Overview

FHA loans offer significant benefits for families looking to upgrade their homes. With low down payment requirements, flexible credit standards, and competitive interest rates, homeownership becomes more accessible than ever. We know how challenging this can be, and these features are designed to alleviate financial burdens. By promoting homeownership among families, FHA loans play a crucial role in enhancing living conditions and fostering community stability.

Imagine the relief of knowing that your dream home is within reach. These loans not only support your financial journey but also empower you to create a better environment for your loved ones. As you navigate this process, remember that we’re here to support you every step of the way. Embrace the opportunity to improve your living situation and contribute to a thriving community.

Introduction

FHA loans have emerged as a vital resource for families seeking to upgrade their homes. They provide a pathway to homeownership that is often more accessible than traditional financing options. With benefits like low down payment requirements and flexible credit standards, these loans empower families to invest in their living spaces without the burden of overwhelming financial constraints.

However, we know how challenging this journey can be. As many families navigate this complex landscape, a key question arises: How can they effectively leverage the advantages of FHA loans to not only secure a home but also enhance their overall quality of life? We’re here to support you every step of the way.

F5 Mortgage: Personalized FHA Loan Solutions for Homebuyers

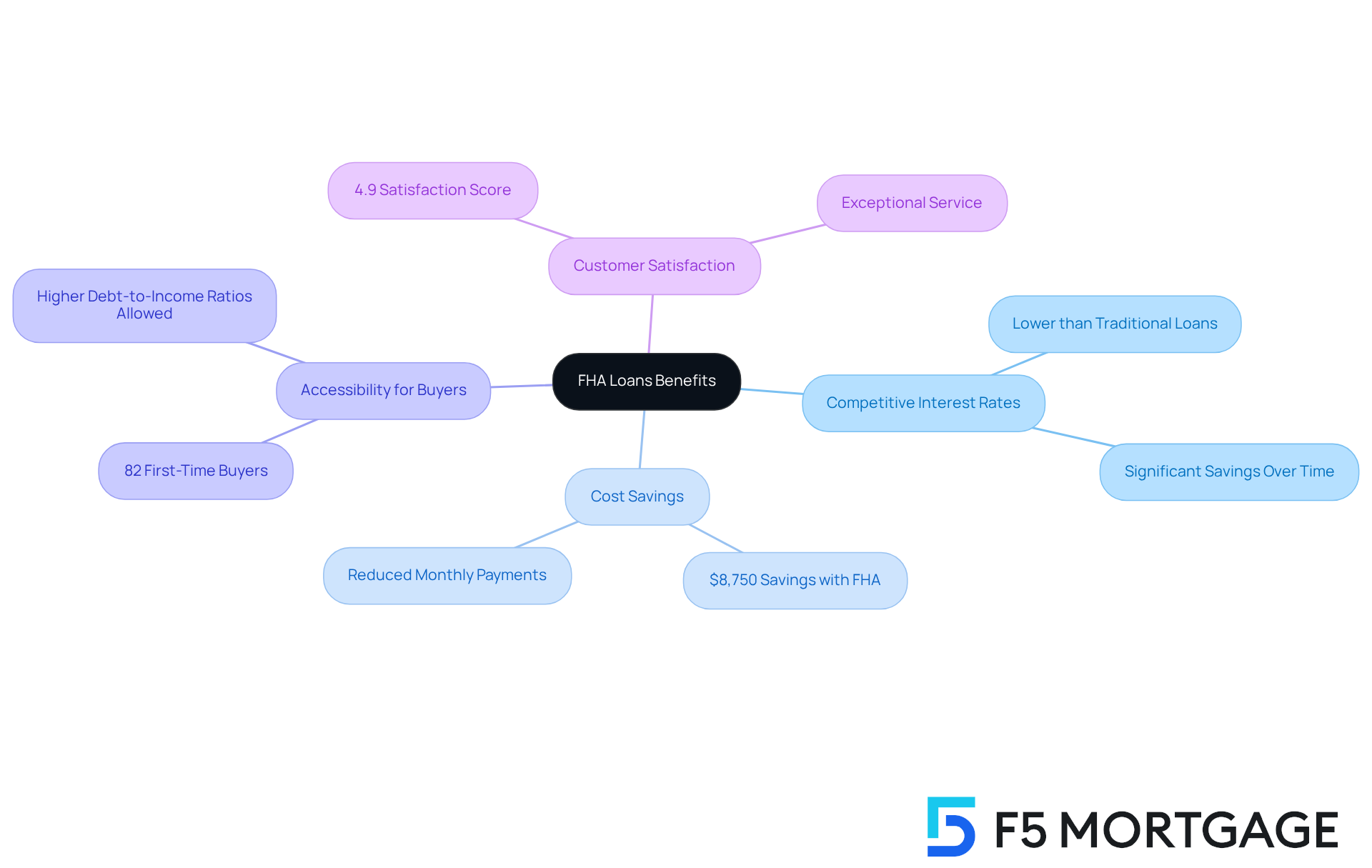

At F5 Mortgage, we understand how challenging the journey to homeownership can be. That’s why we excel in providing customized options that highlight the FHA loan benefits tailored to the unique needs of families looking to enhance their residences. Our priority is your satisfaction, which is why we conduct personalized consultations that help you understand the FHA loan benefits. We’re here to help you identify the most advantageous options for your situation.

This personalized approach simplifies the mortgage process, allowing for pre-approval in less than an hour. We empower you to make informed choices about your home financing. Our focus on tailored service significantly enhances client satisfaction, as you’ll feel supported and understood throughout your mortgage journey.

Don’t just take our word for it—testimonials from our pleased clients highlight our commitment to outstanding service. Many commend our team’s responsiveness and expertise in securing favorable financing terms. This client-centered approach ensures that you receive no-pressure assistance and quick financing closure, often in under three weeks. With F5 Mortgage, you can trust that you have a reliable ally by your side as you navigate your path to homeownership.

