage, resulting in favorable loan terms and a smoother home-buying experience. By understanding your options and leveraging expert advice, you can make informed decisions that align with your financial goals. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding what house you can afford on a $100,000 annual income can feel overwhelming. We know how challenging this can be, but with a thorough assessment of your financial health and strategic planning, you can navigate this journey with confidence. By evaluating your income, expenses, and the additional costs of homeownership, you can make informed decisions that truly align with your financial capabilities.

Key steps include:

- Calculating your debt-to-income ratio

- Assessing your net income against monthly expenses

- Accounting for property taxes, insurance, and maintenance costs

Utilizing a mortgage affordability calculator can provide valuable insights into potential home prices and monthly payments. This tool enables you to explore various loan options tailored to your unique circumstances.

Ultimately, the journey toward homeownership on a $100,000 salary is about more than just finding a house; it’s about making smart financial choices that ensure long-term stability and satisfaction. By taking the time to understand your personal finances, leveraging expert advice, and preparing diligently, you can navigate the complexities of the housing market with assurance. This proactive approach not only enhances the likelihood of securing a suitable home but also fosters a sustainable financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What financial documents should I gather to understand my financial situation?

You should gather essential financial documents including pay stubs, tax returns, and bank statements.

Why is it important to assess my total income?

Assessing your total income, including bonuses and additional sources, is crucial for understanding your financial situation and determining your debt-to-income (DTI) ratio.

What should I include in my list of monthly debts?

You should include all regular debt obligations such as credit card payments, student loans, and car loans.

How do I calculate my debt-to-income (DTI) ratio?

To calculate your DTI ratio, divide your total monthly debts by your gross monthly income. Aim for a ratio below 36% for better mortgage options.

What is considered a healthy DTI ratio for mortgage applications?

Lenders typically prefer a DTI ratio of 36% or lower to minimize risk and improve approval chances.

What is the home-to-value loan ratio that many lenders require?

Many lenders require homeowners to have at least an 80% home-to-value loan ratio, meaning you should have paid down at least 20% of your original loan amount or your home should have increased in value.

Why is it important to keep a cash reserve when buying a home?

Keeping a cash reserve to cover several months of housing payments is prudent in case of income loss.

Should I open new lines of credit during the homebuying process?

It is advisable to avoid opening new lines of credit during the homebuying process to help maintain a low DTI.

How do I calculate my net monthly income?

Calculate your net monthly income by using your after-tax income for accuracy.

What expenses should I list to evaluate my financial situation?

You should list all regular expenses, including utilities, groceries, transportation, and entertainment.

How do I determine my disposable income?

To determine your disposable income, subtract your total expenses from your net income.

What percentage of my gross monthly income should I aim to allocate for housing costs?

Aim to keep housing costs within 28% of your gross monthly income. For example, this translates to approximately $2,333 for a $100,000 salary.