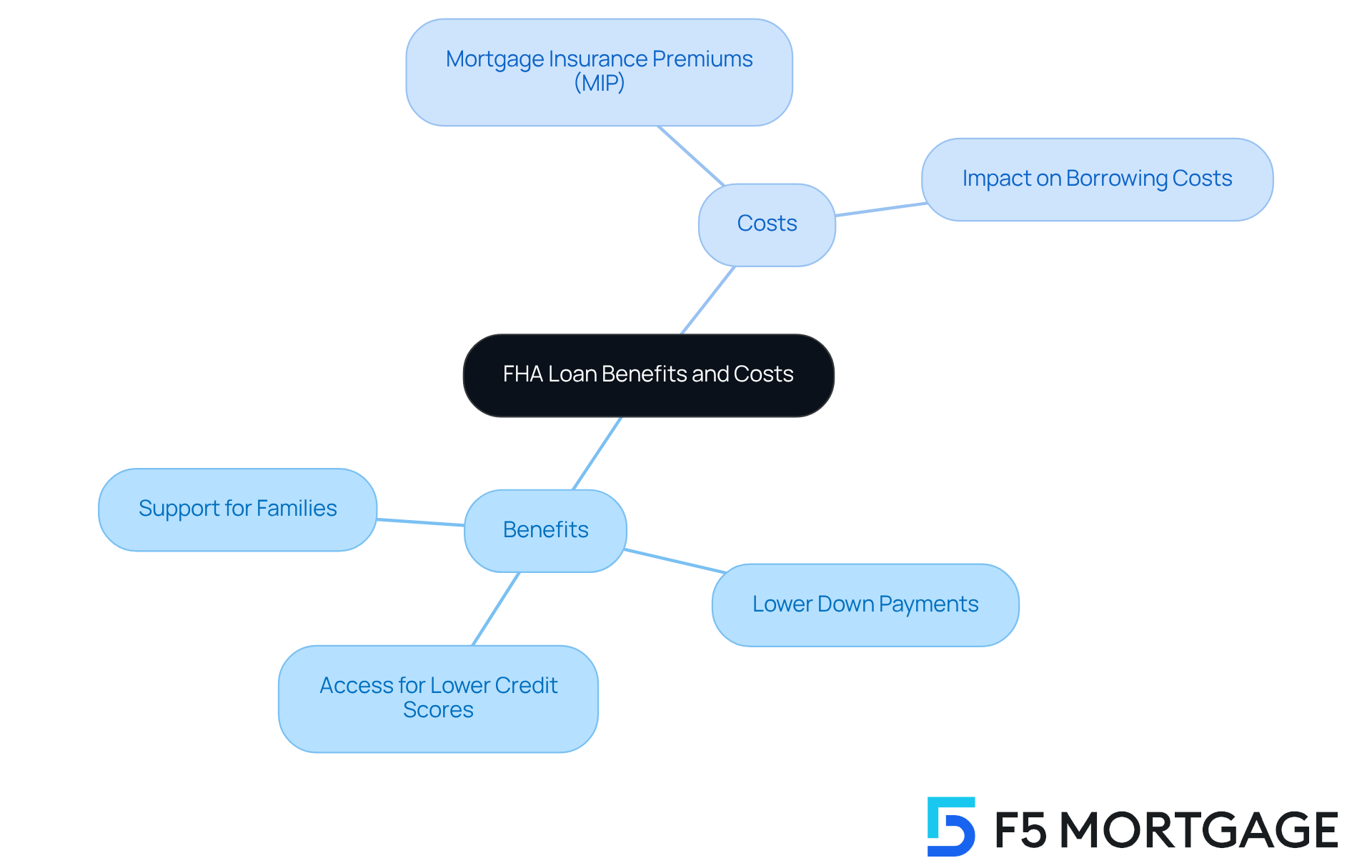

Lower Down Payment Requirements: A Major Advantage of FHA Loans

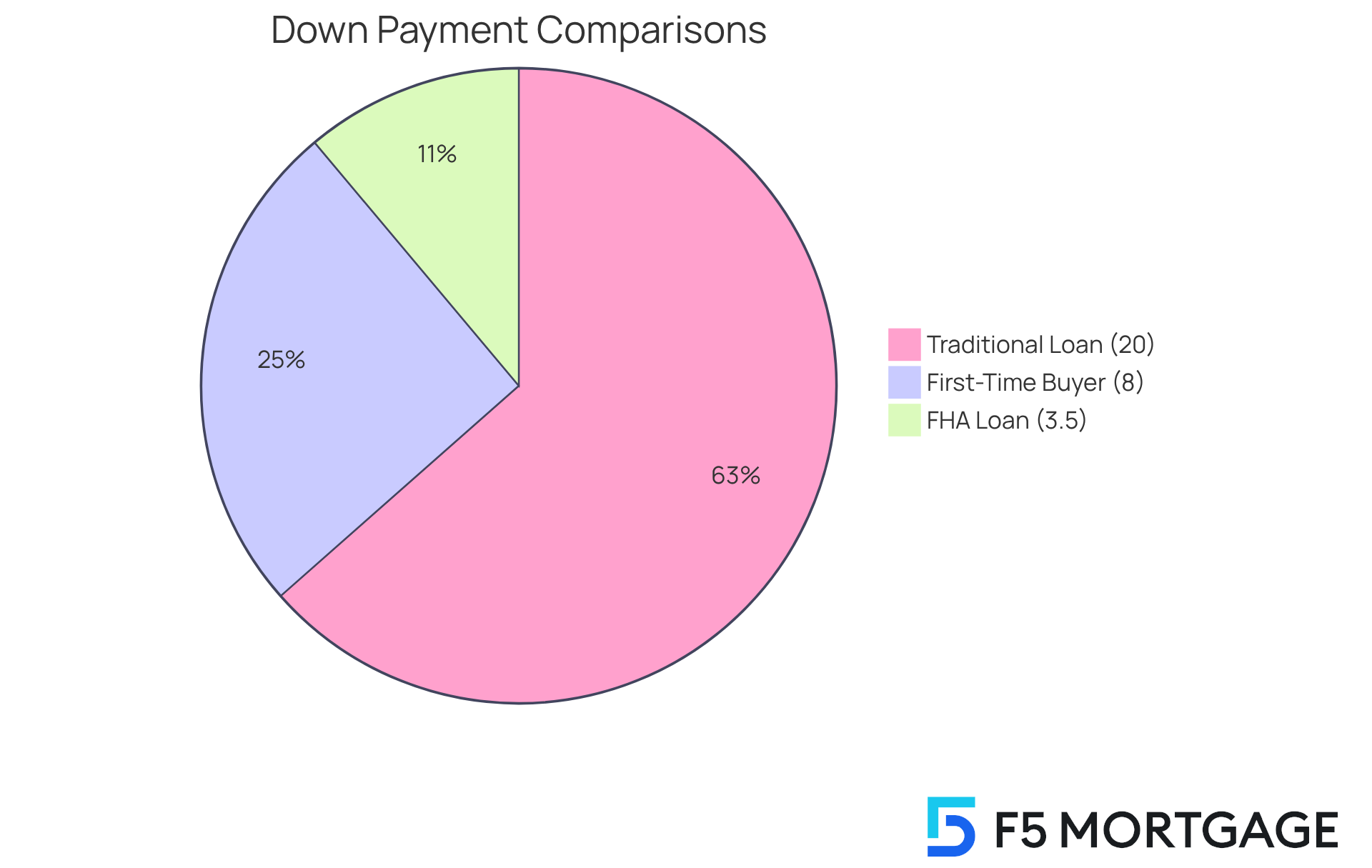

One of the fha loan benefits is their remarkably low down payment requirement, which can be as little as 3.5% of the purchase price. This feature greatly assists families looking to enhance their residences, as it reduces the necessity to accumulate a substantial amount for a down payment. For instance, a household buying a $300,000 home would only need to offer $10,500 upfront, making homeownership more attainable. We know how challenging it can be to save for a down payment, and financial advisors stress that reduced down payments enable families to access the housing market earlier, allowing them to direct resources toward other vital expenses.

Statistics show that many families encounter difficulties when saving for down payments, with over half of homebuyers relying on personal savings. The median down payment for first-time buyers is often around 8%, highlighting the financial strain many experience. The fha loan benefits offer a pathway for families with limited savings to obtain a home without the burden of a substantial down payment.

Furthermore, FHA mortgages allow buyers to use gift funds and down payment assistance programs for their initial payment, further easing financial strain. Real-life examples illustrate this advantage: families who have used FHA financing express increased confidence in their ability to purchase homes, thanks to the reduced financial hurdle. This accessibility not only encourages homeownership but also nurtures stability and growth within communities, highlighting the FHA loan benefits as an essential resource for families seeking to improve their living conditions. Moreover, FHA mortgages may permit higher debt-to-income ratios compared to traditional financing, which can be beneficial for families managing existing debt.

For families considering an FHA mortgage, seeking guidance from a mortgage consultant at F5 Mortgage can provide valuable insights and help navigate the wide range of financing options available, including both standard and nontraditional products. F5 Mortgage offers a variety of financing programs designed for different financial needs, ensuring that families have access to the best choices for their unique situations. We’re here to support you every step of the way.

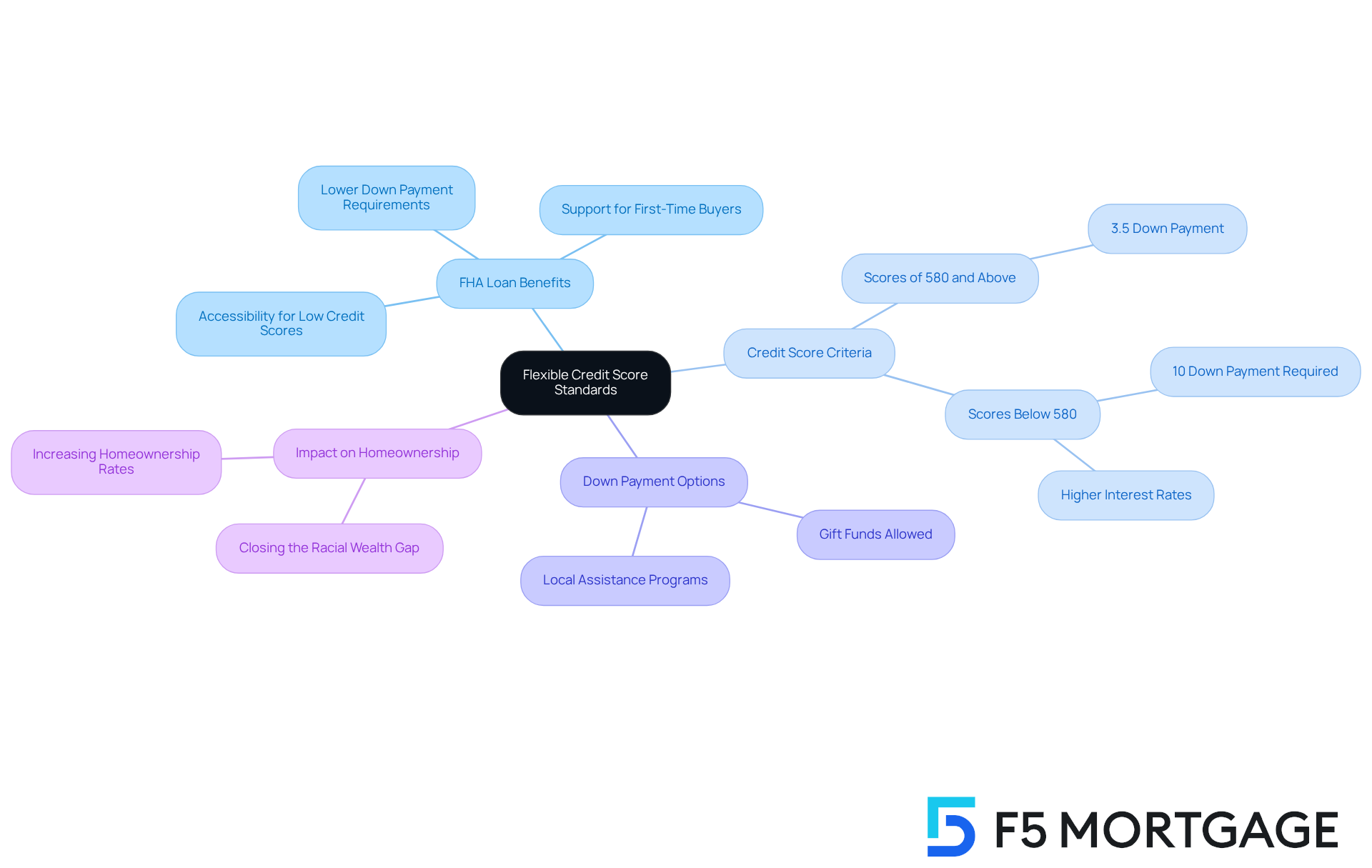

Flexible Credit Score Standards: FHA Loans for Diverse Borrowers

The FHA loan benefits include flexible credit score criteria, which enable borrowers with scores as low as 580 to access low down payment options. We understand how challenging it can be to navigate credit issues, and this flexibility significantly enhances homeownership opportunities for families who may have faced difficulties in the past. For those with credit scores below 580, the FHA still provides pathways to qualification, though with a higher down payment requirement, further broadening access to financing.

In 2023, an impressive 82% of FHA purchase financing was secured by first-time buyers, underscoring the program’s vital role in promoting homeownership for moderate-income households. Specialists emphasize that credit ratings are essential in determining mortgage eligibility, with higher scores typically leading to better borrowing conditions. However, we want you to know that the FHA loan benefits include allowing individuals with less-than-perfect credit to qualify, provided they demonstrate responsible financial behavior, such as maintaining a consistent payment history.

This inclusive approach not only helps families achieve their homeownership dreams but also works to close the gap in homeownership rates across different communities. We’re here to support you every step of the way, ensuring that you have the guidance needed to navigate this process with confidence.

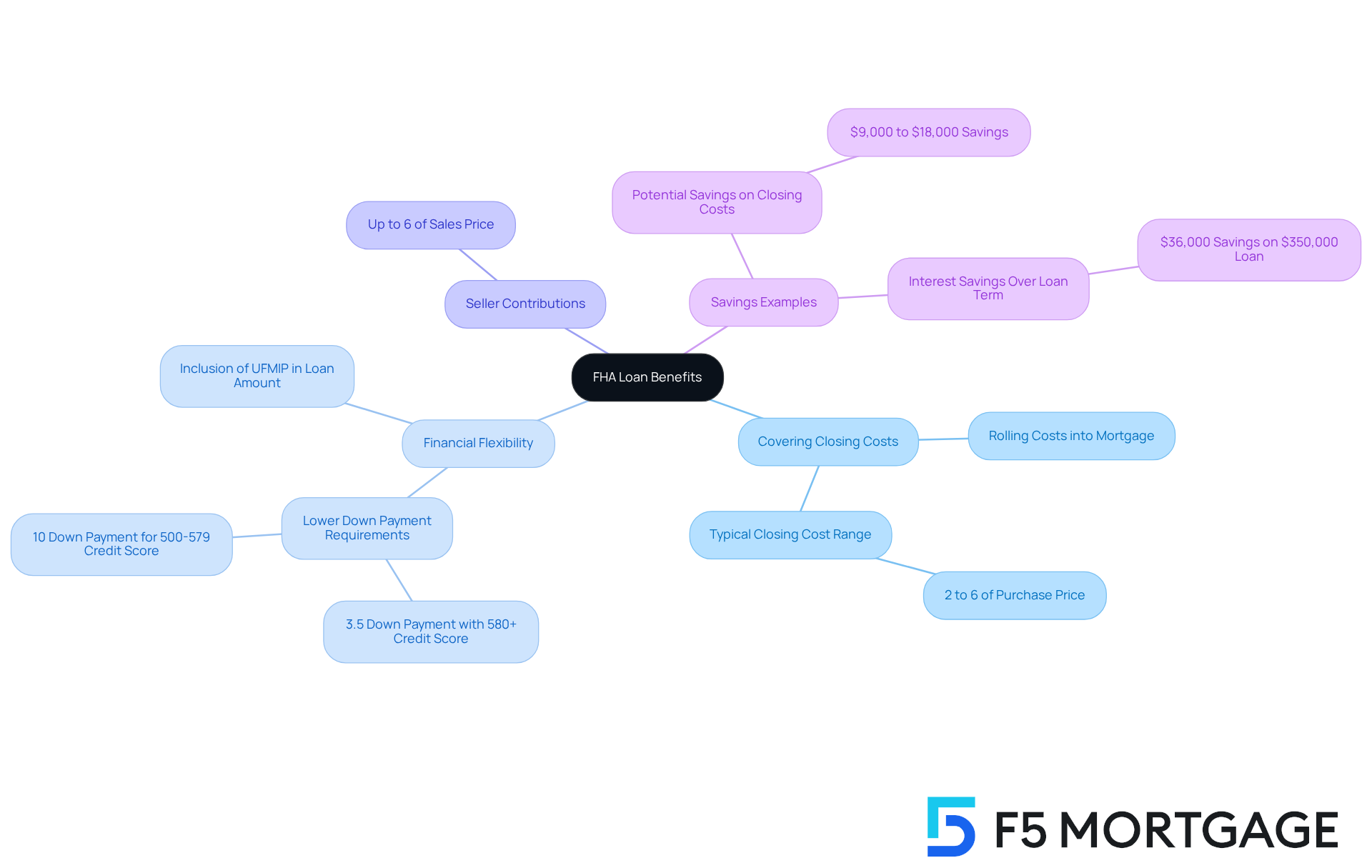

Competitive Interest Rates: Save More with FHA Loans

FHA mortgages are recognized for their competitive interest rates, often lower than those of traditional financing options. This can lead to significant savings over the life of the mortgage. For households enhancing their residences, these lower rates can greatly reduce monthly mortgage costs and total interest expenditures. For instance, a household obtaining a $250,000 FHA mortgage with a 3.5% down payment could save around $8,750 upfront compared to a traditional mortgage requiring a 20% down payment. This financial assistance allows families to redirect resources towards crucial home improvements or other essential expenses.

Additionally, FHA mortgages permit elevated debt-to-income ratios, empowering households with diverse financial situations to qualify more easily. In 2023, 82% of FHA purchase financing was utilized by first-time buyers, underscoring the program’s accessibility and appeal. Economists note that the flexibility of FHA financing, along with its FHA loan benefits such as reduced upfront costs, makes it an attractive option for families looking to enhance their living spaces without stretching their budgets.

F5 Mortgage has achieved an impressive customer satisfaction score of 4.9 from over 300 reviews, reflecting the exceptional service provided to clients throughout the mortgage process. Real-life examples illustrate the cost savings provided by FHA loan benefits: families that opted for FHA options reported being able to invest in renovations and improvements that would have been financially challenging with traditional financing. This strategic choice not only enhances their homes but also improves their overall quality of life, highlighting the FHA loan benefits as a wise financial decision for families seeking to upgrade their living spaces.

Mortgage Insurance Benefits: Understanding FHA Loan Costs

FHA mortgages come with mortgage insurance premiums (MIP), which are designed to protect lenders in the event of a default. We understand that this can increase the overall cost of borrowing, but it also opens doors for families with lower credit scores and smaller down payments. This financing option offers FHA loan benefits that can be a lifeline for those who might otherwise struggle to secure a mortgage.

Understanding how MIP works is crucial for families as they weigh the FHA loan benefits in comparison to their expenses. By doing so, you can make more informed financial decisions that align with your goals. Remember, we’re here to support you every step of the way as you navigate this important journey.

Financing Closing Costs: Ease Financial Burden with FHA Loans

The FHA loan benefits include a unique advantage that allows households to cover their closing costs, significantly easing the financial burden of purchasing a home. This feature lets borrowers roll these costs into their mortgage, which means less immediate cash is needed at closing. For instance, families buying a home valued at $350,000 could save about $9,000 to $18,000 in upfront costs, making their transition to a new home smoother and less stressful.

We know how challenging it can be for many property buyers to face substantial closing expenses, which typically range from 2% to 6% of the home’s purchase price. By opting for FHA financing, families can enjoy FHA loan benefits that help lower these costs, allowing them to manage their finances more effectively. Moreover, FHA guidelines permit sellers to contribute up to 6% of the property’s sales price toward the buyer’s closing costs, further alleviating the financial load.

Mortgage professionals emphasize that FHA loan benefits provide vital flexibility for first-time homebuyers or those with limited savings, creating a pathway to homeownership without the immediate financial strain. The ability to include closing costs in the loan amount means families can focus on settling into their new homes instead of worrying about initial expenses. This approach not only simplifies the financial transition but also empowers families to make informed decisions about their property purchase, ultimately enhancing their overall experience in the buying process.

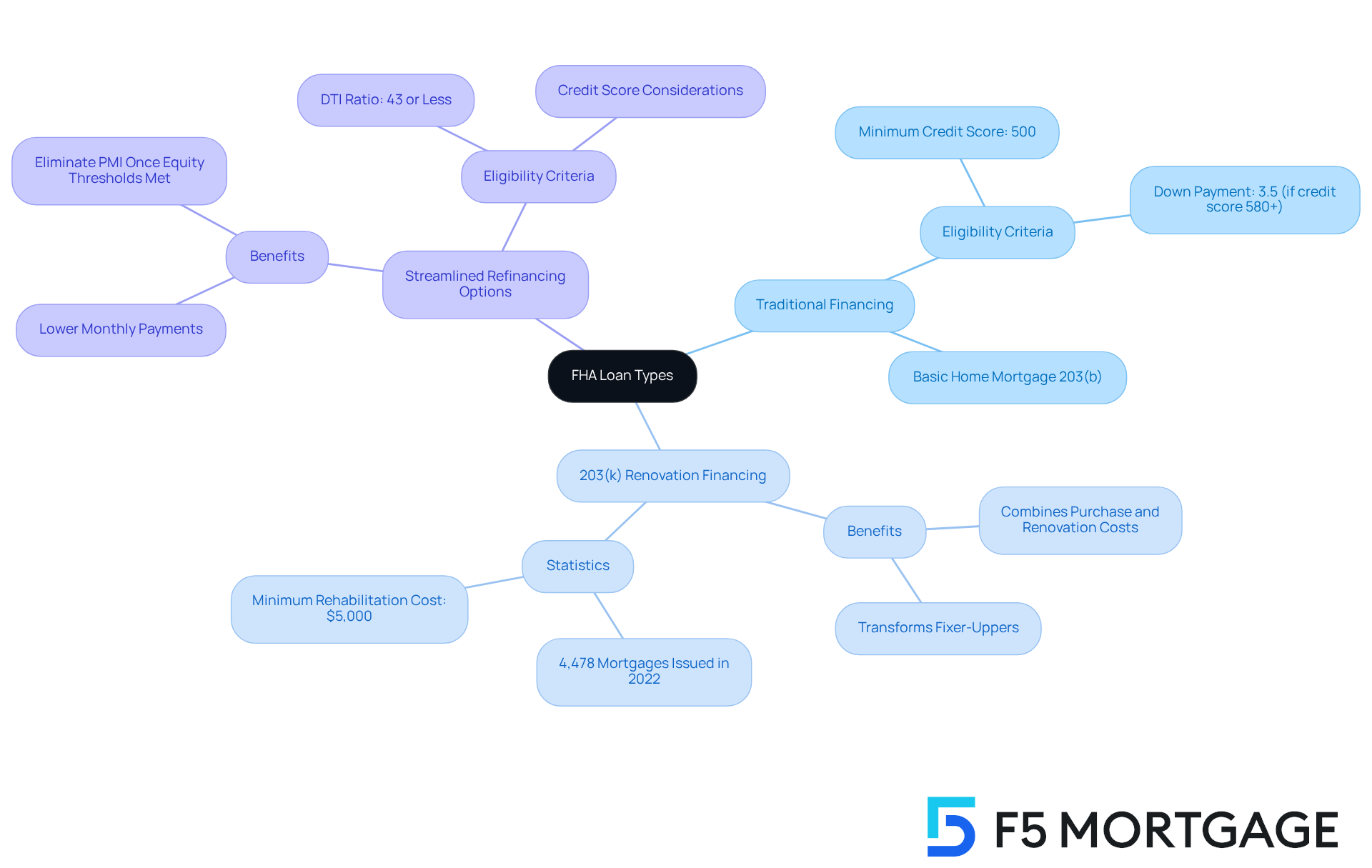

Variety of FHA Loan Types: Tailored Solutions for Homebuyers

The FHA loan benefits offer a variety of choices, including traditional property acquisition financing, 203(k) renovation financing, and streamlined refinancing options. This diversity empowers families to select financing that aligns with their unique needs, whether they are buying a new home, renovating an existing property, or refinancing an FHA mortgage.

The FHA 203(k) program, which allows borrowers to fund both the purchase and renovation of a home, has seen a significant increase in interest. With 4,478 mortgages issued, this reflects a growing recognition of its benefits. Families utilizing 203(k) financing have successfully transformed fixer-uppers into their dream homes, highlighting the program’s potential to enhance property value and improve community aesthetics.

Moreover, the FHA loan benefits are designed to accommodate various financial situations. With FHA loan benefits that include a minimum credit score of 500 and a debt-to-income ratio of 43% or less, these choices become appealing for families seeking personalized mortgage solutions. Additionally, FHA loan benefits include refinancing options available through FHA mortgages, which enable homeowners to adjust their financing terms, potentially lowering monthly payments and eliminating private mortgage insurance (PMI) once equity thresholds are met.

As mortgage expert Warren Buffett wisely states, a home is not merely a financial asset; it is also a place where cherished memories are created. We know how challenging this process can be, but we’re here to support you every step of the way.

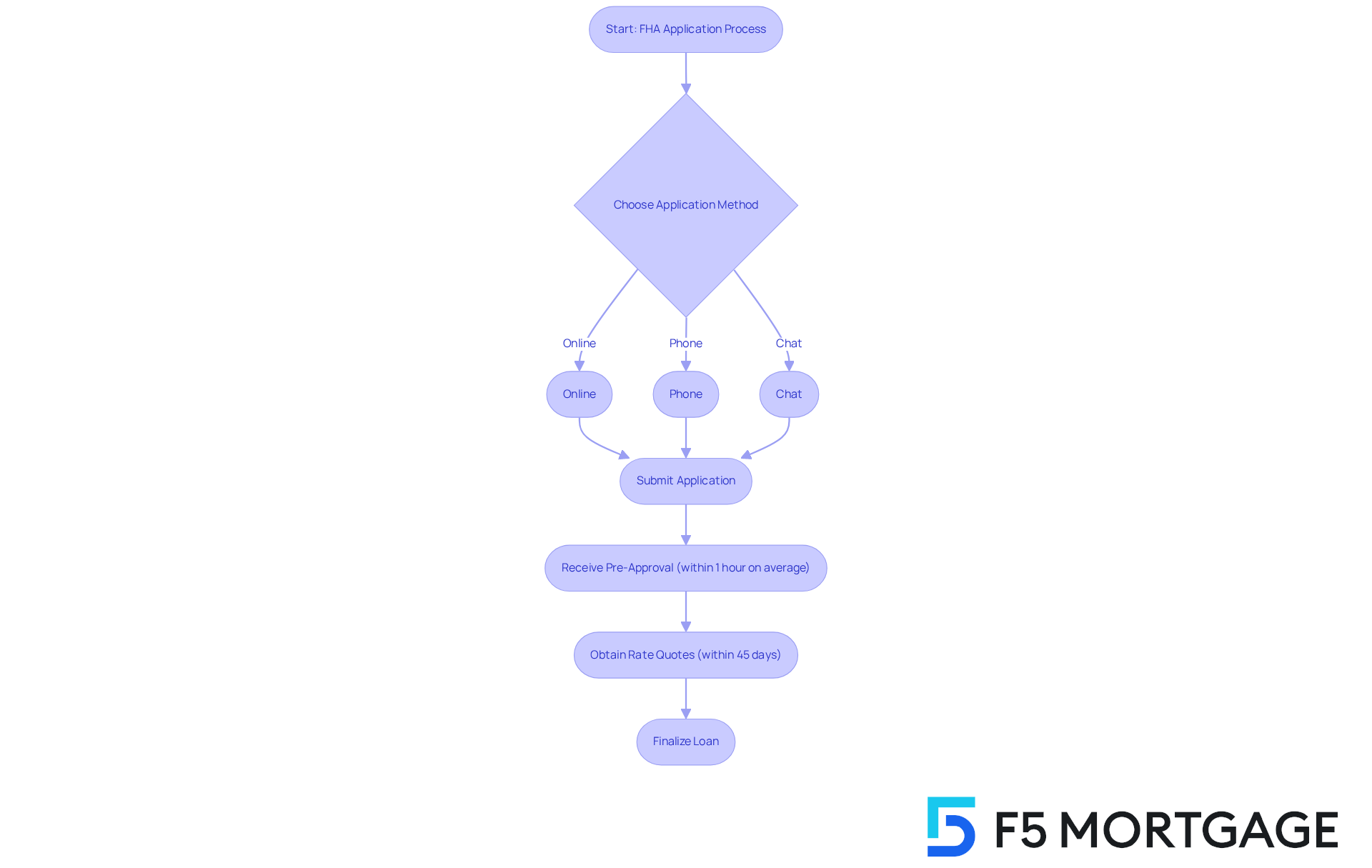

Streamlined Application Process: Quick Access to FHA Loans

Navigating the FHA application procedure can feel overwhelming, but it’s designed for efficiency, allowing households to secure funding quickly. At F5 Mortgage, we understand how important this process is for families, and we strive to provide a streamlined experience that minimizes paperwork and accelerates approval times. You can apply online, by phone, or through chat, enabling us to tailor financial solutions that meet your unique needs.

This approach is especially beneficial for families juggling various responsibilities, as it allows you to obtain the necessary funding without unnecessary delays. Many families have shared their experiences, with numerous clients receiving pre-approval in less than an hour. This reflects our commitment to ensuring swift access to FHA financing.

Moreover, F5 Mortgage connects you with top realtors in your area, offering collaborative support throughout your home-buying journey. Research shows that obtaining just one additional rate quote could save homebuyers an average of $1,500 over the life of the loan. We recommend that families conduct their mortgage shopping within a 45-day window to minimize the impact on credit scores.

By choosing F5 Mortgage, you can confidently navigate the complexities of FHA financing and take advantage of FHA loan benefits, allowing you to focus on what truly matters—upgrading your home. Remember, we’re here to support you every step of the way.

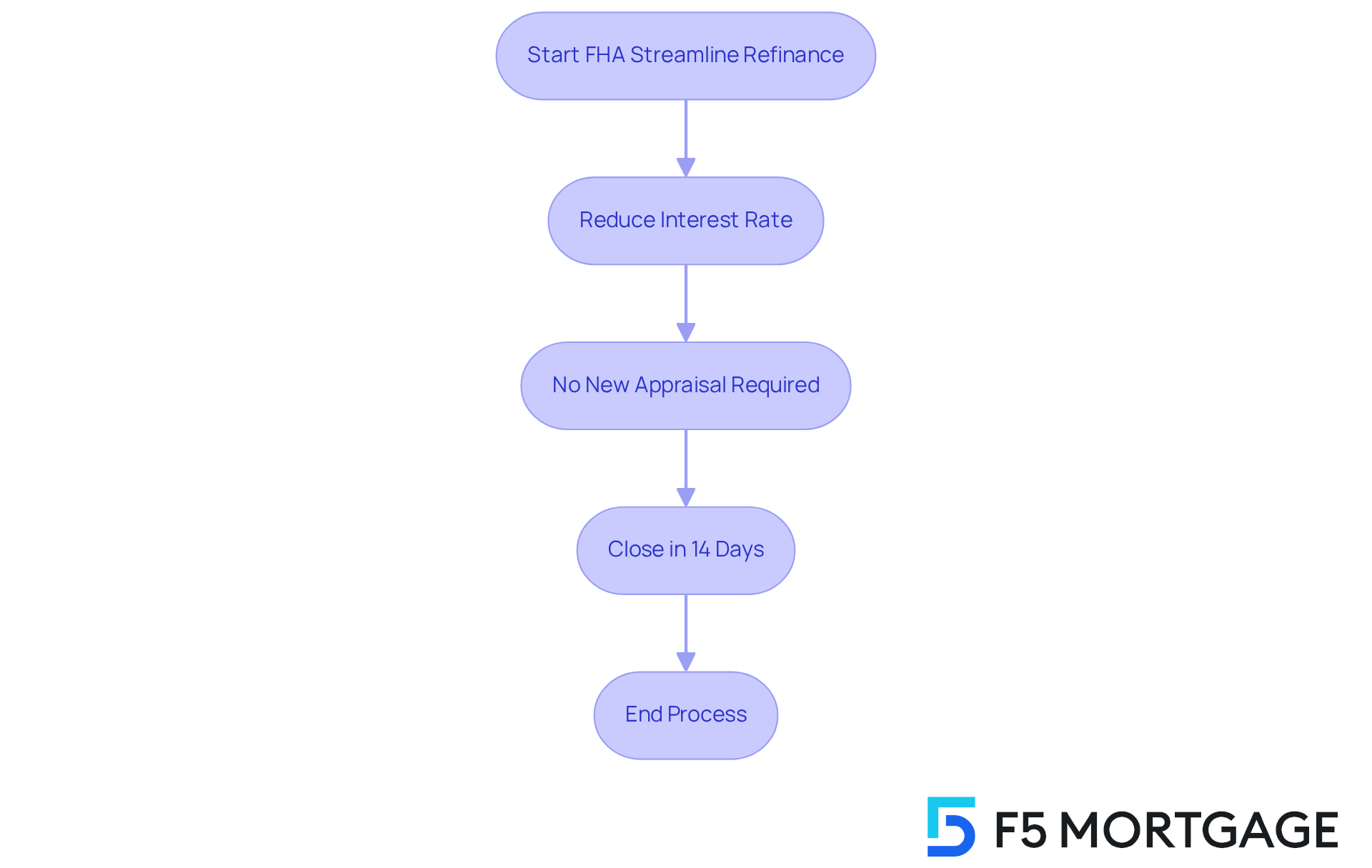

Refinancing Opportunities: Leverage FHA Loans for Better Terms

The FHA loan benefits include valuable refinancing options, particularly through the FHA Streamline Refinance program. This program allows homeowners to reduce their interest rates with minimal documentation, which can be a significant relief for families seeking to lower their monthly payments or improve their financial situation without the stress of extensive paperwork. For instance, by reducing their interest rate from 7.25% to 6.5% on a $400,000 mortgage, households can save around $200 each month. This savings can be redirected towards essential expenses like education or healthcare, making a real difference in their lives.

Moreover, the FHA Streamline Refinance does not require a new appraisal, which speeds up the refinancing process. Families can close loans in as little as 14 days, a crucial advantage for those looking to seize favorable market conditions. Importantly, homeowners can refinance even if they owe more than their home’s value, making this option accessible for those facing negative equity situations.

Financial advisors emphasize that the FHA Streamline Refinance provides FHA loan benefits, which can lead to substantial savings over the life of the mortgage, ultimately enhancing overall financial health. By lowering interest rates and potentially lengthening loan terms, households can significantly decrease their monthly payments. This creates more room in their budgets for savings or other vital needs. This program not only simplifies the refinancing process but also empowers families to achieve greater financial stability and housing affordability. We’re here to support you every step of the way in navigating these options.

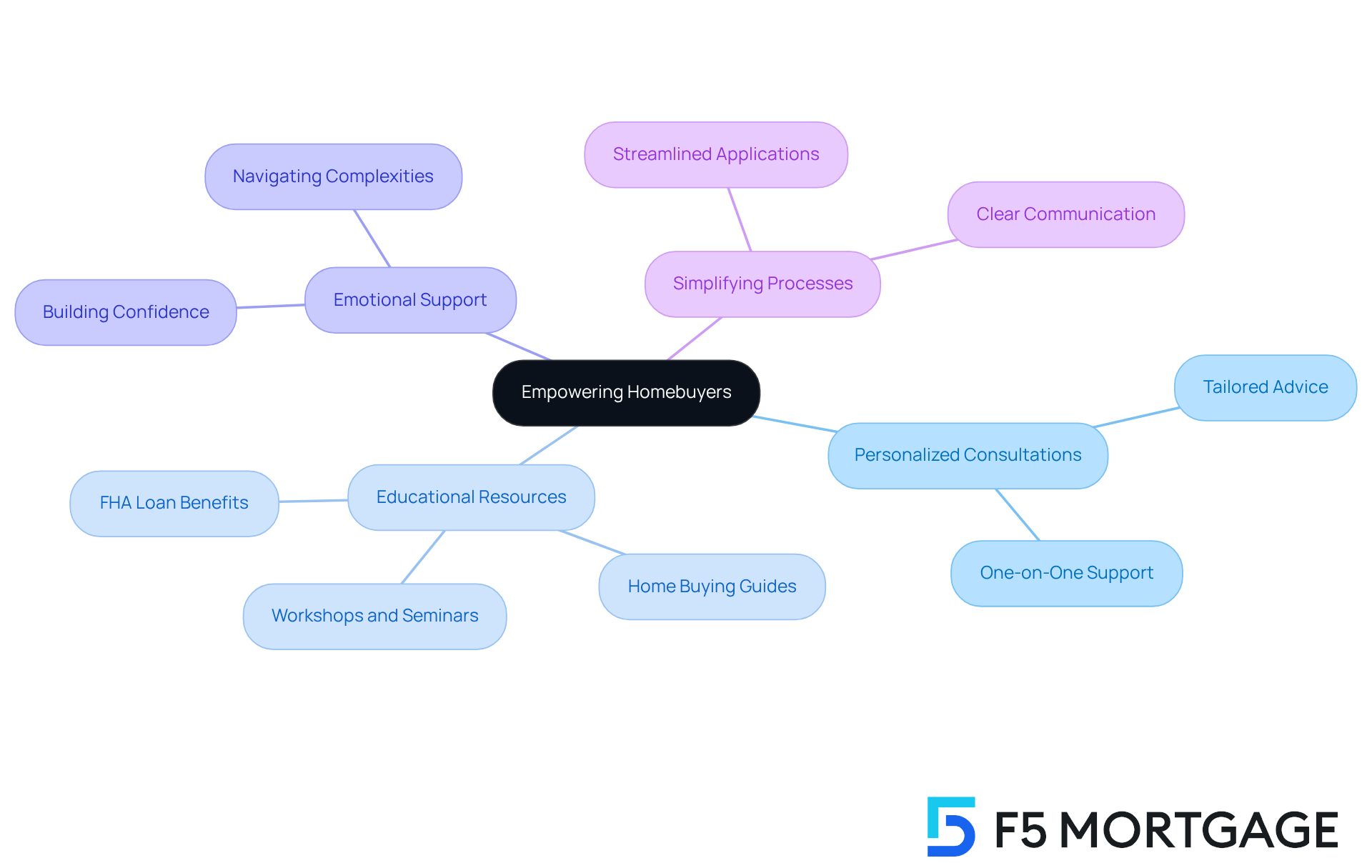

Comprehensive Support from F5 Mortgage: Empowering Homebuyers

At F5 Mortgage, we understand how challenging the home buying process can be. That’s why we are committed to empowering homebuyers by providing extensive support and resources tailored to your needs. Through personalized consultations and a wealth of educational materials, we ensure that families are well-informed throughout their mortgage journey.

This dedication to client education not only enhances your home buying experience but also instills confidence in making informed financial decisions. We know how important it is for families to navigate the complexities of FHA loan benefits easily. With our commitment to simplifying the process, we foster a deeper understanding of your options.

By prioritizing education, we help families feel secure and knowledgeable as they embark on their path to homeownership. We’re here to support you every step of the way, making this journey as smooth as possible.

Conclusion

FHA loans offer a wonderful opportunity for families eager to enhance their homes, presenting a variety of benefits that simplify the journey to homeownership. With low down payment requirements, flexible credit standards, and competitive interest rates, these loans make securing financing easier for families, allowing them to invest in their living spaces. By understanding and utilizing the benefits of FHA loans, families can confidently navigate the complexities of home buying and realize their dreams of homeownership.

This article has explored key advantages of FHA loans, such as:

- The accessibility of lower down payments

- The inclusivity of flexible credit score standards

- The potential for significant savings on interest rates

- The ability to cover closing costs

- The variety of loan types available

These features collectively empower families to make informed decisions and improve their financial situations while upgrading their homes.

In summary, the benefits of FHA loans are a vital resource for families looking to improve their living conditions. By embracing these opportunities, families can achieve homeownership and foster stability and growth within their communities. If you are considering an FHA loan, seeking expert guidance from professionals like F5 Mortgage can provide the support you need to navigate this rewarding journey. We know how challenging this can be, but together, we can take that first step toward transforming your living space into the home of your dreams.

Frequently Asked Questions

What does F5 Mortgage offer to homebuyers?

F5 Mortgage provides personalized FHA loan solutions tailored to the unique needs of families, helping them understand the benefits of FHA loans and guiding them through the mortgage process.

How quickly can I get pre-approved for a mortgage with F5 Mortgage?

F5 Mortgage can facilitate pre-approval in less than an hour, simplifying the mortgage process for homebuyers.

What are the advantages of FHA loans regarding down payment requirements?

FHA loans have a low down payment requirement, as low as 3.5% of the purchase price, making homeownership more accessible for families with limited savings.

Can gift funds or down payment assistance be used with FHA loans?

Yes, FHA mortgages allow buyers to use gift funds and down payment assistance programs, further easing the financial burden of home purchasing.

What credit score is needed to qualify for an FHA loan?

Borrowers with credit scores as low as 580 can access low down payment options with FHA loans. Those with lower scores may still qualify but will face higher down payment requirements.

Who primarily benefits from FHA loans?

FHA loans are particularly beneficial for first-time buyers and moderate-income households, as evidenced by 82% of FHA purchase financing being secured by first-time buyers in 2023.

How does F5 Mortgage support clients with credit issues?

F5 Mortgage recognizes the challenges of navigating credit issues and provides flexible credit score criteria, allowing individuals with less-than-perfect credit to qualify for FHA loans if they demonstrate responsible financial behavior.

What is the overall goal of F5 Mortgage when assisting clients?

F5 Mortgage aims to enhance client satisfaction by offering tailored services, quick financing closure, and support throughout the mortgage journey, ensuring families can achieve their homeownership dreams.